Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

738 viewsFringe Benefit Tax

Fringe Benefit Tax

Uploaded by

KHAkadsbdhsgWBV Company provided their Filipino branch manager Ms. Leni an additional ₱5,000 quarterly for golf club membership fees. This fringe benefit is subject to Fringe Benefits Tax (FBT) in the Philippines. Based on the calculations provided, the grossed-up monetary value of the fringe benefit is ₱7,692.31. Multiplying this by the 35% FBT rate results in a total Fringe Benefits Tax of ₱2,692.31 that is due for this benefit.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- Finman - Module 5 ActivitiesDocument7 pagesFinman - Module 5 ActivitiesTricia Dimaano0% (1)

- Chapter 13 Part 1Document11 pagesChapter 13 Part 1Danielle Angel MalanaNo ratings yet

- M6 - Deductions P4 (13C) Students'Document43 pagesM6 - Deductions P4 (13C) Students'micaella pasionNo ratings yet

- Module 3 Tax On CorporationsDocument33 pagesModule 3 Tax On Corporationscha1150% (2)

- TaxationDocument23 pagesTaxationaliciajumaran100% (1)

- Midterm Examination With SolutionDocument2 pagesMidterm Examination With SolutionSeulgi Bear100% (1)

- Word Problems TaDocument15 pagesWord Problems TaMaissyNo ratings yet

- 3.1 Exercise - Non Individual FWTDocument2 pages3.1 Exercise - Non Individual FWTGiselle Martinez100% (2)

- Fringe Benefits, de Minimis Benefits, Filing of Income Tax ReturnDocument5 pagesFringe Benefits, de Minimis Benefits, Filing of Income Tax ReturndgdeguzmanNo ratings yet

- Discuss The Components and Characteristics of Maximization and Minimization ModelDocument5 pagesDiscuss The Components and Characteristics of Maximization and Minimization ModelNicole AutrizNo ratings yet

- Acc 223a - Answers To CH 15 AssignmentDocument7 pagesAcc 223a - Answers To CH 15 AssignmentAna Leah DelfinNo ratings yet

- Chapter 3Document88 pagesChapter 3giezele ballatanNo ratings yet

- Incremental Analysis Problems 111320Document4 pagesIncremental Analysis Problems 111320KHAkadsbdhsgNo ratings yet

- Lim Tax 5 Quiz AnswerDocument4 pagesLim Tax 5 Quiz AnswerIvan AnaboNo ratings yet

- COSTRAM - Topic 2 Assignment #4Document2 pagesCOSTRAM - Topic 2 Assignment #4Gray JavierNo ratings yet

- Assignment 3 Prepare A Cash Budget KarununganDocument3 pagesAssignment 3 Prepare A Cash Budget KarununganRenzo KarununganNo ratings yet

- AssesmentDocument12 pagesAssesmentMaya Keizel A.No ratings yet

- Final Withholding Tax FWT and CapitalDocument40 pagesFinal Withholding Tax FWT and CapitalEdna PostreNo ratings yet

- Basic Income Tax and ITR FilingDocument1 pageBasic Income Tax and ITR FilingKHAkadsbdhsgNo ratings yet

- Statement of Changes in EquityDocument8 pagesStatement of Changes in EquityGonzalo Jr. RualesNo ratings yet

- SITUS OF DIVIDEND INCOME - QuizzerDocument2 pagesSITUS OF DIVIDEND INCOME - Quizzerbrr brrNo ratings yet

- BAM031 - P2 - Q2 - Introduction To Gross Income, Inclusions and Exclusions - AnswersDocument8 pagesBAM031 - P2 - Q2 - Introduction To Gross Income, Inclusions and Exclusions - AnswersShane QuintoNo ratings yet

- PRELIM Chapter 9 10 11Document37 pagesPRELIM Chapter 9 10 11Bisag AsaNo ratings yet

- SW06Document6 pagesSW06Nadi HoodNo ratings yet

- Chapter 14Document16 pagesChapter 14Kristian Romeo NapiñasNo ratings yet

- Self-Study Practice 2-Decision Match-Accept or Reject A Special Order - ManguraliDocument2 pagesSelf-Study Practice 2-Decision Match-Accept or Reject A Special Order - ManguraliKHAkadsbdhsgNo ratings yet

