Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

20 viewsFor The Calendar Year 2018: Municipality of Cantilan

For The Calendar Year 2018: Municipality of Cantilan

Uploaded by

sandra bolokThe Municipality of Cantilan conducted a physical inventory of its property, plant, and equipment (PPE) but did not reconcile the results with its accounting records, casting doubt on the reported PPE balance. It also spent funds on fuel and oil without complete documentation and with alterations, making the expenses' reasonableness uncertain. Various financial reports and disbursement vouchers were also submitted late. The audit made recommendations to address these issues, including reconciling PPE records, enforcing fuel documentation policies, and submitting reports on time.

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

You might also like

- APMT 2016 - FinalDocument17 pagesAPMT 2016 - FinalmarivicNo ratings yet

- Micro and Macro Environment of BusinessDocument5 pagesMicro and Macro Environment of BusinessCyrus BondoNo ratings yet

- AAPSI For CY 2016 - CPD COPY FOR GCG COMPLIANCE PDFDocument123 pagesAAPSI For CY 2016 - CPD COPY FOR GCG COMPLIANCE PDFLyka Mae Palarca IrangNo ratings yet

- Republic of The Philippines Caraga Region XIII Province of Surigao Del NorteDocument16 pagesRepublic of The Philippines Caraga Region XIII Province of Surigao Del NorteLeo SindolNo ratings yet

- Commission On AuditDocument207 pagesCommission On AuditJaniceNo ratings yet

- Aapsi 2021Document29 pagesAapsi 2021Moda ArgonaNo ratings yet

- MSU-IIT2021 Audit ReportDocument153 pagesMSU-IIT2021 Audit ReportMiss_AccountantNo ratings yet

- Department of Trade and Industry: Annex BDocument1 pageDepartment of Trade and Industry: Annex BAngel BacaniNo ratings yet

- 03-MunCantilan2019 AAPSIDocument1 page03-MunCantilan2019 AAPSIsandra bolokNo ratings yet

- CSU2021 Audit ReportDocument155 pagesCSU2021 Audit ReportMiss_AccountantNo ratings yet

- AAPSI BFP-ARMM Annex B APMT FORMDocument2 pagesAAPSI BFP-ARMM Annex B APMT FORMBon YuseffNo ratings yet

- San Juan National High SchoolDocument8 pagesSan Juan National High SchoolYom KiroNo ratings yet

- 02-Agency Action PlanDocument1 page02-Agency Action PlanJerome MangundayaoNo ratings yet

- Philippine Carabao Center USM Kabacan, North Cotabato Agency Action Plan and Status of Implementation Audit Observations and Recommendations For The Calendar Year 2018 As of March 2019Document2 pagesPhilippine Carabao Center USM Kabacan, North Cotabato Agency Action Plan and Status of Implementation Audit Observations and Recommendations For The Calendar Year 2018 As of March 2019Mea Cocal JTNo ratings yet

- Ciap Aapsi 2016Document12 pagesCiap Aapsi 2016Hoven MacasinagNo ratings yet

- Aapsi - Lra Abra Dec 2018Document5 pagesAapsi - Lra Abra Dec 2018Jayson GuerreroNo ratings yet

- Agency Action Plan and Status of Implementation Audit Observations and Recommendations For The Calendar Year 2016 As ofDocument1 pageAgency Action Plan and Status of Implementation Audit Observations and Recommendations For The Calendar Year 2016 As ofjaymark camachoNo ratings yet

- Agency Action Plan and Status of Implementations 2023Document11 pagesAgency Action Plan and Status of Implementations 2023Jek PanerioNo ratings yet

- AAPSI FormatDocument1 pageAAPSI Formatmutt kyn piczNo ratings yet

- AAPSI CY 2021 - DepEd PPC - As of 08312022Document5 pagesAAPSI CY 2021 - DepEd PPC - As of 08312022chiam.starrailNo ratings yet

- 06-BOC Gensan - 2022 - AAPSIDocument5 pages06-BOC Gensan - 2022 - AAPSIReihannah Paguital-MagnoNo ratings yet

- Dbm-Roii-Coa-Submission of Duly Accomplished Agency Action Plan and Status of Implementation (Aapsi) As of February 28 2023Document3 pagesDbm-Roii-Coa-Submission of Duly Accomplished Agency Action Plan and Status of Implementation (Aapsi) As of February 28 2023Harvey Harry SiribanNo ratings yet

- Agency Action Plan 2022Document12 pagesAgency Action Plan 2022Enerita AllegoNo ratings yet

- Annex B Action Plan Monitoring Tool: Agency Action Plan and Status of Implementation I Results of Coa ValidationDocument1 pageAnnex B Action Plan Monitoring Tool: Agency Action Plan and Status of Implementation I Results of Coa ValidationaliahNo ratings yet

- Bureau of Fire Protection Autonomous Region in Muslim MindanaoDocument2 pagesBureau of Fire Protection Autonomous Region in Muslim MindanaoBon YuseffNo ratings yet

- 03-Wvsu2021 AapsiDocument1 page03-Wvsu2021 AapsiMiss_AccountantNo ratings yet

- Action Plan Monitoring Tool COA and COMELECDocument7 pagesAction Plan Monitoring Tool COA and COMELECVicky Danila Albano100% (1)

- Aapsi 2020Document9 pagesAapsi 2020Ragnar LothbrokNo ratings yet

- Philippine Carabao Center: Republic of The Philippines University of Southern Mindanao, Kabacan, CotabatoDocument3 pagesPhilippine Carabao Center: Republic of The Philippines University of Southern Mindanao, Kabacan, CotabatoMea Cocal JTNo ratings yet

- Audit Observations APMT 2017Document22 pagesAudit Observations APMT 2017jaymark camachoNo ratings yet

- 02-BLGF AAPSI 2019 - Annex BDocument5 pages02-BLGF AAPSI 2019 - Annex BJavie T. GualbertoNo ratings yet

- Matanao 2019 AapsiDocument13 pagesMatanao 2019 AapsiAnonymous iScW9lNo ratings yet

- Republic of The Philippines: General Manager Aurora Water District Aurora, IsabelaDocument13 pagesRepublic of The Philippines: General Manager Aurora Water District Aurora, IsabelaEG ReyesNo ratings yet

