Professional Documents

Culture Documents

Two-Date Bank Reconciliation Receivables: Example Format Only

Two-Date Bank Reconciliation Receivables: Example Format Only

Uploaded by

magic costa0 ratings0% found this document useful (0 votes)

13 views2 pagesThis document provides information about accounts receivable, including:

1) It defines accounts receivable as a financial asset representing the contractual right to receive cash from customers for goods or services sold. It distinguishes between trade receivables from ordinary business operations and non-trade receivables from other sources.

2) It discusses the initial and subsequent measurement of accounts receivable, including recognizing them at fair value plus transaction costs initially and using amortized cost or net realizable value models subsequently.

3) It covers accounting for bad debts through either the allowance method, which recognizes expected uncollectible amounts upfront, or the direct write-off method, which recognizes losses only when debts are proven uncollect

Original Description:

Original Title

111 3-4.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides information about accounts receivable, including:

1) It defines accounts receivable as a financial asset representing the contractual right to receive cash from customers for goods or services sold. It distinguishes between trade receivables from ordinary business operations and non-trade receivables from other sources.

2) It discusses the initial and subsequent measurement of accounts receivable, including recognizing them at fair value plus transaction costs initially and using amortized cost or net realizable value models subsequently.

3) It covers accounting for bad debts through either the allowance method, which recognizes expected uncollectible amounts upfront, or the direct write-off method, which recognizes losses only when debts are proven uncollect

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

13 views2 pagesTwo-Date Bank Reconciliation Receivables: Example Format Only

Two-Date Bank Reconciliation Receivables: Example Format Only

Uploaded by

magic costaThis document provides information about accounts receivable, including:

1) It defines accounts receivable as a financial asset representing the contractual right to receive cash from customers for goods or services sold. It distinguishes between trade receivables from ordinary business operations and non-trade receivables from other sources.

2) It discusses the initial and subsequent measurement of accounts receivable, including recognizing them at fair value plus transaction costs initially and using amortized cost or net realizable value models subsequently.

3) It covers accounting for bad debts through either the allowance method, which recognizes expected uncollectible amounts upfront, or the direct write-off method, which recognizes losses only when debts are proven uncollect

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

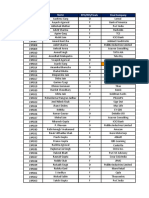

PROOF OF CASH ACCOUNTS RECEIVABLE

Two-date Bank Reconciliation Receivables

- Omitted information: (beg & end)

- Financial assets = contractual right to receive

Book & Bank balance

cash / fin asset from another entity

DIT & OC

TRADE Receivables

DIT – beg of month - From sale of mdse/service in ordinary business

Add: Cash RECEIPTS deposited during month - AR

Total deposits to be acknowledged by bank Sale of goods and service from ordinary

Less: Deposits acknowledged by bank during month business

DIT – end of month NO promi notes

Customer account, trade debtors, trade

OC – beg of month AR

Add: Checks DRAWN by depositor during month - NR

Total checks to be paid by bank WITH formal promises to pay in form of

Less: Checks paid by bank during month notes

OC – end of month

NON-TRADE Receivables

ALL items debited (credited) to CIB which do

NOT represent deposits should be DEDUCTED - From other sources of sale of merchandise or

from book DEBITS (CREDITS) total to arrive at service in ordinary business

cash receipts deposited (to determine deposits

acknowledged by bank) a. Advances to (receivable from) shareholders,

direct, office/employee

ALL items NOT representing CHECKS credited

to CIB which do NOT represent deposits should b. Advances to affiliates (subsidiary) = LTI

