Professional Documents

Culture Documents

Intern Report - ajoy.ASH 1510049M

Intern Report - ajoy.ASH 1510049M

Uploaded by

AjoyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Intern Report - ajoy.ASH 1510049M

Intern Report - ajoy.ASH 1510049M

Uploaded by

AjoyCopyright:

Available Formats

1

Foreign Remittance of Pubali Bank Ltd and its contribution on the Economy of Bangladesh.

Table of Contents

Chapter-1: Introduction.................................................................................................................................. 4

1.1 Background of the Study .................................................................................................................... 4

1.2 Objectives of the Study: ..................................................................................................................... 5

1.3 Scope of the Report: ........................................................................................................................... 5

1.4 Research Methodology....................................................................................................................... 5

1.5 Rationale of the Study: ....................................................................................................................... 6

1.6 Limitations of the Study: .................................................................................................................... 6

Chapter-2: ....................................................................................................................................................... 7

Theoretical Review ......................................................................................................................................... 7

2.1 What is Foreign Remittance? ............................................................................................................. 7

2.2 Importance of Foreign Remittance .................................................................................................... 7

2.3 Determinants of Foreign Remittance: ................................................................................................ 7

2.3.1 Migration stock: ............................................................................................................................. 7

2.3.2 Host Country Economic Condition: ............................................................................................... 8

2.3.3 Home Country Economic Condition: ............................................................................................. 8

2.3.4 Income Differential: ....................................................................................................................... 8

2.3.5 Dummy variables: .......................................................................................................................... 8

2.3.6 Inflation Differential: ..................................................................................................................... 9

2.3.7 Return on financial assets:............................................................................................................. 9

2.3.8 Exchange rate: ............................................................................................................................... 9

Chapter-3 ...................................................................................................................................................... 10

Literature Review ......................................................................................................................................... 10

Chapter-4: ..................................................................................................................................................... 11

Background of Pubali Bank Ltd ..................................................................................................................... 11

Department of Business Administration

2

Foreign Remittance of Pubali Bank Ltd and its contribution on the Economy of Bangladesh.

4.1 Corporate Mission and Vision .......................................................................................................... 11

4.2 Organization Hierarchy ..................................................................................................................... 12

4.3 Bank Divisions ................................................................................................................................... 13

4.4 SWOT Analysis of Pubali Bank .......................................................................................................... 13

Chapter-5: Foreign Remittance of Pubali Bank Ltd ...................................................................................... 15

5.1 Foreign Remittance Types of Pubali Bank Ltd .................................................................................. 15

5.2 Inward Remittance ........................................................................................................................... 15

5.2.1 Purpose of Inward Remittance .................................................................................................... 15

5.2.2 Source of Inward Remittance: ..................................................................................................... 16

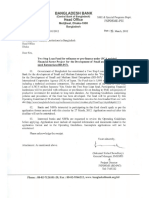

5.2.3 Bangladesh Bank Restrictions on Inward Remittance: ................................................................ 16

5.2.4 Role of Exchange Houses in foreign Inward remittance: ............................................................ 16

5.2.5 List of Exchange Houses: ............................................................................................................. 16

5.3 Outward Remittance: ....................................................................................................................... 18

5.3.1 Purpose of Outward Remittance: ................................................................................................ 18

5.3.2 Different Types of Outward Remittances: ................................................................................... 18

5.3.3 Bangladesh Bank Restrictions on Outward Remittance: ............................................................. 21

5.4 Role of Different Institutes Considering Foreign Remittance .......................................................... 21

5.5 Mode of Foreign Inward and Outward Remittance: ........................................................................ 23

5.6 Foreign Remittance Process of PBL .................................................................................................. 23

5.6.2 Informal Channel: ........................................................................................................................ 24

5.6.3 Disadvantages of informal channel of remittance: ..................................................................... 24

5.6.4 Bangladesh Bank initiatives to bring more remittances in formal channels: .............................. 24

5.6.5 Remittance Flow in Bangladesh: ................................................................................................. 24

5.6.6 Impact of Foreign Remittance on Our Economy: ........................................................................ 25

5.6.7 Socio-Economic Impact of Remittance ........................................................................................ 26

Chapter-6: Foreign Remittance in ................................................................................................................ 27

Pubali Bank Ltd (Performance Measurement and Analysis) ........................................................................ 27

6.1. Import Position Pubali Bank Ltd as of 2019 ..................................................................................... 27

6.2 Export position of PBL as of 2019 ..................................................................................................... 28

6.3 Area wise Import and Export position of PBL -2019......................................................................... 29

6.4 Yearly Foreign Remittance Position of PBL....................................................................................... 30

6.5 Comparison of Remittance Earning with other existing commercial banks .................................... 31

Department of Business Administration

3

Foreign Remittance of Pubali Bank Ltd and its contribution on the Economy of Bangladesh.

Chapter-6: Findings of the study .................................................................................................................. 32

Chapter: 7 Problems of Pubali Bank Ltd in Remittance Management System ............................................ 32

Chapter: 8 Recommendations ...................................................................................................................... 33

Chapter: 9 ..................................................................................................................................................... 33

Conclusion .................................................................................................................................................... 33

Chapter-10 .................................................................................................................................................... 34

References .................................................................................................................................................... 34

Department of Business Administration

4

Foreign Remittance of Pubali Bank Ltd and its contribution on the Economy of Bangladesh.

Chapter-1: Introduction

1.1 Background of the Study

To help the Non-resident Bangladeshis for remitting their earnings to home through legal channels Wage

Earners' Scheme was initiated in 1974. That scheme soon became very popular among the Bangladeshi

migrant workers working abroad. Migrants of Bangladesh remitted some $11.8 million to their home

country in the fiscal year of 1974-75. The amount of remittance increased over $350 million in the fiscal

year of 1980-81 and $750 million in the fiscal year of 1990-91.Since then Bangladesh has been receiving

higher remittance year by year. Since the number of emigrant workers from Bangladesh has been rapidly

increased over the years, there is a significant rise in the amount of annual remittance to the country. In June,

2015 Bangladesh receives almost $15 billion remittance amount. Remittance is rising day by day as a key

force to the growth of economy and reduction in poverty in Bangladesh. In indeed, it is the second position

among the foreign currency earnings sector of Bangladesh (Bangladesh Bank, 2012).

Bangladesh is one of the largest remittance receiver among other countries in the world. It has a large number

of people working abroad as skilled, semiskilled or unskilled manpower. The Middle East countries like

Saudi Arabia, UAE, Kuwait, Qatar, Oman, Iran etc. are major countries where the workers of Bangladesh

go and work hardly for earning money. Remittance wage earners plays an important role to match the gap

of trade deficit (Import payment is higher than export receipt) of Bangladesh.

Remittances have helped to ameliorate the social and economic indicators like nutrition, living condition

and housing, education, healthcare, poverty reduction, social security, and investment activities of the

recipient households. Remittances have been playing a large role to the economic growth and the livelihoods

of people in Bangladesh. Remittance income is more valuable for any developing country like Bangladesh.

The importance of remittances has also evolved against most of the macroeconomic variables along with the

contribution to the GDP.

