Professional Documents

Culture Documents

Beleid Pajak Untuk ECommerce Batal

Beleid Pajak Untuk ECommerce Batal

Uploaded by

Daisy Anita SusiloCopyright:

Available Formats

You might also like

- UAPS2021144054 - Sigma2 Work Progress Summary 2021Document19 pagesUAPS2021144054 - Sigma2 Work Progress Summary 2021Carlos Manuel ValdezNo ratings yet

- Impact of GST On Small and Medium EnterprisesDocument5 pagesImpact of GST On Small and Medium Enterprisesarcherselevators0% (2)

- Business PlanDocument7 pagesBusiness PlanEphrance100% (2)

- PROSIDING INTERNATIONAL - The Effect of M-Pajak and E-Form Use On Msmes' Tax Compliance in Pematang Serai Village, Langkat Region - 15 MARET 2023Document9 pagesPROSIDING INTERNATIONAL - The Effect of M-Pajak and E-Form Use On Msmes' Tax Compliance in Pematang Serai Village, Langkat Region - 15 MARET 2023sucisayangbundaNo ratings yet

- E-Commerce System For Tax Payments and An Obstacle On Its Implementation Myanmar Tax Reform PlanDocument3 pagesE-Commerce System For Tax Payments and An Obstacle On Its Implementation Myanmar Tax Reform PlanKaung HtetZawNo ratings yet

- Addressing The Tax Challenge of E-Commerce TransactionsDocument11 pagesAddressing The Tax Challenge of E-Commerce Transactionsmỹ linh nguyễnNo ratings yet

- Online Business (E-Commerce) in Indonesia TaxationDocument12 pagesOnline Business (E-Commerce) in Indonesia TaxationIndah NovitasariNo ratings yet

- Implementasi E-Faktur Versi 30 Dalam Upaya MeningkDocument10 pagesImplementasi E-Faktur Versi 30 Dalam Upaya MeningkZhafira Ramadhani ArimurtiNo ratings yet

- PMK 210 Brief English - DraftDocument7 pagesPMK 210 Brief English - DraftAnonymous MNgYrvIC3No ratings yet

- Jurnal InternasionalDocument11 pagesJurnal Internasionalsilvia gynaNo ratings yet

- Licke - Jia Unpam 2020Document14 pagesLicke - Jia Unpam 2020Licke BieattantNo ratings yet

- Insentif PMK 862020 Di Tengah Pandemi Covid 19 Apakah MempengaruhiDocument18 pagesInsentif PMK 862020 Di Tengah Pandemi Covid 19 Apakah MempengaruhiTaruna Putra Dirgantara100% (1)

- Newsletter - Okt I - Part 3Document6 pagesNewsletter - Okt I - Part 3Daisy Anita SusiloNo ratings yet

- Jurnal Kak ErmaDocument13 pagesJurnal Kak ErmaRahmat Rahmat25No ratings yet

- Effects of Online Tax System On Tax CompDocument18 pagesEffects of Online Tax System On Tax CompDaniel MuchaiNo ratings yet

- Obayemi Emmanuel Ayomide ID Number: 20222928 Taxation Theory and PracticeDocument6 pagesObayemi Emmanuel Ayomide ID Number: 20222928 Taxation Theory and PracticeObayemi AyomideNo ratings yet

- Chemexcil: Key Highlights & Provisions For Exports/ Chemicals SectorDocument6 pagesChemexcil: Key Highlights & Provisions For Exports/ Chemicals SectorRRSNo ratings yet

- Tax Administration Indonesia IJMSSSR00616Document13 pagesTax Administration Indonesia IJMSSSR00616Ayu ChotibahNo ratings yet

- Reflection B Taxation Both QuestionsDocument14 pagesReflection B Taxation Both Questionsmohd reiNo ratings yet

- Finance Compiled FinalDocument21 pagesFinance Compiled Finaljadyn nicholasNo ratings yet

- E-Commerce As The Tax Potential Revenue in Indonesia: Nufransa Wira SaktiDocument20 pagesE-Commerce As The Tax Potential Revenue in Indonesia: Nufransa Wira SaktiadhystyNo ratings yet

- System Analysis of The Ethiopian EDocument7 pagesSystem Analysis of The Ethiopian EyordanosNo ratings yet

- System Analysis of The Ethiopian EDocument7 pagesSystem Analysis of The Ethiopian EyordanosNo ratings yet

- Impact On IT Sector Related To BudgetDocument2 pagesImpact On IT Sector Related To BudgetAmruta SawantNo ratings yet

- The Effectiveness of Tax Administration Digitalization To Reduce Compliance Cost Taxpayers of Micro Small, and Medium EnterprisesDocument8 pagesThe Effectiveness of Tax Administration Digitalization To Reduce Compliance Cost Taxpayers of Micro Small, and Medium EnterprisesElychia Roly PutriNo ratings yet

- Attitude Towards Electronic Tax System and Value-ADocument21 pagesAttitude Towards Electronic Tax System and Value-AJhane GarciaNo ratings yet

- Public Benefit Principle in Regulating E-Commerce Tax On Consumer's Location in IndonesiaDocument11 pagesPublic Benefit Principle in Regulating E-Commerce Tax On Consumer's Location in IndonesiaArif AfriadyNo ratings yet

