Professional Documents

Culture Documents

Solangon Vs Salazar PDF

Solangon Vs Salazar PDF

Uploaded by

kmanligoyCopyright:

Available Formats

You might also like

- For Those of Us With Thick SkullsDocument40 pagesFor Those of Us With Thick SkullsPhillip Stilley100% (4)

- 8 Microfinance Lending ModelsDocument12 pages8 Microfinance Lending Modelsanamikabhoumik100% (12)

- Castro vs. TanDocument11 pagesCastro vs. TanRegion 6 MTCC Branch 3 Roxas City, CapizNo ratings yet

- Sps. Castro Vs - TanDocument12 pagesSps. Castro Vs - TanJhonrey LalagunaNo ratings yet

- Classification of Property and Ownership Case Digest - CHAM UpdatedDocument26 pagesClassification of Property and Ownership Case Digest - CHAM Updatedmelaniem_1No ratings yet

- Fortune Motors Corp. vs. CADocument11 pagesFortune Motors Corp. vs. CAStefan SalvatorNo ratings yet

- Selected Decisions of Human Rights Committee, 8Document434 pagesSelected Decisions of Human Rights Committee, 8Oliullah Laskar100% (1)

- Press Release by Ogden CityDocument2 pagesPress Release by Ogden CityMcKenzie StaufferNo ratings yet

- Case 95 Royal Plant Workers Union v. Coca-Cola Bottlers Philippines, IncDocument2 pagesCase 95 Royal Plant Workers Union v. Coca-Cola Bottlers Philippines, Incbernadeth ranolaNo ratings yet

- 86 Broadway Centrum Condominium Corp. v. Tropical Hut - DIGESTDocument2 pages86 Broadway Centrum Condominium Corp. v. Tropical Hut - DIGESTAllen Windel BernabeNo ratings yet

- Dino V CA Case DigestDocument2 pagesDino V CA Case DigestZirk TanNo ratings yet

- In Re - Atty. Rufillo D. BucanaDocument6 pagesIn Re - Atty. Rufillo D. BucanacanyoumovemeNo ratings yet

- Francisco Lao Lim vs. CA, G.R. No. 87047, October 31, 1990Document4 pagesFrancisco Lao Lim vs. CA, G.R. No. 87047, October 31, 1990Fides DamascoNo ratings yet

- Broadway Vs Tropical Hut DigestDocument2 pagesBroadway Vs Tropical Hut DigestCarl AngeloNo ratings yet

- 30-Board of Assessment Appeal Q.C. vs. Meralco, 10 SCRA 68Document4 pages30-Board of Assessment Appeal Q.C. vs. Meralco, 10 SCRA 68Jopan SJNo ratings yet

- Underhill v. Hernandez, 168 U.S. 250 (1897)Document4 pagesUnderhill v. Hernandez, 168 U.S. 250 (1897)Scribd Government DocsNo ratings yet

- Domingo vs. CA 226 SCRA 572Document2 pagesDomingo vs. CA 226 SCRA 572RR FNo ratings yet

- Nicolas VdelnaciaDocument4 pagesNicolas VdelnaciaHollyhock MmgrzhfmNo ratings yet

- LegresDocument3 pagesLegresevflorendoNo ratings yet

- Rule 118: Pre - Trial: Criminal Procedure Notes (2013 - 2014) Atty. Tranquil SalvadorDocument3 pagesRule 118: Pre - Trial: Criminal Procedure Notes (2013 - 2014) Atty. Tranquil SalvadorRache GutierrezNo ratings yet

- Republic Act No. 9522 (Baseline Law)Document4 pagesRepublic Act No. 9522 (Baseline Law)Ciara Navarro100% (1)

- Khe Hong Cheng v. CA, 355 SCRA 701 (2001)Document4 pagesKhe Hong Cheng v. CA, 355 SCRA 701 (2001)Fides DamascoNo ratings yet

- Rule 112 DigestDocument8 pagesRule 112 DigestRufino Gerard MorenoNo ratings yet

- A - People Versus LamahangDocument4 pagesA - People Versus LamahangArcie LaconicoNo ratings yet

- PALMA GIL - Plasabas V Court of AppealsDocument8 pagesPALMA GIL - Plasabas V Court of AppealsLouis p100% (1)

- Luna v. EncarnacionDocument2 pagesLuna v. Encarnacionrichelle_orpilla5942No ratings yet

- Leviste Vs CADocument1 pageLeviste Vs CAEderic ApaoNo ratings yet

- Lim V GamosaDocument2 pagesLim V GamosaJohnNo ratings yet

- Telefast v. Castro, 158 SCRA 445 (1988)Document2 pagesTelefast v. Castro, 158 SCRA 445 (1988)Fides DamascoNo ratings yet

- Lotus Case (France v. Turkey) NFDocument31 pagesLotus Case (France v. Turkey) NFJereca Ubando JubaNo ratings yet

- Asylum Case Colombia v. Peru ICJ Reports 20 November 1950Document7 pagesAsylum Case Colombia v. Peru ICJ Reports 20 November 1950Alelojo, NikkoNo ratings yet

- Broadway Centrum v. Tropical HutDocument20 pagesBroadway Centrum v. Tropical HutChescaSeñeresNo ratings yet

- Development Bank V CA - GR L-109937 - Mar 21 1994Document4 pagesDevelopment Bank V CA - GR L-109937 - Mar 21 1994Jeremiah ReynaldoNo ratings yet

- Difference Relating To Immunity From Legal Process of A Special Rapporteur of The Commission of Human RightsDocument3 pagesDifference Relating To Immunity From Legal Process of A Special Rapporteur of The Commission of Human RightsAlljun Serenado0% (1)

- Treatment Aliens : Doctrine WithDocument5 pagesTreatment Aliens : Doctrine WithMika SantiagoNo ratings yet

- Construction Development Corp. v. EstrellaDocument7 pagesConstruction Development Corp. v. Estrellajetzon2022No ratings yet

