Professional Documents

Culture Documents

WMB 608 - Financial Management

WMB 608 - Financial Management

Uploaded by

MALAVIKA SCopyright:

Available Formats

You might also like

- CMT Curriculum 2021 LEVEL 1 Wiley FINALDocument19 pagesCMT Curriculum 2021 LEVEL 1 Wiley FINALJamesMc114462% (13)

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- Portfolio Management Handout 1 - Questions PDFDocument6 pagesPortfolio Management Handout 1 - Questions PDFPriyankaNo ratings yet

- CA Intermediate Mock Test Eco FM 16.10.2018 EM Only QuestionDocument6 pagesCA Intermediate Mock Test Eco FM 16.10.2018 EM Only QuestionTanmayNo ratings yet

- SFM New Sums AddedDocument78 pagesSFM New Sums AddedRohit KhatriNo ratings yet

- FM & Eco - Test 1Document3 pagesFM & Eco - Test 1Ritam chaturvediNo ratings yet

- Practice Problems CorpFinDocument2 pagesPractice Problems CorpFinSrestha ChatterjeeNo ratings yet

- CA33 Advanced Financial Management-1Document4 pagesCA33 Advanced Financial Management-1Bob MarshellNo ratings yet

- Sessional Examination: Master of Business Administration (MBA) Semester: IIIDocument4 pagesSessional Examination: Master of Business Administration (MBA) Semester: IIINishaTripathiNo ratings yet

- Choose The Correct Answer From The Given Four Alternatives:: Not Attempt!!!! Public Provident FundDocument11 pagesChoose The Correct Answer From The Given Four Alternatives:: Not Attempt!!!! Public Provident FundHari BabuNo ratings yet

- Model Paper Financial ManagementDocument6 pagesModel Paper Financial ManagementSandumin JayasingheNo ratings yet

- Module-III Portfolio Risk & Return-1 ProblemDocument3 pagesModule-III Portfolio Risk & Return-1 Problemgaurav supadeNo ratings yet

- 6th Sem-FM - Model QP by Srijita Datta and Arunangsu Das Sarma-26Apr2020Document15 pages6th Sem-FM - Model QP by Srijita Datta and Arunangsu Das Sarma-26Apr2020Kashish GroverNo ratings yet

- FM Questions MSDocument7 pagesFM Questions MSUdayan KarnatakNo ratings yet

- Documents - MX - FM Questions MsDocument7 pagesDocuments - MX - FM Questions MsgopalNo ratings yet

- Gujarat Technological UniversityDocument3 pagesGujarat Technological Universitysiddharth devnaniNo ratings yet

- FM Assignment - 01Document3 pagesFM Assignment - 01usafreefire078No ratings yet

- Financial Management Assignment (2009)Document5 pagesFinancial Management Assignment (2009)sleshiNo ratings yet

- Question No. 1 Is Compulsory. Attempt Any Five Questions From The Remaining Six Questions. Working Notes Should Form Part of The AnswerDocument17 pagesQuestion No. 1 Is Compulsory. Attempt Any Five Questions From The Remaining Six Questions. Working Notes Should Form Part of The AnswerMajidNo ratings yet

- Exam Practice SolutionsDocument11 pagesExam Practice Solutionssir bookkeeperNo ratings yet

- FM Practical QuestionsDocument6 pagesFM Practical QuestionsLakshayNo ratings yet

- Financial Management: Assignment MB0029 (3 Credits) Set 1 Marks 60Document3 pagesFinancial Management: Assignment MB0029 (3 Credits) Set 1 Marks 60JhorapaataNo ratings yet

- Techniques For Risk AnalysisDocument7 pagesTechniques For Risk AnalysisshahiankitNo ratings yet

- Practice CorpDocument2 pagesPractice CorpShafiquer RahmanNo ratings yet

- Practice Questions May 2018Document11 pagesPractice Questions May 2018Minnie.NNo ratings yet

