Professional Documents

Culture Documents

Makauno Co.: Semi-Monthly Payroll August 1-15, 2020

Makauno Co.: Semi-Monthly Payroll August 1-15, 2020

Uploaded by

Chincel G. ANICopyright:

Available Formats

You might also like

- 15 MCQ Estate Taxation WITH ANSWERS PDFDocument4 pages15 MCQ Estate Taxation WITH ANSWERS PDFChincel G. ANI50% (2)

- WPS Salary Debit Authority Letter TemplateDocument1 pageWPS Salary Debit Authority Letter Templatetaraivan100% (2)

- Entrepreneurship G11-1Document88 pagesEntrepreneurship G11-1athyNo ratings yet

- Accounts Payable EssayDocument2 pagesAccounts Payable EssayInday MiraNo ratings yet

- Payroll ProcessDocument8 pagesPayroll ProcesssrikarchanduNo ratings yet

- Payroll AccountingDocument7 pagesPayroll Accountingmobinil1No ratings yet

- Autocount Manual PDFDocument28 pagesAutocount Manual PDFKelvin Leong100% (1)

- PESTEL Analysis of McDonaldDocument2 pagesPESTEL Analysis of McDonaldpoonamNo ratings yet

- Burlington Northern Railroad CompanyDocument13 pagesBurlington Northern Railroad CompanysdNo ratings yet

- PartnershipDocument41 pagesPartnershipBinex67% (3)

- 20 Easy Steps To Starting Your Bookkeeping Business: by Sylvia JaumannDocument13 pages20 Easy Steps To Starting Your Bookkeeping Business: by Sylvia JaumannDave A ValcarcelNo ratings yet

- Resignation LetterDocument1 pageResignation LetterJohanna DawnNo ratings yet

- Notes On Registration of Book of AccountsDocument3 pagesNotes On Registration of Book of AccountsDenzel Edward CariagaNo ratings yet

- Applicant Information SheetDocument2 pagesApplicant Information SheetppppNo ratings yet

- Payroll: Policy and ProceduresDocument5 pagesPayroll: Policy and ProceduresHer Huw100% (1)

- Payroll ManagementDocument6 pagesPayroll ManagementNisha_Yadav_6277No ratings yet

- AWOL NoticeDocument1 pageAWOL NoticeAmianan BulletinNo ratings yet

- Accounting Cycle Upto Trial BalanceDocument60 pagesAccounting Cycle Upto Trial BalancejobwangaNo ratings yet

- Notice of Furlough (COVID-19)Document1 pageNotice of Furlough (COVID-19)Narayana Swaroop VeerubhotlaNo ratings yet

- Tax Compliance On PayrollDocument2 pagesTax Compliance On PayrollJoyceNo ratings yet

- Payroll TrackerDocument27 pagesPayroll Trackerkurtkomeng1820% (1)

- Presentation - Payroll ProcessDocument29 pagesPresentation - Payroll ProcessMujtaba Merchant0% (1)

- Flow Chart (Accounts Payable Clerk)Document2 pagesFlow Chart (Accounts Payable Clerk)cristynvilNo ratings yet

- Accounting, Tax and Payroll Services - Lani-Rose Shipping PDFDocument6 pagesAccounting, Tax and Payroll Services - Lani-Rose Shipping PDFjohnkurt catipayNo ratings yet

- Compensation Management Mod 1Document36 pagesCompensation Management Mod 1Nikita SangalNo ratings yet

- External Users of AccountingDocument3 pagesExternal Users of AccountingMarko Zero Four0% (1)

- Management Accounting: S.K. Gupta Guest LecturerDocument37 pagesManagement Accounting: S.K. Gupta Guest LecturersantNo ratings yet

- Termination LetterDocument1 pageTermination LetterrianzaresmrlonNo ratings yet

- Topic 1: Complete Initial Setup TasksDocument5 pagesTopic 1: Complete Initial Setup TasksRobelyn LacorteNo ratings yet

- Payroll SystemDocument15 pagesPayroll SystemPrince Persia100% (1)

- Accounting Worksheet V 1.0Document6 pagesAccounting Worksheet V 1.0Adil IqbalNo ratings yet

- Human Resources & It's ImpactDocument36 pagesHuman Resources & It's ImpactSyed Bilal MahmoodNo ratings yet

- HR FormsDocument5 pagesHR FormsBindu ManoharNo ratings yet

- ABRY Scheme GuidelinesDocument12 pagesABRY Scheme GuidelinesreenaNo ratings yet

- Payroll SystemDocument6 pagesPayroll SystemPriyan Trivedi50% (2)

- Performance Appraisals. 2011Document4 pagesPerformance Appraisals. 2011Koya Clement AhmiegbeNo ratings yet

- Accountant Interview Questions 2Document1 pageAccountant Interview Questions 2evaNo ratings yet

- MYOB GST Preparation Guide (Existing Users)Document18 pagesMYOB GST Preparation Guide (Existing Users)manimaran75No ratings yet

- Employee Id No. Name of Employee: TotalDocument15 pagesEmployee Id No. Name of Employee: TotalRoldan Arca PagaposNo ratings yet

- Sunshine Hospitality: Salary (P.M.) Net Salary Working DaysDocument7 pagesSunshine Hospitality: Salary (P.M.) Net Salary Working DayssuneelstarNo ratings yet

- Mandatory-ContributionsDocument2 pagesMandatory-Contributionspao reyesNo ratings yet

