Professional Documents

Culture Documents

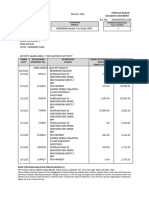

AALendingAdvancedPart4 PDF

AALendingAdvancedPart4 PDF

Uploaded by

lolitaferozCopyright:

Available Formats

You might also like

- Arrangement Architecture - Accounts - TM - R15 PDFDocument336 pagesArrangement Architecture - Accounts - TM - R15 PDFrajan shukla100% (2)

- AADocument73 pagesAAazza youness100% (3)

- RC PDFDocument116 pagesRC PDFkhan100% (1)

- TCIB6 IntegrationwithT24 R17Document69 pagesTCIB6 IntegrationwithT24 R17Zareen Zia KhanNo ratings yet

- PRG10.Multi Threading in T24-R13Document32 pagesPRG10.Multi Threading in T24-R13Gnana SambandamNo ratings yet

- T24 TellerDocument57 pagesT24 TellerJaya Narasimhan100% (2)

- Acc117 Group AssignmentDocument15 pagesAcc117 Group AssignmentMUHAMMAD HIFZHANI AZMANNo ratings yet

- T24 Setting Up A Nostro AccountDocument10 pagesT24 Setting Up A Nostro Accountlolitaferoz100% (1)

- Welcome To The Learning Unit On: T24 Application Structure and FilesDocument25 pagesWelcome To The Learning Unit On: T24 Application Structure and FilesTes Tesfu100% (1)

- T24 Induction Business - Customer R13 v1.0 Oct 12 PDFDocument52 pagesT24 Induction Business - Customer R13 v1.0 Oct 12 PDFclement100% (2)

- T24 Induction Business - TellerDocument62 pagesT24 Induction Business - TellerCHARLES TUMWESIGYE100% (1)

- Day 1 BASEL-standardized Program For All The Banks : Aa CoreDocument16 pagesDay 1 BASEL-standardized Program For All The Banks : Aa CoreAlexandra Sache100% (4)

- A A Technical FrameworkDocument120 pagesA A Technical Frameworkabu huraira100% (2)

- T24 AaDocument6 pagesT24 Aatujthevux0% (2)

- Integration Framework Overview r15 PDFDocument17 pagesIntegration Framework Overview r15 PDFigomez100% (1)

- CUS16.Deal SlipDocument28 pagesCUS16.Deal SlipMrCHANTHANo ratings yet

- Installing Temenos t24Document8 pagesInstalling Temenos t24Ezy Akpan100% (4)

- Pw2.Userdefinedscreens-R17 1Document14 pagesPw2.Userdefinedscreens-R17 1Sohaib Khalil100% (1)

- R14 - UG - Profit Distribution System PDFDocument40 pagesR14 - UG - Profit Distribution System PDFSathya Kumar100% (1)

- T24 Account: September 2011Document66 pagesT24 Account: September 2011Jaya Narasimhan100% (2)

- T24-Multi CompanyDocument24 pagesT24-Multi CompanyBernard Solomon80% (5)

- T24 Induction Business - Customer v1.4Document53 pagesT24 Induction Business - Customer v1.4CHARLES TUMWESIGYE100% (2)

- t24 Directory Structure and Core Parameter Files in t24Document8 pagest24 Directory Structure and Core Parameter Files in t24HSHADINo ratings yet

- T4 AA Retail PDFDocument481 pagesT4 AA Retail PDFShaqif Hasan Sajib100% (2)

- DesignStudio ReleaseNotes R18.86Document34 pagesDesignStudio ReleaseNotes R18.86Cuong NC100% (2)

- T24 Induction Business - AA AccountDocument44 pagesT24 Induction Business - AA AccountDeveloper T2490% (10)

- Late Charges in R12Document13 pagesLate Charges in R12venkat83% (6)

- Outward Remittances (MT 103)Document7 pagesOutward Remittances (MT 103)lolitaferozNo ratings yet

- Senarai Industri Yang Berhubung Dengan UniversitiDocument152 pagesSenarai Industri Yang Berhubung Dengan UniversitiJumie SamsudinNo ratings yet

- Wise Practice TestDocument9 pagesWise Practice TestJosh SimonNo ratings yet

- AALendingAdvancedPart2 PDFDocument99 pagesAALendingAdvancedPart2 PDFlolitaferoz100% (1)

- AALendingAdvancedPart1 PDFDocument90 pagesAALendingAdvancedPart1 PDFlolitaferoz100% (1)

- AALendingAdvancedPart5Workshops PDFDocument66 pagesAALendingAdvancedPart5Workshops PDFlolitaferoz100% (1)

- Aa Deposit FinalDocument89 pagesAa Deposit FinalNagesh Kumar100% (3)

- T24 Reporting Introduction R16Document22 pagesT24 Reporting Introduction R16adyani_0997No ratings yet

- T3TAAC - Arrangement Architecture - Core - R11.1Document163 pagesT3TAAC - Arrangement Architecture - Core - R11.1Sojanya KatareNo ratings yet

- T24 CollateralDocument23 pagesT24 CollateralJaya Narasimhan100% (1)

- AALendingAdvancedPart3 PDFDocument102 pagesAALendingAdvancedPart3 PDFlolitaferozNo ratings yet

- Workshop Solution For Bulk ProcessingDocument20 pagesWorkshop Solution For Bulk Processingmuruganandhan100% (3)

- 1a. T24 Limit - Parameter V1.0Document33 pages1a. T24 Limit - Parameter V1.0gasay sinhto100% (1)

- T24 Customer: September 2011Document57 pagesT24 Customer: September 2011Jaya Narasimhan100% (1)

- Applications in t24Document7 pagesApplications in t24Priyanka Raut100% (1)

- T24 Technical Kick Start Training PDFDocument49 pagesT24 Technical Kick Start Training PDFZAIN100% (3)

- Introduction To OFSDocument22 pagesIntroduction To OFSnana yaw100% (6)

- T24 System Build - FX V1 0Document12 pagesT24 System Build - FX V1 0Quoc Dat Tran100% (2)

- IRIS Integration User GuideDocument17 pagesIRIS Integration User GuideTamilselvan pNo ratings yet

- T24 VersionsDocument25 pagesT24 Versionsvikki chowdary100% (1)

- Business EventsDocument28 pagesBusiness EventsSuhasini ANo ratings yet

- Loans & Deposits: September 2011Document194 pagesLoans & Deposits: September 2011Jaya Narasimhan100% (3)

- T24 Basics: Presented by Shyamala RajendranDocument18 pagesT24 Basics: Presented by Shyamala RajendranBhavapriyaNo ratings yet

- t24 Directory Structure and Core Parameter Files in t24Document8 pagest24 Directory Structure and Core Parameter Files in t24lolitaferozNo ratings yet

- T24 Islamic Banking - MurabahaDocument139 pagesT24 Islamic Banking - MurabahaSaif Rehman100% (2)

- Payment HubDocument51 pagesPayment Hubjames kimemia100% (2)

- T24 Induction Business - Customer - R14Document47 pagesT24 Induction Business - Customer - R14Developer T240% (1)

- Temenos T24 Product Overview PDFDocument28 pagesTemenos T24 Product Overview PDFazza younessNo ratings yet

- AAAdvanced Customisation Part 1Document99 pagesAAAdvanced Customisation Part 1kishoreNo ratings yet

- Temenos PGM T24Document5 pagesTemenos PGM T24Anonymous ALiban0% (1)

- T24 Islamic Banking - Diminishing MusharakaDocument61 pagesT24 Islamic Banking - Diminishing MusharakaSaif RehmanNo ratings yet

- Programming in InfobasicDocument23 pagesProgramming in Infobasicgnana_sam100% (1)

- Amodia - Notes (SIM 3)Document2 pagesAmodia - Notes (SIM 3)CLUVER AEDRIAN AMODIANo ratings yet

- Complex - PO - Retainage InvoiceDocument16 pagesComplex - PO - Retainage InvoiceRanjeet KumarNo ratings yet

- T3TAAD - Arrangement Architecture - DepositsDocument349 pagesT3TAAD - Arrangement Architecture - DepositsSimbarashe MudzindikoNo ratings yet

- BBB Balance Sheet 1CDocument20 pagesBBB Balance Sheet 1CPrasad NcNo ratings yet

- Multi-Level Cash PoolingDocument2 pagesMulti-Level Cash PoolinglolitaferozNo ratings yet

- Ac Locked EventsDocument2 pagesAc Locked EventslolitaferozNo ratings yet

- Lesson + Practices ReactJS 1.1Document7 pagesLesson + Practices ReactJS 1.1lolitaferozNo ratings yet

- T24 Account Settlement Enquiry - Inactive AccountsDocument3 pagesT24 Account Settlement Enquiry - Inactive AccountslolitaferozNo ratings yet

