Professional Documents

Culture Documents

Chapter 4 Answer Key

Chapter 4 Answer Key

Uploaded by

Stefanie Saphira0 ratings0% found this document useful (0 votes)

37 views1 pageThis document contains two passages about cash flow and cash budgeting. The first passage discusses how operating cash flow is calculated by taking earnings before interest and taxes, subtracting taxes on that amount, and adding back depreciation since it is a non-cash expense. The second passage presents a cash budget for a company over five months, showing projected cash receipts, disbursements, net cash flow, and ending cash balance each month to determine if there are excess cash balances.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains two passages about cash flow and cash budgeting. The first passage discusses how operating cash flow is calculated by taking earnings before interest and taxes, subtracting taxes on that amount, and adding back depreciation since it is a non-cash expense. The second passage presents a cash budget for a company over five months, showing projected cash receipts, disbursements, net cash flow, and ending cash balance each month to determine if there are excess cash balances.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

37 views1 pageChapter 4 Answer Key

Chapter 4 Answer Key

Uploaded by

Stefanie SaphiraThis document contains two passages about cash flow and cash budgeting. The first passage discusses how operating cash flow is calculated by taking earnings before interest and taxes, subtracting taxes on that amount, and adding back depreciation since it is a non-cash expense. The second passage presents a cash budget for a company over five months, showing projected cash receipts, disbursements, net cash flow, and ending cash balance each month to determine if there are excess cash balances.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

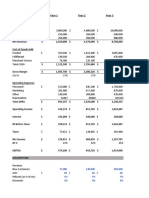

P4-4 Depreciation and cash flow (LG 2 and LG 3; Intermediate)

a. Operating cash flow (OCF) = [Earnings before interest and taxes Tax rate)]

Depreciation

OCF = ($420,000 − $295,000 − $74,250) × (1 − 0.4)] + ($165,000 × 0.45) = $104,700

b. Items such as depreciation are noncash items and present not as physical cash outflow

for a firm. Since it is not a real cash outflow, it needs to be added back to the cash flow

as NOPAT, and EBIT excludes noncash items.

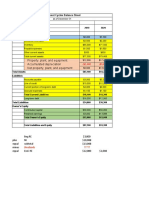

P4-10. Cash budget (LG 4; Basic)

July August September October November

Sales $380,000 $390,000 $385,000 $418,000 $429,000

Cash sales 115,500 125,400 128,700

Collections of A/R 253,000 250,250 271,700

Other income 3,000 3,000 3,000

Total cash receipts $371,500 $378,650 $403,400

Disbursements

Cash purchases $150,000 $120,000 $115,000

Payments of A/P 60,000 75,000 60,000

Rent 3,500 3,500

Wages & salaries 46,800 46,200 50,160

Taxes 8,250

Principal & interest 4,700

Fixed asset outlays 8,500

Dividends 4,600

Total cash disbursements $186,400 $189,400 $187,910

Net cash flow 185,100 189,250 215,490

Add: Beginning cash 150,000 335,100 524,350

Ending cash 335,100 524,350 739,840

Less: Minimum cash 8,000 8,000 8,000

Excess cash balance

(marketable securities) $327,100 $516,350 $731,840

You might also like

- College Accounting Chapters 1-27-23rd Edition Heintz Solutions ManualDocument23 pagesCollege Accounting Chapters 1-27-23rd Edition Heintz Solutions Manualthomasgillespiesbenrgxcow97% (30)

- This Study Resource Was: RequiredDocument3 pagesThis Study Resource Was: RequiredJoel Christian MascariñaNo ratings yet

- PNP Payslip Portal - Print PDFDocument1 pagePNP Payslip Portal - Print PDFEric libatonNo ratings yet

- Gitman IM Ch03Document15 pagesGitman IM Ch03tarekffNo ratings yet

- Statement of Cash Flows: Balances Accounts Jan 1, 2015 Dec 31, 2015Document2 pagesStatement of Cash Flows: Balances Accounts Jan 1, 2015 Dec 31, 2015Alyssa AlejandroNo ratings yet