- Final IannaDocument83 pagesFinal IannaJuzetteValerieSarceNo ratings yet

- B127-Aragon-A No 4Document6 pagesB127-Aragon-A No 4Shaina AragonNo ratings yet

- Business-Plan Final WorksheetDocument43 pagesBusiness-Plan Final WorksheetKrishia Belacsi BajanaNo ratings yet

- Pasia Singapore Plans Discussion Document: 18 Feb 2019 Rev 3Document6 pagesPasia Singapore Plans Discussion Document: 18 Feb 2019 Rev 3Aljon DagalaNo ratings yet

- F&a Cash Collection Report For October 2022Document5 pagesF&a Cash Collection Report For October 2022Esther AkpanNo ratings yet

- 2ND Mandatory-Deduction-For-2023Document2 pages2ND Mandatory-Deduction-For-2023EgieMae GarcesNo ratings yet

- School Canteen Records v2 TemplateDocument34 pagesSchool Canteen Records v2 TemplateYeshua Yesha100% (1)

- SSS Contribution CalculatorDocument3 pagesSSS Contribution Calculatorcool08coolNo ratings yet

- Arnaez MBCPayroll CalculatorDocument12 pagesArnaez MBCPayroll Calculatoracctg2012No ratings yet

- Exercise-1 pg.103Document4 pagesExercise-1 pg.103cherein6soriano6paelNo ratings yet

- Azucena MBCPayroll CalculatorDocument14 pagesAzucena MBCPayroll Calculatoracctg2012No ratings yet

- Tax Calculator FormulaDocument5 pagesTax Calculator FormulaLizaNo ratings yet

- Tax Calculator FormulaDocument5 pagesTax Calculator FormulaCJ De LunaNo ratings yet

- Tax Calculator FormulaDocument5 pagesTax Calculator FormulaTaeeeee taeNo ratings yet

- Budget 2023Document105 pagesBudget 2023CarlNo ratings yet

- Martin MBCPayroll CalculatorDocument12 pagesMartin MBCPayroll Calculatoracctg2012No ratings yet

- Payroll 2023 1Document19 pagesPayroll 2023 1Carl Dela CruzNo ratings yet

- Tax Calculator FormulaDocument5 pagesTax Calculator FormulaKerwin Lester MandacNo ratings yet

- Tax Calculator FormulaDocument5 pagesTax Calculator FormulaDonghyuk KimNo ratings yet

- Egv Entertainment Co.,Ltd Majorcineplex Co.,Ltd.: PAY - ACCOUNT.234-0-2485-6 PAY ACCOUNT 223-0-36814-0 GV กบขDocument8 pagesEgv Entertainment Co.,Ltd Majorcineplex Co.,Ltd.: PAY - ACCOUNT.234-0-2485-6 PAY ACCOUNT 223-0-36814-0 GV กบขhoneypuengNo ratings yet

- 2023 SSS TableDocument2 pages2023 SSS TableJanielee HernandezNo ratings yet

- BC XCDocument6 pagesBC XCKaren Sofía Villa RealNo ratings yet

- Age 29 Male - 50T Premium InvDocument2 pagesAge 29 Male - 50T Premium InvRon CatalanNo ratings yet

- Joepryl: Would Like To Invite You To His ChristeningDocument1 pageJoepryl: Would Like To Invite You To His ChristeningChincel G. ANINo ratings yet

- What Is Your Biggest Concern About The FutureDocument3 pagesWhat Is Your Biggest Concern About The FutureChincel G. ANINo ratings yet

- IS The Accountants Perspective SummaryDocument32 pagesIS The Accountants Perspective SummaryChincel G. ANINo ratings yet

- Accounting For Foreign Currency Transaction PDFDocument3 pagesAccounting For Foreign Currency Transaction PDFChincel G. ANINo ratings yet

- Indian CivilizationDocument19 pagesIndian CivilizationChincel G. ANINo ratings yet

- Marcos Martial Law: Huk Supremo Luis TarucDocument1 pageMarcos Martial Law: Huk Supremo Luis TarucChincel G. ANINo ratings yet

- Mer Cu Ri Al: Phi Lan DerDocument3 pagesMer Cu Ri Al: Phi Lan DerChincel G. ANINo ratings yet

- Home Office, Branch and Agency AccountingDocument5 pagesHome Office, Branch and Agency AccountingChincel G. ANINo ratings yet

- POWER PlantDocument26 pagesPOWER PlantChincel G. ANINo ratings yet

- RATIONAL CHOICE THEORY JohnDocument33 pagesRATIONAL CHOICE THEORY JohnChincel G. ANINo ratings yet

- Research Sample ReportDocument1 pageResearch Sample ReportChincel G. ANINo ratings yet

- Chapter 1 - Multiple Choice Problem Answers AfarDocument13 pagesChapter 1 - Multiple Choice Problem Answers AfarChincel G. ANINo ratings yet

- STEM Quiz Answers: Culham Centre For Fusion EnergyDocument2 pagesSTEM Quiz Answers: Culham Centre For Fusion EnergyChincel G. ANINo ratings yet

- It AppDocument22 pagesIt AppChincel G. ANINo ratings yet

- Notes To Financial Statement MeaningDocument2 pagesNotes To Financial Statement MeaningChincel G. ANINo ratings yet

- Illustrative Problem 2.1-2Document3 pagesIllustrative Problem 2.1-2Chincel G. ANINo ratings yet

- Illustrative Problem 4.1 PDFDocument1 pageIllustrative Problem 4.1 PDFChincel G. ANINo ratings yet

