Professional Documents

Culture Documents

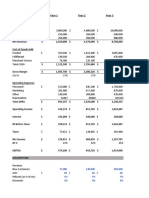

Net After Tax Rate of Return 2018

Net After Tax Rate of Return 2018

Uploaded by

cherry LiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Net After Tax Rate of Return 2018

Net After Tax Rate of Return 2018

Uploaded by

cherry LiCopyright:

Available Formats

TECHNICAL BULLETIN

Net After-Tax Rates of Return

advanced sales

2018 Federal

10% 12% 22% 24% 32% 35% 37%

Tax Bracket

Over Over Over

Over $19,050 Over $77,400

$0 to not $165,000 $315,000 $400,000 Over

Married Filing Jointly 1

to not over to not over

over $19,050 to not over to not over to not over $600,000

$77,400 $165,000

$315,000 $400,000 $600,000

Over Over

Over $9,525 Over $38,700 Over $82,500

$0 to not $157,500 $200,000 Over

Single 1

to not over to not over to not over

over $9,525 to not over to not over $500,000

$38,700 $82,500 $157,500

$200,000 $500,000

Over $2,550 Over $9,150

$0 to not

Estates and Trusts2 to not over to not over Over $12,500

over $2,550

$9,150 $12,500

Your Taxable

Your After-Tax Rate

Interest Rate

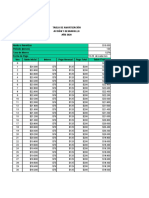

10.00% 9.00% 8.80% 7.80% 7.60% 6.80% 6.50% 6.30%

9.50% 8.55% 8.36% 7.41% 7.22% 6.46% 6.18% 5.99%

9.00% 8.10% 7.92% 7.02% 6.84% 6.12% 5.85% 5.67%

8.50% 7.65% 7.48% 6.63% 6.46% 5.78% 5.53% 5.36%

8.00% 7.20% 7.04% 6.24% 6.08% 5.44% 5.20% 5.04%

7.50% 6.75% 6.60% 5.85% 5.70% 5.10% 4.88% 4.73%

7.00% 6.30% 6.16% 5.46% 5.32% 4.76% 4.55% 4.41%

6.50% 5.85% 5.72% 5.07% 4.94% 4.42% 4.23% 4.10%

6.00% 5.40% 5.28% 4.68% 4.56% 4.08% 3.90% 3.78%

5.50% 4.95% 4.84% 4.29% 4.18% 3.74% 3.58% 3.47%

5.00% 4.50% 4.40% 3.90% 3.80% 3.40% 3.25% 3.15%

4.50% 4.05% 3.96% 3.51% 3.42% 3.06% 2.93% 2.84%

4.00% 3.60% 3.52% 3.12% 3.04% 2.72% 2.60% 2.52%

3.50% 3.15% 3.08% 2.73% 2.66% 2.38% 2.28% 2.21%

3.00% 2.70% 2.64% 2.34% 2.28% 2.04% 1.95% 1.89%

2.50% 2.25% 2.20% 1.95% 1.90% 1.70% 1.63% 1.58%

2.00% 1.80% 1.76% 1.56% 1.52% 1.36% 1.30% 1.26%

1.50% 1.35% 1.32% 1.17% 1.14% 1.02% 0.97% 0.94%

1.00% 0.90% 0.88% 0.78% 0.76% 0.68% 0.65% 0.63%

1

In addition to what is shown here, taxpayers are generally subject to a 3.8% surtax on net investment income if they file as “single” and have a modified Adjusted Gross Income

(AGI) over $200,000 or file as “married filing jointly” and have a modified AGI over $250,000. For estates and trusts, the surtax is applied to the lesser of (A) the undistributed net

investment income, or (B) the amount by which the AGI exceeds the dollar amount at which the highest tax bracket begins for an estate or trust in that tax year (in 2018, this

amount is $12,700). Certain trusts and estates are exempt from this surtax. See IRC §1411.

2

Applicable only to those estates and trusts that have a federal income tax liability at the estate or trust level. For example, certain grantor trusts, charitable trusts, and trusts with

substantial distributions might not incur an income tax liability at the trust level.

For Insurance Professional Use Only. Not intended for use in solicitation of sales to the public. Not intended to recommend the use of any product or

strategy for any particular client or class of clients. For use with non-registered products only. The annuity and insurance products described may be

issued by various companies and may not be available in all states. All comments about such products are subject to the terms and conditions of the

annuity and/or insurance contract issued by the carrier. These materials are provided for educational purposes only. Crump makes no representation

regarding the suitability of this concept or the product(s) for an individual nor is Crump providing tax or legal advice. Crump is not recommending the

use of distributions from an IRA or qualified plan to fund premiums for such products. You should consult your own tax, legal or other professional

advisor before promoting these products to your clients. 02.18 ADVM17-7658-A, 1218 III-C

®

Copyright © 2018 Crump Life Insurance Services, Inc.

