Professional Documents

Culture Documents

Bottom Up Unlevered Beta

Bottom Up Unlevered Beta

Uploaded by

Uyen HoangOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bottom Up Unlevered Beta

Bottom Up Unlevered Beta

Uploaded by

Uyen HoangCopyright:

Available Formats

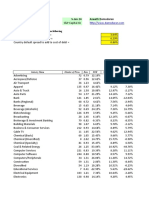

Bottom up unlevered beta

Business Revenues EV/Sales Estimated valWeights

Apparel $12,056.00 1.89135 $22,802.17 19.96%

Building Materials $17,090.00 1.60430 $27,417.42 24.00%

Machinery $13,964.00 2.58163 $36,049.89 31.55%

Aerospace/Defense $8,334.00 2.26617 $18,886.28 16.53%

Air Transport $6,791.00 1.33929 $9,095.10 7.96%

Total operating businesses $58,235.00 $114,250.87 100.00%

Other inputs

Cash $4,819

Total Debt $24,020 (See worksheet for converting book value of interest bearing

PV of lease commitments $2,265 ( See worksheet for converting leases)

Market capitalization $84,050

Marginal tax rate 24% (See worksheet for marginal tax rate, by country)

Unlevered beta for operating assets = 1.0021

Unlevered beta for company = 0.9615

D/E ratio = 31.27%

Levered beta for operating assets = 1.2402 This is the beta to use in your cost of capital computation. Co

Levered beta for company = 1.1419 This is the beta to use if you want a cost of equity for your en

You may use this to compare to an overall return on equity o

Pure play beta Weight* Beta

0.8296 0.16557962

1.0185 0.24442269

1.0985 0.34661939

1.0785 0.17828545

0.8437 0.0671618

1.00206895

g book value of interest bearing debt to market value)

tax rate, by country)

r cost of capital computation. Cost of capital applies only to operating assets.

want a cost of equity for your entire firm.

to an overall return on equity or to discount any cashflow that includes interest income in it.

Effective

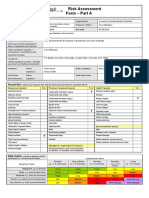

Industry Name Number of firms Beta D/E Ratio Tax rate Unlevered beta Cash/Firm value Unlevered beta corrected for cash EV/Sales

