Professional Documents

Culture Documents

5 - Assign - Pad & Sad Co.

5 - Assign - Pad & Sad Co.

Uploaded by

Pinky DaisiesOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

5 - Assign - Pad & Sad Co.

5 - Assign - Pad & Sad Co.

Uploaded by

Pinky DaisiesCopyright:

Available Formats

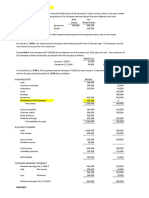

6 PAD & SAD COMPANY Downstream sale

On January 1, YEAR 1, Pad Company purchased 40,000 shares of Sad Company's P 20 par ordinary shares in the open

market for P 1,480,000.

On that date, the net assets of Sad Company amounted to P 1,600,000. and had book values that approximated their

market values.

The excess is due to an equipment with a market value P 250,000 higher than its book value. It has a useful life of

10 years from the acquisition date. Pad Company uses the cost method to account for its investment

On December 31, YEAR 3, Sad Company owed Pad Company P 140,000 on open account from purchases made during 2008.

The amount of the sales to Sad Company during YEAR 3 is P 1,000,000. Pad Company shipped merchandise to Sad Co.

at its normal shipping price and had a cost of P 400,000. The entire ending inventory of Sad Co. was purchased from

Pad Co. The beginning inventory of Sad Company included P 200,000 of inventory acquired from Pad Company at the

same rate of profit.

Financial statement for the two companies for the year ended December 31, YEAR 3 are as follows:

A BALANCE SHEET PAD CO. SAD CO.

Cash 600,000 400,000

Accounts receivable 520,000 400,000

Inventories 800,000 400,000

Land 1,200,000

Building-net 800,000

Equipment-net 2,606,000 2,000,000

Investment in SAD Company 1,480,000 0

Total assets 8,006,000 3,200,000

Accounts payable 604,000 360,000

Bonds payable 196,000

Ordinary shares 1,000,000 1,000,000

Share premium 600,000

Retained earnings 5,606,000 1,840,000

Total liabilities & equity 8,006,000 3,200,000

B INCOME STATEMENT

Sales 4,000,000 2,000,000

Cost of sales 1,600,000 1,200,000

Gross income 2,400,000 800,000

Dividend income 96,000 0

Total income 2,496,000 800,000

Operating expenses 1,560,000 560,000

NET INCOME 936,000 240,000

C RETAINED EARNINGS STATEMENT

Retained earnings, Jan 1, YEAR 3 5,470,000 1,720,000

Add: Net income 936,000 240,000

6,406,000 1,960,000

Less Dividends 800,000 120,000

Retained earnings, Dec 31, YEAR 3 5,606,000 1,840,000

REQUIRED:

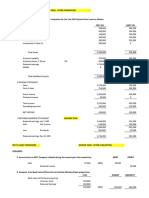

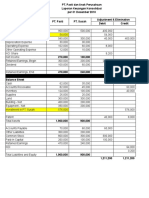

1. COMPUTATION OF COST/BOOK VALUE DIFFERENTIAL

2. CONSOLIDATED NET INCOME

3. ELIMINATION ENTRIES:

4. WORKING PAPER

ELIMINATIONS CONSOLI

BALANCE SHEET PAD SAD DEBIT CREDIT BS

Cash 600,000 400,000

Accounts receivable 520,000 400,000

Inventories 800,000 400,000

Land 1,200,000

Building 800,000

Equipment 2,606,000 2,000,000

INVESTMENT IN SAD 1,480,000 0

Total assets 8,006,000 3,200,000

Accounts payable 604,000 360,000

Bonds payable 196,000

Ordinary shares 1,000,000 1,000,000

Share premium 600,000

Retained earnings 5,606,000 1,840,000

MINORITY INTEREST (MINAS)

Total liabilities & equity 8,006,000 3,200,000

INCOME STATEMENT

Sales 4,000,000 2,000,000

Cost of sales 1,600,000 1,200,000

Gross income 2,400,000 800,000

Dividend income 96,000 0

Total income 2,496,000 800,000

Operating expenses 1,560,000 560,000

NET INCOME 936,000 240,000

Minority Interest Net Income

Consolidated Net Income

RETAINED EARNINGS STATEMENT

Retained earnings, Jan 1, Yr. 3 5,470,000 1,720,000

Add: Net income 936,000 240,000

6,406,000 1,960,000

Less Dividends 800,000 120,000

Retained earnings, Dec 31, Yr. 3 5,606,000 1,840,000

You might also like

- ProblemDocument30 pagesProblemJenika AtanacioNo ratings yet

- Discussion 1 Second Sem .PDF-1Document11 pagesDiscussion 1 Second Sem .PDF-1Io Aya100% (2)