- COA M2014-002 AnnexADocument1 pageCOA M2014-002 AnnexARap RapNo ratings yet

- Agency Action Plan and Status of Implementation Audit Observation and Recommendations For The Calendar Year 2018 As ofDocument1 pageAgency Action Plan and Status of Implementation Audit Observation and Recommendations For The Calendar Year 2018 As ofGracielle Falcasantos DalaguitNo ratings yet

- 10-BacacayAlbay2017 - Status of PYs Audit RecommendationsDocument10 pages10-BacacayAlbay2017 - Status of PYs Audit RecommendationsotabNo ratings yet

- Annex P - AAPSIDocument1 pageAnnex P - AAPSIMaria Criselda LuceroNo ratings yet

- Monitoring Coa ValidationDocument14 pagesMonitoring Coa Validationnoelbautista.tsulawNo ratings yet

- COA-Alabel Audit Report2019Document130 pagesCOA-Alabel Audit Report2019Rascille LaranasNo ratings yet

- Final AAPSI - Maam RejDocument21 pagesFinal AAPSI - Maam RejrejieobsiomaNo ratings yet

- Republic of The Philippines Commonwealth Avenue, Quezon CityDocument5 pagesRepublic of The Philippines Commonwealth Avenue, Quezon CityOrlando V. Madrid Jr.No ratings yet

- Part Iii - Status of Implementation of Prior Year'S Audit RecommendationsDocument5 pagesPart Iii - Status of Implementation of Prior Year'S Audit RecommendationsAlicia NhsNo ratings yet

- Liwanag Elementary School Ld1Document9 pagesLiwanag Elementary School Ld1Renato CatembungNo ratings yet

- COA & COMELEC R4A - APMT 2017 ML SAOR With DetailsDocument8 pagesCOA & COMELEC R4A - APMT 2017 ML SAOR With DetailsVicky Danila AlbanoNo ratings yet

- Wayne County Juvenile Assessment Center Audit 2004Document14 pagesWayne County Juvenile Assessment Center Audit 2004Beverly Tran100% (2)

- Patnanungan2018 Audit ReportDocument93 pagesPatnanungan2018 Audit ReportNascelAguilarGabitoNo ratings yet

- Business Procedure: Event Management HSEQDocument16 pagesBusiness Procedure: Event Management HSEQAmr EssamNo ratings yet

- RTS 2022 DARPO Davao OccidentalDocument31 pagesRTS 2022 DARPO Davao OccidentalLouie Mark lligan (COA - Louie Mark Iligan)No ratings yet

- Annex J Agency Action Plan and Status of Implementation Audit Observations and Recommendations For Calendar Year 2019 As of June 30, 2020Document5 pagesAnnex J Agency Action Plan and Status of Implementation Audit Observations and Recommendations For Calendar Year 2019 As of June 30, 2020Oleksandyr UsykNo ratings yet

- SMEA ToolDocument1 pageSMEA ToolEmily D. MontecilloNo ratings yet

- Nagbukel Es AipwfpDocument41 pagesNagbukel Es AipwfpabalosjamesreyNo ratings yet

- Action Plans For COA Audit Observations 2019 and Prior YearsDocument6 pagesAction Plans For COA Audit Observations 2019 and Prior YearsJebs KwanNo ratings yet

- Module 7Document53 pagesModule 7Laarni Esma DomingoNo ratings yet

- 06-05-2021 Ops Dept MomDocument3 pages06-05-2021 Ops Dept MomErika Nell LachicaNo ratings yet

- Audit Report - TuburanDocument87 pagesAudit Report - TuburanMaria100% (1)

- Overall Accomplishment-September WewewewDocument48 pagesOverall Accomplishment-September WewewewGeofel SorianoNo ratings yet

- Annex E Pro-Forma Monthly Report March 9 2018Document3 pagesAnnex E Pro-Forma Monthly Report March 9 2018OmsNo ratings yet

- Part Iii - Status of Implementation of Prior Years' Audit RecommendationsDocument12 pagesPart Iii - Status of Implementation of Prior Years' Audit RecommendationsAlicia NhsNo ratings yet

- LDH Petty Cash Status ImplementationDocument5 pagesLDH Petty Cash Status ImplementationLoreto District Hospital LDHNo ratings yet

- Budgeting System ReportDocument38 pagesBudgeting System ReportHearthy HernandezNo ratings yet

- Corrective Action and Preventive Action (CAPA) in Pharmaceutical IndustryFrom EverandCorrective Action and Preventive Action (CAPA) in Pharmaceutical IndustryNo ratings yet

- 04-MunCantilan2019 Executive SummaryDocument7 pages04-MunCantilan2019 Executive Summarysandra bolokNo ratings yet

- 03-MunCantilan2019 AAPSIDocument1 page03-MunCantilan2019 AAPSIsandra bolokNo ratings yet

- Statement of Financial Position - General Fund: Current AssetsDocument15 pagesStatement of Financial Position - General Fund: Current Assetssandra bolokNo ratings yet

- 02-MunCantilan2019 Transmittal LettersDocument5 pages02-MunCantilan2019 Transmittal Letterssandra bolokNo ratings yet

- Catanauan2019 Audit ReportDocument135 pagesCatanauan2019 Audit Reportsandra bolokNo ratings yet

- Executive Summary A. Introduction: Governmen T Equity 42%Document5 pagesExecutive Summary A. Introduction: Governmen T Equity 42%sandra bolokNo ratings yet

- Ormoc City Comparative Statements of Financial Position: Total Current AssetsDocument6 pagesOrmoc City Comparative Statements of Financial Position: Total Current Assetssandra bolokNo ratings yet

- Status of Implementation of Prior Years' Unimplemented Audit RecommendationsDocument35 pagesStatus of Implementation of Prior Years' Unimplemented Audit Recommendationssandra bolokNo ratings yet

- 08-OrmocCity2018 Part1-Notes To FSDocument33 pages08-OrmocCity2018 Part1-Notes To FSsandra bolokNo ratings yet

- 03-OrmocCity2018 Executive SummaryDocument6 pages03-OrmocCity2018 Executive Summarysandra bolokNo ratings yet

