Professional Documents

Culture Documents

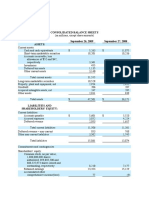

Consolidated Statement of Financial Position: Beximco Pharmaceuticals Limited and Its Subsidiaries As at June 30, 2019

Consolidated Statement of Financial Position: Beximco Pharmaceuticals Limited and Its Subsidiaries As at June 30, 2019

Uploaded by

palashndc0 ratings0% found this document useful (0 votes)

42 views4 pagesThis document is the consolidated statement of financial position and profit or loss for Beximco Pharmaceuticals Limited and its subsidiaries. It shows that as of June 30, 2019, the company had total assets of BDT 49.21 billion, with current assets of BDT 13.26 billion and non-current assets of BDT 35.95 billion. It also shows that for the fiscal year ending June 30, 2019, the company had a net revenue of BDT 22.82 billion and profit after tax of BDT 3.04 billion.

Original Description:

Original Title

FS_2019Beximco

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document is the consolidated statement of financial position and profit or loss for Beximco Pharmaceuticals Limited and its subsidiaries. It shows that as of June 30, 2019, the company had total assets of BDT 49.21 billion, with current assets of BDT 13.26 billion and non-current assets of BDT 35.95 billion. It also shows that for the fiscal year ending June 30, 2019, the company had a net revenue of BDT 22.82 billion and profit after tax of BDT 3.04 billion.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

42 views4 pagesConsolidated Statement of Financial Position: Beximco Pharmaceuticals Limited and Its Subsidiaries As at June 30, 2019

Consolidated Statement of Financial Position: Beximco Pharmaceuticals Limited and Its Subsidiaries As at June 30, 2019

Uploaded by

palashndcThis document is the consolidated statement of financial position and profit or loss for Beximco Pharmaceuticals Limited and its subsidiaries. It shows that as of June 30, 2019, the company had total assets of BDT 49.21 billion, with current assets of BDT 13.26 billion and non-current assets of BDT 35.95 billion. It also shows that for the fiscal year ending June 30, 2019, the company had a net revenue of BDT 22.82 billion and profit after tax of BDT 3.04 billion.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 4

