Professional Documents

Culture Documents

PI Industries Limited BSE 523642 Financials Ratios

PI Industries Limited BSE 523642 Financials Ratios

Uploaded by

Rehan TyagiOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PI Industries Limited BSE 523642 Financials Ratios

PI Industries Limited BSE 523642 Financials Ratios

Uploaded by

Rehan TyagiCopyright:

Available Formats

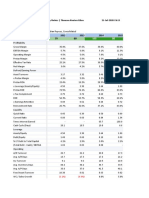

PI Industries Limited (BSE:523642) > Financials > Ratios

Restatement: Latest Filings Period Type: Annual

Order: Latest on Right Decimals: Capital IQ (Default)

Source: Capital IQ & Proprietar

Ratios

For the Fiscal Period Ending 12 months 12 months 12 months 12 months 12 months

Mar-31-2016 Mar-31-2017 Mar-31-2018 Mar-31-2019 Mar-31-2020

Profitability

Return on Assets % 13.2% 14.1% 10.4% 10.5% 9.8%

Return on Capital % 20.3% 19.6% 13.7% 14.0% 13.2%

Return on Equity % 30.1% 32.8% 20.7% 19.5% 18.6%

Return on Common Equity % 30.1% 32.8% 20.7% 19.5% 18.6%

Margin Analysis

Gross Margin % 44.3% 48.3% 47.3% 44.0% 43.7%

SG&A Margin % 11.2% 12.4% 13.4% 11.6% 11.1%

EBITDA Margin % 20.6% 24.2% 21.6% 20.3% 20.7%

EBITA Margin % 18.1% 21.1% 18.0% 17.1% 17.3%

EBIT Margin % 18.1% 21.1% 18.0% 17.1% 17.3%

Earnings from Cont. Ops Margin % 14.9% 20.2% 16.1% 14.4% 13.6%

Net Income Margin % 14.9% 20.2% 16.1% 14.4% 13.6%

Net Income Avail. for Common Margin % 14.9% 20.2% 16.1% 14.4% 13.6%

Normalized Net Income Margin % 12.1% 13.9% 12.6% 11.6% 11.4%

Levered Free Cash Flow Margin % (1.9%) 3.4% 2.9% (3.4%) (7.7%)

Unlevered Free Cash Flow Margin % (1.7%) 3.6% 3.0% (3.3%) (7.4%)

