Professional Documents

Culture Documents

Phoenix Finance 1st MF 30.09.2019

Phoenix Finance 1st MF 30.09.2019

Uploaded by

Abrar Faisal0 ratings0% found this document useful (0 votes)

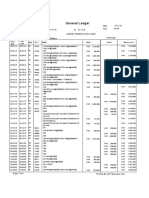

16 views2 pagesThe Phoenix Finance 1st Mutual Fund statement shows that as of September 30, 2019:

1) The fund's net assets decreased to Taka 705.49 crore from Taka 729.95 crore on June 30, 2019 mainly due to dividend distribution of Taka 30 crore.

2) Income was Taka 8.31 crore including profit from share sales and dividends, while expenses were Taka 2.76 crore.

3) Net profit for the period was Taka 5.55 crore and earnings per unit was 0.09.

Original Description:

Original Title

10. Phoenix finance 1st MF 30.09.2019

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe Phoenix Finance 1st Mutual Fund statement shows that as of September 30, 2019:

1) The fund's net assets decreased to Taka 705.49 crore from Taka 729.95 crore on June 30, 2019 mainly due to dividend distribution of Taka 30 crore.

2) Income was Taka 8.31 crore including profit from share sales and dividends, while expenses were Taka 2.76 crore.

3) Net profit for the period was Taka 5.55 crore and earnings per unit was 0.09.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

16 views2 pagesPhoenix Finance 1st MF 30.09.2019

Phoenix Finance 1st MF 30.09.2019

Uploaded by

Abrar FaisalThe Phoenix Finance 1st Mutual Fund statement shows that as of September 30, 2019:

1) The fund's net assets decreased to Taka 705.49 crore from Taka 729.95 crore on June 30, 2019 mainly due to dividend distribution of Taka 30 crore.

2) Income was Taka 8.31 crore including profit from share sales and dividends, while expenses were Taka 2.76 crore.

3) Net profit for the period was Taka 5.55 crore and earnings per unit was 0.09.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

PHOENIX FINANCE 1st MUTUAL FUND

Statement of Financial Position (Unaudited)

as at September 30, 2019

Amount in Taka

Particulars Notes

30/Sep/2019 30/Jun/2019

Assets

Marketable investment - at cost 700,926,403 721,768,165

Other current assets 1.00 3,379,022 2,001,387

Cash at bank 37,237,004 34,118,009

Total Assets 741,542,429 757,887,561

Equity and Liabilities

Equity:

Unit capital 600,000,000 600,000,000

Reserve and surplus 2.00 40,795,876 65,248,264

Provision for Marketable Investments 64,697,255 64,697,255

Total Equity 705,493,131 729,945,519

Liabilities:

Current liabilities 3.00 36,049,298 27,942,042

Total Equity and Liabilities 741,542,429 757,887,561

Net Asset Value (NAV)

At cost price 11.76 12.17

At market price 6.72 7.99

Statement of Profit or Loss and Other Comprehensive Income (Unaudited)

For the period ended September 30, 2019

Amount in Taka

Particulars Notes 01 July, 2019 to 01 July, 2018 to

30 Sept, 2019 30 Sept, 2018

Income

Profit on sale of investments 5,424,724 5,434,628

Dividend from investment in shares 2,886,701 3,922,169

Interest on bank deposits and bonds - 13,010

Total income 8,311,425 9,369,807

Expenses

Management fee 2,062,193 2,254,550

Trustee fee 150,000 150,000

Custodian fee 108,197 119,830

Annual fee to SEC 101,427 114,188

Listing fee 150,000 150,000

Audit fee 5,750 4,313

Other operating expenses 4.00 186,246 83,097

Total expenses 2,763,813 2,875,978

Net profit for the period 5,547,612 6,493,829

Earnings Per Unit 0.09 0.11

Statement of Changes in Equity (Unaudited)

For the period ended September 30, 2019

Provision for Dividend

Share Retained Total

Particulars Marketable Equlization

Capital Earnings Equity

investment Reserve

Balance as at July 01, 2019 600,000,000 64,697,255 3,564,736 61,683,528 729,945,519

Last year dividend - - (541,275) (29,458,725) (30,000,000)

Net profit for the year - - - 5,547,612 5,547,612

Balance as at September 30, 2019 600,000,000 64,697,255 3,023,461 37,772,415 705,493,131

Balance as at July 01, 2018 600,000,000 59,697,255 3,564,736 62,320,400 725,582,391

Last year dividend - - (30,000,000) (30,000,000)

