Professional Documents

Culture Documents

Career Paths Accounting SB-27

Career Paths Accounting SB-27

Uploaded by

YanetOriginal Description:

Original Title

Copyright

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Career Paths Accounting SB-27

Career Paths Accounting SB-27

Uploaded by

YanetCopyright:

Overdrafts

Get Ready!

0 Before you read the passage, talk about

these questions.

1 What happens if you write a check for more

money than you have in your bank account?

2 What are the penalties for overdrawing a bank

account?

Reading

f) Read the notice from a bank. Then,

choose the correct answers.

1 What is the passage mainly about?

A a missing check

B an excessive bank fee

C an overdrawn bank account

D an upcoming account statement

2 How can Mr. Johnson compensate for the

overdraft?

A pay the bank $235

B pay the bank $200

C request a transfer

D choose a different bank

Dear Mr. Johnson,

3 What can be inferred about overdraft charges?

Account No. 58756 A Some of them can be negotiated.

We regret to inform you that you B There are new charges for every overdraft.

have an overdraft of $200.00 on

C They vary according to the overdraft amount.

your account. On April 3, 2010, Total

Value Office Supply cashed a check D Customer service representatives can

in the amount of $500.00. Your block them.

account balance on that date was

$300.00. Your upcoming statement Vocabulary

includes overdraft charges in the

amount of $35.00. To avoid further E) Match the words (1-5) with the definitions

charges, please do not make any (A-E).

additional withdrawals or transfers

1 _ overdraft 4 _upcoming

until compensating for this overdraft. If

you have any questions or concerns, 2 _ compensate 5 _ cash a check

please contact us. For your convenience, 3 _transfer

customer service representatives are

available twenty-four hours a day by A appearing or arriving in the near future

phone. B to receive money in exchange for a document

C a withdrawal that exceeds an account's balance

D to restore or replace something

E to move something from one place to another

You might also like

- Fine Print Checking Account Statement 1Document3 pagesFine Print Checking Account Statement 1api-680806307No ratings yet

- Fundamentals of Accountancy, Business and Management 2: Senior High SchoolDocument17 pagesFundamentals of Accountancy, Business and Management 2: Senior High SchoolHart Gensoli100% (2)

- Chapter Two:: Measuring National IncomeDocument42 pagesChapter Two:: Measuring National IncomeArni Ayuni100% (1)

- Reviewer in Ac17 Management AccountingDocument27 pagesReviewer in Ac17 Management AccountingJaneth NavalesNo ratings yet

- Career Paths Accounting SB-28Document1 pageCareer Paths Accounting SB-28YanetNo ratings yet

- InglesDocument3 pagesInglesYanetNo ratings yet

- Unit 5 - CashDocument2 pagesUnit 5 - CashGabriel CamperoNo ratings yet

- Unit - 2 BRSDocument10 pagesUnit - 2 BRSD20BRM036 SukantNo ratings yet

- Kami Export - U1 Vocabulary Personal FinanceDocument2 pagesKami Export - U1 Vocabulary Personal FinanceAbel CopaNo ratings yet

- Bank ReconciliationDocument35 pagesBank ReconciliationGurmeet SinghNo ratings yet

- QuizDocument3 pagesQuizXuXu DienNo ratings yet

- Client ExamDocument8 pagesClient ExamKimberly May AbayonNo ratings yet

- Quiz 1Document9 pagesQuiz 1Czarhiena SantiagoNo ratings yet

- Unit7 2Document2 pagesUnit7 2jennie rubyNo ratings yet

- Chapter 3 Problem 5 THEORYDocument1 pageChapter 3 Problem 5 THEORY2021aismedinacamilleNo ratings yet

- MCQ Nov11 OlevelDocument2 pagesMCQ Nov11 OlevelAbid faisal AhmedNo ratings yet

- 3108 13 06 FinancialResponsibility GN SEDocument9 pages3108 13 06 FinancialResponsibility GN SENEEVE SHETHNo ratings yet

- M10 TranscriptDocument3 pagesM10 TranscriptJanna RodriguezNo ratings yet

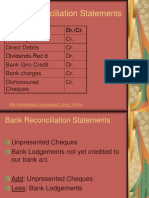

- Bank Reconciliation StatementDocument35 pagesBank Reconciliation StatementRafeeq MuhammadhNo ratings yet

