Professional Documents

Culture Documents

USC - 11 Financial Data

USC - 11 Financial Data

Uploaded by

Abrar FaisalOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

USC - 11 Financial Data

USC - 11 Financial Data

Uploaded by

Abrar FaisalCopyright:

Available Formats

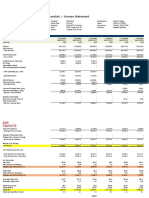

Selected Consolidated Financial Data

Year Ended or at December 31, 2004 2003 2002 2001 2000

(Dollars in thousands, except per share amounts)

Operating Data

Service revenues $2,647,227 $2,423,789 $2,098,893 $1,826,385 $1,653,922

Equipment sales 190,392 158,994 98,693 68,445 62,718

Operating revenues 2,837,619 2,582,783 2,197,586 1,894,830 1,716,640

Operating income 177,762 118,983 281,166 317,212 292,313

Investment income 68,481 52,063 42,068 41,934 43,727

Gain (loss) on investments 24,436 (5,200) (295,454) — 96,075

Income (loss) before income taxes

and minority interest 192,632 106,150 (12,388) 331,337 377,165

Income (loss) before cumulative effect

of accounting change 109,021 57,006 (18,385) 173,876 197,568

Cumulative effect of accounting change, net of tax — (14,346) (8,560) — (4,661)

Net income (loss) $ «109,021 $ «42,660 $ (26,945) $ «173,876 $ «192,907

Basic weighted average shares outstanding (000s) 86,244 86,136 86,086 86,200 86,355

Basic earnings per share from:

Income (loss) before cumulative effect

of accounting change $ «1.26 $ «0.67 $ (0.22) $ «2.02 $ «2.28

Cumulative effect of accounting change — (0.17) (0.09) — (0.05)

Net income (loss) $ «1.26 $ «0.50 $ (0.31) $ «2.02 $ «2.23

Diluted weighted average shares outstanding (000s) 86,736 86,602 86,086 89,977 90,874

Diluted earnings per share from:

Income (loss) before cumulative effect

of accounting change $ «1.26 $ «0.66 $ (0.22) $ «1.99 $ «2.27

Cumulative effect of accounting change — (0.17) (0.09) — (0.05)

Net income (loss) $ «1.26 $ «0.49 $ (0.31) $ «1.99 $ «2.22

Pro forma (a)

Net income (loss) N/A $«««««57,006 $««««(30,047) $«««171,481 $«««190,837

Basic earnings (loss) per share N/A 0.67 (0.34) 1.99 2.21

Diluted earnings (loss) per share N/A $«««««««««0.66 $««««««««(0.34) $«««««««««1.97 $«««««««««2.20

Balance Sheet Data

Property, plant and equipment, net $2,365,436 $2,173,884 $2,033,791 $1,419,341 $1,145,623

Investments

Licenses 1,186,764 1,189,326 1,247,197 858,791 857,607

Goodwill 425,918 430,256 504,744 473,975 400,966

Marketable equity securities 282,829 260,188 185,961 272,390 377,900

Unconsolidated entities 162,764 170,569 161,451 159,454 137,474

Total assets 5,181,927 4,945,747 4,769,597 3,759,157 3,501,177

Long-term debt (excluding current portion) 1,160,786 1,144,344 806,460 403,156 448,817

Common shareholders’ equity $2,588,090 $2,465,403 $2,402,377 $2,335,669 $2,214,571

Current ratio (b) 1.06 0.73 0.46 0.70 1.03

Return on average equity (c) 4.3% 2.3% (0.8) % 7.6% 8.8%

Results from previous years have been restated to conform to current period presentation.

U.S. Cellular has not paid any cash dividends and currently intends to retain all earnings for use in U.S. Cellular’s business.

(a) Pro forma amounts reflect the effect of the retroactive application of the change in accounting principle for the adoption of SFAS No. 143, ”Accounting for Asset Retirement Obligations” in 2003.

