Professional Documents

Culture Documents

Ecommerce Sbi HDFC PDF

Ecommerce Sbi HDFC PDF

Uploaded by

Simran ChauhanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ecommerce Sbi HDFC PDF

Ecommerce Sbi HDFC PDF

Uploaded by

Simran ChauhanCopyright:

Available Formats

Pramana Research Journal ISSN NO: 2249-2976

E.Commerce: A comparative Study of SBI and HDFC Bank

Roop Kamal, Assistant Professor, Chandigarh University

E.mail id: Roope7606@cumail.in

Introduction

Banking Industry in India has travelled a long path to assume its present status. It has

undergone a major structural transformation after the independence including the assumption

of social banking. The success in transformation has been achieved by overcoming hurdles and

impediments, stresses and strains. Thus, the development in the banking industry covers the

activities of money lenders with their limited resources and of large scale operations by banks

with huge resources and diversified activities.

The earliest banking system played a significant role till the Mughal period. Their importance is

reduced during the British period as they could not make much use of their services on account

of difference in language and style. In order to meet their financial requirements and banking

assistance, the English agency houses started their own banking business in Calcutta and

Bombay. This was the beginning of the modern banking system in India. So, the history of

modern banking in India dates back to the last quarter of 18th Century. The earliest European

Bank was started by the English agency houses along with their trading activities in 1710 in the

name of Bank of Hindustan. This was followed by setting up of the Bengal Bank in 1984,

General Bank of India in 1786 etc. However, all these banks failed sooner or later due to

various reasons.

ESTABLISHMENT OF RESERVE BANK OF INDIA

The Hilton Young Commission in 1926 recommended the establishment of a separate bank in

the country known as Reserve Bank of India. So a bill was introduced in the Legislative

Assembly in 1933 which led to the establishment of Reserve Bank in 1935. After the

establishment of Reserve Bank of India, the Imperial Bank was authorized to function as a sole

Volume 8, Issue 9, 2018 282 https://pramanaresearch.org/

Pramana Research Journal ISSN NO: 2249-2976

agent of the Reserve Bank of India at all places in India where the Reserve Bank had no

branches.

GROWTH POTENTIALS FOR INDIAN BANKING SYSTEM

Banking sector has remained the backbone of Indian economy since independence. After the

reformative measures of 1991, this industry has been undergoing major changes. Advent of hi-

tech communication and information technology has facilitated growth in Internet banking.

Various other modern services are provided by the banks these days like, ATM services, Mobile

banking, plastic money, paytm etc. these services has improved the banking system to a great

extent. Also, now a days, along with the consumer durable goods, there is marketing of

financial products, like mutual funds, investment policies and insurance policies as well. This is

possible due to the modern banking practices. And also, various initiatives are taken by the

government of India, in the regard of financial inclusion. Various schemes are launched by the

government to promote financial inclusion like Pradhan Mantri Jan Dhan Yojana, with a slogan

of Mera khata, Bhagya Vidhata, as this scheme is providing the option of zero balance account

to its clients. This was done to cover the unbanked population as most of the people, especially

financial illiterate people remain unbanked just because of lack of financial knowledge, so the

government id providing the financial education to the clients through various programs. And

to promote financial inclusion, various banks are appointing its business facilitators and

business correspondents by following the BCBF model initiated by RBI. In this model, various

banking services and functions are performed by the facilitators or correspondents appointed

by the banks. Here, in this model, Business facilitators acts as a agent for its principle bank. So

by following these initiatives, banking system has improved to the great extent and also the

coverage of banking has increased to a great extent.

Internet banking is changing the banking industry and is having the major effects on banking

relationships. Banking is now no longer confined to the branches were one has to approach the

branch in person, to withdraw cash or deposit a cheque or request a statement of accounts. In

true Internet banking, any inquiry or transaction is processed online without any reference to

Volume 8, Issue 9, 2018 283 https://pramanaresearch.org/

Pramana Research Journal ISSN NO: 2249-2976

the branch (anywhere banking) at any time. Providing Internet banking is increasingly becoming

a "need to have" than a "nice to have" service. The net banking, thus, now is more of a norm

rather than an exception in many developed countries due to the fact that it is the cheapest

way of providing banking services

Literature Review

Gupta, 2008, Kamel, 2005, has explained the e banking system as an invaluable and powerful

tool that is developing the banking system t the great extent.