- Central Philippine University Course Syllabus Acctg 2312 - IT Application Tools in Business (Accounting)Document5 pagesCentral Philippine University Course Syllabus Acctg 2312 - IT Application Tools in Business (Accounting)Chincel G. ANINo ratings yet

- Cost Monitoring FormDocument38 pagesCost Monitoring FormChincel G. ANINo ratings yet

- Anti - Money Laundering Act: RA No. 9160, As Amended by RA No. 10167 and RA No. 10365Document43 pagesAnti - Money Laundering Act: RA No. 9160, As Amended by RA No. 10167 and RA No. 10365Chincel G. ANINo ratings yet

- EFM-CHAPTER11 Management AccountingDocument52 pagesEFM-CHAPTER11 Management AccountingChincel G. ANINo ratings yet

- Garrison Lecture Chapter 5Document97 pagesGarrison Lecture Chapter 5Chincel G. ANINo ratings yet

- FACTS OF CASE EnronDocument8 pagesFACTS OF CASE EnronChincel G. ANINo ratings yet

- Chapter 2: Finanacial Markets and InstitutionsDocument6 pagesChapter 2: Finanacial Markets and InstitutionsChincel G. ANINo ratings yet

- Chapter 15 PDFDocument61 pagesChapter 15 PDFChincel G. ANINo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Sourav bhattacharyya0% (1)

- Compare The Merits of The Entry Strategies Discussed in This ChapterDocument3 pagesCompare The Merits of The Entry Strategies Discussed in This ChapterVikram KumarNo ratings yet

- RCM vs. FMEA - There Is A Distinct Difference!: RCM - Reliability Centered MaintenanceDocument4 pagesRCM vs. FMEA - There Is A Distinct Difference!: RCM - Reliability Centered Maintenanceg_viegasNo ratings yet

- EntryDocument6 pagesEntryadomniteimiki2No ratings yet

- Quiz ResearchDocument11 pagesQuiz ResearchEmmanuel BalitostosNo ratings yet

- FINALDocument20 pagesFINALShubhangi BishnoiNo ratings yet

- Sample Questionnaire For Job AnalysisDocument4 pagesSample Questionnaire For Job AnalysisJinal DamaniNo ratings yet

- Policy WriteupDocument3 pagesPolicy Writeupdey.joybrotoNo ratings yet

- Trainee'S Record Book: Technical Education and Skills Development AuthorityDocument10 pagesTrainee'S Record Book: Technical Education and Skills Development AuthorityVirgil Keith Juan PicoNo ratings yet

- Inflation. Interest Rates. Balance of Payments. Government Intervention. Other FactorsDocument2 pagesInflation. Interest Rates. Balance of Payments. Government Intervention. Other FactorsEmmanuelle RojasNo ratings yet

- My ContractDocument9 pagesMy Contractbaniprakoso90No ratings yet

- JfefhehfejhfnyryryyyyyrryyrDocument3 pagesJfefhehfejhfnyryryyyyyrryyrAtulit AgarwalNo ratings yet

- What Is Accounts Receivable (AR) ?Document2 pagesWhat Is Accounts Receivable (AR) ?Art B. EnriquezNo ratings yet

- Single Entry SystemDocument15 pagesSingle Entry Systemmdhanjalah08No ratings yet

- Module 3 Navigating The Trail 1Document7 pagesModule 3 Navigating The Trail 1Daienne Abegail EspinosaNo ratings yet

- Marketing Debate Ch17Document3 pagesMarketing Debate Ch17Mariska Putri Adelia67% (3)

- Odoo OpenERP Implementation MethodologyDocument6 pagesOdoo OpenERP Implementation MethodologyyourreddyNo ratings yet

- Slide RMK Chapter 1 - Kelompok 5 - Maksi 43CDocument15 pagesSlide RMK Chapter 1 - Kelompok 5 - Maksi 43CJali FusNo ratings yet

- Implication of Management Functions in Nayyer CarpetDocument14 pagesImplication of Management Functions in Nayyer CarpetAhmad AzharNo ratings yet

- Entrep 5Document5 pagesEntrep 5Kenth Godfrei DoctoleroNo ratings yet

- Reflection Paper - Pledge 1% Model - Ronan VillagonzaloDocument1 pageReflection Paper - Pledge 1% Model - Ronan Villagonzaloronan.villagonzaloNo ratings yet

- Taxation Quizzer Quizzes For Tax PDFDocument62 pagesTaxation Quizzer Quizzes For Tax PDFCelestino AlisNo ratings yet

- Warren County EDA Communication On Lawsuit Against Director On FraudDocument2 pagesWarren County EDA Communication On Lawsuit Against Director On FraudBeverly TranNo ratings yet

- Karina Market Structure SummaryDocument4 pagesKarina Market Structure SummaryKarina Permata SariNo ratings yet

- Recruitment Process of Coca-Cola CompanyDocument31 pagesRecruitment Process of Coca-Cola CompanySagar SahaNo ratings yet

- SM - Distinctive CompetenciesDocument2 pagesSM - Distinctive CompetenciesVivek PimpleNo ratings yet

- Earned Value ManagementDocument15 pagesEarned Value ManagementNguyen Chi ThanhNo ratings yet

Makauno Co.: Semi-Monthly Payroll August 1-15, 2020

Makauno Co.: Semi-Monthly Payroll August 1-15, 2020

Uploaded by

Chincel G. ANIOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Makauno Co.: Semi-Monthly Payroll August 1-15, 2020

Makauno Co.: Semi-Monthly Payroll August 1-15, 2020

Uploaded by

Chincel G. ANICopyright:

Available Formats

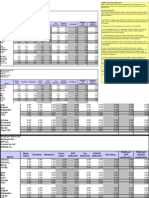

MAKAUNO CO.

