Professional Documents

Culture Documents

Dr. Gloria D. Lacson Foundation Colleges, Inc

Dr. Gloria D. Lacson Foundation Colleges, Inc

Uploaded by

Ma. Liza MagatCopyright:

Available Formats

You might also like

- Principles of Accounting (AC1025)Document2 pagesPrinciples of Accounting (AC1025)Geza bumNo ratings yet

- RFBT (1) Cpa Reviewer 2019Document24 pagesRFBT (1) Cpa Reviewer 2019Ma. Liza Magat100% (3)

- Syllabus - Bsa 3101-Accounting For Special TransactionsDocument10 pagesSyllabus - Bsa 3101-Accounting For Special TransactionsMaviel SuaverdezNo ratings yet

- Conceptual Framework and Accounting Standard SyllabusDocument11 pagesConceptual Framework and Accounting Standard SyllabusAnas Aloyodan60% (5)

- AE13 Financial Accounting and Reporting PDFDocument50 pagesAE13 Financial Accounting and Reporting PDFMa. Liza MagatNo ratings yet

- Magic Quadrant For IT Vendor Risk Management ToolsDocument3 pagesMagic Quadrant For IT Vendor Risk Management ToolsJohn RhoNo ratings yet

- ACCT 1026 Financial Accounting and Reporting 2019Document11 pagesACCT 1026 Financial Accounting and Reporting 2019Kath DayagNo ratings yet

- Financial Statement Analysis: Standard Course OutlineDocument6 pagesFinancial Statement Analysis: Standard Course OutlineMahmoud ZizoNo ratings yet

- Financial Accounting Theory and Reporting IDocument16 pagesFinancial Accounting Theory and Reporting IKendrick PajarinNo ratings yet

- Wharton Reports Wharton Mba Course ListDocument63 pagesWharton Reports Wharton Mba Course ListMd. Sahinur RahmanNo ratings yet

- ACCTG. 315N Accounting For Business Combinations COURSE SYLLABUS 2021-2022Document14 pagesACCTG. 315N Accounting For Business Combinations COURSE SYLLABUS 2021-2022NURHAM SUMLAYNo ratings yet

- Conceptual Framework and Accounting Standard SyllabusDocument12 pagesConceptual Framework and Accounting Standard Syllabusrenzelmagbitang222No ratings yet

- Course Outline Introduction To Financial AccountingDocument8 pagesCourse Outline Introduction To Financial AccountingLuciferNo ratings yet

- Bachelor of Science in Accountancy Saint PaulDocument16 pagesBachelor of Science in Accountancy Saint PaulJeremias PerezNo ratings yet

- ACCT 100-Principles of Financial Accounting - Fall 2018-19Document7 pagesACCT 100-Principles of Financial Accounting - Fall 2018-19Qudsia AbbasNo ratings yet

- San Beda College Alabang: College of Arts and Sciences (Name of The) DepartmentDocument4 pagesSan Beda College Alabang: College of Arts and Sciences (Name of The) DepartmentKhristian Joshua G. JuradoNo ratings yet

- Acc 111Document11 pagesAcc 111Jhanna Vee DamaleNo ratings yet

- AF5115Document5 pagesAF5115Chin LNo ratings yet

- Detailed Teaching Syllabus (DTS) and Instructor Guide (Ig'S)Document20 pagesDetailed Teaching Syllabus (DTS) and Instructor Guide (Ig'S)Blecemie MonteraNo ratings yet

- JMC Guidelines and Template For Compendium 2 1Document63 pagesJMC Guidelines and Template For Compendium 2 1kingsters zabateNo ratings yet

- ACCT 100-Principle of Financial Accounting-Saira RizwanDocument6 pagesACCT 100-Principle of Financial Accounting-Saira Rizwanraziqachaudhry9665No ratings yet

- Acco 30013 Accounting For Special Transactions 2019Document8 pagesAcco 30013 Accounting For Special Transactions 2019Azel Ann AlibinNo ratings yet

- Accounting for Non-Accountants _Aug2024Document8 pagesAccounting for Non-Accountants _Aug2024Catherine Joy CarlosNo ratings yet

- M. Mendoza - Aud03-Syllabus (Sy 2021-2022)Document9 pagesM. Mendoza - Aud03-Syllabus (Sy 2021-2022)Mark Domingo MendozaNo ratings yet

- FAR 3 Intermediate Accounting I SyllabusDocument8 pagesFAR 3 Intermediate Accounting I SyllabusABMAYALADANO ,ErvinNo ratings yet

- 2020 FMGT 1013 - Financial Management RevisedDocument9 pages2020 FMGT 1013 - Financial Management RevisedYANIII12345No ratings yet