Mahdi and Mehrdad, 2013; Dube, et. al., 2012 has described e banking as a important and

technical tool that is to be used more extensively, for the overall development of banking

system. And e banking also helps in marketing of banking products and services and also in

making the business strategies.

Goi, 2005, he explained the concept of e banking in the light of technological advancement, and

concluded that, it contribute to the distribution channel of banks.

Chang, 2003; Gallup Consulting, 2008, said that the evolution of banking technology has been

driven by changes in distribution channels as evidenced by automated teller machine (ATM),

Phone- banking, Tele-banking, PC-banking and most recently internet banking

Objectives of study

To know the performance of SBI and HDFC on the grounds of E Banking

To know the level of satisfaction among customers on the basis of electronic services

offered by the banks.

Research Methodology

Both primary and secondary data is used for this study. For comparing the performance of both

the banks, the secondary data is collected from the bank’s websites, bank brochures, annual

Volume 8, Issue 9, 2018 284 https://pramanaresearch.org/

Pramana Research Journal ISSN NO: 2249-2976

reports, IBA bulletins etc. And for studying the customer satisfaction, primary data Is collected

from the customers on the basis of questionnaires, one to one interaction etc.

Data Analysis & Interpretation

State Bank of India

CURRENT RATIO:

Formula: Current ratio/ current liability

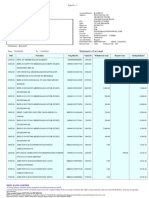

Table no.1 Shows the current assets, current liability and current ratio 2012-2016 of SBI Bank

YEAR 2012 2013 2014 2015 2016

Current assets 142137.07 131296.61 166652 150276.19 162712.19

Current liabilities 169280.15 146920.78 170869.43 165537.33 195022.78

Current ratio 0.839 0.839 0.975 0.907 0.834

Graph. 1

Current ratio

Current ratio

0.975

0.907

0.839

0.839 0.834

2012 2013 2014 2015 2016

PROFITABILITY RATIO:

Gross profit ratio: gross profit ×100/sale

Volume 8, Issue 9, 2018 285 https://pramanaresearch.org/

Pramana Research Journal ISSN NO: 2249-2976

Table no.2 Shows the Gross profit , sales and GP ratio 2012-2016 of SBI bank

Years 2012 2013 2014 2015 2016

Gross profit 10403.06 11831.63 4764.19 5133.87 6595.7

Sales 74880.76 85909.36 81394.36 106521.45 119657.10

G.P ratio 13.89 13.77 5.85 4.81 5.51

Graph. 2

Gross profit

Gross profit

11831.63

10403.06

6595.7

4764.19 5133.87

2012 2013 2014 2015 2016

LEVERAGE RATIO:

Formula: Short term debt +long term debt/shareholder fund

Table no.3 shows that total debt , shareholder funds and leverage ratio.

Years 2012 2013 2014 2015 2016

Total debt 795786.81 907127.83 1053501.77 1170652.93 1371922.28

Shareholder 57947.7 65949.2 64986.04 83951.2 98883.68

fund

Ratio 13.73 13.75 16.21 13.94 13.87

Graph: 3

Volume 8, Issue 9, 2018 286 https://pramanaresearch.org/

Pramana Research Journal ISSN NO: 2249-2976

Leverage Ratio SBI Bank

Ratio

16.21

13.73 13.75 13.94 13.87

2012 2013 2014 2015 2016

LIQUID RATIO:

Formula: Quick assets/ current liability

Table no.4 Shows the Quick assets, Quick liability and Quick ratio 2012-2016 of Sbi bank

Year 2012 2013 2014 2015 2016

Quick assets 105338.93 70325.69 119409.41 27044.03 18607.61

Quick 169280.15 146920.78 170869.43 165537.33 195022.78

liabilities

Quick ratio 0.622 0.478 0.698 0.163 0.095

Graph.4

Liquid ratio SBI Bank

Quick ratio

0.698

0.622

0.478

0.163

0.095

2012 2013 2014 2015 2016

Volume 8, Issue 9, 2018 287 https://pramanaresearch.org/

Pramana Research Journal ISSN NO: 2249-2976

HDFC Bank

CURRENT RATIO:

Formula: Current ratio/ current liability

Table no.1 Shows the current assets, current liability and current ratio 2012-2016 of HDFC

bank.

