Professional Documents

Culture Documents

What Are The Kinds of Bill of Exchange?

What Are The Kinds of Bill of Exchange?

Uploaded by

AireyCopyright:

Available Formats

You might also like

- Unit 4 - Contracts 2-1Document30 pagesUnit 4 - Contracts 2-1sarthak chughNo ratings yet

- Features of A Negotiable InstrumentDocument4 pagesFeatures of A Negotiable InstrumentAditi100% (7)

- Procedure de 799Document9 pagesProcedure de 799JOHN MONROYNo ratings yet

- Notes On Negotiable Intruments Law Part 1Document13 pagesNotes On Negotiable Intruments Law Part 1JurilBrokaPatiño100% (1)

- BUS LAW 103 AssignmentDocument4 pagesBUS LAW 103 AssignmentAireyNo ratings yet

- Unit - 2 Negotiable Instruments: Kantharaju N.P. Ananya Institute of Commerce and ManagementDocument9 pagesUnit - 2 Negotiable Instruments: Kantharaju N.P. Ananya Institute of Commerce and ManagementvasistaharishNo ratings yet

- UNIT 4 NotesDocument8 pagesUNIT 4 NotesPiyush SinglaNo ratings yet

- Negotiable Instrument & Bill of ExchangeDocument12 pagesNegotiable Instrument & Bill of ExchangeAlokha Vincent100% (1)

- Nego Finals ReviewerDocument22 pagesNego Finals ReviewerAnna Katrina VistanNo ratings yet

- Nego Finals ReviewerDocument22 pagesNego Finals ReviewerJay-ArhNo ratings yet

- Credit Function and A Payment Function. The Credit Function Allows NegotiableDocument2 pagesCredit Function and A Payment Function. The Credit Function Allows NegotiableGerson Lipaygo Dela PeñaNo ratings yet

- Reviewer in NegoDocument7 pagesReviewer in NegoJoan BartolomeNo ratings yet

- ASSIGNMENTDocument12 pagesASSIGNMENTMindalyn FranciscoNo ratings yet

- The Negotiable Instrument Act, 1881Document18 pagesThe Negotiable Instrument Act, 1881GarimaNo ratings yet

- Governing Law: - The Negotiable Instruments Law (ACT No. 2031)Document7 pagesGoverning Law: - The Negotiable Instruments Law (ACT No. 2031)Leilani WeeNo ratings yet

- Chapter 5 Bank Credit InstrumentsDocument5 pagesChapter 5 Bank Credit InstrumentsMariel Crista Celda Maravillosa100% (2)

- Jannel Yza S. Gunida Bsba - Iv Negotiation Lecture I. Preliminary Subject - Matter On Negotiation A. Most Common Forms of Negotiable InstrumentDocument6 pagesJannel Yza S. Gunida Bsba - Iv Negotiation Lecture I. Preliminary Subject - Matter On Negotiation A. Most Common Forms of Negotiable Instrumentyza gunidaNo ratings yet

- Topic 2 - NegoDocument3 pagesTopic 2 - NegoDANICA FLORESNo ratings yet

- Negotiable Instruments ActDocument15 pagesNegotiable Instruments ActParag Darwade100% (1)

- NEGOTIABLE INST-WPS OfficeDocument9 pagesNEGOTIABLE INST-WPS OfficeJeanmarie Raker100% (1)

- NEGO Part1 by k2Document3 pagesNEGO Part1 by k2'atsirk-sinu AlemaniaNo ratings yet

- Characteristics of Negotiable InstrumentsDocument12 pagesCharacteristics of Negotiable InstrumentsSiddh Shah ⎝⎝⏠⏝⏠⎠⎠No ratings yet

- Nego Finals ReviewerDocument20 pagesNego Finals ReviewerHaifa Apple Sampaco PimpingNo ratings yet

- B.Law Assignment N.IDocument9 pagesB.Law Assignment N.IWazeeer AhmadNo ratings yet

- Negotiable InstrumentsDocument17 pagesNegotiable InstrumentsShamaarajShankerNo ratings yet

- 2negotiable InstrumentDocument8 pages2negotiable Instrumenttanjimalomturjo1No ratings yet

- NIL THEORY - Doc 2Document7 pagesNIL THEORY - Doc 2nikoleNo ratings yet

- Credit InstrumentsDocument18 pagesCredit InstrumentsRichard100% (2)

- Nego Finals RevieweDocument20 pagesNego Finals RevieweiambaybayanonNo ratings yet

- Negotiable Instrument ActDocument9 pagesNegotiable Instrument ActHimanshu DarganNo ratings yet

- Bankingtheorylawpracticeunitiiippt 240307181015 7e5977faDocument29 pagesBankingtheorylawpracticeunitiiippt 240307181015 7e5977fadharshan0425No ratings yet