- FA Day 11Document17 pagesFA Day 11abelthomas1972No ratings yet

- Fabm2 QTR.2 Las 7.1Document10 pagesFabm2 QTR.2 Las 7.1Trunks KunNo ratings yet

- ExcerptDocument10 pagesExcerptethanmaistryNo ratings yet

- Int Acc 1Document49 pagesInt Acc 1kookie bunnyNo ratings yet

- Bank ReconciliationDocument35 pagesBank ReconciliationTin BatacNo ratings yet

- Bank Reconciliation: Mrs. Rosalie Rosales-Makil, Cpa, LPT, MbaDocument18 pagesBank Reconciliation: Mrs. Rosalie Rosales-Makil, Cpa, LPT, MbaPSHNo ratings yet

- Accounting MCQ s16 qp12Document12 pagesAccounting MCQ s16 qp12Wafi Bin Hassan The InevitableNo ratings yet

- ACC 205 TheoriesDocument9 pagesACC 205 TheoriesCASSANDRANo ratings yet

- F3 - ACCA Chapter-15-1Document14 pagesF3 - ACCA Chapter-15-1Nile NguyenNo ratings yet

- Banking - Unit 10 11Document4 pagesBanking - Unit 10 11taylormit1242003No ratings yet

- Steps and Rules For Preparing of Bank Reconciliation Statement Name of Company Bank Reconciliation Statement DateDocument2 pagesSteps and Rules For Preparing of Bank Reconciliation Statement Name of Company Bank Reconciliation Statement DaterajdeepNo ratings yet

- Career Paths Accounting - Liquidity Pag 45, 46 B 2Document2 pagesCareer Paths Accounting - Liquidity Pag 45, 46 B 2contabilidadcasamazdaNo ratings yet

- MCQ Set 1Document6 pagesMCQ Set 1judysaysNo ratings yet

- INTACCDocument4 pagesINTACCmrgrthflxsubNo ratings yet

- Description: Tags: PK200701AttachmentADocument1 pageDescription: Tags: PK200701AttachmentAanon-543937No ratings yet

- Sr. No Course Outline Topics: Chapter - 7 Bank Reconciliation Statement (BRS)Document11 pagesSr. No Course Outline Topics: Chapter - 7 Bank Reconciliation Statement (BRS)muhammad zainNo ratings yet

- QP Economics 12 Common Set 1Document9 pagesQP Economics 12 Common Set 1VISHAL S. VNo ratings yet

- VUB English Platform M2 U3Document2 pagesVUB English Platform M2 U3Chanadda ChatmontreeNo ratings yet

- San Lorenzo Ruiz Senior High SchoolDocument3 pagesSan Lorenzo Ruiz Senior High SchoolKrysteen Ciara de SagunNo ratings yet

- Banking and Insurance. KSLU.Document21 pagesBanking and Insurance. KSLU.Liz DsouzaNo ratings yet

- BankrecDocument6 pagesBankrecMahediNo ratings yet

- Cash Book & BRSDocument9 pagesCash Book & BRSRahul NegiNo ratings yet

- Notes Chapter 6Document2 pagesNotes Chapter 6syafaNo ratings yet

- L2 Bank ReconciliationDocument3 pagesL2 Bank ReconciliationAshley BrevaNo ratings yet

- Elite Gold NCDocument2 pagesElite Gold NCAakash AgarwalNo ratings yet

- Abm Fabm2 Module 7 Lesson 1 Bank ReconciliationDocument15 pagesAbm Fabm2 Module 7 Lesson 1 Bank ReconciliationAtria Lenn Villamiel Bugal100% (1)

- Quiz Xem Lại Lần Làm ThửDocument1 pageQuiz Xem Lại Lần Làm ThửhaletktonpNo ratings yet

- 2.1F Diy-Mcq (Answer Key)Document5 pages2.1F Diy-Mcq (Answer Key)Chinito Reel CasicasNo ratings yet

- ACCT1198Document6 pagesACCT1198RuthNo ratings yet

- Bank Reconciliation StatementsDocument6 pagesBank Reconciliation StatementsTawanda Tatenda Herbert0% (2)

- Accounting QuestionsDocument12 pagesAccounting Questionssnowd.0820No ratings yet

- Petty CashDocument1 pagePetty CashRose Marie Anne ReyesNo ratings yet

- BANKING - Unit 1 2Document6 pagesBANKING - Unit 1 2taylormit1242003No ratings yet

- Bank ReconciliationDocument22 pagesBank ReconciliationstanleymasemulaNo ratings yet

- Mgt101-7 - Bank Reconciliation StatementDocument36 pagesMgt101-7 - Bank Reconciliation StatementUmer MateenNo ratings yet

- Bank Reconciliation StatementsDocument5 pagesBank Reconciliation Statementsjason deruloNo ratings yet

- ATIS - Long Quiz # 1 AnswersDocument4 pagesATIS - Long Quiz # 1 AnswersredassdawnNo ratings yet