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- Quiz 002 Classification of Taxpayers - PALACIODocument3 pagesQuiz 002 Classification of Taxpayers - PALACIOPinky Daisies100% (1)

- 6 - Pat & Sat Co. - PALACIODocument7 pages6 - Pat & Sat Co. - PALACIOPinky DaisiesNo ratings yet

- DIFFICULTDocument7 pagesDIFFICULTQueen ValleNo ratings yet

- Contoh Soal Pelaporan KorporatDocument4 pagesContoh Soal Pelaporan Korporatirma cahyani kawi0% (1)

- SCI Handout 1 PDFDocument4 pagesSCI Handout 1 PDFhairu keyansamNo ratings yet

- Engagement Letter For Business Bookkeeping and Tax PrepartionDocument2 pagesEngagement Letter For Business Bookkeeping and Tax PrepartionPinky Daisies100% (1)

- 6 - Pat & Sat Co. - PALACIODocument7 pages6 - Pat & Sat Co. - PALACIOPinky DaisiesNo ratings yet

- TB Chapter02Document54 pagesTB Chapter02Dan Andrei BongoNo ratings yet

- Paw and Saw DownstreamDocument3 pagesPaw and Saw DownstreamLorie Roncal JimenezNo ratings yet

- Bab III Buku Bu IinDocument14 pagesBab III Buku Bu IinAditya Agung SatrioNo ratings yet

- Book 11Document4 pagesBook 11Actg SolmanNo ratings yet

- Business Combination Accounted For Under The Equity MethodDocument4 pagesBusiness Combination Accounted For Under The Equity MethodMixx MineNo ratings yet

- Randall Corporation and Sharp Company Consolidation Worksheet December 31, 20X7Document5 pagesRandall Corporation and Sharp Company Consolidation Worksheet December 31, 20X7Diane MagnayeNo ratings yet

- Depreciation Expense: For Year Ended 2015 Elimination Debit Credit P S..Document14 pagesDepreciation Expense: For Year Ended 2015 Elimination Debit Credit P S..Agitha Juniaty PasalliNo ratings yet

- Intangibles Assignment - Valix 2017Document3 pagesIntangibles Assignment - Valix 2017Shinny Jewel VingnoNo ratings yet

- A4 PalacioDocument3 pagesA4 PalacioPinky DaisiesNo ratings yet

- FSA Financial StatementsDocument4 pagesFSA Financial StatementsabidjaysNo ratings yet

- Chapter 15Document12 pagesChapter 15Nikki GarciaNo ratings yet

- Sukoako Company Statement of Financial Position Current Assets Year 1 Year 2Document5 pagesSukoako Company Statement of Financial Position Current Assets Year 1 Year 2Kevin GarnettNo ratings yet

- Acc AnswerDocument1 pageAcc AnswerFierryl MenisNo ratings yet

- FINMAN MIDTERMS FinalDocument5 pagesFINMAN MIDTERMS FinalJennifer RasonabeNo ratings yet

- Solusi Inventory Downstream-UpstreamDocument19 pagesSolusi Inventory Downstream-UpstreamKurrniadi AndiNo ratings yet

- Bus ComDocument14 pagesBus ComSITTIE AINNAH SHIREEHN DIDAAGUNNo ratings yet

- Midterms I Answer KeyDocument5 pagesMidterms I Answer Keyaldric taclanNo ratings yet

- Chapter 6Document7 pagesChapter 6Its meh SushiNo ratings yet

- PFRS 3 Business CombinationDocument3 pagesPFRS 3 Business CombinationRay Allen UyNo ratings yet

- Asset AcquisitionDocument3 pagesAsset AcquisitionMerliza JusayanNo ratings yet

- Advanced Accounting 2 - Chapter 4 James B. Cantorne Problem 1. T/FDocument7 pagesAdvanced Accounting 2 - Chapter 4 James B. Cantorne Problem 1. T/FJames CantorneNo ratings yet

- Buscom DiscussionDocument3 pagesBuscom DiscussionLorie Grace LagunaNo ratings yet

