Professional Documents

Culture Documents

Assignment 1 - CAPITAL RATIONING AND PI

Assignment 1 - CAPITAL RATIONING AND PI

Uploaded by

Chirag JainOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assignment 1 - CAPITAL RATIONING AND PI

Assignment 1 - CAPITAL RATIONING AND PI

Uploaded by

Chirag JainCopyright:

Available Formats

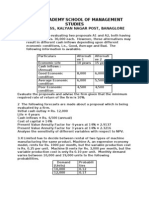

CAPITAL RATIONING AND RELEVANT CASH FLOWS

Basril plc is reviewing investment proposals that have been submitted by divisional

managers. The investment funds of the company are limited to Rs.800,000 in the current

year. Details of three possible investments, none of which can be delayed, are given below.

Project 1

An investment of Rs.300,000 in work-station assessments. Each assessment would be on an

individual employee basis and would lead to savings in labour costs from increased

efficiency and from reduced absenteeism due to work-related illness. Savings in labour costs

from these assessments in money terms are expected to be as follows:

Year 1 2 3 4 5

Cash flows (Rs.000) 85 90 95 100 95

Project 2

An investment of Rs.450,000 in individual workstations for staff that is expected to reduce

administration costs by Rs.140,800 per annum in money terms for the next five years.

Project 3

An investment of Rs.400,000 in new ticket machines. Net cash savings of Rs.120,000 per

annum are expected in current price terms and these are expected to increase by 3·6% per

annum due to inflation during the five-year life of the machines.

Basril plc has a money cost of capital of 12% and taxation should be ignored.

Required:

(a) Determine the best way for Basril plc to invest the available funds and calculate the

resultant NPV:

(i) on the assumption that each of the three projects is divisible;

(ii) on the assumption that none of the projects are divisible.

(b) Explain how the NPV investment appraisal method is applied in situations where

capital is rationed.

(c) Discuss the reasons why capital rationing may arise.

(d) Discuss the meaning of the term ‘relevant cash flows’ in the context of investment

appraisal, giving examples to illustrate your discussion.

ASSIGNEMENT HOME 1

You might also like

- 8508Document10 pages8508Danyal ChaudharyNo ratings yet

- Question of Capital BudgetingDocument7 pagesQuestion of Capital Budgeting29_ramesh170100% (2)

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- MBA Project Report On DLFDocument35 pagesMBA Project Report On DLFChirag JainNo ratings yet

- Capital Budgeting-ProblemsDocument5 pagesCapital Budgeting-ProblemsUday Gowda50% (2)

- Tutorial 5 Investment Appraisal Tutorial QuestionsDocument3 pagesTutorial 5 Investment Appraisal Tutorial QuestionsNicholas LowNo ratings yet

- Section A - QuestionsDocument27 pagesSection A - Questionsnek_akhtar87250% (1)

- Capital Budgeting Illustrative NumericalsDocument6 pagesCapital Budgeting Illustrative NumericalsPriyanka Dargad100% (1)

- B1 Free Solving Nov 2019) - Set 4Document11 pagesB1 Free Solving Nov 2019) - Set 4paul sagudaNo ratings yet

- P4 Advanced Investment AppraisalDocument37 pagesP4 Advanced Investment AppraisalfarzycimaNo ratings yet

- Capital Budgeting3Document1 pageCapital Budgeting3Avishek GhosalNo ratings yet

- Business Finance II: Exercise 1Document7 pagesBusiness Finance II: Exercise 1faisalNo ratings yet

- ICAI Nov 2013 - SuggestedDocument26 pagesICAI Nov 2013 - SuggestedcaamitthapaNo ratings yet

- Project Appraisal-1 PDFDocument23 pagesProject Appraisal-1 PDFFareha RiazNo ratings yet

- Project Appraisal 1Document23 pagesProject Appraisal 1Fareha RiazNo ratings yet

- 4a. Capital BudgetingDocument6 pages4a. Capital BudgetingShubhrant ShuklaNo ratings yet

- Model Papers: (C B E - T R A)Document23 pagesModel Papers: (C B E - T R A)Asal IslamNo ratings yet

- Capital Investment Appraisal MethodsDocument13 pagesCapital Investment Appraisal MethodsBwami Vieira PatrickNo ratings yet

- Tutorial 4 - SolutionDocument16 pagesTutorial 4 - SolutionNg Chun SenfNo ratings yet

- CF - PWS - 5Document3 pagesCF - PWS - 5cyclo tronNo ratings yet

- Investment Decision QuestionsDocument44 pagesInvestment Decision QuestionsAkash JhaNo ratings yet