- Unit 02 Conceptual FrameworkDocument17 pagesUnit 02 Conceptual FrameworkNixsan MenaNo ratings yet

- SBR-INT S24-J25 Syllabus and Study Guide - FinalDocument17 pagesSBR-INT S24-J25 Syllabus and Study Guide - FinalMyo NaingNo ratings yet

- Tomas Del Rosario College: City of Balanga Curricular Program: AccountancyDocument12 pagesTomas Del Rosario College: City of Balanga Curricular Program: AccountancyVanessa L. VinluanNo ratings yet

- Institute of Management Technology: HyderabadDocument6 pagesInstitute of Management Technology: HyderabadShivamKhareNo ratings yet

- 1.1 Course Outline Accy206Document3 pages1.1 Course Outline Accy206bsaccyinstructorNo ratings yet

- SBR-UK S24-J25 Syllabus and Study Guide - FinalDocument18 pagesSBR-UK S24-J25 Syllabus and Study Guide - Finaljanani0% (1)

- Chapter 3 Conceptual Framework Part 1Document9 pagesChapter 3 Conceptual Framework Part 1FrakeZNo ratings yet

- PDF Conceptual Framework and Accounting Standard Syllabus DDDocument11 pagesPDF Conceptual Framework and Accounting Standard Syllabus DDMariya BhavesNo ratings yet

- BBDocument9 pagesBBChreann RachelNo ratings yet

- Appendix-20Document56 pagesAppendix-20SivahariNo ratings yet

- AEP101 Accounting Enhancement Program Financial Accounting and ReportingDocument6 pagesAEP101 Accounting Enhancement Program Financial Accounting and ReportingMiles SantosNo ratings yet

- Acctg 201A Course GuideDocument13 pagesAcctg 201A Course GuideDomingo Bay-anNo ratings yet

- ACCTG 208 Rev 2022 Acctg Govt Not For Profit OrgDocument8 pagesACCTG 208 Rev 2022 Acctg Govt Not For Profit OrgRoschelle MiguelNo ratings yet

- Principles of Financial AccountingDocument7 pagesPrinciples of Financial Accountinghnoor94No ratings yet

- Module 1Document13 pagesModule 1Liz PobleteNo ratings yet

- Learning Mod 1 CfasDocument20 pagesLearning Mod 1 CfasKristine CamposNo ratings yet

- Financial Analysis 1Document3 pagesFinancial Analysis 1Kendra LeslyNo ratings yet

- RPS 2021 - Akuntansi Dasar I - TFJDocument18 pagesRPS 2021 - Akuntansi Dasar I - TFJSILVINA SEPTIANINGSIHNo ratings yet

- Intermediate Financial Accounting ACC 201 Faculty:: 1. Overall Aims of The CourseDocument11 pagesIntermediate Financial Accounting ACC 201 Faculty:: 1. Overall Aims of The CourseSZANo ratings yet

- BSA 3104 - Governance, Business Ethics, Risk Management and Internal ControlDocument17 pagesBSA 3104 - Governance, Business Ethics, Risk Management and Internal ControlGERWIN REQUIROSO100% (1)

- 14512Document21 pages14512klaus010323No ratings yet

- Learning Guide: Accounts and Budget ServiceDocument28 pagesLearning Guide: Accounts and Budget ServicerameNo ratings yet

- Acct 1510 W2021Document6 pagesAcct 1510 W2021j8noelNo ratings yet

- BSA 3101 - Accounting For Special TransactionsDocument12 pagesBSA 3101 - Accounting For Special TransactionsMariel TagubaNo ratings yet

- ACCT 100 POFA Course Outline Fall Semester 2022-23Document6 pagesACCT 100 POFA Course Outline Fall Semester 2022-23MuhammadNo ratings yet

- Detailed Teaching Syllabus (DTS) and Instructor Guide (Ig'S)Document15 pagesDetailed Teaching Syllabus (DTS) and Instructor Guide (Ig'S)Charo Gironella100% (1)

- Module Acctg1Document49 pagesModule Acctg1Belle TurredaNo ratings yet

- OBE Syllabus Stategic Bus. Analysis Mgt. Acctg.Document10 pagesOBE Syllabus Stategic Bus. Analysis Mgt. Acctg.Rowena RogadoNo ratings yet

- Acctg 4 Financial Accounting IDocument16 pagesAcctg 4 Financial Accounting IvaneknekNo ratings yet

- Financial Accounting and Reporting 2021Document662 pagesFinancial Accounting and Reporting 2021pronab sarker100% (3)

- Unit 2Document25 pagesUnit 2FantayNo ratings yet

- Acctg 150 Course Guide 1st Sem 21 22 Fin. Acctg. ReportingDocument19 pagesAcctg 150 Course Guide 1st Sem 21 22 Fin. Acctg. ReportingVivian TamerayNo ratings yet