Beximco Pharmaceuticals Limited and its Subsidiaries

Consolidated Statement of Financial Position

As at June 30, 2019

Amount in Taka

Notes June 30, 2019 June 30, 2018

ASSETS

Non-Current Assets 35,949,930,818 32,394,686,712

Property, Plant and Equipment- Carrying Value 4 34,056,667,212 30,524,692,707

Intangible Assets 5 1,334,921,698 1,280,695,416

Goodwill 6 546,691,213 546,691,213

Investment In Associates 7 - 30,749,850

Other Investment 8 5,329,379 5,757,808

Other Non-current Assets 6,321,316 6,099,718

Current Assets 13,264,161,542 11,344,199,700

Inventories 9 5,924,031,678 5,058,847,681

Spares & Supplies 10 726,127,262 663,911,096

Accounts Receivable 11 3,334,958,905 2,761,509,393

Loans, Advances and Deposits 12 2,309,503,747 2,094,229,902

Advance Income Tax 35,681,115 32,568,508

Short Term Investment 13 323,364,536 339,397,174

Cash and Cash Equivalents 14 610,494,299 393,735,946

TOTAL ASSETS 49,214,092,360 43,738,886,412

SHAREHOLDERS’ EQUITY AND LIABILITIES

Equity Attributable to the Owners of the Company 29,588,317,284 27,081,962,616

Issued Share Capital 15 4,055,564,450 4,055,564,450

Share Premium 5,269,474,690 5,269,474,690

Excess of Issue Price over Face Value of GDRs 1,689,636,958 1,689,636,958

Capital Reserve on Merger 294,950,950 294,950,950

Revaluation Surplus 1,131,853,004 1,159,277,845

Unrealized Gain/(Loss) 2,504,203 4,356,762

Retained Earnings 17,144,333,029 14,608,700,961

Non-Controlling Interest 16 276,006,553 269,874,176

TOTAL EQUITY 29,864,323,837 27,351,836,792

Non-Current Liabilities 6,603,936,369 7,368,863,860

Long Term Borrowings-Net of Current Maturity 17 2,595,607,792 4,017,425,267

Liability for Gratuity and WPPF & Welfare Funds 18 1,860,904,996 1,324,166,498

Deferred Tax Liability 2,147,423,581 2,027,272,095

Current Liabilities and Provisions 12,745,832,154 9,018,185,760

Short Term Borrowings 19 9,272,501,280 5,600,826,635

Long Term Borrowings-Current Maturity 20 1,616,670,549 1,568,989,745

Creditors and Other Payables 21 1,091,809,722 991,712,907

Accrued Expenses 22 590,317,150 418,476,895

Dividend Payable 7,235,215 4,763,126

Income Tax Payable 167,298,238 433,416,452

TOTAL EQUITY AND LIABILITIES 49,214,092,360 43,738,886,412

The Notes are an integral part of the Financial Statements.

Approved and authorised for issue by the Board of Directors on October 28, 2019 and signed for and on behalf of the Board :

Salman F Rahman Nazmul Hassan Mohammad Ali Nawaz

Vice Chairman Managing Director Chief Financial Officer

Per our report of even date

Dhaka M.J. Abedin & Co.

October 28, 2019 Chartered Accountants

Beximco Pharmaceuticals Limited and its Subsidiaries

Consolidated Statement of Profit or Loss and Other Comprehensive Income

For the Year ended June 30, 2019

Amount in Taka

Notes July 2018 - July 2017 -

June 2019 June 2018

Net Revenue 23 22,816,629,795 17,716,716,855

Cost of Goods Sold 24 (12,196,286,770) (9,430,737,431)

Gross Profit 10,620,343,025 8,285,979,424

Operating Expenses (5,554,169,458) (4,259,811,440)

Administrative Expenses 27 (752,944,182) (618,675,127)

Selling, Marketing and Distribution Expenses 28 (4,801,225,276) (3,641,136,313)

Profit from Operations 5,066,173,567 4,026,167,984

Other Income 29 139,917,665 43,757,880

Finance Cost 30 (1,029,762,542) (540,283,443)

Share of Loss of Associates 7 (29,325,720) -

Profit Before Contribution to WPPF & Welfare Funds 4,147,002,970 3,529,642,421

Contribution to WPPF & Welfare Funds (200,937,234) (168,308,290)

Profit Before Tax 3,946,065,736 3,361,334,131

Income Tax Expenses 31 (905,662,782) (828,679,830)

Current Tax (803,760,846) (792,620,241)

Deferred Tax (101,901,936) (36,059,589)

Profit After Tax 3,040,402,954 2,532,654,301

Profit/(Loss) Attributable to:

Owners of the Company 3,033,402,333 2,536,543,948

Non-controlling interest 7,000,621 (3,889,647)

3,040,402,954 2,532,654,301

Other Comprehensive Income-Unrealized Gain/(Loss) (1,852,559) 481,697

Total Comprehensive Income for the Period 3,038,550,395 2,533,135,998

Total Comprehensive Income Attributable to:

Owners of the Company 3,031,549,774 2,537,025,645

Non-controlling interest 7,000,621 (3,889,647)

3,038,550,395 2,533,135,998

Earnings Per Share (EPS) 32 7.48 6.25

The Notes are an integral part of the Financial Statements.

Approved and authorised for issue by the Board of Directors on October 28, 2019 and signed for and on behalf of the Board :

Salman F Rahman Nazmul Hassan Mohammad Ali Nawaz

Vice Chairman Managing Director Chief Financial Officer

Per our report of even date

Dhaka M.J. Abedin & Co.

October 28, 2019 Chartered Accountants

Beximco Pharmaceuticals Limited and its Subsidiaries

Consolidated Statement of Changes in Equity

For the Year Ended June 30, 2019

As at June 30, 2019 Amount in Taka

Excess of Equity

Capital Unrealized Non-Con-

Share Issue Price Revaluation Retained attributable to

Share Capital Reserve on Gain/ trolling Total Equity

Premium over Face Surplus Earnings Owners of the

Merger (Loss) Interests

Value of GDRs Company

Balance as on July 01, 2018 4,055,564,450 5,269,474,690 1,689,636,958 294,950,950 1,159,277,845 4,356,762 14,608,700,961 27,081,962,616 269,874,176 27,351,836,792

