Professional Documents

Culture Documents

Hero Motocorp Eva

Hero Motocorp Eva

Uploaded by

proOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Hero Motocorp Eva

Hero Motocorp Eva

Uploaded by

proCopyright:

Available Formats

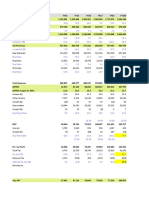

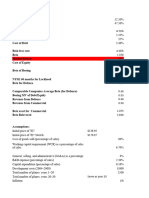

Economic Value-added

(EVA) Statement

` crores

2006-07 2007-08 2008-09 2009-10 2010-11 2011-12 2012-13

Average capital employed 2,415 2,877 3,499 3,705 3,989 4,866 5,286

Average debt/ Average capital (%) 1.1 1.1 0.6 0.2 2.2 3.4 1.8

Average equity/ Average 98.9 98.9 99.4 99.8 97.8 96.7 98.3

capital (%)

Cost of debt (% post-tax ) 0.6 0.9 1.6 1.9 1.4 1.2 1.2

Cost of Equity

Beta 0.75 0.59 0.59 0.63 0.64 0.66 0.73

Cost of risk-free debt (%) 8.15 7.94 6.99 7.50 7.99 8.53 7.96

Market premium (%) 10 10 10 10 10 10 10

Cost of equity (%) 15.65 13.83 12.85 13.80 14.39 15.16 15.22

Economic Value Added (EVA)

Profit after tax 857.89 967.88 1,281.76 2,231.83 1,927.90 2,378.13 2,118.16

Add: Interest*(1-tax rate) 1.02 1.32 1.67 1.39 10.55 14.39 7.86

NOPAT=PAT + interest*(1-t) 859 969 1283 2233 1938 2393 2126

Cost of capital 374 394 448 510 563 715 792

EVA 485 575 835 1723 1376 1677 1334

Return on capital employed (%) 35.6 33.7 36.7 60.3 48.6 49.2 40.2

Weighted average cost of 15.5 13.7 12.8 13.8 14.1 14.7 15

capital (%)

EVA/Capital employed (%) 20.1 20.0 23.9 46.5 34.5 34.5 25.2

ENTERPRISE VALUE

Market capitalisation 13753 13869 21390 38827 31739 41041 30792

Add: Debt 165 132 78 66 1491 995 281

Less: Financial assets 2010 2698 3,588 5,833 5,200 4,041 3,805

Enterprise value (EV) 11909 11303 17880 33060 28030 37995 27268

EV/Year end capital 4.5 3.6 4.6 9.4 6.3 7.2 5.2

employed (times)

29

CORPORATE OVERVIEW STATUTORY REPORTS FINANCIAL STATEMENTS

You might also like

- AirThreads Valuation SolutionDocument20 pagesAirThreads Valuation SolutionBill JoeNo ratings yet

- Case Worksheet Volkswagen AGDocument3 pagesCase Worksheet Volkswagen AGDavid50% (2)

- Coca-Cola: Residual Income Valuation Exercise & Coca-Cola: Residual Income Valuation Exercise (TN)Document7 pagesCoca-Cola: Residual Income Valuation Exercise & Coca-Cola: Residual Income Valuation Exercise (TN)sarthak mendiratta100% (1)

- Liquidity Concepts by Victorious 5Document17 pagesLiquidity Concepts by Victorious 5zorronguyen100% (2)

- A) Stock Performance of Ahold and Tesco Between Jan-2008 and Dec-2011Document4 pagesA) Stock Performance of Ahold and Tesco Between Jan-2008 and Dec-2011MANAV ROY100% (3)

- Gainesboro SolutionDocument7 pagesGainesboro SolutionakashNo ratings yet

- Peng Plasma Solutions Tables PDFDocument12 pagesPeng Plasma Solutions Tables PDFDanielle WalkerNo ratings yet

- Intuit ValuationDocument4 pagesIntuit ValuationcorvettejrwNo ratings yet

- Tesla DCF Valuation by Ihor MedvidDocument105 pagesTesla DCF Valuation by Ihor Medvidpriyanshu14No ratings yet

- Airthreads Valuation Case Study Excel File PDF FreeDocument18 pagesAirthreads Valuation Case Study Excel File PDF Freegoyalmuskan412No ratings yet

- Rosetta Stone IPODocument5 pagesRosetta Stone IPOFatima Ansari d/o Muhammad AshrafNo ratings yet