- Assignment 3 - Conceptual ConnectionDocument2 pagesAssignment 3 - Conceptual Connectionjoint accountNo ratings yet

- (Solved) 1. Mr. Lolong, Supervisory Employee, Received The Following Income... - Course HeroDocument11 pages(Solved) 1. Mr. Lolong, Supervisory Employee, Received The Following Income... - Course HeroBisag AsaNo ratings yet

- Fman April 3,2020 - Operating and Financial LeverageDocument2 pagesFman April 3,2020 - Operating and Financial LeverageAngela Dela PeñaNo ratings yet

- Minimum Wage EarnerDocument1 pageMinimum Wage EarnerJonna LynneNo ratings yet

- Exclusions and Inclusions - MANTUANODocument8 pagesExclusions and Inclusions - MANTUANODonita MantuanoNo ratings yet

- PFRS of SME and SE - Concept MapDocument1 pagePFRS of SME and SE - Concept MapRey OñateNo ratings yet

- Management Science MidDocument10 pagesManagement Science MidKaren Kaye PasamonteNo ratings yet

- Chap 14 Corp Gov Biasura Jhazreel 2 BDocument6 pagesChap 14 Corp Gov Biasura Jhazreel 2 BJhazreel BiasuraNo ratings yet

- Tax On Corp. Sample ProblemsDocument2 pagesTax On Corp. Sample ProblemsWenjunNo ratings yet

- IT Module No. 7: Introduction To Regular Income TaxDocument13 pagesIT Module No. 7: Introduction To Regular Income TaxjakeNo ratings yet

- BUS-TAX M1Exer2Document1 pageBUS-TAX M1Exer2joint accountNo ratings yet

- Exercise 4-6 Case StudyDocument13 pagesExercise 4-6 Case Studymariyha PalangganaNo ratings yet

- Direction: Answer The Problem and Provide Your Solution in Good FormDocument1 pageDirection: Answer The Problem and Provide Your Solution in Good FormRenzo KarununganNo ratings yet

- Quiz 6 - Fringe BenefitsDocument7 pagesQuiz 6 - Fringe BenefitsCarlo manejaNo ratings yet

- INCOME TAXATION OF CORPORATION ExercisesDocument3 pagesINCOME TAXATION OF CORPORATION ExercisesCheska DizonNo ratings yet

- Tax 1Document2 pagesTax 1Che CheNo ratings yet

- Multiple Choice-ProbDocument5 pagesMultiple Choice-ProbAngela RuedasNo ratings yet

- Tax - Post Test 1&2Document2 pagesTax - Post Test 1&2lena cpaNo ratings yet

- Chapter 3 Introduction To Income TaxDocument20 pagesChapter 3 Introduction To Income TaxDANICKA JANE ENERONo ratings yet

- Fringe Benefit Tax Lesson 11Document24 pagesFringe Benefit Tax Lesson 11lcNo ratings yet

- Taxation SituationalDocument113 pagesTaxation SituationalMartin GragasinNo ratings yet

- Fringe Benefits ScenariosDocument2 pagesFringe Benefits ScenariosKatherine BorjaNo ratings yet

- Document 3 PDFDocument50 pagesDocument 3 PDFChristine Jane AbangNo ratings yet

- What Makes The Banking Industry A Specialized IndustryDocument3 pagesWhat Makes The Banking Industry A Specialized IndustrylalagunajoyNo ratings yet

- Dealon Prelim Take Home ExamDocument12 pagesDealon Prelim Take Home ExamPATATASNo ratings yet

- Chapter 6 - Income Tax For PartnershipDocument40 pagesChapter 6 - Income Tax For PartnershipNineteen Aùgùst100% (1)

- Requirement 1: Problem 7 (Transfer Pricing)Document5 pagesRequirement 1: Problem 7 (Transfer Pricing)Jane TuazonNo ratings yet

- Quiz On Chapter 13B&CDocument23 pagesQuiz On Chapter 13B&Cdianne caballeroNo ratings yet