be DEDUCTED from book CREDITS total to

arrive at checks drawn by depositor c. Advances to supplier for acquisition of

merchandise = CURRENT

ALL items DEBITED to account of depositor

not representing checks paid should be d. Subscriptions Receivable = CURRENT if

DEDUCTED from BANK DEBITS total to collectible within 1 year/ deduct from

arrive at checks PAID by bank subscription share capital

e. Creditors account with debit bal result of

Proof of Cash overpayment/return/allowances = CURRENT

- Expanded reconciliation including proof of But if NOT material, can be offset

receipts and disbursements

f. Special deposits on contract bids = NON-

COMPANY X CURRENT

PROOF OF CASH

For the Month of February

g. Accrued income dividend, accrued rent, accrued

Jan 31 Receipts Disbursements Feb 28

Bal per book royalties, accrued interest on bond investment =

Note collected CURRENT

Jan Example format only

Feb.. h. Claims receivable against common carriers for

Adj book bal

losses/damage; for rebates and tax refunds; from

insurance entity = CURRENT

Loans Receivable Accounting for BAD DEBTS loss

- Loans TO customers 1. ALLOWANCE Method

- Made to HETERO customer - Recognize bad debts loss if doubtful of collection

- Repayment frequently longer/over several years - Doubtful accounts

Allowance for DA

Classify asset as CURRENT when expects to - If worthless / uncollectible- written off as:

realize asset, sell or consume it in normal ADA

operating cycle OR when expects to realize asset AR

WITHIN 12 months AFTER reporting period - GAAP requires this method because conforms

with matching principle

Customer’s CREDIT balances

2. DIRECT WRITEOFF Method

= CURRENT LIABILITIES - Recognize when proven worthless /

uncollectible

- Not offset against debit bal in other customers

- Bad debts

except when not material

AR

Initial Measurement of AR - BIR=for income tax puposes only

- Violates matching principle

- Fair Value (transaction price) + transaction cost - Not permitted under IFRS

- Short-term receivables- FV=orig/face amount

ALLOWANC DIRECT

E WRITEOFF

Subsequent Measurement Accounts of P30 are DA No entry

doubtful of collection ADA

- Amortized Cost – Net Realizable Value Subsequently ADA Bad Debts

- more relevance in long term NR discovered to be AR AR

- amount of cash expected to be worthless

collected/estimated recoverable amount Previously written AR AR

off are unexpectedly ADA Bad Debts

Net Realizable Value recovered / collected Cash Cash

AR AR

- deduct allowance for freight charge; sales

return; sales discount; doubtful accounts

Methods of recording Credit Sales Doubtful accounts in Income Statement

GROSS NET 1. Distribution Cost

Sale of Mdse AR AR - Selling/marketing expense

Sales Sales

- If granting of credit and collection under sales

Collection w/in discount Cash Cash

manager, doubtful accounts = distribution cost

SD AR

AR

Collection after discount Cash Cash 2. Administrative Expense

AR AR - General/office expense

SD forfeited - Under officer other than sales manager

SD forfeited = Other Income If silent=admin expense

You might also like

- Matthew Lesko Let Uncle Sam Pay Your Bills PDFDocument33 pagesMatthew Lesko Let Uncle Sam Pay Your Bills PDFCarol100% (4)

- Case Study Ii-Be-Gouri NDocument4 pagesCase Study Ii-Be-Gouri Ngouri75% (4)

- Accounting For LawyersDocument51 pagesAccounting For Lawyersnamratha minupuri100% (2)

- RECEIVABLESDocument7 pagesRECEIVABLESbona jirahNo ratings yet

- (ACCCOB2) Chapters 3-5 Receivables, Investments, InventoryDocument11 pages(ACCCOB2) Chapters 3-5 Receivables, Investments, InventoryMichaella PurgananNo ratings yet

- Chapter 2 - The Accounting Equation and The Double Entry SystemDocument3 pagesChapter 2 - The Accounting Equation and The Double Entry SystemalonNo ratings yet

- Accounts Receivable: 1. Trade ReceivablesDocument3 pagesAccounts Receivable: 1. Trade ReceivablesCzar RabayaNo ratings yet

- Accounts ReceivableDocument2 pagesAccounts ReceivableCzar RabayaNo ratings yet

- BUSI 2001 Int. AccountingDocument3 pagesBUSI 2001 Int. AccountingJoshNo ratings yet