- Accounting and Financial Analysis.Document3 pagesAccounting and Financial Analysis.athirah binti shazaliNo ratings yet

- M. MENDOZA - AUD05-SYLLABUS 2nd SEM (SY 2021-2022)Document14 pagesM. MENDOZA - AUD05-SYLLABUS 2nd SEM (SY 2021-2022)Mark Domingo MendozaNo ratings yet

- Detailed Teaching Syllabus (DTS) and Instructor Guide (Ig'S)Document19 pagesDetailed Teaching Syllabus (DTS) and Instructor Guide (Ig'S)Charo Gironella67% (3)

- GID15713037-SBR GRPB Lesson - 1Document28 pagesGID15713037-SBR GRPB Lesson - 1Kat LeighNo ratings yet

- The Balanced Scorecard: Turn your data into a roadmap to successFrom EverandThe Balanced Scorecard: Turn your data into a roadmap to successRating: 3.5 out of 5 stars3.5/5 (4)

- 3 Acctg 327Document19 pages3 Acctg 327Ma. Liza MagatNo ratings yet

- Production Operations SyllabusDocument5 pagesProduction Operations SyllabusMa. Liza MagatNo ratings yet

- HBO Handouts 1.2.3Document9 pagesHBO Handouts 1.2.3Ma. Liza MagatNo ratings yet

- Production and Operation ManagementDocument4 pagesProduction and Operation ManagementMa. Liza MagatNo ratings yet

- reVIEW MATERIALS TAxDocument5 pagesreVIEW MATERIALS TAxMa. Liza MagatNo ratings yet

- Finac 4 REVIEWER 2019 CPADocument3 pagesFinac 4 REVIEWER 2019 CPAMa. Liza MagatNo ratings yet

- Financial Accounting 2reviewer 2019 CPADocument8 pagesFinancial Accounting 2reviewer 2019 CPAMa. Liza MagatNo ratings yet

- Financial Accounting 1Document4 pagesFinancial Accounting 1Ma. Liza MagatNo ratings yet

- ComfortClass 400Document24 pagesComfortClass 400Philippine Bus Enthusiasts SocietyNo ratings yet

- 2023-05-25 Calvert County TimesDocument40 pages2023-05-25 Calvert County TimesSouthern Maryland OnlineNo ratings yet

- Als Bow Ls 4 Quarter 3 & 4Document7 pagesAls Bow Ls 4 Quarter 3 & 4Iren Castor MabutinNo ratings yet

- Types of AgentsDocument5 pagesTypes of Agentsवैभव कौशिकNo ratings yet

- Negotiable Instruments Act 1Document4 pagesNegotiable Instruments Act 1Aysha AlamNo ratings yet

- Webinar (11 MAR'20) Impact of Ongoing Events On Marcellus' Pms PortfoliosDocument11 pagesWebinar (11 MAR'20) Impact of Ongoing Events On Marcellus' Pms PortfoliosslohariNo ratings yet

- 2023 RIBA Chartered Practice UK Membership Application FormDocument7 pages2023 RIBA Chartered Practice UK Membership Application FormsNo ratings yet

- CO1 2301E IP03.SolutionDocument8 pagesCO1 2301E IP03.Solutionnasie.kazemiNo ratings yet

- PT GAJAH TUNGGAL TBK PDFDocument96 pagesPT GAJAH TUNGGAL TBK PDFKholila Mutia SafitriNo ratings yet

- BusinessMathematics q1 Mod7 ProfitLoss v1Document23 pagesBusinessMathematics q1 Mod7 ProfitLoss v1Jinalyn CaberNo ratings yet

- TakeoversDocument28 pagesTakeoversPreetam Jain100% (1)

- Recycling of WaterDocument5 pagesRecycling of WatershaniaNo ratings yet

- Rural Finance Loan Portfolio Guarantee: ObjectiveDocument2 pagesRural Finance Loan Portfolio Guarantee: ObjectiveMariaPanchitaNo ratings yet

- Fitout GuideDocument44 pagesFitout GuideMohammad pharabiaNo ratings yet

- Opportunistic Acquisition of Companies in COVID-19Document7 pagesOpportunistic Acquisition of Companies in COVID-19minku.srivastava97No ratings yet

- Important Penalties (COMPANY LAW) - Executive-RevisionDocument2 pagesImportant Penalties (COMPANY LAW) - Executive-RevisionCma SankaraiahNo ratings yet

- Introducing The Australian Defence Consultancy Group (ADCG) Defence Industry Security Program (DISP) CapabilityDocument3 pagesIntroducing The Australian Defence Consultancy Group (ADCG) Defence Industry Security Program (DISP) CapabilityKarthik KumarNo ratings yet