- TRUE OR FALSE (p.179,180)Document2 pagesTRUE OR FALSE (p.179,180)Aberin GalenzogaNo ratings yet

- Chapter 4 EXERCISES - Estates and TrustsDocument9 pagesChapter 4 EXERCISES - Estates and TrustscathyydumpNo ratings yet

- CostRam Topic 2 Assignment #1Document2 pagesCostRam Topic 2 Assignment #1Gray JavierNo ratings yet

- Divided by 65%: Fringe Benefit P14,400 Monetary Value P14,400Document4 pagesDivided by 65%: Fringe Benefit P14,400 Monetary Value P14,400Bernardita OpongNo ratings yet

- Fringe Benefit Taxes Sample ProblemsDocument4 pagesFringe Benefit Taxes Sample Problemscharlene marie goNo ratings yet

- Fringe Benefit TAX: Mr. Mario M. Castro, Cpa, Mba Tax ConsultantDocument19 pagesFringe Benefit TAX: Mr. Mario M. Castro, Cpa, Mba Tax ConsultantKristine Aubrey AlvarezNo ratings yet

- Preparation of Statement of Financial PositionDocument6 pagesPreparation of Statement of Financial PositionKHAkadsbdhsgNo ratings yet

- Introduction To Information Systems AuditDocument1 pageIntroduction To Information Systems AuditKHAkadsbdhsgNo ratings yet

- Banana Frit OohDocument34 pagesBanana Frit OohKHAkadsbdhsgNo ratings yet

- Estate Tax Return: - Taxpayer InformationDocument2 pagesEstate Tax Return: - Taxpayer InformationKHAkadsbdhsgNo ratings yet

- Calculation of Cash Receipt Expected in OctoberDocument2 pagesCalculation of Cash Receipt Expected in OctoberKHAkadsbdhsgNo ratings yet

- Cost of Goods Sold BudgetDocument1 pageCost of Goods Sold BudgetKHAkadsbdhsgNo ratings yet

- Cash Disbursements On Accounts PayableDocument1 pageCash Disbursements On Accounts PayableKHAkadsbdhsgNo ratings yet

- Total Cash Receipts 157,558Document2 pagesTotal Cash Receipts 157,558KHAkadsbdhsgNo ratings yet

- 3.3 Exercise Key AnswerDocument2 pages3.3 Exercise Key AnswerKHAkadsbdhsgNo ratings yet

- Incremental Profit/Loss 1,000 10,000,000Document2 pagesIncremental Profit/Loss 1,000 10,000,000KHAkadsbdhsgNo ratings yet

- Direct Materials Purchases BudgetDocument1 pageDirect Materials Purchases BudgetKHAkadsbdhsgNo ratings yet

- Setting Transfer Prices - Market Price vs. Full CostDocument1 pageSetting Transfer Prices - Market Price vs. Full CostKHAkadsbdhsgNo ratings yet

- 3.1 Exercise Key AnswerDocument1 page3.1 Exercise Key AnswerKHAkadsbdhsgNo ratings yet

- Buslare FA2Document2 pagesBuslare FA2KHAkadsbdhsgNo ratings yet

- Total Direct Labor Cost 1,051,200 984,000 1,206,000 3,241,200Document1 pageTotal Direct Labor Cost 1,051,200 984,000 1,206,000 3,241,200KHAkadsbdhsgNo ratings yet

- Drills - Keep or DropDocument4 pagesDrills - Keep or DropKHAkadsbdhsgNo ratings yet

- CMC, LTD.: Last Name First Name Salary Years Job Title BonusDocument1 pageCMC, LTD.: Last Name First Name Salary Years Job Title BonusKHAkadsbdhsgNo ratings yet

- FinMan FA3Document1 pageFinMan FA3KHAkadsbdhsgNo ratings yet

- 12 Item MCQDocument1 page12 Item MCQKHAkadsbdhsgNo ratings yet

- Self-Study Practice 2-Decision Match-Accept or Reject A Special Order - ManguraliDocument2 pagesSelf-Study Practice 2-Decision Match-Accept or Reject A Special Order - ManguraliKHAkadsbdhsgNo ratings yet