Therefore, no pro forma amounts are required in 2004.

(b) Current ratio is calculated by dividing current assets by current liabilities. These amounts are taken directly from the Consolidated Balance Sheets.

(c) Return on average equity is calculated by dividing income (loss) before cumulative effect of accounting change by the average of the beginning and ending common shareholders’ equity. These

amounts are taken from the Consolidated Statements of Operations and Balance Sheets. The result is shown as a percentage.

U.S. Cellular 17

You might also like

- Comments On Past Exam Question PracticeDocument9 pagesComments On Past Exam Question Practicetcqing1012No ratings yet

- So Energy BillDocument1 pageSo Energy BillPhill LivesleyNo ratings yet

- Imfpa Format BTCDocument1 pageImfpa Format BTCKiki Saja100% (1)

- Model Assignment Aug-23Document3 pagesModel Assignment Aug-23Abner ogegaNo ratings yet

- Case 29 Gainesboro Machine Tools CorporationDocument33 pagesCase 29 Gainesboro Machine Tools CorporationUshna100% (1)

- Marriott Corporation (A) Harvard Business School Case 9-394-085 Courseware 9-307-703Document3 pagesMarriott Corporation (A) Harvard Business School Case 9-394-085 Courseware 9-307-703CH NAIR100% (1)

- 2019-12 - EIC Accelerator Pilot - Annex - 4 - Financial Information - Proposal Template Part BDocument3 pages2019-12 - EIC Accelerator Pilot - Annex - 4 - Financial Information - Proposal Template Part BminossotaNo ratings yet

- Devon Q4-2019-DVN-Supplemental-TablesDocument11 pagesDevon Q4-2019-DVN-Supplemental-TablesMiguel RamosNo ratings yet

- Wal-Mart Stores, Inc.: Notes To Consolidated Financial Statements 7 Stock-Based Compensation PlansDocument5 pagesWal-Mart Stores, Inc.: Notes To Consolidated Financial Statements 7 Stock-Based Compensation PlansNamitNo ratings yet

- Blackstone 1 Q 20 Earnings Press ReleaseDocument40 pagesBlackstone 1 Q 20 Earnings Press ReleaseZerohedgeNo ratings yet

- Bestbuy Income StatementDocument1 pageBestbuy Income Statementmeverick_leeNo ratings yet

- Table of Contents: Years Ended December 31, 2015 2014 2013Document2 pagesTable of Contents: Years Ended December 31, 2015 2014 2013Phan DuyetNo ratings yet

- HCL Income StatementDocument4 pagesHCL Income StatementAswini Kumar BhuyanNo ratings yet

- Tata Steel LTD (TATA IN) - AdjustedDocument10 pagesTata Steel LTD (TATA IN) - AdjustedAswini Kumar BhuyanNo ratings yet

- Bank of China Limited SEHK 3988 Financials Income StatementDocument3 pagesBank of China Limited SEHK 3988 Financials Income StatementJaime Vara De ReyNo ratings yet

- Eastboro ExhibitsDocument9 pagesEastboro ExhibitstimbulmanaluNo ratings yet

- Acme FinancialsDocument2 pagesAcme Financialsakash.rajanstl02No ratings yet

- Eastboro Data - Class - DiscussionDocument11 pagesEastboro Data - Class - Discussionvasuca2007No ratings yet

- Blackstone 2 Q 22 Earnings Press ReleaseDocument41 pagesBlackstone 2 Q 22 Earnings Press ReleaseLinh Linh NguyenNo ratings yet

- Eerr EnronDocument5 pagesEerr EnronCamila PeñaNo ratings yet

- Apple Valuation Exercise - AAPL Financials (Annual) July 31 2020Document44 pagesApple Valuation Exercise - AAPL Financials (Annual) July 31 2020/jncjdncjdnNo ratings yet

- Att-Ar-2012-Financials Cut PDFDocument5 pagesAtt-Ar-2012-Financials Cut PDFDevandro MahendraNo ratings yet