- 10-Compostela2016 Part1-Notes To FSDocument84 pages10-Compostela2016 Part1-Notes To FSsandra bolokNo ratings yet

- Part I - Audited Financial StatementsDocument4 pagesPart I - Audited Financial Statementssandra bolokNo ratings yet

- Part II - Audit Observations and RecommendationsDocument32 pagesPart II - Audit Observations and Recommendationssandra bolokNo ratings yet

- Part I - Audited Financial StatementsDocument4 pagesPart I - Audited Financial Statementssandra bolokNo ratings yet

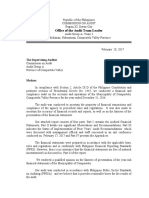

- Independent Auditor's Report: Commission On Audit Office of The Audit Team LeaderDocument2 pagesIndependent Auditor's Report: Commission On Audit Office of The Audit Team Leadersandra bolokNo ratings yet

- Annual Audit Report: Republic of The Philippines Commission On Audit Regional Office No. Xi Davao CityDocument1 pageAnnual Audit Report: Republic of The Philippines Commission On Audit Regional Office No. Xi Davao Citysandra bolokNo ratings yet

- Executive Summary: A. IntroductionDocument5 pagesExecutive Summary: A. Introductionsandra bolokNo ratings yet

- Statement of Financial Position - All Funds: Current AssetsDocument7 pagesStatement of Financial Position - All Funds: Current Assetssandra bolokNo ratings yet

- Office of The Audit Team LeaderDocument2 pagesOffice of The Audit Team Leadersandra bolokNo ratings yet

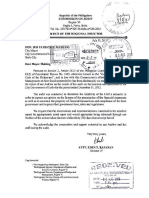

- Office of The Regional Director: Commission On AuditDocument1 pageOffice of The Regional Director: Commission On Auditsandra bolokNo ratings yet

- Part 1 - Financial Statements: Audit RecommendationsDocument1 pagePart 1 - Financial Statements: Audit Recommendationssandra bolokNo ratings yet

- Executive Summary: A. Introduction The AgencyDocument5 pagesExecutive Summary: A. Introduction The Agencysandra bolokNo ratings yet

- Status of Implementation of Prior Years' Audit RecommendationDocument8 pagesStatus of Implementation of Prior Years' Audit Recommendationsandra bolokNo ratings yet

- Part Ii-Observations and RecommendationsDocument23 pagesPart Ii-Observations and Recommendationssandra bolokNo ratings yet

- 02-TuguegaraoCity2017 CoverDocument1 page02-TuguegaraoCity2017 Coversandra bolokNo ratings yet

- 01-TuguegaraoCity2017 Transmittal LettersDocument12 pages01-TuguegaraoCity2017 Transmittal Letterssandra bolokNo ratings yet

- 04-BaaoCamSur2018 Table of ContentsDocument1 page04-BaaoCamSur2018 Table of Contentssandra bolokNo ratings yet

- Part I - Audited Financial StatementsDocument3 pagesPart I - Audited Financial Statementssandra bolokNo ratings yet

- A. Introduction: Executive SummaryDocument4 pagesA. Introduction: Executive Summarysandra bolokNo ratings yet

- Statement of Management'S Responsibility For Financial StatementsDocument1 pageStatement of Management'S Responsibility For Financial Statementssandra bolokNo ratings yet

- BSBWHS402 - Assist With Compliance With WHS Laws - V3 Feb 2017Document105 pagesBSBWHS402 - Assist With Compliance With WHS Laws - V3 Feb 2017Paula Martinez100% (1)

- Shrimp Turtle RulingDocument8 pagesShrimp Turtle RulingNJPMsmashNo ratings yet

- TMT DATA Protection Survival Guide Singles PDFDocument56 pagesTMT DATA Protection Survival Guide Singles PDFDanijelBaraNo ratings yet

- Cs. Nishant Mishra: E-Mail: Mobile: +91 8920043956Document3 pagesCs. Nishant Mishra: E-Mail: Mobile: +91 8920043956Nash MarxsNo ratings yet

- Rti PresentationDocument11 pagesRti PresentationMrinalkatkarNo ratings yet

- Andhra Pradesh Final Standardized Development and Building RegulationsDocument348 pagesAndhra Pradesh Final Standardized Development and Building Regulationsdarimadugu100% (1)

- Sindh Government Gazette PDFDocument55 pagesSindh Government Gazette PDFaqeel laghariNo ratings yet

- Industrial Policy-FinalDocument50 pagesIndustrial Policy-FinalShikha DubeyNo ratings yet

- Competition Policy in Romania After The Eu AccessionDocument7 pagesCompetition Policy in Romania After The Eu AccessionAndreea OancaNo ratings yet

- Introduction To Cross Border InsolvencyDocument25 pagesIntroduction To Cross Border Insolvencyharshil.rmlNo ratings yet

- 2020 05 WRAP PrinciplesDocument4 pages2020 05 WRAP PrinciplesAlimul EhsanNo ratings yet

- Auditing Islamic Financial Institutions (Haniffa)Document4 pagesAuditing Islamic Financial Institutions (Haniffa)Sirajudin HamdyNo ratings yet

- Partnership Firm Registration in TelanganaDocument6 pagesPartnership Firm Registration in TelanganaPrathap GoudNo ratings yet

- Auditing Project Sem2Document32 pagesAuditing Project Sem2madhuriNo ratings yet

- Final Draft: TOPIC: Comparative Study of Depository Receipts Relating To TheirDocument20 pagesFinal Draft: TOPIC: Comparative Study of Depository Receipts Relating To TheirDhanrajPatelNo ratings yet

- PreviewDocument8 pagesPreviewAnh Tuan PhamNo ratings yet

- TPA Rental ApplicationDocument2 pagesTPA Rental ApplicationPatrick NolanNo ratings yet

- 1 Republic v. HarpDocument92 pages1 Republic v. HarpArren RelucioNo ratings yet

- MIL-STD-961E SpecificationsDocument111 pagesMIL-STD-961E SpecificationsFranco SwanepoelNo ratings yet

- Benefits of Gov't EmployeeDocument10 pagesBenefits of Gov't EmployeeMyriz AlvarezNo ratings yet