- 2902 10778 1 PBDocument11 pages2902 10778 1 PBOlivia OchaNo ratings yet

- The Effectiveness Utilization of Electronic Tax Filing in Kantor Pelayanan Pajak (KPP) Pratama Jakarta Pluit, North JakartaDocument21 pagesThe Effectiveness Utilization of Electronic Tax Filing in Kantor Pelayanan Pajak (KPP) Pratama Jakarta Pluit, North JakartaVermouthNo ratings yet

- Analisis Penerapan E-Faktur Dalam Prosedur Dan Pembuatan Faktur Pajak Dan Pelaporan SPT Masa PPN Pada Cv. Wastu Citra PratamaDocument11 pagesAnalisis Penerapan E-Faktur Dalam Prosedur Dan Pembuatan Faktur Pajak Dan Pelaporan SPT Masa PPN Pada Cv. Wastu Citra PratamaThata AgathaNo ratings yet

- Muhammad Luthfi Mahendra - 2001036085 - EssayDocument2 pagesMuhammad Luthfi Mahendra - 2001036085 - Essayluthfi mahendraNo ratings yet

- Uganda Management InstituteDocument6 pagesUganda Management InstitutekitstonNo ratings yet

- The Implementation of Value Added Tax (Vat) On E-Transactions in Nigeria: Issues and ImplicationsDocument9 pagesThe Implementation of Value Added Tax (Vat) On E-Transactions in Nigeria: Issues and ImplicationsaijbmNo ratings yet

- Abstrac 2Document2 pagesAbstrac 2Angela KrismonikaNo ratings yet

- Jurnal Internasional PerpajakanDocument15 pagesJurnal Internasional PerpajakanNurul MutiaraNo ratings yet

- 1531-Article Text-4099-1-10-20210705Document6 pages1531-Article Text-4099-1-10-20210705rofirheinNo ratings yet

- Task 8Document23 pagesTask 8Anooja SajeevNo ratings yet

- Central Taxes Replaced by GSTDocument6 pagesCentral Taxes Replaced by GSTBijosh ThomasNo ratings yet

- Business WorldDocument2 pagesBusiness WorldJames Ryan AlzonaNo ratings yet

- Pajak E-Commerce Di Indonesia: Corresponding Author: Hastanti - Rahayu@uinsby - Ac.idDocument11 pagesPajak E-Commerce Di Indonesia: Corresponding Author: Hastanti - Rahayu@uinsby - Ac.idPutri suryaNo ratings yet

- 19-Article Text-22-1-10-20201109Document20 pages19-Article Text-22-1-10-20201109JanuarNo ratings yet

- Report On Developing SMEs 2Document12 pagesReport On Developing SMEs 2wizardwatch88No ratings yet

- Optimizing Income Tax and Value Added Tax On E-Commerce TransactionDocument10 pagesOptimizing Income Tax and Value Added Tax On E-Commerce TransactionHanyfah ArifiaNo ratings yet

- The Introduction of GST in MalaysiaDocument2 pagesThe Introduction of GST in MalaysiaDamon CopelandNo ratings yet

- Public Benefit Principlein Regulation E-Commerce Tax On Consumers Location in IndonesiaDocument12 pagesPublic Benefit Principlein Regulation E-Commerce Tax On Consumers Location in IndonesiaIndah NovitasariNo ratings yet

- Analysis of Tax Payment Compliance On E-Commerce Transaction in SurabayaDocument12 pagesAnalysis of Tax Payment Compliance On E-Commerce Transaction in Surabayaanderson.andersonNo ratings yet

- VAT On Digital Services: Briefing PaperDocument15 pagesVAT On Digital Services: Briefing Papercarolina2912No ratings yet

- Value Added Tax and EVATDocument2 pagesValue Added Tax and EVATImperator FuriosaNo ratings yet

- The Effect of Tax Incentives and Good Corporate Governance On Tax AvoidanceDocument12 pagesThe Effect of Tax Incentives and Good Corporate Governance On Tax AvoidanceArief SuryadiNo ratings yet

- Newsletter Vol3 - 2014 PDFDocument11 pagesNewsletter Vol3 - 2014 PDFrahul422No ratings yet

- A Project Proposal On The Effects of Value Added Tax On Financial Performance of Small and Medium Enterprises - EditedDocument14 pagesA Project Proposal On The Effects of Value Added Tax On Financial Performance of Small and Medium Enterprises - Editedjw3990725No ratings yet

- Equalisation Levy ICAI ModuleDocument37 pagesEqualisation Levy ICAI Modulelekhha bhansaliNo ratings yet

- Automation and Tax Compliance Empirical Evidence From Nigeria 2020Document10 pagesAutomation and Tax Compliance Empirical Evidence From Nigeria 2020Stalyn Celi BarreraNo ratings yet

- 2101654516-Bella OktavianiDocument15 pages2101654516-Bella Oktavianikhrisna02No ratings yet

- Automation and Tax Compliance in NigeriaDocument10 pagesAutomation and Tax Compliance in NigeriapaulevbadeeseosaNo ratings yet

- Recommendations For Tax ReformsDocument2 pagesRecommendations For Tax ReformsSajjad Ahmed SialNo ratings yet

- 1 SMDocument12 pages1 SMAngela Fye LlagasNo ratings yet

- Group Fin533 Important TaxationDocument4 pagesGroup Fin533 Important Taxationnurul affidaNo ratings yet

- Upto Chapter 3@rojila LuitelDocument31 pagesUpto Chapter 3@rojila LuitelRojila luitelNo ratings yet

- 63-Article Text-324-2-10-20230129Document12 pages63-Article Text-324-2-10-20230129Fariz YaserNo ratings yet