- CA Intermediate - Financial Management: Swapnil Patni's ClassesDocument3 pagesCA Intermediate - Financial Management: Swapnil Patni's ClassesAniket PatelNo ratings yet

- Solution 1Document8 pagesSolution 1frq qqrNo ratings yet

- CH 456Document8 pagesCH 456Syed TabrezNo ratings yet

- Paper 2 Advanced Financial Management 170737012920240208100249Document25 pagesPaper 2 Advanced Financial Management 170737012920240208100249Pranav CrtNo ratings yet

- Choose The Correct Answer From The Given Four AlternativesDocument10 pagesChoose The Correct Answer From The Given Four AlternativesHari BabuNo ratings yet

- MBA 5109 - Financial Management (MBA 2020-2022)Document6 pagesMBA 5109 - Financial Management (MBA 2020-2022)sreekavi19970120No ratings yet

- P8 FM ECO Q MTP 1 Nov 23Document5 pagesP8 FM ECO Q MTP 1 Nov 23spyverse01No ratings yet

- SFM Mixed Compilation QTSDocument25 pagesSFM Mixed Compilation QTSBijay AgrawalNo ratings yet

- QuestionsDocument5 pagesQuestionsTina BhushanNo ratings yet

- Gujarat Technological UniversityDocument2 pagesGujarat Technological UniversityIsha KhannaNo ratings yet

- SFM MTP - May 2018 QuestionDocument6 pagesSFM MTP - May 2018 QuestionMajidNo ratings yet

- CF Paper Summer 2015Document4 pagesCF Paper Summer 2015Vicky ThakkarNo ratings yet

- Time-Bound Home Exam-2020: Purbanchal UniversityDocument2 pagesTime-Bound Home Exam-2020: Purbanchal UniversityEnysa DlNo ratings yet

- R21 Capital Budgeting Q Bank PDFDocument10 pagesR21 Capital Budgeting Q Bank PDFZidane KhanNo ratings yet

- Financial Management (Ba 3601) Assignment Spring 2020 - Bba 6 ADocument7 pagesFinancial Management (Ba 3601) Assignment Spring 2020 - Bba 6 ANoor Nabi ShaikhNo ratings yet

- Final Exam PFIN 3Document5 pagesFinal Exam PFIN 310622006No ratings yet

- Set ADocument3 pagesSet AManish KumarNo ratings yet

- Final Examination::I: I... " .,+3 Anh, Surendra Mode School of Comrerap+,/'/ - :, I + ,.... 9 DDocument8 pagesFinal Examination::I: I... " .,+3 Anh, Surendra Mode School of Comrerap+,/'/ - :, I + ,.... 9 DSREYA JAGARLAPUDINo ratings yet

- PRM41 - FM - End Term Question PaperDocument2 pagesPRM41 - FM - End Term Question PapershravaniNo ratings yet

- FM Previous Year Questions 2020-2023Document18 pagesFM Previous Year Questions 2020-2023Sibam BanikNo ratings yet

- Paper - 2: Strategic Financial Management Questions Foreign Exchange Risk ManagementDocument30 pagesPaper - 2: Strategic Financial Management Questions Foreign Exchange Risk ManagementNirupa ChoppaNo ratings yet

- Fina H 6th-Sem 2022Document4 pagesFina H 6th-Sem 2022dapurva134No ratings yet

- Business FinanceDocument6 pagesBusiness FinanceChhabilal KandelNo ratings yet

- S.Y. SEE 6M SumsQBDocument6 pagesS.Y. SEE 6M SumsQBAcash GuptaNo ratings yet

- Business Finance Sample Examination PaperDocument4 pagesBusiness Finance Sample Examination PaperYeshey ChodenNo ratings yet

- Capital Budgeting Sums - 16-17 (2018 - 05 - 19 12 - 01 - 33 UTC) (2019 - 01 - 22 04 - 17 - 23 UTC) (2019 - 07 - 02 05 - 43 - 05 UTC) PDFDocument7 pagesCapital Budgeting Sums - 16-17 (2018 - 05 - 19 12 - 01 - 33 UTC) (2019 - 01 - 22 04 - 17 - 23 UTC) (2019 - 07 - 02 05 - 43 - 05 UTC) PDFutsavNo ratings yet

- Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerDocument5 pagesQuestion No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswercdNo ratings yet

- Model Questions BBS 3rd Year Fundamental of Financial Management PDFDocument9 pagesModel Questions BBS 3rd Year Fundamental of Financial Management PDFShah SujitNo ratings yet

- 06 Investment DecisionsDocument23 pages06 Investment Decisionsnsm2zmvnbbNo ratings yet

- An Autonomous Institution, Affiliated To Anna University, ChennaiDocument7 pagesAn Autonomous Institution, Affiliated To Anna University, Chennaisibi chandanNo ratings yet

- Homework4 With Ans JDocument18 pagesHomework4 With Ans JBarakaNo ratings yet

- July 2020 BBF20103 Introduction To Financial Management Assignment 2Document5 pagesJuly 2020 BBF20103 Introduction To Financial Management Assignment 2Muhamad SaifulNo ratings yet

- Financial Decision MakingDocument4 pagesFinancial Decision MakingHarsh DedhiaNo ratings yet

- Paper14 SolutionDocument15 pagesPaper14 Solutionharshrathore17579No ratings yet

- ICAI - Question BankDocument6 pagesICAI - Question Bankkunal mittalNo ratings yet

- Finance Re-Exam 3Document4 pagesFinance Re-Exam 3mrdirriminNo ratings yet

- Aindumps 2020-Sep-24 by Gary 139q Vce PDFDocument9 pagesAindumps 2020-Sep-24 by Gary 139q Vce PDFMALAVIKA SNo ratings yet

- Financial Management - Reading MaterialDocument318 pagesFinancial Management - Reading MaterialMALAVIKA SNo ratings yet

- WILP - CGEC - Reading Material PDFDocument273 pagesWILP - CGEC - Reading Material PDFMALAVIKA SNo ratings yet

- WMB 602 - MarketingDocument1 pageWMB 602 - MarketingMALAVIKA SNo ratings yet

- Troika Dialog Report: Kazakh Strategy Jan 2010Document41 pagesTroika Dialog Report: Kazakh Strategy Jan 2010mazik3313491No ratings yet

- Crude Oil Trading StrategyDocument27 pagesCrude Oil Trading Strategyforwaqar100% (1)

- Freight InfoDocument7 pagesFreight InfoIulianaNo ratings yet

- (SEC) Stats2005Document31 pages(SEC) Stats2005rlindseyNo ratings yet

- CU CQG Infographic PDFDocument1 pageCU CQG Infographic PDFachihaiaNo ratings yet

- FMETF Vs EW PTF Vs BDO PIF Vs PSIFDocument8 pagesFMETF Vs EW PTF Vs BDO PIF Vs PSIFKristine ChavezNo ratings yet

- International FinanceDocument9 pagesInternational FinancelawrelatedNo ratings yet

- Tekumatla SupriyaDocument11 pagesTekumatla SupriyamubeenuddinNo ratings yet

- Asset Liability Management Canara BankDocument69 pagesAsset Liability Management Canara BankSanthosh Soma75% (4)

- Angel - Account Closure Request FormDocument1 pageAngel - Account Closure Request Formkirangs029No ratings yet

- Eye Opening Webinar (Blooming Trades)Document31 pagesEye Opening Webinar (Blooming Trades)Gaurang DaveNo ratings yet

- An Investigation of Heston and SVJ Model During Financial CrisesDocument30 pagesAn Investigation of Heston and SVJ Model During Financial CrisesSally YuNo ratings yet

- The GIC Weekly: Change in Rates or Rates of Change?Document14 pagesThe GIC Weekly: Change in Rates or Rates of Change?Dylan AdrianNo ratings yet

- Q3 2023 Crypto Report PreviewDocument11 pagesQ3 2023 Crypto Report PreviewAlexander GunawanNo ratings yet