- 29 - Lechugas v. CADocument2 pages29 - Lechugas v. CARan MendozaNo ratings yet

- Celestial v. CachoperoDocument23 pagesCelestial v. CachoperoRon Jacob AlmaizNo ratings yet

- Philippine National Bank Vs Lilibeth ChanDocument14 pagesPhilippine National Bank Vs Lilibeth ChanJoatham GenovisNo ratings yet

- Case Digests 1. Fabian Vs Desierto, GR No. 129742 Facts:: Petitioner's ArgumentDocument14 pagesCase Digests 1. Fabian Vs Desierto, GR No. 129742 Facts:: Petitioner's ArgumentJMXNo ratings yet

- WERR Corp. vs. Highlands Prime Inc. (G.R. No. 187543. February 08, 2017)Document4 pagesWERR Corp. vs. Highlands Prime Inc. (G.R. No. 187543. February 08, 2017)Random VidsNo ratings yet

- 305 Scra 721 DIGESTDocument2 pages305 Scra 721 DIGESTjodelle11No ratings yet

- Lemon v. Kurtzman, 403 U.S. 602 (1971)Document50 pagesLemon v. Kurtzman, 403 U.S. 602 (1971)Scribd Government DocsNo ratings yet

- Decision On SAJE MIGUEL MOLATO Et Al. v. JANN RAILEY E. MONTALANDocument9 pagesDecision On SAJE MIGUEL MOLATO Et Al. v. JANN RAILEY E. MONTALANAteneo Student Judicial CourtNo ratings yet

- Concept of StateDocument3 pagesConcept of StatebrittaNo ratings yet

- Philsat Case The Stairway To Becoming A LawyerDocument5 pagesPhilsat Case The Stairway To Becoming A LawyerPauline Eunice LobiganNo ratings yet

- National Power Corp. v. IbrahimDocument13 pagesNational Power Corp. v. Ibrahimjuju_batugalNo ratings yet

- Vinuya Vs RomuloDocument7 pagesVinuya Vs RomuloRica Corsica LazanaNo ratings yet

- 13 Sibayan Vs AldaDocument6 pages13 Sibayan Vs AldaAngelica Joyce BelenNo ratings yet

- Licuanan V Melo 170 SCRA 100 1989 Full TextDocument3 pagesLicuanan V Melo 170 SCRA 100 1989 Full TextAnthony De La CruzNo ratings yet

- Republic Vs CatubagDocument3 pagesRepublic Vs CatubagamazingmomNo ratings yet

- Magdalena Estates V RodriguezDocument2 pagesMagdalena Estates V RodriguezMartin Benjamin Tomelden LagmayNo ratings yet

- Adm. Case No. 1418. August 31, 1976. Jose Misamin, Complainant, vs. Attorney Miguel A. SAN JUAN, RespondentDocument6 pagesAdm. Case No. 1418. August 31, 1976. Jose Misamin, Complainant, vs. Attorney Miguel A. SAN JUAN, RespondentMarisse CastañoNo ratings yet

- Liang v. People, GR No.125865Document3 pagesLiang v. People, GR No.125865Ryan MostarNo ratings yet

- 20 Standard Chartered Vs Confesor ManaloDocument2 pages20 Standard Chartered Vs Confesor ManaloRabelais MedinaNo ratings yet

- LIM FILCRO Illegal RecruitmentDocument2 pagesLIM FILCRO Illegal RecruitmentVivienne Nicole LimNo ratings yet

- ExtraditionDocument37 pagesExtraditionjasper_T_TNo ratings yet

- Property: Ownership: Realty & Dev. Corp. V. Cruz 410 SCRA 484Document7 pagesProperty: Ownership: Realty & Dev. Corp. V. Cruz 410 SCRA 484Mikail Lee BelloNo ratings yet

- Conjugal Partnership of Gains (CPG)Document8 pagesConjugal Partnership of Gains (CPG)Cora NovusNo ratings yet

- Salita Vs MagtolisDocument1 pageSalita Vs MagtolisGretch MaryNo ratings yet

- JOSE AVELINO SALAZAR, Respondents. Sandoval-Gutierrez, J.Document3 pagesJOSE AVELINO SALAZAR, Respondents. Sandoval-Gutierrez, J.Mary Divina FranciscoNo ratings yet

- Solangon vs. SalazarDocument7 pagesSolangon vs. SalazarMary RoseNo ratings yet

- 5 National Steel V CADocument17 pages5 National Steel V CAkmanligoyNo ratings yet

- 3d Paper Flower Template PDFDocument1 page3d Paper Flower Template PDFkmanligoy100% (1)

- Deposits Part 1 Digest 2Document12 pagesDeposits Part 1 Digest 2kmanligoyNo ratings yet

- Laudato SiDocument1 pageLaudato SikmanligoyNo ratings yet

- Generally Considered Are The Following:: Unfair Labor Practice Guaranteed and Reliable Labor ContractorsDocument8 pagesGenerally Considered Are The Following:: Unfair Labor Practice Guaranteed and Reliable Labor ContractorskmanligoyNo ratings yet

- Omnibus Election Code of The PhilippinesDocument64 pagesOmnibus Election Code of The PhilippinesElfenLiedFanGirlNo ratings yet

- Labor Case DigestDocument8 pagesLabor Case DigestkmanligoyNo ratings yet

- Search and Seizures Case DigestsDocument23 pagesSearch and Seizures Case DigestsJustine Marie100% (1)

- Midterm Cases in PropertyDocument18 pagesMidterm Cases in PropertykmanligoyNo ratings yet

- People Vs FieldadDocument10 pagesPeople Vs FieldadkmanligoyNo ratings yet

- G.R. No. 150429Document5 pagesG.R. No. 150429kmanligoyNo ratings yet

- G.R. No. L-47722Document4 pagesG.R. No. L-47722kmanligoyNo ratings yet

- A.M. No. MTJ-92-706Document3 pagesA.M. No. MTJ-92-706kmanligoyNo ratings yet

- Nha vs. GuivelondoDocument3 pagesNha vs. GuivelondokmanligoyNo ratings yet

- G.R. No. 88211Document10 pagesG.R. No. 88211kmanligoyNo ratings yet

- Kabboudi: Problem NotesDocument7 pagesKabboudi: Problem NotesamanittaNo ratings yet