Advertising 47 1.44 85.08% 4.13% 0.88 6.00% 0.93 1.94

Aerospace/Defense 77 1.23 24.28% 8.54% 1.04 3.40% 1.08 2.27

Air Transport 18 1.44 103.43% 18.47% 0.81 4.19% 0.84 1.34

Apparel 51 1.06 41.77% 11.11% 0.80 3.16% 0.83 1.89

Auto & Truck 13 1.10 164.93% 5.93% 0.49 6.89% 0.53 1.26

Auto Parts 46 1.21 50.86% 7.25% 0.88 7.44% 0.95 0.75

Bank (Money Center) 7 1.00 177.75% 19.36% 0.43 23.33% 0.56 7.28

Banks (Regional) 611 0.57 62.92% 17.46% 0.39 10.69% 0.43 5.95

Beverage (Alcoholic) 21 1.13 31.28% 6.62% 0.91 0.72% 0.92 4.62

Beverage (Soft) 34 1.22 19.24% 4.00% 1.07 2.34% 1.09 4.88

Broadcasting 27 1.21 98.45% 13.31% 0.70 4.35% 0.73 2.72

Brokerage & Investment 39 1.46 268.39% 12.83% 0.48 14.58% 0.57 6.17

Building Materials 42 1.23 32.07% 16.26% 0.99 2.52% 1.02 1.60

Business & Consumer Ser 165 1.07 30.31% 8.32% 0.87 2.95% 0.89 2.39

Cable TV 14 1.11 60.17% 14.55% 0.77 1.11% 0.78 3.44

Chemical (Basic) 43 1.37 61.09% 6.66% 0.94 5.60% 0.99 1.30

Chemical (Diversified) 6 1.85 78.66% 11.89% 1.17 4.06% 1.21 1.35

Chemical (Specialty) 94 1.14 28.53% 11.01% 0.94 3.08% 0.96 2.09

Coal & Related Energy 22 1.40 79.69% 0.97% 0.87 16.68% 1.05 0.62

Computer Services 106 1.20 44.65% 8.92% 0.90 5.42% 0.95 1.28

Computers/Peripherals 48 1.75 15.49% 6.21% 1.57 4.51% 1.64 3.23

Construction Supplies 44 1.36 40.14% 15.82% 1.05 5.03% 1.10 1.68

Diversified 23 1.40 31.16% 6.68% 1.14 8.99% 1.25 2.45

Drugs (Biotechnology) 503 1.43 14.58% 0.61% 1.29 6.99% 1.39 7.33

Drugs (Pharmaceutical) 267 1.36 14.93% 1.36% 1.22 4.76% 1.29 5.44

Education 35 1.61 33.68% 6.56% 1.28 5.47% 1.36 2.59

Electrical Equipment 113 1.44 21.00% 3.94% 1.25 4.51% 1.31 2.56

Electronics (Consumer & O 20 1.28 20.67% 5.45% 1.10 11.72% 1.25 0.91

Electronics (General) 153 1.15 18.24% 6.65% 1.01 5.46% 1.07 1.99

Engineering/Construction 54 1.60 39.27% 9.44% 1.23 6.88% 1.33 0.70

Entertainment 107 1.33 20.07% 1.93% 1.16 3.57% 1.20 4.72

Environmental & Waste S 82 1.27 31.69% 4.14% 1.02 2.25% 1.05 3.08

Farming/Agriculture 31 0.89 62.39% 5.91% 0.61 2.98% 0.63 1.08

Financial Svcs. (Non-bank 232 0.73 882.21% 14.42% 0.10 2.14% 0.10 30.15

Food Processing 88 0.88 37.38% 6.44% 0.68 1.89% 0.70 2.30

Food Wholesalers 17 0.87 43.95% 7.79% 0.65 0.75% 0.66 0.60

Furn/Home Furnishings 35 1.08 48.35% 8.15% 0.79 3.45% 0.82 1.11

Green & Renewable Ener 22 1.07 112.64% 1.52% 0.58 2.10% 0.59 9.94

Healthcare Products 242 1.04 13.25% 3.52% 0.95 3.37% 0.98 5.94

Healthcare Support Servi 128 1.17 39.91% 8.26% 0.90 4.81% 0.95 0.69

Heathcare Information a 129 1.24 14.67% 3.84% 1.12 2.70% 1.15 5.41

Homebuilding 32 0.83 44.20% 17.02% 0.62 6.39% 0.66 1.21

Hospitals/Healthcare Facil 36 1.22 130.18% 7.50% 0.62 1.18% 0.63 1.63

Hotel/Gaming 65 1.26 56.41% 12.52% 0.89 3.05% 0.91 3.78

Household Products 127 1.03 17.17% 5.93% 0.91 2.62% 0.94 3.74

Information Services 69 1.09 11.89% 8.34% 1.00 2.70% 1.03 9.17

Insurance (General) 19 0.74 41.41% 16.10% 0.57 4.40% 0.59 1.95

Insurance (Life) 24 1.08 97.50% 14.78% 0.62 15.14% 0.73 1.36

Insurance (Prop/Cas.) 51 0.68 26.36% 14.03% 0.57 3.86% 0.59 1.49

Investments & Asset Ma 192 1.03 54.41% 7.47% 0.73 15.18% 0.86 4.58

Machinery 120 1.25 23.86% 12.32% 1.06 3.71% 1.10 2.58

Metals & Mining 92 1.31 38.21% 1.96% 1.02 6.27% 1.09 2.04

Office Equipment & Servi 22 1.65 54.88% 15.29% 1.17 6.32% 1.24 1.20