Remittance contributes to our national economy in a large scale by increasing foreign exchange reserve, per

capita income and employment opportunities. Bangladesh has been continuously received robust remittance

because migrant workers are working hard and earning huge money in abroad and thus the GDP (Gross

Domestic Product) of Bangladesh has been expanding. In 2016, the remittance which has sent by the migrant

workers is the 5.15 percent of the total GDP ($195 billion) of Bangladesh. With these remittances, the

government has been compensating trade deficit. The determinants of remittance include employment in

abroad, GDP growth, exchange rate and oil price. Remittance is contributing to alleviate the poverty of

Bangladesh through microenterprise development, generating substantial employment and income.

Remittance also contributes to the expansion of financial market activities such as banks and

insurance companies and the development of payment systems through enhancing direct capital flows and

distributing those funds to users end and for investment or finance consumption purposes. The government

Department of Business Administration

5

Foreign Remittance of Pubali Bank Ltd and its contribution on the Economy of Bangladesh.

of Bangladesh is using remittance income to build schools, colleges, universities hospitals, roads, &

highways, bridges, culverts, etc. Remittance income is positively the socio-economic condition of migrant

families. Remittance income makes more strong local currency (Bangladesh) against US dollar.

Several banking institutes throughout Bangladesh have been contributing to help the people of this country

to these remittance from these foreign countries through their various modern technological equipment and

skilled human resources. To know more about the actual contribution of commercial named Pubali Bank

Ltd, I selected this subject among the rest other subject to conduct study. Here, i explained every related

topics and issue of the foreign remittance and tried my best to provide all relevant as required.

1.2 Objectives of the Study:

Remittance unit of Pubali Bank Ltd plays a vital role like other commercial banks in our economy.

The main objective of the study has been mentioned below:

To find out the remittance process of Pubali Bank Ltd and to know its contribution on the

economy of Bangladesh.

Secondary objectives of this study are:

To find out the problems of remittance income of Bangladesh; and

To recommend some suggestions based on findings to overcome the barriers of remittance

income in Bangladesh

1.3 Scope of the Report:

The scope of this report was extended to the foreign remittance activities of Pubali Bank Limited.

In my report, I have highlighted the various steps, procedures of PBL remittance. I have also discussed

about the process and income of the PBL remittance after learning from the bank personnel. So the

scope of the report covers the specific knowledge on PBL remittance. I have tried to analyze and evaluate

of foreign remittance income of our country based on adequate information contained in documents and

articles. I have tried to show the actual impact of remittance on our economy as well as on the profit of

banking sector.

1.4 Research Methodology

This research study has been conducted and analyzed on the basis of

Secondary data and information.

The sample period of these secondary data and information is for last 6 years. These data and

information were collected from different A-ranked journals, articles, published books, conference

proceedings, newspapers, and from last 6 years annual report of Pubali Bank Ltd. A large part of

data and information of this report was collected from the website of Bangladesh Bank, Ministry

Department of Business Administration

6

Foreign Remittance of Pubali Bank Ltd and its contribution on the Economy of Bangladesh.

of Expatriates’ Welfare and Overseas Employment, Bureau of Manpower, Employment and

Training, and the World Bank.

This report mainly focused on three things. Firstly, it shows the remittance income of Bangladesh.

Secondly, it shows the impact of remittance on our economy and financial sector. At last, it

investigates and find out the opportunities and challenges of remittance income in Bangladesh.

Tabular, chart, and graphical representation have been used to properly reflect the actual data and

information.

1.5 Rationale of the Study:

As remittance is the lifeline of a country Pubali Bank Ltd should extend their remittance services

and improve the condition of the bank through remittance flows. Remittance can also increase the

profit of bank by receiving the higher remittance have done this report to show up performance of

Pubali Bank Ltd in terms of remittance and also find out the reasons why the bank is receiving

lower remittance at recent years. And the ways through which the bank overcome this problem.

1.6 Limitations of the Study:

Difficulty in collecting some primary data because of company secrecy.

The record system of the annual report is not efficient for related data collection.

Lack of access to full remittance service providing process.

Limitation of time and

As I am still under graduation process, the thing I have explained here may not reach the

perfection level that could be possible to reach for our teacher who are more knowledgeable

than I am.

Department of Business Administration

7

Foreign Remittance of Pubali Bank Ltd and its contribution on the Economy of Bangladesh.

Chapter-2:

Theoretical Review

2.1 What is Foreign Remittance?

Remittances actually refers to the transfer of funds by the migrants workers (expatriates) to their

families at home. Foreign remittance define the transfer of foreign currencies from one place/person

to another place/person. Elaborately foreign remittances refers to sale and purchase of all foreign

currencies for the purposes of Import, Export,Travel and others. Anyway, particularly Foreign

Remittance means sale and purchase of foreign currencies for the purposes except export and

import.

2.2 Importance of Foreign Remittance

In any developing countries the common problem is shortages of foreign exchange reserve which

is very essential to pay the import bills. Bangladesh is not an exceptional country but Bangladesh

depends more on remittances to meet the problem of payment of the import bills.

Remittances functions as an alternative to inefficient or nonexistent credit markets and also

promotes growth by smoothing the investment constraint. There may be positive impact of

remittances on economic growth if remittances are used for the purpose of children’s education and

welfare expenses such as health care, rehabilitation. There may be a positive impact on labor

productivity and output of the home country in the long run. A positive multiplier effects on GDP

may be occurred because of spending remittances on either consumption or real estate. Remittances

may act as an alternative way to promote investment in those countries in which there is poor

financial sector. Foreign remittance has a great impact on socio economic conditions of a

country.Banking system also makes profit through remittance and can expand its financial inclusion

program.

There may be negative impact of remittances on growth in the host country if “demonstration

effect” exist. To consume import the remittance recipients can be motivated.

2.3 Determinants of Foreign Remittance:

2.3.1 Migration stock:

It is generally supposed that there is a correlation between increase in the number of migrant

workers abroad and level of remittances. Howsoever, it is important to determine the amount of

remittance sent home by migrants on the basis of compositional features of them. Mixing

of temporary and permanent migrants is such a feature where the temporary migrants are thought

Department of Business Administration

8

Foreign Remittance of Pubali Bank Ltd and its contribution on the Economy of Bangladesh.

to send higher proportion of their income. Remittance flow has been increasing from those countries

to which our country people go to earn more money. For an example, most number of migrant labor

workers are working in Saudi Arabia so the remittance flow from Saudi Arabia is higher than any

other countries in the world Other countries such as U.A.E, Oman, Malaysia etc. have also large

number of Bangladeshi migrants and so our country receives huge remittance from that countries

2.3.2 Host Country Economic Condition:

Many studies found significant relationship between host countries’ output with the flow of

remittances. At present we know that the economic condition of Saudi Arabia is not good because

of falling the price of oil and gold. Many expatriates in Saudi Arabia are not getting salaries at

proper time and many people lose their jobs because of company’s decision to reduce employees.

As a result there is a negative impact on remittance flow from Saudi Arabia. Because of

bad economic conditions many people are not willing to go to Saudi Arabia though the govt. of

K.S.A has released a large number of Visas. Expected economic condition of the labor importing

countries may raise because of existing migrant workers’ wages and creates a positive incentive on

demanding for low-cost foreign workers

2.3.3 Home Country Economic Condition:

The migrants’ home country economic condition is also regarded as one of the important

determinants of remittances of workers. An adverse economic situation in the migrants’ home

country will play a vital role in sending remittances. Adverse economic condition results in a fall

in income of a family in a home country may lead to a surge in inflow of remittances as the migrant

will send more remittance to family by working harder. In case of considering the flow of

remittances from various source countries to home country, we don’t use home country economic

activities directly in our model while we use income deferential between host and home country to

reflect the benevolence motive to remit.