- Meredith Corporation Employees Fund For Better Government - 6099 - DR2 - SummaryDocument1 pageMeredith Corporation Employees Fund For Better Government - 6099 - DR2 - SummaryZach EdwardsNo ratings yet

- My Budget: Your Total IncomeDocument3 pagesMy Budget: Your Total Incomeyun3No ratings yet

- BLANK FORM Secretary's CertificateDocument3 pagesBLANK FORM Secretary's CertificateJulie SaltarinNo ratings yet

- Fider - ProblemSet1 (EngEco)Document7 pagesFider - ProblemSet1 (EngEco)TRICIA MARIE FIDERNo ratings yet

- Advances Process Managementat Citi Financial Mba Project ReportDocument96 pagesAdvances Process Managementat Citi Financial Mba Project ReportBabasab Patil (Karrisatte)No ratings yet

- A Decentralized, Uniswap-And Pancakeswap-Based, Algorithmic Margin Trading ProtocolDocument10 pagesA Decentralized, Uniswap-And Pancakeswap-Based, Algorithmic Margin Trading ProtocolRakesh SharmaNo ratings yet

- Oman Labour LawDocument23 pagesOman Labour LawAshok SureshNo ratings yet

- Fresh Start', A Big Challenge Facing The Microfinance IndustryDocument4 pagesFresh Start', A Big Challenge Facing The Microfinance IndustryVinod ChanrasekharanNo ratings yet

- VC Glossary Terms TLV PartnersDocument12 pagesVC Glossary Terms TLV PartnersAditya PatelNo ratings yet

- Stegner V StegnerDocument3 pagesStegner V StegnerLizzette Dela PenaNo ratings yet

- Artisanal Fisheries Promotion Project PDFDocument95 pagesArtisanal Fisheries Promotion Project PDFJege Leather AccessoriesNo ratings yet

- Perfast Corporation - NotesDocument9 pagesPerfast Corporation - NotesMCDABCNo ratings yet

- Expropriated Properties ActDocument9 pagesExpropriated Properties ActReal TrekstarNo ratings yet

- Reflective Essay - TVDocument21 pagesReflective Essay - TVAnthony MuchiriNo ratings yet

- It 11ga2016Document17 pagesIt 11ga2016shiblu39100% (1)

- Ram Narain Popli Vs Central Bureau of Investigation On 14 January, 2003Document124 pagesRam Narain Popli Vs Central Bureau of Investigation On 14 January, 2003Mahesh RawatNo ratings yet

- G.R. No. 184458 January 14, 2015 RODRIGO RIVERA, Petitioner, Spouses Salvador Chua and Violeta S. Chua, RespondentsDocument12 pagesG.R. No. 184458 January 14, 2015 RODRIGO RIVERA, Petitioner, Spouses Salvador Chua and Violeta S. Chua, RespondentsMarifel LagareNo ratings yet

- Ehrentraud & Garcia (2020) - Managing The Winds of Change - Policy Responses To FintechDocument8 pagesEhrentraud & Garcia (2020) - Managing The Winds of Change - Policy Responses To FintechJeffersonNo ratings yet

- Money Vocabulary Quiz 40814Document2 pagesMoney Vocabulary Quiz 40814marin_m_o3084No ratings yet

- BCom Income Tax Procedure and PracticeDocument61 pagesBCom Income Tax Procedure and PracticeUjjwal Kandhawe100% (1)

- CCSF - Annual Salary Ordinance - 2010 - Aso 2009-2010 - 07-21-09Document219 pagesCCSF - Annual Salary Ordinance - 2010 - Aso 2009-2010 - 07-21-09prowagNo ratings yet

- Funds Flow AnalysisDocument54 pagesFunds Flow AnalysisSriram DivyaNo ratings yet

- Finance of Loan and Emi ProblemDocument6 pagesFinance of Loan and Emi ProblemPuducheri Yashwanth KumarNo ratings yet

- Observations of An Urban FrameworkDocument94 pagesObservations of An Urban FrameworkAnonymous YhthzGNo ratings yet

- 7 Tambunting Pawnshop v. Commissioner of Internal RevenueDocument4 pages7 Tambunting Pawnshop v. Commissioner of Internal RevenueChristian Edward CoronadoNo ratings yet

- Simple Interest and Simple Discount: Intended Learning OutcomesDocument3 pagesSimple Interest and Simple Discount: Intended Learning Outcomesmike guiamalNo ratings yet

- Order-205 of 2021Document18 pagesOrder-205 of 2021Sumit RaturiNo ratings yet

Solangon Vs Salazar PDF

Solangon Vs Salazar PDF

Uploaded by

kmanligoyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Solangon Vs Salazar PDF

Solangon Vs Salazar PDF

Uploaded by

kmanligoyCopyright:

Available Formats

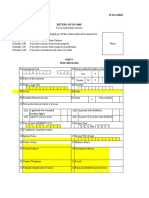

VOL.

360, JUNE 29, 2001 379

Solangon vs. Salazar

*

G.R. No. 125944. June 29, 2001.

SPOUSES DANILO SOLANGON and URSULA

SOLANGON, petitioners, vs. JOSE AVELINO SALAZAR,

respondent.