- Requirement 1:: Sales Cost of Goods Sold) Cost of Goods Sold X 100 X 100 X 100Document1 pageRequirement 1:: Sales Cost of Goods Sold) Cost of Goods Sold X 100 X 100 X 100KHAkadsbdhsgNo ratings yet

- How Is It Going? Sell or Process FurtherDocument2 pagesHow Is It Going? Sell or Process FurtherKHAkadsbdhsg100% (1)

- Intacc2 - Assignment 3Document4 pagesIntacc2 - Assignment 3KHAkadsbdhsgNo ratings yet

- Incremental Analysis Problems 111320Document4 pagesIncremental Analysis Problems 111320KHAkadsbdhsgNo ratings yet

- Topic 1: Financial Manager (3 Fundamental Questions)Document8 pagesTopic 1: Financial Manager (3 Fundamental Questions)KHAkadsbdhsg100% (1)

- BasketballDocument5 pagesBasketballKHAkadsbdhsgNo ratings yet

- Basic Income Tax and ITR FilingDocument1 pageBasic Income Tax and ITR FilingKHAkadsbdhsgNo ratings yet

Fringe Benefit Tax

Fringe Benefit Tax

Uploaded by

KHAkadsbdhsg0 ratings0% found this document useful (0 votes)

738 views1 pageWBV Company provided their Filipino branch manager Ms. Leni an additional ₱5,000 quarterly for golf club membership fees. This fringe benefit is subject to Fringe Benefits Tax (FBT) in the Philippines. Based on the calculations provided, the grossed-up monetary value of the fringe benefit is ₱7,692.31. Multiplying this by the 35% FBT rate results in a total Fringe Benefits Tax of ₱2,692.31 that is due for this benefit.

Original Description:

Original Title

Fringe Benefit Tax.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentWBV Company provided their Filipino branch manager Ms. Leni an additional ₱5,000 quarterly for golf club membership fees. This fringe benefit is subject to Fringe Benefits Tax (FBT) in the Philippines. Based on the calculations provided, the grossed-up monetary value of the fringe benefit is ₱7,692.31. Multiplying this by the 35% FBT rate results in a total Fringe Benefits Tax of ₱2,692.31 that is due for this benefit.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

738 views1 pageFringe Benefit Tax

Fringe Benefit Tax

Uploaded by

KHAkadsbdhsgWBV Company provided their Filipino branch manager Ms. Leni an additional ₱5,000 quarterly for golf club membership fees. This fringe benefit is subject to Fringe Benefits Tax (FBT) in the Philippines. Based on the calculations provided, the grossed-up monetary value of the fringe benefit is ₱7,692.31. Multiplying this by the 35% FBT rate results in a total Fringe Benefits Tax of ₱2,692.31 that is due for this benefit.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

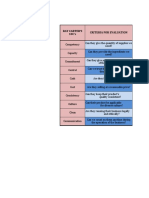

WBV Company (a domestic employer/company) granted Ms.

Leni (a Filipino branch manager

employee), in addition to her basic salaries, ₱5,000 cash per quarter for her personal membership

fees at Country Golf Club. Compute for the Fringe Benefits Tax (FBT).

Solution:

Monetary Value of Fringe Benefit P 5,000

Divided by Gross Factor 65%

Grossed-Up Monetary Value P 7,692.31

x FBT Rate 35%

Fringe Benefits Tax P 2,692.31

You might also like

- Finman - Module 5 ActivitiesDocument7 pagesFinman - Module 5 ActivitiesTricia Dimaano0% (1)

- Chapter 13 Part 1Document11 pagesChapter 13 Part 1Danielle Angel MalanaNo ratings yet

- M6 - Deductions P4 (13C) Students'Document43 pagesM6 - Deductions P4 (13C) Students'micaella pasionNo ratings yet

- Module 3 Tax On CorporationsDocument33 pagesModule 3 Tax On Corporationscha1150% (2)

- TaxationDocument23 pagesTaxationaliciajumaran100% (1)