Semi-monthly Payroll

August 1-15, 2020

Semi-Monthly

Name of Employee Position Basic Pay

1 Alfred Chief Executive Officer 180,000.00 90,000.00

2 Binondo Accountant 90,000.00 45,000.00

3 Cara Marketing Manager 60,000.00 30,000.00

4 De Juan Auditor 50,000.00 25,000.00

5 Ella Bookkeeper 30,000.00 15,000.00

6 Fiona Payroll Analyst 25,000.00 12,500.00

7 Gaspin Financial Analyst 35,000.00 17,500.00

8 Hannah Sales Assistant 40,000.00 20,000.00

9 Ian Accounting Analyst 30,000.00 15,000.00

10 Jay Cashier 25,000.00 12,500.00

11 Krispin HR Head 55,000.00 27,500.00

12 Lance Sales Representative 22,000.00 11,000.00

13 Miguel Office Manager 50,000.00 25,000.00

TOTAL 346,000.00

Table of Other Pay

Rice Subsidy

Uniform Allowance

Medical Allowance

Chistmas Gifts

NO CO.

hly Payroll

5, 2020

Em

Over/(Under) Other Pay Gross SSS Cont

Time Pay Particulars Amount Pay EE Share

Uniform Allowance 3,000.00 93,000.00 620.00

Uniform Allowance 3,000.00 48,000.00 620.00

Medical Allowance 5,000.00 35,000.00 620.00

Rice Subsidy 2,000.00 27,000.00 620.00

3,000.00 Uniform Allowance 3,000.00 21,000.00 600.00

1,500.00 Rice Subsidy 2,000.00 16,000.00 500.00

2,000.00 Rice Subsidy 2,000.00 21,500.00 620.00

2,000.00 Rice Subsidy 2,000.00 24,000.00 620.00

2,500.00 Rice Subsidy 2,000.00 19,500.00 600.00

1,000.00 Rice Subsidy 2,000.00 15,500.00 500.00

Uniform Allowance 3,000.00 30,500.00 620.00

2,000.00 Uniform Allowance 3,000.00 16,000.00 440.00

Medical Allowance 5,000.00 30,000.00 620.00

12,000.00 37,000.00 7,600.00

Employees Contribution

Phil-Health Pag-IBIG Taxable Withholding

EE Share EE Share Income Tax NET PAY

437.50 1,800.00 90,142.50 22,594.71 67,547.79

437.50 900.00 46,042.50 9,229.52 36,812.98

375.00 600.00 33,405.00 5,438.27 27,966.73

312.50 500.00 25,567.50 3,475.13 22,092.38

187.50 300.00 19,912.50 2,061.38 17,851.13

150.00 250.00 15,100.00 936.60 14,163.40

212.50 350.00 20,317.50 2,162.63 18,154.88

250.00 400.00 22,730.00 2,765.75 19,964.25

187.50 300.00 18,412.50 1,686.38 16,726.13

150.00 250.00 14,600.00 836.60 13,763.40

337.50 550.00 28,992.50 4,331.38 24,661.13

137.50 220.00 15,202.50 957.10 14,245.40

312.50 500.00 28,567.50 4,225.13 24,342.38

3,487.50 6,920.00 378,992.50 60,700.55 318,291.95

Employers Contribution

SSS Cont Phil-Health Pag-IBIG

ER Share ER Share ER Share TOTAL SSS

1,240.00 437.50 1,800.00 3,477.50 1,860.00

1,240.00 437.50 900.00 2,577.50 1,860.00

1,240.00 375.00 600.00 2,215.00 1,860.00

1,240.00 312.50 500.00 2,052.50 1,860.00

1,200.00 187.50 300.00 1,687.50 1,800.00

1,000.00 150.00 250.00 1,400.00 1,500.00

1,240.00 212.50 350.00 1,802.50 1,860.00

1,240.00 250.00 400.00 1,890.00 1,860.00

1,200.00 187.50 300.00 1,687.50 1,800.00

1,000.00 150.00 250.00 1,400.00 1,500.00

1,240.00 337.50 550.00 2,127.50 1,860.00

880.00 137.50 220.00 1,237.50 1,320.00

1,240.00 312.50 500.00 2,052.50 1,860.00

15,200.00 3,487.50 6,920.00 25,607.50 22,800.00

TOTAL LIABILITY

Phil-Health Pag-IBIG BIR TOTAL

875.00 3,600.00 22,594.71 28,929.71

875.00 1,800.00 9,229.52 13,764.52

750.00 1,200.00 5,438.27 9,248.27

625.00 1,000.00 3,475.13 6,960.13

375.00 600.00 2,061.38 4,836.38

300.00 500.00 936.60 3,236.60

425.00 700.00 2,162.63 5,147.63

500.00 800.00 2,765.75 5,925.75

375.00 600.00 1,686.38 4,461.38

300.00 500.00 836.60 3,136.60

675.00 1,100.00 4,331.38 7,966.38

275.00 440.00 957.10 2,992.10

625.00 1,000.00 4,225.13 7,710.13

6,975.00 13,840.00 60,700.55 104,315.55

MAKAUNO CO.