Asset Turnover

Total Asset Turnover 1.2x 1.1x 0.9x 1.0x 0.9x

Fixed Asset Turnover 2.7x 2.4x 2.2x 2.4x 2.0x

Accounts Receivable Turnover 5.3x 5.5x 4.7x 4.5x 4.5x

Inventory Turnover 3.0x 2.8x 2.7x 3.2x 2.8x

Short Term Liquidity

Current Ratio 1.6x 2.2x 2.4x 2.1x 1.8x

Quick Ratio 0.8x 1.2x 1.4x 1.2x 1.0x

Cash from Ops. to Curr. Liab. 0.6x 0.6x 0.5x 0.5x 0.6x

Avg. Days Sales Out. 69.0 66.9 77.5 80.9 80.5

Avg. Days Inventory Out. 121.1 128.1 134.4 113.3 128.9

Avg. Days Payable Out. 111.2 98.2 98.2 96.1 93.6

Avg. Cash Conversion Cycle 78.9 96.8 113.7 98.1 115.8

Long Term Solvency

Total Debt/Equity 12.9% 7.4% 4.3% 2.2% 21.7%

Total Debt/Capital 11.4% 6.9% 4.2% 2.1% 17.8%

LT Debt/Equity 10.5% 5.1% 2.4% 0.4% 16.5%

LT Debt/Capital 9.3% 4.7% 2.3% 0.4% 13.5%

Total Liabilities/Total Assets 39.9% 29.3% 26.7% 27.6% 38.0%

EBIT / Interest Exp. 42.1x 70.5x 82.2x 103.1x 34.6x

EBITDA / Interest Exp. 48.0x 81.1x 98.4x 122.5x 42.6x

(EBITDA-CAPEX) / Interest Exp. 12.3x 60.2x 64.5x 44.1x 2.5x

Total Debt/EBITDA 0.4x 0.2x 0.2x 0.1x 0.8x

Net Debt/EBITDA 0.2x NM NM NM 0.4x

Total Debt/(EBITDA-CAPEX) 1.4x 0.3x 0.3x 0.2x 13.7x

Net Debt/(EBITDA-CAPEX) 0.9x NM NM NM 7.3x

Altman Z Score 9.46 12.4 12.49 10.55 8.91

Growth Over Prior Year

Total Revenue 8.2% 8.6% 0.0% 24.8% 18.5%

Gross Profit 13.7% 18.5% (2.0%) 16.1% 17.7%

EBITDA 14.0% 27.8% (10.9%) 17.0% 21.1%

EBITA 14.7% 26.9% (14.5%) 17.9% 20.2%

EBIT 14.7% 26.9% (14.5%) 17.9% 19.9%

Earnings from Cont. Ops. 26.7% 47.5% (20.0%) 11.6% 11.3%

Net Income 26.7% 47.5% (20.0%) 11.6% 11.3%

Normalized Net Income 11.7% 25.2% (9.6%) 15.3% 15.8%

Diluted EPS before Extra 26.6% 47.1% (19.7%) 11.5% 11.3%

Accounts Receivable 4.1% 6.9% 24.3% 35.0% 4.7%

Inventory 4.4% 9.4% 4.6% 18.5% 49.1%

Net PP&E 42.4% 7.3% 6.4% 25.8% 47.8%

Total Assets 19.3% 18.1% 14.1% 20.1% 33.9%

Tangible Book Value 30.8% 38.7% 18.5% 18.6% 9.5%

Common Equity 30.6% 39.0% 18.3% 18.7% 14.6%

Cash from Ops. 99.2% (7.6%) (5.7%) 22.4% 78.6%

Capital Expenditures 90.1% (55.9%) 19.6% 117.1% 83.0%

Levered Free Cash Flow NM NM (14.9%) NM NM

Unlevered Free Cash Flow NM NM (15.5%) NM NM

Dividend per Share 24.0% 29.0% 0.0% 0.0% 0.0%

Compound Annual Growth Rate Over Two Years

Total Revenue 14.7% 8.4% 4.2% 11.7% 21.6%

Gross Profit 27.3% 16.1% 7.7% 6.6% 16.9%

EBITDA 20.9% 20.7% 6.7% 2.1% 19.0%

EBITA 19.6% 20.6% 4.2% 0.4% 19.1%

EBIT 19.6% 20.6% 4.2% 0.4% 18.9%

Earnings from Cont. Ops. 28.7% 36.7% 8.6% (5.5%) 11.5%

Net Income 28.7% 36.7% 8.6% (5.5%) 11.5%

Normalized Net Income 23.4% 18.2% 6.4% 2.1% 15.6%

Diluted EPS before Extra 28.3% 36.5% 8.7% (5.4%) 11.4%

Accounts Receivable 24.5% 5.5% 15.2% 29.5% 18.9%

Inventory 11.3% 6.9% 7.0% 11.4% 32.9%

Net PP&E 28.9% 23.6% 6.9% 15.7% 36.4%

Total Assets 21.6% 18.7% 16.1% 17.1% 26.8%

Tangible Book Value 29.9% 34.7% 28.2% 18.5% 14.0%

Common Equity 29.8% 34.7% 28.2% 18.5% 16.6%

Cash from Ops. 29.4% 35.7% (6.7%) 7.4% 47.8%

Capital Expenditures 123.3% (8.4%) (27.3%) 61.2% 99.3%

Levered Free Cash Flow NM 192.6% NM NM NM

Unlevered Free Cash Flow NM 134.3% NM NM NM

Dividend per Share 24.5% 26.5% 13.6% 0.0% 0.0%

Compound Annual Growth Rate Over Three Years

Total Revenue 22.1% 12.6% 5.5% 10.7% 13.9%

Gross Profit 31.8% 24.3% 9.7% 10.4% 10.2%

EBITDA 33.1% 23.1% 9.1% 10.0% 8.1%

EBITA 32.9% 22.0% 7.6% 8.6% 6.6%

EBIT 32.9% 22.0% 7.6% 8.6% 6.5%

Earnings from Cont. Ops. 47.4% 34.7% 14.3% 9.6% (0.2%)