- T24 Account StatementDocument3 pagesT24 Account StatementlolitaferozNo ratings yet

- T24 Category Codes and Interest AdjustmentsDocument4 pagesT24 Category Codes and Interest AdjustmentslolitaferozNo ratings yet

- T24 Internal Account - Close AccountDocument7 pagesT24 Internal Account - Close AccountlolitaferozNo ratings yet

- Introduction To ReactJS-PracticesDocument4 pagesIntroduction To ReactJS-PracticeslolitaferozNo ratings yet

- Retail Operations - SWIFT Message T24Document2 pagesRetail Operations - SWIFT Message T24lolitaferozNo ratings yet

- Treasury SwiftDocument16 pagesTreasury SwiftlolitaferozNo ratings yet

- Transfer Through MT200:: Menu Navigation: Transfer AC/GL/PL TransferDocument2 pagesTransfer Through MT200:: Menu Navigation: Transfer AC/GL/PL TransferlolitaferozNo ratings yet

- DM Tool T24 - TablesDocument6 pagesDM Tool T24 - TableslolitaferozNo ratings yet

- LC Amendment MT707 (BTB)Document3 pagesLC Amendment MT707 (BTB)lolitaferozNo ratings yet

- User Manual: SWIFT Message Generation From Temenos T24 CBSDocument14 pagesUser Manual: SWIFT Message Generation From Temenos T24 CBSlolitaferozNo ratings yet

- Overview of Delivery T24Document2 pagesOverview of Delivery T24lolitaferozNo ratings yet

- Accounts Part3Document5 pagesAccounts Part3lolitaferozNo ratings yet

- Image Capture-Image Enquiry T24Document4 pagesImage Capture-Image Enquiry T24lolitaferozNo ratings yet

- Account - Parameter: Posting RestrictionsDocument2 pagesAccount - Parameter: Posting RestrictionslolitaferozNo ratings yet

- Accounts Part1Document3 pagesAccounts Part1lolitaferozNo ratings yet

- Accounts - User Guide: Release R15.000Document207 pagesAccounts - User Guide: Release R15.000lolitaferozNo ratings yet

- SWIFT Abort ReasonsDocument1 pageSWIFT Abort ReasonslolitaferozNo ratings yet

- SWIFT Report ErrorsDocument19 pagesSWIFT Report ErrorslolitaferozNo ratings yet

- SWIFT Bulk Retrieval Errors CodesDocument1 pageSWIFT Bulk Retrieval Errors CodeslolitaferozNo ratings yet

- SWIFT Bulk Retrieval Errors CodesDocument24 pagesSWIFT Bulk Retrieval Errors CodeslolitaferozNo ratings yet

- High-Yield Savings AccountsDocument32 pagesHigh-Yield Savings AccountsPakistan WiseNo ratings yet

- JomPAY GuideDocument6 pagesJomPAY GuideSai Arein KiruvanantharNo ratings yet

- Visa Checklist For Uk Student VisaDocument15 pagesVisa Checklist For Uk Student VisaSathish SatiNo ratings yet

- RBIBULLETINJANUARYCB26Document212 pagesRBIBULLETINJANUARYCB26Shaun joe jacobNo ratings yet

- How To Use An ATMDocument4 pagesHow To Use An ATMHabtamu AssefaNo ratings yet

- Audit Questionnaire 888Document9 pagesAudit Questionnaire 888Sheenee VillariasNo ratings yet

- Intermediate Accounting 8th Edition Spiceland Solutions Manual DownloadDocument94 pagesIntermediate Accounting 8th Edition Spiceland Solutions Manual DownloadKenneth Travis100% (28)

- OBU Policy 2019 FX TXN ForumDocument26 pagesOBU Policy 2019 FX TXN ForumArif IslamNo ratings yet

- First Citizens Checking: Important Account InformationDocument3 pagesFirst Citizens Checking: Important Account InformationAbhishek VNo ratings yet

- 2980 Daf1206 LendingDocument118 pages2980 Daf1206 Lendingmargaret kurgatNo ratings yet

- Saurabh Kansal - Statement 01.11.20 To 08.02.21Document3 pagesSaurabh Kansal - Statement 01.11.20 To 08.02.21sourav84No ratings yet

- 2020 - ED - BED - 001-WPS OfficeDocument3 pages2020 - ED - BED - 001-WPS OfficeAmbroseNo ratings yet

- Case Study & Marketing Strategies of Axis Bank: Tolani College of CommerceDocument56 pagesCase Study & Marketing Strategies of Axis Bank: Tolani College of Commerce2kd Termanito100% (1)

- Republic of Uganda: Ministry of Internal A AirsDocument6 pagesRepublic of Uganda: Ministry of Internal A Airsfreddy tumwiineNo ratings yet

- 4.2. Loan Requirements: Unit 4: Sources and Uses of Short-Term and Long-Term FundsDocument5 pages4.2. Loan Requirements: Unit 4: Sources and Uses of Short-Term and Long-Term FundsTin CabosNo ratings yet

- The Financial Market Environment: All Rights ReservedDocument30 pagesThe Financial Market Environment: All Rights ReservedSajjad RavinNo ratings yet

- 4 5845754552065723218Document23 pages4 5845754552065723218Mehari TemesgenNo ratings yet

- CC GiroDocument1 pageCC GirohjwhtfvttrvakjjchoNo ratings yet

- Nov 2023Document7 pagesNov 2023applybizzNo ratings yet

- BanksDocument34 pagesBanksabhikaamNo ratings yet

- Fbi Last AssignmentDocument3 pagesFbi Last Assignmenttanmay agarwalNo ratings yet

- Economies of ScaleDocument6 pagesEconomies of ScaleWordsmith WriterNo ratings yet

- Develop and Use Saving PlanDocument55 pagesDevelop and Use Saving PlanAshenafi AbdurkadirNo ratings yet

- Deposit Account Agreement 31 933409 (11 19)Document64 pagesDeposit Account Agreement 31 933409 (11 19)Meezoom MDNo ratings yet

- Cash and Cash Equivalents PDFDocument7 pagesCash and Cash Equivalents PDFFritzey Faye RomeronaNo ratings yet

- International FinanceDocument202 pagesInternational FinanceKannan RNo ratings yet

- Statement of Account: State Bank of IndiaDocument10 pagesStatement of Account: State Bank of IndiaChandrasekar SekarNo ratings yet

AALendingAdvancedPart4 PDF

AALendingAdvancedPart4 PDF

Uploaded by

lolitaferozOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AALendingAdvancedPart4 PDF

AALendingAdvancedPart4 PDF

Uploaded by

lolitaferozCopyright:

Available Formats

AA Lending Advanced Part 4

Temenos University - Novembre 2012 1

AA Lending Advanced Part 4

Temenos University - Novembre 2012 2

AA Lending Advanced Part 4

BALANCE.MAINTENANCE is an optional Property Class of LENDING Product Line. This

property class allows to capture bills, balances and adjust the balances of the bill for

those contracts which has been taken over from existing legacy system or existing T24

lending module into T24 AA module.

The action routines CAPTURE.BILL, ADJUST.BILL etc help in capturing the bill and its

balances into the new system.

LENDING-ADJUST.BILL-BALANCE.MAINTENANCE is an activity (class) for adjusting

balance / making the balance ‘0’.

Temenos University - Novembre 2012 3

AA Lending Advanced Part 4

This Property Class allows to capture bills, balances and adjust balances of bills taken

over from contracts.

Allowed values in Bill Type are PAYMENT, EXPECTED, ACT.CHARGE, PR.CHARGE, INFO ,

EXPECTED, DEF.CHARGE

The BALANCE.MAINTENANCE property class supports the following Types:

DATED,NON.TRACKING,CCY,MULTIPLE,ARRANGEMENT

Temenos University - Novembre 2012 4

AA Lending Advanced Part 4

Rules are set for Capturing Bills and Balances, Adjusting Bills and Balances and writing off

Bills and Balances. We will see these in the following slides.

Temenos University - Novembre 2012 5

AA Lending Advanced Part 4

This facility allows to manually capture existing bills in other legacy systems into AA

Module. Bills can be captured through CAPTURE.BILL activity.

Amounts by Properties, bill dates, bill due dates, total amounts, etc. need to be entered.

The bills should be dated before the date of creation of arrangement.

Once a bill is captured, further processing will be done as per product conditions.

Temenos University - Novembre 2012 6

AA Lending Advanced Part 4

Capture Balance is used to manually capture the unbilled balances (not yet become due)

from legacy systems in to AA.

Interest accrued, charges accrued can be captured before they become due or billed.

The value date should be before the start date of Arrangement

Temenos University - Novembre 2012 7

AA Lending Advanced Part 4

Temenos University - Novembre 2012 8

AA Lending Advanced Part 4

Balances captured can be adjusted. They can be increased or decreased or even adjusted

to Zero. It is possible to adjust more balances at a time in a single transaction.

