Professional Documents

Culture Documents

ANNEX A-1 NEW PN FORM For New and Repeat Borrowers

ANNEX A-1 NEW PN FORM For New and Repeat Borrowers

Uploaded by

Kay RiveroCopyright:

Available Formats

You might also like

- Cochrane J. H. Asset Pricing Solution 2010Document34 pagesCochrane J. H. Asset Pricing Solution 2010ire04100% (3)

- SCSLA Multi 2014 - BlankDocument3 pagesSCSLA Multi 2014 - BlankElden Cunanan Bonilla88% (8)

- "Emma Zunz" Revisited. (01-MAR-07) The Romanic ReviewDocument8 pages"Emma Zunz" Revisited. (01-MAR-07) The Romanic ReviewEzequiel Rivas100% (1)

- Salary Loan Application Form: Name of Spouse: Age of Spouse: Occupation/Trade (Spouse)Document2 pagesSalary Loan Application Form: Name of Spouse: Age of Spouse: Occupation/Trade (Spouse)yolanda capati100% (2)

- LIC Superannuation Claim Form PDFDocument3 pagesLIC Superannuation Claim Form PDFManoj Mantri50% (2)

- Newfortis: Development Loan Application FormDocument2 pagesNewfortis: Development Loan Application FormJohn MitaruNo ratings yet

- Disclosure StatementDocument3 pagesDisclosure StatementEstrelita B. SantiagoNo ratings yet

- Loan Form and PN 2021Document2 pagesLoan Form and PN 2021tom10carandangNo ratings yet

- Form 135Document4 pagesForm 135TechnetNo ratings yet

- PF Advance ApplicationDocument2 pagesPF Advance ApplicationTarunKaranamNo ratings yet

- Neptune Loan Application FormDocument2 pagesNeptune Loan Application FormKelvin MulumbaNo ratings yet

- Application Form For ZakatDocument14 pagesApplication Form For ZakatYPI MalutNo ratings yet

- Vijana Baharia Loan Application Form FinalDocument9 pagesVijana Baharia Loan Application Form FinalkibeNo ratings yet

- BranchDocument3 pagesBranchKabir KhanNo ratings yet

- Loan Application FormDocument2 pagesLoan Application FormPalawan TeachersNo ratings yet

- Loan Application Form With CollateralDocument4 pagesLoan Application Form With CollateralIBP Bohol ChapterNo ratings yet

- Ameen MPMG Mandatory DocumentsDocument10 pagesAmeen MPMG Mandatory DocumentsFatima ShahidNo ratings yet

- Staff OD Application Format-Process-DocumentsDocument9 pagesStaff OD Application Format-Process-DocumentsSonu YadavNo ratings yet

- Bank of Baroda Education Form 135Document3 pagesBank of Baroda Education Form 135umesh78% (9)

- Union Share ApplicationDocument4 pagesUnion Share ApplicationBalasubramanyam M DNo ratings yet

- Policy On BolaDocument6 pagesPolicy On BolapaglaummisNo ratings yet

- DEMPCC Loan FormDocument2 pagesDEMPCC Loan FormMikko RamiraNo ratings yet

- GP Fund Enrollment FormDocument2 pagesGP Fund Enrollment Formmuhammad nazir60% (5)

- Policyloanapplicationform PDFDocument2 pagesPolicyloanapplicationform PDFEdgar Compala100% (1)

- New Loan Form WordDocument2 pagesNew Loan Form WordProvident Fund Bjmp67% (3)

- Application For Loan FillableDocument2 pagesApplication For Loan FillableRheon M JosephNo ratings yet

- DENALOANSCHEMESDocument4 pagesDENALOANSCHEMESHardikPatelNo ratings yet

- Application To Rent/Screening FeeDocument2 pagesApplication To Rent/Screening FeeAna CastroNo ratings yet

- HRCPC - Loan Application FormsDocument15 pagesHRCPC - Loan Application FormsAtul GuptaNo ratings yet

- F No - 135Document3 pagesF No - 135Treena Majumder SarkarNo ratings yet

- SBP Financing Scheme For Renewable Energy: RE-1 Refinance Application FormDocument10 pagesSBP Financing Scheme For Renewable Energy: RE-1 Refinance Application FormMuhammad Bilal QadirNo ratings yet

- Promissory NoteDocument2 pagesPromissory NoteRoselyn IgartaNo ratings yet

- Reschedule & Restructure (R&R) FormDocument3 pagesReschedule & Restructure (R&R) FormBryan ChongNo ratings yet

- Capitol Government Employees MultiDocument3 pagesCapitol Government Employees MultijakezyrusNo ratings yet

- Application For Grant of Advances PDFDocument3 pagesApplication For Grant of Advances PDFBilal SaleemNo ratings yet

- Gdfi Promissory NoteDocument2 pagesGdfi Promissory NoteLy M. LumapagNo ratings yet

- Form-Loan Express March 2015 PDFDocument3 pagesForm-Loan Express March 2015 PDFJesse Carredo0% (1)

- Jnri Credit 127 Corporation: Promissory NoteDocument3 pagesJnri Credit 127 Corporation: Promissory NoteEra gasperNo ratings yet