Net Income 47.4% 34.7% 14.3% 9.6% (0.2%)

Normalized Net Income 40.7% 24.0% 8.1% 9.3% 6.5%

Diluted EPS before Extra 43.8% 34.3% 14.3% 9.6% (0.2%)

Accounts Receivable 15.0% 18.3% 11.4% 21.5% 20.7%

Inventory 17.8% 10.7% 6.1% 10.7% 22.7%

Net PP&E 20.4% 21.3% 17.6% 12.8% 25.5%

Total Assets 19.8% 20.4% 17.2% 17.4% 22.4%

Tangible Book Value 30.1% 32.8% 29.1% 24.9% 15.4%

Common Equity 30.1% 32.8% 29.0% 25.0% 17.2%

Cash from Ops. 53.2% 15.6% 20.2% 2.1% 27.2%

Capital Expenditures 28.6% 30.1% 0.1% 4.7% 68.1%

Levered Free Cash Flow NM (14.0%) 93.9% NM NM

Unlevered Free Cash Flow NM (14.1%) 66.8% NM NM

Dividend per Share 45.8% 26.0% 17.0% 8.9% 0.0%

Compound Annual Growth Rate Over Five Years

Total Revenue 26.8% 21.0% 14.6% 12.2% 11.7%

Gross Profit 29.6% 26.9% 21.6% 16.9% 12.5%

EBITDA 31.4% 29.7% 21.9% 14.3% 13.0%

EBITA 31.9% 29.2% 20.5% 12.9% 12.0%

EBIT 31.9% 29.2% 20.5% 12.9% 12.0%

Earnings from Cont. Ops. 38.3% 34.7% 30.4% 16.9% 13.2%

Net Income 36.8% 34.7% 30.4% 16.9% 13.2%

Normalized Net Income 36.3% 35.1% 25.8% 14.7% 11.0%

Diluted EPS before Extra 35.5% 32.1% 28.6% 16.7% 13.1%

Accounts Receivable 18.0% 19.9% 15.1% 22.7% 14.3%

Inventory 22.9% 19.3% 13.3% 10.9% 16.1%

Net PP&E 26.6% 21.7% 14.8% 19.0% 24.8%

Total Assets 24.0% 23.5% 18.3% 19.1% 20.9%

Tangible Book Value 41.5% 38.0% 29.3% 26.9% 22.8%

Common Equity 41.6% 38.0% 29.3% 26.9% 23.9%

Cash from Ops. 77.1% 26.5% 25.6% 12.3% 30.5%

Capital Expenditures 27.1% 3.8% 2.4% 41.7% 31.9%

Levered Free Cash Flow NM NM NM NM NM

Unlevered Free Cash Flow NM NM NM NM NM

Dividend per Share 50.6% 32.0% 32.0% 14.9% 9.9%

You might also like

- Final Solution - New Heritage Doll CompanyDocument6 pagesFinal Solution - New Heritage Doll CompanyRehan Tyagi100% (2)

- FULL Download Ebook PDF International Logistics The Management of International Trade Operations 4th Edition PDF EbookDocument41 pagesFULL Download Ebook PDF International Logistics The Management of International Trade Operations 4th Edition PDF Ebookkathy.galayda516100% (43)

- Complete DCF Template v3Document1 pageComplete DCF Template v3javed PatelNo ratings yet

- FIN254 Assignment# 1Document6 pagesFIN254 Assignment# 1Zahidul IslamNo ratings yet

- UPL Limited BSE 512070 Financials RatiosDocument5 pagesUPL Limited BSE 512070 Financials RatiosRehan TyagiNo ratings yet

- Comparative Analysis With Key Retail Sector OrganizationsDocument3 pagesComparative Analysis With Key Retail Sector OrganizationsMuhammad ImranNo ratings yet