- ReceivablesDocument2 pagesReceivablesSecond YearNo ratings yet

- CH 3.1 ReceivablesDocument3 pagesCH 3.1 ReceivablesKate CamachoNo ratings yet

- Caie Igcse Accounting 0452 Theory v3Document23 pagesCaie Igcse Accounting 0452 Theory v3tarzan.shakilNo ratings yet

- Accounts ReceivableDocument3 pagesAccounts Receivablelea atienza100% (1)

- Pointers To Review: FABM 2: Recording Phase: Answer KeyDocument9 pagesPointers To Review: FABM 2: Recording Phase: Answer KeyMaria Janelle BlanzaNo ratings yet

- INTACC 1 - REVIEWER - MIDTERMS (Receivables)Document3 pagesINTACC 1 - REVIEWER - MIDTERMS (Receivables)olerianaryzzsc.56No ratings yet

- Auditing Problems: Audit ProceduresDocument21 pagesAuditing Problems: Audit ProceduresRoyce DenolanNo ratings yet

- Far 1 ReviewerDocument12 pagesFar 1 ReviewerMargarette RobiegoNo ratings yet

- Balance Sheet - Ratio AnalysisDocument49 pagesBalance Sheet - Ratio AnalysisKarishmaAshuNo ratings yet

- Expressed As A Percentage of The Value of Revenue or Sales.: Balance Sheet: Reports What The Organization Owns and OwesDocument3 pagesExpressed As A Percentage of The Value of Revenue or Sales.: Balance Sheet: Reports What The Organization Owns and OwesDGNo ratings yet

- Accounting Simplified 1Document6 pagesAccounting Simplified 1kala1975No ratings yet

- Financial Accounting and ReportingDocument6 pagesFinancial Accounting and Reportingsinatoyakoto051No ratings yet

- Chapter 9 Final Accounts (With Adjustment)Document100 pagesChapter 9 Final Accounts (With Adjustment)priyam.200409No ratings yet

- Pdfcaie Igcse Accounting 0452 Theory v2 PDFDocument24 pagesPdfcaie Igcse Accounting 0452 Theory v2 PDFrumaisaaltaf287No ratings yet

- Adjusting Entries and Merchandising BusinessDocument5 pagesAdjusting Entries and Merchandising BusinessLing lingNo ratings yet

- ACCOUNTING CYCLE STEP 1 TO 4 With IllustrationsDocument6 pagesACCOUNTING CYCLE STEP 1 TO 4 With IllustrationsmallarilecarNo ratings yet

- Caie Igcse Accounting 0452 Theory v2Document24 pagesCaie Igcse Accounting 0452 Theory v2Haaris UsmanNo ratings yet

- Chapter 4 Lecture Trade and Non Trade Receivables Part 1 StudentDocument3 pagesChapter 4 Lecture Trade and Non Trade Receivables Part 1 StudentAshlene CruzNo ratings yet

- Cash and Cash Equivalents: If Silent, Our Stale CheckDocument2 pagesCash and Cash Equivalents: If Silent, Our Stale CheckJustine CruzNo ratings yet

- Accounting NotesDocument6 pagesAccounting NotesD AngelaNo ratings yet

- Accounting Finals 1 ReviewerDocument5 pagesAccounting Finals 1 ReviewerlaurenNo ratings yet

- Seminar 3: The Accounting Cycle and Preparation of Financial StatementsDocument14 pagesSeminar 3: The Accounting Cycle and Preparation of Financial StatementsElaine TohNo ratings yet

- 2.1 Trade and Other ReceivablesDocument4 pages2.1 Trade and Other ReceivablesShally Lao-unNo ratings yet

- Cash To Inventory Reviewer 1Document15 pagesCash To Inventory Reviewer 1Patricia Camille AustriaNo ratings yet

- Intermediate AccountingDocument2 pagesIntermediate AccountingKylie CortezNo ratings yet