- Dccco Loan FormDocument2 pagesDccco Loan FormJane CA100% (3)

- Application Form - COCOLIFE HEALTHCARDDocument1 pageApplication Form - COCOLIFE HEALTHCARDkimidors143No ratings yet

- Loan Application: Annex 1Document18 pagesLoan Application: Annex 1NinoSawiranNo ratings yet

- Promissory Note OrigDocument2 pagesPromissory Note Origcarlo laguraNo ratings yet

- TCF Personal Unsecured Secured Loan Application FormDocument1 pageTCF Personal Unsecured Secured Loan Application FormMichael DavidNo ratings yet

- Renewal FormDocument2 pagesRenewal Formjojomancao046No ratings yet

- Payoff Statement Form: Loan InformationDocument2 pagesPayoff Statement Form: Loan InformationdelricedNo ratings yet

- Credit ApplicationDocument3 pagesCredit ApplicationALSIRAT CONTRACTINGNo ratings yet

- Provident Loan FormDocument3 pagesProvident Loan FormrobotmatinoNo ratings yet

- Hudco Niwas Home Loans: Individual Home Loan Application FormDocument4 pagesHudco Niwas Home Loans: Individual Home Loan Application FormMunganda pavan kumar KumarNo ratings yet

- Active Loan Form With SPADocument4 pagesActive Loan Form With SPANono AprilNo ratings yet

- Membership Application 2023 PDFDocument5 pagesMembership Application 2023 PDFPearl Hope Vestal BustamanteNo ratings yet

- PBC Disclosure StatementDocument2 pagesPBC Disclosure StatementJugger AfrondozaNo ratings yet

- PMJDY DocumentsDocument74 pagesPMJDY DocumentsDd DdNo ratings yet

- Personal Advantage Loan Form 1Document4 pagesPersonal Advantage Loan Form 1JOSEPHINE MAGBUTAYNo ratings yet

- PNP Nup Loan Application Form and Promissory NoteDocument2 pagesPNP Nup Loan Application Form and Promissory NoteEnteng Teng TengitsNo ratings yet

- Application For Crop InsuranceDocument1 pageApplication For Crop InsuranceMark Angelo Ebasco GofredoNo ratings yet

- Punjab & Sind Bank: Application For Vehicle LoanDocument13 pagesPunjab & Sind Bank: Application For Vehicle LoanJaggi GurpreetNo ratings yet

- Superannuation Withdrawal FormDocument5 pagesSuperannuation Withdrawal FormGaneshNo ratings yet

- Life Membership FormDocument1 pageLife Membership FormSheila Marie OmegaNo ratings yet

- 4 We Care Loan FormDocument2 pages4 We Care Loan FormJaneth ApatNo ratings yet

- Papf Application Form FinalDocument5 pagesPapf Application Form FinalOrolf BuansiNo ratings yet

- Land to Lots: How to Borrow Money You Don't Have to Pay Back and LAUNCH Master Planned CommunitiesFrom EverandLand to Lots: How to Borrow Money You Don't Have to Pay Back and LAUNCH Master Planned CommunitiesNo ratings yet

- How to Raise your Credit Score: Proven Strategies to Repair Your Credit Score, Increase Your Credit Score, Overcome Credit Card Debt and Increase Your Credit Limit Volume 3From EverandHow to Raise your Credit Score: Proven Strategies to Repair Your Credit Score, Increase Your Credit Score, Overcome Credit Card Debt and Increase Your Credit Limit Volume 3No ratings yet

- HR Manual Materials - 1Document26 pagesHR Manual Materials - 1Kay RiveroNo ratings yet

- Knowledge Management LectureDocument7 pagesKnowledge Management LectureKay RiveroNo ratings yet

- Knowledge Management ModelsDocument1 pageKnowledge Management ModelsKay RiveroNo ratings yet

- The ToriiDocument1 pageThe ToriiKay RiveroNo ratings yet

- Knowledge Management White PaperDocument7 pagesKnowledge Management White PaperKay Rivero100% (1)

- What Is Knowledge Management?Document17 pagesWhat Is Knowledge Management?Kay RiveroNo ratings yet

- KNOMAN SlidesDocument17 pagesKNOMAN SlidesKay RiveroNo ratings yet

- Knowledge Management LectureDocument6 pagesKnowledge Management LectureKay RiveroNo ratings yet

- Knowldege Management Midterms ExamDocument2 pagesKnowldege Management Midterms ExamKay RiveroNo ratings yet

- Knowledge Management ModelsDocument1 pageKnowledge Management ModelsKay RiveroNo ratings yet

- Knowledge Management Lecture 2Document14 pagesKnowledge Management Lecture 2Kay RiveroNo ratings yet

- Knowledge Management Lecture 01Document14 pagesKnowledge Management Lecture 01Kay RiveroNo ratings yet

- Knowledge Management Lecture 3Document12 pagesKnowledge Management Lecture 3Kay RiveroNo ratings yet

- Knowledge Management Lecture 7Document21 pagesKnowledge Management Lecture 7Kay RiveroNo ratings yet

- Knowledge Management Lecture 6Document22 pagesKnowledge Management Lecture 6Kay RiveroNo ratings yet