- Income Statement - FacebookDocument6 pagesIncome Statement - FacebookFábia RodriguesNo ratings yet

- Annual Report 2016: Financial SectionDocument39 pagesAnnual Report 2016: Financial SectionAlezNgNo ratings yet

- Q4 16 Website Data PDFDocument11 pagesQ4 16 Website Data PDFAnggun SetyantoNo ratings yet

- Letter To Shareholders: 667 Madison Ave. New York, NY 10065Document20 pagesLetter To Shareholders: 667 Madison Ave. New York, NY 10065Michael Cano LombardoNo ratings yet

- 2 Income StatmentDocument1 page2 Income StatmentKatia LopezNo ratings yet

- Morgan Stanley (MS US) - AdjustedDocument24 pagesMorgan Stanley (MS US) - AdjustedAswini Kumar BhuyanNo ratings yet

- Agricultural Bank of China Limited SEHK 1288 Financials Income StatementDocument3 pagesAgricultural Bank of China Limited SEHK 1288 Financials Income StatementJaime Vara De ReyNo ratings yet

- 2022 Form 10-K Consolidated Balance SheetDocument1 page2022 Form 10-K Consolidated Balance SheetYashasvi RaghavendraNo ratings yet

- Tata MotorsDocument41 pagesTata MotorsShubham SharmaNo ratings yet

- Cfin Sep2022Document14 pagesCfin Sep2022jdNo ratings yet

- Advanced Info Service PCL (ADVANC TB) - AdjustedDocument12 pagesAdvanced Info Service PCL (ADVANC TB) - AdjustedYounG TerKNo ratings yet

- Solutions (Chapter17)Document5 pagesSolutions (Chapter17)James Domini Lopez LabianoNo ratings yet

- Net Revenue $ 15,301 $ 16,883 $ 14,950 Operating Expenses: Consolidated Statement of OperationsDocument1 pageNet Revenue $ 15,301 $ 16,883 $ 14,950 Operating Expenses: Consolidated Statement of OperationsMaanvee JaiswalNo ratings yet

- Session8 FMD Mdim 2021Document20 pagesSession8 FMD Mdim 2021MOHAMMED ARBAZ ABBASNo ratings yet

- Summary Consolidated and Separate Financial Statements For The Period Ended 30 Sept 2021 (Unaudited)Document1 pageSummary Consolidated and Separate Financial Statements For The Period Ended 30 Sept 2021 (Unaudited)Fuaad DodooNo ratings yet

- CF ExcelDocument4 pagesCF ExcelAnam AbrarNo ratings yet

- 105 10 Walmart Financial StatementsDocument5 pages105 10 Walmart Financial StatementsAhmad IqbalNo ratings yet

- Flujo de Caja AaplDocument9 pagesFlujo de Caja AaplPablo Alejandro JaldinNo ratings yet

- NetflixDocument3 pagesNetflixNikkii SharmaNo ratings yet

- Excel Files For Case 12 - Value PublishinDocument12 pagesExcel Files For Case 12 - Value PublishinGerry RuntukahuNo ratings yet

- Coca-Cola 10-K Item 06Document1 pageCoca-Cola 10-K Item 06junerubinNo ratings yet

- Q32023VZDocument17 pagesQ32023VZLuis DavidNo ratings yet

- Ayala Corporation and Subsidiaries Consolidated Statements of Changes in EquityDocument2 pagesAyala Corporation and Subsidiaries Consolidated Statements of Changes in EquitybyuntaexoNo ratings yet

- 4Q FY 2015 Press Release FinancialsDocument4 pages4Q FY 2015 Press Release Financialspedro_noiretNo ratings yet

- GAR02 28 02 2024 FY2023 Results ReleaseDocument29 pagesGAR02 28 02 2024 FY2023 Results Releasedesifatimah87No ratings yet