- Classification of CorporationDocument3 pagesClassification of CorporationHazel OnahonNo ratings yet

- Dissertation Topics Hotel ManagementDocument4 pagesDissertation Topics Hotel ManagementWriteMyPaperPleaseDurham100% (1)

- PSL35Document2 pagesPSL35musaismail8863No ratings yet

- The Effect of Cosmetic Packaging DesignDocument13 pagesThe Effect of Cosmetic Packaging DesignVo Minh Thu (Aptech HCM)No ratings yet

- Standard Costs and Variance Analysis Standard Costs and Variance AnalysisDocument26 pagesStandard Costs and Variance Analysis Standard Costs and Variance Analysischiji chzzzmeowNo ratings yet

- Organizational Behaviour in Sport 2017Document263 pagesOrganizational Behaviour in Sport 2017Güngör BoroNo ratings yet

- Suggested Answer CAP III December 2016Document122 pagesSuggested Answer CAP III December 2016Roshan PanditNo ratings yet

- Chapter 3: Answers To Questions For ReviewDocument5 pagesChapter 3: Answers To Questions For ReviewlilyNo ratings yet

- Module # Topics 4: Unit 4Document15 pagesModule # Topics 4: Unit 4ANNA MARY GINTORONo ratings yet

- Mb0047 Management Information SystemDocument234 pagesMb0047 Management Information SystemManish SinghNo ratings yet

- StoryTellings 360 Brand Story BuildingDocument21 pagesStoryTellings 360 Brand Story Buildingpry75100% (2)

- Automatic Cut & Strip Machine: Multistrip 9480Document192 pagesAutomatic Cut & Strip Machine: Multistrip 9480Ernesto AlemanNo ratings yet

Dr. Gloria D. Lacson Foundation Colleges, Inc

Dr. Gloria D. Lacson Foundation Colleges, Inc

Uploaded by

Ma. Liza MagatOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Dr. Gloria D. Lacson Foundation Colleges, Inc

Dr. Gloria D. Lacson Foundation Colleges, Inc

Uploaded by

Ma. Liza MagatCopyright:

Available Formats

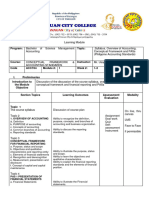

DR. GLORIA D. LACSON FOUNDATION COLLEGES, INC.

Castellano, San Leonardo, Nueva Ecija

Tel No. ( 044 ) 486 – 2919 / Fax (044) 486-29-18

OUTCOMES – BASED ACCOUNTANCY COURSE SYLLABUS

COLLEGE OF ACCOUNTANCY

AE13 - FINANCIAL ACCOUNTING & REPORTING

First Semester, SY 2018 – 2019

I. PRELIMINARIES

A. College

Vision: The College of Accountancy will continue to be a department of excellence with a strong focus on its civic-based

identity and academic distinction with a dedicated and caring faculty who value above their students care & support.

Mission: The College of Accountancy extends its generosity & altruism to all aspiring students who are determined to become

an ACCOUNTANT and later will pass the Board Exam for CPA in the near future through the nurturing & support afforded

to them.

Goals: 1. To train future accountant in business, private and government who can be relied upon in their chosen endeavor;

2. To promote and disseminate practical knowhow in the field of accountancy and allied fields through training,

production and networking services.

B. Course Title: AE13 – FINANCIAL ACOUNTING & REPORTING

3 units

II. COURSE DESCRIPTION

This course provides an in depth study of the regulation, concepts, standards and processes relevant to financial accounting and reporting. It

covers topics on accounting and its environment, the conceptual framework for financial accounting generally accepted principles, the

regulation, measurement, and statement presentation of asset items in the balance sheet. The unit develops graduate capabilities associated

with discipline specific knowledge, technical skills and professional judgement, and their application to solving practical financial reporting

issues, and with effective business communication skills for accountants.

III. COURSE OBJECTIVES

1. To introduce and understand accounting and used for decision making.

2. To comprehend the fundamentals in order to develop the necessary technical and bookkeeping skills.

3. To able to develop a strong yet flexible business background that will allow coping up with the challenges of economic models.

IV. COURSE CONTENTS

Week Require Intended Graduate

d Topic Outline Intended Teaching Students Attributes

Number Learning Learning Assessment (in support of the

of Hours Outcomes Strategies/ Modalities overall institutional

Methodology outcomes)

PRELIM

1-6 The student 1. Lecture 1.Quizzes Demonstrate

The Financial Reporting Environment must be able 2. Class 2.Recitation accounting prowess

to show discussion 3.Exam by solving questions

Describe the regulatory environment for financial 3. Report / 4.Reports

accounting correctly & can

reporting and the reasons for accounting and Chart

reporting requirements

skills & prepare a financial

4. Practice set

Discuss the main types of business entity and analysis. reports.

explain the reasons for selecting each structure.

