Professional Documents

Culture Documents

Feature Contract

Feature Contract

Uploaded by

Tin RobisoCopyright:

Available Formats

You might also like

- Futures Trading Strategies: Enter and Exit the Market Like a Pro with Proven and Powerful Techniques For ProfitsFrom EverandFutures Trading Strategies: Enter and Exit the Market Like a Pro with Proven and Powerful Techniques For ProfitsRating: 1 out of 5 stars1/5 (1)

- Conserve Our Cultural IdentityDocument5 pagesConserve Our Cultural IdentityTin RobisoNo ratings yet

- Derivatives and Risk Management (2017)Document10 pagesDerivatives and Risk Management (2017)ashok kumar vermaNo ratings yet

- Submitted To Submitted By:-Mr. Amit Kumar Neha Deepak Harish Mohit KrishanDocument9 pagesSubmitted To Submitted By:-Mr. Amit Kumar Neha Deepak Harish Mohit KrishanrajatNo ratings yet

- Assignment 3 Sheeza RM 0036Document4 pagesAssignment 3 Sheeza RM 0036SHEZE RAJPOOTNo ratings yet

- Types of DerivativesDocument4 pagesTypes of DerivativesPriyadharshiniNo ratings yet

- What Are Derivative InstrumentsDocument7 pagesWhat Are Derivative Instrumentsदिल रिश्ता तेरा मेराNo ratings yet

- FD 04Document3 pagesFD 04sid1982No ratings yet

- Derivative 2-1Document9 pagesDerivative 2-1Abhijeet Gupta 1513No ratings yet

- Forward Contract Vs Futures ContractDocument4 pagesForward Contract Vs Futures ContractabdulwadoodansariNo ratings yet

- Characteristics of DerivativesDocument5 pagesCharacteristics of Derivativesdhirendra shuklaNo ratings yet

- What Are Futures and ForwardsDocument22 pagesWhat Are Futures and ForwardsMuneeza AzharNo ratings yet

- Unit IiDocument31 pagesUnit IiMister MarlegaNo ratings yet

- Financial Engineering - Futures, Forwards and SwapsDocument114 pagesFinancial Engineering - Futures, Forwards and Swapsqari saibNo ratings yet

- Futures and ForwardsDocument2 pagesFutures and ForwardsmariyahtodorovaNo ratings yet

- Introduction To Forwards & Futures: NotesDocument8 pagesIntroduction To Forwards & Futures: Notesamit pNo ratings yet

- Project On Futures and OptionsDocument19 pagesProject On Futures and Optionsaanu1234No ratings yet

- DifferencesDocument4 pagesDifferencesPratik BanerjeeNo ratings yet

- Financial DerivativesDocument2 pagesFinancial Derivativesm.shehrooz23No ratings yet

- Cfa Derivados-Word: DeliveryDocument5 pagesCfa Derivados-Word: DeliverySebastian Ramirez MoranNo ratings yet

- Common Derivative ContractDocument7 pagesCommon Derivative ContractMd. Saiful IslamNo ratings yet

- Module-2 Future and Forward ContractDocument8 pagesModule-2 Future and Forward ContractNamrathaNo ratings yet

- Delivery PriceDocument29 pagesDelivery PricePremendra SahuNo ratings yet

- Classification of Securities-1Document9 pagesClassification of Securities-1prity krishnaNo ratings yet

- Structure of Forward and Future MarketsDocument27 pagesStructure of Forward and Future MarketsAkhileshwari AsamaniNo ratings yet

- Derivatives Concepts: What Is A Derivative?Document5 pagesDerivatives Concepts: What Is A Derivative?Fatma AbdelRehiemNo ratings yet

- Price in Cash - Price of Futures Contract BasisDocument2 pagesPrice in Cash - Price of Futures Contract BasisAli KhanNo ratings yet

- Derivatives: Cash Flows Securities AssetsDocument63 pagesDerivatives: Cash Flows Securities AssetsAaron RosalesNo ratings yet