2.3.4 Income Differential:

The ratio of GDP of host and home country at purchasing power parity (PPP) is used to measure

income differential between host and home country. The benefits of using this measure over other

measures are of considering for non-tradables. Valuation of non-tradeables depends on decision of

remitters because they send remittance to purchasing goods and services at home. One can dispute

that the flow of remittances has a propensity to rise during the economic downturn in home country

if the estimated coefficient of this variable is positive. Chami et al (2005) used the difference

between home and host country (US) per capita output to reflect the benevolence motive in their

empirical model. Schiopu and Siegfried (2006) used the ratio of GDP per capita in USD at PPP as

a proxy for the income differential.

2.3.5 Dummy variables:

The recent worldwide surge in the flow of workers’ remittances has been occurred because of

regulatory tightening for the terrorist attack on USA on September 11, 2001 and it’s supported by

Department of Business Administration

9

Foreign Remittance of Pubali Bank Ltd and its contribution on the Economy of Bangladesh.

many surveys. Two different factors are supposed to have contributed in this regard; one is the

increase in monitoring by financial regulators on remittance service providers, which caused a shift

of remittances from informal to formal sources. Another may have resulted from the uncertainty of

deportation among undocumented migrants, inducing them to send a larger proportion of their

income.

2.3.6 Inflation Differential:

There may be increase or decrease in the flow of remittances due to higher inflation in the home

country relative to host country can. Higher inflation at home country reduces the purchasing power

of family of migrants. Therefore the migrants try to send more remittances. On the contrary, it also

represents more risk and uncertainty in the home country relative to host country. If money of

domestic country is depreciated, migrants will intend to send more remittance to home country as

the families at home country will receive more money in local currency. If money of domestic

country is appreciated, migrants will intend to send less remittance to home country as the families

at home country will receive less money in local current .

2.3.7 Return on financial assets:

The level of remittances should be correlated with the return on financial assets if remittances are

influenced by investment motive. So remittances in home country can be negatively correlated with

the host country real interest rate or positively correlated with the home country real interest rate.

Increase in real interest rate differential between home and host country should have effect on the

level of remittances, assuming equal market risk in both countries

2.3.8 Exchange rate:

Workers’ motive to send remittance is influenced by bilateral exchange rate between host and home

country. Due to exchange rate depreciation two opposing effects may arise. They are namely wealth

effect and substitution effect. Prices of goods and services reduce in the foreign currency because

of depreciation or devaluation of home currency. A remitter buys more foreign goods rather than

domestic ones due to this condition. On the contrary, the remittance sender becomes affluent as

his/her income increases in the domestic currency. Thus he is encouraged to buy more goods

(including real estates) and services in home country. The remittance flows in the home country

may temporarily increase because of depreciation but eventually it might undermine the confidence

of remitters in the economy. Meaningful depreciation of domestic currency in the floating rule also

played a key role in the current increase in workers’ remittance in the country.

Department of Business Administration

10

Foreign Remittance of Pubali Bank Ltd and its contribution on the Economy of Bangladesh.

Chapter-3

Literature Review

Bangladesh is one of the leading remittance recipient countries through the export of its labor services to the

Middle East and South East Asian countries since the early 1970s. At present there are more than 7 million

Bangladeshi expatriates are working in the Middle East’s countries, Malaysia, Singapore, Korea, USA,

Canada, UK, Europe, Australia, New Zealand, etc. The number of illegal migrants should be taken into

consideration. Despite ongoing political, diplomatic crisis and economic recession in the Middle East’s

countries, United States and Europe, overseas workers of Bangladesh remitted $20.62 billion (10% growth

over the last year) in June 13, 2015 and it is a record in the country’s history. Moreover, Bangladesh has

maintained a steady 6% plus growth over most of the last10 years with the aid of strong export and remittance

growth. (REMITTANCE, F, 2015)

Remittances can help relax the budget constraint in the recipient economies and increase consumption

of both durables and nondurables. Moreover remittances can lead to higher accumulation of human capital

through allowing for education and health care, and also can lead to increased physical and financial

investment. The inflow of remittances on the macro-economy can lead to accelerated long-run growth as a

result of additional investments in physical and human capital IMF (2005).

In last few decades, the remittance amount has increased as the number of Bangladeshi migrants in world’s

other countries are increasing. Siddiqui (2003) states, Bangladesh has a long history of migration. Migration

has shaped and is still shaping Bangladeshi society showed that three quarters of sixty two (62) villages

migrating from rural areas migrate internally, and some twenty four per cent (24%) people of them can

migrate overseas (Afsar, 2004).

Transfer of remittances takes place through different methods. Forty six per cent (46%) of the total volume

of remittance has been channeled through official sources, around forty (40 %) through hundi, four point six

one per cent (4.61%) through friends and relatives, and about eight per cent (8%) of the total was hand

carried by migrant workers themselves when they visited home (Siddiqui & Abrar 2001).

Banks are the major actors in remittance transfer. On the issue of transfer of remittance the banking services

have to be made more attractive to wean clients away from hundi. Banks have to match the level of services

currently provided by the hundi operators such as cost and speed. Different steps may be undertaken to

improve the quality of services provided by the banks (Siddiqui & Abrar 2001)

Remittance service is not only used by migrants but also government uses to settle import export transactions

etc. Salim (1992) point out that remittances are used to make import payments and are used for productive

investment by the government. Ali (1981) identified overseas remittances achieving a favorable balance of

payments and as well as creating a new resources base for the country. Puri and Ritzema (2001) tell that

remittance is the portion of international migrant workers’ earnings sent back from the country of

employment to the country of origin, play a central role in the economies of many labor sending countries.

Each additional migrant worker brings in $ 816 in remittances annually, Hussain and Naeem (2009). Osmani

(2004) tells that remittances have been identified as one of the three factors that have been responsible for

reducing the overall incidence of poverty in Bangladesh. Remittance inflows increase during downturns as

emigrant workers went to provide financial support to the family members in the country of their origin

Department of Business Administration

11

Foreign Remittance of Pubali Bank Ltd and its contribution on the Economy of Bangladesh.

(Sayan, 2006). Remittance inflows increase during downturns as emigrant workers went to provide financial

support to the family members in the country of their origin (Sayan, 2006).

Chapter-4:

Background of Pubali Bank Ltd

Pubali Bank Limited is the largest Commercial Bank in Private Sector in Bangladesh. It provides

mass banking services to the customers through its branch network all over the country. This Bank

has been playing a vital role in socio-economic, industrial and agricultural development as well as

in the overall economic development of the country since its inception through savings mobilization

and investment of funds. Pubali Bank limited has achieved constantly about 20% growth for the

last 6 (six) years.The Bank was initially emerged in the Banking scenario of the then East Pakistan

as Eastern.