Payroll Period: August 1-15, 2020

PAY SLIP

Name of Employee Alfred

Position Chief Executive Officer

Amount

Basic Pay 90,000.00

Add:

Over/(Undertime) -

Other Pay Uniform Allowance 3,000.00

Total 93,000.00

Less: Deductions

SSS Contribution 620.00

Phil-Health 437.50

Pag-IBIG 1,800.00

Withholding Tax 22,594.71

Total Deductions 25,452.21

Net Pay 67,547.79

Signature Over Printed Name

Semi-Monthly Tax Table

Over NOT OVER Basic Plus of excess over

- 10,417 - 0% -

10,417 16,667 - 20% 10,417

16,667 33,333 1,250 25% 16,667

33,333 83,333 5,417 30% 33,333

83,333 333,333 20,416 32% 83,333

333,333 - 100,418 35% 333,333

Employee Taxable Income Basic Tax Rate Excess over Additional

1 Alfred 90,142.50 20,415.67 32% 83,333.00 2,179.04

2 Binondo 46,042.50 5,416.67 30% 33,333.00 3,812.85

3 Cara 33,405.00 5,416.67 30% 33,333.00 21.60

4 De Juan 25,567.50 1,250.00 25% 16,667.00 2,225.13

5 Ella 19,912.50 1,250.00 25% 16,667.00 811.38

6 Fiona 15,100.00 - 20% 10,417.00 936.60

7 Gaspin 20,317.50 1,250.00 25% 16,667.00 912.63

8 Hannah 22,730.00 1,250.00 25% 16,667.00 1,515.75

9 Ian 18,412.50 1,250.00 25% 16,667.00 436.38

10 Jay 14,600.00 - 20% 10,417.00 836.60

11 Krispin 28,992.50 1,250.00 25% 16,667.00 3,081.38

12 Lance 15,202.50 - 20% 10,417.00 957.10

13 Miguel 28,567.50 1,250.00 25% 16,667.00 2,975.13

Using "VLOOKUP" Using "IF"

Income Tax Income Tax

22,594.71 22,594.71

9,229.52 9,229.52

5,438.27 5,438.27

3,475.13 3,475.13

2,061.38 2,061.38

936.60 936.60

2,162.63 2,162.63

2,765.75 2,765.75

1,686.38 1,686.38

836.60 836.60

4,331.38 4,331.38

957.10 957.10

4,225.13 4,225.13

SSS Contribution Table

Employer Employee

Salary Range Mo. Credit ER EE Total

- 2,250 2,000 160.00 80.00 240.00

2,250 2,750 2,500 200.00 100.00 300.00

2,750 3,250 3,000 240.00 120.00 360.00

3,250 3,750 3,500 280.00 140.00 420.00

3,750 4,250 4,000 320.00 160.00 480.00

4,250 4,750 4,500 360.00 180.00 540.00

4,750 5,250 5,000 400.00 200.00 600.00

5,250 5,750 5,500 440.00 220.00 660.00

5,750 6,250 6,000 480.00 240.00 720.00

6,250 6,750 6,500 520.00 260.00 780.00

6,750 7,250 7,000 560.00 280.00 840.00

7,250 7,750 7,500 600.00 300.00 900.00

7,750 8,250 8,000 640.00 320.00 960.00

8,250 8,750 8,500 680.00 340.00 1,020.00

8,750 9,250 9,000 720.00 360.00 1,080.00

9,250 9,750 9,500 760.00 380.00 1,140.00

9,750 10,250 10,000 800.00 400.00 1,200.00

10,250 10,750 10,500 840.00 420.00 1,260.00

10,750 11,250 11,000 880.00 440.00 1,320.00

11,250 11,750 11,500 920.00 460.00 1,380.00

11,750 12,250 12,000 960.00 480.00 1,440.00

12,250 12,750 12,500 1,000.00 500.00 1,500.00

12,750 13,250 13,000 1,040.00 520.00 1,560.00

13,250 13,750 13,500 1,080.00 540.00 1,620.00

13,750 14,250 14,000 1,120.00 560.00 1,680.00

14,250 14,750 14,500 1,160.00 580.00 1,740.00

14,750 15,250 15,000 1,200.00 600.00 1,800.00

15,250 15,750 15,500 1,240.00 620.00 1,860.00

Phil-Health Contributions (Effective January 2020)

Salary Range Salary Base Employer Employee Total

- 9,000 8,000.00 100.00 100.00 200.00

9,000 10,000 9,000.00 112.50 112.50 225.00

10,000 11,000 10,000.00 125.00 125.00 250.00

11,000 12,000 11,000.00 137.50 137.50 275.00

12,000 13,000 12,000.00 150.00 150.00 300.00

13,000 14,000 13,000.00 162.50 162.50 325.00

14,000 15,000 14,000.00 175.00 175.00 350.00

15,000 16,000 15,000.00 187.50 187.50 375.00

16,000 17,000 16,000.00 200.00 200.00 400.00

17,000 18,000 17,000.00 212.50 212.50 425.00

18,000 19,000 18,000.00 225.00 225.00 450.00

19,000 20,000 19,000.00 237.50 237.50 475.00

20,000 21,000 20,000.00 250.00 250.00 500.00

21,000 22,000 21,000.00 262.50 262.50 525.00

22,000 23,000 22,000.00 275.00 275.00 550.00

23,000 24,000 23,000.00 287.50 287.50 575.00

24,000 25,000 24,000.00 300.00 300.00 600.00

25,000 26,000 25,000.00 312.50 312.50 625.00

26,000 27,000 26,000.00 325.00 325.00 650.00

27,000 28,000 27,000.00 337.50 337.50 675.00

28,000 29,000 28,000.00 350.00 350.00 700.00

29,000 30,000 29,000.00 362.50 362.50 725.00

30,000 31,000 30,000.00 375.00 375.00 750.00

31,000 32,000 31,000.00 387.50 387.50 775.00

32,000 33,000 32,000.00 400.00 400.00 800.00

33,000 34,000 33,000.00 412.50 412.50 825.00

34,000 35,000 34,000.00 425.00 425.00 850.00

35,000 0ver 35,000.00 437.50 437.50 875.00

PAG-IBIG

Employee Employer

2% 2%

You might also like

- 15 MCQ Estate Taxation WITH ANSWERS PDFDocument4 pages15 MCQ Estate Taxation WITH ANSWERS PDFChincel G. ANI50% (2)