- Karunya University: M.B.A. Trimester Examination - January 2010Document2 pagesKarunya University: M.B.A. Trimester Examination - January 2010nandhuNo ratings yet

- Discounted Cash Flow - 082755Document3 pagesDiscounted Cash Flow - 082755EuniceNo ratings yet

- Sums On Project AnalysisDocument26 pagesSums On Project AnalysisAlbert Thomas80% (5)

- Mba Executive - I Year 2 Semester / January 2021Document2 pagesMba Executive - I Year 2 Semester / January 2021gaurav jainNo ratings yet

- SFMDocument29 pagesSFMShrinivas PrabhuneNo ratings yet

- Project Financial Appraisal - NumericalsDocument5 pagesProject Financial Appraisal - NumericalsAbhishek KarekarNo ratings yet

- Investment Decisions Problems 2Document5 pagesInvestment Decisions Problems 2MussaNo ratings yet

- MTP 19 53 Questions 1713430127Document12 pagesMTP 19 53 Questions 1713430127Murugesh MuruNo ratings yet

- Business - Analysis Dec-11Document3 pagesBusiness - Analysis Dec-11SHEIKH MOHAMMAD KAUSARUL ALAMNo ratings yet

- BBM 410 Final FM EXAMDocument4 pagesBBM 410 Final FM EXAMcyrusNo ratings yet

- SFM - 1Document3 pagesSFM - 1ketulNo ratings yet

- Management Programme Term-End Examination December, 2018 Ms-004: Accounting and Finance For ManagersDocument3 pagesManagement Programme Term-End Examination December, 2018 Ms-004: Accounting and Finance For ManagersreliableplacementNo ratings yet

- 01 - Adv Issues in Cap BudgetingDocument17 pages01 - Adv Issues in Cap BudgetingMudit KumarNo ratings yet

- Investment Appraisal Review QuestionsDocument5 pagesInvestment Appraisal Review QuestionsGadafi FuadNo ratings yet

- Capital Budgeting Exercise1Document14 pagesCapital Budgeting Exercise1rohini jha0% (1)

- 78735bos63031 p6Document44 pages78735bos63031 p6dileepkarumuri93No ratings yet

- Capital Budgeting Sums - 16-17 (2018 - 05 - 19 12 - 01 - 33 UTC) (2019 - 01 - 22 04 - 17 - 23 UTC) (2019 - 07 - 02 05 - 43 - 05 UTC) PDFDocument7 pagesCapital Budgeting Sums - 16-17 (2018 - 05 - 19 12 - 01 - 33 UTC) (2019 - 01 - 22 04 - 17 - 23 UTC) (2019 - 07 - 02 05 - 43 - 05 UTC) PDFutsavNo ratings yet

- PBF Assignment 1Document2 pagesPBF Assignment 1Sujith SomanNo ratings yet

- Financial Management - QB & Model - 2016 RegulationsDocument11 pagesFinancial Management - QB & Model - 2016 RegulationsGowthamSathyamoorthySNo ratings yet

- Ii Semester Endterm Examination March 2016Document2 pagesIi Semester Endterm Examination March 2016Nithyananda PatelNo ratings yet

- Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerDocument5 pagesQuestion No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerSushmanth ReddyNo ratings yet

- Financial Management-Capital Budgeting:: Answer The Following QuestionsDocument2 pagesFinancial Management-Capital Budgeting:: Answer The Following QuestionsMitali JulkaNo ratings yet

- (l6) Corporate Financial Management2015Document22 pages(l6) Corporate Financial Management2015Moses Mvula100% (2)

- MCom - Accounts Ch-3 Topic7Document20 pagesMCom - Accounts Ch-3 Topic7Sameer GoyalNo ratings yet

- Adv AnsDocument13 pagesAdv AnsOcto ManNo ratings yet

- Paper - 2: Strategic Financial Management Questions and Answers Questions International Capital BudgetingDocument33 pagesPaper - 2: Strategic Financial Management Questions and Answers Questions International Capital BudgetingAyushNo ratings yet

- Ex.C.BudgetDocument3 pagesEx.C.BudgetGeethika NayanaprabhaNo ratings yet

- Finance RTP Cap-II June 2016Document37 pagesFinance RTP Cap-II June 2016Artha sarokarNo ratings yet

- Financial Management - Sem Ii - Question BankDocument11 pagesFinancial Management - Sem Ii - Question BankHIDDEN Life OF 【शैलेष】No ratings yet