Mercantile Bank Limited at the initiative of some Bangali entrepreneurs in the year 1959 under

Bank Companies Act 1913. After independence of Bangladesh in 1972 this Bank was nationalized

as per policy of the Government and renamed as Pubali Bank. Subsequently due to changed

circumstances this Bank was denationalized in the year 1983 as a private bank and renamed as

Pubali Bank Limited. The Government of the People’s Republic of Bangladesh handed over all

assets and liabilities of the then Pubali Bank to the Pubali Bank Limited. Since inception this Bank

has been playing a vital role in socio-economic, industrial and agricultural development as well as

in the overall economic development of the country through savings mobilization and investment

of funds. At Present, Pubali Bank is the largest private commercial bank having 465 branches and

it has the largest real time centralized online banking network.

4.1 Corporate Mission and Vision

Mission Statement

High quality financial services with the help of the latest technology

Fast and accurate customer service

Balanced growth strategy

High standard business ethics

Steady return on shareholders' equity

Innovative banking at a competitive price

To review all business lines regularly and develop the Best Practices in the industry

Working environment to be supportive of Teamwork, enabling the Employees to perform

to the very best of their abilities.

Vision Statement

Providing customer centric lifelong banking service.

Department of Business Administration

12

Foreign Remittance of Pubali Bank Ltd and its contribution on the Economy of Bangladesh.

4.2 Organization Hierarchy

Chairman

↓

Board of Directors

↓

Managing Director

↓

Additional Managing Director

↓

Deputy Managing Directors

↓

General Manager

↓

Deputy General Manager

↓

Assistant General Manager

↓

Senior Principle Officer

↓

Principle Officer

↓

Senior Officer

↓

Officer

↓

Junior Officer

Department of Business Administration

13

Foreign Remittance of Pubali Bank Ltd and its contribution on the Economy of Bangladesh.

4.3 Bank Divisions

Board Division & MD's Secretariat

Human Resources Division

Establishment Division

Law Division

International Division

Credit Division

Credit Administration, Monitoring & Recovery Division

Consumers Credit Division

Central Accounts Division

ICT Operation Division

Software Development Division

Lease Financing Division

Compliance Division

4.4 SWOT Analysis of Pubali Bank

Each and every organization should be aware of their strengths, weaknesses, opportunities and

threats. This analysis is known as SWOT analysis. The central purpose of SWOT analysis is to

identify strategies that fit or match a company’s resources and capabilities according to the demand

of environment in which company operates. So the strategic alternatives generated by a SWOT

analysis should be built on company’s strengths in order to exploit opportunities and counter threats

and to correct weaknesses.

SWOT analysis explains environment of an organization in two broad ways. They are:

a) Internal Environment Analysis: It includes strengths and weaknesses.

b) External Environment Analysis: It includes opportunities and threats

During my internship period in Pubali Bank I have found some aspects relating to the Bank’s

strengths, opportunities, weaknesses and threats, which I think, affect the bank’s performance.

These are given below:

Strengths

As a large bank, it has qualified and experienced manpower.

Branch location is suitable for business.

Bank’s assets position is quite satisfactory and now there is no fund crisis.

Bank has requisite wealth to sustain in the various challenges of market economy.

Department of Business Administration

14

Foreign Remittance of Pubali Bank Ltd and its contribution on the Economy of Bangladesh.

Weakness

As many employers retired from the bank, there is a crisis for manpower in the bank.

Bureaucrat official process hampered the daily internal workflow.

Lack of motivation for the workers.

Low salary structure for the employees.

In some cases management-employee relation is not good.

Opportunities

Expansion of new investment areas.

Scope for automation will open a big door of opportunity.

The bank undertakes need-based training program.

Threats

Newly developed privatized and foreign banks.

Facing a great competition with other commercial banks and financial institutions.

Loan recovery systems are very weak.

Policies are not practiced properly.

Department of Business Administration

15

Foreign Remittance of Pubali Bank Ltd and its contribution on the Economy of Bangladesh.

Chapter-5: Foreign Remittance of Pubali Bank Ltd

5.1 Foreign Remittance Types of Pubali Bank Ltd

According to the Foreign Exchange Regulation Act, 1947 and guidelines for Foreign Exchange

Transactions, Bangladesh Bank has classified all foreign remittances into two broad categories:

1. Inward remittance

2. Outward remittance

5.2 Inward Remittance

Inward remittance takes place when our country receives remittance from foreign countries. In

details, foreign inward remittance means the remittance of freely convertible foreign currencies that

we receive from foreign countries against which the permitted dealers make payment in local

currency to the beneficiaries. The ways of receiving inward remittances are draft, mail transfer, TT,

export bills, travelers’ cheques and foreign bills. A local bank receives specific commission for

providing inward remittance service.

5.2.1 Purpose of Inward Remittance

Remittances are being sent from abroad for the following purposes:-

Family maintenance

Indenting Commission

Recruiting Agents Commission

Realization of Export Proceeds

Donation

Department of Business Administration

16

Foreign Remittance of Pubali Bank Ltd and its contribution on the Economy of Bangladesh.

Gift

Export broker’s Commission etc.

5.2.2 Source of Inward Remittance:

The ways through which remittance comes in our country are mentioned below:

Expatriate Bangladeshis.

Exporters.

Visitors.

5.2.3 Bangladesh Bank Restrictions on Inward Remittance:

Any amount can be sent as remittance by the remitters.

The beneficiary must fill and sign in Form ‘C’ (Appendix 5/6) for above US$5000

mentioning the purpose of remittance.

If any incoming passenger bring more than US $5000, the fact must be declared to the

custom TAND he remittance is for gift, donation, and permission to be obtained from

respective ministry/authority.

All banks have to report to Bangladesh Bank about total foreign exchanges of each month on inward

remittances through statements along with schedules before a stipulated date.

5.2.4 Role of Exchange Houses in foreign Inward remittance:

Exchange houses offer a wide range of services from Demand Drafts (DD) to instant credit facilities. They

facilitate easy access for customers by delivering products. Exchange houses are extensively used for

remittances from UAE. Unlike the banking channel this channel is based on Vostro accounts I.e. accounts

maintained by exchange houses with various banks in beneficiary countries. These accounts are prefunded

by exchange houses.

5.2.5 List of Exchange Houses:

The list of exchange houses of Pubali Bank Ltd has been mentioned below with their geographical position.

At present total number of exchange houses of Pubali Bank Ltd is 54 (Bank 12 and

Exchange houses 42)

Table 03: List of exchange houses.

Name of exchange houses/bank. Geographical location

Bahrain Financing Company

Dalil Exchange

Department of Business Administration

17

Foreign Remittance of Pubali Bank Ltd and its contribution on the Economy of Bangladesh.

Zenj Exchange Co. W.L.L.

Nation Finance Exchange CO,

Bahrain

Hamdan Exchange

Bahrain

Daulat Enterprise Inc. Canada

Al-rajhi Bank

Al Rajhi Commercial Foreign Exchange

Bank Al-Jazira , K.S.A. Al Amoudi Exchange Company

National Commercial Bank

Arab National Bank

Bank Al Bilad

Al. Jamil Exchange Co.

K.S.A.

Al Mulla International Exchange Co. W.L.L.

Al Muzaini Exchange Co. K.S.C.C.

Al Moosa Exchange Company W.L.L.

Bahrain Exchange Company W.L.L

City International Exchange Co. W.L.L.

Dollarco Exchange Co. Ltd.

Kuwait Bahrain International Ex. Co. W.L.L.