- Y-Y Growth (%) Y-Y Growth (%) Y-Y Growth (%) Utilization (%) Y-Y Growth (%) % of Sales % of Sales % of SalesDocument45 pagesY-Y Growth (%) Y-Y Growth (%) Y-Y Growth (%) Utilization (%) Y-Y Growth (%) % of Sales % of Sales % of SalesSHIKHA CHAUHANNo ratings yet

- Purchases / Average Payables Revenue / Average Total AssetsDocument7 pagesPurchases / Average Payables Revenue / Average Total AssetstannuNo ratings yet

- Also Annual Report Gb2022 enDocument198 pagesAlso Annual Report Gb2022 enmihirbhojani603No ratings yet

- Supplement Du Pont 1983Document13 pagesSupplement Du Pont 1983Eesha KNo ratings yet

- Performance AGlanceDocument1 pagePerformance AGlanceHarshal SawaleNo ratings yet

- Listed Companies Highlights: Bcel: Banque Pour Le Commerce Exterieur Lao PublicDocument1 pageListed Companies Highlights: Bcel: Banque Pour Le Commerce Exterieur Lao PubliclaomedNo ratings yet

- Ten Year Review - Standalone: Asian Paints LimitedDocument10 pagesTen Year Review - Standalone: Asian Paints Limitedmaruthi631No ratings yet

- Bcel 2019Q1Document1 pageBcel 2019Q1Dương NguyễnNo ratings yet

- Particulars (INR in Crores) FY2015A FY2016A FY2017A FY2018ADocument6 pagesParticulars (INR in Crores) FY2015A FY2016A FY2017A FY2018AHamzah HakeemNo ratings yet

- Excel Workings ITE ValuationDocument19 pagesExcel Workings ITE Valuationalka murarka100% (1)

- Mar-19 Dec-18 Sep-18 Jun-18 Figures in Rs CroreDocument12 pagesMar-19 Dec-18 Sep-18 Jun-18 Figures in Rs Croreneha singhNo ratings yet

- Summary of Cooper Tire & Rubber Company's Financial and Operating Performance, 2009$2013 (Dollar Amounts in Millions, Except Per Share Data)Document4 pagesSummary of Cooper Tire & Rubber Company's Financial and Operating Performance, 2009$2013 (Dollar Amounts in Millions, Except Per Share Data)Sanjaya WijesekareNo ratings yet

- News Release INDY Result 6M22Document7 pagesNews Release INDY Result 6M22Rama Usaha MandiriNo ratings yet

- Altagas Green Exhibits With All InfoDocument4 pagesAltagas Green Exhibits With All InfoArjun NairNo ratings yet

- Mett International Pty LTD Financial Forecast 3 Year SummaryDocument134 pagesMett International Pty LTD Financial Forecast 3 Year SummaryJamilexNo ratings yet

- Super Project AnalysisDocument6 pagesSuper Project AnalysisDHRUV SONAGARANo ratings yet

- Werner - Financial Model - Final VersionDocument2 pagesWerner - Financial Model - Final VersionAmit JainNo ratings yet

- Nike Case Study VrindaDocument4 pagesNike Case Study VrindaAnchal ChokhaniNo ratings yet

- Ratio Analysis: Investor Liquidity RatiosDocument11 pagesRatio Analysis: Investor Liquidity RatiosjayRNo ratings yet

- Soumya Lokhande 1353 - Manmouth CaseDocument13 pagesSoumya Lokhande 1353 - Manmouth CasednesudhudhNo ratings yet

- 2023.08.31 KMX Historical Financial STMT Info For AnalystsDocument33 pages2023.08.31 KMX Historical Financial STMT Info For AnalystsjohnsolarpanelsNo ratings yet

- Solution - Eicher Motors LTDDocument28 pagesSolution - Eicher Motors LTDvasudevNo ratings yet

- FINANCIAL STATEMENTS-SQUARE PHARMA (Horizontal & Vertical)Document6 pagesFINANCIAL STATEMENTS-SQUARE PHARMA (Horizontal & Vertical)Hridi RahmanNo ratings yet

- Solution To ATCDocument17 pagesSolution To ATCGuru Charan ChitikenaNo ratings yet

- 14-10 Years HighlightsDocument1 page14-10 Years HighlightsJigar PatelNo ratings yet

