Professional Documents

Culture Documents

Adjusting Entries For Merchandising (4 Step) : Merchandising Concern Manufacturing Concern

Adjusting Entries For Merchandising (4 Step) : Merchandising Concern Manufacturing Concern

Uploaded by

yzaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Adjusting Entries For Merchandising (4 Step) : Merchandising Concern Manufacturing Concern

Adjusting Entries For Merchandising (4 Step) : Merchandising Concern Manufacturing Concern

Uploaded by

yzaCopyright:

Available Formats

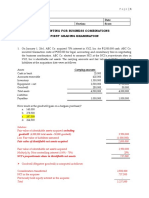

MERCHANDISING CONCERN MANUFACTURING CONCERN

Adjusting Entries for Closing Entries

Merchandising (4th step) 1. closing of the manufacturing accounts

2. closing of the income accounts

Under the Adjusting Entry Method

Step 1

(merchandise adjustment)

A.) Debit the accounts with credit balances and

Income & expense summary xx credit the Manufacturing Summary.

Merchandise inv, beg. xx Credit the accounts with debit balances and

debit the Manufacturing Summary.

Merch inv, end xx

Income & expense summary xx Example:

Work in process, end xx

Under the Closing Entry Method Raw materials, end xx

Manufacturing summary xx

Merch inv, end xx

Purchase discount xx Manufacturing Summary xx

Purchase returns xx Work in process, beg xx

Income & expense summary xx Raw materials, beg xx

Merch, inv beg. xx Purchases – raw materials xx

Purchases xx Freight-in xx

Freight-in xx Direct labor xx

Indirect materials xx

To close COGS acc to I&E summary and Indirect labor xx

establish ending inv. Repairs and maintenance xx

Dep’n- factory equipment xx

Closing Entry ( 7th step ) Amortization of patent xx

Step 1 – close the sales accounts to I&E B.) close manufacturing account to I&E

Step 2 – establish merch, end and close merch, beg.

Together with the COGS accounts. Step 2

Step 3 – close all the expense accounts to I&E A.) Debit the accounts with credit balances and

Step 4 – close I&E to capital credit to Income & Expense Summary.

Step 5 – close drawing acc to capital Credit the accounts with debit balances and

debit to Income & Expense Summary.

Special journals

Example:

o Sales Journal – involving sale of merchs on acc or in Sales xx

cash Finished Goods, beg. xx

o Purchases Journal – purchases of merch on acc or in Income & expense summary xx

cash.

o Cash Receipt Journal – only when with receipts of Income & expense summary xx

cash. Finished Goods, end xx

o Cash Disbursement Journal – involving cash Repairs and Maintenance xx

payments. Office Salaries xx

o General Journal Dep’n-office equipment xx

Original investments of the owner

Return of merchandise bought on account B.) close Income and Expense summary to capital

Adjusting and correcting journal entries

Closing and reversing entries

You might also like

- Ibm Case Answers - Case No. 1Document7 pagesIbm Case Answers - Case No. 1Jasper R. Parcon-Bayles100% (1)

- Accounting For Business Combinations First Grading ExaminationDocument18 pagesAccounting For Business Combinations First Grading Examinationjoyce77% (13)

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- The McGraw-Hill 36-Hour Course: Finance for Non-Financial Managers 3/EFrom EverandThe McGraw-Hill 36-Hour Course: Finance for Non-Financial Managers 3/ERating: 4.5 out of 5 stars4.5/5 (6)

- 8811 Chartof Accounts 6 TheditionelectronicversionDocument127 pages8811 Chartof Accounts 6 TheditionelectronicversionNyasha MakoreNo ratings yet

- Finals ReviewersDocument213 pagesFinals ReviewersAngelica RubiosNo ratings yet

- Chapter 8 - Completing The Cycle For A Merchandising BusinessDocument11 pagesChapter 8 - Completing The Cycle For A Merchandising BusinesskakaoNo ratings yet

- Unit V Manufacturing ConcernDocument14 pagesUnit V Manufacturing ConcernCamelia CanamanNo ratings yet

- Merchandising and Manufacturing Activities: Petter James C. Benaldo FM 22Document15 pagesMerchandising and Manufacturing Activities: Petter James C. Benaldo FM 22Ian CalinawanNo ratings yet

- ACC 123 HO 1 Introduction To Cost AccountingDocument2 pagesACC 123 HO 1 Introduction To Cost AccountingLily Scarlett ChìnNo ratings yet

- Manufacturing OperationsDocument13 pagesManufacturing OperationsAlyssa Camille CabelloNo ratings yet