Temenos University - Novembre 2012 9

AA Lending Advanced Part 4

Bill can be written of through write off bill activity.

This allows existing bills to be written off. When the bills are written off, the balances are

set to zero and the bills will be set to written off status.

Temenos University - Novembre 2012 10

AA Lending Advanced Part 4

Balances which are not related to Bills can be written of through Write off balance

activity. This allows balances to be written off. When the balances are written off, they

are set to zero and the status will be set to written off status.

Temenos University - Novembre 2012 11

AA Lending Advanced Part 4

This activity adjusts both billed and non billed balances. The bills vis-à-vis the balances

due and the balances not due can be adjusted in a single transaction. They can be

increased, decreased, even written off.

Temenos University - Novembre 2012 12

AA Lending Advanced Part 4

The recommended steps during migration are - Take-over Arrangement, Capture

outstanding Principal, Capture overdue Bills, Capture current accruals

• TAKE OVER ARRANGEMENT – Matured contracts having overdue payments in legacy

system can be taken over into T24 using the activity LENDING-TAKEOVER-

ARRANGEMENT. Similar activity class have been release for the Deposits and Savings

product lines as well. In the Takeover arrangement activity field

ORIG.CONTRACT.DATE is mandatory. This field is used to record the original value date

of the contract in the Legacy System. The field Amount in TERM.AMOUNT property

class must be set to zero for Take over arrangements. If it is a live contract in the

Takeover arrangement field Amount should have the contract outstanding amount.

Temenos University - Novembre 2012 13

AA Lending Advanced Part 4

• CAPTURE BALANCE– After the Takeover arrangement is created (Live contract

captured in T24) the balances in the CUR<Account> to be captured. Instead of

triggering the disbursement the activity LENDING-CAPTURE.BALANCE-MAINTENANCE

can be used to capture any balances. System will not allow the user to capture

suspended balances.

• CAPTURE.BILL - Like Capturing the balance there can be scenarios where we need to

capture bills from the Legacy System. In case of Loan we may have to take over the

overdue bill by using LENDING-CAPTURE.BILL-BALANCE.MAINTENANCE

• CAPTURE CURRENT ACCRUALS

Temenos University - Novembre 2012 14

AA Lending Advanced Part 4

User can initiate activities in every arrangement through Arrangement Overview > New

Activity Tab.

Temenos University - Novembre 2012 15

AA Lending Advanced Part 4

BALANCE.MAINTENANCE is an optional Property Class of LENDING Product Line. This

property class allows to capture bills, balances and adjust the balances of the bill for

those contracts which has been taken over from existing legacy system or existing T24

lending module into T24 AA module.

The action routines CAPTURE.BILL, ADJUST.BILL etc help in capturing the bill and its

balances into the new system.

LENDING-ADJUST.BILL-BALANCE.MAINTENANCE is an activity (class) for adjusting

balance / making the balance ‘0’.

Temenos University - Novembre 2012 16

AA Lending Advanced Part 4

PROPERTY.CLASS Field identifies which Property Class condition allows this periodic

attribute definition.

ACTION Field represents the valid ACTION for the Property Class.

COMPARISON.TYPE Field refers comparison types defined in EB.COMPARISON.TYPE file.

DATA.TYPE -This field represents the Valid Data Type. For example : AMT, PERIOD, R

(Rate), D (Date), A (Alpha), N (Numeric) and DAO (DEPT.ACCT.OFFICER). The attribute to

which the periodic rule is defined should have a data type specified so that the existing

core routines validate the rule content.

RULE.VAL.RTN Field represents a routine which returns the value for the comparison

routine to do the compare from property record. Should be valid entry in EB.API file.

Temenos University - Novembre 2012 17

AA Lending Advanced Part 4

PR.ATTR.CLASS Field identifies the Periodic Attribute Class to which the Periodic Rule

belongs to. Must be a valid AA.PERIODIC.ATTRIBUTE.CLASS Id.

PERIOD.TYPE Field represents rule that needs to be applied on a specific period or life

time of Arrangement. Possible values are:

LIFE – Restriction applies to entire life of Arrangement;

INITIAL – Restriction applies to an initial period only of an arrangement during its life;

REPEATING - Restriction applies for a fixed repeating period during life of an

arrangement (e.g. every 3 month period say April to June);

ROLLING – Restriction applies for a rolling period that ends at date of transaction (e.g.

Maximum repayments in last three months).

PERIOD Field represents exact period to define for the Rule.

If DATE.TYPE is set to Calendar, then this field should be in 'Y'(years) or 'M' (months).

Accepted values are :

nnM or nnY or nnD or nnW (For Example : 01D, 12M )

Temenos University - Novembre 2012 18

AA Lending Advanced Part 4

RULE.START Field represents start date of the period defined. Possible values are:

AGREEMENT – Effective start Date of the Product; ARRANGEMENT– start date of lending

Arrangement;

START – Date of the First disbursement in Arrangement; if not disbursed, then the

arrangement start date will be taken till it is disbursed

ANNIVERSARY - takes the date and month from the field anniversary in ACCOUNT

property class; not valid for Period Type – Life and Initial;

COOLING-OFF - takes the cooling date from Term Amount property as the base date for

calculating the periodic restriction.

(Eg. Cooling period ends on 31st Dec. 2010, periodic restriction is set for

AMOUNT.INCREASE and the period is set to 1 year when RULE.START is set to COOLING-

OFF, then periodic restriction will apply from the end date of cooling period and not

from the date of arrangement.)

Any charges that need to be collected during pre-closure of Loan can be controlled using

COOLING-OFF period.

A sample of a periodic attribute configured for this would be: PERIOD.TYPE>LIFE;

RULE.START>COOLING-OFF

The above definition would charge the customer if any pre-closure is triggered after the

cooling period.

RULE.ERR.MSG Field represents error message that needs to be raised when the rule is

broken. Should be a valid record Id of the file EB.ERROR.

RULE.OVE.MSG Field represents override message that needs to be raised when the rule

is broken. Should be valid record Id of the file OVERRIDE.

Temenos University - Novembre 2012 19

AA Lending Advanced Part 4

The file AA.PERIODIC.ATTRIBUTE.CLASS is released by Temenos. This file will contain

standard rule definitions.

This table will contain the definitions of

•property class that it can be linked to

•the comparison type to be used

•the action that should trigger this rule to be validated

•the value routine used to derive the data values to be compared as part of the

validation

Temenos University - Novembre 2012 20

AA Lending Advanced Part 4

AA.PERIODIC.ATTRIBUTE file contains the Period level definition. This file allows the

user to create records which has specific period definition in them.

Temenos University - Novembre 2012 21

AA Lending Advanced Part 4

PERIOD.TYPE field represents the rule that needs to be applied on a specific period or life

time of the contract.

Options are:

LIFE – Restriction applies for the entire life of an arrangement or arrangement life as a

certain product.

INITIAL – Restriction applies for an initial period only of an arrangement during its life

time or the initial period of an arrangement as a certain product.

REPEATING – Restriction applies for a fixed repeating period during either the life of the

arrangement or the life of an arrangement as a certain product. For example the

restriction may be based on a 12 a month calendar period (i.e. Jan to Dec) or a 3 month

period starting on the anniversary of the loan,

ROLLING – Restriction applies for a rolling period that ends at the date of a transaction.

For example the maximum repayment in the last three months.

Temenos University - Novembre 2012 22

AA Lending Advanced Part 4

PERIOD field represents the exact period the user wants to define for the Rule.

Validation Rules :

No input if

1) the PERIOD.TYPE is INITIAL or

2) RULE.START is ANNIVERSARY

Mandatory input otherwise. If DATE.TYPE is set to Calendar, then this field should be in

'Y'(years) or 'M' (months).

Temenos University - Novembre 2012 23

AA Lending Advanced Part 4

CALENDAR - This denotes if the rule is applicable for Calendar period or not. When set to

Calendar, Rule Start will be applied from the calendar start date of the month or year as

specified.

Other set up to support Calendar type are:

1) PERIOD - should be in 'Y', or in 'M'

2) PERIOD.TYPE - should be either INITIAL or REPEATING.

E.g.

Arrangement Start - 20070601

RULE.START - ARRANGEMENT

PERIOD - 12M

PERIOD.TYPE - REPEATING

Then the Start & End dates of the Rule when the Effective Date is 20071001 is

Start Date : 20070601(Actually it should be 20070101 - since arrangement start date

falls later, this date is taken)

End Date : 20071231 (ends on calendar end date)

and when Effective Date is 20080201,

Start Date : 20080101

End Date : 20081231 (ends on calendar end date)

Temenos University - Novembre 2012 24

AA Lending Advanced Part 4

RULE.START - This field represents the base date which is to be taken for computing the

periods.

Mandatory Input field.

• AGREEMENT - takes the current Product's Effective date as the base date.