- Tax and MSMEs in the Digital Age: Why Do We Need To Pay Taxes And What Are The Benefits For Us As MSME Entrepreneurs And How To Build Regulations That Are Empathetic And Proven To Encourage Tax Revenue In The Informal SectorFrom EverandTax and MSMEs in the Digital Age: Why Do We Need To Pay Taxes And What Are The Benefits For Us As MSME Entrepreneurs And How To Build Regulations That Are Empathetic And Proven To Encourage Tax Revenue In The Informal SectorNo ratings yet

- Indonesian Taxation: for Academics and Foreign Business Practitioners Doing Business in IndonesiaFrom EverandIndonesian Taxation: for Academics and Foreign Business Practitioners Doing Business in IndonesiaNo ratings yet

- Receipt: No: 10706028/KWT/FIN-GOLD/XII/17Document1 pageReceipt: No: 10706028/KWT/FIN-GOLD/XII/17Daisy Anita SusiloNo ratings yet

- Per Dir Pajak 32 2012Document17 pagesPer Dir Pajak 32 2012Daisy Anita SusiloNo ratings yet

- Nio Daisy Anita: Surabaya - T2 (SUB)Document2 pagesNio Daisy Anita: Surabaya - T2 (SUB)Daisy Anita SusiloNo ratings yet

- Newsletter Maret I - EnglishDocument6 pagesNewsletter Maret I - EnglishDaisy Anita SusiloNo ratings yet

- Business English: No. Title PublisherDocument4 pagesBusiness English: No. Title PublisherDaisy Anita SusiloNo ratings yet

- Taxflash: Tax Indonesia / July 2017 / No.09Document3 pagesTaxflash: Tax Indonesia / July 2017 / No.09Daisy Anita SusiloNo ratings yet

- Ketentuan Angsuran PPH Pasal 25 Untuk WP Kriteria Tertentu - EnglishDocument2 pagesKetentuan Angsuran PPH Pasal 25 Untuk WP Kriteria Tertentu - EnglishDaisy Anita SusiloNo ratings yet

- Nio Daisy Anita: Jakarta (CGK)Document2 pagesNio Daisy Anita: Jakarta (CGK)Daisy Anita SusiloNo ratings yet

- Ketentuan Terbaru Atas Pemotongan PPH BungaDocument2 pagesKetentuan Terbaru Atas Pemotongan PPH BungaDaisy Anita SusiloNo ratings yet

- Indonesia Taxation Quarterly Report 2019 - I: ForewordDocument47 pagesIndonesia Taxation Quarterly Report 2019 - I: ForewordDaisy Anita SusiloNo ratings yet

- Ketentuan Terbaru PBB-P2 JakartaDocument2 pagesKetentuan Terbaru PBB-P2 JakartaDaisy Anita SusiloNo ratings yet

- Receipt PDFDocument1 pageReceipt PDFDaisy Anita SusiloNo ratings yet

- Klaim Asuransi JiwaDocument2 pagesKlaim Asuransi JiwaDaisy Anita SusiloNo ratings yet

- Tax - Newsletter R&D 10 2019Document6 pagesTax - Newsletter R&D 10 2019Daisy Anita SusiloNo ratings yet

- Diymarketingpresentation 190302212312 PDFDocument19 pagesDiymarketingpresentation 190302212312 PDFDaisy Anita SusiloNo ratings yet

- Newsletter - Content - Feb 2019 EnglishDocument7 pagesNewsletter - Content - Feb 2019 EnglishDaisy Anita SusiloNo ratings yet

- Katun TaiwanDocument5 pagesKatun TaiwanDaisy Anita SusiloNo ratings yet

- Kedudukan: DJP Selayang PandangDocument2 pagesKedudukan: DJP Selayang PandangDaisy Anita SusiloNo ratings yet

- Newsletter - Okt I - Part 3Document6 pagesNewsletter - Okt I - Part 3Daisy Anita SusiloNo ratings yet

- Compile Newsletter April I 2019 ENGLISH Edit PagiDocument7 pagesCompile Newsletter April I 2019 ENGLISH Edit PagiDaisy Anita SusiloNo ratings yet

- Newsletter - Okt I - Part 4Document3 pagesNewsletter - Okt I - Part 4Daisy Anita SusiloNo ratings yet

- Newsletter - Agustus I - Part IIIDocument11 pagesNewsletter - Agustus I - Part IIIDaisy Anita SusiloNo ratings yet

- Safeguard Import Duty On Fructose Syrup Products: Mof Reg. 126/2020Document3 pagesSafeguard Import Duty On Fructose Syrup Products: Mof Reg. 126/2020Daisy Anita SusiloNo ratings yet

- Exemptions of Aid, Donations, and Grants From Objects of Income TaxDocument3 pagesExemptions of Aid, Donations, and Grants From Objects of Income TaxDaisy Anita SusiloNo ratings yet

- Government Regulates Tax Incentives To Boost Ease of ExportDocument2 pagesGovernment Regulates Tax Incentives To Boost Ease of ExportDaisy Anita SusiloNo ratings yet

- PerkenalanDocument1 pagePerkenalanDaisy Anita SusiloNo ratings yet

- Writing Poin 6Document1 pageWriting Poin 6Daisy Anita SusiloNo ratings yet

- Nara - English Course Homework - Circular LetterDocument1 pageNara - English Course Homework - Circular LetterDaisy Anita SusiloNo ratings yet