- Analisis FinancieroDocument124 pagesAnalisis FinancieroJesús VelázquezNo ratings yet

- Banco Santander Chile 2Q18 Earnings Report: July 26, 2018Document27 pagesBanco Santander Chile 2Q18 Earnings Report: July 26, 2018manuel querolNo ratings yet

- LBO (Leveraged Buyout) Model For Private Equity FirmsDocument2 pagesLBO (Leveraged Buyout) Model For Private Equity FirmsDishant KhanejaNo ratings yet

- Straco Corporation Limited SGX S85 FinancialsDocument80 pagesStraco Corporation Limited SGX S85 FinancialsP.RaviNo ratings yet

- Creative Enterprise Holdings Limited SEHK 3992 FinancialsDocument32 pagesCreative Enterprise Holdings Limited SEHK 3992 FinancialsxunstandupNo ratings yet

- RatioDocument11 pagesRatioAnant BothraNo ratings yet

- Bank of Kigali Announces AuditedDocument10 pagesBank of Kigali Announces AuditedinjishivideoNo ratings yet

- Himatsingka Seida LTD.: Ratio Analysis SheetDocument1 pageHimatsingka Seida LTD.: Ratio Analysis SheetNeetesh DohareNo ratings yet

- Banco Santander Chile 3Q18 Earnings Report: October 31, 2018Document32 pagesBanco Santander Chile 3Q18 Earnings Report: October 31, 2018manuel querolNo ratings yet

- Kovai Medical Center and Hospital Limited BSE 523323 FinancialsDocument39 pagesKovai Medical Center and Hospital Limited BSE 523323 Financialsakumar4uNo ratings yet

- Likhitha InfraDocument26 pagesLikhitha InfraMoulyaNo ratings yet

- Case Study #1: Bigger Isn't Always Better!: Jackelyn Maguillano Hannylen Faye T. Valente Coas Ii-ADocument9 pagesCase Study #1: Bigger Isn't Always Better!: Jackelyn Maguillano Hannylen Faye T. Valente Coas Ii-AHannylen Faye ValenteNo ratings yet

- Adani Power Limited NSEI ADANIPOWER FinancialsDocument34 pagesAdani Power Limited NSEI ADANIPOWER FinancialsSHAMBHAVI GUPTANo ratings yet

- Dabu LTD Dupont AnalysisDocument2 pagesDabu LTD Dupont AnalysisKrishna TapariaNo ratings yet

- BOLT DCF ValuationDocument1 pageBOLT DCF ValuationOld School ValueNo ratings yet

- Company Name: Financial ModelDocument13 pagesCompany Name: Financial ModelGabriel AntonNo ratings yet

- 2008 Annual Financial ReportDocument268 pages2008 Annual Financial Reportpcelica77No ratings yet

- Complete Private Equity ModelDocument16 pagesComplete Private Equity ModelMichel MaryanovichNo ratings yet

- HDFC Life Presentation - H1 FY19 - F PDFDocument43 pagesHDFC Life Presentation - H1 FY19 - F PDFMaithili SUBRAMANIANNo ratings yet

- Private Equity Model Template For InvestorsDocument12 pagesPrivate Equity Model Template For InvestorsousmaneNo ratings yet

- Peer Company COmparision For Startups NewDocument2 pagesPeer Company COmparision For Startups NewBiki BhaiNo ratings yet

- Class Exercise Fashion Company Three Statements Model - CompletedDocument16 pagesClass Exercise Fashion Company Three Statements Model - CompletedbobNo ratings yet

- Key Operating Financial DataDocument1 pageKey Operating Financial DataShbxbs dbvdhsNo ratings yet

- Exxon Mobil Corporation NYSE XOM FinancialsDocument117 pagesExxon Mobil Corporation NYSE XOM Financialsdpr7033No ratings yet

- Jollibee Foods Corporation PSE JFC FinancialsDocument38 pagesJollibee Foods Corporation PSE JFC FinancialsJasper Andrew AdjaraniNo ratings yet