- Risk Management - Future and Forward - pptx-1Document20 pagesRisk Management - Future and Forward - pptx-1peiqi chaiNo ratings yet

- Strategies in Stock MarketDocument30 pagesStrategies in Stock Marketaddi05No ratings yet

- HEDGINGDocument1 pageHEDGINGSonam KusNo ratings yet

- Derivatives IsmDocument2 pagesDerivatives IsmRupjeet DasNo ratings yet

- DerivativesDocument5 pagesDerivativesibong tiriritNo ratings yet

- DerivativesDocument18 pagesDerivativesJay Lord FlorescaNo ratings yet

- Derivatives Note SeminarDocument7 pagesDerivatives Note SeminarCA Vikas NevatiaNo ratings yet

- Gist Of Financial TermsDocument17 pagesGist Of Financial TermsSagar JadhavNo ratings yet

- Notes F.D. Unit - 2Document20 pagesNotes F.D. Unit - 2kamya saxenaNo ratings yet

- FD ReportDocument16 pagesFD ReportRudresh TrivediNo ratings yet

- Financial DerivativesDocument64 pagesFinancial DerivativesKirabpalNo ratings yet

- Forward and Futures MarketDocument51 pagesForward and Futures MarketHarsh DaniNo ratings yet

- Chapitre 11 - DerivativesDocument6 pagesChapitre 11 - DerivativesAxelNo ratings yet

- Derivatives and Risk Management: What Does Forward Contract MeanDocument9 pagesDerivatives and Risk Management: What Does Forward Contract MeanMd Hafizul HaqueNo ratings yet

- Type of F DerivativeDocument2 pagesType of F DerivativeJack TurnerNo ratings yet

- Risk Management in Future ContractsDocument4 pagesRisk Management in Future Contractsareesakhtar100% (1)

- ContractsDocument3 pagesContractsrohitpatel13No ratings yet

- Forwards & Futures: Prof Mahesh Kumar Amity Business SchoolDocument105 pagesForwards & Futures: Prof Mahesh Kumar Amity Business Schoolasifanis100% (1)

- Futures in Investment PortfolioDocument4 pagesFutures in Investment PortfolioAhmad Waqas DarNo ratings yet

- Before Commitment Commits You, Commit To The Commitment: Sundar B. N. Assistant Professor Coordinator ofDocument34 pagesBefore Commitment Commits You, Commit To The Commitment: Sundar B. N. Assistant Professor Coordinator ofH B SantoshNo ratings yet

- Introduction To DerivativesDocument4 pagesIntroduction To DerivativesMuhammad BilalNo ratings yet

- Advanced Financial ManagementDocument17 pagesAdvanced Financial ManagementJames M. HillNo ratings yet

- Derivatives Chapter2 EbookDocument17 pagesDerivatives Chapter2 EbookSaurabh GharatNo ratings yet

- Spot Contract: Delivery PriceDocument14 pagesSpot Contract: Delivery PriceSruthy RaviNo ratings yet

- Derivatives and Risk ManagementDocument17 pagesDerivatives and Risk ManagementDeepak guptaNo ratings yet

- Diff Forward and FuturesDocument3 pagesDiff Forward and FuturesPuja DuaNo ratings yet

- Differences Between Forward and FutureDocument3 pagesDifferences Between Forward and Futureanish-kc-8151No ratings yet

- Derivatives and Risk Management PDFDocument7 pagesDerivatives and Risk Management PDFYogesh GovindNo ratings yet

- Derivatives Futures ReportDocument17 pagesDerivatives Futures ReportKhushi ShahNo ratings yet

- Forward & Futures Forward & Futures Forward & FuturesDocument34 pagesForward & Futures Forward & Futures Forward & FuturesN ArunsankarNo ratings yet

- IFM Home AssignmentDocument6 pagesIFM Home AssignmentAnshita GargNo ratings yet

- Futures Contract FinalDocument6 pagesFutures Contract FinalSundus KhalidNo ratings yet