- Midterm Examination With SolutionDocument2 pagesMidterm Examination With SolutionSeulgi Bear100% (1)

- Word Problems TaDocument15 pagesWord Problems TaMaissyNo ratings yet

- 3.1 Exercise - Non Individual FWTDocument2 pages3.1 Exercise - Non Individual FWTGiselle Martinez100% (2)

- Fringe Benefits, de Minimis Benefits, Filing of Income Tax ReturnDocument5 pagesFringe Benefits, de Minimis Benefits, Filing of Income Tax ReturndgdeguzmanNo ratings yet

- Discuss The Components and Characteristics of Maximization and Minimization ModelDocument5 pagesDiscuss The Components and Characteristics of Maximization and Minimization ModelNicole AutrizNo ratings yet

- Acc 223a - Answers To CH 15 AssignmentDocument7 pagesAcc 223a - Answers To CH 15 AssignmentAna Leah DelfinNo ratings yet

- Chapter 3Document88 pagesChapter 3giezele ballatanNo ratings yet

- Incremental Analysis Problems 111320Document4 pagesIncremental Analysis Problems 111320KHAkadsbdhsgNo ratings yet

- Lim Tax 5 Quiz AnswerDocument4 pagesLim Tax 5 Quiz AnswerIvan AnaboNo ratings yet

- COSTRAM - Topic 2 Assignment #4Document2 pagesCOSTRAM - Topic 2 Assignment #4Gray JavierNo ratings yet

- Assignment 3 Prepare A Cash Budget KarununganDocument3 pagesAssignment 3 Prepare A Cash Budget KarununganRenzo KarununganNo ratings yet

- AssesmentDocument12 pagesAssesmentMaya Keizel A.No ratings yet

- Final Withholding Tax FWT and CapitalDocument40 pagesFinal Withholding Tax FWT and CapitalEdna PostreNo ratings yet

- Basic Income Tax and ITR FilingDocument1 pageBasic Income Tax and ITR FilingKHAkadsbdhsgNo ratings yet

- Statement of Changes in EquityDocument8 pagesStatement of Changes in EquityGonzalo Jr. RualesNo ratings yet

- SITUS OF DIVIDEND INCOME - QuizzerDocument2 pagesSITUS OF DIVIDEND INCOME - Quizzerbrr brrNo ratings yet

- BAM031 - P2 - Q2 - Introduction To Gross Income, Inclusions and Exclusions - AnswersDocument8 pagesBAM031 - P2 - Q2 - Introduction To Gross Income, Inclusions and Exclusions - AnswersShane QuintoNo ratings yet

- PRELIM Chapter 9 10 11Document37 pagesPRELIM Chapter 9 10 11Bisag AsaNo ratings yet

- SW06Document6 pagesSW06Nadi HoodNo ratings yet

- Chapter 14Document16 pagesChapter 14Kristian Romeo NapiñasNo ratings yet

- Self-Study Practice 2-Decision Match-Accept or Reject A Special Order - ManguraliDocument2 pagesSelf-Study Practice 2-Decision Match-Accept or Reject A Special Order - ManguraliKHAkadsbdhsgNo ratings yet

- Assignment 3 - Conceptual ConnectionDocument2 pagesAssignment 3 - Conceptual Connectionjoint accountNo ratings yet

- (Solved) 1. Mr. Lolong, Supervisory Employee, Received The Following Income... - Course HeroDocument11 pages(Solved) 1. Mr. Lolong, Supervisory Employee, Received The Following Income... - Course HeroBisag AsaNo ratings yet

- Fman April 3,2020 - Operating and Financial LeverageDocument2 pagesFman April 3,2020 - Operating and Financial LeverageAngela Dela PeñaNo ratings yet

- Minimum Wage EarnerDocument1 pageMinimum Wage EarnerJonna LynneNo ratings yet

- Exclusions and Inclusions - MANTUANODocument8 pagesExclusions and Inclusions - MANTUANODonita MantuanoNo ratings yet

- PFRS of SME and SE - Concept MapDocument1 pagePFRS of SME and SE - Concept MapRey OñateNo ratings yet

- Management Science MidDocument10 pagesManagement Science MidKaren Kaye PasamonteNo ratings yet