- ABM Fundamentals of ABM 1 Module 12 Accounting Cycle of A Merchandising BusinessDocument16 pagesABM Fundamentals of ABM 1 Module 12 Accounting Cycle of A Merchandising BusinessMariel Santos67% (3)

- Merchandising and Manufacturing ActivitiesDocument15 pagesMerchandising and Manufacturing ActivitiesgloryblessmNo ratings yet

- CA 03 - Cost Accounting CycleDocument6 pagesCA 03 - Cost Accounting CycleJoshua UmaliNo ratings yet

- ACC 101 - Module 7Document14 pagesACC 101 - Module 7Rhian BarzanaNo ratings yet

- Unit III Manufacturing ConcernDocument12 pagesUnit III Manufacturing ConcernAlezandra SantelicesNo ratings yet

- Module 1 BuscomDocument9 pagesModule 1 Buscommoon binnieNo ratings yet

- ACT115 - Topic 3Document10 pagesACT115 - Topic 3Le MinouNo ratings yet

- Accounting For Production Losses in A Job Order Costing SystemDocument7 pagesAccounting For Production Losses in A Job Order Costing Systemfirestorm riveraNo ratings yet

- Fabm1 Module 12Document13 pagesFabm1 Module 12Mika GerminoNo ratings yet

- Class No 14 & 15Document31 pagesClass No 14 & 15WILD๛SHOTッ tanvirNo ratings yet

- Chapter 01 InventoriesDocument65 pagesChapter 01 InventoriescherunegashNo ratings yet

- Cost Accounting System Financial Accounting System Non-Integrated Accounting System Integrated Accounting SystemDocument17 pagesCost Accounting System Financial Accounting System Non-Integrated Accounting System Integrated Accounting SystemSANTHOSH KUMAR T MNo ratings yet

- Principles of Cost AccountingDocument28 pagesPrinciples of Cost AccountingKristine AlonzoNo ratings yet

- Unit Costing: Nitin PatelDocument20 pagesUnit Costing: Nitin Patelmegh418100% (1)

- Accounting For Materials: Lecture # 6Document17 pagesAccounting For Materials: Lecture # 6Aima AmirNo ratings yet

- Financial, Managerial Accounting and ReportingDocument29 pagesFinancial, Managerial Accounting and ReportingleenajaiswalNo ratings yet

- Week 08 - 01 - Module 18 - Accounting For InventoriesDocument10 pagesWeek 08 - 01 - Module 18 - Accounting For Inventories지마리No ratings yet

- Test I Poa II MarketingDocument2 pagesTest I Poa II MarketingTesfaye SimeNo ratings yet

- Principles of Cost Accounting 14EDocument30 pagesPrinciples of Cost Accounting 14Etegegn mogessieNo ratings yet

- Manufacturing Accounts FormatDocument7 pagesManufacturing Accounts Formatlaguda babajide100% (10)

- Chapter 2. Financial Mangerial ReportingDocument9 pagesChapter 2. Financial Mangerial Reportingnaveen728No ratings yet

- Cost Accounting CycleDocument8 pagesCost Accounting CycleRosiel Mae CadungogNo ratings yet

- Cost Systems: TermsDocument19 pagesCost Systems: TermsJames BarzoNo ratings yet

- Practical Accounting 2: Advance Financial Accounting Vol. 2Document38 pagesPractical Accounting 2: Advance Financial Accounting Vol. 2domingasNo ratings yet

- Adjusting - Entries Lecture - 1014647190Document5 pagesAdjusting - Entries Lecture - 1014647190Ashera MonasterioNo ratings yet

- Financial & Managerial AccountingDocument28 pagesFinancial & Managerial AccountingPrabir Kumer RoyNo ratings yet

- Introduction of The Merchandising Business: Subject-Descriptive Title Subject - CodeDocument13 pagesIntroduction of The Merchandising Business: Subject-Descriptive Title Subject - CodeRose LaureanoNo ratings yet

- MA1 T2 MD Cost Terms Concepts and ClassificationsDocument113 pagesMA1 T2 MD Cost Terms Concepts and ClassificationsMae Ciarie YangcoNo ratings yet

- Job CostingDocument4 pagesJob CostingNi Putu Cetana Sri HandayaniNo ratings yet

- Handouts DiscussionDocument7 pagesHandouts DiscussionAvox EverdeenNo ratings yet

- Nu Summary of FsDocument4 pagesNu Summary of FsKrizel AtienzaNo ratings yet

- Chapter 4 Job Order CostingDocument9 pagesChapter 4 Job Order CostingSteffany RoqueNo ratings yet