Actions; Appeals; In a petition for review under Rule 45 of the

1997 Rules of Civil Procedure, as amended, only questions of law

may be raised and they must be distinctly set forth; Findings of fact

of the lower courts (including the Court of Appeals) are final and

conclusive and will not be reviewed on appeal; Exceptions.·It is

readily apparent that petitioners are raising issues of fact in this

petition. In a petition for review under Rule 45 of the 1997 Rules of

Civil Procedure, as amended, only questions of law may be raised

and they must be distinctly set forth. The settled rule is that

findings of fact of the lower courts (including the Court of Appeals)

are final and conclusive and will not be reviewed on appeal except:

(1) when the conclusion is a finding grounded entirely on

speculation, surmises or conjectures; (2) when the inference made is

manifestly mistaken, absurd or impossible; (3) when there is grave

abuse of discretion; (4) when the judgment is based on a

misapprehension, of facts; (5) when the findings of facts are

conflicting; (6) when the Court of Appeals, in making its findings,

went beyond the issues of the case and such findings are contrary to

the admission of both appellant and appellee; (6) when the findings

of the Court of Appeals are contrary to those of the trial court; and

(7) when the findings of fact are conclusions without citation of

specific evidence on which they are based.

Usury Law; Interests; While the Usury Law ceiling on interest

rates was lifted by Central Bank (C.B.) Circular No. 905, nothing in

the said circular grants lenders carte blanche authority to raise

interest rates to levels which will either enslave their borrowers or

lead to a hemorrhaging of their assets.·The factual circumstances

of the present case require the application of a different

jurisprudential instruction. While the Usury Law ceiling on interest

rates was lifted by C.B. Circular No. 905, nothing in the said

circular grants lenders carte blanche authority to raise interest

rates to levels which will either enslave their borrowers or lead to a

hemorrhaging of their assets. In Medel v. Court of Appeals, this

Court had the occasion to rule on this question·whether or not the

stipulated rate of interest at 5.5% per month on a loan amounting

to P500,000.00 is usurious. While decreeing that the

aforementioned interest was not usurious,

_____________

* THIRD DIVISION.

380

380 SUPREME COURT REPORTS ANNOTATED

Solangon vs. Salazar

this Court held that the same must be equitably reduced for being

iniquitous, unconscionable and exorbitant.

Same; Same; A stipulated interest rate of 6% per month or 72%

per annum is definitely outrageous and inordinate·an interest of

12% per annum is deemed fair and reasonable.·In the case at

bench, petitioners stand on a worse situation. They are required to

pay the stipulated interest rate of 6% per month or 72% per annum

which is definitely outrageous and inordinate. Surely, it is more

consonant with justice that the said interest rate be reduced

equitably. An interest of 12% per annum is deemed fair and

reasonable.

PETITION for review on certiorari of a decision of the

Court of Appeals.

The facts are stated in the opinion of the Court.

Pedro Delgado Diwa for petitioners.

Ernesto P. Fernandez for private respondent.

SANDOVAL-GUTIERREZ, J.:

Petition for review on certiorari under Rule 45 of the 1997

Rules of Civil Procedure, as amended, of the decision of the

Court of Appeals in CA-G.R. CV No. 37899, affirming the

decision of the Regional Trial Court, Branch 16, Malolos,

Bulacan in Civil Case No. 375-M-91, „Spouses Danilo and

Ursula Solangon vs. Jose Avelino Salazar‰ for annulment of

mortgage. The dispositive portion of the RTC decision

reads:

„WHEREFORE, judgment is hereby rendered against the plaintiffs

in favor of the defendant Salazar, as follows:

1. Ordering the dismissal of the complaint;

2. Ordering the dissolution of the preliminary injunction

issued on July 8, 1991;

3. Ordering the plaintiffs to pay the defendant the amount of

P10,000.00 by way of attorneyÊs fees; and

4. To pay the costs.

381

VOL. 360, JUNE 29, 2001 381

Solangon vs. Salazar

1

SO ORDERED.‰

The facts as summarized by the Court of Appeals in its

decision being challenged are:

„On August 22, 1986, the plaintiffs-appellants executed a deed or

real estate mortgage in which they mortgaged a parcel of land

situated in-Sta. Maria, Bulacan, in favor of the defendant-appellee,

to secure payment of a loan of P60,000.00 payable within a period of

four (4) months, with interest thereon at the rate of 6% per month

(Exh. „B‰).

On May 27, 1987, the plaintiffs-appellants executed a deed of

real estate mortgage in which they mortgaged the same parcel of

land to the defendant-appellee, to secure payment of a loan of

P136,512.00, payable within a period of one (1) year with interest

thereon at the legal rate (Exh. „1‰).

On December 29, 1990, the plaintiffs-appellants executed a deed

of real estate mortgage in which they mortgaged the same parcel of

land in favor of defendant-appellee, to secure payment of a loan in

the amount of P230,000.00 payable within a period of four (4)

months, with interest thereon at the legal rate (Exh. „2,‰ Exh. „C‰).

This action was initiated by the plaintiffs-appellants to prevent

the foreclosure of the mortgaged property. They alleged that they

obtained only one loan from the defendant-appellee, and that was

for the amount of P60,000.00, the payment of which was secured by

the first of the above-mentioned mortgages. The subsequent

mortgages were merely continuations of the first one, which is null

and void because it provided for unconscionable rate of interest.

Moreover, the defendant-appellee assured them that he will not

foreclose the mortgage as long as they pay the stipulated interest

upon maturity or within a reasonable time thereafter. They have

already paid the defendant-appellee P78,000.00 and tendered

P47,000.00 more, but the latter has initiated foreclosure

proceedings for their alleged failure to pay the loan P230,000.00

plus interest.

On the other hand, the defendant-appellee Jose Avelino Salazar

claimed that the above-described mortgages were executed to secure

three separate loans of P60,000.00, P136,512.00 and P230,000.00,

and that the first two loans were paid, but the last one, was not. He

denied having represented that he will not foreclose the mortgage

as long as the plaintiffs-appellants pay interest.‰

_____________

1 Rollo, p. 85.

382

382 SUPREME COURT REPORTS ANNOTATED

Solangon vs. Salazar

In the petition, spouses Danilo and Ursula Solangon

ascribe to the Court of Appeals the following errors:

1. The Court of Appeals erred in holding that three (3)

mortgage contracts were executed by the parties

instead of one (1);

2. The Court of Appeals erred in ruling that a loan

obligation secured by a real estate mortgage with

an interest of 72% per cent per annum or 6% per

month is not unconscionable;

3. The Court of Appeals erred in holding that the loan

of P136,512.00 HAS NOT BEEN PAID when the

mortgagee himself states in his ANSWER that the

same was already paid; and

4. The Court of Appeals erred in not resolving the

SPECIFIC ISSUES raised by the appellants.