- Nsitf ActDocument55 pagesNsitf Actabhi_akNo ratings yet

- CLU v. Exec SecDocument2 pagesCLU v. Exec SecGRNo ratings yet

- CGSR 10 MarksDocument16 pagesCGSR 10 Markssurya rathishNo ratings yet

- Software and Services Agreement TemplateDocument26 pagesSoftware and Services Agreement Templateanon_829377543No ratings yet

- Land Reforms 1 PDFDocument14 pagesLand Reforms 1 PDFPrashanthNo ratings yet

- LeaseDocument25 pagesLeaseJennylyn Biltz AlbanoNo ratings yet

- Re: Docket No. OCC-2011-0008/RIN 1557-AD43 Docket No. R-1415 /RIN 7100 AD74 RIN 3064-AD79 RIN 3052-AC69 RIN 2590-AA45Document42 pagesRe: Docket No. OCC-2011-0008/RIN 1557-AD43 Docket No. R-1415 /RIN 7100 AD74 RIN 3064-AD79 RIN 3052-AC69 RIN 2590-AA45MarketsWikiNo ratings yet

- Innodata Philippines Inc. vs. Jocelyn L. Quejada and Estella G. NatividadDocument2 pagesInnodata Philippines Inc. vs. Jocelyn L. Quejada and Estella G. NatividadMark MateoNo ratings yet

- Vi1notice PDFDocument5 pagesVi1notice PDFNavneetNo ratings yet

For The Calendar Year 2018: Municipality of Cantilan

For The Calendar Year 2018: Municipality of Cantilan

Uploaded by

sandra bolok0 ratings0% found this document useful (0 votes)

20 views7 pagesThe Municipality of Cantilan conducted a physical inventory of its property, plant, and equipment (PPE) but did not reconcile the results with its accounting records, casting doubt on the reported PPE balance. It also spent funds on fuel and oil without complete documentation and with alterations, making the expenses' reasonableness uncertain. Various financial reports and disbursement vouchers were also submitted late. The audit made recommendations to address these issues, including reconciling PPE records, enforcing fuel documentation policies, and submitting reports on time.

Original Description:

Original Title

03-MunCantilan2018_AAPSI

Copyright

© © All Rights Reserved

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe Municipality of Cantilan conducted a physical inventory of its property, plant, and equipment (PPE) but did not reconcile the results with its accounting records, casting doubt on the reported PPE balance. It also spent funds on fuel and oil without complete documentation and with alterations, making the expenses' reasonableness uncertain. Various financial reports and disbursement vouchers were also submitted late. The audit made recommendations to address these issues, including reconciling PPE records, enforcing fuel documentation policies, and submitting reports on time.

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

Download as xls, pdf, or txt

0 ratings0% found this document useful (0 votes)

20 views7 pagesFor The Calendar Year 2018: Municipality of Cantilan

For The Calendar Year 2018: Municipality of Cantilan

Uploaded by

sandra bolokThe Municipality of Cantilan conducted a physical inventory of its property, plant, and equipment (PPE) but did not reconcile the results with its accounting records, casting doubt on the reported PPE balance. It also spent funds on fuel and oil without complete documentation and with alterations, making the expenses' reasonableness uncertain. Various financial reports and disbursement vouchers were also submitted late. The audit made recommendations to address these issues, including reconciling PPE records, enforcing fuel documentation policies, and submitting reports on time.

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

Download as xls, pdf, or txt

You are on page 1of 7

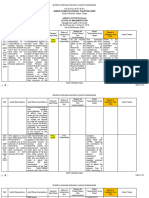

MUNICIPALITY OF CANTILAN

Surigao del Sur

AGENCY ACTION PLAN and STATUS of IMPLEMENTATION

Audit Observations and Recommendations

For the Calendar Year 2018

Agency Action Plan

Target

Implementat Reason for

ion Date Partial/ Action

Person/ Status of

Delay/ Non- Taken/

Ref. Audit Observations Audit Recommendations Action Dept. Impleme

Implementa Action to

Plan Respon ntation

From To tion, if be Taken

sible applicable

The non-reconciliation of accounting

We recommended that Management direct the

records with the submitted Report of

Municipal Accounting Office and Municipal

Physical Count of PPE (RPCPPE)

AAR Treasurer’s Office to render an accounting on the

casted doubt as to the reasonableness

2018 result of recently conducted physical inventory and

of the ₱ 244,671,946.97 PPE account

reconcile differences of the two records.

balance reported in the Statement of

Financial Position.

Agency Action Plan

Target

Implementat Reason for

ion Date Partial/ Action

Person/ Status of

Delay/ Non- Taken/

Ref. Audit Observations Audit Recommendations Action Dept. Impleme

Implementa Action to

Plan Respon ntation

From To tion, if be Taken

sible applicable

We recommended the Management to:

1. Use sequentially numbered trip tickets duly

approved by the Agency Head or the authorized

representative for proper monitoring of fuel

consumption with complete information being filled

The reasonableness of the expenses out in every detail needed to support the claims for

incurred for Fuel, Oil and Lubricants payment of fuel expenses.

amounting to P831,585.45 under the

20% Economic Development Fund 2. Enforce the “No approved Driver’s trip ticket,

(20% EDF) could not be ascertained No Withdrawal Policy.”

due to incomplete documentation and

AAR the presence of material 3. Direct the authorized personnel to reconcile

2018 alterations/corrections made in the every month the Driver’s trip ticket with the

attached supporting documents, Monthly Fuel consumption and Summary of

differing to the rules and regulations Monthly Report of official Travels as mandated

prescribed in COA Circular No. 77- under COA Circular No. 77-61 D.6 to determine

61 and Sec. 2 of Presidential Decree whether the said fuel usage is valid and is being

No. 1445, thus exposing government used appropriately.

funds to unnecessary loss or wastage.

4. Direct the Municipal Accountant to impose the

policy that every information provided in the

Purchase Request and Withdrawal slip were

complete, true, correct and without alterations to

make the transaction valid for payment.