Oil/Gas (Integrated) 4 1.30 26.82% 24.54% 1.08 3.10% 1.12 1.61

Oil/Gas (Production and E 269 1.48 56.39% 3.70% 1.04 3.51% 1.08 2.71

Oil/Gas Distribution 24 1.02 89.69% 5.46% 0.61 1.63% 0.62 4.44

Oilfield Svcs/Equip. 136 1.58 48.65% 5.06% 1.16 5.06% 1.22 0.74

Packaging & Container 24 0.99 65.94% 12.18% 0.66 2.29% 0.68 1.59

Paper/Forest Products 15 1.54 39.45% 10.41% 1.19 5.46% 1.25 0.77

Power 52 0.58 72.51% 13.27% 0.37 1.44% 0.38 4.11

Precious Metals 83 1.44 18.37% 1.75% 1.26 5.31% 1.33 5.05

Publishing & Newspapers 31 1.07 67.57% 8.10% 0.71 6.38% 0.76 1.07

R.E.I.T. 234 0.68 84.38% 1.92% 0.42 1.60% 0.43 13.48

Real Estate (Development 20 1.24 70.02% 2.19% 0.81 9.04% 0.89 5.37

Real Estate (General/Diver 12 1.63 45.43% 6.55% 1.22 18.91% 1.50 6.57

Real Estate (Operations & 57 0.93 58.80% 5.58% 0.65 4.13% 0.68 1.39

Recreation 63 0.90 33.68% 8.21% 0.72 4.52% 0.75 2.35

Reinsurance 2 0.82 29.01% 17.55% 0.67 12.62% 0.77 1.12

Restaurant/Dining 77 0.97 41.65% 6.57% 0.74 1.40% 0.75 4.26

Retail (Automotive) 26 1.33 72.87% 14.04% 0.86 0.79% 0.87 1.19

Retail (Building Supply) 17 1.36 25.71% 14.90% 1.14 1.03% 1.15 2.03

Retail (Distributors) 80 1.28 60.86% 11.96% 0.88 1.74% 0.89 1.40

Retail (General) 18 1.14 32.10% 15.49% 0.92 2.53% 0.95 0.88

Retail (Grocery and Food) 13 0.59 96.66% 12.78% 0.34 1.26% 0.35 0.49

Retail (Online) 70 1.23 12.87% 2.92% 1.12 3.24% 1.16 3.42

Retail (Special Lines) 89 1.03 70.57% 11.89% 0.67 2.41% 0.69 1.19

Rubber& Tires 4 0.98 178.03% 20.75% 0.42 7.11% 0.45 0.74

Semiconductor 72 1.29 11.80% 6.15% 1.18 4.44% 1.24 5.38

Semiconductor Equip 39 1.28 12.17% 9.71% 1.17 6.54% 1.25 4.00

Shipbuilding & Marine 10 2.17 55.71% 4.89% 1.53 2.44% 1.57 1.98

Shoe 11 0.87 8.80% 13.98% 0.81 2.30% 0.83 3.55

Software (Entertainment) 86 1.29 3.80% 2.58% 1.25 2.58% 1.29 6.76

Software (Internet) 30 1.67 20.41% 1.23% 1.45 3.49% 1.50 7.64

Software (System & Appli 363 1.20 9.67% 2.60% 1.12 2.93% 1.15 8.77

Steel 32 1.62 46.97% 9.25% 1.20 6.89% 1.29 0.70

Telecom (Wireless) 18 1.14 131.19% 5.89% 0.58 3.49% 0.60 2.43

Telecom. Equipment 91 0.89 17.22% 4.31% 0.79 5.25% 0.84 3.50

Telecom. Services 67 1.05 79.19% 4.17% 0.66 1.35% 0.67 2.85

Tobacco 17 1.68 28.56% 11.48% 1.38 2.98% 1.43 5.19

Transportation 18 1.31 54.23% 12.76% 0.93 3.08% 0.96 1.35

Transportation (Railroads 8 2.24 26.24% 12.24% 1.87 1.05% 1.89 6.32

Trucking 33 1.37 57.88% 16.73% 0.96 8.09% 1.04 1.93

Utility (General) 16 0.28 66.95% 13.45% 0.19 0.35% 0.19 4.26

Utility (Water) 17 0.68 35.75% 10.01% 0.54 4.52% 0.57 8.83

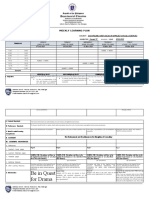

Inputs

Book value of debt $23,221.00

Interest expense 893 (Gross interest expense, if you can get it)

Average maturity 12.45

Pre-tax cost of debt 3.50%

Book interest rate = 3.85%

Estimated market value of debt $24,019.94

Operating Lease Converter

Operating lease expenses are really financial expenses, and should be treated as such. Accounting standards allow th

be treated as operating expenses. This program will convert commitments to make operating leases into debt and

adjust the operating income accordingly, by adding back the imputed interest expense on this debt.

Inputs

Operating lease expense in current year = $ 646.00

Operating Lease Commitments (From footnote to financials)

Year Commitment ! Year 1 is next year, ….