Total Comprehensive Income:

Share Capital Beximco Pharma API Ltd. 100 100

Profit/(Loss) for the Period - - - - - - 3,033,402,333 3,033,402,333 7,000,621 3,040,402,954

Other Comprehensive Income/(Loss)

- - - - - (1,852,559) - (1,852,559) - (1,852,559)

Transactions with the Shareholders:

Cash Dividend (506,945,556) (506,945,556) (868,344) (507,813,900)

Adjustment for Depreciation on (9,175,291) 9,175,291 - -

Revalued Assets

Adjustment for Deferred Tax on - - - - (18,249,550) - - (18,249,550) (18,249,550)

Revalued Assets

Balance as on June 30, 2019 4,055,564,450 5,269,474,690 1,689,636,958 294,950,950 1,131,853,004 2,504,203 17,144,333,029 29,588,317,284 276,006,553 29,864,323,837

Net Asset Value (NAV) Per Share (Note-33) 72.96

As at June 30, 2018

Excess of

Equity

Issue Price Capital Unreaized Non-Con-

Share Revaluation Retained attributable to

Share Capital over Face Reserve on Gain/ trolling Total Equity

Premium Surplus Earnings Owners of the

Value of Merger (Loss) Interests

Company

GDRs

Balance as on July 01, 2017 4,055,564,450 5,269,474,690 1,689,636,958 294,950,950 1,190,203,818 3,875,065 12,568,719,969 25,072,425,900 - 25,072,425,900

Acquisition of Subsidiary 273,763,823 273,763,823

Total Comprehensive Income:

Profit/(Loss) for the Period - - - - - - 2,536,543,948 2,536,543,948 (3,889,647) 2,532,654,301

Other Comprehensive Income / (Loss) - - - - - 481,697 - 481,697 - 481,697

Transactions with the Shareholders:

Cash Dividend - - - - - - (506,945,556) (506,945,556) (506,945,556)

Adjustment for Depreciation on

Revalued Assets - - - - (10,382,600) - 10,382,600 - -

Adjustment for Deferred Tax on

Revalued Assets - - - - (20,543,373) - - (20,543,373) (20,543,373)

Balance as on June 30, 2018 4,055,564,450 5,269,474,690 1,689,636,958 294,950,950 1,159,277,845 4,356,762 14,608,700,961 27,081,962,616 269,874,176 27,351,836,792

Net Asset Value (NAV) Per Share (Note-33) 66.78

The Notes are an integral part of the Financial Statements.

Approved and authorised for issue by the Board of Directors on October 28, 2019 and signed for and on behalf of the Board :

Salman F Rahman Nazmul Hassan Mohammad Ali Nawaz

Vice Chairman Managing Director Chief Financial Officer

Per our report of even date

Dhaka M.J. Abedin & Co.

October 28, 2019 Chartered Accountants

88 | Annual Report 2018-19 | Financial Statements-Consolidated

Beximco Pharmaceuticals Limited and its Subsidiaries

Consolidated Statement of Cash Flows

For the Year ended June 30, 2019

Amount in Taka

Notes July 2018- July 2017-

June 2019 June 2018

Cash Flows from Operating Activities :

Receipts from Customers and Others 22,463,550,299 17,195,399,333

Payments to Suppliers and Employees (17,434,690,241) (14,113,012,465)

Cash Generated from Operations 5,028,860,058 3,082,386,868

Interest Paid (1,032,409,014) (536,570,775)

Interest Received 36,457,527 54,928,425

Income Tax Paid (1,072,991,667) (781,630,595)

Net Cash Generated from Operating Activities 35 2,959,916,904 1,819,113,923

Cash Flows from Investing Activities :

Acquisition of Property, Plant and Equipment (4,416,446,385) (4,951,352,340)

Intangible Assets (128,619,282) (106,921,036)

Investment in Subsidiary - (2,125,186,000)

Disposal of Property, Plant and Equipment 17,540,625 14,114,722

Dividend Received 1,491,901 1,504,092

Decrease in Short Term Investment 16,032,638 547,179,732

Net Cash Used in Investing Activities (4,510,000,503) (6,620,660,830)

Cash Flows from Financing Activities :