- WPS Salary Debit Authority Letter TemplateDocument1 pageWPS Salary Debit Authority Letter Templatetaraivan100% (2)

- Entrepreneurship G11-1Document88 pagesEntrepreneurship G11-1athyNo ratings yet

- Accounts Payable EssayDocument2 pagesAccounts Payable EssayInday MiraNo ratings yet

- Payroll ProcessDocument8 pagesPayroll ProcesssrikarchanduNo ratings yet

- Payroll AccountingDocument7 pagesPayroll Accountingmobinil1No ratings yet

- Autocount Manual PDFDocument28 pagesAutocount Manual PDFKelvin Leong100% (1)

- PESTEL Analysis of McDonaldDocument2 pagesPESTEL Analysis of McDonaldpoonamNo ratings yet

- Burlington Northern Railroad CompanyDocument13 pagesBurlington Northern Railroad CompanysdNo ratings yet

- PartnershipDocument41 pagesPartnershipBinex67% (3)

- 20 Easy Steps To Starting Your Bookkeeping Business: by Sylvia JaumannDocument13 pages20 Easy Steps To Starting Your Bookkeeping Business: by Sylvia JaumannDave A ValcarcelNo ratings yet

- Resignation LetterDocument1 pageResignation LetterJohanna DawnNo ratings yet

- Notes On Registration of Book of AccountsDocument3 pagesNotes On Registration of Book of AccountsDenzel Edward CariagaNo ratings yet

- Applicant Information SheetDocument2 pagesApplicant Information SheetppppNo ratings yet

- Payroll: Policy and ProceduresDocument5 pagesPayroll: Policy and ProceduresHer Huw100% (1)

- Payroll ManagementDocument6 pagesPayroll ManagementNisha_Yadav_6277No ratings yet

- AWOL NoticeDocument1 pageAWOL NoticeAmianan BulletinNo ratings yet

- Accounting Cycle Upto Trial BalanceDocument60 pagesAccounting Cycle Upto Trial BalancejobwangaNo ratings yet

- Notice of Furlough (COVID-19)Document1 pageNotice of Furlough (COVID-19)Narayana Swaroop VeerubhotlaNo ratings yet

- Tax Compliance On PayrollDocument2 pagesTax Compliance On PayrollJoyceNo ratings yet

- Payroll TrackerDocument27 pagesPayroll Trackerkurtkomeng1820% (1)

- Presentation - Payroll ProcessDocument29 pagesPresentation - Payroll ProcessMujtaba Merchant0% (1)

- Flow Chart (Accounts Payable Clerk)Document2 pagesFlow Chart (Accounts Payable Clerk)cristynvilNo ratings yet

- Accounting, Tax and Payroll Services - Lani-Rose Shipping PDFDocument6 pagesAccounting, Tax and Payroll Services - Lani-Rose Shipping PDFjohnkurt catipayNo ratings yet

- Compensation Management Mod 1Document36 pagesCompensation Management Mod 1Nikita SangalNo ratings yet

- External Users of AccountingDocument3 pagesExternal Users of AccountingMarko Zero Four0% (1)

- Management Accounting: S.K. Gupta Guest LecturerDocument37 pagesManagement Accounting: S.K. Gupta Guest LecturersantNo ratings yet

- Termination LetterDocument1 pageTermination LetterrianzaresmrlonNo ratings yet

- Topic 1: Complete Initial Setup TasksDocument5 pagesTopic 1: Complete Initial Setup TasksRobelyn LacorteNo ratings yet

- Payroll SystemDocument15 pagesPayroll SystemPrince Persia100% (1)

- Accounting Worksheet V 1.0Document6 pagesAccounting Worksheet V 1.0Adil IqbalNo ratings yet

- Human Resources & It's ImpactDocument36 pagesHuman Resources & It's ImpactSyed Bilal MahmoodNo ratings yet

- HR FormsDocument5 pagesHR FormsBindu ManoharNo ratings yet

- ABRY Scheme GuidelinesDocument12 pagesABRY Scheme GuidelinesreenaNo ratings yet

- Payroll SystemDocument6 pagesPayroll SystemPriyan Trivedi50% (2)

- Performance Appraisals. 2011Document4 pagesPerformance Appraisals. 2011Koya Clement AhmiegbeNo ratings yet

- Accountant Interview Questions 2Document1 pageAccountant Interview Questions 2evaNo ratings yet

- MYOB GST Preparation Guide (Existing Users)Document18 pagesMYOB GST Preparation Guide (Existing Users)manimaran75No ratings yet

- Employee Id No. Name of Employee: TotalDocument15 pagesEmployee Id No. Name of Employee: TotalRoldan Arca PagaposNo ratings yet