1 $ 646.00

2 $ 444.00

3 $ 444.00

4 $ 206.50

5 $ 206.50

6 and beyond $ 539.00

Pre-tax Cost of Debt = 3.00%

From the current financial statements, enter the following

Reported Operating Income (EBIT) = $ 10,000.00 ! This is the EBIT reported in the current income statement

Reported Debt = $ 25,000.00 ! This is the interest-bearing debt reported on the balance sheet

Reported Interest Expenses = $ 2,000.00

Output

Number of years embedded in yr 6 estimate = 1 ! I use the average lease expense over the first five years

to estimate the number of years of expenses in yr 6

Converting Operating Leases into debt

Year Commitment Present Value

1 $ 646.00 $ 627.18

2 $ 444.00 $ 418.51

3 $ 444.00 $ 406.32

4 $ 206.50 $ 183.47

5 $ 206.50 $ 178.13

6 and beyond $ 539.00 $ 451.40 ! Commitment beyond year 6 converted into an annuity for ten years

Debt Value of leases = $ 2,265.03

verter

Accounting standards allow them to

perating leases into debt and

e on this debt.

urrent income statement

ported on the balance sheet

er the first five years

xpenses in yr 6

uity for ten years

Country 2019

Afghanistan 20.00%

Albania 15.00%

Algeria 26.00%

Andorra 10.00%

Angola 30.00%

Anguilla 0.00%

Antigua and Barbuda 25.00%

Argentina 30.00%

Armenia 20.00%

Aruba 25.00%

Australia 30.00%

Austria 25.00%

Azerbaijan 20.00%

Bahamas 0.00%

Bahrain 0.00%

Bangladesh 25.00%

Barbados 5.50%

Belarus 18.00%

Belgium 29.00%

Benin 30.00%

Bermuda 0.00%

Bolivia 25.00%

Bonaire, Saint Eustatiu 25.00%

Bosnia and Herzegovin 10.00%

Botswana 22.00%

Brazil 34.00%

Brunei Darussalam 18.50%

Bulgaria 10.00%

Burkina Faso 28.00%

Burundi 30.00%

Cambodia 20.00%

Cameroon 33.00%

Canada 26.50%

Cayman Islands 0.00%

Chile 27.00%

China 25.00%

Colombia 33.00%

Congo (Democratic Repu 35.00%

Costa Rica 30.00%

Croatia 18.00%

Curacao 22.00%

Cyprus 12.50%

Czech Republic 19.00%

Denmark 22.00%

Djibouti 25.00%

Dominica 25.00%

Dominican Republic 27.00%

Ecuador 25.00%

Egypt 22.50%

El Salvador 30.00%

Estonia 20.00%

Ethiopia 30.00%

Fiji 20.00%

Finland 20.00%

France 31.00%

Gabon 30.00%

Gambia 31.00%

Georgia 15.00%

Germany 30.00%

Ghana 25.00%

Gibraltar 10.00%

Greece 28.00%

Grenada 28.00%

Guatemala 25.00%

Guernsey 0.00%

Honduras 25.00%

Hong Kong SAR 16.50%

Hungary 9.00%

Iceland 20.00%

India 30.00%

Indonesia 25.00%

Iraq 15.00%

Ireland 12.50%

Isle of Man 0.00%

Israel 23.00%

Italy 24.00%

Ivory Coast 25.00%

Jamaica 25.00%

Japan 30.62%

Jersey 0.00%

Jordan 20.00%

Kazakhstan 20.00%

Kenya 30.00%

Korea, Republic of 25.00%

Kuwait 15.00%

Kyrgyzstan 10.00%

Latvia 20.00%

Lebanon 17.00%

Libya 20.00%

Liechtenstein 12.50%

Lithuania 15.00%

Luxembourg 24.94%

Macau 12.00%

Macedonia 10.00%

Madagascar 20.00%

Malawi 30.00%

Malaysia 24.00%

Malta 35.00%

Mauritius 15.00%

Mexico 30.00%

Moldova 12.00%

Monaco 33.00%

Mongolia 25.00%

Montenegro 9.00%

Morocco 31.00%

Mozambique 32.00%

Myanmar 25.00%

Namibia 32.00%

Netherlands 25.00%

New Zealand 28.00%

Nicaragua 30.00%

Nigeria 30.00%

Norway 22.00%

Oman 15.00%

Pakistan 30.00%

Palestinian Territory 15.00%

Panama 25.00%

Papua New Guinea 30.00%

Paraguay 10.00%

Peru 29.50%

Philippines 30.00%

Poland 19.00%

Portugal 21.00%

Qatar 10.00%

Romania 16.00%

Russia 20.00%

Rwanda 30.00%

Saint Kitts and Nevis 33.00%

Saint Lucia 30.00%

Saint Vincent and the 30.00%