- Chapter 5 - Bank Credit InstrumentsDocument5 pagesChapter 5 - Bank Credit InstrumentsMhaiNo ratings yet

- Promises To Pay Versus Order To PayDocument1 pagePromises To Pay Versus Order To Paylou merphy castilloNo ratings yet

- Negotiable Instrument: Promissory Note, Bill of Exchange, or Cheque Payable Either To Order or To The Bearer"Document5 pagesNegotiable Instrument: Promissory Note, Bill of Exchange, or Cheque Payable Either To Order or To The Bearer"Amandeep Singh Manku100% (1)

- Negotiable Instruments ReviewerDocument31 pagesNegotiable Instruments ReviewerFaye Cience BoholNo ratings yet

- Negotiable Instruments: - MicaellagarciaDocument4 pagesNegotiable Instruments: - MicaellagarciaMicaella100% (1)

- Notes - 11092020Document4 pagesNotes - 11092020DANICA FLORESNo ratings yet

- Negotiable InstrumentsDocument9 pagesNegotiable Instrumentskehindemustapha505No ratings yet

- Unit - 4 LPB - Negotiable InstrumentsDocument13 pagesUnit - 4 LPB - Negotiable InstrumentsVeena ReddyNo ratings yet

- Bills of ExchangeDocument10 pagesBills of ExchangeRomesh DulanNo ratings yet

- Reviewer in NegoDocument9 pagesReviewer in NegoMhayBinuyaJuanzonNo ratings yet

- Unit 13: 1. What Is A Negotiable InstrumentDocument7 pagesUnit 13: 1. What Is A Negotiable InstrumentAyas JenaNo ratings yet

- Negotiable Instruments Act, 1881Document33 pagesNegotiable Instruments Act, 1881Vinayak Khemani100% (1)

- Banking PresentationDocument21 pagesBanking Presentationpreetha1507mNo ratings yet

- Banking Law B.com - Docx LatestDocument69 pagesBanking Law B.com - Docx LatestViraja Guru100% (1)

- PDF&Rendition 1 1Document73 pagesPDF&Rendition 1 1Srividya SNo ratings yet

- NegoDocument17 pagesNegoIrene QuimsonNo ratings yet

- Business Law Unit-4 NotesDocument16 pagesBusiness Law Unit-4 NotesTushar GaurNo ratings yet

- Ni PDFDocument67 pagesNi PDFShubham SharmaNo ratings yet

- College Financial-Mgmt-Accounting 9Document4 pagesCollege Financial-Mgmt-Accounting 9Naka MakuNo ratings yet

- Negotiable InstrumentsDocument23 pagesNegotiable Instrumentssweetchotu100% (1)

- Law On SalesDocument4 pagesLaw On SalesCarie Joy CabilloNo ratings yet

- Negotiable InstrumentDocument9 pagesNegotiable Instrumentvishal bagariaNo ratings yet

- Negotiable Instrument Law Module: 1 Semester, AY 2020-2021Document5 pagesNegotiable Instrument Law Module: 1 Semester, AY 2020-2021Diomar GusiNo ratings yet

- Bill of ExchangeDocument4 pagesBill of ExchangeS K MahapatraNo ratings yet

- Assignment No. 7 - JAReyes - COMMREVDocument6 pagesAssignment No. 7 - JAReyes - COMMREVReyes JericksonNo ratings yet

- A Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsFrom EverandA Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsNo ratings yet

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

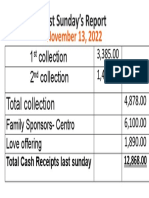

- Financial Report-1Document1 pageFinancial Report-1AireyNo ratings yet

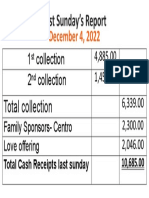

- 2 CollectionDocument1 page2 CollectionAireyNo ratings yet

- Pretest Post TestDocument40 pagesPretest Post TestAireyNo ratings yet

- IFRS 16 - Sale and LeasebackDocument2 pagesIFRS 16 - Sale and LeasebackAireyNo ratings yet

- Other Comprehensive Income - 2022Document2 pagesOther Comprehensive Income - 2022AireyNo ratings yet

- Theoretical FrameworkDocument6 pagesTheoretical FrameworkAireyNo ratings yet

- Financial ReportDocument1 pageFinancial ReportAireyNo ratings yet

- John Mark D. Terante Activity 3.1 1. Planting A Garden and Having A Family. 2. SimilarDocument3 pagesJohn Mark D. Terante Activity 3.1 1. Planting A Garden and Having A Family. 2. SimilarAireyNo ratings yet

- Aireyca Glenn G. Lanaban Bsa-3 WTH 5:15Pm-6:45 PMDocument2 pagesAireyca Glenn G. Lanaban Bsa-3 WTH 5:15Pm-6:45 PMAireyNo ratings yet