Identify different types of accounting regulation,

including laws, Generally Accepted Accounting

Principles and International Financial Reporting

Standards.

Explain how the requirements from users,

together with social and environmental

developments, impact the underlying principles

and requirements of financial reporting and the

desire to establish a single set of international

accounting standards.

Describe the role of the International Accounting

Standards Board in developing a regulatory

framework and explain how new policies and

standards are established.

Identify the purpose of a conceptual framework

and the key characteristics in the Generally

Accepted Accounting Principles (GAAP) and

apply the knowledge to define and recognize the

different elements of the financial statements.

Describe and demonstrate the role of accounting

standards and accounting policies in fairly

presenting the financial performance and financial

position of an entity.

The Accounting Theory

Compare historical cost accounting with other

methods of valuation and explain the differences.

Explain agency and contracting theories and how

they relate to accounting policy choice (positive

accounting theory).

Apply the recognition criteria for the elements of

the financial statements according to the

conceptual framework (normative theory).

MIDTERM

7-12 Financial Statements

Prepare and present the statement of profit or loss

and other comprehensive income with appropriate

disclosure in accordance with relevant accounting

standards and policies.

Prepare and present the statement of financial

position with appropriate disclosure in accordance

with relevant accounting standards and policies.

Prepare and present the statement of cash flows in

accordance with relevant accounting standards

and policies.

Demonstrate the ability to detect, investigate and

correct discrepancies or particular items/events

while matching the financial statements to

supporting documentation.

Application of Specific Accounting Standards

Calculate the carrying amounts of different classes

of intangible assets and prepare the relevant

journal entries.

Interpret contracts to determine the amount and

timing of revenue to be recognised in the financial

statements and reconcile the differences between

ledgers if necessary.

Calculate current and deferred income tax and

prepare the relevant journal entries to record the

tax effect in the financial statements.

Calculate and account for foreign currency

transactions at transaction date and subsequent

dates

Translate financial statements from a functional

currency to a presentation currency

FINALS

12-18 Business Combinations

Discuss the accounting issues for various forms of

business combinations.

Explain how goodwill is measured and disclosed

at the date of acquisition and prepare the relevant

journal entries.

Explain how goodwill is measured and impaired

subsequent to acquisition and prepare the relevant

journal entries

Discuss the concept of control and calculate the

non-controlling interest share of equity.

Prepare consolidated statements of financial

position, including the entries for goodwill and

non-controlling interests

Analysis of Financial Statements

Calculate, analyze and interpret financial ratios

and their interrelationship in the financial

statements.

Explain the limitations of financial statement

analysis.

Recommended Text and Readings:

FINANCIAL ACCOUNTING AND REPORTING STUDY GUIDE 7TH EDITION

Recommending Approval: Prepared by:

CEZARIO G. TAN, CPA Renzi Joyce G. Calma

OIC-DEAN INSTRUCTOR

Approved:

DR. LEONARDO L. NAVARRO

Vice President for Academic Affairs

You might also like

- Principles of Accounting (AC1025)Document2 pagesPrinciples of Accounting (AC1025)Geza bumNo ratings yet

- RFBT (1) Cpa Reviewer 2019Document24 pagesRFBT (1) Cpa Reviewer 2019Ma. Liza Magat100% (3)

- Syllabus - Bsa 3101-Accounting For Special TransactionsDocument10 pagesSyllabus - Bsa 3101-Accounting For Special TransactionsMaviel SuaverdezNo ratings yet

- Conceptual Framework and Accounting Standard SyllabusDocument11 pagesConceptual Framework and Accounting Standard SyllabusAnas Aloyodan60% (5)

- AE13 Financial Accounting and Reporting PDFDocument50 pagesAE13 Financial Accounting and Reporting PDFMa. Liza MagatNo ratings yet

- Magic Quadrant For IT Vendor Risk Management ToolsDocument3 pagesMagic Quadrant For IT Vendor Risk Management ToolsJohn RhoNo ratings yet

- ACCT 1026 Financial Accounting and Reporting 2019Document11 pagesACCT 1026 Financial Accounting and Reporting 2019Kath DayagNo ratings yet

- Financial Statement Analysis: Standard Course OutlineDocument6 pagesFinancial Statement Analysis: Standard Course OutlineMahmoud ZizoNo ratings yet

- Financial Accounting Theory and Reporting IDocument16 pagesFinancial Accounting Theory and Reporting IKendrick PajarinNo ratings yet