- SOFP-mcq ProblemsDocument4 pagesSOFP-mcq Problemschey dabest100% (1)

- Bac 203 Cat 2Document3 pagesBac 203 Cat 2Brian MutuaNo ratings yet

- 1.statement of Cash Flows - MIDTERMDocument27 pages1.statement of Cash Flows - MIDTERMMaeNo ratings yet

- Latihan Intercompany Profit Transactions-Plant Assets WS 2Document5 pagesLatihan Intercompany Profit Transactions-Plant Assets WS 2Raihan SalehNo ratings yet

- Abc ProbsDocument12 pagesAbc ProbsZNo ratings yet

- Q5 Vikings LimitedDocument2 pagesQ5 Vikings Limitedamosmalusi5No ratings yet

- Ilham Dwi L - 261Document1 pageIlham Dwi L - 261Via jyNo ratings yet

- P1 Cash FlowDocument2 pagesP1 Cash FlowBeth Diaz LaurenteNo ratings yet

- Auditing Problem Quiz 2 Long Problem SolutionsDocument7 pagesAuditing Problem Quiz 2 Long Problem Solutionsreina maica terradoNo ratings yet

- GPV & SCF (Assignment)Document16 pagesGPV & SCF (Assignment)Mica Moreen GuillermoNo ratings yet

- Business Combination at The Date of AcquisitionDocument1 pageBusiness Combination at The Date of AcquisitionDarren Joy CoronaNo ratings yet

- Cash Flow AnalysisDocument4 pagesCash Flow AnalysisMargin Pason RanjoNo ratings yet

- FFS - NumericalsDocument5 pagesFFS - NumericalsFunny ManNo ratings yet

- Activity 1Document4 pagesActivity 1Lezi WooNo ratings yet

- Accounting Assignment CHP 1-1Document11 pagesAccounting Assignment CHP 1-1MUHAMMAD AMMAD ARSHADNo ratings yet

- Intacc 3 Fs ProblemsDocument25 pagesIntacc 3 Fs ProblemsUn knownNo ratings yet

- Quiz - Consolidated FS Part 2Document3 pagesQuiz - Consolidated FS Part 2skyieNo ratings yet

- Acc2 CH11Document6 pagesAcc2 CH11Leah CalataNo ratings yet

- 2ND Year QualiDocument4 pages2ND Year QualiMark Domingo MendozaNo ratings yet

- Advanced Accounting 2DDocument5 pagesAdvanced Accounting 2DHarusiNo ratings yet

- The Institute of Chartered Accountants of Bangladesh: Sample Question Paper Certificate Level-AccountingDocument8 pagesThe Institute of Chartered Accountants of Bangladesh: Sample Question Paper Certificate Level-AccountingArif UddinNo ratings yet

- Latihan P7-4Document6 pagesLatihan P7-4ryuNo ratings yet

- 7295 - Single EntryDocument2 pages7295 - Single EntryJulia MirhanNo ratings yet

- Discussion 1 Second Sem PDFDocument11 pagesDiscussion 1 Second Sem PDFRNo ratings yet

- Statement of Cash FlowsDocument6 pagesStatement of Cash FlowsLuiNo ratings yet

- Net Working Capital Current Assets - Current LiabilitiesDocument11 pagesNet Working Capital Current Assets - Current LiabilitiesRahul YadavNo ratings yet

- FR 2018 Paper PrelimDocument12 pagesFR 2018 Paper PrelimshashalalaxiangNo ratings yet

- Akuntansi Chapter 4Document23 pagesAkuntansi Chapter 4Alfian Rizal MahendraNo ratings yet

- Statement of CashflowDocument2 pagesStatement of CashflowAna Marie IllutNo ratings yet

- Assignment Brief - Case StudyDocument9 pagesAssignment Brief - Case StudyuzzicauberNo ratings yet

- Assets AmountsDocument6 pagesAssets Amountsaashir chNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Orca Share Media1563805272988Document3 pagesOrca Share Media1563805272988Pinky DaisiesNo ratings yet

- Steps in Consolidation Working Papers On The Date of AcquisitionDocument3 pagesSteps in Consolidation Working Papers On The Date of AcquisitionPinky DaisiesNo ratings yet

- Privity Sample Letter 1Document2 pagesPrivity Sample Letter 1Pinky DaisiesNo ratings yet