- Dividend PolicyDocument8 pagesDividend PolicyHarsh SethiaNo ratings yet

- Unit 14Document14 pagesUnit 14LOKESH BATRANo ratings yet

- Employee Name Job Title Description Annual Salarydate HiredDocument15 pagesEmployee Name Job Title Description Annual Salarydate HiredParents' Coalition of Montgomery County, Maryland100% (1)

- Financial Statement Analysis: K R Subramanyam John J WildDocument40 pagesFinancial Statement Analysis: K R Subramanyam John J WildGustrilimandaNo ratings yet

- How The U.S. Dollar Became The World's Reserve CurrencyDocument9 pagesHow The U.S. Dollar Became The World's Reserve CurrencyParvez ShakilNo ratings yet

- Pivot Points and CandlesticksDocument4 pagesPivot Points and CandlesticksMisterSimpleNo ratings yet

- Free Cash FlowsDocument2 pagesFree Cash FlowsMuhammad Awais SabirNo ratings yet

- Full FSA ST - Vol IIIDocument421 pagesFull FSA ST - Vol IIIVîkter VîshváNo ratings yet

- Risk Management at EnronDocument28 pagesRisk Management at Enronbim_durNo ratings yet

- Bill Gross Investment Outlook Jul - 07Document3 pagesBill Gross Investment Outlook Jul - 07Brian McMorrisNo ratings yet

- Organizer: Rajendra Adhikari Presenter Anish OjhaDocument11 pagesOrganizer: Rajendra Adhikari Presenter Anish Ojhaanish ojhaNo ratings yet

- Intrinsic Value - Digital BookDocument60 pagesIntrinsic Value - Digital Bookfuzzychan50% (2)

- Mutual Fund Portfolio Tracker Using MS ExcelDocument1,546 pagesMutual Fund Portfolio Tracker Using MS Excelrajanvaidya11100% (2)

- Wintergreen Fund, Inc.: Investor Class (WGRNX) Institutional Class (WGRIX)Document48 pagesWintergreen Fund, Inc.: Investor Class (WGRNX) Institutional Class (WGRIX)CanadianValue100% (1)

- Govt Bond Debentures and MFDocument10 pagesGovt Bond Debentures and MFRishabh ThapaNo ratings yet

WMB 608 - Financial Management

WMB 608 - Financial Management

Uploaded by

MALAVIKA SOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

WMB 608 - Financial Management

WMB 608 - Financial Management

Uploaded by

MALAVIKA SCopyright:

Available Formats

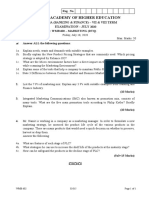

Reg. No.

MANIPAL ACADEMY OF HIGHER EDUCATION

WILP - MBA (BANKING & FINANCE) – VII & VIII TERM

EXAMINATION – JULY 2020

SUBJECT: WMB 608– FINANCIAL MANAGEMENT (DTQ)

Saturday, July 11, 2020

Time: 11:30 – 13:30 Hrs. Max. Marks: 50

Answer ALL the following questions:

1a. Explain some of the common agency problems that arise in the banking business and

suggest some of the viable propositions avoid agency problems in the banking industry.

1b. Mr. Madhu deposits ₹6,000 every year into his account which pays him 6% interest pa.

Calculate what would be the total value of his investment after 10 years.

1c. The face value of debenture is ₹1,000 with an interest rate of 20%. The interest is payable

annually and the instrument can be redeemed only after 10 years at a premium of 5%.

Further, the company is anticipated to issue non-convertible bonds at a discount of 3% to

ensure the quick sale in the market. The corporate tax is 50%. Calculate the cost of a

debenture.

1d. Explain the two different forms of public issue.

1e. Define (i) Forward (ii) Future (iii) Option

(5 x 3 = 15 Marks)

2a. Sony Ltd. shares are being traded at ₹50 in the market. The company paid a dividend of ₹2

and is expected to pay dividends perpetually. The dividend is expected to have a growth rate

of 10%. What return will an investor get if he buys the share of Sony Ltd at the current

price?