• ANNIVERSARY - takes the date and month from the field anniversary in the property

corresponding to ACCOUNT property class. This is not a valid input for the

PERIOD.TYPE - LIFE.

• ARRANGEMENT - takes the start date of the Arrangement

Temenos University - Novembre 2012 25

AA Lending Advanced Part 4

• START - takes the first disbursement date as the base date. If not disbursed, then the

arrangement start date will be taken till it is disbursed.

• COOLING.PERIOD - Takes the cooling date as the base date for calculating the

periodic restriction (Eg. If the cooling period ends on 31st Dec. 2010, periodic

restriction is set For AMOUNT.INCREASE and the period is set to 1 year when

RULE.START is set to COOLING.PERIOD, then periodic restriction will apply from the

end date of cooling period and not from the date of arrangement).

Temenos University - Novembre 2012 26

AA Lending Advanced Part 4

RESTRICTION - Provides another layer for restriction to the Rule. By default, the rule is

applicable for the specified period mentioned in RULE.START. Optionally the user could

input this field to restrict the period further by defining a start period & end period

within the period(defined in PERIOD) between which the Rule is applied.

Input must be like nnnT-mmmT, where nnnT & mmmT should be a valid Period Type

with the exception of allowing 0.

E.g: 0D-1D, 0M-1M; 1M-12M;

Arrangement Start - 20070601

RULE.START - ARRANGEMENT

PERIOD - 12M

PERIOD.TYPE - REPEATING

RESTRICTION.PERIOD- 0M-1M

DATE.TYPE - NULL

The rule is applied only for 1M from 01-June every year.

RULE.START.PERIOD - This field represents the start period from when the rule is

applicable. The actual start date is calculated based on RULE.START definition.

RULE.END .PERIOD- This field represents the end period until when the rule is applicable

Temenos University - Novembre 2012 27

AA Lending Advanced Part 4

Controlling Attribute values of an Arrangement over a period of time is done by Periodic

Rules, which in turn depends on Periodic Attributes. Let us try to understand linkages

between various components related to Periodic Attributes.

Top-level component to control Attribute values over a period is the Periodic Attribute

Class. These are not Property Classes, but can be used to control other Property Classes.

They are defined by Temenos. They are linked to EB.COMPARISON.TYPE records and

routines to evaluate Attribute values updated in an Arrangement. A Periodic Attribute

can act on the Attributes of a specified Property Class.

Periodic Attributes can be defined by Users by combining a time element with a Periodic

Attribute Class.

Finally, User can attach the Periodic Attributes to a Product Condition. While attaching a

Periodic Attribute to a Product Condition, User has to specify a comparison value for

evaluation and can optionally specify a Break Result and Break Charges. Whenever the

Attributes of the Property Class are updated in an Arrangement, the Periodic Attributes

will be evaluated. The Break Result is used to tell the system how it should behave when

the Periodic Attribute fails and how much has to be charged for such failure.

Temenos University - Novembre 2012 28

AA Lending Advanced Part 4

MAXIMUM.RATE: Checking the maximum legal rate of interest, generating an override /

error when rule is violated.

MINIMUM.RATE: Checking the minimum rate of interest, generating an override / error

when rule is violated.

RATE.DECREASE : Checking the decrease in rate of interest

RATE. DECREASE.TOLERANCE - Checking the percentage decrease in rate of interest

RATE. INCREASE - Checking the increase in rate of interest

RATE.INCREAS E.TOLERANCE - Checking the percentage increase in rate of interest

MAXIMUM.CHARGE – Checking the maximum charge for a product

MINIMUM.CHARGE - Checking the minimum charge for a product

Temenos University - Novembre 2012 29

AA Lending Advanced Part 4

Set a Periodic Attribute for tolerance of decrease in Interest Rate during any 1 year

period. Rule to be applied from effective of arrangement.

Temenos University - Novembre 2012 30

AA Lending Advanced Part 4

In this workshop, we are going to create a Periodic attribute with the following Settings:

Set a Periodic Attribute for tolerance of decrease in Interest Rate during any 1 year

period.

Rule to be applied from effective of arrangement.

Temenos University - Novembre 2012 31

AA Lending Advanced Part 4

Term Amount Property Class:

• AMOUNT DECREASE - Used to restrict the maximum amount that the committed

principal can be decreased by over a specified period of time. The rule is validated

when a DECREASE activity takes place on the TERM.AMOUNT Property. Amounts are

compared from the AMOUNT field in the TERM.AMOUNT property. The PR.VALUE

value must specify the maximum decrease AMOUNT.

• For example a rule could be specified that specifies a maximum decrease in principal

of 1,000 is allowed over a 6 month period.

Committed amount 6 months ago 20,000

Allowed decrease in 6 month period is 1,000

If the new AMOUNT is less than 19,000 the rule will be broken.

• AMOUNT DECREASE TOLERANCE - the rule specifies the percentage decrease allowed

over time rather than a specific amount. The percentage decrease is calculated as the

percentage of the value at the start of the restriction period. The rule is validated

when a DECREASE activity takes place.

The PR.VALUE value must specify the maximum decrease PERCENTAGE.

• For example a rule specifies that a 5% decrease is allowed over a 6 month period.

Available balance 6 months ago 10,000

Allowed decrease in the 6 month period is 5% of 10,000 = 500

If the new AMOUNT value in the property is less than 9,500 the rule will be broken.

AMOUNT INCREASE - Periodic Rule to control increase in Principal Amount.

Temenos University - Novembre 2012 32

AA Lending Advanced Part 4

AMOUNT INCREASE TOLERANCE - Periodic Rule to control percentage increase in

Principal Amount.

FULL.DISBURSE - Periodic Rule controls disbursal of Commitment

Amount

Temenos University - Novembre 2012 32

AA Lending Advanced Part 4

• AMOUNT INCREASE - restrict the maximum amount that the committed principal can

be increased by over a specified period of time. The rule is validated when an

INCREASE activity takes place on the TERM.AMOUNT property. Amounts are

compared from the AMOUNT field in the TERM.AMOUNT property.

The PR.VALUE value must specify the maximum increase AMOUNT.

• For example a rule could be specified that specifies a maximum increase in principal

of 1,000 is allowed over a 6 month period.

Committed amount 6 months ago 20,000

Allowed decrease in 6 month period is 1,000

If the new AMOUNT is more than 21,000 the rule will be broken

• AMOUNT INCREASE TOLERANCE - rule specifies the percentage increase allowed over

time rather than a specific amount. The percentage increase is calculated as the

percentage of the value at the start of the restriction period. The rule is validated

when an INCREASE activity takes place.

• For example a rule specifies that a 5% increase is allowed over a 6 month period.

The PR.VALUE value must specify the maximum increase PERCENTAGE.

Available balance 6 months ago 10,000

Allowed increase in the 6 month period is 5% of 10,000 = 500

If the new AMOUNT value in the property is more than 10,500 the rule will be broken.

• FULL.DISBURSE - Allows control of whether partial disbursement is allowed. A value of YES

will specify that when the arrangement is disbursed all committed principal for the effective

date of the disbursal should be disbursed

Temenos University - Novembre 2012 33

AA Lending Advanced Part 4

Set a periodic attribute for decreasing commitment amount during the first year of

arrangement, starting from arrangement date and

Set a periodic attribute for full disbursement for life of the product, starting from

product effective date

Temenos University - Novembre 2012 34

AA Lending Advanced Part 4

In this workshop, we are going to create a PERIODIC.ATTRIBUTE with the following

Settings:

Set a periodic attribute for decreasing commitment amount during the first year

of arrangement, starting from arrangement date

Set a periodic attribute for disbursement amount for life of product, starting from

product effective date

Temenos University - Novembre 2012 35

AA Lending Advanced Part 4

ACTIVITY.RESTRICTION is an optional Property Class of LENDING Product Line. It can be

used to restrict certain Activities. Please recollect that an Activity is an instance of an

Activity Class and that it is related to a Property.

Temenos University - Novembre 2012 36

AA Lending Advanced Part 4

ACTIVITY.RESTRICTION Property class is DATED, CCY, TRACKING and MULTIPLE Types.

It is possible to have more than one instance of a ACTIVITY.RESTRICTION property class.

The TYPE FORWARD.DATED in the PROPERTY.CLASS controls and allows the user to

introduce a new definition at the arrangement level, it will be dated

Temenos University - Novembre 2012 37

AA Lending Advanced Part 4

It is possible to restrict an Activity in full, wherein the Activity cannot be run altogether.

Prevent an Activity from occurring by restricting the activity – LENDING-

CHANGE.PRIMARY-CUSTOMER, LENDING-CHANGE.PRODUCT-ARRANGEMENT. The

activity being restricted must be a valid activity under AA.ACTIVITY. The restriction could

pertain to e.g. Not to allow change of Customer, not to permit change of Product, not to

allow change in Interest rate, not to permit repayment/Prepayment in loan account

below the prescribed minimum amount, not to allow prepayments beyond a maximum

transaction amount etc. Partial or conditional restriction is also based on Activities. The

activity is permitted, with an Override or additionally, with a charge.