Agency Action Plan

Target

Implementat Reason for

ion Date Partial/ Action

Person/ Status of

Delay/ Non- Taken/

Ref. Audit Observations Audit Recommendations Action Dept. Impleme

Implementa Action to

Plan Respon ntation

From To tion, if be Taken

sible applicable

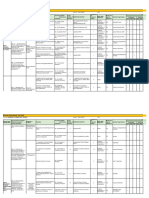

We recommended the Management to:

1. Instruct the Municipal Treasurer not to allow

any payee or representative to bring the DVs

The Journals, disbursement vouchers,

outside her office premises. Forward the Report of

liquidation reports and report of

Checks Issued with DVs to the accounting office on

collections and deposits together with

the fifth day of the following month and attach

its supporting documents were not

Report of Unreleased Checks to support the lacking

submitted on time as of December 15,

DVs of unclaimed checks.

AAR 2018 as prescribed in COA Circular

2018 No. 2009 – 006 dated September 15,

2. Direct the Municipal Accountant to monitor and

2009, thus precluding timely review

follow-up from the treasurer’s office the

and verification of the agency’s

submission of DVs, report of collections and

transactions and the timely

deposits and other reports every end of the month

transmission of information of noted

to avoid the same condition to happen.

deficiency.

3. Submit the financial reports and lacking DVs as

shown in the attached monitoring.

Agency Action Plan

Target

Implementat Reason for

ion Date Partial/ Action

Person/ Status of

Delay/ Non- Taken/

Ref. Audit Observations Audit Recommendations Action Dept. Impleme

Implementa Action to

Plan Respon ntation

From To tion, if be Taken

sible applicable

We recommended to Management that payrolls

Payment of honoraria to Bids and representing honoraria claims for involvement in

Awards Committee (BAC) members, procurement projects be supported with the related

Technical Working Group (TWG) BAC Resolution, list of successfully completed

and BAC Secretariat totaling procurement projects, the source of fund certified

P501,600.00 for CY 2018 was not by the Municipal Treasurer and contracts

AAR

supported with documentary pertaining to the period of the claim that will

2018

requirements to prove validity and support the validity and correctness of honoraria

correctness of payments made and the claims. Also, the Accounting Department require

rates did not conform to the the BAC Secretariat to submit subject documents to

provisions of Item 5 of DBM Circular support honoraria claims and to come up with a

No. 2004-5A. re-computation of the correct amount of honoraria

for CY 2018.

Agency Action Plan

Target

Implementat Reason for

ion Date Partial/ Action

Person/ Status of

Delay/ Non- Taken/

Ref. Audit Observations Audit Recommendations Action Dept. Impleme

Implementa Action to

Plan Respon ntation

From To tion, if be Taken

sible applicable

We recommended the Management to:

1. Direct the officials responsible to submit the

related documents to prove the legality of the above

The payment of tax delinquency from

transactions, such as: a.) Breakdown/Schedule of

tax on compensation, final VAT,

unremitted taxes as reported in the account Due to

Expanded withholding taxes and

BIR as of December 31, 2014; b.) Breakdown of

other percentage tax amounting to

taxes remitted amounting to P898,313.28.

P855,895.85 were not sufficiently

AAR documented to support the legality of

2. Direct the responsible officials to see to it that

2018 the transaction and the payment of

taxes withheld are remitted on time and in

interest and surcharges totaling

accordance with the Bureau of Internal Revenue

P42,417.43 due to tax deficiency

Rules and Regulations to avoid surcharges and

were considered irregular pursuant to

interest.

COA Circular 2012-003 dated

October 29, 2012.

3. In case of delay, any penalty and surcharges be

charged personally to officials or employees

directly responsible.

Agency Action Plan

Target

Implementat Reason for

ion Date Partial/ Action

Person/ Status of

Delay/ Non- Taken/

Ref. Audit Observations Audit Recommendations Action Dept. Impleme

Implementa Action to

Plan Respon ntation

From To tion, if be Taken

sible applicable

We recommended that Management to:

1. Direct the Project Management Team in the

Municipal level to conduct an actual inspection of

the tools and equipment delivered and come up

with a report on the project status to aid the

management in formulating possible courses of

action.

The Meat Processing Project with a

total project cost of P892,150.00,

2. Inform the DOLE-CARAGA of the project status

intended for use by Cantilan OFW

as stipulated in the MOA.

and Dependent Association as the

beneficiary was not successful due to

AAR 3. Require the Beneficiary, represented by the

the delay in its implementation and its

2018 Association President, to make a letter informing

insufficient counterpart fund as

the management of their intention to continue the

provided in the Memorandum of

project or not. In case they intend to continue,

Agreement; thus, the project's desired

allocate funds to meet the required equity as

social outcomes had not been

indicated in the MOA.

achieved.

4. Formulate a MOA between LGU-Cantilan and

the Cantilan OFW and Dependent Association to

have a better understanding of the responsibilities

of both parties concerning the project

implementation.

Agency Action Plan

Target

Implementat Reason for

ion Date Partial/ Action

Person/ Status of

Delay/ Non- Taken/

Ref. Audit Observations Audit Recommendations Action Dept. Impleme

Implementa Action to

Plan Respon ntation

From To tion, if be Taken

sible applicable

7. The Municipality’s 20% Economic

Development Fund for CY 2018 and

its continuing appropriation

amounting to P13,111,847.08 and In view of the foregoing, we recommended that the

P8,115,040.99, respectively, were not Management direct the Local Finance Committee

utilized due to either delayed or non- to meticulously and judiciously plan in order to

AAR

implementation of the identified achieve the proper allocation of expenditures for

2018

programs, projects and activities, thus each development activity. Moreover, require the

depriving the public of a timely and MPDC to submit status of implementation for the

maximum use of the projects and projects funded under continuing appropriation.

likewise hinders the uplifting of the

economic and social condition of its

constituents.