- Lanaban, Midterm Government AccountingDocument4 pagesLanaban, Midterm Government AccountingAireyNo ratings yet

- (After Aning Naa Sa Above Na Slide Glenny I Insert Ni:) : Example 1Document3 pages(After Aning Naa Sa Above Na Slide Glenny I Insert Ni:) : Example 1AireyNo ratings yet

- Revenue CycleDocument3 pagesRevenue CycleAireyNo ratings yet

- A Vocation For EveryoneDocument2 pagesA Vocation For EveryoneAireyNo ratings yet

- T-Test: T-TEST PAIRS Radial WITH Belted (PAIRED) /CRITERIA CI (.9500) /missing AnalysisDocument2 pagesT-Test: T-TEST PAIRS Radial WITH Belted (PAIRED) /CRITERIA CI (.9500) /missing AnalysisAireyNo ratings yet

- Defined Benefit PlanDocument6 pagesDefined Benefit PlanAireyNo ratings yet

- Cuses, Issues, Impact-Final OuputDocument2 pagesCuses, Issues, Impact-Final OuputAireyNo ratings yet

- Acquaintance Party: College of Accounting EducationDocument2 pagesAcquaintance Party: College of Accounting EducationAireyNo ratings yet

- Lanaban, Journal 1 ReflectionDocument2 pagesLanaban, Journal 1 ReflectionAireyNo ratings yet

- BUS LAW 103 AssignmentDocument4 pagesBUS LAW 103 AssignmentAireyNo ratings yet

- Revised Standard Chart of Accounts For Cooperatives: Account Code Account TitleDocument36 pagesRevised Standard Chart of Accounts For Cooperatives: Account Code Account TitleAireyNo ratings yet

- Assumption College of Nabunturan: Nabunturan, Compostela Valley ProvinceDocument4 pagesAssumption College of Nabunturan: Nabunturan, Compostela Valley ProvinceAireyNo ratings yet

- San Vicente Ferrer Quasi Parish Statement of Cash Flow For The Fiscal Year Ended August 31, 2019Document2 pagesSan Vicente Ferrer Quasi Parish Statement of Cash Flow For The Fiscal Year Ended August 31, 2019AireyNo ratings yet

- Cuses, Issues, Impact-Final OuputDocument2 pagesCuses, Issues, Impact-Final OuputAireyNo ratings yet

- ABM 1 - Module 2 Assessment Name: SectionDocument1 pageABM 1 - Module 2 Assessment Name: SectionAireyNo ratings yet

- CG Croup 2 ExcelDocument25 pagesCG Croup 2 ExcelKhanh LinhNo ratings yet

- Trade Off Between Liquidity and Profitability: Hina Mushtaq, Dr. Anwar F. Chishti, Sumaira Kanwal, Sobia SaeedDocument20 pagesTrade Off Between Liquidity and Profitability: Hina Mushtaq, Dr. Anwar F. Chishti, Sumaira Kanwal, Sobia SaeedNiravNo ratings yet

- Soneva Total Impact Assessment 2018Document32 pagesSoneva Total Impact Assessment 2018Maud RamillonNo ratings yet

- Planning: 7. Outsourcing and Risk ManagementDocument20 pagesPlanning: 7. Outsourcing and Risk ManagementJoão PedroNo ratings yet

- Capital BudgetingDocument15 pagesCapital BudgetingJoshua Naragdag ColladoNo ratings yet

- The Factors That Affects The Investment Behavior (PPT c1)Document24 pagesThe Factors That Affects The Investment Behavior (PPT c1)Jiezle JavierNo ratings yet

- Rptviewer1 - 2023-08-28T182709.656Document1 pageRptviewer1 - 2023-08-28T182709.656Zeeshan ZaheerNo ratings yet

- HollandZorg Flexpolis - EngelsDocument56 pagesHollandZorg Flexpolis - EngelsKrzysztof DrozdNo ratings yet

- 12 Ipsas 12 Inventories 1Document19 pages12 Ipsas 12 Inventories 1Hastings KapalaNo ratings yet

- 11 - Sales Force Effectiveness Zoltners PDFDocument19 pages11 - Sales Force Effectiveness Zoltners PDFAdarsh Singh RathoreNo ratings yet

- What Programmatic Acquirers Do DifferentlyDocument7 pagesWhat Programmatic Acquirers Do DifferentlyMohammed ShalawyNo ratings yet

- Case 12 Heinz FIN 635Document39 pagesCase 12 Heinz FIN 635jack stauberNo ratings yet

- Updated FAC4866 Test 1suggested Solution April 2024Document4 pagesUpdated FAC4866 Test 1suggested Solution April 2024malwandeNo ratings yet