- IA 1 - 4 ReceivablesDocument9 pagesIA 1 - 4 ReceivablesVJ MacaspacNo ratings yet

- Short-Term Financing ReviewerDocument3 pagesShort-Term Financing ReviewerSeleenaNo ratings yet

- BFAR 09 - 09 - 2022 Double Entry SystemDocument5 pagesBFAR 09 - 09 - 2022 Double Entry SystemSheryl cornelNo ratings yet

- FARreviewerDocument5 pagesFARreviewerKimNo ratings yet

- 1 Statement of Financial Position - Part 1Document14 pages1 Statement of Financial Position - Part 1Johann LeoncitoNo ratings yet

- Theories in Ia Midterms ExamDocument12 pagesTheories in Ia Midterms ExamLOMA, ABIGAIL JOY C.No ratings yet

- FAR Chapt. 7Document8 pagesFAR Chapt. 7Ryan GaniaNo ratings yet

- Final AccountsDocument7 pagesFinal AccountsSushank Kumar 7278No ratings yet

- Chapter - 1: Quick Revision Notes Accounting For Not-For-Profit Organisation General FormatsDocument3 pagesChapter - 1: Quick Revision Notes Accounting For Not-For-Profit Organisation General FormatsSadik ShaikhNo ratings yet

- Fabm 2Document5 pagesFabm 2lhoriereyes8No ratings yet

- !!!!guide To Cash FlowsDocument3 pages!!!!guide To Cash Flowsws. cloverNo ratings yet

- Notes - FAR - Loans and Receivables (Financial Assets at Amortized Cost)Document10 pagesNotes - FAR - Loans and Receivables (Financial Assets at Amortized Cost)ElaineJrV-IgotNo ratings yet

- Cash Cash - Money and Other Negotiable Instrument That Is Payable in Money and Acceptable by TheDocument4 pagesCash Cash - Money and Other Negotiable Instrument That Is Payable in Money and Acceptable by TheannyeongNo ratings yet

- Accounting Glossary: © OUP 2013: This Can Be Reproduced For Class Use Solely For The Purchaser's InstituteDocument13 pagesAccounting Glossary: © OUP 2013: This Can Be Reproduced For Class Use Solely For The Purchaser's InstituteAdeenaNo ratings yet

- Basic Accounts TermsDocument7 pagesBasic Accounts TermsJoanne CrysantherNo ratings yet

- G11 FABM Fourth QuarterDocument11 pagesG11 FABM Fourth QuarterFrancis Aaron RafananNo ratings yet

- Cash and Accrual Basis & Single Entry - OUTLINEDocument3 pagesCash and Accrual Basis & Single Entry - OUTLINESophia Marie VerdeflorNo ratings yet

- AccountingDocument24 pagesAccountingnour mohammedNo ratings yet

- ReceivablesDocument20 pagesReceivablesGemmalyn FolguerasNo ratings yet

- Control AccountsDocument1 pageControl AccountsFalak MuscatiNo ratings yet

- RECEIVABLESDocument12 pagesRECEIVABLESNath BongalonNo ratings yet

- Reviewer For Fundamentals of Abm 2 Adjusting EntriesDocument1 pageReviewer For Fundamentals of Abm 2 Adjusting EntriesPsalm Ruvi TalaNo ratings yet

- Fabm 4THDocument3 pagesFabm 4THDrahneel MarasiganNo ratings yet

- Andriod 3Document5 pagesAndriod 3Mark Ghever PopuliNo ratings yet

- Accounting Equation and Double Entry SystemDocument52 pagesAccounting Equation and Double Entry SystemArmandoNo ratings yet

- Statement of Financial PositionDocument2 pagesStatement of Financial PositionRhianne AndradaNo ratings yet

- Chapter 6 Cfas ReviewerDocument2 pagesChapter 6 Cfas ReviewerBabeEbab AndreiNo ratings yet

- 978940180663C SMPLDocument22 pages978940180663C SMPLVi PhươngNo ratings yet

- Project Objectives Key DeliverablesDocument2 pagesProject Objectives Key DeliverablesDeepNo ratings yet