Net Increase /(Decrease) in Long Term Borrowings (1,412,334,115) 1,859,021,877

Net Increase in Short Term Borrowings 3,684,312,230 3,546,896,539

Share capital 100 -

Dividend Paid (505,351,881) (502,757,959)

Net Cash Generated from Financing Activities 1,766,626,334 4,903,160,457

Increase in Cash and Cash Equivalents 216,542,735 101,613,550

Cash and Cash Equivalents at Beginning of Year 14 393,735,946 292,122,396

Effect of exchange rate changes on Cash and Cash Equivalents 215,618 -

Cash and Cash Equivalents at End of Year 610,494,299 393,735,946

Net Operating Cash Flow Per Share 34 7.30 4.49

The Notes are an integral part of the Financial Statements.

Approved and authorised for issue by the Board of Directors on October 28, 2019 and signed for and on behalf of the Board :

Salman F Rahman Nazmul Hassan Mohammad Ali Nawaz

Vice Chairman Managing Director Chief Financial Officer

Per our report of even date

Dhaka M.J. Abedin & Co.

October 28, 2019 Chartered Accountants

Financial Statements-Consolidated | Annual Report 2018-19 | 89

You might also like

- Learn Financial Accounting DifferentDocument68 pagesLearn Financial Accounting Differentmehmood.warraichNo ratings yet

- Chat GPTDocument13 pagesChat GPTsuly maniyahNo ratings yet

- NitinolDocument20 pagesNitinolTamara PricilaNo ratings yet

- Coca-Cola Common Size Financials - Balance SheetDocument1 pageCoca-Cola Common Size Financials - Balance Sheetapi-584364787No ratings yet

- Lead Schedule Fixed AssetDocument9 pagesLead Schedule Fixed Assetkelvin hervangga18No ratings yet

- Ch10 ProblemDocument2 pagesCh10 ProblempalashndcNo ratings yet

- Sequence of Operation of FahuDocument1 pageSequence of Operation of FahuahmedNo ratings yet

- Final Report of SIPDocument56 pagesFinal Report of SIPRahul Parashar100% (1)

- Air Modelling BasicsDocument3 pagesAir Modelling Basicsnav.No ratings yet

- Report Form Exemplar Company Statement of Financial Position December 31, 2020Document4 pagesReport Form Exemplar Company Statement of Financial Position December 31, 2020Azuh ShiNo ratings yet

- Audited Financial Results For The Quarter and Financial Year Ended 31st March 2021Document12 pagesAudited Financial Results For The Quarter and Financial Year Ended 31st March 2021Abhilash ABNo ratings yet

- Latihan P7-4Document6 pagesLatihan P7-4ryuNo ratings yet

- PT Jayatama - Dhiwa - Laba Rugi (Standar)Document1 pagePT Jayatama - Dhiwa - Laba Rugi (Standar)Dhiwa RafiantoNo ratings yet

- Face Amount 5,000,000 Cost 4,562,000 Bond Discount 438,000Document2 pagesFace Amount 5,000,000 Cost 4,562,000 Bond Discount 438,000Tin BatacNo ratings yet

- Montefiore Health System Q3 2019 Financial StatementsDocument25 pagesMontefiore Health System Q3 2019 Financial StatementsJonathan LaMantiaNo ratings yet

- Balance SheetDocument25 pagesBalance SheetImran AhmedNo ratings yet

- HBL FSAnnouncement 3Q2016Document9 pagesHBL FSAnnouncement 3Q2016Ryan Hock Keong TanNo ratings yet

- Finmene Angelyca NatasyaDocument4 pagesFinmene Angelyca NatasyaANGELYCA LAURANo ratings yet

- Balance Sheet: United Spirits Limited Annual ReportDocument4 pagesBalance Sheet: United Spirits Limited Annual ReportUppiliappan GopalanNo ratings yet

- 8 MIS November 2012Document129 pages8 MIS November 2012kr__santoshNo ratings yet

- CH 5Document2 pagesCH 5tigger5191No ratings yet

- Chap 004Document84 pagesChap 004MubasherAkramNo ratings yet

- PDFDocument6 pagesPDFjoshua yakubuNo ratings yet

- Statement of Financial Position As at 31st December 2013Document5 pagesStatement of Financial Position As at 31st December 2013Joseph KanyiNo ratings yet