In his comment, respondent Jose Avelino Salazar avers

that the petition should not be given due course as it raises

questions of facts which are not allowed in a petition for

review on certiorari.

We find no merit in the instant petition.

The core of the present controversy is the validity of the

third contract of mortgage which was foreclosed.

Petitioners contend that they obtained from respondent

Avelino Salazar only one (1) loan in the amount of

P60,000.00 secured by the first mortgage of August 1986.

According to them, they signed the third mortgage contract

in view of respondentÊs assurance that the same will not be

foreclosed. The trial court, which is in the best position to

evaluate the evidence presented before it, did not give

credence to petitionersÊ corroborated testimony and ruled:

„The testimony is improbable, The real estate mortgage was signed

not only by Ursula Solangon but also by her husband including the

Promissory Note appended to it. Signing a document without

knowing its contents is contrary to common experience. The

uncorroborated testimony of Ursula Solangon cannot be given

2

weight.‰

Petitioners likewise insist that, contrary to the finding of

the Court of Appeals, they had paid the amount of

P136,512.00, or the

_____________

2 Decision, p, 6; Rollo, 83.

383

VOL. 360, JUNE 29, 2001 383

Solangon vs. Salazar

second loan. In fact, such payment was confirmed by

respondent Salazar in his answer to their complaint.

It is readily apparent that petitioners are raising issues

of fact in this petition. In a petition for review under Rule

45 of the 1997 Rules of Civil Procedure, as amended, only

questions of law may be raised and they must be distinctly

set forth. The settled rule is that findings of fact of the

lower courts (including the Court of Appeals) are final and

conclusive and will not be reviewed on appeal except: (1)

when the conclusion is a finding grounded entirely on

speculation, surmises or conjectures; (2) when the inference

made is manifestly mistaken, absurd or impossible; (3)

when there is grave abuse of discretion; (4) when the

judgment is based on a misapprehension of facts; (5) when

the findings of facts are conflicting; (6) when the Court of

Appeals, in making its findings, went beyond the issues of

the case and such findings are contrary to the admission of

both appellant and appellee; (6) when the findings of the

Court of Appeals are contrary to those of the trial court;

and (7) when the findings of fact are conclusions without

3

citation of specific evidence on which they are based.

None of these instances are extant in the present case.

Parenthetically, petitioners are questioning the rate of

interest involved here. They maintain that the Court of

Appeals erred in decreeing that the stipulated interest rate

of 72% per annum or 6% per month is not unconscionable.

The Court of Appeals, in sustaining the stipulated

interest rate, ratiocinated that since the Usury Law had

been repealed by Central Bank Circular No. 905 there is no

more maximum rate of interest and the rate will just

depend on the mutual agreement of the parties. Obviously,

this was in consonance 4

with our ruling in Liam Law v.

Olympic Sawmill Co.

______________

3 Republic vs. Court of Appeals, 258 SCRA 712 (1996).

4 129 SCRA 439 (1984).

„Moreover, for sometime now, usury has been legally nonexistent. Interest can

now be charged as lender and borrower may agree upon. This rules of Court in

regards to allegations of usury, procedural in nature, should be considered

repealed with retroactive effect.‰

384

384 SUPREME COURT REPORTS ANNOTATED

Solangon vs. Salazar

The factual circumstances of the present case require the

application of a different jurisprudential instruction. While

the Usury Law ceiling on interest rates was lifted by C.B.

Circular No. 905, nothing in the said circular grants

lenders carte blanche authority to raise interest rates to

levels which will either enslave their

5

borrowers or lead to a

hemorrhaging

6

of their assets. In Medel v. Court of

Appeals, this Court had the occasion to rule on this

question·whether or not the stipulated rate of interest at

5.5% per month on a loan amounting to P500,000.00 is

usurious. While decreeing that the aforementioned interest

was not usurious, this Court held that the same must be

equitably reduced for being iniquitous, unconscionable and

exorbitant, thus:

„We agree with petitioners that the stipulated rate of interest at 5.5%

per month on the P500,000.00 loan is excessive, iniquitous,

unconscionable and exorbitant. However, we can not consider the

rate ÂusuriousÊ because this Court has consistently held that

Circular No. 905 of the Central Bank, adopted on December 22,

1982, has expressly removed the interest ceilings prescribed by the

Usury Law and that the Usury Law is now legally inexistent.Ê

In Security Bank and Trust Company vs. Regional Trial Court of

Makati, Branch 61 the Court held that CB Circular No. 905 did not

repeal nor in any way amend the Usury Law but simply suspended

the latterÊs effectivity. Indeed, we have held that Âa Central Bank

Circular can not repeal a law. Only a law can repeal another law. In

the recent case of Florendo v. Court of Appeals, the Court reiterated

the ruling that Âby virtue of CB Circular 905, the Usury Law has

been rendered ineffective.Ê ÂUsury Law has been legally non-existent

in our jurisdiction. Interest can now be charged as lender and

borrower may agree upon.Ê

Nevertheless, we find the interest at 5.5% per month, or 66% per

annum, stipulated upon by the parties in the promissory note

iniquitous or unconscionable, and hence, contrary to morals (Âcontra

bonos moresÊ), if not against the law. The stipulation is void. The

courts shall reduce equitably liquidated damages, whether intended

as an indemnity or a penalty if they are iniquitous or

unconscionable.‰ (Emphasis supplied)

______________

5 Almeda v. Court of Appeals, 256 SCRA 292 (1996).

6 299 SCRA 481 (1998).

385

VOL. 360, JUNE 29, 2001 385

Solangon vs. Salazar

In the case at bench, petitioners stand on a worse situation.