National Money Exchange Co. W.L.L.

Oman Exchange Company Ltd.

U.A.E. Exchange Centre W.L.L.

Kuwait

May Bank

Ime (M) Sdn.Bhd

Nbl Sdn Malaysia

Malaysia

28 Bank Muscat S.A.O.G.)

Gulf Overseas Exchange Co. L.L.C.

National Bank Of Oman

Oman International Exchange L.L.C.

Oman & Uae Exchange Centre & Co. L.L.C.

Oman

Eastern Exchange Eastablishment

Trust Exchange Company W.L.L.

Al Dar For Exchange Works

Arabian Exchange Qatar

Indian Bank

Balaka Exchange Pte Ltd

Singapore

Eastern Union Remittance & Exchange Ltd.

British Arab Commercial Bank, U.K.

Department of Business Administration

18

Foreign Remittance of Pubali Bank Ltd and its contribution on the Economy of Bangladesh.

Al Ansari Exchange

Habib Exchange Co. L.L.C.

Mashreq Bank Psc

Al Rostamani International Exchange Company.

5.3 Outward Remittance:

Outward foreign remittance occurs when our country remits currency to foreign countries. In details,

Outward remittance means selling of foreign currency by the authorized dealers or formal channels. It must

be assured by the authorized dealers that foreign currencies are remitted and used only for the right purpose.

Outward remittance can be done by appropriate method to the country to which remittance facility is

authorized by Bangladesh Bank.

5.3.1 Purpose of Outward Remittance:

To settle Import Payment.

To meet Travel Expenses/Medical Expenses/Educational Expenses etc.

5.3.2 Different Types of Outward Remittances:

A) Private Remittance

B) Official & Business Travel related Remittance

C) Commercial Remittance

A) Private Remittance:

Family remittance facility:

Expatriates working in Bangladesh with the approval of the Government Bangladeshi migrant worker

can remit 75% of their net income through an Authorized Dealer (to the country of their origin). They can

also remit 100% of their leave salary as savings and pension benefits, without the prior approval of

Bangladesh Bank. Here net income indicates the gross income of the applicant less all mandatory deductions

of income tax, provident fund and pension fund, house rent and others of a fixed nature. (FE Circular No.06,

April 15, 2013)

Moderate amounts of remittance for maintaining family members of abroad (spouse, children, parents)

are permitted by BB on written request supported by certificates/required documents from the related

country.

Membership fee and registration fee:

Authorized Dealer (AD) may remit for membership fee and registration fee to professional/scientific

institutions without prior approval of Bangladesh Bank. They can also remit fees for application, registration,

admission, examination (TOEFL, SAT etc.) so that students can admit into foreign educational institutions

on the basis of written application from the related foreign institution showing the amount that will be

remitted. Such remittances should be paid directly to the related institution through draft/TT etc. and the

transaction should be reported to the BB backed by Form TM in the usual monthly return.

Department of Business Administration

19

Foreign Remittance of Pubali Bank Ltd and its contribution on the Economy of Bangladesh.

Education:

Bangladesh Bank approval is required to release foreign exchange for the students at school level in foreign

countries to support their education expenditures. Besides, ADs can release remittances for Bangladesh

students to admit and study in regular courses. Undergraduate, post graduate and language courses are pre-

requisite for bachelor degree & professional diploma/certificate in recognized institutions in foreign

countries subject to verification of bona fides according to the following conditions.

Application duly filled in;

The educational institution issue original and photocopy of admission letter on behalf ofthe student

(such as US institutions require I-20);

The concerned educational institution issue original and photocopy of estimated annual tuition fee,

board and lodging, incidental expenses etc.

The applicant need to attest copies of educational certificates.

Valid passport is required.

The facility of purchasing of foreign exchange/remittance will not be allowed for more one academic

year at a time;

The current progress report and current estimated costs of the educational institution should be taken

into consideration for releasing of foreign exchange subsequent each time.

The ADs will keep individual file for each student with all relevant papers in readiness for inspection

of BB officials

Remittance of consular fees:

Foreign embassies in Bangladesh collect consular fees and deposit in a Taka Account maintained with an

AD for remitting consular fees to foreign countries without prior approval of Bangladesh Bank. The AD

needs to submit report of such remittance in the usual monthly returns along with the relevant TM Form to

Bangladesh.

Travel:

Bangladeshi adult nationals can visit to SAARC member countries and Myanmar and other countries under

the annual travel quota contract at maximum $5000 or equivalent $7000 respectively during a calendar year.

The minors (below 12 years age) can avail the facility of applicable quota for half amount than adults’ fee.

But, cash amount in foreign exchange must not surpass $3000 per person for per trip.

Department of Business Administration

20

Foreign Remittance of Pubali Bank Ltd and its contribution on the Economy of Bangladesh.

ADs should ensure the following conditions at the time of releasing foreign exchange for travel purposes:

The willing traveler is a client of Authorized Dealer bank (AD bank)

The willing traveler is well known to the authorized dealer bank.

The AD bank must be satisfied about the authenticity of the application;

The willing traveler must possess a confirmed air ticket (if needed) for the journey;

The released amount is endorsed on the passport and air ticket of the traveler with irremovable ink,

signature and name of the authorized dealer branch inscribed in the passport and ticket.

Health/Medical

Without prior approval of Bangladesh Bank, ADs may release up to $ 10,000 as remittance for medical

treatment in foreign countries on the basis of the recommendation of the medical board/specialist fixed by

the Health Directorate and the cost estimation of the foreign medical institutions. The AD must submit

documents to BB (foreign exchange operation dept.) if the releasing amount of remittance exceeding $10000

to support treatment in foreign countries. And the supporting documents will be verified by Bangladesh

Bank to justify the authenticity of the expenses.

Seminars and workshops:

ADs may release remittance to the participants of private sectors up to $200 per day for SAARC member

countries or Myanmar and $250 per day for other countries without prior approval of Bangladesh Bank.

Foreign nationals:

The ADs may issue Transaction Currency to foreign nationals limitlessly and foreign currency notes up to

$2000 per person against submitting of equal amounts in foreign currencies. However, the TCs and foreign

currency notes should be released only on origin of a ticket for a country outside Bangladesh and the issued

amount should be endorsed on the concerned passports.

Remittance for Hajj:

Each year Government of Bangladesh announces the scale at which foreign exchange will be issued to

willing pilgrims to perform Hajj. It should be ensured that release of foreign exchange will be made as per

instructions (issued by BB each year).

B) Official and Business Travel Related Remittance:

Business travel for new exporters:

New exporters are allowed to carry up to $6,000 and ADs may issue this amount without prior

approval of Bangladesh Bank on the basis of the recommendation letter from EPB (Export

Department of Business Administration

21

Foreign Remittance of Pubali Bank Ltd and its contribution on the Economy of Bangladesh.

Promotion Bureau). Bangladesh Bank will grant more than $6000 requirements after considering

the applications submitted by ADs with supporting documents.

Business travel quota for importers and non-exporters:

Importers carry business travel quota such as annual upper limit of $5000 and non-exporting

producers have a quota of 1% of their imports/turnover settled during the previous year/declared

in their tax returns.

Retention Quota of Exporters:

Merchandise exporters may retain up to 50% of repatriated FOB (Free On Board) value of their

exports in foreign currency accounts (for garments exporters, the quota is 10%) may use for

business. Through this amount they can visit abroad, participate in export fairs, attend at seminars,

office maintenance abroad, and import of raw materials.