- Knowledge Management Lecture 4Document10 pagesKnowledge Management Lecture 4Kay RiveroNo ratings yet

- Knowledge Management Lecture 5Document7 pagesKnowledge Management Lecture 5Kay RiveroNo ratings yet

- City Government of Lamitan Donates To PNP - ArticleDocument2 pagesCity Government of Lamitan Donates To PNP - ArticleKay RiveroNo ratings yet

- President's ReportDocument6 pagesPresident's ReportKay RiveroNo ratings yet

- The Openid Connect Handbook v1Document45 pagesThe Openid Connect Handbook v1Juan Sebastian Romero FernandezNo ratings yet

- Feasibility Study Kelas CDocument94 pagesFeasibility Study Kelas CangelenesmangubatNo ratings yet

- Robinson, Jennifer - Cities in A World of CitiesDocument23 pagesRobinson, Jennifer - Cities in A World of CitiesCarina GomesNo ratings yet

- Keyboard Shortcuts in TallyPrime - 1Document15 pagesKeyboard Shortcuts in TallyPrime - 1perfect printNo ratings yet

- BSP CampDocument7 pagesBSP CampArleneTalledoNo ratings yet

- Tiefling Dungeon Crawl ClassicsDocument6 pagesTiefling Dungeon Crawl ClassicspopmiticNo ratings yet

- Historical Mortgage Rates - Averages and Trends From The 1970s To 2020 - ValuePenguinDocument11 pagesHistorical Mortgage Rates - Averages and Trends From The 1970s To 2020 - ValuePenguinGoKi VoregisNo ratings yet

- Ab 2015 Law NisheshDocument2 pagesAb 2015 Law NisheshAVANI MalhotraNo ratings yet

- PDF Sermon Notes - The Kingdom Authority and Power of Jesus (Luke 4-31-44)Document4 pagesPDF Sermon Notes - The Kingdom Authority and Power of Jesus (Luke 4-31-44)fergie45315100% (1)

- Problem Areas Analysis and Reflection On Disbarment CasesDocument7 pagesProblem Areas Analysis and Reflection On Disbarment CasesAl-kevin AmingNo ratings yet

- Edelweiss Pirates InfoDocument2 pagesEdelweiss Pirates InfoTheo ChingombeNo ratings yet

- Estate Tax Problems 2Document5 pagesEstate Tax Problems 2howaanNo ratings yet

- TOPIC 5 ch16 Dilutive Securities and EPSDocument16 pagesTOPIC 5 ch16 Dilutive Securities and EPSmahfuzNo ratings yet

- Obama Illinois Attorney RegistrationDocument2 pagesObama Illinois Attorney RegistrationPamela BarnettNo ratings yet

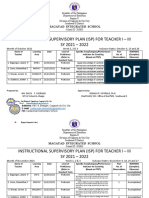

- ISP For Teacher 1Document25 pagesISP For Teacher 1Carlz BrianNo ratings yet

- Thesis Statement For Emersons Self RelianceDocument6 pagesThesis Statement For Emersons Self Relianceamandabarbergilbert100% (2)

- Citi Park For PHDocument49 pagesCiti Park For PHjefferson GuillemerNo ratings yet

- Joy To The World: That's Christmas To Me (Deluxe Edition)Document11 pagesJoy To The World: That's Christmas To Me (Deluxe Edition)RAQUEL IRENE ECHALAR ORTIZNo ratings yet

- N3 Osha 1994 2019Document123 pagesN3 Osha 1994 2019Suhaila JamaluddinNo ratings yet

- Hagerstown Community College Nursing 229 Clinical Prep CardDocument3 pagesHagerstown Community College Nursing 229 Clinical Prep CardBenNo ratings yet

- Erf FormsDocument2 pagesErf FormsstartonNo ratings yet

- 2015 SALN FormDocument3 pages2015 SALN FormMiamor NatividadNo ratings yet

- Template - Tender Management ProcessDocument9 pagesTemplate - Tender Management ProcessGryswolf0% (1)

- A Wave of Mergers and Buy-Outs Hits Uganda'S Corporate MarketDocument4 pagesA Wave of Mergers and Buy-Outs Hits Uganda'S Corporate MarketEdward BiryetegaNo ratings yet

- Socrates A Guide For The Perplexed PDFDocument196 pagesSocrates A Guide For The Perplexed PDFAndres Torres100% (3)

- Practice QuestionsDocument11 pagesPractice QuestionsMichaella PangilinanNo ratings yet

- US V Nagarwala Dismissal Order 11-20-18Document28 pagesUS V Nagarwala Dismissal Order 11-20-18Beverly Tran100% (1)

- Set of Tender Documents (On Line)Document14 pagesSet of Tender Documents (On Line)pyushgupta87No ratings yet

ANNEX A-1 NEW PN FORM For New and Repeat Borrowers

ANNEX A-1 NEW PN FORM For New and Repeat Borrowers

Uploaded by

Kay RiveroOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ANNEX A-1 NEW PN FORM For New and Repeat Borrowers

ANNEX A-1 NEW PN FORM For New and Repeat Borrowers

Uploaded by

Kay RiveroCopyright:

Available Formats

KASANYANGAN CENTER FOR COMMUNITY DEV’T. AND MICROFINANCE FOUNDATION, INC.