2b. Let us assume that you have two choices in front of you.

• Your friend will give you ₹1,000 now

• Your friend promise to give you ₹1,000 a year after

Which option would you choose and why? Present your views with a strong rationale.

(5+5=10 Marks)

3a. Mr. Shrava has two assets, namely, Alpha and Beta. Which option should he prefer and,

why?

Alpha

Market Expectation Probability Return

Pessimistic 0.25 15%

Most Likely 0.6 9%

Optimistic 0.15 20%

Beta

Market Expectation Probability Return

Pessimistic 0.3 10%

Most Likely 0.4 15%

Optimistic 0.3 8%

3b. Explain the sources of risk.

(5+5=10 Marks)

WMB 608 E-015 Page 1 of 2

4a. Shambu Ltd. planning to acquire a project from the available three projects. The company

assumes that all the projects generate positive cashflows for the next five years. The cost of

capital for the acquisition of the project is 10% which it uses as the discount rate to construct

the net present value of the project. Calculate the Net Present Value of each project and

recommend the project that satisfies the NPV decision rule.

Cash Flow (₹)

Year Project A Project B Project C

0 -40,00,000 -45,00,000 -50,00,000

1 10,00,000 11,00,000 12,00,000

2 11,00,000 12,00,000 13,00,000

3 9,00,000 13,00,000 15,00,000

4 12,00,000 13,00,000 13,00,000

5 15,00,000 10,00,000 14,00,000

4b. Calculate payback period of aforementioned Project A, Project B and Project C and suggest

which project acceptable basing your decision on payback period.

(10+5=15 Marks)

WMB 608 E-015 Page 2 of 2

You might also like

- CMT Curriculum 2021 LEVEL 1 Wiley FINALDocument19 pagesCMT Curriculum 2021 LEVEL 1 Wiley FINALJamesMc114462% (13)

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- Portfolio Management Handout 1 - Questions PDFDocument6 pagesPortfolio Management Handout 1 - Questions PDFPriyankaNo ratings yet

- CA Intermediate Mock Test Eco FM 16.10.2018 EM Only QuestionDocument6 pagesCA Intermediate Mock Test Eco FM 16.10.2018 EM Only QuestionTanmayNo ratings yet

- SFM New Sums AddedDocument78 pagesSFM New Sums AddedRohit KhatriNo ratings yet

- FM & Eco - Test 1Document3 pagesFM & Eco - Test 1Ritam chaturvediNo ratings yet

- Practice Problems CorpFinDocument2 pagesPractice Problems CorpFinSrestha ChatterjeeNo ratings yet

- CA33 Advanced Financial Management-1Document4 pagesCA33 Advanced Financial Management-1Bob MarshellNo ratings yet

- Sessional Examination: Master of Business Administration (MBA) Semester: IIIDocument4 pagesSessional Examination: Master of Business Administration (MBA) Semester: IIINishaTripathiNo ratings yet

- Choose The Correct Answer From The Given Four Alternatives:: Not Attempt!!!! Public Provident FundDocument11 pagesChoose The Correct Answer From The Given Four Alternatives:: Not Attempt!!!! Public Provident FundHari BabuNo ratings yet

- Model Paper Financial ManagementDocument6 pagesModel Paper Financial ManagementSandumin JayasingheNo ratings yet

- Module-III Portfolio Risk & Return-1 ProblemDocument3 pagesModule-III Portfolio Risk & Return-1 Problemgaurav supadeNo ratings yet

- 6th Sem-FM - Model QP by Srijita Datta and Arunangsu Das Sarma-26Apr2020Document15 pages6th Sem-FM - Model QP by Srijita Datta and Arunangsu Das Sarma-26Apr2020Kashish GroverNo ratings yet