They are required to pay the stipulated interest rate of 6%

per month or 72% per annum which is definitely

outrageous and inordinate. Surely, it is more consonant

with justice that the said interest rate be reduced

equitably. An interest of 12% per annum is deemed fair and

reasonable.

WHEREFORE, the appealed decision of the Court of

Appeals is AFFIRMED, subject to the MODIFICATION

that the interest rate of 72% per annum is ordered reduced

to 12% per annum.

SO ORDERED.

Melo (Chairman), Vitug, Panganiban and Gonzaga-

Reyes, JJ., concur.

Judgment affirmed with modification.

Notes.·Lending money at usurious rates of interest is

specifically listed as ground for disciplinary action. (RTC

Makati Movement Against Graft and Corruption vs.

Dumlao, 247 SCRA 108 [1995])

C.B. Circular No. 905 could not be properly invoked to

justify the escalation clauses requiring that the increase be

„within the limits allowed by law,‰ such circular not being a

grant of specific authority. (Almeda vs. Court of Appeals,

256 SCRA 292 [1996])

A stipulated rate of interest at 5.5% per month on a

P500,000.00 loan is excessive, iniquitous, unconscionable

and exorbitant. The Usury Law is now „legally inexistent.‰

(Medel vs. Court of Appeals, 299 SCRA 481 [1998])

··o0o··

386

© Copyright 2017 Central Book Supply, Inc. All rights reserved.

You might also like

- For Those of Us With Thick SkullsDocument40 pagesFor Those of Us With Thick SkullsPhillip Stilley100% (4)

- 8 Microfinance Lending ModelsDocument12 pages8 Microfinance Lending Modelsanamikabhoumik100% (12)

- Castro vs. TanDocument11 pagesCastro vs. TanRegion 6 MTCC Branch 3 Roxas City, CapizNo ratings yet

- Sps. Castro Vs - TanDocument12 pagesSps. Castro Vs - TanJhonrey LalagunaNo ratings yet

- Classification of Property and Ownership Case Digest - CHAM UpdatedDocument26 pagesClassification of Property and Ownership Case Digest - CHAM Updatedmelaniem_1No ratings yet

- Fortune Motors Corp. vs. CADocument11 pagesFortune Motors Corp. vs. CAStefan SalvatorNo ratings yet

- Selected Decisions of Human Rights Committee, 8Document434 pagesSelected Decisions of Human Rights Committee, 8Oliullah Laskar100% (1)

- Press Release by Ogden CityDocument2 pagesPress Release by Ogden CityMcKenzie StaufferNo ratings yet

- Case 95 Royal Plant Workers Union v. Coca-Cola Bottlers Philippines, IncDocument2 pagesCase 95 Royal Plant Workers Union v. Coca-Cola Bottlers Philippines, Incbernadeth ranolaNo ratings yet

- 86 Broadway Centrum Condominium Corp. v. Tropical Hut - DIGESTDocument2 pages86 Broadway Centrum Condominium Corp. v. Tropical Hut - DIGESTAllen Windel BernabeNo ratings yet

- Dino V CA Case DigestDocument2 pagesDino V CA Case DigestZirk TanNo ratings yet

- In Re - Atty. Rufillo D. BucanaDocument6 pagesIn Re - Atty. Rufillo D. BucanacanyoumovemeNo ratings yet

- Francisco Lao Lim vs. CA, G.R. No. 87047, October 31, 1990Document4 pagesFrancisco Lao Lim vs. CA, G.R. No. 87047, October 31, 1990Fides DamascoNo ratings yet

- Broadway Vs Tropical Hut DigestDocument2 pagesBroadway Vs Tropical Hut DigestCarl AngeloNo ratings yet

- 30-Board of Assessment Appeal Q.C. vs. Meralco, 10 SCRA 68Document4 pages30-Board of Assessment Appeal Q.C. vs. Meralco, 10 SCRA 68Jopan SJNo ratings yet

- Underhill v. Hernandez, 168 U.S. 250 (1897)Document4 pagesUnderhill v. Hernandez, 168 U.S. 250 (1897)Scribd Government DocsNo ratings yet

- Domingo vs. CA 226 SCRA 572Document2 pagesDomingo vs. CA 226 SCRA 572RR FNo ratings yet

- Nicolas VdelnaciaDocument4 pagesNicolas VdelnaciaHollyhock MmgrzhfmNo ratings yet

- LegresDocument3 pagesLegresevflorendoNo ratings yet

- Rule 118: Pre - Trial: Criminal Procedure Notes (2013 - 2014) Atty. Tranquil SalvadorDocument3 pagesRule 118: Pre - Trial: Criminal Procedure Notes (2013 - 2014) Atty. Tranquil SalvadorRache GutierrezNo ratings yet

- Republic Act No. 9522 (Baseline Law)Document4 pagesRepublic Act No. 9522 (Baseline Law)Ciara Navarro100% (1)

- Khe Hong Cheng v. CA, 355 SCRA 701 (2001)Document4 pagesKhe Hong Cheng v. CA, 355 SCRA 701 (2001)Fides DamascoNo ratings yet

- Rule 112 DigestDocument8 pagesRule 112 DigestRufino Gerard MorenoNo ratings yet

- A - People Versus LamahangDocument4 pagesA - People Versus LamahangArcie LaconicoNo ratings yet

- PALMA GIL - Plasabas V Court of AppealsDocument8 pagesPALMA GIL - Plasabas V Court of AppealsLouis p100% (1)

- Luna v. EncarnacionDocument2 pagesLuna v. Encarnacionrichelle_orpilla5942No ratings yet

- Leviste Vs CADocument1 pageLeviste Vs CAEderic ApaoNo ratings yet

- Lim V GamosaDocument2 pagesLim V GamosaJohnNo ratings yet

- Telefast v. Castro, 158 SCRA 445 (1988)Document2 pagesTelefast v. Castro, 158 SCRA 445 (1988)Fides DamascoNo ratings yet