- Sunshine Hospitality: Salary (P.M.) Net Salary Working DaysDocument7 pagesSunshine Hospitality: Salary (P.M.) Net Salary Working DayssuneelstarNo ratings yet

- Mandatory-ContributionsDocument2 pagesMandatory-Contributionspao reyesNo ratings yet

- Final IannaDocument83 pagesFinal IannaJuzetteValerieSarceNo ratings yet

- B127-Aragon-A No 4Document6 pagesB127-Aragon-A No 4Shaina AragonNo ratings yet

- Business-Plan Final WorksheetDocument43 pagesBusiness-Plan Final WorksheetKrishia Belacsi BajanaNo ratings yet

- Pasia Singapore Plans Discussion Document: 18 Feb 2019 Rev 3Document6 pagesPasia Singapore Plans Discussion Document: 18 Feb 2019 Rev 3Aljon DagalaNo ratings yet

- F&a Cash Collection Report For October 2022Document5 pagesF&a Cash Collection Report For October 2022Esther AkpanNo ratings yet

- 2ND Mandatory-Deduction-For-2023Document2 pages2ND Mandatory-Deduction-For-2023EgieMae GarcesNo ratings yet

- School Canteen Records v2 TemplateDocument34 pagesSchool Canteen Records v2 TemplateYeshua Yesha100% (1)

- SSS Contribution CalculatorDocument3 pagesSSS Contribution Calculatorcool08coolNo ratings yet

- Arnaez MBCPayroll CalculatorDocument12 pagesArnaez MBCPayroll Calculatoracctg2012No ratings yet

- Exercise-1 pg.103Document4 pagesExercise-1 pg.103cherein6soriano6paelNo ratings yet

- Azucena MBCPayroll CalculatorDocument14 pagesAzucena MBCPayroll Calculatoracctg2012No ratings yet

- Tax Calculator FormulaDocument5 pagesTax Calculator FormulaLizaNo ratings yet

- Tax Calculator FormulaDocument5 pagesTax Calculator FormulaCJ De LunaNo ratings yet

- Tax Calculator FormulaDocument5 pagesTax Calculator FormulaTaeeeee taeNo ratings yet

- Budget 2023Document105 pagesBudget 2023CarlNo ratings yet

- Martin MBCPayroll CalculatorDocument12 pagesMartin MBCPayroll Calculatoracctg2012No ratings yet

- Payroll 2023 1Document19 pagesPayroll 2023 1Carl Dela CruzNo ratings yet

- Tax Calculator FormulaDocument5 pagesTax Calculator FormulaKerwin Lester MandacNo ratings yet

- Tax Calculator FormulaDocument5 pagesTax Calculator FormulaDonghyuk KimNo ratings yet

- Egv Entertainment Co.,Ltd Majorcineplex Co.,Ltd.: PAY - ACCOUNT.234-0-2485-6 PAY ACCOUNT 223-0-36814-0 GV กบขDocument8 pagesEgv Entertainment Co.,Ltd Majorcineplex Co.,Ltd.: PAY - ACCOUNT.234-0-2485-6 PAY ACCOUNT 223-0-36814-0 GV กบขhoneypuengNo ratings yet

- 2023 SSS TableDocument2 pages2023 SSS TableJanielee HernandezNo ratings yet

- BC XCDocument6 pagesBC XCKaren Sofía Villa RealNo ratings yet

- Age 29 Male - 50T Premium InvDocument2 pagesAge 29 Male - 50T Premium InvRon CatalanNo ratings yet

- Joepryl: Would Like To Invite You To His ChristeningDocument1 pageJoepryl: Would Like To Invite You To His ChristeningChincel G. ANINo ratings yet

- What Is Your Biggest Concern About The FutureDocument3 pagesWhat Is Your Biggest Concern About The FutureChincel G. ANINo ratings yet

- IS The Accountants Perspective SummaryDocument32 pagesIS The Accountants Perspective SummaryChincel G. ANINo ratings yet

- Accounting For Foreign Currency Transaction PDFDocument3 pagesAccounting For Foreign Currency Transaction PDFChincel G. ANINo ratings yet

- Indian CivilizationDocument19 pagesIndian CivilizationChincel G. ANINo ratings yet

- Marcos Martial Law: Huk Supremo Luis TarucDocument1 pageMarcos Martial Law: Huk Supremo Luis TarucChincel G. ANINo ratings yet

- Mer Cu Ri Al: Phi Lan DerDocument3 pagesMer Cu Ri Al: Phi Lan DerChincel G. ANINo ratings yet

- Home Office, Branch and Agency AccountingDocument5 pagesHome Office, Branch and Agency AccountingChincel G. ANINo ratings yet

- POWER PlantDocument26 pagesPOWER PlantChincel G. ANINo ratings yet

- RATIONAL CHOICE THEORY JohnDocument33 pagesRATIONAL CHOICE THEORY JohnChincel G. ANINo ratings yet

- Research Sample ReportDocument1 pageResearch Sample ReportChincel G. ANINo ratings yet

- Chapter 1 - Multiple Choice Problem Answers AfarDocument13 pagesChapter 1 - Multiple Choice Problem Answers AfarChincel G. ANINo ratings yet

- STEM Quiz Answers: Culham Centre For Fusion EnergyDocument2 pagesSTEM Quiz Answers: Culham Centre For Fusion EnergyChincel G. ANINo ratings yet

- It AppDocument22 pagesIt AppChincel G. ANINo ratings yet

- Notes To Financial Statement MeaningDocument2 pagesNotes To Financial Statement MeaningChincel G. ANINo ratings yet