- Case Entry From Simple Invoice CreationDocument4 pagesCase Entry From Simple Invoice CreationchiragNo ratings yet

- CH 12 Irrecoverable Debts and Allowance v3Document8 pagesCH 12 Irrecoverable Debts and Allowance v3BuntheaNo ratings yet

- Answer Key Chap 29 PDFDocument5 pagesAnswer Key Chap 29 PDFDuy TháiNo ratings yet

- ch10 PDFDocument19 pagesch10 PDFpompomNo ratings yet

- Personal Finance Vocabulary Warm-UpDocument3 pagesPersonal Finance Vocabulary Warm-UpSamuel MakikuNo ratings yet

- Learn to Repair Credit | Get Approved for Business Loans: Loans, Tradelines and CreditFrom EverandLearn to Repair Credit | Get Approved for Business Loans: Loans, Tradelines and CreditRating: 4.5 out of 5 stars4.5/5 (3)

- The Debt Pit Escape Plan: Get Creditors Off Your Back, Climb Out of Debt and Rebuild Your CreditFrom EverandThe Debt Pit Escape Plan: Get Creditors Off Your Back, Climb Out of Debt and Rebuild Your CreditNo ratings yet

- Hear OrderDocument3 pagesHear OrderYanetNo ratings yet

- Sent Catch: Order HearDocument3 pagesSent Catch: Order HearYanetNo ratings yet

- InventoryDocument2 pagesInventoryYanetNo ratings yet

- Wha 1'S Going On: 'Ntheback Offlce?Document2 pagesWha 1'S Going On: 'Ntheback Offlce?YanetNo ratings yet

- Extra Material Units 1 and 2Document4 pagesExtra Material Units 1 and 2YanetNo ratings yet

- Guiding Principles of Accounting: Get Ready!Document2 pagesGuiding Principles of Accounting: Get Ready!Yanet0% (1)

- Career Paths Accounting SB-30 PDFDocument1 pageCareer Paths Accounting SB-30 PDFYanetNo ratings yet

- Career Paths Accounting SB-33Document1 pageCareer Paths Accounting SB-33YanetNo ratings yet

- Career Paths Accounting SB-17Document1 pageCareer Paths Accounting SB-17YanetNo ratings yet

- Career Paths Accounting SB-22Document1 pageCareer Paths Accounting SB-22YanetNo ratings yet

- Cash Flow Statements: Get Ready!Document1 pageCash Flow Statements: Get Ready!YanetNo ratings yet

- Career Paths Accounting SB-31Document1 pageCareer Paths Accounting SB-31YanetNo ratings yet

- Career Paths Accounting SB-20 PDFDocument1 pageCareer Paths Accounting SB-20 PDFYanetNo ratings yet

- Gleaning Information From Financial Statements: ReadingDocument1 pageGleaning Information From Financial Statements: ReadingYanetNo ratings yet

- Career Paths Accounting SB-26Document1 pageCareer Paths Accounting SB-26YanetNo ratings yet

- Career Paths Accounting SB-34 PDFDocument1 pageCareer Paths Accounting SB-34 PDFYanetNo ratings yet

- Career Paths Accounting SB-30Document1 pageCareer Paths Accounting SB-30YanetNo ratings yet

- Career Paths Accounting SB-32Document1 pageCareer Paths Accounting SB-32YanetNo ratings yet

- Office: MaterialsDocument1 pageOffice: MaterialsYanetNo ratings yet

- Speaking: Adjusted Trial BalanceDocument1 pageSpeaking: Adjusted Trial BalanceYanetNo ratings yet

- Speaking: There S A Problem With You Sent .. But We Ordered I Apologize For The Error We LL ..Document1 pageSpeaking: There S A Problem With You Sent .. But We Ordered I Apologize For The Error We LL ..YanetNo ratings yet

- Vocabulary Pay Attention Naughty Lovely Parents Feed Fight All The Time Do The Bed Candy (Ies) Share Toys As Advices BehaviorDocument2 pagesVocabulary Pay Attention Naughty Lovely Parents Feed Fight All The Time Do The Bed Candy (Ies) Share Toys As Advices BehaviorYanetNo ratings yet

- A Continuación, Encontrarás El Texto Visto en Clase. El Texto Tiene Algunos Errores Que Tú Debes Corregir. Revisa Muy CuidadosamenteDocument4 pagesA Continuación, Encontrarás El Texto Visto en Clase. El Texto Tiene Algunos Errores Que Tú Debes Corregir. Revisa Muy CuidadosamenteYanetNo ratings yet

- Bookkeeping Cycle: ReadingDocument1 pageBookkeeping Cycle: ReadingYanetNo ratings yet