YEARS 2012 2013 2014 2015 2016

Current asset 23863.45 35897.54 44269.92 42659.36 46294.58

Current lib. 168218.04 201236.07 251973.33 307984.83 364117.75

Current ratio 0.141 0.178 0.175 0.138 0.127

Graph .1

Current ratio HDFC Bank

0.178 0.175

0.141 0.138

0.127

2012 2013 2014 2015 2016

PROFITABILITY RATIO:

The Analysis of financial data of HDFC has been taken from 2012-2016

Gross profit ratio: gross profit ×100/sale

Table no.2 Shows the Gross profit, sales and GP ratio 2012-2016 of HDFC bank

Volume 8, Issue 9, 2018 288 https://pramanaresearch.org/

Pramana Research Journal ISSN NO: 2249-2976

Years 2012 2013 2014 2015 2016

Gross profit 2703.08 2347.19 2170.65 4707.97 3956.63

Sales 19770.72 19958.76 19928.21 27286.35 35064.87

Ratio 0.136 0.117 0.108 0.172 0.112

Graph .2

Gross Profit Ratio HDFC Bank

0.172

0.136

0.117 0.108 0.112

2012 2013 2014 2015 2016

LEVERAGE RATIO:

The Analysis of financial data of HDFC has been taken from 2012-2016

Formula: Short term debt +long term debt/shareholder fund

Table no.3 shows that total debt , shareholder funds and leverage ratio

Years 2012 2013 2014 2015 2016

Long &short 145497.42 180320.13 222980.47 270552.96 329253.58

Equity fund 14652.81 21522.49 25367.36 29924.42 36214.14

Ratio 9.92 8.37 8.79 9.04 0.091

Graph .3

Volume 8, Issue 9, 2018 289 https://pramanaresearch.org/

Pramana Research Journal ISSN NO: 2249-2976

Leverage Ratio of HDFC Bank

9.92

8.37 8.79 9.04

0.091

2012 2013 2014 2015 2016

LIQUID RATIO:

The Analysis of financial data of HDFC has been taken from 2012-2016

Formula: Quick assets/ current liability

Table no.4 Shows the Quick assets, Quick liability and Quick ratio 2012-2016 of HDFC bank.

Years 2012 2013 2014 2015 2016

Quick asset 16659.42 28387.41 35708.31 33175.12 351856.9

Current lib. 168218.04 201236.07 251973.33 307984.83 364117.75

Quick ratio 0.099 0.141 0.141 0.107 0.966

Graph:4

Liquid ratio HDFC Bank

0.966

0.099 0.141 0.141 0.107

2012 2013 2014 2015 2016

Volume 8, Issue 9, 2018 290 https://pramanaresearch.org/

Pramana Research Journal ISSN NO: 2249-2976

Findings

1. The current ratio of SBI has shown non fluctuating trend as 0.839, 0.839, 0.975 , 0.907

and 0.834 during 2012 ,2013, 2014, 2015 and 2016. And The current ratio of HDFC has

also shown non fluctuating trend as 0.141 , 0.178,0.175,0.138 and 0.127 during 2012 ,

2013,2014,2015 and 2016.

2. The gross profit ratio of SBI is in fluctuation manner. It decreased in the current year

compared with the previous year from 13.89% to 4.81%. The gross profit ratio of HDFC

is also in fluctuation manner. It decreased in the current year compared with the

previous year from 0.172% to 0.108%.

3. The leverage ratio is maximum in the year 2014 and minimum in the year 2012. In 2014

the levarage ratio is very high is not a good indicater of sbi. The leverag ratio is

maximum in the year 2012 and minimum in the year 2016. In 2012 the levrage ratio is

very high is not a good indicater of hdfc.

Comparative study of two banks

1. The comparative study of table no .1 in 2016 the current assets of SBI are better than

the current assets of H.D.F.C. and in 2016 the current liabilities of H.D.F.C is better than

the SBI.IN 2015 the current assets of SBI has a better than the current assets of H.D.F.C

and current liabilities of H.D.F.C is better than the SBI. In overall the current position of

SBI is good.

2. The comparative study of table no .2 in 2016 the liquid assets and current liabilities of

H.D.F.C is better than the liquid assets and current liabilities of SBI. In 2015 the liquid

assets and current liabilities of H.D.F.C has a better than the SBI. In overall the current

position of HDFC is good.