Agency sign-off:

_______________________________ __________

Name and Position of Agency Officer Date

Note: Status of Implementation may either be (a) Fully Implemented, (b) Ongoing,

(c) Not Implemented, (d) Partially Implemented, or (e) Delayed

You might also like

- APMT 2016 - FinalDocument17 pagesAPMT 2016 - FinalmarivicNo ratings yet

- Micro and Macro Environment of BusinessDocument5 pagesMicro and Macro Environment of BusinessCyrus BondoNo ratings yet

- AAPSI For CY 2016 - CPD COPY FOR GCG COMPLIANCE PDFDocument123 pagesAAPSI For CY 2016 - CPD COPY FOR GCG COMPLIANCE PDFLyka Mae Palarca IrangNo ratings yet

- Republic of The Philippines Caraga Region XIII Province of Surigao Del NorteDocument16 pagesRepublic of The Philippines Caraga Region XIII Province of Surigao Del NorteLeo SindolNo ratings yet

- Commission On AuditDocument207 pagesCommission On AuditJaniceNo ratings yet

- Aapsi 2021Document29 pagesAapsi 2021Moda ArgonaNo ratings yet

- MSU-IIT2021 Audit ReportDocument153 pagesMSU-IIT2021 Audit ReportMiss_AccountantNo ratings yet

- Department of Trade and Industry: Annex BDocument1 pageDepartment of Trade and Industry: Annex BAngel BacaniNo ratings yet

- 03-MunCantilan2019 AAPSIDocument1 page03-MunCantilan2019 AAPSIsandra bolokNo ratings yet

- CSU2021 Audit ReportDocument155 pagesCSU2021 Audit ReportMiss_AccountantNo ratings yet

- AAPSI BFP-ARMM Annex B APMT FORMDocument2 pagesAAPSI BFP-ARMM Annex B APMT FORMBon YuseffNo ratings yet

- San Juan National High SchoolDocument8 pagesSan Juan National High SchoolYom KiroNo ratings yet

- 02-Agency Action PlanDocument1 page02-Agency Action PlanJerome MangundayaoNo ratings yet

- Philippine Carabao Center USM Kabacan, North Cotabato Agency Action Plan and Status of Implementation Audit Observations and Recommendations For The Calendar Year 2018 As of March 2019Document2 pagesPhilippine Carabao Center USM Kabacan, North Cotabato Agency Action Plan and Status of Implementation Audit Observations and Recommendations For The Calendar Year 2018 As of March 2019Mea Cocal JTNo ratings yet

- Ciap Aapsi 2016Document12 pagesCiap Aapsi 2016Hoven MacasinagNo ratings yet

- Aapsi - Lra Abra Dec 2018Document5 pagesAapsi - Lra Abra Dec 2018Jayson GuerreroNo ratings yet

- Agency Action Plan and Status of Implementation Audit Observations and Recommendations For The Calendar Year 2016 As ofDocument1 pageAgency Action Plan and Status of Implementation Audit Observations and Recommendations For The Calendar Year 2016 As ofjaymark camachoNo ratings yet

- Agency Action Plan and Status of Implementations 2023Document11 pagesAgency Action Plan and Status of Implementations 2023Jek PanerioNo ratings yet

- AAPSI FormatDocument1 pageAAPSI Formatmutt kyn piczNo ratings yet

- AAPSI CY 2021 - DepEd PPC - As of 08312022Document5 pagesAAPSI CY 2021 - DepEd PPC - As of 08312022chiam.starrailNo ratings yet

- 06-BOC Gensan - 2022 - AAPSIDocument5 pages06-BOC Gensan - 2022 - AAPSIReihannah Paguital-MagnoNo ratings yet

- Dbm-Roii-Coa-Submission of Duly Accomplished Agency Action Plan and Status of Implementation (Aapsi) As of February 28 2023Document3 pagesDbm-Roii-Coa-Submission of Duly Accomplished Agency Action Plan and Status of Implementation (Aapsi) As of February 28 2023Harvey Harry SiribanNo ratings yet

- Agency Action Plan 2022Document12 pagesAgency Action Plan 2022Enerita AllegoNo ratings yet

- Annex B Action Plan Monitoring Tool: Agency Action Plan and Status of Implementation I Results of Coa ValidationDocument1 pageAnnex B Action Plan Monitoring Tool: Agency Action Plan and Status of Implementation I Results of Coa ValidationaliahNo ratings yet

- Bureau of Fire Protection Autonomous Region in Muslim MindanaoDocument2 pagesBureau of Fire Protection Autonomous Region in Muslim MindanaoBon YuseffNo ratings yet

- 03-Wvsu2021 AapsiDocument1 page03-Wvsu2021 AapsiMiss_AccountantNo ratings yet

- Action Plan Monitoring Tool COA and COMELECDocument7 pagesAction Plan Monitoring Tool COA and COMELECVicky Danila Albano100% (1)

- Aapsi 2020Document9 pagesAapsi 2020Ragnar LothbrokNo ratings yet

- Philippine Carabao Center: Republic of The Philippines University of Southern Mindanao, Kabacan, CotabatoDocument3 pagesPhilippine Carabao Center: Republic of The Philippines University of Southern Mindanao, Kabacan, CotabatoMea Cocal JTNo ratings yet

- Audit Observations APMT 2017Document22 pagesAudit Observations APMT 2017jaymark camachoNo ratings yet

- 02-BLGF AAPSI 2019 - Annex BDocument5 pages02-BLGF AAPSI 2019 - Annex BJavie T. GualbertoNo ratings yet

- Matanao 2019 AapsiDocument13 pagesMatanao 2019 AapsiAnonymous iScW9lNo ratings yet

- Republic of The Philippines: General Manager Aurora Water District Aurora, IsabelaDocument13 pagesRepublic of The Philippines: General Manager Aurora Water District Aurora, IsabelaEG ReyesNo ratings yet

- COA M2014-002 AnnexADocument1 pageCOA M2014-002 AnnexARap RapNo ratings yet

- Agency Action Plan and Status of Implementation Audit Observation and Recommendations For The Calendar Year 2018 As ofDocument1 pageAgency Action Plan and Status of Implementation Audit Observation and Recommendations For The Calendar Year 2018 As ofGracielle Falcasantos DalaguitNo ratings yet

- 10-BacacayAlbay2017 - Status of PYs Audit RecommendationsDocument10 pages10-BacacayAlbay2017 - Status of PYs Audit RecommendationsotabNo ratings yet

- Annex P - AAPSIDocument1 pageAnnex P - AAPSIMaria Criselda LuceroNo ratings yet

- Monitoring Coa ValidationDocument14 pagesMonitoring Coa Validationnoelbautista.tsulawNo ratings yet

- COA-Alabel Audit Report2019Document130 pagesCOA-Alabel Audit Report2019Rascille LaranasNo ratings yet

- Final AAPSI - Maam RejDocument21 pagesFinal AAPSI - Maam RejrejieobsiomaNo ratings yet