- TM 7 Tugas PDF Bank ConsiliationDocument2 pagesTM 7 Tugas PDF Bank ConsiliationNajla Aura KhansaNo ratings yet

- TopGlove 4QFY2019 Financial ResultsDocument18 pagesTopGlove 4QFY2019 Financial ResultsAnonymous 3OFvtiNo ratings yet

- Sibl-Fs 30 June 2018Document322 pagesSibl-Fs 30 June 2018Faizal KhanNo ratings yet

- q1 Ifrs Usd Earnings ReleaseDocument26 pagesq1 Ifrs Usd Earnings Releaseashokdb2kNo ratings yet

- 3 MDocument11 pages3 MDENNIS DEPITA MORONNo ratings yet

- Annexure 4116790Document31 pagesAnnexure 4116790ayesha ansariNo ratings yet

- NICOL Financial Statement For The Period Ended 30 Sept 2023Document4 pagesNICOL Financial Statement For The Period Ended 30 Sept 2023Uk UkNo ratings yet

- Translate Book Accounting KiesoDocument147 pagesTranslate Book Accounting KiesoAdelia MarshandaNo ratings yet

- "Dewan Cement": Income Statement 2008 2007 2006 2005 2004Document30 pages"Dewan Cement": Income Statement 2008 2007 2006 2005 2004Asfand Kamal0% (1)

- Profit & Loss (Accrual) SETELAH PAJAKDocument1 pageProfit & Loss (Accrual) SETELAH PAJAKnasanya.nanaNo ratings yet

- Profit & Loss (Accrual)Document1 pageProfit & Loss (Accrual)englisclub smkpekuncenNo ratings yet

- I. Assets: 2018 2019Document7 pagesI. Assets: 2018 2019Kean DeeNo ratings yet

- Titan Shoppers Stop Ratio Analysis - 2014Document25 pagesTitan Shoppers Stop Ratio Analysis - 2014Jigyasu PritNo ratings yet

- Q1FY2020 - Financials & Fact SheetDocument4 pagesQ1FY2020 - Financials & Fact SheetChirag LaxmanNo ratings yet

- 11 MalabonCity2018 - Part4 AnnexesDocument4 pages11 MalabonCity2018 - Part4 AnnexesJuan Uriel CruzNo ratings yet

- 7-E Fin Statement 2022Document4 pages7-E Fin Statement 20222021892056No ratings yet

- Cost Accounting Cost AccumulationDocument57 pagesCost Accounting Cost AccumulationRoi Martin A. De VeyraNo ratings yet

- Soal Dan Jawaban Flexible BudgetDocument6 pagesSoal Dan Jawaban Flexible BudgetBayu SasongkoNo ratings yet

- PSO StatementDocument1 pagePSO StatementNaseeb Ullah TareenNo ratings yet

- Statement of Profit and Loss: 2012 2011 Net SalesDocument1 pageStatement of Profit and Loss: 2012 2011 Net Salesgaurav SinghNo ratings yet

- Financial ReportsDocument14 pagesFinancial Reportssardar amanat aliHadian00rNo ratings yet

- The Group AssetsDocument46 pagesThe Group Assetsit4728No ratings yet

- Balance Sheet RsDocument5 pagesBalance Sheet RsBinesh BashirNo ratings yet

- RFL 3rd Quarter 2017 FinalDocument4 pagesRFL 3rd Quarter 2017 Finalanup dasNo ratings yet

- Bab 11 Prospective AnalysisDocument57 pagesBab 11 Prospective AnalysisNovilia FriskaNo ratings yet

- Sirius XM Holdings Inc.: FORM 10-QDocument62 pagesSirius XM Holdings Inc.: FORM 10-QguneetsahniNo ratings yet

- Noman Ahmed Consulting - Profit and LossDocument1 pageNoman Ahmed Consulting - Profit and LossNoman ChoudharyNo ratings yet

- You Exec - Financial Statements FreeDocument13 pagesYou Exec - Financial Statements Freesk.propsearchNo ratings yet

- FINANCIAL PERFORMANCE June302017Document9 pagesFINANCIAL PERFORMANCE June302017Reginald ValenciaNo ratings yet