- FM Questions MSDocument7 pagesFM Questions MSUdayan KarnatakNo ratings yet

- Documents - MX - FM Questions MsDocument7 pagesDocuments - MX - FM Questions MsgopalNo ratings yet

- Gujarat Technological UniversityDocument3 pagesGujarat Technological Universitysiddharth devnaniNo ratings yet

- FM Assignment - 01Document3 pagesFM Assignment - 01usafreefire078No ratings yet

- Financial Management Assignment (2009)Document5 pagesFinancial Management Assignment (2009)sleshiNo ratings yet

- Question No. 1 Is Compulsory. Attempt Any Five Questions From The Remaining Six Questions. Working Notes Should Form Part of The AnswerDocument17 pagesQuestion No. 1 Is Compulsory. Attempt Any Five Questions From The Remaining Six Questions. Working Notes Should Form Part of The AnswerMajidNo ratings yet

- Exam Practice SolutionsDocument11 pagesExam Practice Solutionssir bookkeeperNo ratings yet

- FM Practical QuestionsDocument6 pagesFM Practical QuestionsLakshayNo ratings yet

- Financial Management: Assignment MB0029 (3 Credits) Set 1 Marks 60Document3 pagesFinancial Management: Assignment MB0029 (3 Credits) Set 1 Marks 60JhorapaataNo ratings yet

- Techniques For Risk AnalysisDocument7 pagesTechniques For Risk AnalysisshahiankitNo ratings yet

- Practice CorpDocument2 pagesPractice CorpShafiquer RahmanNo ratings yet

- Practice Questions May 2018Document11 pagesPractice Questions May 2018Minnie.NNo ratings yet

- CA Intermediate - Financial Management: Swapnil Patni's ClassesDocument3 pagesCA Intermediate - Financial Management: Swapnil Patni's ClassesAniket PatelNo ratings yet

- Solution 1Document8 pagesSolution 1frq qqrNo ratings yet

- CH 456Document8 pagesCH 456Syed TabrezNo ratings yet

- Paper 2 Advanced Financial Management 170737012920240208100249Document25 pagesPaper 2 Advanced Financial Management 170737012920240208100249Pranav CrtNo ratings yet

- Choose The Correct Answer From The Given Four AlternativesDocument10 pagesChoose The Correct Answer From The Given Four AlternativesHari BabuNo ratings yet

- MBA 5109 - Financial Management (MBA 2020-2022)Document6 pagesMBA 5109 - Financial Management (MBA 2020-2022)sreekavi19970120No ratings yet

- P8 FM ECO Q MTP 1 Nov 23Document5 pagesP8 FM ECO Q MTP 1 Nov 23spyverse01No ratings yet

- SFM Mixed Compilation QTSDocument25 pagesSFM Mixed Compilation QTSBijay AgrawalNo ratings yet

- QuestionsDocument5 pagesQuestionsTina BhushanNo ratings yet

- Gujarat Technological UniversityDocument2 pagesGujarat Technological UniversityIsha KhannaNo ratings yet

- SFM MTP - May 2018 QuestionDocument6 pagesSFM MTP - May 2018 QuestionMajidNo ratings yet

- CF Paper Summer 2015Document4 pagesCF Paper Summer 2015Vicky ThakkarNo ratings yet

- Time-Bound Home Exam-2020: Purbanchal UniversityDocument2 pagesTime-Bound Home Exam-2020: Purbanchal UniversityEnysa DlNo ratings yet

- R21 Capital Budgeting Q Bank PDFDocument10 pagesR21 Capital Budgeting Q Bank PDFZidane KhanNo ratings yet

- Financial Management (Ba 3601) Assignment Spring 2020 - Bba 6 ADocument7 pagesFinancial Management (Ba 3601) Assignment Spring 2020 - Bba 6 ANoor Nabi ShaikhNo ratings yet