Samoa 27.00%

Saudi Arabia 20.00%

Senegal 30.00%

Serbia 15.00%

Sierra Leone 30.00%

Singapore 17.00%

Sint Maarten (Dutch par 35.00%

Slovakia 21.00%

Slovenia 19.00%

Solomon Islands 30.00%

South Africa 28.00%

Spain 25.00%

Sri Lanka 28.00%

St Maarten 35.00%

Sudan 35.00%

Suriname 36.00%

Swaziland 27.50%

Sweden 21.40%

Switzerland 18.00%

Syria 28.00%

Taiwan 20.00%

Tanzania 30.00%

Thailand 20.00%

Trinidad and Tobago 35.00%

Tunisia 25.00%

Turkey 22.00%

Turkmenistan 20.00%

Turks and Caicos Islan 0.00%

Uganda 30.00%

Ukraine 18.00%

United Arab Emirates 55.00%

United Kingdom 19.00%

United States 27.00%

Uruguay 25.00%

Uzbekistan 7.50%

Vanuatu 0.00%

Venezuela 34.00%

Vietnam 20.00%

Yemen 20.00%

Zambia 35.00%

Zimbabwe 25.00%

Africa average 28.24%

Americas average 27.21%

Asia average 21.09%

EU average 21.12%

Europe average 19.35%

Global average 23.79%

Latin America average 27.24%

North America average 26.75%

Oceania average 28.43%

OECD average 23.35%

South America average 27.24%

You might also like

- AirThreads Valuation SolutionDocument20 pagesAirThreads Valuation SolutionBill JoeNo ratings yet

- Gentile 2013Document18 pagesGentile 2013Desi HemavianaNo ratings yet

- Eric Evans Domain Driven Design PDFDocument2 pagesEric Evans Domain Driven Design PDFMayra10% (10)

- Betas by SectorDocument2 pagesBetas by SectorTrose Li100% (1)

- Schaum's Outline of Basic Business Mathematics, 2edFrom EverandSchaum's Outline of Basic Business Mathematics, 2edRating: 5 out of 5 stars5/5 (2)

- Unilever Sustainable Living Plan: A Critical Analysis: ResearchDocument10 pagesUnilever Sustainable Living Plan: A Critical Analysis: ResearchUyen Hoang100% (1)

- Scenario 4 Lever Details PDFDocument4 pagesScenario 4 Lever Details PDFUyen HoangNo ratings yet

- Unilever Sustainable Living Plan: A Critical Analysis: ResearchDocument10 pagesUnilever Sustainable Living Plan: A Critical Analysis: ResearchUyen Hoang100% (1)

- Bottom-Up BetaDocument15 pagesBottom-Up BetaMihael Od SklavinijeNo ratings yet

- Bottom Up BetaDocument18 pagesBottom Up BetaTimothy NguyenNo ratings yet

- BetasDocument4 pagesBetasRICARDO ANDRES ROJAS ALARCONNo ratings yet

- Date Updated: 5-Jan-14 Aswath DamodaranDocument3 pagesDate Updated: 5-Jan-14 Aswath DamodaranHillary DayanNo ratings yet

- Gloria-Grupo 5Document424 pagesGloria-Grupo 5giban mendozaNo ratings yet

- BetasDocument8 pagesBetasHillary DayanNo ratings yet

- Indicadores 2023 08Document21 pagesIndicadores 2023 08Maria Fernanda TrigoNo ratings yet

- Betas DamodaranDocument2 pagesBetas DamodaranFabiola Brigida Yauri QuispeNo ratings yet

- Tabla 01 - Beta Del SectorDocument2 pagesTabla 01 - Beta Del SectorGambi LopezNo ratings yet

- Cap - 12 - Betas by Sector DamodaranDocument4 pagesCap - 12 - Betas by Sector DamodaranVanessa José Claudio IsaiasNo ratings yet

- Indicadores 2024 2Document18 pagesIndicadores 2024 2JH MurruNo ratings yet

- Betas (Utility Water)Document1 pageBetas (Utility Water)hfredianNo ratings yet

- Finance Beta - IndiaDocument4 pagesFinance Beta - Indiag9573407No ratings yet

- Date Updated: Created By: What Is This Data? Home Page: Data Website: Companies in Each Industry: Variable DefinitionsDocument6 pagesDate Updated: Created By: What Is This Data? Home Page: Data Website: Companies in Each Industry: Variable DefinitionsJose Hines-AlvaradoNo ratings yet