- DDDDDocument1 pageDDDDYanetNo ratings yet

- New MHRD FormatDocument114 pagesNew MHRD Formatapk576563No ratings yet

- Cash Flow Statement ExerciseDocument3 pagesCash Flow Statement ExerciseVikas YadavNo ratings yet

- Client at Age 25 Sample ProposalsDocument4 pagesClient at Age 25 Sample ProposalsAbbygail ViernesNo ratings yet

- Chapter 15 Test Bank Assessment Macroeconomic Issues and Measurement Econ 101 (Section 1 F19)Document24 pagesChapter 15 Test Bank Assessment Macroeconomic Issues and Measurement Econ 101 (Section 1 F19)The WAVERNo ratings yet

- Contest MASDocument29 pagesContest MASTerence Jeff Tamondong100% (1)

- Guru Jambheshwar University of Sc. & Technology, Hisar: Date Class/Sem./Scheme Paper Code Nomenclature SR./ Id. NoDocument6 pagesGuru Jambheshwar University of Sc. & Technology, Hisar: Date Class/Sem./Scheme Paper Code Nomenclature SR./ Id. NoDheeraj DhimanNo ratings yet

- Accounting Assignment Summer 2023Document2 pagesAccounting Assignment Summer 2023codeofinweNo ratings yet

- NICE Information Service: 2021 Investors RelationsDocument23 pagesNICE Information Service: 2021 Investors RelationspuchooNo ratings yet

- The MBA Decision-Q1456Document11 pagesThe MBA Decision-Q1456anuragNo ratings yet

- Capital Budgeting IIDocument28 pagesCapital Budgeting IIy64d54mkh5No ratings yet

- Corpo - PJA Notes 2019-2020Document206 pagesCorpo - PJA Notes 2019-2020Mikee ClamorNo ratings yet

- A Study On Microfinance Sector in KarnatakaDocument84 pagesA Study On Microfinance Sector in KarnatakaPrashanth PB100% (3)

- Control AccountsDocument8 pagesControl AccountsAejaz MohamedNo ratings yet

- National Bank Act A/k/a Currency Act, Public Law 38, Volume 13 Stat 99-118Document21 pagesNational Bank Act A/k/a Currency Act, Public Law 38, Volume 13 Stat 99-118glaxayiii100% (2)

- Docu - Tips Accounts r1201Document10 pagesDocu - Tips Accounts r1201Michael A9 TsangNo ratings yet

- AB-EB-Unlocking-Operational-Risk-Management-Empower-the-Front Line to-Effectively-Manage-RiskDocument12 pagesAB-EB-Unlocking-Operational-Risk-Management-Empower-the-Front Line to-Effectively-Manage-RiskSirak AynalemNo ratings yet

- IIFL NCD 29jul2011Document302 pagesIIFL NCD 29jul2011Mohan SharmaNo ratings yet

- Meaning of BankDocument56 pagesMeaning of BankDan John KarikottuNo ratings yet

- Inventory ValuationDocument12 pagesInventory Valuationcooldude690No ratings yet

- Neral CashierDocument27 pagesNeral Cashiersiti rahimahNo ratings yet

- PAS 16 - Property, Plant and EquipmentDocument3 pagesPAS 16 - Property, Plant and EquipmentDEX MAYNo ratings yet

- Managerial Economics 4th Edition Froeb McCann Ward Shor Solution ManualDocument4 pagesManagerial Economics 4th Edition Froeb McCann Ward Shor Solution Manualcharles100% (23)

- CIBC Business Bank Account StatementDocument24 pagesCIBC Business Bank Account StatementJames RossNo ratings yet

- Business Math Midterm Reviewer Session 8 Introduction To Salaries and WagesDocument8 pagesBusiness Math Midterm Reviewer Session 8 Introduction To Salaries and WagesJwyneth Royce DenolanNo ratings yet

- Mode of Payment Person Liable Who FileDocument12 pagesMode of Payment Person Liable Who FileXiaoyu KensameNo ratings yet

- "A Study On Awareness of Mutual Funds Among Investors": by Simran Lalchandani 17P125 Batch 2017-19Document18 pages"A Study On Awareness of Mutual Funds Among Investors": by Simran Lalchandani 17P125 Batch 2017-19Simran lalchandaniNo ratings yet

- Division of Real Estate Response To Homie ApplicationDocument4 pagesDivision of Real Estate Response To Homie ApplicationRobert GehrkeNo ratings yet

- Entrepreneurship Chapter 7Document22 pagesEntrepreneurship Chapter 7Muhammad shahzadNo ratings yet