- 5, 6 & 7 Capital BudgetingDocument42 pages5, 6 & 7 Capital BudgetingNaman AgarwalNo ratings yet

- MBA-I Sem - II Subject: Financial Management (202) : Assignment Submission: 5 Nov 2016Document3 pagesMBA-I Sem - II Subject: Financial Management (202) : Assignment Submission: 5 Nov 2016ISLAMICLECTURESNo ratings yet

- Topic 4-Use Appraisal Techniques in Project Evaluation - Review Questions Only-StudentsDocument5 pagesTopic 4-Use Appraisal Techniques in Project Evaluation - Review Questions Only-Studentseliza ChaleNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument0 pages© The Institute of Chartered Accountants of IndiaamitmdeshpandeNo ratings yet

- BFDDocument4 pagesBFDaskermanNo ratings yet

- Investment Appraisal TAE TESTDocument2 pagesInvestment Appraisal TAE TESTJames MartinNo ratings yet

- Tutorial 3a-Cash Flow EstimationDocument3 pagesTutorial 3a-Cash Flow EstimationPrincessCC20No ratings yet

- Unit 2 Capital Budgeting Decisions: IllustrationsDocument4 pagesUnit 2 Capital Budgeting Decisions: IllustrationsJaya SwethaNo ratings yet

- MS-4 (2007)Document6 pagesMS-4 (2007)singhbaneetNo ratings yet

- sFikv8tLO3DuTOB3I8bY 4762Document2 pagessFikv8tLO3DuTOB3I8bY 4762dipusharma4200No ratings yet

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosFrom EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNo ratings yet

- Corporate Tax Planning & Management Mid Term Assessment-1 Maximum Marks: 20 Duration: 9:30 AM-11:00 AMDocument3 pagesCorporate Tax Planning & Management Mid Term Assessment-1 Maximum Marks: 20 Duration: 9:30 AM-11:00 AMChirag JainNo ratings yet

- NegotiationDocument9 pagesNegotiationChirag JainNo ratings yet

- Submitted by - 1. Simran Agarwal 2. Rohit Kumar Singh 3. Rishabh Rajora 4. Hitesh Khandawal 5. Aditi SinghDocument20 pagesSubmitted by - 1. Simran Agarwal 2. Rohit Kumar Singh 3. Rishabh Rajora 4. Hitesh Khandawal 5. Aditi SinghChirag JainNo ratings yet

- BNPP MF Fund Facts August 2020 5245Document39 pagesBNPP MF Fund Facts August 2020 5245Chirag JainNo ratings yet

- The U.S. Textile and Apparel Industry in The Age of GlobalizationDocument25 pagesThe U.S. Textile and Apparel Industry in The Age of GlobalizationChirag JainNo ratings yet

- Bata WatnaDocument2 pagesBata WatnaChirag JainNo ratings yet

- Aditya - Empower September 2020 PDFDocument102 pagesAditya - Empower September 2020 PDFChirag JainNo ratings yet

- Baroda Factsheet August 2020Document28 pagesBaroda Factsheet August 2020Chirag JainNo ratings yet

- Ah Counter Report: DirectionsDocument1 pageAh Counter Report: DirectionsChirag JainNo ratings yet

- Credit Derivatives: An Overview and The Basics of PricingDocument39 pagesCredit Derivatives: An Overview and The Basics of PricingChirag JainNo ratings yet

- Material VarianceDocument10 pagesMaterial VarianceChirag JainNo ratings yet

- Factsheet: August 31st, 2020Document40 pagesFactsheet: August 31st, 2020Chirag JainNo ratings yet

- New Doc 2019-11-14 10.40.15Document2 pagesNew Doc 2019-11-14 10.40.15Chirag JainNo ratings yet

- DLF LTD 4 728Document1 pageDLF LTD 4 728Chirag JainNo ratings yet

- Presentation By:: Laxminarasimhan (27) Vaibhav Agarwal (37) Mayank Singhal (38) Chirag JainDocument9 pagesPresentation By:: Laxminarasimhan (27) Vaibhav Agarwal (37) Mayank Singhal (38) Chirag JainChirag JainNo ratings yet

- SM Topics For PsdaDocument1 pageSM Topics For PsdaChirag JainNo ratings yet

- Contribution of Msmes With Reference To Entrepreneurship Development and Employment Generation in North-East India: A Critical EvaluationDocument8 pagesContribution of Msmes With Reference To Entrepreneurship Development and Employment Generation in North-East India: A Critical EvaluationChirag JainNo ratings yet