- Betas de DamodaranDocument3 pagesBetas de DamodaranDIEGO ALONSO PARI CORDOVANo ratings yet

- Betas EmergDocument7 pagesBetas EmergSindy JimenezNo ratings yet

- IAS 36 Example: Calculation of WACCDocument36 pagesIAS 36 Example: Calculation of WACCJessyRityNo ratings yet

- Date Updated: Created By: What Is This Data? Home Page: Data Website: Companies in Each Industry: Variable DefinitionsDocument7 pagesDate Updated: Created By: What Is This Data? Home Page: Data Website: Companies in Each Industry: Variable DefinitionsvicoraulNo ratings yet

- RATIOS (Common Size Balance Sheet)Document4 pagesRATIOS (Common Size Balance Sheet)meenakshi vermaNo ratings yet

- Date Updated: 5-Jan-14 Aswath Damodaran: To Update This Spreadsheet, Enter The FollowingDocument9 pagesDate Updated: 5-Jan-14 Aswath Damodaran: To Update This Spreadsheet, Enter The FollowingTony BrookNo ratings yet

- BetasDocument7 pagesBetasJulio Cesar ChavezNo ratings yet

- BetasDocument7 pagesBetasWendy FernándezNo ratings yet

- Industry Name Number of Firms Beta D/E Ratio Tax RateDocument6 pagesIndustry Name Number of Firms Beta D/E Ratio Tax RateAndres ZNo ratings yet

- BetasDocument10 pagesBetasVilmaCastilloMNo ratings yet

- Damodaran DataDocument2 pagesDamodaran DataVirginia BalboaNo ratings yet

- Industry FinancialsDocument3 pagesIndustry FinancialsVadinee TailorNo ratings yet

- Industry Name Number of Firms Beta D/E Ratio Tax RateDocument6 pagesIndustry Name Number of Firms Beta D/E Ratio Tax RateIngebusas IngebusasNo ratings yet

- Betas DamodaranDocument312 pagesBetas DamodaranJoseLuisTangaraNo ratings yet

- Rohit Pandey-15E-064 - FSA - EnduranceDocument6 pagesRohit Pandey-15E-064 - FSA - EnduranceROHIT PANDEYNo ratings yet

- Omaxe 1Document2 pagesOmaxe 1Shreemat PattajoshiNo ratings yet

- Projections 2023Document8 pagesProjections 2023DHANAMNo ratings yet

- Industry Name Number of Firms ROC Reinvestment Rate Expected Growth in EBITDocument3 pagesIndustry Name Number of Firms ROC Reinvestment Rate Expected Growth in EBITruchi gulatiNo ratings yet

- Hot-Accounts Google FinanceDocument5 pagesHot-Accounts Google Financerbp_1973No ratings yet

- Data Patterns Income&CashFlow - 4 Years - 19052020Document8 pagesData Patterns Income&CashFlow - 4 Years - 19052020Sundararaghavan RNo ratings yet

- Chapter 3 Data Analysis and InterpretationDocument28 pagesChapter 3 Data Analysis and Interpretationhivamol906No ratings yet

- Midland EnergyDocument7 pagesMidland EnergyNischal UpretiNo ratings yet

- Yuken IndiaDocument18 pagesYuken IndiaVishalPandeyNo ratings yet

- SectorDocument2 pagesSectorMd. Real MiahNo ratings yet

- Pi Daily Strategy 24112023 SumDocument7 pagesPi Daily Strategy 24112023 SumPateera Chananti PhoomwanitNo ratings yet

- Casting CompareDocument2 pagesCasting Compareprith.m217425No ratings yet

- Cases SolutionDocument10 pagesCases Solutionhimanshu sagarNo ratings yet

- Campbell Soups Company: Year 11 Year 10 Year 9 Net Sales Costs and ExpensesDocument2 pagesCampbell Soups Company: Year 11 Year 10 Year 9 Net Sales Costs and ExpensesBhavesh MotwaniNo ratings yet

- Campbell SoupsDocument2 pagesCampbell SoupsBhavesh MotwaniNo ratings yet

- Tvs MotorDocument6 pagesTvs MotortusharbwNo ratings yet

- EXHIBITDocument5 pagesEXHIBITmelisaNo ratings yet

- Eva GlobalDocument7 pagesEva GlobalRodrigo FedaltoNo ratings yet

- Fsa B-32Document24 pagesFsa B-32Pihu MouryaNo ratings yet

- Adlabs InfoDocument3 pagesAdlabs InfovineetjogalekarNo ratings yet

- Oil and Natural Gas CorporationDocument43 pagesOil and Natural Gas CorporationNishant SharmaNo ratings yet