- Condensed Consolidated Statements of Income: Weighted-Average Shares Outstanding (In Millions) 4,201 4,141 4,201 4,141Document10 pagesCondensed Consolidated Statements of Income: Weighted-Average Shares Outstanding (In Millions) 4,201 4,141 4,201 4,141Annemiek BlezerNo ratings yet

- Tarea Razones RentabilidadDocument12 pagesTarea Razones RentabilidadEmilio BazaNo ratings yet

- Patisserie Haya (PP) FinalDocument10 pagesPatisserie Haya (PP) FinalWolfManNo ratings yet

- Recipe Unlimited Corporation: Condensed Consolidated Interim Financial Statements (Unaudited)Document46 pagesRecipe Unlimited Corporation: Condensed Consolidated Interim Financial Statements (Unaudited)polodeNo ratings yet

- Pepsico Inc: Financial Statement: Business Type: IndustryDocument3 pagesPepsico Inc: Financial Statement: Business Type: Industrychandel100No ratings yet

- Erro Jaya Rosady - 042024353001Document261 pagesErro Jaya Rosady - 042024353001Erro Jaya RosadyNo ratings yet

- Fs AnalysisDocument14 pagesFs Analysisyusuf pashaNo ratings yet

- Starbucks Fiscal 2021 Annual ReportDocument1 pageStarbucks Fiscal 2021 Annual ReportLeslie GuillermoNo ratings yet

- AsahiDocument2 pagesAsahiABHAY KUMAR SINGHNo ratings yet

- Blackstone 3 Q21 Supplemental Financial DataDocument20 pagesBlackstone 3 Q21 Supplemental Financial DataW.Derail McClendonNo ratings yet

- MBF5207201004 Strategic Financial ManagementDocument5 pagesMBF5207201004 Strategic Financial ManagementtawandaNo ratings yet

- Nasdaq Aaon 2018Document92 pagesNasdaq Aaon 2018gaja babaNo ratings yet

- OMV Annual Report 2016 enDocument240 pagesOMV Annual Report 2016 enAhmed Ben HmidaNo ratings yet

- Blackstone 1 Q 24 Earnings Press ReleaseDocument43 pagesBlackstone 1 Q 24 Earnings Press ReleasepriyasivagsNo ratings yet

- Abans QuarterlyDocument14 pagesAbans QuarterlyGFMNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Half - Prime Bank 1st ICB AMCL Mutual Fund 10-11Document1 pageHalf - Prime Bank 1st ICB AMCL Mutual Fund 10-11Abrar FaisalNo ratings yet

- 3rd Quarterly Accounts - Prime Finance 1st MF 13Document1 page3rd Quarterly Accounts - Prime Finance 1st MF 13Abrar FaisalNo ratings yet

- Prime Finance First MF2012Document1 pagePrime Finance First MF2012Abrar FaisalNo ratings yet

- Phoenix Finance 1st MF 30.09.2019Document2 pagesPhoenix Finance 1st MF 30.09.2019Abrar FaisalNo ratings yet

- PHOENIX FINANCE 1st MUTUAL FUND 31.03.19Document1 pagePHOENIX FINANCE 1st MUTUAL FUND 31.03.19Abrar FaisalNo ratings yet

- Prime Finance First Mutrual Fund 31.12.19 - 2Document4 pagesPrime Finance First Mutrual Fund 31.12.19 - 2Abrar FaisalNo ratings yet

- Prime Bank 1st ICB AMCL MF 31.12.2019 PDFDocument2 pagesPrime Bank 1st ICB AMCL MF 31.12.2019 PDFAbrar FaisalNo ratings yet

- Critical Evaluation of Leadership StylesDocument13 pagesCritical Evaluation of Leadership StylesThe HoopersNo ratings yet

- Survey of Econ 3rd Edition Sexton Solutions ManualDocument11 pagesSurvey of Econ 3rd Edition Sexton Solutions Manualdariusarnoldvin100% (30)

- CL14 - ROSE - MOOE - February 2021Document54 pagesCL14 - ROSE - MOOE - February 2021Rose Diesta-SolivioNo ratings yet