- Final Exam PFIN 3Document5 pagesFinal Exam PFIN 310622006No ratings yet

- Set ADocument3 pagesSet AManish KumarNo ratings yet

- Final Examination::I: I... " .,+3 Anh, Surendra Mode School of Comrerap+,/'/ - :, I + ,.... 9 DDocument8 pagesFinal Examination::I: I... " .,+3 Anh, Surendra Mode School of Comrerap+,/'/ - :, I + ,.... 9 DSREYA JAGARLAPUDINo ratings yet

- PRM41 - FM - End Term Question PaperDocument2 pagesPRM41 - FM - End Term Question PapershravaniNo ratings yet

- FM Previous Year Questions 2020-2023Document18 pagesFM Previous Year Questions 2020-2023Sibam BanikNo ratings yet

- Paper - 2: Strategic Financial Management Questions Foreign Exchange Risk ManagementDocument30 pagesPaper - 2: Strategic Financial Management Questions Foreign Exchange Risk ManagementNirupa ChoppaNo ratings yet

- Fina H 6th-Sem 2022Document4 pagesFina H 6th-Sem 2022dapurva134No ratings yet

- Business FinanceDocument6 pagesBusiness FinanceChhabilal KandelNo ratings yet

- S.Y. SEE 6M SumsQBDocument6 pagesS.Y. SEE 6M SumsQBAcash GuptaNo ratings yet

- Business Finance Sample Examination PaperDocument4 pagesBusiness Finance Sample Examination PaperYeshey ChodenNo ratings yet

- Capital Budgeting Sums - 16-17 (2018 - 05 - 19 12 - 01 - 33 UTC) (2019 - 01 - 22 04 - 17 - 23 UTC) (2019 - 07 - 02 05 - 43 - 05 UTC) PDFDocument7 pagesCapital Budgeting Sums - 16-17 (2018 - 05 - 19 12 - 01 - 33 UTC) (2019 - 01 - 22 04 - 17 - 23 UTC) (2019 - 07 - 02 05 - 43 - 05 UTC) PDFutsavNo ratings yet

- Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerDocument5 pagesQuestion No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswercdNo ratings yet

- Model Questions BBS 3rd Year Fundamental of Financial Management PDFDocument9 pagesModel Questions BBS 3rd Year Fundamental of Financial Management PDFShah SujitNo ratings yet

- 06 Investment DecisionsDocument23 pages06 Investment Decisionsnsm2zmvnbbNo ratings yet

- An Autonomous Institution, Affiliated To Anna University, ChennaiDocument7 pagesAn Autonomous Institution, Affiliated To Anna University, Chennaisibi chandanNo ratings yet

- Homework4 With Ans JDocument18 pagesHomework4 With Ans JBarakaNo ratings yet

- July 2020 BBF20103 Introduction To Financial Management Assignment 2Document5 pagesJuly 2020 BBF20103 Introduction To Financial Management Assignment 2Muhamad SaifulNo ratings yet

- Financial Decision MakingDocument4 pagesFinancial Decision MakingHarsh DedhiaNo ratings yet

- Paper14 SolutionDocument15 pagesPaper14 Solutionharshrathore17579No ratings yet

- ICAI - Question BankDocument6 pagesICAI - Question Bankkunal mittalNo ratings yet

- Finance Re-Exam 3Document4 pagesFinance Re-Exam 3mrdirriminNo ratings yet

- Aindumps 2020-Sep-24 by Gary 139q Vce PDFDocument9 pagesAindumps 2020-Sep-24 by Gary 139q Vce PDFMALAVIKA SNo ratings yet

- Financial Management - Reading MaterialDocument318 pagesFinancial Management - Reading MaterialMALAVIKA SNo ratings yet

- WILP - CGEC - Reading Material PDFDocument273 pagesWILP - CGEC - Reading Material PDFMALAVIKA SNo ratings yet

- WMB 602 - MarketingDocument1 pageWMB 602 - MarketingMALAVIKA SNo ratings yet

- Troika Dialog Report: Kazakh Strategy Jan 2010Document41 pagesTroika Dialog Report: Kazakh Strategy Jan 2010mazik3313491No ratings yet