You might also like

- Wakeland Community Hospital Statement of Operations For The Years Ended December 31, 20X1 and 20X0 (In Thousands) Particulars RevenuesDocument10 pagesWakeland Community Hospital Statement of Operations For The Years Ended December 31, 20X1 and 20X0 (In Thousands) Particulars Revenuesmohitgaba19100% (1)

- From Pentecost to Patmos, 2nd Edition: An Introduction to Acts through RevelationFrom EverandFrom Pentecost to Patmos, 2nd Edition: An Introduction to Acts through RevelationRating: 5 out of 5 stars5/5 (1)

- 1000 Usd Trading PlanDocument1 page1000 Usd Trading PlanM Reza FauziNo ratings yet

- Barangay Micro Business Enterprise (Bmbe) Act: 13284-TOPIC 3Document16 pagesBarangay Micro Business Enterprise (Bmbe) Act: 13284-TOPIC 3kim cheNo ratings yet

- Cost SheetDocument15 pagesCost SheetSandeep SinghNo ratings yet

- Category Assumptions Name Category Price - Min. Price - Max. Volume Year 1Document6 pagesCategory Assumptions Name Category Price - Min. Price - Max. Volume Year 1Evert TrochNo ratings yet

- Q1 2011 Quarterly EarningsDocument15 pagesQ1 2011 Quarterly EarningsRip Empson100% (1)

- Advance2 HW - P6-9Document4 pagesAdvance2 HW - P6-9Fernando HermawanNo ratings yet

- Lista de Precios ActualizadaDocument1 pageLista de Precios Actualizadaventas.risolsolutionsNo ratings yet

- Loan Amount Closing Costs: 30 Year Amortization Per $1000 FinancedDocument1 pageLoan Amount Closing Costs: 30 Year Amortization Per $1000 Financedapi-26011493No ratings yet

- Q4 2010 Quarterly EarningsDocument15 pagesQ4 2010 Quarterly EarningsAlexia BonatsosNo ratings yet

- Salary TableDocument2 pagesSalary TableabedNo ratings yet

- Wassim Zhani Corporate Taxation Reconcialiation of Income Per BooksDocument7 pagesWassim Zhani Corporate Taxation Reconcialiation of Income Per BookswassimzhaniNo ratings yet

- Presentacion - ENGLISHDocument16 pagesPresentacion - ENGLISHAfaceri AllNo ratings yet

- Group Assignment 1, (Afsana)Document11 pagesGroup Assignment 1, (Afsana)Afsana Mim JotyNo ratings yet

- Profit & Loss For Kami's Clothing As at 2018Document3 pagesProfit & Loss For Kami's Clothing As at 2018Veer SinghNo ratings yet

- Capital Investment Model - NPV IRR Payback: Strictly ConfidentialDocument3 pagesCapital Investment Model - NPV IRR Payback: Strictly ConfidentialKrishna YagnamurthyNo ratings yet

- Resumen Cartera Enero 2018Document7 pagesResumen Cartera Enero 2018yorgen alvarezNo ratings yet

- Business Finance Week 5Document5 pagesBusiness Finance Week 5Ahlam KassemNo ratings yet

- Equity CalclutorDocument89 pagesEquity CalclutorShrinivas ReddyNo ratings yet

- Planilla - Flujo - de - Caja C1-3Document5 pagesPlanilla - Flujo - de - Caja C1-3Yisela LizcanoNo ratings yet

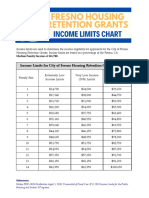

- Fresno Housing Retention Grants Income Limits ChartDocument1 pageFresno Housing Retention Grants Income Limits ChartSteve HawkinsNo ratings yet

- Inflation AssignmentDocument2 pagesInflation Assignmentaneeshbadola01No ratings yet

- Budget Summary Template USDocument1 pageBudget Summary Template USSachin KulkarniNo ratings yet

- Capital Investment Model - NPV IRR Payback: Strictly ConfidentialDocument4 pagesCapital Investment Model - NPV IRR Payback: Strictly Confidentialsh munnaNo ratings yet

- Forecast 663210613-9Document1 pageForecast 663210613-99twyp8bpd2No ratings yet

- Year 0 Year 1 Year 2 Year 3 Year 4Document14 pagesYear 0 Year 1 Year 2 Year 3 Year 4nina9121No ratings yet

- Tabla de Amortización Acción Y Desarrollo AÑO 2020Document4 pagesTabla de Amortización Acción Y Desarrollo AÑO 2020Paula BallesterosNo ratings yet