The partial restriction could mean e.g. Allow Disbursement in loan Account, but only in

multiples of 100, Allow more than 12 repayments in loan Account in a period. This is

achieved by linking periodic rules to the ACTIVITY.RESTRICITON Product Conditions.

Temenos University - Novembre 2012 38

AA Lending Advanced Part 4

Activity restrictions can be defined based upon the activity itself (number or count of

activities or amount of the activity) or based on the balances that are affected by this

activity (minimum balance requirements).

Balance Rules – when activity restriction rules are based on balance types, whenever an

activity is triggered, it can be specified to check a balance and further assign a charge if

the rule is broken. E.g. Minimum balance requirements in an Account etc.,

Transaction Rules can be of two types. Transaction amount based and Transaction count

based.

When the activity rules are based on transaction amount, whenever the activity occurs,

the transaction amount rules are checked. A charge can be assigned if the rule is broken.

E.g. Transaction amount must be in multiples of 500, Prescribe Minimum transaction

amount for Prepayment of loan Account etc. When the activity restriction rules are

based on transaction count, and the activity is triggered, the transaction count rules are

checked. A charge can be assigned if the rule is broken. E.g. Repayments in loan Account

cannot exceed 12 in a year, 2 Prepayments in loan account is generally permitted, any

extra Prepayments would attract a charge.

Temenos University - Novembre 2012 39

AA Lending Advanced Part 4

It is possible to place restrictions on Interest and Periodic Charge properties defined in

Payment schedule product condition. These restrictions can be based on the transaction

count / based on the transaction amount of the activity / based on the balances that the

restrictions affect (e.g. minimum balance or maximum balance).

When an activity restriction rule is broken, there are 2 options available:

a) To waive the Interest or Periodic Charge Property amount and apply an alternate

Interest or Periodic Charge Property if it has been defined. Or

b) To apply the actual Interest amount and ignore the alternate Interest that has been

defined.

If the activity restriction rule is not broken, the available options are:

a) To waive the Interest or Periodic Charge Property amount and apply an alternate

Interest Charge Property, if defined. Or

b) To apply the actual Interest amount and not to apply alternate Interest.

The rule based restriction helps in regulating the processing of properties – both Interest

and charges – and provide alternate properties. When an activity restriction rule is

broken, penalty interest can be used as alternate property. Again when the rule is

satisfied, a better rate of Interest (bonus) can be provided with an alternate Interest

property.

Temenos University - Novembre 2012 40

AA Lending Advanced Part 4

The property activity restriction has three sets of fields to define restrictions based on

the Activity itself or on the balance types that the activity affects.

a) Rule based fields b) Activity based fields c) Property based fields. The rule based

restrictions could be imposed at the time of the activity being triggered or at the time

when a property like interest or charge defined in the payment schedule is processed or

during close of business.

Rule based fields– rules created to impose restrictions on activities. It is possible to

create as many rules as desired in an arrangement in the same record. Next, Activities

are attached to these rules which are defined in activity based fields.

Activity based fields – activity that needs to be restricted is defined here. The rule

created earlier in the rule based field is attached to the activity. An override as desired is

also defined here.

Property based fields - Properties like interest and charge that are set to be processed in

a defined frequency (as defined in payment schedule) can be restricted and regulated

based on the defined rules. The rule created earlier in the rule based field is attached to

the property. An override as desired is also defined here.

Temenos University - Novembre 2012 41

AA Lending Advanced Part 4

RULE.NAME : When a rule is created, a name is given to the rule for later use. A

meaningful name can be given.

As desired, any number of rules can be multi-valued.

PERIODIC.ATTRIBUTE: This field should contain a valid record from

AA.PERIODIC.ATTRIBUTE. Periodic attributes are explained

Temenos University - Novembre 2012 42

AA Lending Advanced Part 4

ACTIVITY.CLASS / ACTIVITY : The activity class or the activity on which the restriction is to

be imposed. Any valid AA.ACTIVITY may be stated here.

BALANCE: The balance type on which the rule should apply.

VALUE: The amount of the balance type for which the rule is defined.

Temenos University - Novembre 2012 43

AA Lending Advanced Part 4

ACTIVITY.CLASS / ACTIVITY - The activity class or the activity on which the restriction is to

be imposed. Any valid AA.ACTIVITY may be stated here.

RUN.THE.RULE – The rule created in the earlier rules tab is attached to the Activity by

input of rule in this field.

BREAK.RESULT – Options can be Error / Override. Depending on complete or partial

restriction, the appropriate option is to be chosen.

ERROR - The transaction triggering this activity would be completely blocked. If

transaction is completely blocked, it is mandatory to choose an error message displaying

restriction. Should be a valid entry in EB.ERROR table.

OVERRIDE - The transaction triggering this activity would be allowed after displaying a

warning. If the transaction is to be allowed after displaying a warning, it is mandatory to

state an override message. Should be a valid entry in OVERRIDE table.

Temenos University - Novembre 2012 44

AA Lending Advanced Part 4

CHARGE.PROPERTY - This field denotes the charge property which will calculate charge

amount when a rule is broken. Only charge property can be input in this attribute.

PR.APP.PERIOD – The application period for the given periodic rule charges is input here.

If the value defined is zero, then the charges are applied immediately.

PR.APP.METHOD - field denotes the application method that needs to be applied to the

rule break charges. Allowed values are

Due - Rule break charges are made due

Capitalise - Rule break charges are capitalised

Defer - Rule break charges are calculated but not applied immediately. Charge are

deferred and are collected over a period of time. Collection of these deferred charges is

driven by payment schedule and Periodic charges property classes

Temenos University - Novembre 2012 45

AA Lending Advanced Part 4

PROPERTY: The Interest or (periodic) Charge property scheduled as per definition in

Payments Schedule Property.

RUN.THE.RULE : The rule created in the earlier rules tab is attached to the Property by

input of rule in this field.

Temenos University - Novembre 2012 46

AA Lending Advanced Part 4

EVALUATION: When an activity restriction rule is broken, there are 2 options available.

Breaking the rule or Satisfying the rule. E.g. Penalty interest can be used for breaking the

rule and Bonus interest (a better rate of Interest) can be used for satisfying the rule.

EVALUATION.RESULT: This has two options.

a) To waive the Interest or Periodic Charge Property amount

b) To apply the actual Interest / charge amount

ALTERNATE.PROPERTY: When the evaluation result options is ‘waive’ an alternate

property can be chosen for Interest / charge.

Temenos University - Novembre 2012 47

AA Lending Advanced Part 4

TRANSACTION AMOUNT MAXIMUM - restrict the maximum AMOUNT allowed for the

Activity for any single activity. The amount of the activity is assumed as the

TXN.AMOUNT in the AA.ARRANGEMENT.ACTIVITY record for the current activity

being processed. The PR.VALUE must specify the maximum AMOUNT allowed

TRANSACTION AMOUNT MINIMUM – restrict the minimum AMOUNT allowed for the

Activity for any single activity. The amount of the activity is assumed as the

TXN.AMOUNT in the AA.ARRANGEMENT.ACTIVITY record for the current activity

being processed. The PR.VALUE must specify the minimum AMOUNT allowed.

Temenos University - Novembre 2012 48

AA Lending Advanced Part 4

TRANSACTION AMOUNT MULTIPLE – restrict the amount of an activity to be in

multiples specified as the associated PR.VALUE. For example if disbursal is only

allowed in multiples of 5,000 a rule value of 5,000 should be defined. Processing will

validate that the current activity amount is a multiple of the defined amount.

TRANSACTION AMOUNT TOTAL – restrict the maximum TOTAL AMOUNT for an

activity over a specified (defined in AA.PERIODIC.ATTRIBUTE). Processing will

determine the total amount processed within the defined period to date and will

calculate and verify if the current activity request is within the specified maximum

value. If it is not either an error or override message will be generated. The PR.VALUE

must specify the maximum total AMOUNT for the activity allowed within a period.

Temenos University - Novembre 2012 49

AA Lending Advanced Part 4

TRANSACTION COUNT TOTAL - restrict the number of activity over a specified period.

The Maximum number of transactions allowed in a period is defined in the associated

PR.VALUE. Processing will determine the current count of activities of the current type

requested in the processing period and will validate that an additional activity is

within the allowed number. PR.VALUE must specify the maximum NUMBER of

Activities allowed within a period.

Temenos University - Novembre 2012 50

AA Lending Advanced Part 4

CURR.LOAN.REPAY.TOLERANCE - restriction to control repayment amounts by

comparing the repaid amount as a percentage of the available loan balance at the

start of the restriction period. The periodic attribute will be validated when a

repayment is made against the loan. The periodic rule will be linked to an activity of

the LENDING-APPLYPAYMENT-PAYMENT.RULES class.