- Pyq (June 2018) 2.0Document1 pagePyq (June 2018) 2.0farah sofeaNo ratings yet

- It App - WorkbookDocument8 pagesIt App - WorkbookAsi Cas JavNo ratings yet

- Explained: AccountingDocument3 pagesExplained: AccountingAJNo ratings yet

- Property, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentDocument6 pagesProperty, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentEman KhalilNo ratings yet

- Chapter 3 SolutionsDocument7 pagesChapter 3 Solutionshassan.murad63% (8)

- Dian Sari (A031171703) Tugas Akl IiDocument3 pagesDian Sari (A031171703) Tugas Akl Iidian sariNo ratings yet

- Answer 4 - Excel For Diff. Acctg.Document42 pagesAnswer 4 - Excel For Diff. Acctg.Rheu ReyesNo ratings yet

- Account TitleDocument3 pagesAccount TitleDonna Lyn BoncodinNo ratings yet

- Tyasa Putri R - Tugas Akl 1 TM 4Document6 pagesTyasa Putri R - Tugas Akl 1 TM 4Rayhan MametNo ratings yet

- Latihan Arus KasDocument8 pagesLatihan Arus KasEka Junita HartonoNo ratings yet

- ACE Trading - SARAYDocument11 pagesACE Trading - SARAYLaiza Cristella SarayNo ratings yet

- Lembar JWB PD ANGKASADocument53 pagesLembar JWB PD ANGKASAernyNo ratings yet

- Financial StatementsDocument12 pagesFinancial Statementscecille ramirezNo ratings yet

- Er Cla 2Document2 pagesEr Cla 2Sakshi ManotNo ratings yet

- 3 Statement Financial Model: How To Build From Start To FinishDocument9 pages3 Statement Financial Model: How To Build From Start To FinishMiks EnriquezNo ratings yet

- Akuntansi Keuangan Lanjutan 2Document6 pagesAkuntansi Keuangan Lanjutan 2Marselinus Aditya Hartanto TjungadiNo ratings yet

- Income Statement - Bells Manufacturing Year Ending December 31, 2015Document12 pagesIncome Statement - Bells Manufacturing Year Ending December 31, 2015Elif TuncaNo ratings yet

- Chpater 4 SolutionsDocument13 pagesChpater 4 SolutionsTamar PkhakadzeNo ratings yet

- Rayhan Dewangga Saputra - Tugas AKL TM 4Document6 pagesRayhan Dewangga Saputra - Tugas AKL TM 4Rayhan Dewangga SaputraNo ratings yet

- Financial Statements AnalysisDocument1 pageFinancial Statements AnalysisDELA CRUZ Jesseca V.No ratings yet

- Randall Corporation and Sharp Company Consolidation Worksheet December 31, 20X7Document5 pagesRandall Corporation and Sharp Company Consolidation Worksheet December 31, 20X7Diane MagnayeNo ratings yet

- Total Cash Available (1 + 2) 82,500 124,000 89,275Document6 pagesTotal Cash Available (1 + 2) 82,500 124,000 89,275Nischal LawojuNo ratings yet

- Practice 4 Cash Flow Statement TestDocument4 pagesPractice 4 Cash Flow Statement TestAndini OleyNo ratings yet

- Automotive Shop and DesigningDocument8 pagesAutomotive Shop and DesigningMore, Mary RuthNo ratings yet

- Business Monthly BudgetDocument4 pagesBusiness Monthly BudgetMohamed ElhousniNo ratings yet

- Latihan Soal Kombis (Answered)Document6 pagesLatihan Soal Kombis (Answered)Fajar IskandarNo ratings yet

- Weekly CashflowDocument1 pageWeekly CashflowqcmarketingNo ratings yet

- Chapter 5 Exercise 8Document32 pagesChapter 5 Exercise 8Lady Zyanien DevarasNo ratings yet