- Inventory: Audit ProblemDocument26 pagesInventory: Audit Problemjovelyn labordoNo ratings yet

- 11th - ACCOUNTANCY - PUBLIC EXAM MARCH-2023 ANSWER KEY (EM)Document17 pages11th - ACCOUNTANCY - PUBLIC EXAM MARCH-2023 ANSWER KEY (EM)nishvanprabhuNo ratings yet

- Akuntansi Biaya 2Document29 pagesAkuntansi Biaya 2nurhalizapurnamaapriliaNo ratings yet

- Inventory Systems and Periodic Recap PDFDocument4 pagesInventory Systems and Periodic Recap PDFMicah Ellah Reynoso PatindolNo ratings yet

- FoA CH II Inv 2021Document24 pagesFoA CH II Inv 2021medhane negaNo ratings yet

- Manufacturing OperationsDocument24 pagesManufacturing OperationskayeNo ratings yet

- Chapter - 5 - InventoriesDocument15 pagesChapter - 5 - InventoriesHkNo ratings yet

- Accounting ProcessDocument2 pagesAccounting ProcessKent Raysil PamaongNo ratings yet

- A Review of The Accounting CycleDocument46 pagesA Review of The Accounting CycleLiezl MaigueNo ratings yet

- Accounting Chapter 4: Closing The BooksDocument7 pagesAccounting Chapter 4: Closing The Booksamir rabieNo ratings yet

- Backflu SH Costing: Yusi, Mark Lawrence - Group 4Document19 pagesBackflu SH Costing: Yusi, Mark Lawrence - Group 4Mark Lawrence YusiNo ratings yet

- Final AccountsDocument13 pagesFinal AccountsRahul NegiNo ratings yet

- Accounting For Production LossesDocument5 pagesAccounting For Production LossesVince Christian PadernalNo ratings yet

- A Review of The Accounting CycleDocument44 pagesA Review of The Accounting CycleBelle PenneNo ratings yet

- Impairment of Loans and Receivable FinancingDocument18 pagesImpairment of Loans and Receivable FinancingKerby Gail RulonaNo ratings yet

- 4 Flow of Manufacturing CostsDocument15 pages4 Flow of Manufacturing CostsAlyana Vee VigorNo ratings yet

- Akuntansi p5Document7 pagesAkuntansi p5Alche MistNo ratings yet

- Module 5 Accounting For Manufacturing BusinessDocument5 pagesModule 5 Accounting For Manufacturing Businessmariella ellaNo ratings yet

- Acctg 11 Finals Q2 and Q3 AnswerkeyDocument17 pagesAcctg 11 Finals Q2 and Q3 AnswerkeyCrazy Solo67% (3)

- Korean Business Dictionary: American and Korean Business Terms for the Internet AgeFrom EverandKorean Business Dictionary: American and Korean Business Terms for the Internet AgeNo ratings yet

- Cos AccDocument6 pagesCos Accyza0% (3)

- Auditing Multiple ChoicesDocument8 pagesAuditing Multiple ChoicesyzaNo ratings yet

- Allowable Deductions From Gross Income - ReviewerDocument4 pagesAllowable Deductions From Gross Income - RevieweryzaNo ratings yet

- Compensation Income and Fringe Benefit Tax. ReviewerDocument4 pagesCompensation Income and Fringe Benefit Tax. RevieweryzaNo ratings yet

- Capital Gains ReviewerDocument1 pageCapital Gains RevieweryzaNo ratings yet

- Final Tax ReviewerDocument35 pagesFinal Tax Revieweryza100% (1)

- Market StructuresDocument24 pagesMarket StructuresyzaNo ratings yet

- Unit 4 - Topic 4Document1 pageUnit 4 - Topic 4yzaNo ratings yet

- Fundamental Arms and Feet PositionsDocument10 pagesFundamental Arms and Feet PositionsyzaNo ratings yet

- The Consumer Behaviour Theory: Slope Px/PyDocument3 pagesThe Consumer Behaviour Theory: Slope Px/PyyzaNo ratings yet

- Practical Accounting 1 ValixDocument277 pagesPractical Accounting 1 ValixyzaNo ratings yet

- Unit5-Impairment of Assets - SolutionsDocument1 pageUnit5-Impairment of Assets - SolutionsyzaNo ratings yet

- Activity 2 PDFDocument5 pagesActivity 2 PDFyzaNo ratings yet

- Activity 3 PDFDocument4 pagesActivity 3 PDFyzaNo ratings yet

- Fundamentals of Accountancy: Financial StatementsDocument2 pagesFundamentals of Accountancy: Financial StatementsyzaNo ratings yet