- 6 Interim ReportingDocument3 pages6 Interim ReportingBrian VillaluzNo ratings yet

- Ebook Economics 4Th Edition Krugman Solutions Manual Full Chapter PDFDocument38 pagesEbook Economics 4Th Edition Krugman Solutions Manual Full Chapter PDFalexispatrickespgjiyntd100% (14)

- Solve 111Document2 pagesSolve 111lalalalaNo ratings yet

- C 1 Basic Principles in Engineering EconomicsDocument14 pagesC 1 Basic Principles in Engineering EconomicsAbenezer WondimuNo ratings yet

- Prepayment of Your Personal Loan Account:XXXXXXXXXXXX4785Document2 pagesPrepayment of Your Personal Loan Account:XXXXXXXXXXXX4785Daniel GnanaselvamNo ratings yet

- Cash To Accrual Basis of AccountingDocument6 pagesCash To Accrual Basis of AccountingChocobetternotNo ratings yet

- Chapter 6: International Business and TradeDocument3 pagesChapter 6: International Business and Tradegian reyesNo ratings yet

- Modified Pag-Ibig Ii Enrollment FormDocument2 pagesModified Pag-Ibig Ii Enrollment FormJazziel Fortaliza100% (1)

- Open Loop Payment SystemDocument22 pagesOpen Loop Payment SystemSalman KhanNo ratings yet

- TransNum Mar 29 113605 PDFDocument3 pagesTransNum Mar 29 113605 PDFGomathiNo ratings yet

- 1170693Document12 pages1170693ishare digitalNo ratings yet

- Fin 365 Individual Assignment Muhd Sharizan (2020453984)Document3 pagesFin 365 Individual Assignment Muhd Sharizan (2020453984)mohd ChanNo ratings yet

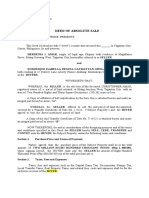

- Deed of Absolute SaleDocument3 pagesDeed of Absolute SalePending_nameNo ratings yet

- Accounts Isc Final ProjectDocument13 pagesAccounts Isc Final ProjectRahit Mitra100% (1)

- Registration As Barangay Micro Business EnterpriseDocument1 pageRegistration As Barangay Micro Business EnterpriseDan GoNo ratings yet

- Tugas Kelompok Manajemen Keuangan Semester 3Document5 pagesTugas Kelompok Manajemen Keuangan Semester 3IdaNo ratings yet

What Are The Kinds of Bill of Exchange?

What Are The Kinds of Bill of Exchange?

Uploaded by

AireyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

What Are The Kinds of Bill of Exchange?

What Are The Kinds of Bill of Exchange?

Uploaded by

AireyCopyright:

Available Formats

Aireyca Glenn G.

Lanaban BSA-3

Business Law 103(MTF 7:15Pm- 8:15Pm)

1. What are the kinds of bill of exchange?

Demand or Sight draft- This bill of exchange is payable on demand at sight, that is, when the

holder presents it for payment, or a stated time after sight.

Time draft- the bill of exchange is payable at a definite future time or some future determinable

time.

Inland bill of exchange- a bill which is drawn and payable within the same state

Foreign bills of exchange- a bill drawn in one state or country and payable in another state or

country

Trade acceptance- A draft or bill of exchange drawn by the seller on the purchaser of goods

and accepted by the latter by signing it as drawee.

Bills in set- This is usually availed of in cases where a bill had to be sent to a distant place

through some conveyance.

2. What are the kinds of promissory note?

Certificate of deposit. It is a written acknowledgment by a bank of the receipt of money received

or on deposit which the bank promises to pay to the depositor, or to him or his order, or to some

other person, or to him or his order, or to bearer, or to a specified person or bearer, on demand or

on a fixed date, often with interest.

Bond. It is an evidence of indebtedness issued by a public or private corporation, promising to

pay a sum of money on a day certain in die future. Its negotiability is controlled by the same rules

governing promissory notes. It runs for a longer period of time than a promissory note and is

issued for debts of substantially larger amounts.

Bank note. It is an instrument issued by a bank for circulation as money payable to bearer on

demand.

Due bill. It is a promissory note which shows on its face an acknowledgment by a person of his

indebtedness to another. The word "due" is usually used.

Mortgage note. Two kinds are: the chattel mortgage note and the real estate mortgage note. As

the name implies, the first is secured by personal property and the second, by real property. In

sale of a house, for example, the note secured by mortgage on the property, is for the unpaid

balance of the purchase price. The security contract, known as a mortgage, most frequently

provides that the mortgage can be foreclosed if the note is not paid when it is due.

Title-retaining note. This type is secured by a conditional sales contract which ordinarily provides

that the title to the goods shall remain in the payee's name until the note is paid in full. It is used to

secure the purchase price of goods.