- Wharton Reports Wharton Mba Course ListDocument63 pagesWharton Reports Wharton Mba Course ListMd. Sahinur RahmanNo ratings yet

- ACCTG. 315N Accounting For Business Combinations COURSE SYLLABUS 2021-2022Document14 pagesACCTG. 315N Accounting For Business Combinations COURSE SYLLABUS 2021-2022NURHAM SUMLAYNo ratings yet

- Conceptual Framework and Accounting Standard SyllabusDocument12 pagesConceptual Framework and Accounting Standard Syllabusrenzelmagbitang222No ratings yet

- Course Outline Introduction To Financial AccountingDocument8 pagesCourse Outline Introduction To Financial AccountingLuciferNo ratings yet

- Bachelor of Science in Accountancy Saint PaulDocument16 pagesBachelor of Science in Accountancy Saint PaulJeremias PerezNo ratings yet

- ACCT 100-Principles of Financial Accounting - Fall 2018-19Document7 pagesACCT 100-Principles of Financial Accounting - Fall 2018-19Qudsia AbbasNo ratings yet

- San Beda College Alabang: College of Arts and Sciences (Name of The) DepartmentDocument4 pagesSan Beda College Alabang: College of Arts and Sciences (Name of The) DepartmentKhristian Joshua G. JuradoNo ratings yet

- Acc 111Document11 pagesAcc 111Jhanna Vee DamaleNo ratings yet

- AF5115Document5 pagesAF5115Chin LNo ratings yet

- Detailed Teaching Syllabus (DTS) and Instructor Guide (Ig'S)Document20 pagesDetailed Teaching Syllabus (DTS) and Instructor Guide (Ig'S)Blecemie MonteraNo ratings yet

- JMC Guidelines and Template For Compendium 2 1Document63 pagesJMC Guidelines and Template For Compendium 2 1kingsters zabateNo ratings yet

- ACCT 100-Principle of Financial Accounting-Saira RizwanDocument6 pagesACCT 100-Principle of Financial Accounting-Saira Rizwanraziqachaudhry9665No ratings yet

- Acco 30013 Accounting For Special Transactions 2019Document8 pagesAcco 30013 Accounting For Special Transactions 2019Azel Ann AlibinNo ratings yet

- Accounting for Non-Accountants _Aug2024Document8 pagesAccounting for Non-Accountants _Aug2024Catherine Joy CarlosNo ratings yet

- M. Mendoza - Aud03-Syllabus (Sy 2021-2022)Document9 pagesM. Mendoza - Aud03-Syllabus (Sy 2021-2022)Mark Domingo MendozaNo ratings yet

- FAR 3 Intermediate Accounting I SyllabusDocument8 pagesFAR 3 Intermediate Accounting I SyllabusABMAYALADANO ,ErvinNo ratings yet

- 2020 FMGT 1013 - Financial Management RevisedDocument9 pages2020 FMGT 1013 - Financial Management RevisedYANIII12345No ratings yet

- Unit 02 Conceptual FrameworkDocument17 pagesUnit 02 Conceptual FrameworkNixsan MenaNo ratings yet

- SBR-INT S24-J25 Syllabus and Study Guide - FinalDocument17 pagesSBR-INT S24-J25 Syllabus and Study Guide - FinalMyo NaingNo ratings yet

- Tomas Del Rosario College: City of Balanga Curricular Program: AccountancyDocument12 pagesTomas Del Rosario College: City of Balanga Curricular Program: AccountancyVanessa L. VinluanNo ratings yet

- Institute of Management Technology: HyderabadDocument6 pagesInstitute of Management Technology: HyderabadShivamKhareNo ratings yet

- 1.1 Course Outline Accy206Document3 pages1.1 Course Outline Accy206bsaccyinstructorNo ratings yet

- SBR-UK S24-J25 Syllabus and Study Guide - FinalDocument18 pagesSBR-UK S24-J25 Syllabus and Study Guide - Finaljanani0% (1)

- Chapter 3 Conceptual Framework Part 1Document9 pagesChapter 3 Conceptual Framework Part 1FrakeZNo ratings yet

- PDF Conceptual Framework and Accounting Standard Syllabus DDDocument11 pagesPDF Conceptual Framework and Accounting Standard Syllabus DDMariya BhavesNo ratings yet

- BBDocument9 pagesBBChreann RachelNo ratings yet

- Appendix-20Document56 pagesAppendix-20SivahariNo ratings yet

- AEP101 Accounting Enhancement Program Financial Accounting and ReportingDocument6 pagesAEP101 Accounting Enhancement Program Financial Accounting and ReportingMiles SantosNo ratings yet

- Acctg 201A Course GuideDocument13 pagesAcctg 201A Course GuideDomingo Bay-anNo ratings yet