- Cost AssignmentDocument4 pagesCost AssignmentAtka chNo ratings yet

- Caps and FloorsDocument12 pagesCaps and Floorsdry_madininaNo ratings yet

- Cost Benefit AnalysisDocument4 pagesCost Benefit AnalysisswapnilNo ratings yet

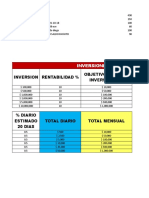

- Inversion Rentabilidad % Objetivo Mensual InversionistaDocument13 pagesInversion Rentabilidad % Objetivo Mensual InversionistaJuan TabaresNo ratings yet

- List of Case Questions: Case #4: The Investment Detective Questions For Case PreparationDocument3 pagesList of Case Questions: Case #4: The Investment Detective Questions For Case PreparationddNo ratings yet

- Laascanood WARD MAN ROOM Foundation Works: Bill of Quantities (BOQ) OUTPATIENTDocument8 pagesLaascanood WARD MAN ROOM Foundation Works: Bill of Quantities (BOQ) OUTPATIENTAbdirazak MohamedNo ratings yet

- Capital Budgeting WorkShop 2 2020-1Document3 pagesCapital Budgeting WorkShop 2 2020-1Valentina Barreto Puerta0% (1)

- Real EstateDocument8 pagesReal EstatenguyentrantoquynhtqNo ratings yet

- Gráfica Trend Pareto Action Paynter SCRAP 031219Document1,279 pagesGráfica Trend Pareto Action Paynter SCRAP 031219alonsoNo ratings yet

- Sample Model - 2Document9 pagesSample Model - 2bookinghub19No ratings yet

- NP EX19 9b JinruiDong 2Document10 pagesNP EX19 9b JinruiDong 2Ike DongNo ratings yet

- 02 - Cash Flow TemplateDocument2 pages02 - Cash Flow Templateprhipolito22No ratings yet

- Computation of Income Tax FormatDocument12 pagesComputation of Income Tax FormatMADHAV JOSHINo ratings yet

- FOCA Compensation ChartDocument1 pageFOCA Compensation ChartprojectcurveappealNo ratings yet

- Simple Financial Plan & Unit Economics - Lead Gen - Template - v3.0 by Future Flow - PUBLICDocument52 pagesSimple Financial Plan & Unit Economics - Lead Gen - Template - v3.0 by Future Flow - PUBLICRaúl GuerreroNo ratings yet

- Financing Roadmap Worksheet InputsDocument4 pagesFinancing Roadmap Worksheet Inputsapi-27087665No ratings yet

- Monthly Total Mont H Total Earned So Far #1 Site (Authority) - Earnings #1 Site (Authority) Pageviews #2 Site (Passive) - EarningsDocument7 pagesMonthly Total Mont H Total Earned So Far #1 Site (Authority) - Earnings #1 Site (Authority) Pageviews #2 Site (Passive) - EarningsPankaj MeenaNo ratings yet

- It App - WorkbookDocument8 pagesIt App - WorkbookAsi Cas JavNo ratings yet

- CAGR Calculator TemplateDocument2 pagesCAGR Calculator TemplateSiyabongaNo ratings yet

- Book 1Document3 pagesBook 1Moetassem billah MikatiNo ratings yet

- Chapter 9 Case Question FinanceDocument3 pagesChapter 9 Case Question FinanceBhargavNo ratings yet

- Cuota Fina Cuota Fija y Recalculo de Cuota Fija Fija para Todos Los PeriodosDocument16 pagesCuota Fina Cuota Fija y Recalculo de Cuota Fija Fija para Todos Los PeriodosPaula GómezNo ratings yet

- Art N Consumo Anual (Unidades) Costo Unitario ($)Document3 pagesArt N Consumo Anual (Unidades) Costo Unitario ($)yerson león carranzaNo ratings yet

- Financial Plan For Meet Green: Locally Grown Produce, Chemical-And Preservative-Free GroceriesDocument6 pagesFinancial Plan For Meet Green: Locally Grown Produce, Chemical-And Preservative-Free Groceriesramsha nishatNo ratings yet

- Tasa Preferencial y CompradeudaDocument39 pagesTasa Preferencial y CompradeudaFernando JimenezNo ratings yet

- D' Crownhorse: InvestoropportunityDocument14 pagesD' Crownhorse: InvestoropportunityTiara AsteriyaniNo ratings yet

- Budget Template - ExampleDocument2 pagesBudget Template - ExampleHeriberto Hernandez RodriguezNo ratings yet

- Patronage Calculation Example 2016-04-05Document6 pagesPatronage Calculation Example 2016-04-05Jhez DiazNo ratings yet