- Headquartered in The Capital City of ManilaDocument9 pagesHeadquartered in The Capital City of ManilaTin RobisoNo ratings yet

- Christine M. RobisoDocument2 pagesChristine M. RobisoTin RobisoNo ratings yet

- The Film Begins With The Exile of Jose Rizal in Dapitan Province of ZamboangaDocument4 pagesThe Film Begins With The Exile of Jose Rizal in Dapitan Province of ZamboangaTin RobisoNo ratings yet

- The Bachelor of Science in AccountancyDocument3 pagesThe Bachelor of Science in AccountancyTin RobisoNo ratings yet

- PLDT 01Document1 pagePLDT 01Tin RobisoNo ratings yet

- PLDT 02Document1 pagePLDT 02Tin RobisoNo ratings yet

- ACTIVITY 1 - Context CluesDocument1 pageACTIVITY 1 - Context CluesTin RobisoNo ratings yet

- International Trade & TheoryDocument1 pageInternational Trade & TheoryTin RobisoNo ratings yet

- Title of The AdDocument1 pageTitle of The AdTin RobisoNo ratings yet

- Briefly Explain The Eight Basic Characteristics of Good GovernanceDocument1 pageBriefly Explain The Eight Basic Characteristics of Good GovernanceTin RobisoNo ratings yet

- Bcom - Ch. 13Document26 pagesBcom - Ch. 13Tin Robiso100% (1)

- Career OpportunitiesDocument1 pageCareer OpportunitiesTin RobisoNo ratings yet

Feature Contract

Feature Contract

Uploaded by

Tin RobisoOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Feature Contract

Feature Contract

Uploaded by

Tin RobisoCopyright:

Available Formats

Feature Contracts

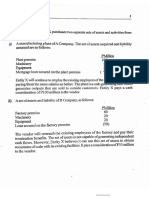

A futures contract is very similar to a forwards contract. The similarity lies in the fact that

futures contracts also mandate the sale of commodity at a future data but at a price which is

decided in the present.

However, futures contracts are listed on the exchange. This means that the exchange is an

intermediary. Hence, these contracts are of standard nature and the agreement cannot be

modified in any way. Exchange contracts come in a pre-decided format, pre-decided sizes and

have pre-decided expirations. Also, since these contracts are traded on the exchange they have

to follow a daily settlement procedure meaning that any gains or losses realized on this contract

on a given day have to be settled on that very day. This is done to negate the counterparty

credit risk.

An important point that needs to be mentioned is that in case of a futures contract, they buyer

and seller do not enter into an agreement with one another. Rather both of them enter into an

agreement with the exchange.

You might also like

- Futures Trading Strategies: Enter and Exit the Market Like a Pro with Proven and Powerful Techniques For ProfitsFrom EverandFutures Trading Strategies: Enter and Exit the Market Like a Pro with Proven and Powerful Techniques For ProfitsRating: 1 out of 5 stars1/5 (1)

- Conserve Our Cultural IdentityDocument5 pagesConserve Our Cultural IdentityTin RobisoNo ratings yet

- Derivatives and Risk Management (2017)Document10 pagesDerivatives and Risk Management (2017)ashok kumar vermaNo ratings yet

- Submitted To Submitted By:-Mr. Amit Kumar Neha Deepak Harish Mohit KrishanDocument9 pagesSubmitted To Submitted By:-Mr. Amit Kumar Neha Deepak Harish Mohit KrishanrajatNo ratings yet

- Assignment 3 Sheeza RM 0036Document4 pagesAssignment 3 Sheeza RM 0036SHEZE RAJPOOTNo ratings yet

- Types of DerivativesDocument4 pagesTypes of DerivativesPriyadharshiniNo ratings yet

- What Are Derivative InstrumentsDocument7 pagesWhat Are Derivative Instrumentsदिल रिश्ता तेरा मेराNo ratings yet