- Chap 14 Corp Gov Biasura Jhazreel 2 BDocument6 pagesChap 14 Corp Gov Biasura Jhazreel 2 BJhazreel BiasuraNo ratings yet

- Tax On Corp. Sample ProblemsDocument2 pagesTax On Corp. Sample ProblemsWenjunNo ratings yet

- IT Module No. 7: Introduction To Regular Income TaxDocument13 pagesIT Module No. 7: Introduction To Regular Income TaxjakeNo ratings yet

- BUS-TAX M1Exer2Document1 pageBUS-TAX M1Exer2joint accountNo ratings yet

- Exercise 4-6 Case StudyDocument13 pagesExercise 4-6 Case Studymariyha PalangganaNo ratings yet

- Direction: Answer The Problem and Provide Your Solution in Good FormDocument1 pageDirection: Answer The Problem and Provide Your Solution in Good FormRenzo KarununganNo ratings yet

- Quiz 6 - Fringe BenefitsDocument7 pagesQuiz 6 - Fringe BenefitsCarlo manejaNo ratings yet

- INCOME TAXATION OF CORPORATION ExercisesDocument3 pagesINCOME TAXATION OF CORPORATION ExercisesCheska DizonNo ratings yet

- Tax 1Document2 pagesTax 1Che CheNo ratings yet

- Multiple Choice-ProbDocument5 pagesMultiple Choice-ProbAngela RuedasNo ratings yet

- Tax - Post Test 1&2Document2 pagesTax - Post Test 1&2lena cpaNo ratings yet

- Chapter 3 Introduction To Income TaxDocument20 pagesChapter 3 Introduction To Income TaxDANICKA JANE ENERONo ratings yet

- Fringe Benefit Tax Lesson 11Document24 pagesFringe Benefit Tax Lesson 11lcNo ratings yet

- Taxation SituationalDocument113 pagesTaxation SituationalMartin GragasinNo ratings yet

- Fringe Benefits ScenariosDocument2 pagesFringe Benefits ScenariosKatherine BorjaNo ratings yet

- Document 3 PDFDocument50 pagesDocument 3 PDFChristine Jane AbangNo ratings yet

- What Makes The Banking Industry A Specialized IndustryDocument3 pagesWhat Makes The Banking Industry A Specialized IndustrylalagunajoyNo ratings yet

- Dealon Prelim Take Home ExamDocument12 pagesDealon Prelim Take Home ExamPATATASNo ratings yet

- Chapter 6 - Income Tax For PartnershipDocument40 pagesChapter 6 - Income Tax For PartnershipNineteen Aùgùst100% (1)

- Requirement 1: Problem 7 (Transfer Pricing)Document5 pagesRequirement 1: Problem 7 (Transfer Pricing)Jane TuazonNo ratings yet

- Quiz On Chapter 13B&CDocument23 pagesQuiz On Chapter 13B&Cdianne caballeroNo ratings yet

- TRUE OR FALSE (p.179,180)Document2 pagesTRUE OR FALSE (p.179,180)Aberin GalenzogaNo ratings yet

- Chapter 4 EXERCISES - Estates and TrustsDocument9 pagesChapter 4 EXERCISES - Estates and TrustscathyydumpNo ratings yet

- CostRam Topic 2 Assignment #1Document2 pagesCostRam Topic 2 Assignment #1Gray JavierNo ratings yet

- Divided by 65%: Fringe Benefit P14,400 Monetary Value P14,400Document4 pagesDivided by 65%: Fringe Benefit P14,400 Monetary Value P14,400Bernardita OpongNo ratings yet

- Fringe Benefit Taxes Sample ProblemsDocument4 pagesFringe Benefit Taxes Sample Problemscharlene marie goNo ratings yet

- Fringe Benefit TAX: Mr. Mario M. Castro, Cpa, Mba Tax ConsultantDocument19 pagesFringe Benefit TAX: Mr. Mario M. Castro, Cpa, Mba Tax ConsultantKristine Aubrey AlvarezNo ratings yet