- Lotus Case (France v. Turkey) NFDocument31 pagesLotus Case (France v. Turkey) NFJereca Ubando JubaNo ratings yet

- Asylum Case Colombia v. Peru ICJ Reports 20 November 1950Document7 pagesAsylum Case Colombia v. Peru ICJ Reports 20 November 1950Alelojo, NikkoNo ratings yet

- Broadway Centrum v. Tropical HutDocument20 pagesBroadway Centrum v. Tropical HutChescaSeñeresNo ratings yet

- Development Bank V CA - GR L-109937 - Mar 21 1994Document4 pagesDevelopment Bank V CA - GR L-109937 - Mar 21 1994Jeremiah ReynaldoNo ratings yet

- Difference Relating To Immunity From Legal Process of A Special Rapporteur of The Commission of Human RightsDocument3 pagesDifference Relating To Immunity From Legal Process of A Special Rapporteur of The Commission of Human RightsAlljun Serenado0% (1)

- Treatment Aliens : Doctrine WithDocument5 pagesTreatment Aliens : Doctrine WithMika SantiagoNo ratings yet

- Construction Development Corp. v. EstrellaDocument7 pagesConstruction Development Corp. v. Estrellajetzon2022No ratings yet

- 29 - Lechugas v. CADocument2 pages29 - Lechugas v. CARan MendozaNo ratings yet

- Celestial v. CachoperoDocument23 pagesCelestial v. CachoperoRon Jacob AlmaizNo ratings yet

- Philippine National Bank Vs Lilibeth ChanDocument14 pagesPhilippine National Bank Vs Lilibeth ChanJoatham GenovisNo ratings yet

- Case Digests 1. Fabian Vs Desierto, GR No. 129742 Facts:: Petitioner's ArgumentDocument14 pagesCase Digests 1. Fabian Vs Desierto, GR No. 129742 Facts:: Petitioner's ArgumentJMXNo ratings yet

- WERR Corp. vs. Highlands Prime Inc. (G.R. No. 187543. February 08, 2017)Document4 pagesWERR Corp. vs. Highlands Prime Inc. (G.R. No. 187543. February 08, 2017)Random VidsNo ratings yet

- 305 Scra 721 DIGESTDocument2 pages305 Scra 721 DIGESTjodelle11No ratings yet

- Lemon v. Kurtzman, 403 U.S. 602 (1971)Document50 pagesLemon v. Kurtzman, 403 U.S. 602 (1971)Scribd Government DocsNo ratings yet

- Decision On SAJE MIGUEL MOLATO Et Al. v. JANN RAILEY E. MONTALANDocument9 pagesDecision On SAJE MIGUEL MOLATO Et Al. v. JANN RAILEY E. MONTALANAteneo Student Judicial CourtNo ratings yet

- Concept of StateDocument3 pagesConcept of StatebrittaNo ratings yet

- Philsat Case The Stairway To Becoming A LawyerDocument5 pagesPhilsat Case The Stairway To Becoming A LawyerPauline Eunice LobiganNo ratings yet

- National Power Corp. v. IbrahimDocument13 pagesNational Power Corp. v. Ibrahimjuju_batugalNo ratings yet

- Vinuya Vs RomuloDocument7 pagesVinuya Vs RomuloRica Corsica LazanaNo ratings yet

- 13 Sibayan Vs AldaDocument6 pages13 Sibayan Vs AldaAngelica Joyce BelenNo ratings yet

- Licuanan V Melo 170 SCRA 100 1989 Full TextDocument3 pagesLicuanan V Melo 170 SCRA 100 1989 Full TextAnthony De La CruzNo ratings yet

- Republic Vs CatubagDocument3 pagesRepublic Vs CatubagamazingmomNo ratings yet

- Magdalena Estates V RodriguezDocument2 pagesMagdalena Estates V RodriguezMartin Benjamin Tomelden LagmayNo ratings yet

- Adm. Case No. 1418. August 31, 1976. Jose Misamin, Complainant, vs. Attorney Miguel A. SAN JUAN, RespondentDocument6 pagesAdm. Case No. 1418. August 31, 1976. Jose Misamin, Complainant, vs. Attorney Miguel A. SAN JUAN, RespondentMarisse CastañoNo ratings yet

- Liang v. People, GR No.125865Document3 pagesLiang v. People, GR No.125865Ryan MostarNo ratings yet

- 20 Standard Chartered Vs Confesor ManaloDocument2 pages20 Standard Chartered Vs Confesor ManaloRabelais MedinaNo ratings yet

- LIM FILCRO Illegal RecruitmentDocument2 pagesLIM FILCRO Illegal RecruitmentVivienne Nicole LimNo ratings yet

- ExtraditionDocument37 pagesExtraditionjasper_T_TNo ratings yet

- Property: Ownership: Realty & Dev. Corp. V. Cruz 410 SCRA 484Document7 pagesProperty: Ownership: Realty & Dev. Corp. V. Cruz 410 SCRA 484Mikail Lee BelloNo ratings yet

- Conjugal Partnership of Gains (CPG)Document8 pagesConjugal Partnership of Gains (CPG)Cora NovusNo ratings yet

- Salita Vs MagtolisDocument1 pageSalita Vs MagtolisGretch MaryNo ratings yet

- JOSE AVELINO SALAZAR, Respondents. Sandoval-Gutierrez, J.Document3 pagesJOSE AVELINO SALAZAR, Respondents. Sandoval-Gutierrez, J.Mary Divina FranciscoNo ratings yet

- Solangon vs. SalazarDocument7 pagesSolangon vs. SalazarMary RoseNo ratings yet

- 5 National Steel V CADocument17 pages5 National Steel V CAkmanligoyNo ratings yet

- 3d Paper Flower Template PDFDocument1 page3d Paper Flower Template PDFkmanligoy100% (1)

- Deposits Part 1 Digest 2Document12 pagesDeposits Part 1 Digest 2kmanligoyNo ratings yet