- Ambuja Cements: Profit & Loss AccountDocument15 pagesAmbuja Cements: Profit & Loss Accountwritik sahaNo ratings yet

- Peer GRP Compsn BankingDocument2 pagesPeer GRP Compsn Bankinganupnayak123No ratings yet

- IFFCO Financial Statement AnalysisDocument2 pagesIFFCO Financial Statement AnalysisSuprabhat SealNo ratings yet

- There Are Three Ways in Which You Can Estimate The Capital Expenditures, Especially in Stable GrowthDocument6 pagesThere Are Three Ways in Which You Can Estimate The Capital Expenditures, Especially in Stable Growthapi-3763138No ratings yet

- Britannia Analysis 2018-19Document32 pagesBritannia Analysis 2018-19Hilal MohammedNo ratings yet

- Relaxo Footwear - Updated BSDocument54 pagesRelaxo Footwear - Updated BSRonakk MoondraNo ratings yet

- KPR Phase - 1Document23 pagesKPR Phase - 1Satyam1771No ratings yet

- Quantitative Finance: Its Development, Mathematical Foundations, and Current ScopeFrom EverandQuantitative Finance: Its Development, Mathematical Foundations, and Current ScopeNo ratings yet

- Case Study - AquionicsDocument10 pagesCase Study - AquionicsUyen HoangNo ratings yet

- Team MembersDocument8 pagesTeam MembersUyen HoangNo ratings yet

- Developer-Driven Sustainable Communities: Lessons From A Case Study of The Sustainable City in DubaiDocument11 pagesDeveloper-Driven Sustainable Communities: Lessons From A Case Study of The Sustainable City in DubaiUyen HoangNo ratings yet

- Honest Tea Invstmt AnalysisDocument1 pageHonest Tea Invstmt AnalysisUyen HoangNo ratings yet

- Personal Leadership Development Plans: Essentials and PracticumDocument8 pagesPersonal Leadership Development Plans: Essentials and PracticumUyen HoangNo ratings yet

- 2019 Sustainability Report Telenet PDFDocument48 pages2019 Sustainability Report Telenet PDFUyen HoangNo ratings yet

- IIRC Practical Aid The International IR Framework Requirements PDFDocument2 pagesIIRC Practical Aid The International IR Framework Requirements PDFUyen HoangNo ratings yet

- Kraft Heinz's Goodwill Charge Tops Consumer-Staples Record - WSJDocument6 pagesKraft Heinz's Goodwill Charge Tops Consumer-Staples Record - WSJUyen HoangNo ratings yet

- Climate Change and The Coffee Industry: Technical PaperDocument36 pagesClimate Change and The Coffee Industry: Technical PaperUyen HoangNo ratings yet

- Appendix 2: Extract From Carbon Tracker's WebsiteDocument2 pagesAppendix 2: Extract From Carbon Tracker's WebsiteUyen HoangNo ratings yet

- Valuation Challenges in Stranded Asset Scenarios - A Risk Discourse of Evidence From The UKDocument19 pagesValuation Challenges in Stranded Asset Scenarios - A Risk Discourse of Evidence From The UKUyen HoangNo ratings yet

- Ifrs Standards and Climate-Related Disclosures: in BriefDocument12 pagesIfrs Standards and Climate-Related Disclosures: in BriefUyen HoangNo ratings yet

- Cuba - Year 46 PDFDocument57 pagesCuba - Year 46 PDFUyen HoangNo ratings yet

- Business Ethics and CSR: Hewlett-Packard - (Company Address)Document9 pagesBusiness Ethics and CSR: Hewlett-Packard - (Company Address)Uyen HoangNo ratings yet

- Session 3 WorkSheetsDocument4 pagesSession 3 WorkSheetsUyen HoangNo ratings yet

- Iendly HotelDocument11 pagesIendly HotelUyen HoangNo ratings yet

- Personal and Organizational Values and Job Satisfaction - Kumar 12Document9 pagesPersonal and Organizational Values and Job Satisfaction - Kumar 12Uyen HoangNo ratings yet

- Cuba - Year 47 PDFDocument45 pagesCuba - Year 47 PDFUyen HoangNo ratings yet

- ROSEN Green InitiativesDocument13 pagesROSEN Green InitiativesUyen HoangNo ratings yet