- Ibra Fa 1Document8 pagesIbra Fa 1Michael KitongaNo ratings yet

- BD21060 Aman Assignment5Document6 pagesBD21060 Aman Assignment5Aman KundraBD21060No ratings yet

- Pre-Cost 3,000,000.00 Pre-Operating ExpensesDocument10 pagesPre-Cost 3,000,000.00 Pre-Operating ExpensesJaselle TantogNo ratings yet

- Financial Assumptions: RevenueDocument12 pagesFinancial Assumptions: RevenueKathleeneNo ratings yet

- Financial Planning and Forecasting: AsssumptionsDocument4 pagesFinancial Planning and Forecasting: AsssumptionssubhenduNo ratings yet

- Ilham Dwi L - 261Document1 pageIlham Dwi L - 261Via jyNo ratings yet

- Carley NDocument11 pagesCarley NaliNo ratings yet

- SCM Topic 1 Blades Solution 2022Document3 pagesSCM Topic 1 Blades Solution 2022Adi KurniawanNo ratings yet

- Excel Merchandising Company WorksheetDocument7 pagesExcel Merchandising Company WorksheetDonna Lyn BoncodinNo ratings yet

- AnswersDocument24 pagesAnswersDeul ErNo ratings yet

- Problem 1 Journal EntryDocument4 pagesProblem 1 Journal EntrySarah Nelle PasaoNo ratings yet

- Trial BalaneDocument2 pagesTrial BalaneBang BangNo ratings yet

- Complete Financial ModelDocument47 pagesComplete Financial ModelArrush AhujaNo ratings yet

- Monthly Budget: Company NameDocument2 pagesMonthly Budget: Company NameMalleshNo ratings yet

- Professor Office's Beach Cabana Balance Sheets As of December 31, 2014 and 2013Document3 pagesProfessor Office's Beach Cabana Balance Sheets As of December 31, 2014 and 2013Precious Uminga100% (1)

- Ent300 - Chapter 12Document31 pagesEnt300 - Chapter 122021206042No ratings yet

- Lecture 3Document22 pagesLecture 3ahmed qazzafiNo ratings yet

- Bac 3 Review QNSDocument16 pagesBac 3 Review QNSsaidkhatib368No ratings yet

- Feb 27 - AssignmentDocument1 pageFeb 27 - AssignmentGeofrey RiveraNo ratings yet

- Revision Questions - 2 Statement of Cash Flows - SolutionDocument7 pagesRevision Questions - 2 Statement of Cash Flows - SolutionNadjah JNo ratings yet

- Account Titles Trial Balance Adjustment Dr. Cr. Dr. CRDocument4 pagesAccount Titles Trial Balance Adjustment Dr. Cr. Dr. CRplaylist erikyoongNo ratings yet

- Jawaban Silus Adijaya 2015Document15 pagesJawaban Silus Adijaya 2015natsu dragnelNo ratings yet

- 23-NURFC 2002 Projections vs. ActualDocument4 pages23-NURFC 2002 Projections vs. ActualCOASTNo ratings yet

- Income Statement: IVAN IZO Law OfficeDocument4 pagesIncome Statement: IVAN IZO Law OfficeClaudio AbinenoNo ratings yet

- To Be Withdrawn by Gangnam: Problem 1 1. Capital Balances Case 1Document12 pagesTo Be Withdrawn by Gangnam: Problem 1 1. Capital Balances Case 1Alizah BucotNo ratings yet

- Income Statement For The Year Ended, December, 31, 2016: Pt. ZaliaDocument4 pagesIncome Statement For The Year Ended, December, 31, 2016: Pt. ZaliaNofi Nurlaila0% (1)

- Statement of Cash FlowsDocument12 pagesStatement of Cash FlowsDaniel PeterNo ratings yet

- Financial Plan For Meet Green: Locally Grown Produce, Chemical-And Preservative-Free GroceriesDocument6 pagesFinancial Plan For Meet Green: Locally Grown Produce, Chemical-And Preservative-Free Groceriesramsha nishatNo ratings yet

- CH 10 Incomplete RecordsDocument27 pagesCH 10 Incomplete RecordsPawan Poynauth0% (1)