- Republic of The Philippines Commonwealth Avenue, Quezon CityDocument5 pagesRepublic of The Philippines Commonwealth Avenue, Quezon CityOrlando V. Madrid Jr.No ratings yet

- Part Iii - Status of Implementation of Prior Year'S Audit RecommendationsDocument5 pagesPart Iii - Status of Implementation of Prior Year'S Audit RecommendationsAlicia NhsNo ratings yet

- Liwanag Elementary School Ld1Document9 pagesLiwanag Elementary School Ld1Renato CatembungNo ratings yet

- COA & COMELEC R4A - APMT 2017 ML SAOR With DetailsDocument8 pagesCOA & COMELEC R4A - APMT 2017 ML SAOR With DetailsVicky Danila AlbanoNo ratings yet

- Wayne County Juvenile Assessment Center Audit 2004Document14 pagesWayne County Juvenile Assessment Center Audit 2004Beverly Tran100% (2)

- Patnanungan2018 Audit ReportDocument93 pagesPatnanungan2018 Audit ReportNascelAguilarGabitoNo ratings yet

- Business Procedure: Event Management HSEQDocument16 pagesBusiness Procedure: Event Management HSEQAmr EssamNo ratings yet

- RTS 2022 DARPO Davao OccidentalDocument31 pagesRTS 2022 DARPO Davao OccidentalLouie Mark lligan (COA - Louie Mark Iligan)No ratings yet

- Annex J Agency Action Plan and Status of Implementation Audit Observations and Recommendations For Calendar Year 2019 As of June 30, 2020Document5 pagesAnnex J Agency Action Plan and Status of Implementation Audit Observations and Recommendations For Calendar Year 2019 As of June 30, 2020Oleksandyr UsykNo ratings yet

- SMEA ToolDocument1 pageSMEA ToolEmily D. MontecilloNo ratings yet

- Nagbukel Es AipwfpDocument41 pagesNagbukel Es AipwfpabalosjamesreyNo ratings yet

- Action Plans For COA Audit Observations 2019 and Prior YearsDocument6 pagesAction Plans For COA Audit Observations 2019 and Prior YearsJebs KwanNo ratings yet

- Module 7Document53 pagesModule 7Laarni Esma DomingoNo ratings yet

- 06-05-2021 Ops Dept MomDocument3 pages06-05-2021 Ops Dept MomErika Nell LachicaNo ratings yet

- Audit Report - TuburanDocument87 pagesAudit Report - TuburanMaria100% (1)

- Overall Accomplishment-September WewewewDocument48 pagesOverall Accomplishment-September WewewewGeofel SorianoNo ratings yet

- Annex E Pro-Forma Monthly Report March 9 2018Document3 pagesAnnex E Pro-Forma Monthly Report March 9 2018OmsNo ratings yet

- Part Iii - Status of Implementation of Prior Years' Audit RecommendationsDocument12 pagesPart Iii - Status of Implementation of Prior Years' Audit RecommendationsAlicia NhsNo ratings yet

- LDH Petty Cash Status ImplementationDocument5 pagesLDH Petty Cash Status ImplementationLoreto District Hospital LDHNo ratings yet

- Budgeting System ReportDocument38 pagesBudgeting System ReportHearthy HernandezNo ratings yet

- Corrective Action and Preventive Action (CAPA) in Pharmaceutical IndustryFrom EverandCorrective Action and Preventive Action (CAPA) in Pharmaceutical IndustryNo ratings yet

- 04-MunCantilan2019 Executive SummaryDocument7 pages04-MunCantilan2019 Executive Summarysandra bolokNo ratings yet

- 03-MunCantilan2019 AAPSIDocument1 page03-MunCantilan2019 AAPSIsandra bolokNo ratings yet

- Statement of Financial Position - General Fund: Current AssetsDocument15 pagesStatement of Financial Position - General Fund: Current Assetssandra bolokNo ratings yet

- 02-MunCantilan2019 Transmittal LettersDocument5 pages02-MunCantilan2019 Transmittal Letterssandra bolokNo ratings yet

- Catanauan2019 Audit ReportDocument135 pagesCatanauan2019 Audit Reportsandra bolokNo ratings yet

- Executive Summary A. Introduction: Governmen T Equity 42%Document5 pagesExecutive Summary A. Introduction: Governmen T Equity 42%sandra bolokNo ratings yet

- Ormoc City Comparative Statements of Financial Position: Total Current AssetsDocument6 pagesOrmoc City Comparative Statements of Financial Position: Total Current Assetssandra bolokNo ratings yet

- Status of Implementation of Prior Years' Unimplemented Audit RecommendationsDocument35 pagesStatus of Implementation of Prior Years' Unimplemented Audit Recommendationssandra bolokNo ratings yet

- 08-OrmocCity2018 Part1-Notes To FSDocument33 pages08-OrmocCity2018 Part1-Notes To FSsandra bolokNo ratings yet

- 03-OrmocCity2018 Executive SummaryDocument6 pages03-OrmocCity2018 Executive Summarysandra bolokNo ratings yet

- 10-Compostela2016 Part1-Notes To FSDocument84 pages10-Compostela2016 Part1-Notes To FSsandra bolokNo ratings yet

- Part I - Audited Financial StatementsDocument4 pagesPart I - Audited Financial Statementssandra bolokNo ratings yet

- Part II - Audit Observations and RecommendationsDocument32 pagesPart II - Audit Observations and Recommendationssandra bolokNo ratings yet

- Part I - Audited Financial StatementsDocument4 pagesPart I - Audited Financial Statementssandra bolokNo ratings yet

- Independent Auditor's Report: Commission On Audit Office of The Audit Team LeaderDocument2 pagesIndependent Auditor's Report: Commission On Audit Office of The Audit Team Leadersandra bolokNo ratings yet

- Annual Audit Report: Republic of The Philippines Commission On Audit Regional Office No. Xi Davao CityDocument1 pageAnnual Audit Report: Republic of The Philippines Commission On Audit Regional Office No. Xi Davao Citysandra bolokNo ratings yet

- Executive Summary: A. IntroductionDocument5 pagesExecutive Summary: A. Introductionsandra bolokNo ratings yet