Last year adjustment - - 1,488 1,488

Net profit for the year - - 6,493,829 6,493,829

Balance as at September 30, 2018 600,000,000 59,697,255 3,564,736 38,815,717 702,077,708

Statement of Cash Flows (Unaudited)

For the period ended September 30, 2019

Amount in Taka

Particulars 01 July, 2019 to 01 July, 2018 to

30 Sept, 2019 30 Sept, 2018

Cash flows from operating activities

Dividend from investment in shares 3,544,180 5,628,083

Interest on bank deposits and bonds 180,400 186,210

Expenses (624,465) (605,805)

Net cash inflow/(outflow) from operating activities 3,100,115 5,208,488

Cash flows from investing activities

Sale of shares-marketable investment 50,200,339 49,101,775

Purchase of shares-marketable investments (26,149,367) (22,183,982)

Share application money deposit - (12,900,000)

Share application money refunded - 9,200,000

Net cash inflow/(outflow) from investment activities 24,050,972 23,217,793

Cash flow from financing activities

Dividend paid (24,032,092) (24,198,662)

Net cash inflow/(outflow) from financing activities (24,032,092) (24,198,662)

Net cash flow increase/(decrease) 3,118,995 4,227,619

Cash equivalent at beginning of the year 34,118,009 32,384,449

Cash equivalent at end of the year 37,237,004 36,612,068

Net Operating Cash Flow Per Unit (NOCFPU) 0.05 0.09

Sd/- Sd/- Sd/- Sd/-

Chief Executive Officer Head of Finance & Accounts Chairman of Trustee Committee Member-Secretary of Trustee Committee

PHOENIX FINANCE 1st MUTUAL FUND

Notes to the financial statements (Unaudited)

For the period ended September 30, 2019

Amount in Taka

30/Sep/2019 30/Jun/2019

1.00 Other current assets

Dividend receivables 217,428 874,907

Interest receivable - 180,400

Security deposit 500,000 500,000

Receivable from ISTCL 2,661,594 446,080

3,379,022 2,001,387

2.00 Reserve and surplus

Dividend equalization reserve (Note 2.01) 3,023,461 3,564,736

Retained earning (Note 2.02) 37,772,415 61,683,528

40,795,876 65,248,264

2.01 Dividend equalization reserve

Balance as at July 01 3,564,736 3,564,736

Less: Last year dividend 541,275

Balance as at June 30 3,023,461 3,564,736

2.02 Retained earning

Balance as at July 01 61,683,528 62,320,400

Less: Last year dividend 29,458,725 30,000,000

Add: Last year adjustment - (95,597)

32,224,803 32,224,803

Addition during the period 5,547,612 29,458,725

Closing balance 37,772,415 61,683,528

3.00 Current liabilities

Management fee payable to ICB AMCL 10,767,935 8,705,742

Trustee fee payable to ICB 150,000 -

Custodian fee payable to ICB 108,197 462,505

Audit fee 5,750 23,000

Annual Fee (SEC) Payable 101,427 4,948

Listing Fee payable 150,000 -

Share application money refundable 10,715,658 10,715,658

Dividend payable 13,994,977 8,027,069

Others 55,354 3,120

Total current liabilities 36,049,298 27,942,042

Amount in Taka

01 July, 2019 to 01 July, 2018 to

30 September, 2019 30 September, 2018

4.00 Other operating expenses

Bank charges & Excise duty 18 585

Advertisement 72,787 55,144

CDBL Charges 5,241 4,518

CDBL annual fee & Connection charge 106,000 -

Dividend distribution expenses 2,200 -

IPO application expenses - 17,000

Others - 5,850

186,246 83,097

You might also like

- Accounting 202 Chapter 14 TestDocument2 pagesAccounting 202 Chapter 14 TestLương Thế CườngNo ratings yet

- Prime Bank 1st ICB AMCL MF 31.12.2019 PDFDocument2 pagesPrime Bank 1st ICB AMCL MF 31.12.2019 PDFAbrar FaisalNo ratings yet

- PHOENIX FINANCE 1st MUTUAL FUND 31.03.19Document1 pagePHOENIX FINANCE 1st MUTUAL FUND 31.03.19Abrar FaisalNo ratings yet

- September 2019 Orion PharmaDocument13 pagesSeptember 2019 Orion PharmaAfia Begum ChowdhuryNo ratings yet

- CHB Jun19 PDFDocument14 pagesCHB Jun19 PDFSajeetha MadhavanNo ratings yet

- Hy RFL 2019Document2 pagesHy RFL 2019anup dasNo ratings yet

- Prime Finance First Mutrual Fund 31.12.19 - 2Document4 pagesPrime Finance First Mutrual Fund 31.12.19 - 2Abrar FaisalNo ratings yet