- Preparation of Statement of Financial PositionDocument6 pagesPreparation of Statement of Financial PositionKHAkadsbdhsgNo ratings yet

- Introduction To Information Systems AuditDocument1 pageIntroduction To Information Systems AuditKHAkadsbdhsgNo ratings yet

- Banana Frit OohDocument34 pagesBanana Frit OohKHAkadsbdhsgNo ratings yet

- Estate Tax Return: - Taxpayer InformationDocument2 pagesEstate Tax Return: - Taxpayer InformationKHAkadsbdhsgNo ratings yet

- Calculation of Cash Receipt Expected in OctoberDocument2 pagesCalculation of Cash Receipt Expected in OctoberKHAkadsbdhsgNo ratings yet

- Cost of Goods Sold BudgetDocument1 pageCost of Goods Sold BudgetKHAkadsbdhsgNo ratings yet

- Cash Disbursements On Accounts PayableDocument1 pageCash Disbursements On Accounts PayableKHAkadsbdhsgNo ratings yet

- Total Cash Receipts 157,558Document2 pagesTotal Cash Receipts 157,558KHAkadsbdhsgNo ratings yet

- 3.3 Exercise Key AnswerDocument2 pages3.3 Exercise Key AnswerKHAkadsbdhsgNo ratings yet

- Incremental Profit/Loss 1,000 10,000,000Document2 pagesIncremental Profit/Loss 1,000 10,000,000KHAkadsbdhsgNo ratings yet

- Direct Materials Purchases BudgetDocument1 pageDirect Materials Purchases BudgetKHAkadsbdhsgNo ratings yet

- Setting Transfer Prices - Market Price vs. Full CostDocument1 pageSetting Transfer Prices - Market Price vs. Full CostKHAkadsbdhsgNo ratings yet

- 3.1 Exercise Key AnswerDocument1 page3.1 Exercise Key AnswerKHAkadsbdhsgNo ratings yet

- Buslare FA2Document2 pagesBuslare FA2KHAkadsbdhsgNo ratings yet

- Total Direct Labor Cost 1,051,200 984,000 1,206,000 3,241,200Document1 pageTotal Direct Labor Cost 1,051,200 984,000 1,206,000 3,241,200KHAkadsbdhsgNo ratings yet

- Drills - Keep or DropDocument4 pagesDrills - Keep or DropKHAkadsbdhsgNo ratings yet

- CMC, LTD.: Last Name First Name Salary Years Job Title BonusDocument1 pageCMC, LTD.: Last Name First Name Salary Years Job Title BonusKHAkadsbdhsgNo ratings yet

- FinMan FA3Document1 pageFinMan FA3KHAkadsbdhsgNo ratings yet

- 12 Item MCQDocument1 page12 Item MCQKHAkadsbdhsgNo ratings yet

- Self-Study Practice 2-Decision Match-Accept or Reject A Special Order - ManguraliDocument2 pagesSelf-Study Practice 2-Decision Match-Accept or Reject A Special Order - ManguraliKHAkadsbdhsgNo ratings yet

- Requirement 1:: Sales Cost of Goods Sold) Cost of Goods Sold X 100 X 100 X 100Document1 pageRequirement 1:: Sales Cost of Goods Sold) Cost of Goods Sold X 100 X 100 X 100KHAkadsbdhsgNo ratings yet

- How Is It Going? Sell or Process FurtherDocument2 pagesHow Is It Going? Sell or Process FurtherKHAkadsbdhsg100% (1)

- Intacc2 - Assignment 3Document4 pagesIntacc2 - Assignment 3KHAkadsbdhsgNo ratings yet

- Incremental Analysis Problems 111320Document4 pagesIncremental Analysis Problems 111320KHAkadsbdhsgNo ratings yet

- Topic 1: Financial Manager (3 Fundamental Questions)Document8 pagesTopic 1: Financial Manager (3 Fundamental Questions)KHAkadsbdhsg100% (1)

- BasketballDocument5 pagesBasketballKHAkadsbdhsgNo ratings yet

- Basic Income Tax and ITR FilingDocument1 pageBasic Income Tax and ITR FilingKHAkadsbdhsgNo ratings yet