- 2008 Annual ReportDocument224 pages2008 Annual Reportpcelica77No ratings yet

- Is Excel Participant - Simplified v2Document9 pagesIs Excel Participant - Simplified v2dikshapatil6789No ratings yet

- DCF Template - v1Document1 pageDCF Template - v1prathmesh KolteNo ratings yet

- Company Equity Enterprise Value Sales Gross Profit: Market Valuation LTM Financial StatisticsDocument34 pagesCompany Equity Enterprise Value Sales Gross Profit: Market Valuation LTM Financial StatisticsRafał StaniszewskiNo ratings yet

- Pms With Evaluation Summary of SummaryDocument1 pagePms With Evaluation Summary of SummaryQuenn NavalNo ratings yet

- Peer Company Comparison For StartupsDocument2 pagesPeer Company Comparison For StartupsBiki BhaiNo ratings yet

- Analysis Spreadsheet PepsiCo 2007-2012Document9 pagesAnalysis Spreadsheet PepsiCo 2007-2012diniratnakNo ratings yet

- 2019 Westpac Group Full Year TablesDocument25 pages2019 Westpac Group Full Year TablesAbs PangaderNo ratings yet

- 2006 Annual ReportDocument196 pages2006 Annual Reportpcelica77No ratings yet

- Apollo Hospitals Enterprise Limited NSEI APOLLOHOSP FinancialsDocument40 pagesApollo Hospitals Enterprise Limited NSEI APOLLOHOSP Financialsakumar4uNo ratings yet

- $ in Millions, Except Per Share DataDocument59 pages$ in Millions, Except Per Share DataTom HoughNo ratings yet

- Gudang Garam (IDX GGRM) Financial Statement Forecasting and Discount Cash Flow (DCF) Valuation ModelDocument2 pagesGudang Garam (IDX GGRM) Financial Statement Forecasting and Discount Cash Flow (DCF) Valuation ModelAndi ErnandaNo ratings yet

- The Presentation MaterialsDocument35 pagesThe Presentation MaterialsZerohedgeNo ratings yet

- Financial Spreadsheet KOSONGAN FinalDocument7 pagesFinancial Spreadsheet KOSONGAN FinalDwi PermanaNo ratings yet

- The Presentation MaterialsDocument28 pagesThe Presentation MaterialsZerohedgeNo ratings yet

- Revised ModelDocument27 pagesRevised ModelAnonymous 0CbF7xaNo ratings yet

- Enph EstimacionDocument38 pagesEnph EstimacionPablo Alejandro JaldinNo ratings yet

- 2013 Annual ReportDocument149 pages2013 Annual Reportpcelica77No ratings yet

- CH 13 Mod 3 Financial IndicatorsDocument2 pagesCH 13 Mod 3 Financial IndicatorsAkshat JainNo ratings yet

- Gymboree LBO Model ComDocument7 pagesGymboree LBO Model ComrolandsudhofNo ratings yet

- DCF ConeDocument37 pagesDCF Conejustinbui85No ratings yet

- Earnings Highlight - DANGSUGAR PLC 9M 2016Document1 pageEarnings Highlight - DANGSUGAR PLC 9M 2016LawNo ratings yet

- Assumptions For Forecasting Model: Income StatementDocument9 pagesAssumptions For Forecasting Model: Income StatementRadhika SarawagiNo ratings yet

- FDIC Certificate # 9092 Salin Bank and Trust CompanyDocument31 pagesFDIC Certificate # 9092 Salin Bank and Trust CompanyWaqas Khalid KeenNo ratings yet

- Max S Group Inc PSE MAXS FinancialsDocument36 pagesMax S Group Inc PSE MAXS FinancialsJasper Andrew AdjaraniNo ratings yet

- Common-Size Analysis: 7.1 Financial RatiosDocument6 pagesCommon-Size Analysis: 7.1 Financial RatiosQayyumNo ratings yet

- WWE q1 2020 Trending SchedulesDocument6 pagesWWE q1 2020 Trending SchedulesHeel By NatureNo ratings yet

- IC Discounted Cash Flow Analysis 10840Document5 pagesIC Discounted Cash Flow Analysis 10840Vishwas ParakkaNo ratings yet