- Statement of Financial Position - All Funds: Current AssetsDocument7 pagesStatement of Financial Position - All Funds: Current Assetssandra bolokNo ratings yet

- Office of The Audit Team LeaderDocument2 pagesOffice of The Audit Team Leadersandra bolokNo ratings yet

- Office of The Regional Director: Commission On AuditDocument1 pageOffice of The Regional Director: Commission On Auditsandra bolokNo ratings yet

- Part 1 - Financial Statements: Audit RecommendationsDocument1 pagePart 1 - Financial Statements: Audit Recommendationssandra bolokNo ratings yet

- Executive Summary: A. Introduction The AgencyDocument5 pagesExecutive Summary: A. Introduction The Agencysandra bolokNo ratings yet

- Status of Implementation of Prior Years' Audit RecommendationDocument8 pagesStatus of Implementation of Prior Years' Audit Recommendationsandra bolokNo ratings yet

- Part Ii-Observations and RecommendationsDocument23 pagesPart Ii-Observations and Recommendationssandra bolokNo ratings yet

- 02-TuguegaraoCity2017 CoverDocument1 page02-TuguegaraoCity2017 Coversandra bolokNo ratings yet

- 01-TuguegaraoCity2017 Transmittal LettersDocument12 pages01-TuguegaraoCity2017 Transmittal Letterssandra bolokNo ratings yet

- 04-BaaoCamSur2018 Table of ContentsDocument1 page04-BaaoCamSur2018 Table of Contentssandra bolokNo ratings yet

- Part I - Audited Financial StatementsDocument3 pagesPart I - Audited Financial Statementssandra bolokNo ratings yet

- A. Introduction: Executive SummaryDocument4 pagesA. Introduction: Executive Summarysandra bolokNo ratings yet

- Statement of Management'S Responsibility For Financial StatementsDocument1 pageStatement of Management'S Responsibility For Financial Statementssandra bolokNo ratings yet

- BSBWHS402 - Assist With Compliance With WHS Laws - V3 Feb 2017Document105 pagesBSBWHS402 - Assist With Compliance With WHS Laws - V3 Feb 2017Paula Martinez100% (1)

- Shrimp Turtle RulingDocument8 pagesShrimp Turtle RulingNJPMsmashNo ratings yet

- TMT DATA Protection Survival Guide Singles PDFDocument56 pagesTMT DATA Protection Survival Guide Singles PDFDanijelBaraNo ratings yet

- Cs. Nishant Mishra: E-Mail: Mobile: +91 8920043956Document3 pagesCs. Nishant Mishra: E-Mail: Mobile: +91 8920043956Nash MarxsNo ratings yet

- Rti PresentationDocument11 pagesRti PresentationMrinalkatkarNo ratings yet

- Andhra Pradesh Final Standardized Development and Building RegulationsDocument348 pagesAndhra Pradesh Final Standardized Development and Building Regulationsdarimadugu100% (1)

- Sindh Government Gazette PDFDocument55 pagesSindh Government Gazette PDFaqeel laghariNo ratings yet

- Industrial Policy-FinalDocument50 pagesIndustrial Policy-FinalShikha DubeyNo ratings yet

- Competition Policy in Romania After The Eu AccessionDocument7 pagesCompetition Policy in Romania After The Eu AccessionAndreea OancaNo ratings yet

- Introduction To Cross Border InsolvencyDocument25 pagesIntroduction To Cross Border Insolvencyharshil.rmlNo ratings yet

- 2020 05 WRAP PrinciplesDocument4 pages2020 05 WRAP PrinciplesAlimul EhsanNo ratings yet

- Auditing Islamic Financial Institutions (Haniffa)Document4 pagesAuditing Islamic Financial Institutions (Haniffa)Sirajudin HamdyNo ratings yet

- Partnership Firm Registration in TelanganaDocument6 pagesPartnership Firm Registration in TelanganaPrathap GoudNo ratings yet

- Auditing Project Sem2Document32 pagesAuditing Project Sem2madhuriNo ratings yet

- Final Draft: TOPIC: Comparative Study of Depository Receipts Relating To TheirDocument20 pagesFinal Draft: TOPIC: Comparative Study of Depository Receipts Relating To TheirDhanrajPatelNo ratings yet

- PreviewDocument8 pagesPreviewAnh Tuan PhamNo ratings yet

- TPA Rental ApplicationDocument2 pagesTPA Rental ApplicationPatrick NolanNo ratings yet

- 1 Republic v. HarpDocument92 pages1 Republic v. HarpArren RelucioNo ratings yet

- MIL-STD-961E SpecificationsDocument111 pagesMIL-STD-961E SpecificationsFranco SwanepoelNo ratings yet

- Benefits of Gov't EmployeeDocument10 pagesBenefits of Gov't EmployeeMyriz AlvarezNo ratings yet

- Nsitf ActDocument55 pagesNsitf Actabhi_akNo ratings yet

- CLU v. Exec SecDocument2 pagesCLU v. Exec SecGRNo ratings yet

- CGSR 10 MarksDocument16 pagesCGSR 10 Markssurya rathishNo ratings yet

- Software and Services Agreement TemplateDocument26 pagesSoftware and Services Agreement Templateanon_829377543No ratings yet

- Land Reforms 1 PDFDocument14 pagesLand Reforms 1 PDFPrashanthNo ratings yet

- LeaseDocument25 pagesLeaseJennylyn Biltz AlbanoNo ratings yet

- Re: Docket No. OCC-2011-0008/RIN 1557-AD43 Docket No. R-1415 /RIN 7100 AD74 RIN 3064-AD79 RIN 3052-AC69 RIN 2590-AA45Document42 pagesRe: Docket No. OCC-2011-0008/RIN 1557-AD43 Docket No. R-1415 /RIN 7100 AD74 RIN 3064-AD79 RIN 3052-AC69 RIN 2590-AA45MarketsWikiNo ratings yet

- Innodata Philippines Inc. vs. Jocelyn L. Quejada and Estella G. NatividadDocument2 pagesInnodata Philippines Inc. vs. Jocelyn L. Quejada and Estella G. NatividadMark MateoNo ratings yet

- Vi1notice PDFDocument5 pagesVi1notice PDFNavneetNo ratings yet