3. The comparative study of table no .3 in 2016 the gross profit and sales of SBI is better

than the H.D.F.C. and also In 2015 gross profit and sales of SBI has a better than the

HDFC. In overall the current position of SBI is good.

Volume 8, Issue 9, 2018 291 https://pramanaresearch.org/

Pramana Research Journal ISSN NO: 2249-2976

Bibliography

https://www.edupristine.com/blog/ratio-analysis-introduction

Ratio analysis by P. Murlidhar.

Financial ratio analysis by Chander Shekhar

Financial statement analysis by Martin. S. Fridson.

Volume 8, Issue 9, 2018 292 https://pramanaresearch.org/

You might also like

- SBI Internet Banking ProjectDocument63 pagesSBI Internet Banking ProjectHiteshwar Singh Andotra82% (22)

- Western Constitutionalism - Andrea BurattiDocument257 pagesWestern Constitutionalism - Andrea BurattiGulrukh SadullayevaNo ratings yet

- Acco 365 Review Class QuestionsDocument31 pagesAcco 365 Review Class QuestionsHeyue XiaoNo ratings yet

- Project On Retail BankingDocument74 pagesProject On Retail BankingManasvi Darshan Tolia80% (5)

- Summer Internship ReportDocument58 pagesSummer Internship ReportSaurabh Mishra100% (2)

- Black Book BbiDocument84 pagesBlack Book BbiVikas Shah67% (3)

- Memorial RespondentDocument23 pagesMemorial RespondentDevender Yadav100% (1)

- A Study On The Performance of Banking Ombudsman Scheme in IndiaDocument9 pagesA Study On The Performance of Banking Ombudsman Scheme in Indiashristi2019.ugNo ratings yet

- Summer Internship SbiDocument64 pagesSummer Internship SbiPriya GuptaNo ratings yet

- Bank of MaharashtraDocument84 pagesBank of Maharashtrachakshyutgupta100% (5)

- Marketing of Financial Services Provided By": Dr. D. Y. Patil Vidyapeeth, PuneDocument114 pagesMarketing of Financial Services Provided By": Dr. D. Y. Patil Vidyapeeth, Punesiddharth_sr21No ratings yet

- Summer Internship ReportDocument72 pagesSummer Internship Reportyogya sri patibandaNo ratings yet

- Summer Internship ReportDocument72 pagesSummer Internship Reportyogya sri patibandaNo ratings yet

- An Analysis of The Retail Asset Portfolio of Kangra Cooperative BankDocument42 pagesAn Analysis of The Retail Asset Portfolio of Kangra Cooperative BankAnmol koundalNo ratings yet

- A Project Report ON "Customer Preference and Satisfaction Level For Credit Schemes Offered by The Varachha Co-Operative Bank"Document109 pagesA Project Report ON "Customer Preference and Satisfaction Level For Credit Schemes Offered by The Varachha Co-Operative Bank"Ankit Malani100% (1)

- Shubam Project 1Document49 pagesShubam Project 1Umar ThukarNo ratings yet

- SBI Mobile BankingDocument46 pagesSBI Mobile BankingAbhishek Tiwari100% (3)

- Thesis 2Document55 pagesThesis 2Akher MilonNo ratings yet

- "Mobile Banking Facility of SBI in Rewa City": Project Report ONDocument49 pages"Mobile Banking Facility of SBI in Rewa City": Project Report ONManju MessiNo ratings yet

- Importance of IT in BankingDocument55 pagesImportance of IT in BankingMoinuddin BaigNo ratings yet

- Loan & Advances in BomDocument50 pagesLoan & Advances in Bomfunkisanju1100% (1)

- A Study On Mobile Banking and Its Impact On Customer's Banking Transactions: A Comparative Analysis of Public and Private Sector Banks in IndiaDocument15 pagesA Study On Mobile Banking and Its Impact On Customer's Banking Transactions: A Comparative Analysis of Public and Private Sector Banks in IndiaHarshit GuptaNo ratings yet

- A Study On Mobile Banking and Its Impact On Customer's Banking Transactions: A Comparative Analysis of Public and Private Sector Banks in IndiaDocument15 pagesA Study On Mobile Banking and Its Impact On Customer's Banking Transactions: A Comparative Analysis of Public and Private Sector Banks in IndiaHarshit GuptaNo ratings yet