- Lanka Bangla FinanceDocument31 pagesLanka Bangla FinanceJacobHauheng0% (1)

- 12 Points) : A B: Over Co de Ex Out Down Re Ultra UnderDocument2 pages12 Points) : A B: Over Co de Ex Out Down Re Ultra UnderRobert CalcanNo ratings yet

- Enclosures - Nuova ASPDocument156 pagesEnclosures - Nuova ASPNicolae VisanNo ratings yet

- DO30-2017 WordDocument72 pagesDO30-2017 Wordrdne89% (19)

- Unit 10 Wages and SalaryDocument20 pagesUnit 10 Wages and Salarysaravanan subbiahNo ratings yet

- Agrarian Reform in The PhilippinesDocument4 pagesAgrarian Reform in The PhilippinesLadymae Barneso SamalNo ratings yet

- EWM CLASS 25 - Physical Inventory - ProcessDocument9 pagesEWM CLASS 25 - Physical Inventory - ProcessRaviteja KanakaNo ratings yet

- Unit III - Bahasa InggrisDocument8 pagesUnit III - Bahasa InggrisInes Tasya Eunike DimuNo ratings yet

- Lord Agnew LetterDocument2 pagesLord Agnew LetterThe Guardian100% (1)

- Guide To The Markets Q3 2023 1688397991Document100 pagesGuide To The Markets Q3 2023 1688397991nicholasNo ratings yet

- Biturox® Bitumen Processing Units: Selected ReferencesDocument6 pagesBiturox® Bitumen Processing Units: Selected ReferencesLAYTHNo ratings yet

- Habeshaaaa PDFDocument86 pagesHabeshaaaa PDFsilesh kebedeNo ratings yet

- A Synopsis Report ON AT Icici Bank LTD: Dividend DecisionDocument10 pagesA Synopsis Report ON AT Icici Bank LTD: Dividend DecisionMOHAMMED KHAYYUMNo ratings yet

- Layton7e PPT ch08Document20 pagesLayton7e PPT ch08Cyan SeaNo ratings yet

- Drafting Service Level Agreements: Best Practices For Corporate and Technology CounselDocument64 pagesDrafting Service Level Agreements: Best Practices For Corporate and Technology CounselstcastemerNo ratings yet

- Pgdca - Syllabus-1 - 20 8 2010Document19 pagesPgdca - Syllabus-1 - 20 8 2010subeeshup100% (2)

- MDI Placement-1Document87 pagesMDI Placement-1Aditya GavadeNo ratings yet

- Principal of MarketingDocument121 pagesPrincipal of MarketingBindu Devender MahajanNo ratings yet

- How To Become A More Effective LeaderDocument36 pagesHow To Become A More Effective LeaderSerpilNo ratings yet

- Solution Manual For Managerial Economics Foundations of Business Analysis and Strategy 13th Edition Christopher Thomas S Charles MauriceDocument12 pagesSolution Manual For Managerial Economics Foundations of Business Analysis and Strategy 13th Edition Christopher Thomas S Charles Mauriceexosmosetusche.mmh6998% (43)

- Project Report at BajajDocument59 pagesProject Report at Bajajammu ps100% (2)

- Independent Work Week 5 Valentina Acosta..Document7 pagesIndependent Work Week 5 Valentina Acosta..Valentina AcostaNo ratings yet

- Audit Financier by Falloul Moulay El MehdiDocument1 pageAudit Financier by Falloul Moulay El MehdiDriss AitbourigueNo ratings yet

- CUEGIS Essay - Change CorpDocument1 pageCUEGIS Essay - Change CorpSrikar ReddyNo ratings yet

- Group3 PizzanadaDocument36 pagesGroup3 Pizzanadatwiceitzyskz100% (1)

- 1 - Economy of The Mauryan Period PDFDocument12 pages1 - Economy of The Mauryan Period PDFdrexter124100% (3)