- 2022 Annual Financial Report - Printer FriendlyDocument304 pages2022 Annual Financial Report - Printer Friendlypcelica77No ratings yet

- Understanding the Mathematics of Personal Finance: An Introduction to Financial LiteracyFrom EverandUnderstanding the Mathematics of Personal Finance: An Introduction to Financial LiteracyNo ratings yet

- RplotDocument1 pageRplotRehan TyagiNo ratings yet

- Project Mahindra Mahindra 1Document53 pagesProject Mahindra Mahindra 1Rehan TyagiNo ratings yet

- Basic Commission (% of Sales) Commission For Sales Reps With $1,000 in Monthly SalesDocument15 pagesBasic Commission (% of Sales) Commission For Sales Reps With $1,000 in Monthly SalesRehan TyagiNo ratings yet

- Pidilite Industries Limited BSE 500331 Financials Income StatementDocument4 pagesPidilite Industries Limited BSE 500331 Financials Income StatementRehan TyagiNo ratings yet

- PI Industries Limited BSE 523642 Financials Income StatementDocument4 pagesPI Industries Limited BSE 523642 Financials Income StatementRehan TyagiNo ratings yet

- UPL Limited BSE 512070 Financials RatiosDocument5 pagesUPL Limited BSE 512070 Financials RatiosRehan TyagiNo ratings yet

- PW-Rule of 72 Understand How To Compute Compound Interest Using XIRR Function and Rule of 72 Q FNo (63780)Document1 pagePW-Rule of 72 Understand How To Compute Compound Interest Using XIRR Function and Rule of 72 Q FNo (63780)Rehan TyagiNo ratings yet

- Imb695 XLS EngDocument73 pagesImb695 XLS EngRehan TyagiNo ratings yet

- Lecture 10Document2 pagesLecture 10Rehan TyagiNo ratings yet

- Group 6 - Industry Analysis - Oil and Natural GasDocument24 pagesGroup 6 - Industry Analysis - Oil and Natural GasRehan TyagiNo ratings yet

- Interglobe Aviation Ltd. (Indigo) - Balance Sheet: Figures in Rs Crore 2014 2015 2016 Sources of FundsDocument6 pagesInterglobe Aviation Ltd. (Indigo) - Balance Sheet: Figures in Rs Crore 2014 2015 2016 Sources of FundsRehan TyagiNo ratings yet

- Group 04 Automobile WarchestDocument44 pagesGroup 04 Automobile WarchestRehan TyagiNo ratings yet

- Group No 5: Snehal Yaglewad Apurv Karwa Himanshu Agrawal Aditya Shekhar Gokada Gagan Pranay Teja Ujjwal RajanDocument4 pagesGroup No 5: Snehal Yaglewad Apurv Karwa Himanshu Agrawal Aditya Shekhar Gokada Gagan Pranay Teja Ujjwal RajanRehan TyagiNo ratings yet

- Ujjwal Ranjan (MBA19155) 5Document7 pagesUjjwal Ranjan (MBA19155) 5Rehan TyagiNo ratings yet

- IIM Kashipur: A Valuation: Group 21Document7 pagesIIM Kashipur: A Valuation: Group 21Rehan TyagiNo ratings yet

- 35 ParivartanDocument6 pages35 ParivartanRehan TyagiNo ratings yet

- Arpan Josh Minj: Preferred Company: Maruti Suzuki Preferred Job Description: HR ManagerDocument6 pagesArpan Josh Minj: Preferred Company: Maruti Suzuki Preferred Job Description: HR ManagerRehan TyagiNo ratings yet

- 11 ConsiliumDocument9 pages11 ConsiliumRehan TyagiNo ratings yet

- ARC Induction Task PDFDocument7 pagesARC Induction Task PDFRehan TyagiNo ratings yet

- 18 TitanDocument6 pages18 TitanRehan TyagiNo ratings yet

- Should Women Be Allowed Leave During Their Mensuration Period?Document7 pagesShould Women Be Allowed Leave During Their Mensuration Period?Rehan TyagiNo ratings yet