- NIKE Inc ReportDocument4 pagesNIKE Inc Reportdeepal patilNo ratings yet

- Ce9midmRRz-EsF2LzY5new Bluejay Natural Gas Solution Midterm-2Document10 pagesCe9midmRRz-EsF2LzY5new Bluejay Natural Gas Solution Midterm-2Karthikeyan VinodNo ratings yet

- Sample Income StatementDocument1 pageSample Income StatementJason100% (34)

- NPV (Discount Rate, Range of Values) +investmentDocument7 pagesNPV (Discount Rate, Range of Values) +investmentNgân NguyễnNo ratings yet

- China Bank Vs CA 336 SCRA 179 (Sec 39 Cap Gain/loss) - InganDocument27 pagesChina Bank Vs CA 336 SCRA 179 (Sec 39 Cap Gain/loss) - InganShanielle Qim CañedaNo ratings yet

- Paystub 2024 03 31Document1 pagePaystub 2024 03 31احمد هزازيNo ratings yet

- Taxation Chapter 2Document17 pagesTaxation Chapter 2KathleenAlfaroDelosoNo ratings yet

- Gross Income and Net IncomeDocument2 pagesGross Income and Net IncomeJasmine PeraltaNo ratings yet

- Bir CalendarDocument40 pagesBir CalendarMd PrejulesNo ratings yet

- Packages of The Comprehensive Tax Reform Program (CTRP)Document2 pagesPackages of The Comprehensive Tax Reform Program (CTRP)VERA FilesNo ratings yet

- Income Taxation NotesDocument15 pagesIncome Taxation NotesJustin Andre SiguanNo ratings yet

- W-2 Wage and Tax Statement: I I I IDocument1 pageW-2 Wage and Tax Statement: I I I Imichelle analieNo ratings yet

- Mixed Family Calculation Worksheet 6-09 - TestDocument7 pagesMixed Family Calculation Worksheet 6-09 - TestDreNo ratings yet

- Sec. 76 NIRC TaxationDocument3 pagesSec. 76 NIRC TaxationbrendamanganaanNo ratings yet

- Midterm Quiz 2Document8 pagesMidterm Quiz 2Jeda UsonNo ratings yet

- IAS 8 - Homework QuestionsDocument2 pagesIAS 8 - Homework QuestionsTsekeNo ratings yet

- Form 12 C Cum Declaration Form To Claim Housing Loan DeductionsDocument3 pagesForm 12 C Cum Declaration Form To Claim Housing Loan DeductionsBhooma ShayanNo ratings yet

- Tax (FE-2019)Document5 pagesTax (FE-2019)Vanessa May GaNo ratings yet

- GST Invoice Format No. 20Document1 pageGST Invoice Format No. 20email2suryazNo ratings yet

- Bid Form For InfraDocument1 pageBid Form For InfraGreater MchinesNo ratings yet

- Treasury Presentation To TBAC ChartsDocument47 pagesTreasury Presentation To TBAC Chartsrichardck61No ratings yet

- AgendaDocument5 pagesAgendaJelena BajićNo ratings yet

- Parallel EconomyDocument6 pagesParallel Economyvarun guptaNo ratings yet

- WWW - ILOE.ae WWW - ILOE.aeDocument2 pagesWWW - ILOE.ae WWW - ILOE.aesumansingh19931019No ratings yet

- Sre 2022 and 2023Document4 pagesSre 2022 and 2023barangaymaharlikawest017No ratings yet

- Lamagan, Kyla T. BSA 401 Intermediate Acct. 2 Final Output Problem 16-13 (IAA)Document14 pagesLamagan, Kyla T. BSA 401 Intermediate Acct. 2 Final Output Problem 16-13 (IAA)lana del reyNo ratings yet

- Class On Pay Fixation in 8th April.Document118 pagesClass On Pay Fixation in 8th April.Crick CompactNo ratings yet

- Mudassar Majeed S/O Abdul Majeed Sehjo Wal Chunian Rural: Web Generated BillDocument1 pageMudassar Majeed S/O Abdul Majeed Sehjo Wal Chunian Rural: Web Generated BillHussnain UmerNo ratings yet

- Rationalization of Customs Tariff Rates in India: (Summary of Expert Group Report 2002)Document17 pagesRationalization of Customs Tariff Rates in India: (Summary of Expert Group Report 2002)Professor Tarun DasNo ratings yet

- (Reviewer) TaxDocument13 pages(Reviewer) TaxchxrlttxNo ratings yet

- 3 DR KBL MathurDocument31 pages3 DR KBL MathurAkhilesh MishraNo ratings yet

- TAXATION - Value-Added TaxDocument10 pagesTAXATION - Value-Added TaxJohn Mahatma Agripa100% (2)