The processing will take the current committed loan balance at the calculated period

start, calculate the percentage, and

compare this with the total repayment in the period.

TOTAL.LOAN.REPAY.TOLERANCE - attribute class is similar to

CURR.LOAN.REPAY.TOLERANCE but will provide a restriction to the repaid amount as a

percentage of the total committed loan balance at the start of a given period.

The periodic attribute will be validated when a repayment is made against the loan.

The periodic rule will be linked to an

activity of the LENDING-APPLYPAYMENT-PAYMENT.RULES class. The processing will

take the total committed loan balance at

the calculated period start calculate the percentage, and compare this with the total

repayment in the period.

Temenos University - Novembre 2012 51

AA Lending Advanced Part 4

An example for Activity restriction with Periodic attribute (Time element) is shown here.

Temenos University - Novembre 2012 52

AA Lending Advanced Part 4

Step 1: Since it is an Activity Restriction , choose a periodic attribute which will suit

this requirement

Step 2: Since this is somewhat related to the frequencies, the ideal periodic

attribute will be Transaction Count Total

Step 3: Create a Periodic Attribute under that Periodic Attribute class with a

PERIOD.TYPE – INITIAL , PERIOD – 1Y,

RULE.START – ARRANGEMENT

Temenos University - Novembre 2012 53

AA Lending Advanced Part 4

Attach the periodic attribute created in the ACTIVITY.RESTRICTION product condition

under the Tab - Rules

Temenos University - Novembre 2012 54

AA Lending Advanced Part 4

Specify the activity that needs to be restricted and indicate whether an error or override

message to be displayed if the rule is broken and optionally a charge property can be

attached which will be triggered if the rule is broken.

Temenos University - Novembre 2012 55

AA Lending Advanced Part 4

Attach the Product condition created for activity restriction in the product designer and

proof and publish it. Since we have attached a rule break charge property

“PRINDECREASEFEE” whenever the rule is broken, attach a valid product condition for

that charge property.

Temenos University - Novembre 2012 56

AA Lending Advanced Part 4

Now create a new arrangement for your customer for the product created earlier.

Temenos University - Novembre 2012 57

AA Lending Advanced Part 4

After authorising the arrangement, we are making a disbursement to the customers

account.

Temenos University - Novembre 2012 58

AA Lending Advanced Part 4

When we try to do a prepayment within a period of one year system is giving us a

warning/Override message.

Temenos University - Novembre 2012 59

AA Lending Advanced Part 4

Set a Periodic Attribute under Activity Restriction Property Class for restricting the

Disbursement Amount in Multiples of USD 1000.

Temenos University - Novembre 2012 60

AA Lending Advanced Part 4

Set a Periodic Attribute under Activity Restriction Property Class for restricting the

Disbursement in Multiples of USD 1000

In the periodic attribute set the following:

Rule to be applied for Life of the arrangement

With effect from start date of arrangement

Temenos University - Novembre 2012 61

AA Lending Advanced Part 4

Create a new Product Condition for ACTIVITY.RESTRICTION with the following Settings:

Set the rule to restrict Disbursement in Multiples of USD1000

(LENDING-DISBURSE-COMMITMENT)

Attach the periodic attribute created in the Previous workshop

(ACTIVITY.RESTRICTION-Periodic Attribute)

If user attempts to break the rule Error message to be displayed,

All Attributes are not negotiable by default.

Temenos University - Novembre 2012 62

AA Lending Advanced Part 4

In this workshop, we will see how to create an Activity Restriction Product condition.

Set the following Conditions:

Set the rule to restrict Disbursement in Multiples of USD1000

(LENDING-DISBURSE-COMMITMENT)

Attach the periodic attribute created in the Previous workshop

(ACTIVITY.RESTRICTION-Periodic Attribute)

If user attempts to break the rule Error message to be displayed,

All Attributes are not negotiable by default.

Temenos University - Novembre 2012 63

AA Lending Advanced Part 4

Temenos University - Novembre 2012 64

AA Lending Advanced Part 4

You have learnt earlier that a Property Class is a fundamental building block of AA and

that a Product Line is a combination of Property Classes. Property Classes and Product

Lines are released by Temenos and you can only amend their Description.

Temenos University - Novembre 2012 65

AA Lending Advanced Part 4

The Product Line provides a high level definition of the business components (Property

Classes) that may be required to construct a product belonging to that line. For example

the LENDING Product Line will enable users to design and service term loan products

such as Loans (personal, small business, etc.) Mortgages Lines of Credit.

The Product Lines are defined by Temenos and cannot be created by the User. A Product

Line is described by the Property Classes which constitute it. The financial institution

may then use these “building blocks” of functionality to construct the individual

products which are available for sale to its customers.

Temenos University - Novembre 2012 66

AA Lending Advanced Part 4

LINE.ATTRIBUTE: This optional field is used to specify whether the product line deals

with amounts/currencies and Reverse and Replay functions are allowed. This field for

lending product line contains a value CCY and REPLAY. Values possible are CCY, REPLAY

and NULL.

MANDATORY field identifies whether inclusion of a Property a Class in the associated

multi value field PROPERTY.CLASS is mandatory when creating a new product in

AA.PRODUCT.GROUP and subsequently, AA.PRODUCT.DESIGNER.

Temenos University - Novembre 2012 67

AA Lending Advanced Part 4

We will look into how you can design a AA Product beginning with Product Group.

Please recollect that the Product Group is in the second level of Product organisation.

Product Line in the first level can be defined only by Temenos. Users can create their

own Product Group under existing Product Lines. Each Product Group has a number of

Properties associated with it and specified as Mandatory or not. Each Product Group

must have one Mandatory Property for each of the mandatory Property Classes of its

Product Line. All Products belong to a Product Group.

Temenos University - Novembre 2012 68

AA Lending Advanced Part 4

GROUP.TYPE Field : Valid options are INTERNAL and EXTERNAL.

INTERNAL – means the group being defined is own Bank's product. Only products

specified as INTERNAL are available for sale to customers.

EXTERNAL - There may be a necessity for Banks to do comparison between its own

product(INTERNAL) and one by its competitor. Those groups may be defined as

EXTERNAL. These products may then be used for comparitive analysis to show the

superiority of Bank's own product. Products of this type are not available for sale to own

customers.

REBUILD.ACTIVITIES Field is used to rebuild AA.ACTIVITY records from

AA.ACTIVITY.CLASS. AA.ACTIVITY is an instance of AA.ACTIVITY.CLASS, records would be

created on AA.ACTIVITY for all instances (properties) of class (property class) at

authorisation stage. This can be used to rebuild activities when a new property is

introduced into a group.

Temenos University - Novembre 2012 69

AA Lending Advanced Part 4

Create a new Product Group

Temenos University - Novembre 2012 70

AA Lending Advanced Part 4

In this workshop, we will create a Product group created by using the existing properties

attached to the Property Class with properties marked as Mandatory or optional.

Temenos University - Novembre 2012 71

AA Lending Advanced Part 4

Temenos University - Novembre 2012 72

AA Lending Advanced Part 4

INHERITANCE.ONLY : T24 product builder follows a structured way of defining products.

In addition to this structural hierarchy, the Product Builder enables the definition of “fam

ilies” of products through Product Inheritance.

This allows for a derivative of a product to be defined by simply

specifying a “parent” product and any different conditions.

Inheritance Only products do not undergo full proofing validations nor are they available

for sale on their own. They are only abstract definition of a product which should be

derived down the hierarchy to define the product in its entirety.

Temenos University - Novembre 2012 73

AA Lending Advanced Part 4

EFFECTIVE Field represents the effective period after which the new property condition

comes into effect. In addition to dated changes of a single Defined Property, the Product

designer also allows a Product to be defined with “timed” changes of its conditions.

These timed changes may be defined as “condition changes” (i.e. a standard product

property is linked to one Defined Property and after a period of time switches to a

different Defined Property.

Temenos University - Novembre 2012 74

AA Lending Advanced Part 4

CURRENCY field indicates the currency(ies) that are possible within this product. The

input must be a valid record from the CURRENCY table.

This is a multi value field.

Temenos University - Novembre 2012 75

AA Lending Advanced Part 4

CALC.PROPERTY: Some properties require calculations for them. For example, a Current

Interest property may have to accrue interest at a specific rate on a specified amount.

The base amount on which such calculations should happen is stated here. The field is

associated with SOURCE.TYPE, SOURCE.BALANCE.

The property stated here would be validated in the proofing stage to verify if they

actually belong to this product.

Temenos University - Novembre 2012 76

AA Lending Advanced Part 4

Create New Product available in USD with existing Product conditions or new product

conditions.

Note : For the Properties marked with red one use the existing product conditions given

in the workshops.