- Crude Oil Trading StrategyDocument27 pagesCrude Oil Trading Strategyforwaqar100% (1)

- Freight InfoDocument7 pagesFreight InfoIulianaNo ratings yet

- (SEC) Stats2005Document31 pages(SEC) Stats2005rlindseyNo ratings yet

- CU CQG Infographic PDFDocument1 pageCU CQG Infographic PDFachihaiaNo ratings yet

- FMETF Vs EW PTF Vs BDO PIF Vs PSIFDocument8 pagesFMETF Vs EW PTF Vs BDO PIF Vs PSIFKristine ChavezNo ratings yet

- International FinanceDocument9 pagesInternational FinancelawrelatedNo ratings yet

- Tekumatla SupriyaDocument11 pagesTekumatla SupriyamubeenuddinNo ratings yet

- Asset Liability Management Canara BankDocument69 pagesAsset Liability Management Canara BankSanthosh Soma75% (4)

- Angel - Account Closure Request FormDocument1 pageAngel - Account Closure Request Formkirangs029No ratings yet

- Eye Opening Webinar (Blooming Trades)Document31 pagesEye Opening Webinar (Blooming Trades)Gaurang DaveNo ratings yet

- An Investigation of Heston and SVJ Model During Financial CrisesDocument30 pagesAn Investigation of Heston and SVJ Model During Financial CrisesSally YuNo ratings yet

- The GIC Weekly: Change in Rates or Rates of Change?Document14 pagesThe GIC Weekly: Change in Rates or Rates of Change?Dylan AdrianNo ratings yet

- Q3 2023 Crypto Report PreviewDocument11 pagesQ3 2023 Crypto Report PreviewAlexander GunawanNo ratings yet

- Dividend PolicyDocument8 pagesDividend PolicyHarsh SethiaNo ratings yet

- Unit 14Document14 pagesUnit 14LOKESH BATRANo ratings yet

- Employee Name Job Title Description Annual Salarydate HiredDocument15 pagesEmployee Name Job Title Description Annual Salarydate HiredParents' Coalition of Montgomery County, Maryland100% (1)

- Financial Statement Analysis: K R Subramanyam John J WildDocument40 pagesFinancial Statement Analysis: K R Subramanyam John J WildGustrilimandaNo ratings yet

- How The U.S. Dollar Became The World's Reserve CurrencyDocument9 pagesHow The U.S. Dollar Became The World's Reserve CurrencyParvez ShakilNo ratings yet

- Pivot Points and CandlesticksDocument4 pagesPivot Points and CandlesticksMisterSimpleNo ratings yet

- Free Cash FlowsDocument2 pagesFree Cash FlowsMuhammad Awais SabirNo ratings yet

- Full FSA ST - Vol IIIDocument421 pagesFull FSA ST - Vol IIIVîkter VîshváNo ratings yet

- Risk Management at EnronDocument28 pagesRisk Management at Enronbim_durNo ratings yet

- Bill Gross Investment Outlook Jul - 07Document3 pagesBill Gross Investment Outlook Jul - 07Brian McMorrisNo ratings yet

- Organizer: Rajendra Adhikari Presenter Anish OjhaDocument11 pagesOrganizer: Rajendra Adhikari Presenter Anish Ojhaanish ojhaNo ratings yet

- Intrinsic Value - Digital BookDocument60 pagesIntrinsic Value - Digital Bookfuzzychan50% (2)

- Mutual Fund Portfolio Tracker Using MS ExcelDocument1,546 pagesMutual Fund Portfolio Tracker Using MS Excelrajanvaidya11100% (2)

- Wintergreen Fund, Inc.: Investor Class (WGRNX) Institutional Class (WGRIX)Document48 pagesWintergreen Fund, Inc.: Investor Class (WGRNX) Institutional Class (WGRIX)CanadianValue100% (1)

- Govt Bond Debentures and MFDocument10 pagesGovt Bond Debentures and MFRishabh ThapaNo ratings yet