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Noncurrent Assets Held For SaleDocument5 pagesNoncurrent Assets Held For Salesoonie leeNo ratings yet

- Budget Template and Samples GuideDocument5 pagesBudget Template and Samples GuidebelijobNo ratings yet

- German Tax Law: An Overview (2014 Edition)Document6 pagesGerman Tax Law: An Overview (2014 Edition)My German Property100% (1)

- Od329407857197047100 3Document6 pagesOd329407857197047100 3Nikhil KatariaNo ratings yet

- Tax Return Documentation Reference SheetDocument3 pagesTax Return Documentation Reference SheetBaljeet SinghNo ratings yet

- Prof Ethics AssignmentDocument5 pagesProf Ethics Assignmentdivyaroy400No ratings yet

- SRS Combined Cargo Pvt. LTD.: A-31, B-1, Extension, Mohan Cooprative Estate, New Delhi 110044Document1 pageSRS Combined Cargo Pvt. LTD.: A-31, B-1, Extension, Mohan Cooprative Estate, New Delhi 110044Vivek KumatNo ratings yet

- PBCOM v. CIR Case DigestDocument4 pagesPBCOM v. CIR Case DigestCareenNo ratings yet

- GEPCO - Gujranwala Electric Power CompanyDocument3 pagesGEPCO - Gujranwala Electric Power CompanyFahad ZulfiqarNo ratings yet

- GST Invoice Format For Goods in ExcelDocument57 pagesGST Invoice Format For Goods in ExcelJugaadi BahmanNo ratings yet

- Invoice 2Document1 pageInvoice 2Ajay MarwalNo ratings yet

- 10 Coca-Cola-Philippines-vs-CIRDocument1 page10 Coca-Cola-Philippines-vs-CIRhigoremso giensdksNo ratings yet

- Taxes and CashFlow ExercisesDocument7 pagesTaxes and CashFlow ExercisesNelson NofantaNo ratings yet

- DepreciationDocument13 pagesDepreciationHarshitPalNo ratings yet

- Invoice Girnar TeaDocument1 pageInvoice Girnar Teafixer_007722No ratings yet

- Recent Post: List of Ust Law Applicants Qualified For Enrollment (For April & MAY 2019 Entrance Exams)Document4 pagesRecent Post: List of Ust Law Applicants Qualified For Enrollment (For April & MAY 2019 Entrance Exams)Nikki Manuel Tionko GutierrezNo ratings yet

- Functions of FBR / Revenue DivisionDocument7 pagesFunctions of FBR / Revenue DivisionWajahat GhafoorNo ratings yet

- Wages Payment FormDocument2 pagesWages Payment Formjiggster1990No ratings yet

- Invoice No.06 - (19-21) - 30-12-2019 - C.CDocument128 pagesInvoice No.06 - (19-21) - 30-12-2019 - C.CHaneen JosephNo ratings yet

- ATO ID 2002 - 319 Beverage Analyst - Purchase of Wine For TastingDocument4 pagesATO ID 2002 - 319 Beverage Analyst - Purchase of Wine For Tastingjo lamosNo ratings yet

- Items of Gross Income Subject To RegularDocument2 pagesItems of Gross Income Subject To Regularhannah drew ovejasNo ratings yet

- 2118-Ea 0919 Encs FinalDocument2 pages2118-Ea 0919 Encs FinalJason YangaNo ratings yet

- Estadosfinancieros FerreycorpDocument2 pagesEstadosfinancieros Ferreycorpluxi0No ratings yet

- Basic Tax EnvironmentDocument8 pagesBasic Tax EnvironmentPeregrin TookNo ratings yet

- 2013 P T D 1420Document6 pages2013 P T D 1420haseeb AhsanNo ratings yet

- National Pension System For Corporates - PresentationDocument10 pagesNational Pension System For Corporates - PresentationSudeep KulkarniNo ratings yet

- Indian ComplianceDocument29 pagesIndian Compliancekundhavai nambiNo ratings yet