- FMDS0329 PDFDocument5 pagesFMDS0329 PDFStory LoveNo ratings yet

- Kleihauer TestDocument3 pagesKleihauer Testteo2211100% (1)

- Taylor v. Uy Tieng Piao and Tan Liuan FINALDocument1 pageTaylor v. Uy Tieng Piao and Tan Liuan FINALJennifer OceñaNo ratings yet

- AA284a Lecture1Document11 pagesAA284a Lecture1masseNo ratings yet

- Transgender Persons (Protection of Rights) Act, 2019 - WikipediaDocument14 pagesTransgender Persons (Protection of Rights) Act, 2019 - WikipediakanmaniNo ratings yet

- Measuring The Readiness of Navotas Polytechnic College For SLO AdoptionDocument5 pagesMeasuring The Readiness of Navotas Polytechnic College For SLO AdoptionMarco MedurandaNo ratings yet

- MBBS Admissions To St. John's Medical College For The Year 2018-19Document10 pagesMBBS Admissions To St. John's Medical College For The Year 2018-19jbvhvmnNo ratings yet

- ContractDocument69 pagesContractmoralesalexandra74No ratings yet

- Bangalore List of CompaniesDocument12 pagesBangalore List of CompaniesAbhishek ChaudharyNo ratings yet

- Group 4 Case DigestsDocument46 pagesGroup 4 Case DigestsStephany PolinarNo ratings yet

- File 926Document3 pagesFile 926amitgarje780No ratings yet

- Intercultural Language Teaching: Principles For Practice: January 2004Document10 pagesIntercultural Language Teaching: Principles For Practice: January 2004Henry OsborneNo ratings yet

- DFM FoodsDocument2 pagesDFM FoodsmitNo ratings yet

- Prayer of TravellerDocument11 pagesPrayer of TravellerMuhammad NabeelNo ratings yet

- Soft Power With Chinese Characteristics: The Ongoing DebateDocument17 pagesSoft Power With Chinese Characteristics: The Ongoing DebateKanka kNo ratings yet

- Home Visitation Form: Department of Education Division of General Santos CityDocument1 pageHome Visitation Form: Department of Education Division of General Santos Citymarvin susminaNo ratings yet

- Life of Geoffrey ChaucerDocument8 pagesLife of Geoffrey ChaucerAwais Ali LashariNo ratings yet

- Ensayo Matar A Un RuiseñorDocument4 pagesEnsayo Matar A Un RuiseñorEdwin CortezNo ratings yet

- Warning Letters To Madeira On Marco Island and Greenscapes of Southwest Florida - Department of Environmental ProtectionDocument9 pagesWarning Letters To Madeira On Marco Island and Greenscapes of Southwest Florida - Department of Environmental ProtectionOmar Rodriguez OrtizNo ratings yet

- Complaint in Walls, Et Al. v. Sanders, Et Al., 4:24-CV-270-KGB.Document56 pagesComplaint in Walls, Et Al. v. Sanders, Et Al., 4:24-CV-270-KGB.egodinezfr100% (1)

- The Four Key Hypnosis Experiences PDFDocument3 pagesThe Four Key Hypnosis Experiences PDFTudor LvdNo ratings yet

- StatconDocument2 pagesStatconRoland Mark GatchalianNo ratings yet

- FIDO's Budget Planner: Start HereDocument2 pagesFIDO's Budget Planner: Start HereJose MagcalasNo ratings yet

- PROVREM Final ExamDocument27 pagesPROVREM Final ExamXandredg Sumpt LatogNo ratings yet

- Cognizant Company FAQDocument4 pagesCognizant Company FAQManojChowdary100% (1)

- Conservation of Plants and AnimalsDocument36 pagesConservation of Plants and AnimalsAngeelina AgarwalNo ratings yet

- MAF307 - Trimester 2 2021 Assessment Task 2 - Equity Research - Group AssignmentDocument9 pagesMAF307 - Trimester 2 2021 Assessment Task 2 - Equity Research - Group AssignmentDawoodHameedNo ratings yet

- Computer ClubDocument1 pageComputer Clublehan19052000No ratings yet

Beleid Pajak Untuk ECommerce Batal

Beleid Pajak Untuk ECommerce Batal

Uploaded by

Daisy Anita SusiloOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Beleid Pajak Untuk ECommerce Batal

Beleid Pajak Untuk ECommerce Batal

Uploaded by

Daisy Anita SusiloCopyright:

Available Formats

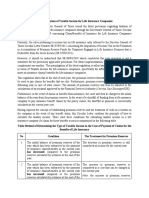

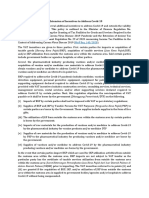

The Tax Regulation for E-Commerce Annulled

The government's efforts to extend taxes through the issuance of taxation provisions on e-commerce

came to a halt after the Press Release on March 29, 2019.1 The latest provisions regarding the taxation

of e-commerce regulated through PMK Number 210/PMK.010/2018 concerning the Taxation on

Trade Transactions Through Electronic Systems (E-Commerce) (PMK No. 210/2018) was supposed

to come into effect as of April 1, 2019 .

One of the underlying reason behind the government’s decision is the obscurity concerning the e-

commerce taxes in that allegedly, the government was to impose new types and rates of taxes for e-

commerce actors whereas this MoF Regulation is an affirmation that there is no difference in taxation

between online and conventional business transactions so as to guarantee the equality of a level

playing field.