- Republic of The PhilippinesDocument6 pagesRepublic of The PhilippinessantasantitaNo ratings yet

- List of Participants Target2.enDocument42 pagesList of Participants Target2.enDima RajaNo ratings yet

- Effect of Employee Involvement in Decision Making and Organization ProductivityDocument7 pagesEffect of Employee Involvement in Decision Making and Organization ProductivityVadsak AkashNo ratings yet

- Enano-Bote Vs Alvarez, GR 223572, Nov. 10, 2020Document21 pagesEnano-Bote Vs Alvarez, GR 223572, Nov. 10, 2020Catherine DimailigNo ratings yet

- Consumerprotectionact1986 130108233332 Phpapp01Document24 pagesConsumerprotectionact1986 130108233332 Phpapp01eva guptaNo ratings yet

- Module 4 - Final Income TaxationDocument4 pagesModule 4 - Final Income TaxationReicaNo ratings yet

- BPL-F-009 Tricycle Driver's Application Form (Vigan)Document1 pageBPL-F-009 Tricycle Driver's Application Form (Vigan)John LowieNo ratings yet

- Ans - CLASS XII - ACCOUNTS CHAPTER 1 - NPO MCQsDocument3 pagesAns - CLASS XII - ACCOUNTS CHAPTER 1 - NPO MCQsKamalNo ratings yet

- Idoc - Pub - Alternative Costing Methods PDFDocument17 pagesIdoc - Pub - Alternative Costing Methods PDFElla DavisNo ratings yet

- Olguioo - Artist Resources - 1.1 - ENDocument8 pagesOlguioo - Artist Resources - 1.1 - ENjune_yayNo ratings yet

- 5 Luna V EncarnacionDocument3 pages5 Luna V EncarnacionFlorieanne May ReyesNo ratings yet

- Measuring E-Marketing Mix Elements For Online BusinessDocument15 pagesMeasuring E-Marketing Mix Elements For Online BusinessAthenaNo ratings yet

- Business and Competitive AnalysisDocument72 pagesBusiness and Competitive AnalysisrcamargopayaresNo ratings yet

- SCM 5000 Lesson 8 - DC & Packaging - 2021 - No BackgroundDocument49 pagesSCM 5000 Lesson 8 - DC & Packaging - 2021 - No BackgroundAndy StarksNo ratings yet

- Financial Management Sri Individidual Cia 1.2Document7 pagesFinancial Management Sri Individidual Cia 1.2ALLIED AGENCIESNo ratings yet

- Sip One Pager Tata Ethical Fun4Document2 pagesSip One Pager Tata Ethical Fun4MohammedNo ratings yet

- Schedule G - Attachment I-VII 3000953944Document18 pagesSchedule G - Attachment I-VII 3000953944xue jun xiangNo ratings yet

- Geographical IndicationDocument4 pagesGeographical IndicationRohan lopesNo ratings yet

- ICPR Saudi Arabia Full ReportDocument56 pagesICPR Saudi Arabia Full ReportBala RaoNo ratings yet

- Lean Thinking in Service IndustryDocument72 pagesLean Thinking in Service IndustryJeff Watson100% (1)

- RBI Circular - Release of Property Documents On Rep - 230915 - 085021Document2 pagesRBI Circular - Release of Property Documents On Rep - 230915 - 085021Motorola G6No ratings yet

- Gratuity CalculationDocument4 pagesGratuity CalculationmeetushekhawatNo ratings yet

- Understanding The Importance of MentoringDocument9 pagesUnderstanding The Importance of MentoringDeepika BorgaonkarNo ratings yet

- Summary of Corresponding Fees of BSP Supervised Financial Institutions (Bsfis) From The Disclosures Submitted As of 30 September 2021Document2 pagesSummary of Corresponding Fees of BSP Supervised Financial Institutions (Bsfis) From The Disclosures Submitted As of 30 September 2021Rosaly Tonelada TabaqueroNo ratings yet