Collateral note. It is used when the maker pledges securities (shares of stocks, bonds, and other

personal property) to the payee to secure the payment of the amount of the note. The securities

are usually placed with the holder as collateral security. Banks also use a device called "signature

note" for short-term unsecured loans or loans made without collaterals.

Judgment note. This is a note to which a power of attorney is added enabling the payee to take

judgment against the maker without the formality of a trial if the note is not paid on its due date.

Installment note. It is a note payable in specified or periodic installments at predetermined time

such as for payment of a refrigerator over a 12-month period.

3. When bill of exchange may be treated as promissory note?

Under Sec. 130 of the Law on Negotiable Instruments, the bill of exchange may be treated as

promissory note, when:

1. The drawer and the drawee are the same person, like a draft drawn by a bank on its branch, or by

a corporation on its treasurer, or by an agent on his principal by authority of the latter;

2. The drawee is a fictitious person, and;

3. The drawee has no capacity to contract.

4. Who are the parties in a promissory note?

1. Maker- the one who makes die promise and signs the instrument.

2. Payee- the party to whom the promise is made or the instrument is payable.

5. Who are the parties in a bill of exchange?

A bill of exchange requires in its inception at least three parties — the drawer, the drawee, and

the payee.

1. Drawer. The person who issues and draws the order bill is called the drawer. He gives

the order to pay money to a third party. He does not pay directly.

2. Drawee. The party upon whom the bill is drawn is called the drawee. He is the person to

whom the bill is addressed and who is ordered to pay. He becomes an acceptor when he

indicates a willingness to accept responsibility for the payment of the bill. (Sec. 62.) The

drawee is a bank in the case of a check.

3. Payee. The party in whose favor the bill is originally drawn or is payable is called the

payee. Up to the time of acceptance by the drawee, the payee looks exclusively to the

drawer. Again, the payee, as in a promissory note, may be specifically designated, or

may be an office or title, or unspecified.

6. Enumerate the types of defective instrument.

1. Fraud. Ex. Brokers employed to buy stock represented that they bought the stock and received a

check therefor, but had not in fact bought. It was held that their title to the check was defective

because they obtained it by means of fraud.

2. Duress, or force or fear. Ex. Where A, by the use of violence and intimidation, forced P to

indorse a promissory note in favor of A.

3. Other unlawful means. Where the instrument has been stolen. It has been held that a person

who acquires an instrument by endorsement of a part thereof gets title by unlawful means since

the transfer is in contravention of the law.

4. Illegal consideration. A note given to stifle a criminal prosecution is invalid, or in consideration of

the payee killing a person.

5. Negotiation in breach of faith. Where the payee of a note negotiated it after receiving payment

from the maker; where the payee transfer the instrument in breach of agreement; where a note is

given in payment of goods to be delivered and the note is negotiated without delivery of the

goods; where a note held merely as collateral or security is negotiated.

6. Circumstances amounting to fraud. Where the payee of a note negotiated it after being told

that the maker intends to resist payment or that the transferor had no legal right to transfer.

You might also like

- Unit 4 - Contracts 2-1Document30 pagesUnit 4 - Contracts 2-1sarthak chughNo ratings yet

- Features of A Negotiable InstrumentDocument4 pagesFeatures of A Negotiable InstrumentAditi100% (7)

- Procedure de 799Document9 pagesProcedure de 799JOHN MONROYNo ratings yet

- Notes On Negotiable Intruments Law Part 1Document13 pagesNotes On Negotiable Intruments Law Part 1JurilBrokaPatiño100% (1)

- BUS LAW 103 AssignmentDocument4 pagesBUS LAW 103 AssignmentAireyNo ratings yet

- Unit - 2 Negotiable Instruments: Kantharaju N.P. Ananya Institute of Commerce and ManagementDocument9 pagesUnit - 2 Negotiable Instruments: Kantharaju N.P. Ananya Institute of Commerce and ManagementvasistaharishNo ratings yet

- UNIT 4 NotesDocument8 pagesUNIT 4 NotesPiyush SinglaNo ratings yet

- Negotiable Instrument & Bill of ExchangeDocument12 pagesNegotiable Instrument & Bill of ExchangeAlokha Vincent100% (1)

- Nego Finals ReviewerDocument22 pagesNego Finals ReviewerAnna Katrina VistanNo ratings yet

- Nego Finals ReviewerDocument22 pagesNego Finals ReviewerJay-ArhNo ratings yet

- Credit Function and A Payment Function. The Credit Function Allows NegotiableDocument2 pagesCredit Function and A Payment Function. The Credit Function Allows NegotiableGerson Lipaygo Dela PeñaNo ratings yet