- ch14 MCDocument13 pagesch14 MCSusan CornelNo ratings yet

- Excel Template, Equipment Inventory ListDocument2 pagesExcel Template, Equipment Inventory ListiPakistan100% (1)

- Macro5 Lecppt ch02Document75 pagesMacro5 Lecppt ch02meuang68No ratings yet

- 2020-12-01 Affidavit of Nosh, LLCDocument2 pages2020-12-01 Affidavit of Nosh, LLCNEWS CENTER MaineNo ratings yet

- M. Velayudhan Vs Registrar of Companies On 7 June, 1978 PDFDocument9 pagesM. Velayudhan Vs Registrar of Companies On 7 June, 1978 PDFAshok ReddyNo ratings yet

- 1 What Implications Do You Draw From The Graph ForDocument2 pages1 What Implications Do You Draw From The Graph ForAmit PandeyNo ratings yet

- Abc 2Document2 pagesAbc 2nguyentuandangNo ratings yet

- Risk Management Slides - Part 3Document9 pagesRisk Management Slides - Part 3nhloniphointelligenceNo ratings yet

- MCQs - CompiledDocument11 pagesMCQs - Compiledfahadkhanffc100% (1)

- Advertisement No. 04 - 2024Document11 pagesAdvertisement No. 04 - 2024Madhu SrivastavaNo ratings yet

- Transnet Freight Rail ReportDocument24 pagesTransnet Freight Rail ReportdatmbathaNo ratings yet

- Research Paper 0333Document25 pagesResearch Paper 0333Ranjith GNo ratings yet

- What Is HR ConsultingDocument2 pagesWhat Is HR ConsultingRustashNo ratings yet

- Cqi ToolsDocument4 pagesCqi ToolsChilufya MulopaNo ratings yet

- MKW 1120 Marketing Theory and Practice: Lecture1:IntroductiontomarketingDocument22 pagesMKW 1120 Marketing Theory and Practice: Lecture1:IntroductiontomarketingPeiyi Li100% (1)

- Godrej Interio Office FurnitureDocument156 pagesGodrej Interio Office FurnitureParv SanchetiNo ratings yet

- Mis Answers in Discussion 1&2Document23 pagesMis Answers in Discussion 1&2Jayson TasarraNo ratings yet

- Sale Deed SumairaDocument4 pagesSale Deed SumairaIbrahim MalikNo ratings yet

- Synergy Basic Trading MethodDocument16 pagesSynergy Basic Trading Methodkazabian kazabian50% (2)

- PGP: Marketing Management: Prof. Siddharth Shekhar SinghDocument46 pagesPGP: Marketing Management: Prof. Siddharth Shekhar SinghAnyone SomeoneNo ratings yet

- Cs-8002 Cloud Computing Cloud Interoperability and Portability B. Tech Iv YearDocument11 pagesCs-8002 Cloud Computing Cloud Interoperability and Portability B. Tech Iv YearVishal JainNo ratings yet

- Geocell APTDocument13 pagesGeocell APTboper dantoNo ratings yet

- CA Foundation Economics Question Paper May 2019Document24 pagesCA Foundation Economics Question Paper May 2019DhruvKumarNo ratings yet

- AP Preliminary Prospectus 04.19.17 - For Website - 2 PDFDocument557 pagesAP Preliminary Prospectus 04.19.17 - For Website - 2 PDF3 stacksNo ratings yet

- Head Procurement & Supply Chain Wee Green IncDocument3 pagesHead Procurement & Supply Chain Wee Green Incsinghd15No ratings yet

- FINAL BSE Research Proposal TemplateDocument4 pagesFINAL BSE Research Proposal TemplateDaniel Cayabyab DelafuenteNo ratings yet

- Indemnity Bond PDFDocument3 pagesIndemnity Bond PDFPradeep RajNo ratings yet

- Bowes ExploringInnovationinHousing 2018CFRDocument97 pagesBowes ExploringInnovationinHousing 2018CFRCecil SolomonNo ratings yet

- Tata MotorsDocument4 pagesTata MotorsVandana VishwakarmaNo ratings yet