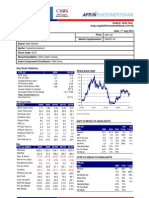

- Hiap Teck RN 20100701 AffinDocument3 pagesHiap Teck RN 20100701 Affinlimml63No ratings yet

- The Project (Or Subsidiary) Cashflows: Lecture ExampleDocument15 pagesThe Project (Or Subsidiary) Cashflows: Lecture ExamplelucaNo ratings yet

- 100 BaggerDocument12 pages100 BaggerRishab WahalNo ratings yet

- Colgate Palmolive ModelDocument51 pagesColgate Palmolive ModelAde FajarNo ratings yet

- Add Dep Less Tax OCF Change in Capex Change in NWC FCFDocument5 pagesAdd Dep Less Tax OCF Change in Capex Change in NWC FCFGullible KhanNo ratings yet

- 12 Annual Report 2008Document158 pages12 Annual Report 2008Elizabeth Sánchez LeónNo ratings yet

- Adidas Chartgenerator ArDocument2 pagesAdidas Chartgenerator ArTrần Thuỳ NgânNo ratings yet

- Key Operating and Financial Data 2017 For Website Final 20.3.2018Document2 pagesKey Operating and Financial Data 2017 For Website Final 20.3.2018MubeenNo ratings yet

- Key Ratio Analysis: Profitability RatiosDocument27 pagesKey Ratio Analysis: Profitability RatioskritikaNo ratings yet

- Final ExamDocument10 pagesFinal ExamMustafa Azeem MunnaNo ratings yet

- Bcel 2019Document1 pageBcel 2019Dương NguyễnNo ratings yet

- Case 1 MarriottDocument14 pagesCase 1 Marriotthimanshu sagar100% (1)

- 17pgp216 ApolloDocument5 pages17pgp216 ApolloVamsi GunturuNo ratings yet

- Caso PolaroidDocument45 pagesCaso PolaroidByron AlarcònNo ratings yet

- Goodyear Indonesia TBK.: Balance SheetDocument20 pagesGoodyear Indonesia TBK.: Balance SheetsariNo ratings yet

- Nike - Case Study MeenalDocument9 pagesNike - Case Study MeenalAnchal ChokhaniNo ratings yet

- Nike - Case StudyDocument9 pagesNike - Case StudyAnchal ChokhaniNo ratings yet

- Dows ExcelDocument18 pagesDows ExcelJaydeep SheteNo ratings yet

- Income Statement Balance Sheet Cash Flow Ratios FCFF Eva & Roic News Analysis 1 News Analysis 2Document9 pagesIncome Statement Balance Sheet Cash Flow Ratios FCFF Eva & Roic News Analysis 1 News Analysis 2ramarao1981No ratings yet

- Tutorial On How To Use The DCF Model. Good Luck!: DateDocument9 pagesTutorial On How To Use The DCF Model. Good Luck!: DateTanya SinghNo ratings yet

- Financial HighlightsDocument4 pagesFinancial HighlightsmomNo ratings yet

- BoeingDocument11 pagesBoeingPreksha GulatiNo ratings yet

- Assumptions: Comparable Companies:Market ValueDocument18 pagesAssumptions: Comparable Companies:Market ValueTanya YadavNo ratings yet

- Apb 30091213 FDocument9 pagesApb 30091213 FNehal Sharma 2027244No ratings yet

- Economic Development AnalysisDocument376 pagesEconomic Development AnalysisAkram Akz ElsarkyNo ratings yet

- To the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioFrom EverandTo the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioNo ratings yet

- HUL - EVA Statement For AnalysisDocument1 pageHUL - EVA Statement For AnalysisproNo ratings yet

- Ford Motor Co., Economic Profit Calculation: USD $ in MillionsDocument2 pagesFord Motor Co., Economic Profit Calculation: USD $ in MillionsproNo ratings yet

- EVA Widgets - Com-01-08-2019Document7 pagesEVA Widgets - Com-01-08-2019proNo ratings yet

- AT&T Inc., Economic Profit Calculation: USD $ in MillionsDocument2 pagesAT&T Inc., Economic Profit Calculation: USD $ in MillionsproNo ratings yet

- Lummis-Gillibrand Responsible Financial Innovation Act (Final)Document69 pagesLummis-Gillibrand Responsible Financial Innovation Act (Final)Robiyanto SuryaNo ratings yet