(KCCDMFI)

KCCDFI Building, MCLL Highway, Guiwan

Zamboanga City

Tel. No. 062 991 93 48

LOAN APPLICATION FORM (recent picture here)

Date of Application : ______________________________

Branch Name : ______________________________

Center Name : ______________________________ A/PN: __New; __Repeat

DATA PRIVACY CONSENT

In compliance with the requirements of the Data Privacy Act of 2012, I hereby agree and authorize Kasanyangan Center for Community Development and Microfinance Foundation, Inc.

(KCCDMFI) on the general use and sharing of information obtained from me in the course of my membership. These data, which include my personal and sensitive personal information, may

be collected, processed, stored, updated, or disclosed by the KCCDMFI (i) for legitimate purposes, (ii) to implement transactions which I have requested, allowed, or authorized, (iii) to offer and

provide new or related services of the KCCDMFI or other related government agencies, and, (iv) to comply with the KCCDMFI internal policies and its reporting obligations to governmental

authorities under applicable laws.

______________________________________ _______________________________

Signature over printed name Date and Place signed

I. BORROWER INFORMATION (IMPORMASYON UKOL SA APLIKANTE)

Name of Borrower: (Last Name) (First Name) (Middle Name) Home Address: (No. & Street, Barangay, City/Municipality, Province)

Mobile Phone Number:

II. LOAN INFORMATION (IMPORMASYON UKOL SA LOAN)

Loan Purpose: Loan Amount Applied:

Latest six (6) cycles loan acquired from KCCDMFI Loan Type:

Amount Cycle Amount Cycle RPA 6 NB RPA 3 mo. EDUC iCARE

1. 4. RPA 6 RB RPA 4 mo. HRL Corn Rice

RPA – 100k+ RPA Balik ACWA12 Vegetables Hogs (fattening)

2. 5. RPA – Sr. Centro ACWA12 – S Seaweeds Crabs (fattening)

3. 6. Loan Amount Approved: Date: Cycle:

Approved by: Date Amount Signature

Field Credit Officer:

Branch Manager:

Area Manager:

Field Operations Head:

COO / President:

III. PROMISSORY NOTE (PANANAGUTAN SA PAGKAKAUTANG)

I, Mr./Mrs./Ms. ________________________________________________, We as co-borrowers, hereby states that we fully understand the significance of this

promissory note and agrees to the liability/responsibility of paying the due amount in case the

of legal age, married to ___________________________________________________ borrower cannot pay its obligation to KCCDMFI.

with residence at ________________________________________________________ CO – BORROWERS:

hereby agrees that this statement is a confirmation that I/we have an outstanding loan 1. _______________________________________________ ____________________

Printed Name of Family Co – Borrower Signature

with KCCDMFI as follows:

1. Loan Amount : ₱____________________ 2. ________________________________________________ ____________________

2. Interest Rate in ______ months ________ % Printed Name of Family Co – Borrower Signature

Corresponding Amount : ₱___________________ 3. _______________________________________________ ____________________

3. Duration of payment: ____ months or _____weeks Printed Name of Neighbor/Friend Co – Borrower Signature

TOTAL DUE : ₱____________________

4. _______________________________________________ ____________________

4. Loan Amortization : ₱ ________________ per week Printed Name of Center/Friend Co – Borrower Signature

CBU : ₱ ________________ per week

MBA : ₱ ________________ per week Witnessed by:

TOTAL WEEKLY AMORTIZATION : ₱ ________________________ ________________________________________________ ____________________

Printed Name of Center Chief / Center Official Signature

I promise to pay my weekly loan amortization including the CBU & MBA religiously and on time which will start on ________________________________ until the whole sum of principal and interest will be

fully paid on _______________________. As long as the interest is not fully paid, ownership – right of the assets acquired by the loan will belong to KCCDMFI. I will not transfer these assets to anybody under any

circumstances. Furthermore, should there be default in the payment, or diversion of the loan proceeds, the whole unpaid balance shall become due and demandable.

I promise to obey all rules and regulations in connection with the loan provided to me by KCCDMFI. I also promise to fully pay the loan even in the event of losses or damages of assets acquired from the

proceeds of the loan.

In case of default or overdue loan payments, I will voluntarily allow KCCDMFI to conduct “follow – up” in our house, pull – out property inside our house as my loan payment or sue me in the regular court

for non – payment of the loan. I further promise to pay any expenses incurred during the follow – up. No objection will be raised in this regard by my successors or me, and even if such objection is raised, will have no

validity in court. I/We, with my/our knowledge and freewill sign/s this promissory note.

____________________________________________ ____________________________________________

Signature of Borrower Signature of Husband

V. WAIVER (PAGPAPAUBAYA)

I hereby certify that all the information given are true and correct as to the best of my knowledge. That, I authorize you to verify and investigate it from whatever sources you may consider appropriate.

This authorization also allows said sources to furnish you information concerning my deposit accounts, placements or credit dealings and any other information that may be requested.