- Reviewer in NegoDocument7 pagesReviewer in NegoJoan BartolomeNo ratings yet

- ASSIGNMENTDocument12 pagesASSIGNMENTMindalyn FranciscoNo ratings yet

- The Negotiable Instrument Act, 1881Document18 pagesThe Negotiable Instrument Act, 1881GarimaNo ratings yet

- Governing Law: - The Negotiable Instruments Law (ACT No. 2031)Document7 pagesGoverning Law: - The Negotiable Instruments Law (ACT No. 2031)Leilani WeeNo ratings yet

- Chapter 5 Bank Credit InstrumentsDocument5 pagesChapter 5 Bank Credit InstrumentsMariel Crista Celda Maravillosa100% (2)

- Jannel Yza S. Gunida Bsba - Iv Negotiation Lecture I. Preliminary Subject - Matter On Negotiation A. Most Common Forms of Negotiable InstrumentDocument6 pagesJannel Yza S. Gunida Bsba - Iv Negotiation Lecture I. Preliminary Subject - Matter On Negotiation A. Most Common Forms of Negotiable Instrumentyza gunidaNo ratings yet

- Topic 2 - NegoDocument3 pagesTopic 2 - NegoDANICA FLORESNo ratings yet

- Negotiable Instruments ActDocument15 pagesNegotiable Instruments ActParag Darwade100% (1)

- NEGOTIABLE INST-WPS OfficeDocument9 pagesNEGOTIABLE INST-WPS OfficeJeanmarie Raker100% (1)

- NEGO Part1 by k2Document3 pagesNEGO Part1 by k2'atsirk-sinu AlemaniaNo ratings yet

- Characteristics of Negotiable InstrumentsDocument12 pagesCharacteristics of Negotiable InstrumentsSiddh Shah ⎝⎝⏠⏝⏠⎠⎠No ratings yet

- Nego Finals ReviewerDocument20 pagesNego Finals ReviewerHaifa Apple Sampaco PimpingNo ratings yet

- B.Law Assignment N.IDocument9 pagesB.Law Assignment N.IWazeeer AhmadNo ratings yet

- Negotiable InstrumentsDocument17 pagesNegotiable InstrumentsShamaarajShankerNo ratings yet

- 2negotiable InstrumentDocument8 pages2negotiable Instrumenttanjimalomturjo1No ratings yet

- NIL THEORY - Doc 2Document7 pagesNIL THEORY - Doc 2nikoleNo ratings yet

- Credit InstrumentsDocument18 pagesCredit InstrumentsRichard100% (2)

- Nego Finals RevieweDocument20 pagesNego Finals RevieweiambaybayanonNo ratings yet

- Negotiable Instrument ActDocument9 pagesNegotiable Instrument ActHimanshu DarganNo ratings yet

- Bankingtheorylawpracticeunitiiippt 240307181015 7e5977faDocument29 pagesBankingtheorylawpracticeunitiiippt 240307181015 7e5977fadharshan0425No ratings yet

- Chapter 5 - Bank Credit InstrumentsDocument5 pagesChapter 5 - Bank Credit InstrumentsMhaiNo ratings yet

- Promises To Pay Versus Order To PayDocument1 pagePromises To Pay Versus Order To Paylou merphy castilloNo ratings yet

- Negotiable Instrument: Promissory Note, Bill of Exchange, or Cheque Payable Either To Order or To The Bearer"Document5 pagesNegotiable Instrument: Promissory Note, Bill of Exchange, or Cheque Payable Either To Order or To The Bearer"Amandeep Singh Manku100% (1)

- Negotiable Instruments ReviewerDocument31 pagesNegotiable Instruments ReviewerFaye Cience BoholNo ratings yet

- Negotiable Instruments: - MicaellagarciaDocument4 pagesNegotiable Instruments: - MicaellagarciaMicaella100% (1)

- Notes - 11092020Document4 pagesNotes - 11092020DANICA FLORESNo ratings yet

- Negotiable InstrumentsDocument9 pagesNegotiable Instrumentskehindemustapha505No ratings yet

- Unit - 4 LPB - Negotiable InstrumentsDocument13 pagesUnit - 4 LPB - Negotiable InstrumentsVeena ReddyNo ratings yet

- Bills of ExchangeDocument10 pagesBills of ExchangeRomesh DulanNo ratings yet

- Reviewer in NegoDocument9 pagesReviewer in NegoMhayBinuyaJuanzonNo ratings yet

- Unit 13: 1. What Is A Negotiable InstrumentDocument7 pagesUnit 13: 1. What Is A Negotiable InstrumentAyas JenaNo ratings yet

- Negotiable Instruments Act, 1881Document33 pagesNegotiable Instruments Act, 1881Vinayak Khemani100% (1)

- Banking PresentationDocument21 pagesBanking Presentationpreetha1507mNo ratings yet

- Banking Law B.com - Docx LatestDocument69 pagesBanking Law B.com - Docx LatestViraja Guru100% (1)