Temenos University - Novembre 2012 77

AA Lending Advanced Part 4

In this workshop, we will create a Product by attaching a Product Condition to each of

the Properties that were used in the product group created earlier.

Note : Product Conditions can be existing ones or new ones that were created in the

previous workshops

Temenos University - Novembre 2012 78

AA Lending Advanced Part 4

In this workshop, we will create a Product by attaching a Product Condition to each of

the Properties that were used in the product group created earlier.

Note : Product Conditions can be existing ones or new ones that were created in the

previous workshops

Temenos University - Novembre 2012 79

AA Lending Advanced Part 4

Temenos University - Novembre 2012 80

AA Lending Advanced Part 4

Set the Calculation source for PRINCIPAL INTEREST and make the Product Available in

USD

Temenos University - Novembre 2012 81

AA Lending Advanced Part 4

A Product in AA goes through three processes – Product designing, proofing and

publishing.

Designing is the Process of creating Products and attaching Product Conditions to their

Properties. It is done using the T24 Product Browser.

When a Product is designed, it has to undergo Proofing process. Proofing validates that

the Product has been configured correctly without errors, and is ready for release.

Proofing is the process that checks whether the Product is in sync with its hierarchy such

as Parent and or the associated Product Group.

Once a Product is proofed, it has to be published. Publishing is the process by which a

Product is put into Product Catalog. Once a Product is published into Product Catalog, it

is available for sale. When a parent Product is proofed and published, these functions

are performed down the line to all the child Products under it. In this case it is not

necessary to individually proof and publish the child Products.

New Arrangements can be created only for a Product published into Product Catalog.

Products are proofed and published through AA.PRODUCT.MANAGER Application.

Temenos University - Novembre 2012 82

AA Lending Advanced Part 4

The above diagram defines a line between proof and publish.

We have seen how Product Designer allows you to create Products with their Properties

and Conditions.

The next stage is Proofing. At the proofing stage, we need to set the available date of the

product. This will allow you to enter the Product into the catalog in advance of it going

on sale.

Proofing then validates that the Product has been configured correctly, and is ready for

release. Proofing includes for example checking whether all mandatory Properties have

been given conditions, that there are no conflicts between those conditions, and any

other errors that would prevent the Product being published.

Any errors generated can be fixed by going back to the Product Designer, and then re-

proofing the product.

When the Product is published, it is entered into the Product Catalog, which is the tool

used to actually create Arrangements.

Once published, Products can be modified at any time. Modification is done in the

Product Designer, using the same method as for creation. Modifications will only appear

in the Product Catalog once the proofing & publishing process has been repeated.

Temenos University - Novembre 2012 83

AA Lending Advanced Part 4

When you proof and publish a product through AA.PRODUCT.MANAGER, you have to

define two dates related to it.

One is the Available Date, which is the date from which the Product is available for sale.

Only from this date, Arrangements for the product can be created. AVAILABLE.DATE Field

is used for this.

Another one is the Expiry Date, from which the Product will cease to exist and no

Arrangements can be input for the Product. However, existing Arrangements for the

Product will continue. EXPIRY.DATE Field is used to mention the expiry date of product.

PRODUCT.ERROR Field in displays the errors caused when Proofing fails.

SUGGESTION Field displays suggestions for rectifications of errors.

Temenos University - Novembre 2012 84

AA Lending Advanced Part 4

Proof and Publish the Product

Temenos University - Novembre 2012 85

AA Lending Advanced Part 4

In this workshop, we are going to Proof the product created

Temenos University - Novembre 2012 86

AA Lending Advanced Part 4

And Publish it.

Temenos University - Novembre 2012 87

AA Lending Advanced Part 4

Create New Arrangement

Temenos University - Novembre 2012 88

AA Lending Advanced Part 4

In this workshop, we are going to create the arrangement for the product published in

the previous workshop in USD for your Customer

Temenos University - Novembre 2012 89

AA Lending Advanced Part 4

Look at the defaulted Term and amount of Arrangement. Is it as per your

condition set in Product designer

Change the term to 1Y and amount to 100,000.

Temenos University - Novembre 2012 90

AA Lending Advanced Part 4

Look at the PAYMENT.SCHEDULE and INTEREST property. Are the values defaulted as per

your Payment Schedule and Interest Product conditions

Temenos University - Novembre 2012 91

AA Lending Advanced Part 4

Look at the Settlement instructions and input the Payin Activity with T24 Account or

Arrangement Account

Commit the Arrangement and accept the overrides

Notice that a charge for New arrangement (NEWARRFEE) is made due

Temenos University - Novembre 2012 92

AA Lending Advanced Part 4

Now select the customer for whom the arrangement was created under the

unauthorised tab and authorise the arrangement created.

Temenos University - Novembre 2012 93

AA Lending Advanced Part 4

Authorise the Arrangement

Temenos University - Novembre 2012 94

AA Lending Advanced Part 4

View the Payment Schedule

Temenos University - Novembre 2012 95

AA Lending Advanced Part 4

Disburse the Loan to your Customers current Account in USD and authorise it.

Temenos University - Novembre 2012 96

AA Lending Advanced Part 4

In this workshop, we are going to Disburse the Arrangement created

Disburse USD 100,000 to Customer’s Current account in USD

Approve Overrides and authorise it

Temenos University - Novembre 2012 97

AA Lending Advanced Part 4

After authorising the disbursement, view the Status of the Arrangement changed to

Current, Financial Summary and the Activity log.

Temenos University - Novembre 2012 98

AA Lending Advanced Part 4

Temenos University - Novembre 2012 99

AA Lending Advanced Part 4

Temenos University - Novembre 2012 100

AA Lending Advanced Part 4

Temenos University - Novembre 2012 101

You might also like

- Arrangement Architecture - Accounts - TM - R15 PDFDocument336 pagesArrangement Architecture - Accounts - TM - R15 PDFrajan shukla100% (2)

- AADocument73 pagesAAazza youness100% (3)

- RC PDFDocument116 pagesRC PDFkhan100% (1)

- TCIB6 IntegrationwithT24 R17Document69 pagesTCIB6 IntegrationwithT24 R17Zareen Zia KhanNo ratings yet

- PRG10.Multi Threading in T24-R13Document32 pagesPRG10.Multi Threading in T24-R13Gnana SambandamNo ratings yet

- T24 TellerDocument57 pagesT24 TellerJaya Narasimhan100% (2)

- Acc117 Group AssignmentDocument15 pagesAcc117 Group AssignmentMUHAMMAD HIFZHANI AZMANNo ratings yet

- T24 Setting Up A Nostro AccountDocument10 pagesT24 Setting Up A Nostro Accountlolitaferoz100% (1)

- Welcome To The Learning Unit On: T24 Application Structure and FilesDocument25 pagesWelcome To The Learning Unit On: T24 Application Structure and FilesTes Tesfu100% (1)

- T24 Induction Business - Customer R13 v1.0 Oct 12 PDFDocument52 pagesT24 Induction Business - Customer R13 v1.0 Oct 12 PDFclement100% (2)

- T24 Induction Business - TellerDocument62 pagesT24 Induction Business - TellerCHARLES TUMWESIGYE100% (1)

- Day 1 BASEL-standardized Program For All The Banks : Aa CoreDocument16 pagesDay 1 BASEL-standardized Program For All The Banks : Aa CoreAlexandra Sache100% (4)

- A A Technical FrameworkDocument120 pagesA A Technical Frameworkabu huraira100% (2)

- T24 AaDocument6 pagesT24 Aatujthevux0% (2)

- Integration Framework Overview r15 PDFDocument17 pagesIntegration Framework Overview r15 PDFigomez100% (1)

- CUS16.Deal SlipDocument28 pagesCUS16.Deal SlipMrCHANTHANo ratings yet

- Installing Temenos t24Document8 pagesInstalling Temenos t24Ezy Akpan100% (4)

- Pw2.Userdefinedscreens-R17 1Document14 pagesPw2.Userdefinedscreens-R17 1Sohaib Khalil100% (1)

- R14 - UG - Profit Distribution System PDFDocument40 pagesR14 - UG - Profit Distribution System PDFSathya Kumar100% (1)

- T24 Account: September 2011Document66 pagesT24 Account: September 2011Jaya Narasimhan100% (2)

- T24-Multi CompanyDocument24 pagesT24-Multi CompanyBernard Solomon80% (5)

- T24 Induction Business - Customer v1.4Document53 pagesT24 Induction Business - Customer v1.4CHARLES TUMWESIGYE100% (2)

- t24 Directory Structure and Core Parameter Files in t24Document8 pagest24 Directory Structure and Core Parameter Files in t24HSHADINo ratings yet

- T4 AA Retail PDFDocument481 pagesT4 AA Retail PDFShaqif Hasan Sajib100% (2)

- DesignStudio ReleaseNotes R18.86Document34 pagesDesignStudio ReleaseNotes R18.86Cuong NC100% (2)