- Illustrative Problem 2.1-2Document3 pagesIllustrative Problem 2.1-2Chincel G. ANINo ratings yet

- Illustrative Problem 4.1 PDFDocument1 pageIllustrative Problem 4.1 PDFChincel G. ANINo ratings yet

- Central Philippine University Course Syllabus Acctg 2312 - IT Application Tools in Business (Accounting)Document5 pagesCentral Philippine University Course Syllabus Acctg 2312 - IT Application Tools in Business (Accounting)Chincel G. ANINo ratings yet

- Cost Monitoring FormDocument38 pagesCost Monitoring FormChincel G. ANINo ratings yet

- Anti - Money Laundering Act: RA No. 9160, As Amended by RA No. 10167 and RA No. 10365Document43 pagesAnti - Money Laundering Act: RA No. 9160, As Amended by RA No. 10167 and RA No. 10365Chincel G. ANINo ratings yet

- EFM-CHAPTER11 Management AccountingDocument52 pagesEFM-CHAPTER11 Management AccountingChincel G. ANINo ratings yet

- Garrison Lecture Chapter 5Document97 pagesGarrison Lecture Chapter 5Chincel G. ANINo ratings yet

- FACTS OF CASE EnronDocument8 pagesFACTS OF CASE EnronChincel G. ANINo ratings yet

- Chapter 2: Finanacial Markets and InstitutionsDocument6 pagesChapter 2: Finanacial Markets and InstitutionsChincel G. ANINo ratings yet

- Chapter 15 PDFDocument61 pagesChapter 15 PDFChincel G. ANINo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Sourav bhattacharyya0% (1)

- Compare The Merits of The Entry Strategies Discussed in This ChapterDocument3 pagesCompare The Merits of The Entry Strategies Discussed in This ChapterVikram KumarNo ratings yet

- RCM vs. FMEA - There Is A Distinct Difference!: RCM - Reliability Centered MaintenanceDocument4 pagesRCM vs. FMEA - There Is A Distinct Difference!: RCM - Reliability Centered Maintenanceg_viegasNo ratings yet

- EntryDocument6 pagesEntryadomniteimiki2No ratings yet

- Quiz ResearchDocument11 pagesQuiz ResearchEmmanuel BalitostosNo ratings yet

- FINALDocument20 pagesFINALShubhangi BishnoiNo ratings yet

- Sample Questionnaire For Job AnalysisDocument4 pagesSample Questionnaire For Job AnalysisJinal DamaniNo ratings yet

- Policy WriteupDocument3 pagesPolicy Writeupdey.joybrotoNo ratings yet

- Trainee'S Record Book: Technical Education and Skills Development AuthorityDocument10 pagesTrainee'S Record Book: Technical Education and Skills Development AuthorityVirgil Keith Juan PicoNo ratings yet

- Inflation. Interest Rates. Balance of Payments. Government Intervention. Other FactorsDocument2 pagesInflation. Interest Rates. Balance of Payments. Government Intervention. Other FactorsEmmanuelle RojasNo ratings yet

- My ContractDocument9 pagesMy Contractbaniprakoso90No ratings yet

- JfefhehfejhfnyryryyyyyrryyrDocument3 pagesJfefhehfejhfnyryryyyyyrryyrAtulit AgarwalNo ratings yet

- What Is Accounts Receivable (AR) ?Document2 pagesWhat Is Accounts Receivable (AR) ?Art B. EnriquezNo ratings yet

- Single Entry SystemDocument15 pagesSingle Entry Systemmdhanjalah08No ratings yet

- Module 3 Navigating The Trail 1Document7 pagesModule 3 Navigating The Trail 1Daienne Abegail EspinosaNo ratings yet

- Marketing Debate Ch17Document3 pagesMarketing Debate Ch17Mariska Putri Adelia67% (3)

- Odoo OpenERP Implementation MethodologyDocument6 pagesOdoo OpenERP Implementation MethodologyyourreddyNo ratings yet

- Slide RMK Chapter 1 - Kelompok 5 - Maksi 43CDocument15 pagesSlide RMK Chapter 1 - Kelompok 5 - Maksi 43CJali FusNo ratings yet

- Implication of Management Functions in Nayyer CarpetDocument14 pagesImplication of Management Functions in Nayyer CarpetAhmad AzharNo ratings yet

- Entrep 5Document5 pagesEntrep 5Kenth Godfrei DoctoleroNo ratings yet

- Reflection Paper - Pledge 1% Model - Ronan VillagonzaloDocument1 pageReflection Paper - Pledge 1% Model - Ronan Villagonzaloronan.villagonzaloNo ratings yet

- Taxation Quizzer Quizzes For Tax PDFDocument62 pagesTaxation Quizzer Quizzes For Tax PDFCelestino AlisNo ratings yet

- Warren County EDA Communication On Lawsuit Against Director On FraudDocument2 pagesWarren County EDA Communication On Lawsuit Against Director On FraudBeverly TranNo ratings yet

- Karina Market Structure SummaryDocument4 pagesKarina Market Structure SummaryKarina Permata SariNo ratings yet

- Recruitment Process of Coca-Cola CompanyDocument31 pagesRecruitment Process of Coca-Cola CompanySagar SahaNo ratings yet

- SM - Distinctive CompetenciesDocument2 pagesSM - Distinctive CompetenciesVivek PimpleNo ratings yet

- Earned Value ManagementDocument15 pagesEarned Value ManagementNguyen Chi ThanhNo ratings yet