I understand that falsifying any information on the enclosed documents is sufficient ground for legal action and for rejection of my application. I understand that should my application be declined, KCCDMFI

has no obligation to furnish the reason for such rejection.

I hereby acknowledge and authorize the following: (1) the regular submission and disclosure of my basic credit data (as defined under RA No. 9510, or the Credit Information System Act, and its

Implementing Rules and Regulations) to the Credit Information Corporation (CIC), as well as any updates or corrections thereof; and (2) the sharing of my basic credit data with other lenders, as authorized by the CIC

and other credit reporting agencies duly accredited by the CIC; and for the sole purpose of establishing my credit worthiness.

__________________________________ __________________________

Borrower’s Signature over Printed Name Date

KCCDMFI Loan Application Form – Revised August 1, 2020

C A SH FLO W A N A LY SIS, CH A R AC TER A SSESSMEN T & PO V ER TY PR O B A B ILITY IN D EX

CASH IN – FLOWS ATTITUDE ASSESSMENT SCORE

Sources of Income Occupation Daily Weekly Monthly 1. Loyalty to KCCDMFI (0-3)

Income from Sales 2. Honesty (0-2)

Business 1 3. Behavior in the Center Meeting (0-1)

4. Respect and Courtesy (0-1)

Business 2

5. Interpersonal Relationship with co-members(0-1)

Business 3 6. Charitable/helpfulness/Generosity (0-1)

Total Business Income 7. Cooperation/ Sense of Volunteerism (0-1)

Household Income TOTAL SCORE

Salaries & Wages ATTITUDE RATE (total score÷10 x 100%)

Member

Husband LOAN APPROVAL COMPUTATION

Children

Repayment Rate (R) :______________ X 60% = ________

Pension Attitude Rate (A) :______________ X 40% = ________

Remittance Abroad Overall Performance Rate (R+A) = ________

Rental

Other income sources Approved Loan Amount

Total Household Income (Overall Performance Rate X loan Applied)

(A) TOTAL INCOME

CASH OUT – FLOWS 2015 Philippines PPI Scorecard for the National Poverty Line

Expenses Daily Weekly Monthly Points

Business Expenses Indicators Responses (National

Raw Materials/Purchases Poverty

Line)

Business 1 1. In which region does the family live? A. ARMM 0

Business 2 B. Ilocos 8

Business 3 C. Cagayan Valley 8

D. Central Luzon 6

Salaries & Wages E. Calabarzon 9

Rent F. Mimaropa 8

G. Western Mindanao 5

Water H. Bicol 4

Electricity I. Western Visayas 8

Fuel J. Central Visayas 4

K. Eastern Visayas 2

Transportation Expenses L. Northern Mindanao 0

Business Taxes & Licenses M. Southern Mindanao 6

N. Central Mindanao 2

Other Business Expenses O. NCR 12

(B) TOTAL BUSINESS EXPENSES P. CAR 7

Q. Caraga 0

Household Expenses 2. How many members are there in the A. 7 or more 0

Food family? (exclude members who are B. 5 or 6 9

overseas Filipinos)* C. 4 and below 18

Clothing

3. What is the highest grade completed by A. 6th grade of school or lower 0

House Rental/ Amortization the head of the family? B. Some high school 6

Transportation C. Completed high school 7

4. What type of construction materials are A. Light materials (cogon, nipa, anahaw), 0

Fuel the roofs made of? Salvaged/makeshift materials, Mixed but

Medical Expenses predominantly light materials, Mixed but

Charcoal/wood predominantly salvaged materials

Kerosene B. Mixed but predominantly strong materials 5

LPG

C. Strong materials (galvanized iron, 6

Communication aluminum, tile, concrete, brick, stone,

Water asbestos)

Electricity 5. What type of construction materials are A. Light materials (bamboo, sawali, cogon, 0

the outer walls made of? nipa, anahaw), Salvaged/makeshift

Other Household Expenses materials, Mixed but predominantly light

Education materials, Mixed but predominantly

salvaged materials

Tuition

Allowance B. Mixed but predominantly strong materials 7

Transportation C. Strong materials (galvanized iron, 8

Other Education Expenses aluminum, tile, concrete, brick, stone, wood,

plywood, asbestos)

Others 6. Is there any electricity in the A. No 0

Paluwagan/MFI building/house? B. Yes 7

Insurance Premium 7. What is the family's main source of A. Other 0

water supply?