- Power Pivots 80Document3 pagesPower Pivots 80Jay Sagar100% (1)

- P.I. Industries (PI IN) : Q1FY20 Result UpdateDocument7 pagesP.I. Industries (PI IN) : Q1FY20 Result UpdateMax BrenoNo ratings yet

- Does Managerial Ownership Affect Investment Efficiency? Causal Evidence From The 2003 Tax CutDocument48 pagesDoes Managerial Ownership Affect Investment Efficiency? Causal Evidence From The 2003 Tax CutNhi TrầnNo ratings yet

- 7 Audit of Shareholders Equity and Related Accounts Dlsau Integ t31920Document5 pages7 Audit of Shareholders Equity and Related Accounts Dlsau Integ t31920Heidee ManliclicNo ratings yet

- Case Study IMU150 (Wakalah)Document16 pagesCase Study IMU150 (Wakalah)Adam BukhariNo ratings yet

- Interest Rates Benchmark Reform and Options Markets: Vladimir V. Piterbarg Natwest Markets July 15, 2020Document22 pagesInterest Rates Benchmark Reform and Options Markets: Vladimir V. Piterbarg Natwest Markets July 15, 2020tw1978No ratings yet

- Annual Report 2008Document249 pagesAnnual Report 2008PiaggiogroupNo ratings yet

- IDirect SunTV Q2FY22Document7 pagesIDirect SunTV Q2FY22Sarah AliceNo ratings yet

- Introduction To Sensitivity of Option PremiumsDocument23 pagesIntroduction To Sensitivity of Option Premiumsmanojbhatia1220No ratings yet

- Equity ValuationDocument38 pagesEquity ValuationkedianareshNo ratings yet

- RKSV Securities India Private Limited Corporate AddressDocument1 pageRKSV Securities India Private Limited Corporate AddressSachin YadavNo ratings yet

- Mediclinic Group 2023 ResultsDocument17 pagesMediclinic Group 2023 ResultsBack To NatureNo ratings yet

- Fitri Risma Utami - Tugas 2Document4 pagesFitri Risma Utami - Tugas 2Resti ViadonaNo ratings yet

- History of Financial ScamsDocument18 pagesHistory of Financial ScamsLilith Karri'sNo ratings yet

- FM Second AssignmentDocument3 pagesFM Second AssignmentpushmbaNo ratings yet

- Volume 5 SFMDocument16 pagesVolume 5 SFMrajat sharmaNo ratings yet

- Particulars Amount Amount Rs. (DR.) Rs. (DR.)Document14 pagesParticulars Amount Amount Rs. (DR.) Rs. (DR.)Alka DwivediNo ratings yet

- MAF603 - Group Case Study - AirAsia - GROUP 6 - 26.01.2022 - MarkedDocument8 pagesMAF603 - Group Case Study - AirAsia - GROUP 6 - 26.01.2022 - Markednurul syakirinNo ratings yet

- Shares: How It Works/ExampleDocument5 pagesShares: How It Works/ExampleSurendra VyasNo ratings yet

- Materi Lab 5 - Consolidated Techniques and ProceduresDocument7 pagesMateri Lab 5 - Consolidated Techniques and ProceduresrahayuNo ratings yet

- InvestmentAccounting QuestionClasswork2023 24Document6 pagesInvestmentAccounting QuestionClasswork2023 247013 Arpit DubeyNo ratings yet

- B Provisional Call FeatureDocument2 pagesB Provisional Call FeatureDanica BalinasNo ratings yet

- Case For High Conviction InvestingDocument2 pagesCase For High Conviction Investingkenneth1195No ratings yet

- ENTREP EXAM QUARTER 2 2023 2024 For PrintDocument6 pagesENTREP EXAM QUARTER 2 2023 2024 For Printcarlo deguzmanNo ratings yet

- Acc 602 AssignmentDocument4 pagesAcc 602 AssignmentSanjeshni KumarNo ratings yet

- Chapter 12Document57 pagesChapter 12frq qqr75% (4)

- Chapter 10 Transaction and Translation Exposure Multiple Choice and True/False Questions 10.1 Types of Foreign Exchange ExposureDocument19 pagesChapter 10 Transaction and Translation Exposure Multiple Choice and True/False Questions 10.1 Types of Foreign Exchange Exposurequeen hassaneenNo ratings yet