- English Circular Canvas PDFDocument9 pagesEnglish Circular Canvas PDFUyen HoangNo ratings yet

- BS 2830Document46 pagesBS 2830Mohammed Rizwan AhmedNo ratings yet

- Bend TestDocument38 pagesBend TestAzan Safril100% (1)

- Pdms 12 HvacDocument4 pagesPdms 12 HvacsadeghmsgNo ratings yet

- Policy - Task 2 ContentDocument6 pagesPolicy - Task 2 ContentJadhav AmitNo ratings yet

- Ricky C. Alfon: - Individual Differences - (Prof Ed 6) Facilitating Learner-Centered TeachingDocument8 pagesRicky C. Alfon: - Individual Differences - (Prof Ed 6) Facilitating Learner-Centered TeachingMark Joseph DacubaNo ratings yet

- Sobha LTD Q2 FY 2020 21 Investor PresentationDocument47 pagesSobha LTD Q2 FY 2020 21 Investor PresentationAdarsh Reddy GuthaNo ratings yet

- BT08 PDFDocument4 pagesBT08 PDFAfdhalNo ratings yet

- Account Summary: Consolidated StatementDocument7 pagesAccount Summary: Consolidated StatementSrinivasan RamachandranNo ratings yet

- M50-2014 V6Document334 pagesM50-2014 V6Dragan MilosevicNo ratings yet

- Reviewer in Pa 108Document14 pagesReviewer in Pa 108Madelyn OrfinadaNo ratings yet

- SPPU MA 2 SyllabusDocument43 pagesSPPU MA 2 SyllabusPranit JavirNo ratings yet

- 03-15-2016 ECF 305 USA V JON RITZHEIMER - Response To Motion by USA As To Jon Ritzheimer Re Motion For Release From CustodyDocument12 pages03-15-2016 ECF 305 USA V JON RITZHEIMER - Response To Motion by USA As To Jon Ritzheimer Re Motion For Release From CustodyJack RyanNo ratings yet

- Kine 2p90 l19Document9 pagesKine 2p90 l19baileyschaefer28No ratings yet

- Nift MFM Placement PDFDocument40 pagesNift MFM Placement PDFAastha BattuNo ratings yet

- Alternative Investment FundsDocument49 pagesAlternative Investment FundsProf. Amit kashyapNo ratings yet

- Risk AssessmentDocument2 pagesRisk AssessmentFaraiMbudaya0% (1)

- Basic Accounting - Final ExaminationDocument5 pagesBasic Accounting - Final ExaminationLaira Diana RamosNo ratings yet

- Gestational Hypertension - UTD PDFDocument21 pagesGestational Hypertension - UTD PDFShahar Perea ArizaNo ratings yet

- English Gs Book July MonthDocument80 pagesEnglish Gs Book July MonthMadhab PatowaryNo ratings yet

- Diass Week 2Document6 pagesDiass Week 2Danica PaglinawanNo ratings yet

- Grade 05 Unit 06 Smart SheetDocument4 pagesGrade 05 Unit 06 Smart Sheetkosemeral köseNo ratings yet

- 802.1AEbw-2013 - IEEE STD For LAN&MANs - Media Access Control (MAC) Security. Amendment 2. Extended Packet NumberingDocument67 pages802.1AEbw-2013 - IEEE STD For LAN&MANs - Media Access Control (MAC) Security. Amendment 2. Extended Packet NumberingLenina Viktoriya TeknyetovaNo ratings yet

- 1h 2019 Assessment1Document72 pages1h 2019 Assessment1api-406108641No ratings yet

- Weather ChangesDocument34 pagesWeather ChangesEmina PodicNo ratings yet

- Pediatric Vestibular Disorders PDFDocument10 pagesPediatric Vestibular Disorders PDFNati GallardoNo ratings yet

- Ch06 Solations Brigham 10th EDocument32 pagesCh06 Solations Brigham 10th ERafay HussainNo ratings yet

- Ground Floor Sewage/Sewer Layout Second Floor Sewage/Sewer LayoutDocument1 pageGround Floor Sewage/Sewer Layout Second Floor Sewage/Sewer LayoutJanine LeiNo ratings yet

- TRA Parameters Audit 2G+3G+4G - 2015Document8 pagesTRA Parameters Audit 2G+3G+4G - 2015Muntazir MehdiNo ratings yet