The tax liabilities regulated by this MoF Regulation are the same types of taxes also applied to

businesses that are run conventionally, namely Income Tax (Pjak Penghasilan/PPh), Value Added

Tax (Pajak Pertambahan Nilai/PPN), and customs and excise in accordance with prevailing

regulations.2 However, due to concerns that this regulation would be unproductive due to the ‘noise’,

the government has decided to to implement more comprehensive coordination and synchronization

between ministries/agencies in the document signed by the Head of the Communication and

Information Services Bureau of the DGT, Nufransa Wira Sakti .

More intensive aspects of socialization and communication with all stakeholders also underlies the

annullment of this MoF Regulation in which the association is the key player. The Indonesian

government still awaits the results of a survey from the Indonesian E-Commerce Association (IdEA)

regarding the portion of Indonesia's digital economy scheduled to be completed by the end of this

year. In the foreseeable future, the government hopes that there will be no noise or resistance from

business people in terms of the tax policies pertaining to the economic actors in the digital field.

1

The Ministry of Finance of the Repulic of Indonesia, “Tarik PMK e-Commerce, Menkeu Tegaskan Komitmen

Dorong Ekosistem Ekonomi Digital,” Press Release (29 March 2019), Internet, can be accessed at:

https://www.kemenkeu.go.id/publikasi/siaran-pers/siaran-pers-tarik-pmk-e-commerce-menkeu-tegaskan-komitmen-

dorong-ekosistem-ekonomi-digital/.

2

Hence, the taxation provisions on e-commerce transactions still refer to the Director General of Taxes Circular

Number SE-62/PJ/2013 concerning the Affirmation of Taxation Provisions on E-Commerce Transactions and SE-

06/PJ/2015 concerning the Withholding of Income Tax on E-Commerce Transactions.

You might also like

- UAPS2021144054 - Sigma2 Work Progress Summary 2021Document19 pagesUAPS2021144054 - Sigma2 Work Progress Summary 2021Carlos Manuel ValdezNo ratings yet

- Impact of GST On Small and Medium EnterprisesDocument5 pagesImpact of GST On Small and Medium Enterprisesarcherselevators0% (2)

- Business PlanDocument7 pagesBusiness PlanEphrance100% (2)

- PROSIDING INTERNATIONAL - The Effect of M-Pajak and E-Form Use On Msmes' Tax Compliance in Pematang Serai Village, Langkat Region - 15 MARET 2023Document9 pagesPROSIDING INTERNATIONAL - The Effect of M-Pajak and E-Form Use On Msmes' Tax Compliance in Pematang Serai Village, Langkat Region - 15 MARET 2023sucisayangbundaNo ratings yet

- E-Commerce System For Tax Payments and An Obstacle On Its Implementation Myanmar Tax Reform PlanDocument3 pagesE-Commerce System For Tax Payments and An Obstacle On Its Implementation Myanmar Tax Reform PlanKaung HtetZawNo ratings yet

- Addressing The Tax Challenge of E-Commerce TransactionsDocument11 pagesAddressing The Tax Challenge of E-Commerce Transactionsmỹ linh nguyễnNo ratings yet

- Online Business (E-Commerce) in Indonesia TaxationDocument12 pagesOnline Business (E-Commerce) in Indonesia TaxationIndah NovitasariNo ratings yet

- Implementasi E-Faktur Versi 30 Dalam Upaya MeningkDocument10 pagesImplementasi E-Faktur Versi 30 Dalam Upaya MeningkZhafira Ramadhani ArimurtiNo ratings yet

- PMK 210 Brief English - DraftDocument7 pagesPMK 210 Brief English - DraftAnonymous MNgYrvIC3No ratings yet

- Jurnal InternasionalDocument11 pagesJurnal Internasionalsilvia gynaNo ratings yet

- Licke - Jia Unpam 2020Document14 pagesLicke - Jia Unpam 2020Licke BieattantNo ratings yet

- Insentif PMK 862020 Di Tengah Pandemi Covid 19 Apakah MempengaruhiDocument18 pagesInsentif PMK 862020 Di Tengah Pandemi Covid 19 Apakah MempengaruhiTaruna Putra Dirgantara100% (1)

- Newsletter - Okt I - Part 3Document6 pagesNewsletter - Okt I - Part 3Daisy Anita SusiloNo ratings yet

- Jurnal Kak ErmaDocument13 pagesJurnal Kak ErmaRahmat Rahmat25No ratings yet

- Effects of Online Tax System On Tax CompDocument18 pagesEffects of Online Tax System On Tax CompDaniel MuchaiNo ratings yet

- Obayemi Emmanuel Ayomide ID Number: 20222928 Taxation Theory and PracticeDocument6 pagesObayemi Emmanuel Ayomide ID Number: 20222928 Taxation Theory and PracticeObayemi AyomideNo ratings yet

- Chemexcil: Key Highlights & Provisions For Exports/ Chemicals SectorDocument6 pagesChemexcil: Key Highlights & Provisions For Exports/ Chemicals SectorRRSNo ratings yet

- Tax Administration Indonesia IJMSSSR00616Document13 pagesTax Administration Indonesia IJMSSSR00616Ayu ChotibahNo ratings yet

- Reflection B Taxation Both QuestionsDocument14 pagesReflection B Taxation Both Questionsmohd reiNo ratings yet

- Finance Compiled FinalDocument21 pagesFinance Compiled Finaljadyn nicholasNo ratings yet

- E-Commerce As The Tax Potential Revenue in Indonesia: Nufransa Wira SaktiDocument20 pagesE-Commerce As The Tax Potential Revenue in Indonesia: Nufransa Wira SaktiadhystyNo ratings yet