- PDF&Rendition 1 1Document73 pagesPDF&Rendition 1 1Srividya SNo ratings yet

- NegoDocument17 pagesNegoIrene QuimsonNo ratings yet

- Business Law Unit-4 NotesDocument16 pagesBusiness Law Unit-4 NotesTushar GaurNo ratings yet

- Ni PDFDocument67 pagesNi PDFShubham SharmaNo ratings yet

- College Financial-Mgmt-Accounting 9Document4 pagesCollege Financial-Mgmt-Accounting 9Naka MakuNo ratings yet

- Negotiable InstrumentsDocument23 pagesNegotiable Instrumentssweetchotu100% (1)

- Law On SalesDocument4 pagesLaw On SalesCarie Joy CabilloNo ratings yet

- Negotiable InstrumentDocument9 pagesNegotiable Instrumentvishal bagariaNo ratings yet

- Negotiable Instrument Law Module: 1 Semester, AY 2020-2021Document5 pagesNegotiable Instrument Law Module: 1 Semester, AY 2020-2021Diomar GusiNo ratings yet

- Bill of ExchangeDocument4 pagesBill of ExchangeS K MahapatraNo ratings yet

- Assignment No. 7 - JAReyes - COMMREVDocument6 pagesAssignment No. 7 - JAReyes - COMMREVReyes JericksonNo ratings yet

- A Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsFrom EverandA Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsNo ratings yet

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- Financial Report-1Document1 pageFinancial Report-1AireyNo ratings yet

- 2 CollectionDocument1 page2 CollectionAireyNo ratings yet

- Pretest Post TestDocument40 pagesPretest Post TestAireyNo ratings yet

- IFRS 16 - Sale and LeasebackDocument2 pagesIFRS 16 - Sale and LeasebackAireyNo ratings yet

- Other Comprehensive Income - 2022Document2 pagesOther Comprehensive Income - 2022AireyNo ratings yet

- Theoretical FrameworkDocument6 pagesTheoretical FrameworkAireyNo ratings yet

- Financial ReportDocument1 pageFinancial ReportAireyNo ratings yet

- John Mark D. Terante Activity 3.1 1. Planting A Garden and Having A Family. 2. SimilarDocument3 pagesJohn Mark D. Terante Activity 3.1 1. Planting A Garden and Having A Family. 2. SimilarAireyNo ratings yet

- Aireyca Glenn G. Lanaban Bsa-3 WTH 5:15Pm-6:45 PMDocument2 pagesAireyca Glenn G. Lanaban Bsa-3 WTH 5:15Pm-6:45 PMAireyNo ratings yet

- Lanaban, Midterm Government AccountingDocument4 pagesLanaban, Midterm Government AccountingAireyNo ratings yet

- (After Aning Naa Sa Above Na Slide Glenny I Insert Ni:) : Example 1Document3 pages(After Aning Naa Sa Above Na Slide Glenny I Insert Ni:) : Example 1AireyNo ratings yet

- Revenue CycleDocument3 pagesRevenue CycleAireyNo ratings yet

- A Vocation For EveryoneDocument2 pagesA Vocation For EveryoneAireyNo ratings yet

- T-Test: T-TEST PAIRS Radial WITH Belted (PAIRED) /CRITERIA CI (.9500) /missing AnalysisDocument2 pagesT-Test: T-TEST PAIRS Radial WITH Belted (PAIRED) /CRITERIA CI (.9500) /missing AnalysisAireyNo ratings yet

- Defined Benefit PlanDocument6 pagesDefined Benefit PlanAireyNo ratings yet

- Cuses, Issues, Impact-Final OuputDocument2 pagesCuses, Issues, Impact-Final OuputAireyNo ratings yet

- Acquaintance Party: College of Accounting EducationDocument2 pagesAcquaintance Party: College of Accounting EducationAireyNo ratings yet

- Lanaban, Journal 1 ReflectionDocument2 pagesLanaban, Journal 1 ReflectionAireyNo ratings yet

- BUS LAW 103 AssignmentDocument4 pagesBUS LAW 103 AssignmentAireyNo ratings yet

- Revised Standard Chart of Accounts For Cooperatives: Account Code Account TitleDocument36 pagesRevised Standard Chart of Accounts For Cooperatives: Account Code Account TitleAireyNo ratings yet

- Assumption College of Nabunturan: Nabunturan, Compostela Valley ProvinceDocument4 pagesAssumption College of Nabunturan: Nabunturan, Compostela Valley ProvinceAireyNo ratings yet

- San Vicente Ferrer Quasi Parish Statement of Cash Flow For The Fiscal Year Ended August 31, 2019Document2 pagesSan Vicente Ferrer Quasi Parish Statement of Cash Flow For The Fiscal Year Ended August 31, 2019AireyNo ratings yet