Other Loan Payments B. Dug well 5

Other Expenses (please specify)

C. Own use, faucet, community water 10

system

(C) TOTAL HOUSEHOLD EXPENSES D. Own use, tubed/piped deep well or 7

Tubed/piped shallow well

(D) NET INCOME (A-B-C)

E. Shared, faucet, community water system 7

(E) Weekly equivalent of daily net income

(F) *Weekly equivalent of monthly net income F. Shared, tubed/piped deep well 6

*If the monthly net income is negative convert it to weekly but if the monthly 8. Does the family own a A. No 0

Refrigerator/freezer? B. Yes 13

Net Income is positive, assign zero to weekly equivalent of monthly net income. 9. Does the family own a television set? A. No 0

(G) TOTAL NET INCOME (Weekly Net Income + E + F) B. Yes 11

10. Does the family own a washing A. No 0

DEBT CAPACITY ANALYSIS SCORE machine? B. Yes 8

(H) Amount Available for Debt Service (G)

(I) Adjusted Debt Capacity (ADC) of 35% (ADC = H x 35%) PPI Score:

Conducted by:

_____________________________________

FIELD CREDIT OFFICER

(Signature over Printed Name)

Validated by:

__________________________________ _____________________________________________

Senior FCO and/or BRANCH MANAGER AREA MANAGER and/or FIELD OPERATONS HEAD

(Signature over Printed Name) (Signature over Printed Name)

KCCDMFI Loan Application Form – Revised August 1, 2020

You might also like

- Cochrane J. H. Asset Pricing Solution 2010Document34 pagesCochrane J. H. Asset Pricing Solution 2010ire04100% (3)

- SCSLA Multi 2014 - BlankDocument3 pagesSCSLA Multi 2014 - BlankElden Cunanan Bonilla88% (8)

- "Emma Zunz" Revisited. (01-MAR-07) The Romanic ReviewDocument8 pages"Emma Zunz" Revisited. (01-MAR-07) The Romanic ReviewEzequiel Rivas100% (1)

- Salary Loan Application Form: Name of Spouse: Age of Spouse: Occupation/Trade (Spouse)Document2 pagesSalary Loan Application Form: Name of Spouse: Age of Spouse: Occupation/Trade (Spouse)yolanda capati100% (2)

- LIC Superannuation Claim Form PDFDocument3 pagesLIC Superannuation Claim Form PDFManoj Mantri50% (2)

- Newfortis: Development Loan Application FormDocument2 pagesNewfortis: Development Loan Application FormJohn MitaruNo ratings yet

- Disclosure StatementDocument3 pagesDisclosure StatementEstrelita B. SantiagoNo ratings yet

- Loan Form and PN 2021Document2 pagesLoan Form and PN 2021tom10carandangNo ratings yet

- Form 135Document4 pagesForm 135TechnetNo ratings yet

- PF Advance ApplicationDocument2 pagesPF Advance ApplicationTarunKaranamNo ratings yet

- Neptune Loan Application FormDocument2 pagesNeptune Loan Application FormKelvin MulumbaNo ratings yet

- Application Form For ZakatDocument14 pagesApplication Form For ZakatYPI MalutNo ratings yet

- Vijana Baharia Loan Application Form FinalDocument9 pagesVijana Baharia Loan Application Form FinalkibeNo ratings yet

- BranchDocument3 pagesBranchKabir KhanNo ratings yet

- Loan Application FormDocument2 pagesLoan Application FormPalawan TeachersNo ratings yet

- Loan Application Form With CollateralDocument4 pagesLoan Application Form With CollateralIBP Bohol ChapterNo ratings yet

- Ameen MPMG Mandatory DocumentsDocument10 pagesAmeen MPMG Mandatory DocumentsFatima ShahidNo ratings yet

- Staff OD Application Format-Process-DocumentsDocument9 pagesStaff OD Application Format-Process-DocumentsSonu YadavNo ratings yet

- Bank of Baroda Education Form 135Document3 pagesBank of Baroda Education Form 135umesh78% (9)

- Union Share ApplicationDocument4 pagesUnion Share ApplicationBalasubramanyam M DNo ratings yet

- Policy On BolaDocument6 pagesPolicy On BolapaglaummisNo ratings yet

- DEMPCC Loan FormDocument2 pagesDEMPCC Loan FormMikko RamiraNo ratings yet

- GP Fund Enrollment FormDocument2 pagesGP Fund Enrollment Formmuhammad nazir60% (5)

- Policyloanapplicationform PDFDocument2 pagesPolicyloanapplicationform PDFEdgar Compala100% (1)

- New Loan Form WordDocument2 pagesNew Loan Form WordProvident Fund Bjmp67% (3)

- Application For Loan FillableDocument2 pagesApplication For Loan FillableRheon M JosephNo ratings yet

- DENALOANSCHEMESDocument4 pagesDENALOANSCHEMESHardikPatelNo ratings yet

- Application To Rent/Screening FeeDocument2 pagesApplication To Rent/Screening FeeAna CastroNo ratings yet

- HRCPC - Loan Application FormsDocument15 pagesHRCPC - Loan Application FormsAtul GuptaNo ratings yet

- F No - 135Document3 pagesF No - 135Treena Majumder SarkarNo ratings yet

- SBP Financing Scheme For Renewable Energy: RE-1 Refinance Application FormDocument10 pagesSBP Financing Scheme For Renewable Energy: RE-1 Refinance Application FormMuhammad Bilal QadirNo ratings yet

- Promissory NoteDocument2 pagesPromissory NoteRoselyn IgartaNo ratings yet

- Reschedule & Restructure (R&R) FormDocument3 pagesReschedule & Restructure (R&R) FormBryan ChongNo ratings yet

- Capitol Government Employees MultiDocument3 pagesCapitol Government Employees MultijakezyrusNo ratings yet