- Income Statement: Assets Non-Current AssetsDocument213 pagesIncome Statement: Assets Non-Current AssetsAhmed_Raza_ShahNo ratings yet

- NRSP-MFBL-Q3-Financials-Sept 2022 - V1Document15 pagesNRSP-MFBL-Q3-Financials-Sept 2022 - V1shahzadnazir77No ratings yet

- Bursa Q3 2015 FinalDocument16 pagesBursa Q3 2015 FinalFakhrul Azman NawiNo ratings yet

- Consolicated PL AccountDocument1 pageConsolicated PL AccountDarshan KumarNo ratings yet

- Laporan Laba RugiDocument1 pageLaporan Laba RugiRictu SempakNo ratings yet

- D4 - 2a - Amp - Minggu6 - 205134024 - Putty Humaira NurgiaDocument6 pagesD4 - 2a - Amp - Minggu6 - 205134024 - Putty Humaira NurgiaNur LaelahNo ratings yet

- Consolidated Balance Sheet of Steel Authority of India (In Rs. Crores) Mar-17 Mar-16 Mar-15 Equity and Liabilities Shareholder'S FundDocument4 pagesConsolidated Balance Sheet of Steel Authority of India (In Rs. Crores) Mar-17 Mar-16 Mar-15 Equity and Liabilities Shareholder'S FundPuneet GeraNo ratings yet

- Profit and Loss TableDocument3 pagesProfit and Loss Table龍徤No ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Result)Document5 pagesFinancial Results & Limited Review Report For June 30, 2015 (Result)Shyam SunderNo ratings yet

- LilyDocument11 pagesLilySheeena OsiasNo ratings yet

- Clarissa Computation StramaDocument29 pagesClarissa Computation StramaZejkeara ImperialNo ratings yet

- PROFIT & LOSS ACCOUNT Gross Premium Written Reinsurance Ceded NetDocument17 pagesPROFIT & LOSS ACCOUNT Gross Premium Written Reinsurance Ceded NetmissphNo ratings yet

- Beximco Pharmaceuticals Limited Statement of Financial PositionDocument55 pagesBeximco Pharmaceuticals Limited Statement of Financial Positionrimon dasNo ratings yet

- BUS207Document2 pagesBUS207palashndcNo ratings yet

- List of Cambridge Attached Centres in BangladeshDocument12 pagesList of Cambridge Attached Centres in BangladeshpalashndcNo ratings yet

- Principles of AccountingDocument3 pagesPrinciples of AccountingpalashndcNo ratings yet

- Accounting Accn1: General Certificate of Education June 2015Document16 pagesAccounting Accn1: General Certificate of Education June 2015palashndcNo ratings yet

- Class Work NAME: - SECTIONDocument1 pageClass Work NAME: - SECTIONpalashndcNo ratings yet

- Accounting Accn4: General Certificate of Education Advanced Level Examination June 2015Document24 pagesAccounting Accn4: General Certificate of Education Advanced Level Examination June 2015palashndcNo ratings yet

- Internal Auditor As Fraud BusterDocument12 pagesInternal Auditor As Fraud BusterpalashndcNo ratings yet

- Cambridge O Level Principles of Accounts (7110) : International Accounting Standards (IAS) Guidance For TeachersDocument26 pagesCambridge O Level Principles of Accounts (7110) : International Accounting Standards (IAS) Guidance For TeacherspalashndcNo ratings yet

- Class Test PartnershipDocument2 pagesClass Test PartnershippalashndcNo ratings yet

- 1 B Limited Is A Private Limited Company Trading As A Wholesaler of Garden Equipment. The DraftDocument2 pages1 B Limited Is A Private Limited Company Trading As A Wholesaler of Garden Equipment. The DraftpalashndcNo ratings yet

- Ch11 Ques ParkinDocument1 pageCh11 Ques ParkinpalashndcNo ratings yet

- American Economic Journal: Macroeconomics 2010, 2:1, 207-223Document17 pagesAmerican Economic Journal: Macroeconomics 2010, 2:1, 207-223palashndcNo ratings yet

- 4 Public SectorDocument5 pages4 Public SectorpalashndcNo ratings yet

- 1 Business OrganisationsDocument2 pages1 Business OrganisationspalashndcNo ratings yet