- Chapter 1 Linear Equations Week 1 and 2Document21 pagesChapter 1 Linear Equations Week 1 and 2Pinky DaisiesNo ratings yet

- BFA Buyback Calculator: Type Item Price Quantity SubtotalDocument3 pagesBFA Buyback Calculator: Type Item Price Quantity SubtotalPinky DaisiesNo ratings yet

- INCOME TAXATION Tabag Summary Chapter 1 and Chapter 2 PDFDocument3 pagesINCOME TAXATION Tabag Summary Chapter 1 and Chapter 2 PDFPinky DaisiesNo ratings yet

- DVK, Inc.: Engagement Letter For Accounting ServicesDocument2 pagesDVK, Inc.: Engagement Letter For Accounting ServicesPinky DaisiesNo ratings yet

- Columban College, Inc: Center For Lifelong Learning and Skills DevelopmentDocument1 pageColumban College, Inc: Center For Lifelong Learning and Skills DevelopmentPinky DaisiesNo ratings yet

- Fair Value of Non-Controlling Interest in The Acquiree (Subsidiary) Is Not GivenDocument11 pagesFair Value of Non-Controlling Interest in The Acquiree (Subsidiary) Is Not GivenPinky Daisies100% (2)

- Fair Value of Non-Controlling Interest in The Acquiree (Subsidiary) Is Not GivenDocument5 pagesFair Value of Non-Controlling Interest in The Acquiree (Subsidiary) Is Not GivenPinky Daisies100% (1)

- Earth Science Week One and Week Two AnwersDocument2 pagesEarth Science Week One and Week Two AnwersPinky DaisiesNo ratings yet

- A Firm Might Reach Its Shutdown Point For Reasons That Range From Standard Diminishing Marginal Returns To Declining Market Prices For Its MerchandiseDocument3 pagesA Firm Might Reach Its Shutdown Point For Reasons That Range From Standard Diminishing Marginal Returns To Declining Market Prices For Its MerchandisePinky DaisiesNo ratings yet

- Petty Cash CountDocument1 pagePetty Cash CountPinky DaisiesNo ratings yet

- Middle Name Birthdate DEPED EmailDocument3 pagesMiddle Name Birthdate DEPED EmailPinky DaisiesNo ratings yet

- NGO 17-Sep Assign 2 General Concepts For Not-For-Profit OrgDocument1 pageNGO 17-Sep Assign 2 General Concepts For Not-For-Profit OrgPinky DaisiesNo ratings yet

- Earth Science Week 2Document1 pageEarth Science Week 2Pinky DaisiesNo ratings yet

- A4 PalacioDocument3 pagesA4 PalacioPinky DaisiesNo ratings yet

- CHAPTER 2: The Philippines in The 19 Century Activity/Quiz 2 Name: Course TitleDocument1 pageCHAPTER 2: The Philippines in The 19 Century Activity/Quiz 2 Name: Course TitlePinky DaisiesNo ratings yet

- A. Engagement Letter From Client To CPA - PALACIODocument2 pagesA. Engagement Letter From Client To CPA - PALACIOPinky DaisiesNo ratings yet

- Activity - Quiz - Chapter 3Document2 pagesActivity - Quiz - Chapter 3Pinky DaisiesNo ratings yet

- B. Acceptance Letter - PALACIODocument2 pagesB. Acceptance Letter - PALACIOPinky DaisiesNo ratings yet

- Black Flag Armory Price ListDocument19 pagesBlack Flag Armory Price ListPinky DaisiesNo ratings yet

- Quiz 002 Classification of TaxpayersDocument2 pagesQuiz 002 Classification of TaxpayersPinky DaisiesNo ratings yet

- Set ExercisesDocument2 pagesSet ExercisesPinky DaisiesNo ratings yet

- Rocks and Minerals - Grade11-Week 2Document39 pagesRocks and Minerals - Grade11-Week 2Pinky Daisies100% (1)

- VQDevcom - Tiny WorkersDocument3 pagesVQDevcom - Tiny WorkersPinky DaisiesNo ratings yet

- Module - 5 Market Structure and Pricing DecisionDocument10 pagesModule - 5 Market Structure and Pricing DecisionRatna V. VyasNo ratings yet