- Research Paper On Sbi BankDocument8 pagesResearch Paper On Sbi Bankfefatudekek3100% (1)

- Project On Retail BankingDocument74 pagesProject On Retail Bankingshreyshaw21No ratings yet

- Retail Lending Schemes at Canara BankDocument56 pagesRetail Lending Schemes at Canara BankJyot Sidhu100% (1)

- A Summer Internship Report: Multistate Scheduled BankDocument23 pagesA Summer Internship Report: Multistate Scheduled BankHetalKachaNo ratings yet

- Bank of Maharashtra ProjectDocument32 pagesBank of Maharashtra Projectpratik kitlekar100% (1)

- Meezan BankDocument39 pagesMeezan BankAsif Ali0% (2)

- DIPAKDocument60 pagesDIPAKVipul KalathiyaNo ratings yet

- Financial Statement Analysis AssignmentDocument19 pagesFinancial Statement Analysis AssignmentNajihah AdnanNo ratings yet

- TAF138 - VAIBHAV PATIL Black Book ProjectDocument60 pagesTAF138 - VAIBHAV PATIL Black Book ProjectVaibhav PatilNo ratings yet

- SWOT Analysis of IBBLDocument9 pagesSWOT Analysis of IBBLtainul hosen95No ratings yet

- Final Project Report SimranDocument42 pagesFinal Project Report SimransimranNo ratings yet

- "Marketing Ofbaroda Cash Management Services by Neelam NiveditaDocument60 pages"Marketing Ofbaroda Cash Management Services by Neelam NiveditaAakash JadiyaNo ratings yet

- Summer Internship Project ReportDocument33 pagesSummer Internship Project ReportRAHUL KUMARNo ratings yet

- Retail Banking Kotak Mahendra Bank (Operational ManagementDocument99 pagesRetail Banking Kotak Mahendra Bank (Operational ManagementMaster PrintersNo ratings yet

- Research Paper On Indian Banking SectorDocument7 pagesResearch Paper On Indian Banking Sectoriimytdcnd100% (1)

- Axis Bank - ConsolidatedDocument43 pagesAxis Bank - ConsolidatedamolkhadseNo ratings yet

- Master of Business Administration Rajasthan Technical University, KOTADocument70 pagesMaster of Business Administration Rajasthan Technical University, KOTAHatim AliNo ratings yet

- Investment BankingDocument22 pagesInvestment Bankingshaikh ahmedNo ratings yet

- Proposal BinodDocument16 pagesProposal BinodbinuNo ratings yet

- Atm MaintenanceDocument59 pagesAtm MaintenanceRanjeet RajputNo ratings yet

- A Report On E-Products of Indian Overseas BankDocument39 pagesA Report On E-Products of Indian Overseas BankThadoi ThangjamNo ratings yet

- SBI Internet BankingDocument21 pagesSBI Internet BankingHiteshwar Singh Andotra60% (5)

- Internship Report AB BankDocument70 pagesInternship Report AB BankS M Mazharul KarimNo ratings yet

- Devendra Tiwari Mba MRPDocument26 pagesDevendra Tiwari Mba MRPambrishgpt9360% (1)

- FM - Amreli Nagrik Bank - 2Document84 pagesFM - Amreli Nagrik Bank - 2jagrutisolanki01No ratings yet

- A Study On Services Quality of SBI In: P.RoselinDocument4 pagesA Study On Services Quality of SBI In: P.RoselinSanchit ParnamiNo ratings yet

- Future Indian Banking - Internet BankingDocument98 pagesFuture Indian Banking - Internet BankingRahul R RohitNo ratings yet

- Retail Banking Project BOIDocument107 pagesRetail Banking Project BOIPooja Mathur100% (1)

- J P BankDocument115 pagesJ P BankPruthviraj RathoreNo ratings yet

- Grand Project ReportDocument127 pagesGrand Project ReportVinay VinayNo ratings yet

- A Project Report On Banking 29Document28 pagesA Project Report On Banking 29manojkumaryadav2514No ratings yet

- DiruDocument84 pagesDirudhiru_hadiaNo ratings yet

- Mergers and Acquisition 02Document77 pagesMergers and Acquisition 02Anil Kumar Singh100% (2)

- A Project Report ON Role of Financial Services in India: AcknowledgementDocument79 pagesA Project Report ON Role of Financial Services in India: AcknowledgementPreeti Vijay ManchandaNo ratings yet