- Mock Unit04 OligopolyDocument3 pagesMock Unit04 Oligopolypalashndc0% (1)

- Iac Advanced Financial Accounting and ReDocument4 pagesIac Advanced Financial Accounting and ReIshi AbainzaNo ratings yet

- Minerals Potential - Minerals Law of Lao PDRDocument44 pagesMinerals Potential - Minerals Law of Lao PDRkhamsone pengmanivongNo ratings yet

- Sinumerik - 828D - Machine Commissioning - 2009 PDFDocument476 pagesSinumerik - 828D - Machine Commissioning - 2009 PDFpavlestepanic9932No ratings yet

- IOSA Guidance For Safety Monitoring Under COVID-19: Edition 5 - 05 May 2021Document18 pagesIOSA Guidance For Safety Monitoring Under COVID-19: Edition 5 - 05 May 2021Pilot Pilot380No ratings yet

- ATS Broussard User ManualDocument33 pagesATS Broussard User ManualMarv d'ar saoutNo ratings yet

- Succession DigestDocument407 pagesSuccession DigestToni Gabrielle Ang EspinaNo ratings yet

- Training LV PanelDocument108 pagesTraining LV PanelruslanNo ratings yet

- VLANS and Other HardwareDocument20 pagesVLANS and Other HardwareVishal KushwahaNo ratings yet

- Mr. Anil Wanarse PatilDocument29 pagesMr. Anil Wanarse PatilANIL INTERAVIONNo ratings yet

- Sop MMD 08 11 Purchase Order Terms and Conditions PDFDocument7 pagesSop MMD 08 11 Purchase Order Terms and Conditions PDFIip EriyaniNo ratings yet

- Souce Najib LeadershipDocument12 pagesSouce Najib LeadershipSharanya Ramasamy100% (1)

- Data Communication and Networking Prelims ExamDocument7 pagesData Communication and Networking Prelims ExamSagarAnchalkarNo ratings yet

- Ruwanpura Expressway Design ProjectDocument5 pagesRuwanpura Expressway Design ProjectMuhammadh MANo ratings yet

- Satellite Communications Chapter 3:satellite Link DesignDocument38 pagesSatellite Communications Chapter 3:satellite Link Designfadzlihashim87100% (5)

- Schedule of FinishesDocument7 pagesSchedule of FinishesĐức ToànNo ratings yet

- Profile: NR Technoserve Pvt. Ltd. 2016 - PresentDocument2 pagesProfile: NR Technoserve Pvt. Ltd. 2016 - PresentSuvam MohapatraNo ratings yet

- Unit of Competence:: Plan and Monitor System PilotDocument14 pagesUnit of Competence:: Plan and Monitor System PilotDo Dothings100% (2)

- Anaesthetic Considerations in Polytrauma PatientsDocument8 pagesAnaesthetic Considerations in Polytrauma PatientsMileidys LopezNo ratings yet

- Pemanfaatan Media Sosial Dan Ecommerce Sebagai Media Pemasaran Dalam Mendukung Peluang Usaha Mandiri Pada Masa Pandemi Covid 19Document12 pagesPemanfaatan Media Sosial Dan Ecommerce Sebagai Media Pemasaran Dalam Mendukung Peluang Usaha Mandiri Pada Masa Pandemi Covid 19Min HwagiNo ratings yet

- Food Safety: Research PaperDocument6 pagesFood Safety: Research PaperJon Slavin100% (1)

- D H Reid - Organic Compounds of Sulphur, Selenium, and Tellurium Vol 1-Royal Society of Chemistry (1970)Document518 pagesD H Reid - Organic Compounds of Sulphur, Selenium, and Tellurium Vol 1-Royal Society of Chemistry (1970)julianpellegrini860No ratings yet

- Corpo 106 01Document49 pagesCorpo 106 01Richie SalubreNo ratings yet

- Pdms List Error CaptureDocument4 pagesPdms List Error Capturehnguyen_698971No ratings yet

- 9601/DM9601 Retriggerable One Shot: General Description FeaturesDocument6 pages9601/DM9601 Retriggerable One Shot: General Description FeaturesMiguel Angel Pinto SanhuezaNo ratings yet

- Company Profile - V2Document4 pagesCompany Profile - V2bhuvaneshelango2209No ratings yet