- Advans Ghana Savings and Loans LimitedDocument5 pagesAdvans Ghana Savings and Loans LimitedElson MelekhNo ratings yet

- Condensed Quarterly Accounts (Un-Audited)Document10 pagesCondensed Quarterly Accounts (Un-Audited)Perah ShaikhNo ratings yet

- Sonali Bank Balancesheet 2019Document9 pagesSonali Bank Balancesheet 2019DHAKA COLLEGENo ratings yet

- CHB Sep19 PDFDocument14 pagesCHB Sep19 PDFSajeetha MadhavanNo ratings yet

- Quarterly Report 20200930Document18 pagesQuarterly Report 20200930Ang SHNo ratings yet

- Panasonic Malaysia - 4Q 19 - Bursa (PMMA) FinalDocument12 pagesPanasonic Malaysia - 4Q 19 - Bursa (PMMA) FinalGan ZhiHanNo ratings yet

- Fusen Pharmaceutical Company Limited 福 森 藥 業 有 限 公 司Document22 pagesFusen Pharmaceutical Company Limited 福 森 藥 業 有 限 公 司in resNo ratings yet

- Financial Reporting Mcom 3 Semester: AssetsDocument2 pagesFinancial Reporting Mcom 3 Semester: AssetsYasir AminNo ratings yet

- U Microfinance Bank Limited Condensed Interim Financial Statements (Un-Audited) For The PeriodDocument20 pagesU Microfinance Bank Limited Condensed Interim Financial Statements (Un-Audited) For The PeriodHayue MemonNo ratings yet

- Half Yearly Report 2010Document12 pagesHalf Yearly Report 2010tans69No ratings yet

- Accounts May 20 Ver 4Document66 pagesAccounts May 20 Ver 4Abdurrehman ShaheenNo ratings yet

- Unaudited FS - 2nd QuarterDocument37 pagesUnaudited FS - 2nd Quarterprasenjitpandit4No ratings yet

- Sitara 2019Document47 pagesSitara 2019Muhammad AhmedNo ratings yet

- Key Financial and Performance Indicators For The Nine Months Ended 30 September 2020Document12 pagesKey Financial and Performance Indicators For The Nine Months Ended 30 September 2020zakkNo ratings yet

- Final IFRS For SMEs Illustrator ExampleDocument30 pagesFinal IFRS For SMEs Illustrator ExampleleekosalNo ratings yet

- This Statement Should Be Read in Conjunction With The Accompanying NotesDocument4 pagesThis Statement Should Be Read in Conjunction With The Accompanying NotesKim Patrick VictoriaNo ratings yet

- Bangladesh q2 Report 2020 Tcm244 553471 enDocument8 pagesBangladesh q2 Report 2020 Tcm244 553471 entdebnath_3No ratings yet

- 1Q 20 - Bursa (PMMA) FinalDocument12 pages1Q 20 - Bursa (PMMA) FinalGan ZhiHanNo ratings yet

- These Financial Statements Should Be Read in Conjunction With The Annexed NotesDocument10 pagesThese Financial Statements Should Be Read in Conjunction With The Annexed NotesSK. Al Mamun MamunNo ratings yet

- 3rd Quarterly Accounts - Prime Finance 1st MF 13Document1 page3rd Quarterly Accounts - Prime Finance 1st MF 13Abrar FaisalNo ratings yet

- Bursa Q3 2015 FinalDocument16 pagesBursa Q3 2015 FinalFakhrul Azman NawiNo ratings yet

- $R3M2NK4Document26 pages$R3M2NK4Hasan Mohammad MahediNo ratings yet

- Beximco PHARMACEUTICALS LTD ISDocument2 pagesBeximco PHARMACEUTICALS LTD ISSuny ChowdhuryNo ratings yet

- Unaudited Interim Results For The Six Months Ended 30 June 2020Document27 pagesUnaudited Interim Results For The Six Months Ended 30 June 2020in resNo ratings yet

- ExecutiveSummary November RBRADocument2 pagesExecutiveSummary November RBRAChaNo ratings yet

- SHV Port - FS English 31 Dec 2019 - SignedDocument54 pagesSHV Port - FS English 31 Dec 2019 - SignedNithiaNo ratings yet

- Balance Sheet As of December 31, 2019 in Rupiah: Pt. Daisen Wood FrameDocument6 pagesBalance Sheet As of December 31, 2019 in Rupiah: Pt. Daisen Wood FrameDwiputra SetiabudhiNo ratings yet