- Sbi Project Copy 1Document200 pagesSbi Project Copy 1Akshay SherekarNo ratings yet

- A Comparative Study On Customer Services Rendered by State Bank of India and ICICI Bank in Sivagangai DistrictDocument15 pagesA Comparative Study On Customer Services Rendered by State Bank of India and ICICI Bank in Sivagangai DistrictRomi.Roy1820 MBANo ratings yet

- Robinson's Galleria Vs SanchezDocument9 pagesRobinson's Galleria Vs SanchezChristelle Ayn BaldosNo ratings yet

- Main Menu: Create Account Log inDocument34 pagesMain Menu: Create Account Log inpbhiztaeujdhwuwnfdNo ratings yet

- As The Inspector Said 2Document1 pageAs The Inspector Said 2Megan MorisNo ratings yet

- GST Invoice: SL No. 1 2.000 KG. 2 2.000 KGDocument2 pagesGST Invoice: SL No. 1 2.000 KG. 2 2.000 KGDNYANESHWAR PAWARNo ratings yet

- Changes at Lee Correctional Since 2018Document2 pagesChanges at Lee Correctional Since 2018WIS Digital News StaffNo ratings yet

- Lessons Learned From Board Members of ColorDocument12 pagesLessons Learned From Board Members of Color3BL Media StaffNo ratings yet

- RBI Mail MessageDocument2 pagesRBI Mail MessageBitan GhoshNo ratings yet

- Pentium Celeron N Series J Series Datasheet Vol 1 PDFDocument220 pagesPentium Celeron N Series J Series Datasheet Vol 1 PDFRivai GoBlog100% (1)

- RephrasingDocument11 pagesRephrasingAlexandraGăină100% (1)

- Jeff Lynne See E13 1 Has Studied The Information You Gave PDFDocument1 pageJeff Lynne See E13 1 Has Studied The Information You Gave PDFAnbu jaromiaNo ratings yet

- ASTM-2030 SandDocument1 pageASTM-2030 SandSauron2014No ratings yet

- PF - Criminal Procedure Cabato NotesDocument128 pagesPF - Criminal Procedure Cabato NotesglaiNo ratings yet

- Torts Case Digest 5Document13 pagesTorts Case Digest 5alyssamaesana100% (3)

- 74LS01 PDFDocument11 pages74LS01 PDFBreno Ortega FernandezNo ratings yet

- Grooming and Sexual Offences DataDocument2 pagesGrooming and Sexual Offences DataKash Ahmed100% (1)

- Delta Green Future Perfect 2Document25 pagesDelta Green Future Perfect 2Paddon100% (2)

- FxView FAQDocument9 pagesFxView FAQCarlaLopesNo ratings yet

- Che Guevara Fundamentals of Guerrilla WarfareDocument35 pagesChe Guevara Fundamentals of Guerrilla WarfareFelix Geromo100% (1)

- Project 3 - Ratio AnalysisDocument2 pagesProject 3 - Ratio AnalysisATANU GANGULYNo ratings yet

- Regd. With A.D. C-11 ESI Corporation, Ashram Road, Ahmedabad-380014Document2 pagesRegd. With A.D. C-11 ESI Corporation, Ashram Road, Ahmedabad-380014Rajput Mittu100% (1)

- MS7SL800 - Assignment - 1 - McBrideDocument36 pagesMS7SL800 - Assignment - 1 - McBrideDaniel AjanthanNo ratings yet

- Nomad Installation GuideDocument46 pagesNomad Installation Guidelmlm007No ratings yet

- PEARL & DEAN (PHIL.), INC. Vs SHOEMART, INC GR No. 148222Document2 pagesPEARL & DEAN (PHIL.), INC. Vs SHOEMART, INC GR No. 148222Cates Torres100% (1)

- History Section 3 Notes PDFDocument24 pagesHistory Section 3 Notes PDFMa Dong ChanNo ratings yet

- (LCVPF Academy) 4.1. Basics of AccountingDocument46 pages(LCVPF Academy) 4.1. Basics of AccountingBayalag Munkh-ErdeneNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument34 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceMehndi HasanNo ratings yet

- Business Law Week 1 and 2Document8 pagesBusiness Law Week 1 and 2HannahNo ratings yet