- Week1 AnswersDocument7 pagesWeek1 AnswersyzaNo ratings yet

- Final Preboard - AFAR-with AnswersDocument12 pagesFinal Preboard - AFAR-with AnswersLuiNo ratings yet

- Seminar On IFRS September 29 2010 Sirc of Icwai S.A.Murali PrasadDocument12 pagesSeminar On IFRS September 29 2010 Sirc of Icwai S.A.Murali PrasadsamservNo ratings yet

- CFA1 2019 Mock3 QuestionsDocument44 pagesCFA1 2019 Mock3 QuestionsmajedmoghadamiNo ratings yet

- 45thGIC Re Annual-Report 2016-17 Eng PDFDocument288 pages45thGIC Re Annual-Report 2016-17 Eng PDFMuthu RaveendranNo ratings yet

- Revised Corporation Code CasesDocument21 pagesRevised Corporation Code CasesIrish CPNo ratings yet

- Unit 1 Legal and Business Environment Notes JNTU - HDocument33 pagesUnit 1 Legal and Business Environment Notes JNTU - Hshiva sai100% (2)

- Consolidated Income Statement: 12 Months Ended: Dec 31, 2020Document2 pagesConsolidated Income Statement: 12 Months Ended: Dec 31, 2020Sefinas KabeerNo ratings yet

- Module 3 Case 11Document2 pagesModule 3 Case 11OnanaNo ratings yet

- Fundamentals of Financial Accounting Canadian 3Rd Edition Phillips Test Bank Full Chapter PDFDocument67 pagesFundamentals of Financial Accounting Canadian 3Rd Edition Phillips Test Bank Full Chapter PDFjocastahaohs63k100% (12)

- Leverage Notes by CA Mayank Kothari SirDocument48 pagesLeverage Notes by CA Mayank Kothari Sirbinu100% (2)

- Sap MM Udemy NotesDocument35 pagesSap MM Udemy NotesSrinivas YNo ratings yet

- AC327PracticeQuiz4 Chapter24 20141129WithoutAnswersDocument6 pagesAC327PracticeQuiz4 Chapter24 20141129WithoutAnswersJuanita Ossa Velez100% (1)

- DIS Investment ReportDocument1 pageDIS Investment ReportHyperNo ratings yet

- Ignou Important Questions MMPC 004Document2 pagesIgnou Important Questions MMPC 004catch meNo ratings yet

- Chapter 13Document2 pagesChapter 13Fatima Nicetas Rabang AlonzoNo ratings yet

- Unit 3: Indian Accounting Standard 113: Fair Value MeasurementDocument26 pagesUnit 3: Indian Accounting Standard 113: Fair Value MeasurementgauravNo ratings yet

- Instructional Guide For Accountancy: Class: Xi-XiiDocument108 pagesInstructional Guide For Accountancy: Class: Xi-XiiYonten PhuntshoNo ratings yet

- Rekening Koran Bulan Mei Juli 2023Document3 pagesRekening Koran Bulan Mei Juli 2023Panji PrakosoNo ratings yet

- Auditing A Risk Based Approach 11th Edition Johnstone Test BankDocument65 pagesAuditing A Risk Based Approach 11th Edition Johnstone Test Bankronaldgonzalezwjkpizoctd100% (14)

- Internship at Carlsquare: DealsDocument1 pageInternship at Carlsquare: DealsReyansh SharmaNo ratings yet

- Ophir Energy Aquisition Morgan Stanley Credit Suisse RBCDocument233 pagesOphir Energy Aquisition Morgan Stanley Credit Suisse RBCredevils86No ratings yet

- Global Public MA Guide PDFDocument741 pagesGlobal Public MA Guide PDFRafael Ernesto Ponce PérezNo ratings yet

- Retail Bakeries Financial Industry Analysis - SageworksDocument4 pagesRetail Bakeries Financial Industry Analysis - SageworksMichael Enrique Pérez MoreiraNo ratings yet

- Chandra Asri Petrochemical (TPIA IJ) : Close To The Top of A Recovery CycleDocument10 pagesChandra Asri Petrochemical (TPIA IJ) : Close To The Top of A Recovery CyclerobNo ratings yet

- FM204Document8 pagesFM204Vinoth KumarNo ratings yet

- GAIL Annual Report 2019Document43 pagesGAIL Annual Report 2019Umer AzizNo ratings yet

- FFA - Fa S20-A21 Examiner's ReportDocument10 pagesFFA - Fa S20-A21 Examiner's ReportNguynNo ratings yet