5.3.3 Bangladesh Bank Restrictions on Outward Remittance:

An application on prescribed form must be submitted to an AD or Bangladesh Bank

wherever necessary for purchasing of foreign currency.

The prescribed application form will be according to Form IMP (Appendix 5/11) and for

other types of remittances Form TM (Appendix 5/5, Chap.5, Sec.1, Para-2) for payments

against imports in to Bangladesh.

Ads must use TM form for reporting even if the remittance is approved by Bangladesh

Bank in any other manner. For example: issuing a special permit.

The ADs may affect the sale of foreign exchange if they have the empowerment to

approve the application after receiving receipt of the application in the prescribed form.

AD should forward the form to the Bangladesh Bank for consideration if the transaction

requires prior approval of the Bangladesh Bank.

5.4 Role of Different Institutes Considering Foreign Remittance

Ministry of Finance:

Ministry of Finance (MoF) is a government body that works with state budget, taxation and

economic policy. This major policy making body is related to banking and remittance. Macro-

economic policies that affect exchange rate, monetary and fiscal mechanisms, foreign exchange

reserve etc. are regulated by this ministry.

Bangladesh Bank:

Department of Business Administration

22

Foreign Remittance of Pubali Bank Ltd and its contribution on the Economy of Bangladesh.

Among other powers and functions, BB regulates scheduled bank activities, acts as a clearing-

house, retain foreign exchange reserves and monitors floating exchange rate mechanism in the

current accounts. Bangladesh Bank exhorts the nationalized and private banks to connect with

foreign banks and exchange houses in the enlisted countries. It has an isolated department for

regulating and monitoring remittance entitled Foreign.

Exchange Policy Department (FEPD):

This department also plays an important role to foreign remittance sector. This department mainly

generates, analyses, interprets and distributes data on inflow of remittance. It provides update

information about remittance with proper description and showing also positive and negative trends

in remittance.

Nationalized Commercial Banks (NCBs):

Nationalized Commercial Banks (NCBs) of Bangladesh make direct banking facilities available

at the doorsteps of Bangladeshi emigrants specially in those countries where a large number of

Bangladeshis are employed. Four NCBs are deeply involved in remittance transfer. These are Pubali

Bank, Janata Bank, Agrani Bank and Pubali Bank Ltd. Within these four NCBs have more than

5000 branches. Through them they can disburse remittances even in distant areas. Besides their

own branches, NCBs have opened exchange houses in joint collaboration with different banks and

financial institutions in different countries of the world.

Private Commercial Banks

Private Commercial Banks (PCBs) are also involved in remittance transfer. Of the PCBs, Islami

Bank of Bangladesh Ltd (IBBL) has been found to be most proactive in the area of migrants’

remittance. National Bank, International Finance and Investment Corporation (IFIC), Prime Bank

and Uttara Bank are other private banks involved in remittance transfer. Most of their activities are

in the Middle East. Saudi Arabia is the major working area of Islami Bank along with Qatar, Bahrain

and UAE.

Department of Business Administration

23

Foreign Remittance of Pubali Bank Ltd and its contribution on the Economy of Bangladesh.

5.5 Mode of Foreign Inward and Outward Remittance:

The following are the mode of Inward/Outward Remittances:

TT (Telegraphic Transfer): An electronic method of transferring funds; it’s utilized

primarily for overseas wire transactions. These transfers are used most commonly in

reference to CHAPS (Clearing House Automated Payment System)

MT (Mail Transfer): This mode is used when you wish to transfer money from your

account in Center 'A' to either your own account in Center 'B' or to somebody else's

account. In this mode of transfer, you are required to fill in an application form similar to the

one for DD, sign a charge slip or give a cheque for the amount to be transferred plus exchange

and collect a receipt.

FD (Foreign Drafts): A bank draft which is drawn on a financial institution in the country of

currency. It can be purchased at commercial banks and usually have a fee depending on the

institution and the type of account you hold.

PO (Payment Order): It refers to a directive to a bank or other financial institution from a bank

account holder instructing the bank to make a payment or series of payments to a third party

via paper and/or electronic means.

TC (Travelers Cheque): A traveler's cheque is a medium of exchange that can be used in place

of hard currency.

EFT (Electronic Fund Transfer): EFT is the electronic transfer of money from one bank account to

another, either within a single financial institution or across multiple institutions, via computer based

systems, without the direct intervention of bank staff.

5.6 Foreign Remittance Process of PBL

Remitting process refers to a process through which fund is transferred from one country to another

country. For example, a local bank has 300 domestic branches. The bank has corresponding relationship

with a foreign bank say “Global Bank”, and maintaining “Nostro Account” in US $ with the bank.

Bangladeshi expatriates are sending foreign remittances to their local beneficiary through that account. Now,

when the Bangladeshi expatriates remit the money through other banks of different countries to their

“Remittance Account” with “Global Bank”, then the international division of Head Office of the local bank

will receive telex message and the remittance section of the local bank will record the advice and originate

the advice letter to the respective branch of the bank. The branch will first decode the test, verify signature

and check the account number and name of the beneficiary. The branch transfers the amount to the account

of the beneficiary after being fully satisfied and intimates the beneficiary accordingly. But sometimes

the complexity arises, if the respective local bank has no branch where the beneficiary maintains his account.

Then the local bank has to take help of a third bank who has branch there.

5.6.1 Formal Channel:

Fund transfer from one country to another country through official channels, i.e. banking channel, post

office, and other private service channels, such as- Western money order, Neno money order etc.

The legitimate purposes for moving money abroad through formal channel are;

To invest

To lend

Department of Business Administration

24

Foreign Remittance of Pubali Bank Ltd and its contribution on the Economy of Bangladesh.

To meet trading/ Personal obligation

To safeguard assets against theft or seizure by repressive regimes.

5.6.2 Informal Channel:

It’s an unofficial channel for fund transferring from one country to another country through hand or over

telephone such as “Hundy”. Haque (1992) remarked that remittance collected by informal “Hundy” rings

operating in Middle East counties and UK are also used to finance illegal trade and transactions.

Islam (2000) observes that as informal channel is needed for illegal trade of goods, as well as gold and drug

into Bangladesh, and therefore, helping the ever-present problem of capital flight out of Bangladesh.

The reasons behind using informal channel for moving money from abroad are as follows:-

The majority of the Bangladeshi remitters are unskilled laborers. As these laborers are

poorly educated, they often prefer informal channels to avert difficulties in formal channel.

Costs of informal channels are about 45 percent of formal costs.

Highly trust based, inexpensive, speedy, accessible and a convenient way of transferring funds.

Strong incentive to use IMTS if the official exchange rate is overvalued.

The weaknesses in conventional financial systems, such as high costs, poor or

Unavailable service and lack of access

Dealing in arms & ammunition

Drug trafficking

Financial terrorist activities

Evasion of exchange regulations/ control

Evasion of taxation

Disguise or remove proceeds of threat/ fraud/ bribe

Making blackmail payments

Paying ransom for kidnappers.

5.6.3 Disadvantages of informal channel of remittance:

Financial inclusion is not extended.

Contribution to GDP decreases.

Contribution to banking sector decreases.