- ACCTG 208 Rev 2022 Acctg Govt Not For Profit OrgDocument8 pagesACCTG 208 Rev 2022 Acctg Govt Not For Profit OrgRoschelle MiguelNo ratings yet

- Principles of Financial AccountingDocument7 pagesPrinciples of Financial Accountinghnoor94No ratings yet

- Module 1Document13 pagesModule 1Liz PobleteNo ratings yet

- Learning Mod 1 CfasDocument20 pagesLearning Mod 1 CfasKristine CamposNo ratings yet

- Financial Analysis 1Document3 pagesFinancial Analysis 1Kendra LeslyNo ratings yet

- RPS 2021 - Akuntansi Dasar I - TFJDocument18 pagesRPS 2021 - Akuntansi Dasar I - TFJSILVINA SEPTIANINGSIHNo ratings yet

- Intermediate Financial Accounting ACC 201 Faculty:: 1. Overall Aims of The CourseDocument11 pagesIntermediate Financial Accounting ACC 201 Faculty:: 1. Overall Aims of The CourseSZANo ratings yet

- BSA 3104 - Governance, Business Ethics, Risk Management and Internal ControlDocument17 pagesBSA 3104 - Governance, Business Ethics, Risk Management and Internal ControlGERWIN REQUIROSO100% (1)

- 14512Document21 pages14512klaus010323No ratings yet

- Learning Guide: Accounts and Budget ServiceDocument28 pagesLearning Guide: Accounts and Budget ServicerameNo ratings yet

- Acct 1510 W2021Document6 pagesAcct 1510 W2021j8noelNo ratings yet

- BSA 3101 - Accounting For Special TransactionsDocument12 pagesBSA 3101 - Accounting For Special TransactionsMariel TagubaNo ratings yet

- ACCT 100 POFA Course Outline Fall Semester 2022-23Document6 pagesACCT 100 POFA Course Outline Fall Semester 2022-23MuhammadNo ratings yet

- Detailed Teaching Syllabus (DTS) and Instructor Guide (Ig'S)Document15 pagesDetailed Teaching Syllabus (DTS) and Instructor Guide (Ig'S)Charo Gironella100% (1)

- Module Acctg1Document49 pagesModule Acctg1Belle TurredaNo ratings yet

- OBE Syllabus Stategic Bus. Analysis Mgt. Acctg.Document10 pagesOBE Syllabus Stategic Bus. Analysis Mgt. Acctg.Rowena RogadoNo ratings yet

- Acctg 4 Financial Accounting IDocument16 pagesAcctg 4 Financial Accounting IvaneknekNo ratings yet

- Financial Accounting and Reporting 2021Document662 pagesFinancial Accounting and Reporting 2021pronab sarker100% (3)

- Unit 2Document25 pagesUnit 2FantayNo ratings yet

- Acctg 150 Course Guide 1st Sem 21 22 Fin. Acctg. ReportingDocument19 pagesAcctg 150 Course Guide 1st Sem 21 22 Fin. Acctg. ReportingVivian TamerayNo ratings yet

- Accounting and Financial Analysis.Document3 pagesAccounting and Financial Analysis.athirah binti shazaliNo ratings yet

- M. MENDOZA - AUD05-SYLLABUS 2nd SEM (SY 2021-2022)Document14 pagesM. MENDOZA - AUD05-SYLLABUS 2nd SEM (SY 2021-2022)Mark Domingo MendozaNo ratings yet

- Detailed Teaching Syllabus (DTS) and Instructor Guide (Ig'S)Document19 pagesDetailed Teaching Syllabus (DTS) and Instructor Guide (Ig'S)Charo Gironella67% (3)

- GID15713037-SBR GRPB Lesson - 1Document28 pagesGID15713037-SBR GRPB Lesson - 1Kat LeighNo ratings yet

- The Balanced Scorecard: Turn your data into a roadmap to successFrom EverandThe Balanced Scorecard: Turn your data into a roadmap to successRating: 3.5 out of 5 stars3.5/5 (4)

- 3 Acctg 327Document19 pages3 Acctg 327Ma. Liza MagatNo ratings yet

- Production Operations SyllabusDocument5 pagesProduction Operations SyllabusMa. Liza MagatNo ratings yet

- HBO Handouts 1.2.3Document9 pagesHBO Handouts 1.2.3Ma. Liza MagatNo ratings yet

- Production and Operation ManagementDocument4 pagesProduction and Operation ManagementMa. Liza MagatNo ratings yet

- reVIEW MATERIALS TAxDocument5 pagesreVIEW MATERIALS TAxMa. Liza MagatNo ratings yet

- Finac 4 REVIEWER 2019 CPADocument3 pagesFinac 4 REVIEWER 2019 CPAMa. Liza MagatNo ratings yet