- Beng Soon Machinery Holdings Limited: Interim Results Announcement For The Six Months Ended 30 June 2020Document34 pagesBeng Soon Machinery Holdings Limited: Interim Results Announcement For The Six Months Ended 30 June 2020in resNo ratings yet

- Bangladesh q3 Report 2020 Tcm244 556009 enDocument8 pagesBangladesh q3 Report 2020 Tcm244 556009 entdebnath_3No ratings yet

- GCB-Q3 2023 - Interim - ReportDocument16 pagesGCB-Q3 2023 - Interim - ReportGan ZhiHanNo ratings yet

- Quarterly Report 20191231Document21 pagesQuarterly Report 20191231Ang SHNo ratings yet

- Citn & IcagDocument5 pagesCitn & IcagAKINROYEJE TEMITOPENo ratings yet

- Greetings Everyone: To My PresentationDocument15 pagesGreetings Everyone: To My PresentationZakaria ShuvoNo ratings yet

- April 2020 PTE 1 PathfinderDocument47 pagesApril 2020 PTE 1 PathfinderbatuchemNo ratings yet

- JHL Financial Statement Year Ended 31st December 2017Document1 pageJHL Financial Statement Year Ended 31st December 2017douglasNo ratings yet

- Greenko - Investment - Company - Audited - Combined - Financial - Statements - FY 2018 - 19Document102 pagesGreenko - Investment - Company - Audited - Combined - Financial - Statements - FY 2018 - 19hNo ratings yet

- Awasr Oman Partners 2019Document44 pagesAwasr Oman Partners 2019abdullahsaleem91No ratings yet

- Financial Statements Analysis: Arsalan FarooqueDocument31 pagesFinancial Statements Analysis: Arsalan FarooqueMuhib NoharioNo ratings yet

- 08 MWSS2020 - Part1 FSDocument6 pages08 MWSS2020 - Part1 FSGabriel OrolfoNo ratings yet

- Guorui Properties Limited 國瑞置業有限公司: Interim Results Announcement For The Six Months Ended June 30, 2020Document38 pagesGuorui Properties Limited 國瑞置業有限公司: Interim Results Announcement For The Six Months Ended June 30, 2020in resNo ratings yet

- 07 PUP2020 - Part1 FSDocument5 pages07 PUP2020 - Part1 FSMiss_AccountantNo ratings yet

- en PDFDocument49 pagesen PDFJ. BangjakNo ratings yet

- Disscor Fs.02Document86 pagesDisscor Fs.02Ricardo DelacruzNo ratings yet

- HCL Tech q1 2020 Us Gaap Accounts PDFDocument44 pagesHCL Tech q1 2020 Us Gaap Accounts PDFSachin SinghNo ratings yet

- Adesoye, Adeniji-Scena - CorrectDocument11 pagesAdesoye, Adeniji-Scena - CorrectAdesoye AdenijiNo ratings yet

- Overseas BankingDocument16 pagesOverseas BankingafzalhashimNo ratings yet

- 2019 Quarter 2 FInancial StatementsDocument1 page2019 Quarter 2 FInancial StatementsKaystain Chris IhemeNo ratings yet

- NIKL PR Aug 07 2020Document5 pagesNIKL PR Aug 07 2020Peter Paul RecaboNo ratings yet

- FSA Tutorial 1Document2 pagesFSA Tutorial 1KHOO TAT SHERN DEXTONNo ratings yet

- Statement of Changes StandaloneDocument2 pagesStatement of Changes StandaloneMadhu MohanNo ratings yet

- H and V Anal ExerciseDocument3 pagesH and V Anal ExerciseSummer ClaronNo ratings yet

- Statements of Financial Position As at December 31 Assets Current AssetsDocument8 pagesStatements of Financial Position As at December 31 Assets Current AssetsCalix CasanovaNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Half - Prime Bank 1st ICB AMCL Mutual Fund 10-11Document1 pageHalf - Prime Bank 1st ICB AMCL Mutual Fund 10-11Abrar FaisalNo ratings yet

- USC - 11 Financial DataDocument1 pageUSC - 11 Financial DataAbrar FaisalNo ratings yet

- 3rd Quarterly Accounts - Prime Finance 1st MF 13Document1 page3rd Quarterly Accounts - Prime Finance 1st MF 13Abrar FaisalNo ratings yet

- PHOENIX FINANCE 1st MUTUAL FUND 31.03.19Document1 pagePHOENIX FINANCE 1st MUTUAL FUND 31.03.19Abrar FaisalNo ratings yet