- FD 04Document3 pagesFD 04sid1982No ratings yet

- Derivative 2-1Document9 pagesDerivative 2-1Abhijeet Gupta 1513No ratings yet

- Forward Contract Vs Futures ContractDocument4 pagesForward Contract Vs Futures ContractabdulwadoodansariNo ratings yet

- Characteristics of DerivativesDocument5 pagesCharacteristics of Derivativesdhirendra shuklaNo ratings yet

- What Are Futures and ForwardsDocument22 pagesWhat Are Futures and ForwardsMuneeza AzharNo ratings yet

- Unit IiDocument31 pagesUnit IiMister MarlegaNo ratings yet

- Financial Engineering - Futures, Forwards and SwapsDocument114 pagesFinancial Engineering - Futures, Forwards and Swapsqari saibNo ratings yet

- Futures and ForwardsDocument2 pagesFutures and ForwardsmariyahtodorovaNo ratings yet

- Introduction To Forwards & Futures: NotesDocument8 pagesIntroduction To Forwards & Futures: Notesamit pNo ratings yet

- Project On Futures and OptionsDocument19 pagesProject On Futures and Optionsaanu1234No ratings yet

- DifferencesDocument4 pagesDifferencesPratik BanerjeeNo ratings yet

- Financial DerivativesDocument2 pagesFinancial Derivativesm.shehrooz23No ratings yet

- Cfa Derivados-Word: DeliveryDocument5 pagesCfa Derivados-Word: DeliverySebastian Ramirez MoranNo ratings yet

- Common Derivative ContractDocument7 pagesCommon Derivative ContractMd. Saiful IslamNo ratings yet

- Module-2 Future and Forward ContractDocument8 pagesModule-2 Future and Forward ContractNamrathaNo ratings yet

- Delivery PriceDocument29 pagesDelivery PricePremendra SahuNo ratings yet

- Classification of Securities-1Document9 pagesClassification of Securities-1prity krishnaNo ratings yet

- Structure of Forward and Future MarketsDocument27 pagesStructure of Forward and Future MarketsAkhileshwari AsamaniNo ratings yet

- Derivatives Concepts: What Is A Derivative?Document5 pagesDerivatives Concepts: What Is A Derivative?Fatma AbdelRehiemNo ratings yet

- Price in Cash - Price of Futures Contract BasisDocument2 pagesPrice in Cash - Price of Futures Contract BasisAli KhanNo ratings yet

- Derivatives: Cash Flows Securities AssetsDocument63 pagesDerivatives: Cash Flows Securities AssetsAaron RosalesNo ratings yet

- Risk Management - Future and Forward - pptx-1Document20 pagesRisk Management - Future and Forward - pptx-1peiqi chaiNo ratings yet

- Strategies in Stock MarketDocument30 pagesStrategies in Stock Marketaddi05No ratings yet

- HEDGINGDocument1 pageHEDGINGSonam KusNo ratings yet

- Derivatives IsmDocument2 pagesDerivatives IsmRupjeet DasNo ratings yet

- DerivativesDocument5 pagesDerivativesibong tiriritNo ratings yet

- DerivativesDocument18 pagesDerivativesJay Lord FlorescaNo ratings yet

- Derivatives Note SeminarDocument7 pagesDerivatives Note SeminarCA Vikas NevatiaNo ratings yet

- Gist Of Financial TermsDocument17 pagesGist Of Financial TermsSagar JadhavNo ratings yet

- Notes F.D. Unit - 2Document20 pagesNotes F.D. Unit - 2kamya saxenaNo ratings yet

- FD ReportDocument16 pagesFD ReportRudresh TrivediNo ratings yet

- Financial DerivativesDocument64 pagesFinancial DerivativesKirabpalNo ratings yet

- Forward and Futures MarketDocument51 pagesForward and Futures MarketHarsh DaniNo ratings yet

- Chapitre 11 - DerivativesDocument6 pagesChapitre 11 - DerivativesAxelNo ratings yet

- Derivatives and Risk Management: What Does Forward Contract MeanDocument9 pagesDerivatives and Risk Management: What Does Forward Contract MeanMd Hafizul HaqueNo ratings yet