Per Capita income is not actually represented due to informal remittance transactions.

5.6.4 Bangladesh Bank initiatives to bring more remittances in formal channels:

Allowing banks to tie up with NGOs to render faster delivery of remittances to beneficiaries.

Automated banking payment system has been launched to provide better services to clients.

Attracting new entrants, including new banks, card companies such as VISA and various

entrepreneurs and non- government organizations (NGOs) to provide remittance facility to make the

remittance market competitive.

Increasing the number of exchange houses to receive more remittance in formal channel. Sending

remittance over mobile phone (currently launched by Bkash) to home country.

5.6.5 Remittance Flow in Bangladesh:

Remittance flow in Bangladesh has been increasing year by year. Now Bangladesh is one of the

best remittance receiving countries among the developing countries. The economic, micro

Department of Business Administration

25

Foreign Remittance of Pubali Bank Ltd and its contribution on the Economy of Bangladesh.

economic and socio economic conditions are improving year by year because of receiving

increasing remittance. Economic experts of Bangladesh, column writers in newspapers, have

expected the remittance flow might be decreased because of reduction in oil prices and gold

which are the main contributing properties of some middle-east countries where a large number

of Bangladeshi migrants are working abroad.

5.6.6 Impact of Foreign Remittance on Our Economy:

The contribution of foreign remittance rising of living standard cannot be described so easily. So

the importance of foreign remittance in the economy of Bangladesh is widely recognized and

requires little reiteration

Impact on GDP:

The Gross Domestic Product (GDP) is one of the main exponents used to get a perception about

the health of a country's economy. It is determined with the total dollar value of all goods and

services produced over a specific time period. GDP is calculated as:

GDP = private consumption + gross investment + government investment + government spending

+ (exports - imports).

Remittance has a great impact on our economy. We know that the increase in consumer spending

in our economy increases GDP. Increase in foreign remittance has been gradually boosting our

GDP (Gross Domestic Product).

Impact of remittance on consumption:

Remittance flow to our country has changed the life of the families of migrants. Now they can admit

their children to private schools and can afford nutrition food and can also bear the treatment cost

of family members. Therefore increase in remittance increase the consumption of goods by people

of the country due to increase in the level of income of country people.

Increase savings:

Foreign remittance has increased the level of income of country people. Now can save money after

their expenditures. Therefore the remittance received by our country people is saved in different

banks by making short term or long term deposit.

Increase capital:

Department of Business Administration

26

Foreign Remittance of Pubali Bank Ltd and its contribution on the Economy of Bangladesh.

A big source of capital in different banks is comprised because of savings by the local people whose

relatives are sending remittance from different developed countries. This huge amount of money is

investing is different project by the bank to make profit.

Impact of remittance on investment:

Foreign remittance is increasing the investment of our country. The remittance is using for small

and big investment in different project, establishing firm or industry, small or big shop which

increases the proper utilization of money.

Increase employment:

Many people of country have been moving to developed countries to earn extra money. As a result

the unemployed people gets job in foreign countries and unemployment rate decreases and

employment increases. As the investment increase, the employments of our country also increase.

The people of our country are getting jobs in different project, firm or industries.

Impact of remittance on import:

It has a negative impact on our economy too. By increasing remittance, it also increases

consumption of foreign product. It increases import of foreign products. People have enough money

to buy foreign product, although government is trying to save our domestic companies by

implementing necessary rules and regulation. Thus the domestic markets lose profit because of

selling less products.

5.6.7 Socio-Economic Impact of Remittance

Remittance has a great impact on our socio economic factors. Remittance flows have changed the

scenario of the socio economic condition of our country by adding the income and consumption

level of immigrant workers’ family. Now rural areas people are building Houses like urban areas’

people.They send their children to private school and college. They use high configured smartphone

with internet connection and LED TV. They live like urban areas people. The scenario of the

economy of society has been changed only because of remittance. Remittance has the following

impacts on our socio-economic condition:

The economic development of the country is ensured by improving the economic condition

of the migrants through remittance.

Unskilled and illiterate people of rural areas can contribute to the development of society.

It improves the ability of investment for self-employment and entrepreneurship.

Hotel, traveling, transportation and other businesses get momentum in the country

for movement of migrant workers.

Department of Business Administration

27

Foreign Remittance of Pubali Bank Ltd and its contribution on the Economy of Bangladesh.

The financial capability and purchasing power of the migrant workers have been

enhancing.

The migrant workers are being conscious about cleanliness, hygienic environment, and

necessity of literacy, discipline, and standard of living.

Technological advancement in migrant workers.

Migrant workers family members get involved with banks and other financial institutions.

Now rural people wants to use gas facility without using chimney because they have the

ability to pay utility bills.

At present rural people get the financial services and remittance through banking agents and

mobile banking services. So they need not to go to town for financial services.

Chapter-6: Foreign Remittance in

Pubali Bank Ltd (Performance Measurement and Analysis)

6.1. Import Position Pubali Bank Ltd as of 2019

Import (BDT in Million)

180000

162773

155714

160000

141670

140000

121852

120000 112564

97517

100000

80000

60000

40000

20000

0

2014 2015 2016 2017 2018 2019

Year

This chart shows an increasing growth of import through PBL indicating the more reliance on import rather

than export. This is the sign of lower production and GDP. More emphasize must be given to improve the

national production of goods and services to lower the import. Government, Financial and other regulatory

authorities must be come forward to work hand in hand to assist in the growth of production activity. Import

activities are necessary for the country like ours which are continuously developing the infrastructural

surrounding the state for improving their development activities and production activities for being able to

Department of Business Administration

28

Foreign Remittance of Pubali Bank Ltd and its contribution on the Economy of Bangladesh.

the future exporter. Such activities must be structure in a structured and planned way thinking the major

future benefits of the people of the state.

6.2 Export position of PBL as of 2019

Export (BDT in Million)

140000

120000 130434

100000

104862

96128

80000 85740 86764

77071

60000

40000

20000

0

2014 2015 2016 2017 2018 2019

Year

Export position of Bangladesh is increasing gradually though there are many internal and external constraints

in the economy of Bangladesh. But this trend must be geared up as early as possible to make the economy

of Bangladesh the strongest one because there is no alternative left without it to robust the economy of

Bangladesh. Such increasing trend ensures the growth of GDP and can improve the condition of poor of the

poorest. The prior condition of the improvement of export activities is to develop of infrastructure of a state.

Improving the export activities is an urgent issue of a country like ours because without sufficient export

activities the balance of trade will be negative that is really adverse for a country like ours. So, banking

institute should come forward to facilitating the export activities in all possible way that they can

Department of Business Administration

29

Foreign Remittance of Pubali Bank Ltd and its contribution on the Economy of Bangladesh.

6.3 Area wise Import and Export position of PBL -2019

REGION WISE EXPORT AND IMPORT POSITION -

2019

Import Export

1399

1241

BDT IN CRORE

849

295

239

204

183

166

156

104

83

68

51

48

37

34

22

14

10

8

5

2

0

0

0

0

AXIS TITLE

Area wise export and import position indicates that Narayanganj is doing a balanced export and import

comparing with the other region. Besides, Central Dhaka, North and South Dhaka are doing well in this

perspective. More initiatives need to be taken to improve the present scenarios of the less developed region

to increase their exports and imports. This growth is crucial for Bangladesh right now as Bangladesh is

heading toward the goal of achieving the status of developing country which required sufficient

infrastructures throughout country to facilitate the export and import activities.