- Prime Finance First Mutrual Fund 31.12.19 - 2Document4 pagesPrime Finance First Mutrual Fund 31.12.19 - 2Abrar FaisalNo ratings yet

- Prime Finance First MF2012Document1 pagePrime Finance First MF2012Abrar FaisalNo ratings yet

- Prime Bank 1st ICB AMCL MF 31.12.2019 PDFDocument2 pagesPrime Bank 1st ICB AMCL MF 31.12.2019 PDFAbrar FaisalNo ratings yet

- Binancelistingagreement 2Document4 pagesBinancelistingagreement 2smithstacy4422No ratings yet

- Balance Sheet Management - BFMDocument4 pagesBalance Sheet Management - BFMakvgauravNo ratings yet

- SG - FSDocument20 pagesSG - FSRoxieNo ratings yet

- Payout Request FormDocument2 pagesPayout Request FormalexNo ratings yet

- Financial Statement Analysis 11th Edition Subramanyam Solutions Manual DownloadDocument60 pagesFinancial Statement Analysis 11th Edition Subramanyam Solutions Manual DownloadDavid Williams100% (21)

- PayPal Verification Guide - AllienwareDocument14 pagesPayPal Verification Guide - Allienware1.o2as100% (1)

- Saadiq Personal/Premium Account Opening FormDocument17 pagesSaadiq Personal/Premium Account Opening FormMahmudur Rahman SunnyNo ratings yet

- Case StudyDocument10 pagesCase Studyamit sharmaNo ratings yet

- Accounting Week 2Document3 pagesAccounting Week 2Erryn M. ParamythaNo ratings yet

- Prudential Regulations For Corporate / Commercial BankingDocument53 pagesPrudential Regulations For Corporate / Commercial BankingMUNTHA ARSHADNo ratings yet

- Bill Overview: Jlb9Rcm79Vkgxfivcivc Ykpfivcu5Kywcvxmvc56Hvcaxga2K7FDocument5 pagesBill Overview: Jlb9Rcm79Vkgxfivcivc Ykpfivcu5Kywcvxmvc56Hvcaxga2K7FAzri JamariNo ratings yet

- Syllabus 4 - Financial Management - Spring 2020Document6 pagesSyllabus 4 - Financial Management - Spring 2020Hayden Rutledge Earle100% (1)

- Penney Merger Case Solution 3Document15 pagesPenney Merger Case Solution 3Carlos VeraNo ratings yet

- Chapter 2Document12 pagesChapter 2Mhmd KaramNo ratings yet

- 2021 年簿记与会计备考paper 2Document34 pages2021 年簿记与会计备考paper 2李迦尼No ratings yet

- FAR 1 Pre Batch Over All Lecture NotesDocument60 pagesFAR 1 Pre Batch Over All Lecture NotesHadeed HafeezNo ratings yet

- Fundamentals of Accountancy Business and Management 1 11 3 QuarterDocument4 pagesFundamentals of Accountancy Business and Management 1 11 3 QuarterPaulo Amposta CarpioNo ratings yet

- Fashion Fund SACDocument22 pagesFashion Fund SACKartik RamNo ratings yet

- MHABJG00118Document1 pageMHABJG00118Gaurav GujrathiNo ratings yet

- Jackielyn Magpantay Chart of AccountsDocument9 pagesJackielyn Magpantay Chart of AccountsIgnite NightNo ratings yet

- Home Management ReportDocument30 pagesHome Management ReportCentienne BatemanNo ratings yet

- Capital Project Funds: Instructor: Janice H. FergussonDocument42 pagesCapital Project Funds: Instructor: Janice H. FergussonZach TaylorNo ratings yet

- LT Nifty Next 50 Index FundDocument2 pagesLT Nifty Next 50 Index FundQUALITY12No ratings yet

- Reviewer in BANKING (Dizon Book)Document59 pagesReviewer in BANKING (Dizon Book)Maureen Kascha OsoteoNo ratings yet

- Summer Internship Project ReportDocument73 pagesSummer Internship Project ReportVishal Patel100% (1)

- Current Trends in International MarketingDocument13 pagesCurrent Trends in International Marketingseema talrejaNo ratings yet

- FM FinalDocument87 pagesFM FinalGaurav S JadhavNo ratings yet

- Screenshot 2023-02-22 at 6.31.09 PMDocument5 pagesScreenshot 2023-02-22 at 6.31.09 PMMian NadeemNo ratings yet

- Methods of Accounting For MergersDocument6 pagesMethods of Accounting For MergersAnwar KhanNo ratings yet