- Type of F DerivativeDocument2 pagesType of F DerivativeJack TurnerNo ratings yet

- Risk Management in Future ContractsDocument4 pagesRisk Management in Future Contractsareesakhtar100% (1)

- ContractsDocument3 pagesContractsrohitpatel13No ratings yet

- Forwards & Futures: Prof Mahesh Kumar Amity Business SchoolDocument105 pagesForwards & Futures: Prof Mahesh Kumar Amity Business Schoolasifanis100% (1)

- Futures in Investment PortfolioDocument4 pagesFutures in Investment PortfolioAhmad Waqas DarNo ratings yet

- Before Commitment Commits You, Commit To The Commitment: Sundar B. N. Assistant Professor Coordinator ofDocument34 pagesBefore Commitment Commits You, Commit To The Commitment: Sundar B. N. Assistant Professor Coordinator ofH B SantoshNo ratings yet

- Introduction To DerivativesDocument4 pagesIntroduction To DerivativesMuhammad BilalNo ratings yet

- Advanced Financial ManagementDocument17 pagesAdvanced Financial ManagementJames M. HillNo ratings yet

- Derivatives Chapter2 EbookDocument17 pagesDerivatives Chapter2 EbookSaurabh GharatNo ratings yet

- Spot Contract: Delivery PriceDocument14 pagesSpot Contract: Delivery PriceSruthy RaviNo ratings yet

- Derivatives and Risk ManagementDocument17 pagesDerivatives and Risk ManagementDeepak guptaNo ratings yet

- Diff Forward and FuturesDocument3 pagesDiff Forward and FuturesPuja DuaNo ratings yet

- Differences Between Forward and FutureDocument3 pagesDifferences Between Forward and Futureanish-kc-8151No ratings yet

- Derivatives and Risk Management PDFDocument7 pagesDerivatives and Risk Management PDFYogesh GovindNo ratings yet

- Derivatives Futures ReportDocument17 pagesDerivatives Futures ReportKhushi ShahNo ratings yet

- Forward & Futures Forward & Futures Forward & FuturesDocument34 pagesForward & Futures Forward & Futures Forward & FuturesN ArunsankarNo ratings yet

- IFM Home AssignmentDocument6 pagesIFM Home AssignmentAnshita GargNo ratings yet

- Futures Contract FinalDocument6 pagesFutures Contract FinalSundus KhalidNo ratings yet

- Headquartered in The Capital City of ManilaDocument9 pagesHeadquartered in The Capital City of ManilaTin RobisoNo ratings yet

- Christine M. RobisoDocument2 pagesChristine M. RobisoTin RobisoNo ratings yet

- The Film Begins With The Exile of Jose Rizal in Dapitan Province of ZamboangaDocument4 pagesThe Film Begins With The Exile of Jose Rizal in Dapitan Province of ZamboangaTin RobisoNo ratings yet

- The Bachelor of Science in AccountancyDocument3 pagesThe Bachelor of Science in AccountancyTin RobisoNo ratings yet

- PLDT 01Document1 pagePLDT 01Tin RobisoNo ratings yet

- PLDT 02Document1 pagePLDT 02Tin RobisoNo ratings yet

- ACTIVITY 1 - Context CluesDocument1 pageACTIVITY 1 - Context CluesTin RobisoNo ratings yet

- International Trade & TheoryDocument1 pageInternational Trade & TheoryTin RobisoNo ratings yet

- Title of The AdDocument1 pageTitle of The AdTin RobisoNo ratings yet

- Briefly Explain The Eight Basic Characteristics of Good GovernanceDocument1 pageBriefly Explain The Eight Basic Characteristics of Good GovernanceTin RobisoNo ratings yet

- Bcom - Ch. 13Document26 pagesBcom - Ch. 13Tin Robiso100% (1)

- Career OpportunitiesDocument1 pageCareer OpportunitiesTin RobisoNo ratings yet