- System Analysis of The Ethiopian EDocument7 pagesSystem Analysis of The Ethiopian EyordanosNo ratings yet

- System Analysis of The Ethiopian EDocument7 pagesSystem Analysis of The Ethiopian EyordanosNo ratings yet

- Impact On IT Sector Related To BudgetDocument2 pagesImpact On IT Sector Related To BudgetAmruta SawantNo ratings yet

- The Effectiveness of Tax Administration Digitalization To Reduce Compliance Cost Taxpayers of Micro Small, and Medium EnterprisesDocument8 pagesThe Effectiveness of Tax Administration Digitalization To Reduce Compliance Cost Taxpayers of Micro Small, and Medium EnterprisesElychia Roly PutriNo ratings yet

- Attitude Towards Electronic Tax System and Value-ADocument21 pagesAttitude Towards Electronic Tax System and Value-AJhane GarciaNo ratings yet

- Public Benefit Principle in Regulating E-Commerce Tax On Consumer's Location in IndonesiaDocument11 pagesPublic Benefit Principle in Regulating E-Commerce Tax On Consumer's Location in IndonesiaArif AfriadyNo ratings yet

- 2902 10778 1 PBDocument11 pages2902 10778 1 PBOlivia OchaNo ratings yet

- The Effectiveness Utilization of Electronic Tax Filing in Kantor Pelayanan Pajak (KPP) Pratama Jakarta Pluit, North JakartaDocument21 pagesThe Effectiveness Utilization of Electronic Tax Filing in Kantor Pelayanan Pajak (KPP) Pratama Jakarta Pluit, North JakartaVermouthNo ratings yet

- Analisis Penerapan E-Faktur Dalam Prosedur Dan Pembuatan Faktur Pajak Dan Pelaporan SPT Masa PPN Pada Cv. Wastu Citra PratamaDocument11 pagesAnalisis Penerapan E-Faktur Dalam Prosedur Dan Pembuatan Faktur Pajak Dan Pelaporan SPT Masa PPN Pada Cv. Wastu Citra PratamaThata AgathaNo ratings yet

- Muhammad Luthfi Mahendra - 2001036085 - EssayDocument2 pagesMuhammad Luthfi Mahendra - 2001036085 - Essayluthfi mahendraNo ratings yet

- Uganda Management InstituteDocument6 pagesUganda Management InstitutekitstonNo ratings yet

- The Implementation of Value Added Tax (Vat) On E-Transactions in Nigeria: Issues and ImplicationsDocument9 pagesThe Implementation of Value Added Tax (Vat) On E-Transactions in Nigeria: Issues and ImplicationsaijbmNo ratings yet

- Abstrac 2Document2 pagesAbstrac 2Angela KrismonikaNo ratings yet

- Jurnal Internasional PerpajakanDocument15 pagesJurnal Internasional PerpajakanNurul MutiaraNo ratings yet

- 1531-Article Text-4099-1-10-20210705Document6 pages1531-Article Text-4099-1-10-20210705rofirheinNo ratings yet

- Task 8Document23 pagesTask 8Anooja SajeevNo ratings yet

- Central Taxes Replaced by GSTDocument6 pagesCentral Taxes Replaced by GSTBijosh ThomasNo ratings yet

- Business WorldDocument2 pagesBusiness WorldJames Ryan AlzonaNo ratings yet

- Pajak E-Commerce Di Indonesia: Corresponding Author: Hastanti - Rahayu@uinsby - Ac.idDocument11 pagesPajak E-Commerce Di Indonesia: Corresponding Author: Hastanti - Rahayu@uinsby - Ac.idPutri suryaNo ratings yet

- 19-Article Text-22-1-10-20201109Document20 pages19-Article Text-22-1-10-20201109JanuarNo ratings yet

- Report On Developing SMEs 2Document12 pagesReport On Developing SMEs 2wizardwatch88No ratings yet

- Optimizing Income Tax and Value Added Tax On E-Commerce TransactionDocument10 pagesOptimizing Income Tax and Value Added Tax On E-Commerce TransactionHanyfah ArifiaNo ratings yet

- The Introduction of GST in MalaysiaDocument2 pagesThe Introduction of GST in MalaysiaDamon CopelandNo ratings yet

- Public Benefit Principlein Regulation E-Commerce Tax On Consumers Location in IndonesiaDocument12 pagesPublic Benefit Principlein Regulation E-Commerce Tax On Consumers Location in IndonesiaIndah NovitasariNo ratings yet

- Analysis of Tax Payment Compliance On E-Commerce Transaction in SurabayaDocument12 pagesAnalysis of Tax Payment Compliance On E-Commerce Transaction in Surabayaanderson.andersonNo ratings yet

- VAT On Digital Services: Briefing PaperDocument15 pagesVAT On Digital Services: Briefing Papercarolina2912No ratings yet

- Value Added Tax and EVATDocument2 pagesValue Added Tax and EVATImperator FuriosaNo ratings yet

- The Effect of Tax Incentives and Good Corporate Governance On Tax AvoidanceDocument12 pagesThe Effect of Tax Incentives and Good Corporate Governance On Tax AvoidanceArief SuryadiNo ratings yet

- Newsletter Vol3 - 2014 PDFDocument11 pagesNewsletter Vol3 - 2014 PDFrahul422No ratings yet