- Aqap-119 (Edition 2) : Nato Guide To Aqaps - 110, - 120 and - 130Document33 pagesAqap-119 (Edition 2) : Nato Guide To Aqaps - 110, - 120 and - 130Bahadır HarmancıNo ratings yet

- Student ListDocument4 pagesStudent ListsodkNo ratings yet

- Assign 2Document2 pagesAssign 2Muhammad Ahsen FahimNo ratings yet

- IFC CAFI PlatformDocument19 pagesIFC CAFI PlatformJehanzebNo ratings yet

- Comparative Study On Npa of Public Sector Bank and Private Sector BankDocument45 pagesComparative Study On Npa of Public Sector Bank and Private Sector BankTushar SikarwarNo ratings yet

- Vehicle Sales Agreement TemplateDocument4 pagesVehicle Sales Agreement TemplateSatya Prakash Trivedi100% (1)

- The Dry Port Concept Theory and PracticeDocument13 pagesThe Dry Port Concept Theory and PracticeMostafa ShaheenNo ratings yet

- Auditing Theory - 2Document11 pagesAuditing Theory - 2Kageyama HinataNo ratings yet

- SampleFoodBusinessPlanOklahomaState 1840Document16 pagesSampleFoodBusinessPlanOklahomaState 1840swalih mohammedNo ratings yet

- Matt E: Amazon Expert - PPC, Listing Optimization, Seller & Vendor CentralDocument4 pagesMatt E: Amazon Expert - PPC, Listing Optimization, Seller & Vendor Centralzee pointNo ratings yet

- Management Accounting and Controlling Group Assignment: Topic - Cost Analysis of Maruti Suzuki LTDDocument10 pagesManagement Accounting and Controlling Group Assignment: Topic - Cost Analysis of Maruti Suzuki LTDManan LodhaNo ratings yet

- Financial Management of HospitalsDocument13 pagesFinancial Management of HospitalsaakarNo ratings yet

- Lembar Jawaban Siklus DagangDocument56 pagesLembar Jawaban Siklus DagangSuci Agriani IdrusNo ratings yet

- ACCBP 100 SIM - WEEK8-9 ULObDocument13 pagesACCBP 100 SIM - WEEK8-9 ULObemem resuentoNo ratings yet

- PRICING DECISIONS NewDocument11 pagesPRICING DECISIONS NewFaiz MohammedNo ratings yet

- HTV International Pvt. Ltd.Document1 pageHTV International Pvt. Ltd.Raj GuptaNo ratings yet

- Light Sweet Crude Oil (WTI) Futures and Options: How The World AdvancesDocument16 pagesLight Sweet Crude Oil (WTI) Futures and Options: How The World AdvancesDark CygnusNo ratings yet

- Solutins Manual For Strategic Staffing 3rd Edition by Jeam M.Phillips and Stan M.GullyDocument7 pagesSolutins Manual For Strategic Staffing 3rd Edition by Jeam M.Phillips and Stan M.Gullyshaikha alneyadiNo ratings yet

- Infrastructure Investing - A Primer: Private Markets InsightsDocument12 pagesInfrastructure Investing - A Primer: Private Markets InsightsSeye BassirNo ratings yet

- Chapter 20Document4 pagesChapter 20Wassim AlwanNo ratings yet

- Social Media Marketing (Universitas Pelita Harapan)Document18 pagesSocial Media Marketing (Universitas Pelita Harapan)Erik PratamaNo ratings yet

- Environmental Audit Manual EDITED 29 Nov 2010Document79 pagesEnvironmental Audit Manual EDITED 29 Nov 2010JocelynKongSingCheah100% (1)

- Adwea Approved Vendors ListDocument2 pagesAdwea Approved Vendors ListRonaldo JuniorNo ratings yet

- Crushing It With YouTubeDocument30 pagesCrushing It With YouTubeEdwin Cuba Huamani100% (1)

- Introduction To Financial Accounting NotesDocument3 pagesIntroduction To Financial Accounting NotesRaksa HemNo ratings yet

- M&A Walmart TakeoverDocument2 pagesM&A Walmart TakeoverPhilip HabersaatNo ratings yet

- Custom Clearance Procedure PDFDocument70 pagesCustom Clearance Procedure PDFManish Chaurasia91% (23)

- 2000 - VAICTM-an Accounting Tool For IC Management - Ante PulicDocument13 pages2000 - VAICTM-an Accounting Tool For IC Management - Ante PulicIklima RahmaNo ratings yet