Department of Business Administration

30

Foreign Remittance of Pubali Bank Ltd and its contribution on the Economy of Bangladesh.

6.4 Yearly Foreign Remittance Position of PBL

Foreign Remittance(BDT in Million)

43542 43807 43683

40565

37757

36593

2014 2015 2016 2017 2018 2019

Year

The above chart shows that after a robust growth in the foreign remittance earning, there are two massive

falls in 2016 and 2017 which may be due to the decrease in the price of oil and changing the legal criteria in

the Middle East countries. But after such falls, the remittance earnings started to go up from 2018 to 2019

which is surely a good sign.

Department of Business Administration

31

Foreign Remittance of Pubali Bank Ltd and its contribution on the Economy of Bangladesh.

6.5 Comparison of Remittance Earning with other existing commercial banks

as of 2019.

Foreign Remittance( BDT in Million)

60000

50000

50454

48423 47312

40000 43683 42354

40921

30000

20000

10000

0

Dutch Bangla Islami Bank Ltd Exim Bank Ltd Pubali Bank Ltd United Citi Bank NA

Bank Ltd Commercial Bank

Ltd

This comparative chart shows Islami Bank Ltd, Dutch Bangla Bank Ltd and Exim Bank Ltd are the highest

remittance earner compare to the Pubali Bank Ltd. But the remittance earning of the Pubali Bank LTD is

higher than that of the United Commercial Bank and Citi Bank N.A.

These analyses give us a clear indication that overall foreign remittance earning is not much rich compare

to other banking institutions. So, required measures must be taken as early as possible to bring about changes

in the policies of foreign remittance sector.

Department of Business Administration

32

Foreign Remittance of Pubali Bank Ltd and its contribution on the Economy of Bangladesh.

Chapter-6: Findings of the study

Findings are given below:

Pubali Bank remittance flow in percentage of total remittance has been decreasing due to some

reasons. The following reasons are mainly liable for decreasing the performance of Pubali Bank in

terms of receiving remittance:

Many newly emerged private commercial banks are receiving remittance from foreign countries.

Inefficiency of remittance unit of Pubali Bank Ltd.

Late payment of remittance amount to the beneficiaries.

Less careful about the remittance services.

Higher cost of remitting money by the expatriates.

Providing lower quality of remittance services.

Internal corruption news of Pubali Bank discourages the expatriates to send money through PBL.

Illiterate family members are unwilling to go to bank to receive remittance because they think it’s

burdensome than informal channel.

In informal channel the family members of migrant receives more money than the banking system

and rural area people feel insecure to go to banks rather they receive remittance through hundi (a

most popular informal channel)

Majority of migrants are unskilled and uneducated and so they fear to send remittance through bank

by facing difficulties.

Chapter: 7 Problems of Pubali Bank Ltd in Remittance Management

System

There are many problems in Pubali Bank remittance management system and these are affecting the

smooth and profitable operation of remittance activities. The problems are mentioned below:

Lack of efficient employees.

Lack of better internet facility.

Lack of effective management system.

Lack of data processing system.

Lack of IT specialized.

Lack of security.

Lack of proper monitoring activities.

Lack of reporting in timely manner.

Vulnerable software with having bugs.

Sometimes the central sever gets too slow that data base system does not work.

Old technological devices disturbs and gets hanged frequently

Department of Business Administration

33

Foreign Remittance of Pubali Bank Ltd and its contribution on the Economy of Bangladesh.

Chapter: 8

Recommendations

As the remittance unit of Pubali Bank Ltd is playing a vital role to our economy and financial development.

So the bank need to improve its remittance receiving facility. Following recommendation can be followed:

They need to recruit specialized and qualified employees for remittance unit. They need to upgrade

their devices through which they perform remittance operations.

They need to improve their central server capacity and also improve the data base management

system so that the server does not get slow at the time working.

They should ensure the security of the RMS+ (software) and also solve the lagging and bugs

problems of the software. Charging less for proving remittance facility in comparison to other banks.

They should use the back cover screen on the monitor of computers so that employees do not face

the problem of eye burn and headache.

They should make the payment of remittance amount as early as possible.

Chapter: 9

Conclusion

In the internship period I have learnt about the operations of remittance unit of Pubali Bank Ltd. As a largest

state owned commercial bank, Pubali Bank Ltd has been receiving huge amount of remittance. But the

amount of remittance receiving by the bank has not been expectedly increasing year by year because of their

some weaknesses. The bank can contribute more to the economy of our country as well as financial

development in terms of remittance. The bank can raise its profit by receiving higher remittance. The bank

need to provide better remittance facility so that they can receive higher remittance comparatively than other

banks in Bangladesh. Moreover the bank must show excellence in remittance area to successfully compete

with other govt. and private banks.

Department of Business Administration

34

Foreign Remittance of Pubali Bank Ltd and its contribution on the Economy of Bangladesh.

Chapter-10

References

Articles

Ahmed, H. A., & Uddin, M. G. S. (2009). “Export, imports, remittance and growth in Bangladesh: An

empirical analysis. Trade and Development review, 2(2).”

Akter, S. (2016). “Remittance Inflows and Its Contribution to the Economic Growth of Bangladesh.”

Afsar, R. (2003, June 22-24). “Internal migration and the development Nexus: The case of Bangladesh.

Paper presented at the Conference on Migration.”

Barua, S. (2007). “Determinants of workers’ remittances in Bangladesh: An empirical study.”

Chowdhury, M. B. (2011). “Remittances flow and financial development in Bangladesh. Economic

Modelling, 28(6), 2600-2608.”

Chowdhury, M. B. (2011). “Remittances flow and financial development. In Proceedings of the Western

Economic Association International 9th Biennial Pacific Rim Conference, 26-29 April 2011, Brisbane,

Australia.”

Datta, K., & Sarkar, B. “Remittances and economic growth in Bangladesh: An ARDL cointegration

approach.”

Foundations of Financial Management by Stanly B. Block and Geoffrey A. Hirt. 11th edition, ISBN-13:

978-0072842296.

Haider, M. Z., Hossain, T., & Siddiqui, O. I. (2016). “Impact of remittance on consumption and Savings

behavior in rural areas of Bangladesh. Journal of Business, 1(4), 25-34.”

International Banking, Banking Theory, and Banking System by A. N. Sachdeva and M. P. Sundaram,

Prokashan Kendra, Lucknow.

International Remittance Payments and the Global Economy (Routledge Studies in the Modern

World Economy) 1st Edition by Bharati Basu and James T. Bang, ISBN-13: 978-0415589949.

Islam, M. N. (2011). “Bangladesh Expatriate Workers and their Contribution to National Development.”

Migration and Remittances Factbook, World Bank, 2016

Mamun, K. A., & Nath, H. K. (2010). “Workers' migration and remittances in Bangladesh. Journal of

Business Strategies, 27(1), 29.”

Department of Business Administration

35

Foreign Remittance of Pubali Bank Ltd and its contribution on the Economy of Bangladesh.

Mannan, K. A., & Farhana, K. M. (2014). “Socio-economic impact of remittances in rural Bangladesh: A

unit analysis of the age of household head.”