- Application For Grant of Advances PDFDocument3 pagesApplication For Grant of Advances PDFBilal SaleemNo ratings yet

- Gdfi Promissory NoteDocument2 pagesGdfi Promissory NoteLy M. LumapagNo ratings yet

- Form-Loan Express March 2015 PDFDocument3 pagesForm-Loan Express March 2015 PDFJesse Carredo0% (1)

- Jnri Credit 127 Corporation: Promissory NoteDocument3 pagesJnri Credit 127 Corporation: Promissory NoteEra gasperNo ratings yet

- Dccco Loan FormDocument2 pagesDccco Loan FormJane CA100% (3)

- Application Form - COCOLIFE HEALTHCARDDocument1 pageApplication Form - COCOLIFE HEALTHCARDkimidors143No ratings yet

- Loan Application: Annex 1Document18 pagesLoan Application: Annex 1NinoSawiranNo ratings yet

- Promissory Note OrigDocument2 pagesPromissory Note Origcarlo laguraNo ratings yet

- TCF Personal Unsecured Secured Loan Application FormDocument1 pageTCF Personal Unsecured Secured Loan Application FormMichael DavidNo ratings yet

- Renewal FormDocument2 pagesRenewal Formjojomancao046No ratings yet

- Payoff Statement Form: Loan InformationDocument2 pagesPayoff Statement Form: Loan InformationdelricedNo ratings yet

- Credit ApplicationDocument3 pagesCredit ApplicationALSIRAT CONTRACTINGNo ratings yet

- Provident Loan FormDocument3 pagesProvident Loan FormrobotmatinoNo ratings yet

- Hudco Niwas Home Loans: Individual Home Loan Application FormDocument4 pagesHudco Niwas Home Loans: Individual Home Loan Application FormMunganda pavan kumar KumarNo ratings yet

- Active Loan Form With SPADocument4 pagesActive Loan Form With SPANono AprilNo ratings yet

- Membership Application 2023 PDFDocument5 pagesMembership Application 2023 PDFPearl Hope Vestal BustamanteNo ratings yet

- PBC Disclosure StatementDocument2 pagesPBC Disclosure StatementJugger AfrondozaNo ratings yet

- PMJDY DocumentsDocument74 pagesPMJDY DocumentsDd DdNo ratings yet

- Personal Advantage Loan Form 1Document4 pagesPersonal Advantage Loan Form 1JOSEPHINE MAGBUTAYNo ratings yet

- PNP Nup Loan Application Form and Promissory NoteDocument2 pagesPNP Nup Loan Application Form and Promissory NoteEnteng Teng TengitsNo ratings yet

- Application For Crop InsuranceDocument1 pageApplication For Crop InsuranceMark Angelo Ebasco GofredoNo ratings yet

- Punjab & Sind Bank: Application For Vehicle LoanDocument13 pagesPunjab & Sind Bank: Application For Vehicle LoanJaggi GurpreetNo ratings yet

- Superannuation Withdrawal FormDocument5 pagesSuperannuation Withdrawal FormGaneshNo ratings yet

- Life Membership FormDocument1 pageLife Membership FormSheila Marie OmegaNo ratings yet

- 4 We Care Loan FormDocument2 pages4 We Care Loan FormJaneth ApatNo ratings yet

- Papf Application Form FinalDocument5 pagesPapf Application Form FinalOrolf BuansiNo ratings yet

- Land to Lots: How to Borrow Money You Don't Have to Pay Back and LAUNCH Master Planned CommunitiesFrom EverandLand to Lots: How to Borrow Money You Don't Have to Pay Back and LAUNCH Master Planned CommunitiesNo ratings yet

- How to Raise your Credit Score: Proven Strategies to Repair Your Credit Score, Increase Your Credit Score, Overcome Credit Card Debt and Increase Your Credit Limit Volume 3From EverandHow to Raise your Credit Score: Proven Strategies to Repair Your Credit Score, Increase Your Credit Score, Overcome Credit Card Debt and Increase Your Credit Limit Volume 3No ratings yet

- HR Manual Materials - 1Document26 pagesHR Manual Materials - 1Kay RiveroNo ratings yet

- Knowledge Management LectureDocument7 pagesKnowledge Management LectureKay RiveroNo ratings yet

- Knowledge Management ModelsDocument1 pageKnowledge Management ModelsKay RiveroNo ratings yet

- The ToriiDocument1 pageThe ToriiKay RiveroNo ratings yet

- Knowledge Management White PaperDocument7 pagesKnowledge Management White PaperKay Rivero100% (1)

- What Is Knowledge Management?Document17 pagesWhat Is Knowledge Management?Kay RiveroNo ratings yet

- KNOMAN SlidesDocument17 pagesKNOMAN SlidesKay RiveroNo ratings yet

- Knowledge Management LectureDocument6 pagesKnowledge Management LectureKay RiveroNo ratings yet

- Knowldege Management Midterms ExamDocument2 pagesKnowldege Management Midterms ExamKay RiveroNo ratings yet

- Knowledge Management ModelsDocument1 pageKnowledge Management ModelsKay RiveroNo ratings yet

- Knowledge Management Lecture 2Document14 pagesKnowledge Management Lecture 2Kay RiveroNo ratings yet