- A Project Proposal On The Effects of Value Added Tax On Financial Performance of Small and Medium Enterprises - EditedDocument14 pagesA Project Proposal On The Effects of Value Added Tax On Financial Performance of Small and Medium Enterprises - Editedjw3990725No ratings yet

- Equalisation Levy ICAI ModuleDocument37 pagesEqualisation Levy ICAI Modulelekhha bhansaliNo ratings yet

- Automation and Tax Compliance Empirical Evidence From Nigeria 2020Document10 pagesAutomation and Tax Compliance Empirical Evidence From Nigeria 2020Stalyn Celi BarreraNo ratings yet

- 2101654516-Bella OktavianiDocument15 pages2101654516-Bella Oktavianikhrisna02No ratings yet

- Automation and Tax Compliance in NigeriaDocument10 pagesAutomation and Tax Compliance in NigeriapaulevbadeeseosaNo ratings yet

- Recommendations For Tax ReformsDocument2 pagesRecommendations For Tax ReformsSajjad Ahmed SialNo ratings yet

- 1 SMDocument12 pages1 SMAngela Fye LlagasNo ratings yet

- Group Fin533 Important TaxationDocument4 pagesGroup Fin533 Important Taxationnurul affidaNo ratings yet

- Upto Chapter 3@rojila LuitelDocument31 pagesUpto Chapter 3@rojila LuitelRojila luitelNo ratings yet

- 63-Article Text-324-2-10-20230129Document12 pages63-Article Text-324-2-10-20230129Fariz YaserNo ratings yet

- Tax and MSMEs in the Digital Age: Why Do We Need To Pay Taxes And What Are The Benefits For Us As MSME Entrepreneurs And How To Build Regulations That Are Empathetic And Proven To Encourage Tax Revenue In The Informal SectorFrom EverandTax and MSMEs in the Digital Age: Why Do We Need To Pay Taxes And What Are The Benefits For Us As MSME Entrepreneurs And How To Build Regulations That Are Empathetic And Proven To Encourage Tax Revenue In The Informal SectorNo ratings yet

- Indonesian Taxation: for Academics and Foreign Business Practitioners Doing Business in IndonesiaFrom EverandIndonesian Taxation: for Academics and Foreign Business Practitioners Doing Business in IndonesiaNo ratings yet

- Receipt: No: 10706028/KWT/FIN-GOLD/XII/17Document1 pageReceipt: No: 10706028/KWT/FIN-GOLD/XII/17Daisy Anita SusiloNo ratings yet

- Per Dir Pajak 32 2012Document17 pagesPer Dir Pajak 32 2012Daisy Anita SusiloNo ratings yet

- Nio Daisy Anita: Surabaya - T2 (SUB)Document2 pagesNio Daisy Anita: Surabaya - T2 (SUB)Daisy Anita SusiloNo ratings yet

- Newsletter Maret I - EnglishDocument6 pagesNewsletter Maret I - EnglishDaisy Anita SusiloNo ratings yet

- Business English: No. Title PublisherDocument4 pagesBusiness English: No. Title PublisherDaisy Anita SusiloNo ratings yet

- Taxflash: Tax Indonesia / July 2017 / No.09Document3 pagesTaxflash: Tax Indonesia / July 2017 / No.09Daisy Anita SusiloNo ratings yet

- Ketentuan Angsuran PPH Pasal 25 Untuk WP Kriteria Tertentu - EnglishDocument2 pagesKetentuan Angsuran PPH Pasal 25 Untuk WP Kriteria Tertentu - EnglishDaisy Anita SusiloNo ratings yet

- Nio Daisy Anita: Jakarta (CGK)Document2 pagesNio Daisy Anita: Jakarta (CGK)Daisy Anita SusiloNo ratings yet

- Ketentuan Terbaru Atas Pemotongan PPH BungaDocument2 pagesKetentuan Terbaru Atas Pemotongan PPH BungaDaisy Anita SusiloNo ratings yet

- Indonesia Taxation Quarterly Report 2019 - I: ForewordDocument47 pagesIndonesia Taxation Quarterly Report 2019 - I: ForewordDaisy Anita SusiloNo ratings yet

- Ketentuan Terbaru PBB-P2 JakartaDocument2 pagesKetentuan Terbaru PBB-P2 JakartaDaisy Anita SusiloNo ratings yet

- Receipt PDFDocument1 pageReceipt PDFDaisy Anita SusiloNo ratings yet

- Klaim Asuransi JiwaDocument2 pagesKlaim Asuransi JiwaDaisy Anita SusiloNo ratings yet

- Tax - Newsletter R&D 10 2019Document6 pagesTax - Newsletter R&D 10 2019Daisy Anita SusiloNo ratings yet

- Diymarketingpresentation 190302212312 PDFDocument19 pagesDiymarketingpresentation 190302212312 PDFDaisy Anita SusiloNo ratings yet

- Newsletter - Content - Feb 2019 EnglishDocument7 pagesNewsletter - Content - Feb 2019 EnglishDaisy Anita SusiloNo ratings yet

- Katun TaiwanDocument5 pagesKatun TaiwanDaisy Anita SusiloNo ratings yet

- Kedudukan: DJP Selayang PandangDocument2 pagesKedudukan: DJP Selayang PandangDaisy Anita SusiloNo ratings yet

- Newsletter - Okt I - Part 3Document6 pagesNewsletter - Okt I - Part 3Daisy Anita SusiloNo ratings yet

- Compile Newsletter April I 2019 ENGLISH Edit PagiDocument7 pagesCompile Newsletter April I 2019 ENGLISH Edit PagiDaisy Anita SusiloNo ratings yet