- Financial Accounting 2reviewer 2019 CPADocument8 pagesFinancial Accounting 2reviewer 2019 CPAMa. Liza MagatNo ratings yet

- Financial Accounting 1Document4 pagesFinancial Accounting 1Ma. Liza MagatNo ratings yet

- ComfortClass 400Document24 pagesComfortClass 400Philippine Bus Enthusiasts SocietyNo ratings yet

- 2023-05-25 Calvert County TimesDocument40 pages2023-05-25 Calvert County TimesSouthern Maryland OnlineNo ratings yet

- Als Bow Ls 4 Quarter 3 & 4Document7 pagesAls Bow Ls 4 Quarter 3 & 4Iren Castor MabutinNo ratings yet

- Types of AgentsDocument5 pagesTypes of Agentsवैभव कौशिकNo ratings yet

- Negotiable Instruments Act 1Document4 pagesNegotiable Instruments Act 1Aysha AlamNo ratings yet

- Webinar (11 MAR'20) Impact of Ongoing Events On Marcellus' Pms PortfoliosDocument11 pagesWebinar (11 MAR'20) Impact of Ongoing Events On Marcellus' Pms PortfoliosslohariNo ratings yet

- 2023 RIBA Chartered Practice UK Membership Application FormDocument7 pages2023 RIBA Chartered Practice UK Membership Application FormsNo ratings yet

- CO1 2301E IP03.SolutionDocument8 pagesCO1 2301E IP03.Solutionnasie.kazemiNo ratings yet

- PT GAJAH TUNGGAL TBK PDFDocument96 pagesPT GAJAH TUNGGAL TBK PDFKholila Mutia SafitriNo ratings yet

- BusinessMathematics q1 Mod7 ProfitLoss v1Document23 pagesBusinessMathematics q1 Mod7 ProfitLoss v1Jinalyn CaberNo ratings yet

- TakeoversDocument28 pagesTakeoversPreetam Jain100% (1)

- Recycling of WaterDocument5 pagesRecycling of WatershaniaNo ratings yet

- Rural Finance Loan Portfolio Guarantee: ObjectiveDocument2 pagesRural Finance Loan Portfolio Guarantee: ObjectiveMariaPanchitaNo ratings yet

- Fitout GuideDocument44 pagesFitout GuideMohammad pharabiaNo ratings yet

- Opportunistic Acquisition of Companies in COVID-19Document7 pagesOpportunistic Acquisition of Companies in COVID-19minku.srivastava97No ratings yet

- Important Penalties (COMPANY LAW) - Executive-RevisionDocument2 pagesImportant Penalties (COMPANY LAW) - Executive-RevisionCma SankaraiahNo ratings yet

- Introducing The Australian Defence Consultancy Group (ADCG) Defence Industry Security Program (DISP) CapabilityDocument3 pagesIntroducing The Australian Defence Consultancy Group (ADCG) Defence Industry Security Program (DISP) CapabilityKarthik KumarNo ratings yet

- Classification of CorporationDocument3 pagesClassification of CorporationHazel OnahonNo ratings yet

- Dissertation Topics Hotel ManagementDocument4 pagesDissertation Topics Hotel ManagementWriteMyPaperPleaseDurham100% (1)

- PSL35Document2 pagesPSL35musaismail8863No ratings yet

- The Effect of Cosmetic Packaging DesignDocument13 pagesThe Effect of Cosmetic Packaging DesignVo Minh Thu (Aptech HCM)No ratings yet

- Standard Costs and Variance Analysis Standard Costs and Variance AnalysisDocument26 pagesStandard Costs and Variance Analysis Standard Costs and Variance Analysischiji chzzzmeowNo ratings yet

- Organizational Behaviour in Sport 2017Document263 pagesOrganizational Behaviour in Sport 2017Güngör BoroNo ratings yet

- Suggested Answer CAP III December 2016Document122 pagesSuggested Answer CAP III December 2016Roshan PanditNo ratings yet

- Chapter 3: Answers To Questions For ReviewDocument5 pagesChapter 3: Answers To Questions For ReviewlilyNo ratings yet

- Module # Topics 4: Unit 4Document15 pagesModule # Topics 4: Unit 4ANNA MARY GINTORONo ratings yet

- Mb0047 Management Information SystemDocument234 pagesMb0047 Management Information SystemManish SinghNo ratings yet

- StoryTellings 360 Brand Story BuildingDocument21 pagesStoryTellings 360 Brand Story Buildingpry75100% (2)

- Automatic Cut & Strip Machine: Multistrip 9480Document192 pagesAutomatic Cut & Strip Machine: Multistrip 9480Ernesto AlemanNo ratings yet