- Knowledge Management Lecture 01Document14 pagesKnowledge Management Lecture 01Kay RiveroNo ratings yet

- Knowledge Management Lecture 3Document12 pagesKnowledge Management Lecture 3Kay RiveroNo ratings yet

- Knowledge Management Lecture 7Document21 pagesKnowledge Management Lecture 7Kay RiveroNo ratings yet

- Knowledge Management Lecture 6Document22 pagesKnowledge Management Lecture 6Kay RiveroNo ratings yet

- Knowledge Management Lecture 4Document10 pagesKnowledge Management Lecture 4Kay RiveroNo ratings yet

- Knowledge Management Lecture 5Document7 pagesKnowledge Management Lecture 5Kay RiveroNo ratings yet

- City Government of Lamitan Donates To PNP - ArticleDocument2 pagesCity Government of Lamitan Donates To PNP - ArticleKay RiveroNo ratings yet

- President's ReportDocument6 pagesPresident's ReportKay RiveroNo ratings yet

- The Openid Connect Handbook v1Document45 pagesThe Openid Connect Handbook v1Juan Sebastian Romero FernandezNo ratings yet

- Feasibility Study Kelas CDocument94 pagesFeasibility Study Kelas CangelenesmangubatNo ratings yet

- Robinson, Jennifer - Cities in A World of CitiesDocument23 pagesRobinson, Jennifer - Cities in A World of CitiesCarina GomesNo ratings yet

- Keyboard Shortcuts in TallyPrime - 1Document15 pagesKeyboard Shortcuts in TallyPrime - 1perfect printNo ratings yet

- BSP CampDocument7 pagesBSP CampArleneTalledoNo ratings yet

- Tiefling Dungeon Crawl ClassicsDocument6 pagesTiefling Dungeon Crawl ClassicspopmiticNo ratings yet

- Historical Mortgage Rates - Averages and Trends From The 1970s To 2020 - ValuePenguinDocument11 pagesHistorical Mortgage Rates - Averages and Trends From The 1970s To 2020 - ValuePenguinGoKi VoregisNo ratings yet

- Ab 2015 Law NisheshDocument2 pagesAb 2015 Law NisheshAVANI MalhotraNo ratings yet

- PDF Sermon Notes - The Kingdom Authority and Power of Jesus (Luke 4-31-44)Document4 pagesPDF Sermon Notes - The Kingdom Authority and Power of Jesus (Luke 4-31-44)fergie45315100% (1)

- Problem Areas Analysis and Reflection On Disbarment CasesDocument7 pagesProblem Areas Analysis and Reflection On Disbarment CasesAl-kevin AmingNo ratings yet

- Edelweiss Pirates InfoDocument2 pagesEdelweiss Pirates InfoTheo ChingombeNo ratings yet

- Estate Tax Problems 2Document5 pagesEstate Tax Problems 2howaanNo ratings yet

- TOPIC 5 ch16 Dilutive Securities and EPSDocument16 pagesTOPIC 5 ch16 Dilutive Securities and EPSmahfuzNo ratings yet

- Obama Illinois Attorney RegistrationDocument2 pagesObama Illinois Attorney RegistrationPamela BarnettNo ratings yet

- ISP For Teacher 1Document25 pagesISP For Teacher 1Carlz BrianNo ratings yet

- Thesis Statement For Emersons Self RelianceDocument6 pagesThesis Statement For Emersons Self Relianceamandabarbergilbert100% (2)

- Citi Park For PHDocument49 pagesCiti Park For PHjefferson GuillemerNo ratings yet

- Joy To The World: That's Christmas To Me (Deluxe Edition)Document11 pagesJoy To The World: That's Christmas To Me (Deluxe Edition)RAQUEL IRENE ECHALAR ORTIZNo ratings yet

- N3 Osha 1994 2019Document123 pagesN3 Osha 1994 2019Suhaila JamaluddinNo ratings yet

- Hagerstown Community College Nursing 229 Clinical Prep CardDocument3 pagesHagerstown Community College Nursing 229 Clinical Prep CardBenNo ratings yet

- Erf FormsDocument2 pagesErf FormsstartonNo ratings yet

- 2015 SALN FormDocument3 pages2015 SALN FormMiamor NatividadNo ratings yet

- Template - Tender Management ProcessDocument9 pagesTemplate - Tender Management ProcessGryswolf0% (1)

- A Wave of Mergers and Buy-Outs Hits Uganda'S Corporate MarketDocument4 pagesA Wave of Mergers and Buy-Outs Hits Uganda'S Corporate MarketEdward BiryetegaNo ratings yet

- Socrates A Guide For The Perplexed PDFDocument196 pagesSocrates A Guide For The Perplexed PDFAndres Torres100% (3)

- Practice QuestionsDocument11 pagesPractice QuestionsMichaella PangilinanNo ratings yet

- US V Nagarwala Dismissal Order 11-20-18Document28 pagesUS V Nagarwala Dismissal Order 11-20-18Beverly Tran100% (1)

- Set of Tender Documents (On Line)Document14 pagesSet of Tender Documents (On Line)pyushgupta87No ratings yet