- Newsletter - Okt I - Part 4Document3 pagesNewsletter - Okt I - Part 4Daisy Anita SusiloNo ratings yet

- Newsletter - Agustus I - Part IIIDocument11 pagesNewsletter - Agustus I - Part IIIDaisy Anita SusiloNo ratings yet

- Safeguard Import Duty On Fructose Syrup Products: Mof Reg. 126/2020Document3 pagesSafeguard Import Duty On Fructose Syrup Products: Mof Reg. 126/2020Daisy Anita SusiloNo ratings yet

- Exemptions of Aid, Donations, and Grants From Objects of Income TaxDocument3 pagesExemptions of Aid, Donations, and Grants From Objects of Income TaxDaisy Anita SusiloNo ratings yet

- Government Regulates Tax Incentives To Boost Ease of ExportDocument2 pagesGovernment Regulates Tax Incentives To Boost Ease of ExportDaisy Anita SusiloNo ratings yet

- PerkenalanDocument1 pagePerkenalanDaisy Anita SusiloNo ratings yet

- Writing Poin 6Document1 pageWriting Poin 6Daisy Anita SusiloNo ratings yet

- Nara - English Course Homework - Circular LetterDocument1 pageNara - English Course Homework - Circular LetterDaisy Anita SusiloNo ratings yet

- FMDS0329 PDFDocument5 pagesFMDS0329 PDFStory LoveNo ratings yet

- Kleihauer TestDocument3 pagesKleihauer Testteo2211100% (1)

- Taylor v. Uy Tieng Piao and Tan Liuan FINALDocument1 pageTaylor v. Uy Tieng Piao and Tan Liuan FINALJennifer OceñaNo ratings yet

- AA284a Lecture1Document11 pagesAA284a Lecture1masseNo ratings yet

- Transgender Persons (Protection of Rights) Act, 2019 - WikipediaDocument14 pagesTransgender Persons (Protection of Rights) Act, 2019 - WikipediakanmaniNo ratings yet

- Measuring The Readiness of Navotas Polytechnic College For SLO AdoptionDocument5 pagesMeasuring The Readiness of Navotas Polytechnic College For SLO AdoptionMarco MedurandaNo ratings yet

- MBBS Admissions To St. John's Medical College For The Year 2018-19Document10 pagesMBBS Admissions To St. John's Medical College For The Year 2018-19jbvhvmnNo ratings yet

- ContractDocument69 pagesContractmoralesalexandra74No ratings yet

- Bangalore List of CompaniesDocument12 pagesBangalore List of CompaniesAbhishek ChaudharyNo ratings yet

- Group 4 Case DigestsDocument46 pagesGroup 4 Case DigestsStephany PolinarNo ratings yet

- File 926Document3 pagesFile 926amitgarje780No ratings yet

- Intercultural Language Teaching: Principles For Practice: January 2004Document10 pagesIntercultural Language Teaching: Principles For Practice: January 2004Henry OsborneNo ratings yet

- DFM FoodsDocument2 pagesDFM FoodsmitNo ratings yet

- Prayer of TravellerDocument11 pagesPrayer of TravellerMuhammad NabeelNo ratings yet

- Soft Power With Chinese Characteristics: The Ongoing DebateDocument17 pagesSoft Power With Chinese Characteristics: The Ongoing DebateKanka kNo ratings yet

- Home Visitation Form: Department of Education Division of General Santos CityDocument1 pageHome Visitation Form: Department of Education Division of General Santos Citymarvin susminaNo ratings yet

- Life of Geoffrey ChaucerDocument8 pagesLife of Geoffrey ChaucerAwais Ali LashariNo ratings yet

- Ensayo Matar A Un RuiseñorDocument4 pagesEnsayo Matar A Un RuiseñorEdwin CortezNo ratings yet

- Warning Letters To Madeira On Marco Island and Greenscapes of Southwest Florida - Department of Environmental ProtectionDocument9 pagesWarning Letters To Madeira On Marco Island and Greenscapes of Southwest Florida - Department of Environmental ProtectionOmar Rodriguez OrtizNo ratings yet

- Complaint in Walls, Et Al. v. Sanders, Et Al., 4:24-CV-270-KGB.Document56 pagesComplaint in Walls, Et Al. v. Sanders, Et Al., 4:24-CV-270-KGB.egodinezfr100% (1)

- The Four Key Hypnosis Experiences PDFDocument3 pagesThe Four Key Hypnosis Experiences PDFTudor LvdNo ratings yet

- StatconDocument2 pagesStatconRoland Mark GatchalianNo ratings yet

- FIDO's Budget Planner: Start HereDocument2 pagesFIDO's Budget Planner: Start HereJose MagcalasNo ratings yet

- PROVREM Final ExamDocument27 pagesPROVREM Final ExamXandredg Sumpt LatogNo ratings yet

- Cognizant Company FAQDocument4 pagesCognizant Company FAQManojChowdary100% (1)

- Conservation of Plants and AnimalsDocument36 pagesConservation of Plants and AnimalsAngeelina AgarwalNo ratings yet

- MAF307 - Trimester 2 2021 Assessment Task 2 - Equity Research - Group AssignmentDocument9 pagesMAF307 - Trimester 2 2021 Assessment Task 2 - Equity Research - Group AssignmentDawoodHameedNo ratings yet

- Computer ClubDocument1 pageComputer Clublehan19052000No ratings yet