- Laudato SiDocument1 pageLaudato SikmanligoyNo ratings yet

- Generally Considered Are The Following:: Unfair Labor Practice Guaranteed and Reliable Labor ContractorsDocument8 pagesGenerally Considered Are The Following:: Unfair Labor Practice Guaranteed and Reliable Labor ContractorskmanligoyNo ratings yet

- Omnibus Election Code of The PhilippinesDocument64 pagesOmnibus Election Code of The PhilippinesElfenLiedFanGirlNo ratings yet

- Labor Case DigestDocument8 pagesLabor Case DigestkmanligoyNo ratings yet

- Search and Seizures Case DigestsDocument23 pagesSearch and Seizures Case DigestsJustine Marie100% (1)

- Midterm Cases in PropertyDocument18 pagesMidterm Cases in PropertykmanligoyNo ratings yet

- People Vs FieldadDocument10 pagesPeople Vs FieldadkmanligoyNo ratings yet

- G.R. No. 150429Document5 pagesG.R. No. 150429kmanligoyNo ratings yet

- G.R. No. L-47722Document4 pagesG.R. No. L-47722kmanligoyNo ratings yet

- A.M. No. MTJ-92-706Document3 pagesA.M. No. MTJ-92-706kmanligoyNo ratings yet

- Nha vs. GuivelondoDocument3 pagesNha vs. GuivelondokmanligoyNo ratings yet

- G.R. No. 88211Document10 pagesG.R. No. 88211kmanligoyNo ratings yet

- Kabboudi: Problem NotesDocument7 pagesKabboudi: Problem NotesamanittaNo ratings yet

- Meredith Corporation Employees Fund For Better Government - 6099 - DR2 - SummaryDocument1 pageMeredith Corporation Employees Fund For Better Government - 6099 - DR2 - SummaryZach EdwardsNo ratings yet

- My Budget: Your Total IncomeDocument3 pagesMy Budget: Your Total Incomeyun3No ratings yet

- BLANK FORM Secretary's CertificateDocument3 pagesBLANK FORM Secretary's CertificateJulie SaltarinNo ratings yet

- Fider - ProblemSet1 (EngEco)Document7 pagesFider - ProblemSet1 (EngEco)TRICIA MARIE FIDERNo ratings yet

- Advances Process Managementat Citi Financial Mba Project ReportDocument96 pagesAdvances Process Managementat Citi Financial Mba Project ReportBabasab Patil (Karrisatte)No ratings yet

- A Decentralized, Uniswap-And Pancakeswap-Based, Algorithmic Margin Trading ProtocolDocument10 pagesA Decentralized, Uniswap-And Pancakeswap-Based, Algorithmic Margin Trading ProtocolRakesh SharmaNo ratings yet

- Oman Labour LawDocument23 pagesOman Labour LawAshok SureshNo ratings yet

- Fresh Start', A Big Challenge Facing The Microfinance IndustryDocument4 pagesFresh Start', A Big Challenge Facing The Microfinance IndustryVinod ChanrasekharanNo ratings yet

- VC Glossary Terms TLV PartnersDocument12 pagesVC Glossary Terms TLV PartnersAditya PatelNo ratings yet

- Stegner V StegnerDocument3 pagesStegner V StegnerLizzette Dela PenaNo ratings yet

- Artisanal Fisheries Promotion Project PDFDocument95 pagesArtisanal Fisheries Promotion Project PDFJege Leather AccessoriesNo ratings yet

- Perfast Corporation - NotesDocument9 pagesPerfast Corporation - NotesMCDABCNo ratings yet

- Expropriated Properties ActDocument9 pagesExpropriated Properties ActReal TrekstarNo ratings yet

- Reflective Essay - TVDocument21 pagesReflective Essay - TVAnthony MuchiriNo ratings yet

- It 11ga2016Document17 pagesIt 11ga2016shiblu39100% (1)

- Ram Narain Popli Vs Central Bureau of Investigation On 14 January, 2003Document124 pagesRam Narain Popli Vs Central Bureau of Investigation On 14 January, 2003Mahesh RawatNo ratings yet

- G.R. No. 184458 January 14, 2015 RODRIGO RIVERA, Petitioner, Spouses Salvador Chua and Violeta S. Chua, RespondentsDocument12 pagesG.R. No. 184458 January 14, 2015 RODRIGO RIVERA, Petitioner, Spouses Salvador Chua and Violeta S. Chua, RespondentsMarifel LagareNo ratings yet

- Ehrentraud & Garcia (2020) - Managing The Winds of Change - Policy Responses To FintechDocument8 pagesEhrentraud & Garcia (2020) - Managing The Winds of Change - Policy Responses To FintechJeffersonNo ratings yet

- Money Vocabulary Quiz 40814Document2 pagesMoney Vocabulary Quiz 40814marin_m_o3084No ratings yet

- BCom Income Tax Procedure and PracticeDocument61 pagesBCom Income Tax Procedure and PracticeUjjwal Kandhawe100% (1)

- CCSF - Annual Salary Ordinance - 2010 - Aso 2009-2010 - 07-21-09Document219 pagesCCSF - Annual Salary Ordinance - 2010 - Aso 2009-2010 - 07-21-09prowagNo ratings yet

- Funds Flow AnalysisDocument54 pagesFunds Flow AnalysisSriram DivyaNo ratings yet

- Finance of Loan and Emi ProblemDocument6 pagesFinance of Loan and Emi ProblemPuducheri Yashwanth KumarNo ratings yet

- Observations of An Urban FrameworkDocument94 pagesObservations of An Urban FrameworkAnonymous YhthzGNo ratings yet

- 7 Tambunting Pawnshop v. Commissioner of Internal RevenueDocument4 pages7 Tambunting Pawnshop v. Commissioner of Internal RevenueChristian Edward CoronadoNo ratings yet

- Simple Interest and Simple Discount: Intended Learning OutcomesDocument3 pagesSimple Interest and Simple Discount: Intended Learning Outcomesmike guiamalNo ratings yet

- Order-205 of 2021Document18 pagesOrder-205 of 2021Sumit RaturiNo ratings yet