- Cuses, Issues, Impact-Final OuputDocument2 pagesCuses, Issues, Impact-Final OuputAireyNo ratings yet

- ABM 1 - Module 2 Assessment Name: SectionDocument1 pageABM 1 - Module 2 Assessment Name: SectionAireyNo ratings yet

- CG Croup 2 ExcelDocument25 pagesCG Croup 2 ExcelKhanh LinhNo ratings yet

- Trade Off Between Liquidity and Profitability: Hina Mushtaq, Dr. Anwar F. Chishti, Sumaira Kanwal, Sobia SaeedDocument20 pagesTrade Off Between Liquidity and Profitability: Hina Mushtaq, Dr. Anwar F. Chishti, Sumaira Kanwal, Sobia SaeedNiravNo ratings yet

- Soneva Total Impact Assessment 2018Document32 pagesSoneva Total Impact Assessment 2018Maud RamillonNo ratings yet

- Planning: 7. Outsourcing and Risk ManagementDocument20 pagesPlanning: 7. Outsourcing and Risk ManagementJoão PedroNo ratings yet

- Capital BudgetingDocument15 pagesCapital BudgetingJoshua Naragdag ColladoNo ratings yet

- The Factors That Affects The Investment Behavior (PPT c1)Document24 pagesThe Factors That Affects The Investment Behavior (PPT c1)Jiezle JavierNo ratings yet

- Rptviewer1 - 2023-08-28T182709.656Document1 pageRptviewer1 - 2023-08-28T182709.656Zeeshan ZaheerNo ratings yet

- HollandZorg Flexpolis - EngelsDocument56 pagesHollandZorg Flexpolis - EngelsKrzysztof DrozdNo ratings yet

- 12 Ipsas 12 Inventories 1Document19 pages12 Ipsas 12 Inventories 1Hastings KapalaNo ratings yet

- 11 - Sales Force Effectiveness Zoltners PDFDocument19 pages11 - Sales Force Effectiveness Zoltners PDFAdarsh Singh RathoreNo ratings yet

- What Programmatic Acquirers Do DifferentlyDocument7 pagesWhat Programmatic Acquirers Do DifferentlyMohammed ShalawyNo ratings yet

- Case 12 Heinz FIN 635Document39 pagesCase 12 Heinz FIN 635jack stauberNo ratings yet

- Updated FAC4866 Test 1suggested Solution April 2024Document4 pagesUpdated FAC4866 Test 1suggested Solution April 2024malwandeNo ratings yet

- 6 Interim ReportingDocument3 pages6 Interim ReportingBrian VillaluzNo ratings yet

- Ebook Economics 4Th Edition Krugman Solutions Manual Full Chapter PDFDocument38 pagesEbook Economics 4Th Edition Krugman Solutions Manual Full Chapter PDFalexispatrickespgjiyntd100% (14)

- Solve 111Document2 pagesSolve 111lalalalaNo ratings yet

- C 1 Basic Principles in Engineering EconomicsDocument14 pagesC 1 Basic Principles in Engineering EconomicsAbenezer WondimuNo ratings yet

- Prepayment of Your Personal Loan Account:XXXXXXXXXXXX4785Document2 pagesPrepayment of Your Personal Loan Account:XXXXXXXXXXXX4785Daniel GnanaselvamNo ratings yet

- Cash To Accrual Basis of AccountingDocument6 pagesCash To Accrual Basis of AccountingChocobetternotNo ratings yet

- Chapter 6: International Business and TradeDocument3 pagesChapter 6: International Business and Tradegian reyesNo ratings yet

- Modified Pag-Ibig Ii Enrollment FormDocument2 pagesModified Pag-Ibig Ii Enrollment FormJazziel Fortaliza100% (1)

- Open Loop Payment SystemDocument22 pagesOpen Loop Payment SystemSalman KhanNo ratings yet

- TransNum Mar 29 113605 PDFDocument3 pagesTransNum Mar 29 113605 PDFGomathiNo ratings yet

- 1170693Document12 pages1170693ishare digitalNo ratings yet

- Fin 365 Individual Assignment Muhd Sharizan (2020453984)Document3 pagesFin 365 Individual Assignment Muhd Sharizan (2020453984)mohd ChanNo ratings yet

- Deed of Absolute SaleDocument3 pagesDeed of Absolute SalePending_nameNo ratings yet

- Accounts Isc Final ProjectDocument13 pagesAccounts Isc Final ProjectRahit Mitra100% (1)

- Registration As Barangay Micro Business EnterpriseDocument1 pageRegistration As Barangay Micro Business EnterpriseDan GoNo ratings yet

- Tugas Kelompok Manajemen Keuangan Semester 3Document5 pagesTugas Kelompok Manajemen Keuangan Semester 3IdaNo ratings yet