- T24 Induction Business - AA AccountDocument44 pagesT24 Induction Business - AA AccountDeveloper T2490% (10)

- Late Charges in R12Document13 pagesLate Charges in R12venkat83% (6)

- Outward Remittances (MT 103)Document7 pagesOutward Remittances (MT 103)lolitaferozNo ratings yet

- Senarai Industri Yang Berhubung Dengan UniversitiDocument152 pagesSenarai Industri Yang Berhubung Dengan UniversitiJumie SamsudinNo ratings yet

- Wise Practice TestDocument9 pagesWise Practice TestJosh SimonNo ratings yet

- AALendingAdvancedPart2 PDFDocument99 pagesAALendingAdvancedPart2 PDFlolitaferoz100% (1)

- AALendingAdvancedPart1 PDFDocument90 pagesAALendingAdvancedPart1 PDFlolitaferoz100% (1)

- AALendingAdvancedPart5Workshops PDFDocument66 pagesAALendingAdvancedPart5Workshops PDFlolitaferoz100% (1)

- Aa Deposit FinalDocument89 pagesAa Deposit FinalNagesh Kumar100% (3)

- T24 Reporting Introduction R16Document22 pagesT24 Reporting Introduction R16adyani_0997No ratings yet

- T3TAAC - Arrangement Architecture - Core - R11.1Document163 pagesT3TAAC - Arrangement Architecture - Core - R11.1Sojanya KatareNo ratings yet

- T24 CollateralDocument23 pagesT24 CollateralJaya Narasimhan100% (1)

- AALendingAdvancedPart3 PDFDocument102 pagesAALendingAdvancedPart3 PDFlolitaferozNo ratings yet

- Workshop Solution For Bulk ProcessingDocument20 pagesWorkshop Solution For Bulk Processingmuruganandhan100% (3)

- 1a. T24 Limit - Parameter V1.0Document33 pages1a. T24 Limit - Parameter V1.0gasay sinhto100% (1)

- T24 Customer: September 2011Document57 pagesT24 Customer: September 2011Jaya Narasimhan100% (1)

- Applications in t24Document7 pagesApplications in t24Priyanka Raut100% (1)

- T24 Technical Kick Start Training PDFDocument49 pagesT24 Technical Kick Start Training PDFZAIN100% (3)

- Introduction To OFSDocument22 pagesIntroduction To OFSnana yaw100% (6)

- T24 System Build - FX V1 0Document12 pagesT24 System Build - FX V1 0Quoc Dat Tran100% (2)

- IRIS Integration User GuideDocument17 pagesIRIS Integration User GuideTamilselvan pNo ratings yet

- T24 VersionsDocument25 pagesT24 Versionsvikki chowdary100% (1)

- Business EventsDocument28 pagesBusiness EventsSuhasini ANo ratings yet

- Loans & Deposits: September 2011Document194 pagesLoans & Deposits: September 2011Jaya Narasimhan100% (3)

- T24 Basics: Presented by Shyamala RajendranDocument18 pagesT24 Basics: Presented by Shyamala RajendranBhavapriyaNo ratings yet

- t24 Directory Structure and Core Parameter Files in t24Document8 pagest24 Directory Structure and Core Parameter Files in t24lolitaferozNo ratings yet

- T24 Islamic Banking - MurabahaDocument139 pagesT24 Islamic Banking - MurabahaSaif Rehman100% (2)

- Payment HubDocument51 pagesPayment Hubjames kimemia100% (2)

- T24 Induction Business - Customer - R14Document47 pagesT24 Induction Business - Customer - R14Developer T240% (1)

- Temenos T24 Product Overview PDFDocument28 pagesTemenos T24 Product Overview PDFazza younessNo ratings yet

- AAAdvanced Customisation Part 1Document99 pagesAAAdvanced Customisation Part 1kishoreNo ratings yet

- Temenos PGM T24Document5 pagesTemenos PGM T24Anonymous ALiban0% (1)

- T24 Islamic Banking - Diminishing MusharakaDocument61 pagesT24 Islamic Banking - Diminishing MusharakaSaif RehmanNo ratings yet

- Programming in InfobasicDocument23 pagesProgramming in Infobasicgnana_sam100% (1)

- Amodia - Notes (SIM 3)Document2 pagesAmodia - Notes (SIM 3)CLUVER AEDRIAN AMODIANo ratings yet

- Complex - PO - Retainage InvoiceDocument16 pagesComplex - PO - Retainage InvoiceRanjeet KumarNo ratings yet

- T3TAAD - Arrangement Architecture - DepositsDocument349 pagesT3TAAD - Arrangement Architecture - DepositsSimbarashe MudzindikoNo ratings yet

- BBB Balance Sheet 1CDocument20 pagesBBB Balance Sheet 1CPrasad NcNo ratings yet

- Multi-Level Cash PoolingDocument2 pagesMulti-Level Cash PoolinglolitaferozNo ratings yet

- Ac Locked EventsDocument2 pagesAc Locked EventslolitaferozNo ratings yet

- Lesson + Practices ReactJS 1.1Document7 pagesLesson + Practices ReactJS 1.1lolitaferozNo ratings yet

- T24 Account Settlement Enquiry - Inactive AccountsDocument3 pagesT24 Account Settlement Enquiry - Inactive AccountslolitaferozNo ratings yet

- T24 Account StatementDocument3 pagesT24 Account StatementlolitaferozNo ratings yet

- T24 Category Codes and Interest AdjustmentsDocument4 pagesT24 Category Codes and Interest AdjustmentslolitaferozNo ratings yet

- T24 Internal Account - Close AccountDocument7 pagesT24 Internal Account - Close AccountlolitaferozNo ratings yet

- Introduction To ReactJS-PracticesDocument4 pagesIntroduction To ReactJS-PracticeslolitaferozNo ratings yet

- Retail Operations - SWIFT Message T24Document2 pagesRetail Operations - SWIFT Message T24lolitaferozNo ratings yet

- Treasury SwiftDocument16 pagesTreasury SwiftlolitaferozNo ratings yet

- Transfer Through MT200:: Menu Navigation: Transfer AC/GL/PL TransferDocument2 pagesTransfer Through MT200:: Menu Navigation: Transfer AC/GL/PL TransferlolitaferozNo ratings yet

- DM Tool T24 - TablesDocument6 pagesDM Tool T24 - TableslolitaferozNo ratings yet

- LC Amendment MT707 (BTB)Document3 pagesLC Amendment MT707 (BTB)lolitaferozNo ratings yet

- User Manual: SWIFT Message Generation From Temenos T24 CBSDocument14 pagesUser Manual: SWIFT Message Generation From Temenos T24 CBSlolitaferozNo ratings yet

- Overview of Delivery T24Document2 pagesOverview of Delivery T24lolitaferozNo ratings yet

- Accounts Part3Document5 pagesAccounts Part3lolitaferozNo ratings yet

- Image Capture-Image Enquiry T24Document4 pagesImage Capture-Image Enquiry T24lolitaferozNo ratings yet

- Account - Parameter: Posting RestrictionsDocument2 pagesAccount - Parameter: Posting RestrictionslolitaferozNo ratings yet

- Accounts Part1Document3 pagesAccounts Part1lolitaferozNo ratings yet

- Accounts - User Guide: Release R15.000Document207 pagesAccounts - User Guide: Release R15.000lolitaferozNo ratings yet

- SWIFT Abort ReasonsDocument1 pageSWIFT Abort ReasonslolitaferozNo ratings yet

- SWIFT Report ErrorsDocument19 pagesSWIFT Report ErrorslolitaferozNo ratings yet

- SWIFT Bulk Retrieval Errors CodesDocument1 pageSWIFT Bulk Retrieval Errors CodeslolitaferozNo ratings yet

- SWIFT Bulk Retrieval Errors CodesDocument24 pagesSWIFT Bulk Retrieval Errors CodeslolitaferozNo ratings yet

- High-Yield Savings AccountsDocument32 pagesHigh-Yield Savings AccountsPakistan WiseNo ratings yet

- JomPAY GuideDocument6 pagesJomPAY GuideSai Arein KiruvanantharNo ratings yet

- Visa Checklist For Uk Student VisaDocument15 pagesVisa Checklist For Uk Student VisaSathish SatiNo ratings yet

- RBIBULLETINJANUARYCB26Document212 pagesRBIBULLETINJANUARYCB26Shaun joe jacobNo ratings yet

- How To Use An ATMDocument4 pagesHow To Use An ATMHabtamu AssefaNo ratings yet

- Audit Questionnaire 888Document9 pagesAudit Questionnaire 888Sheenee VillariasNo ratings yet

- Intermediate Accounting 8th Edition Spiceland Solutions Manual DownloadDocument94 pagesIntermediate Accounting 8th Edition Spiceland Solutions Manual DownloadKenneth Travis100% (28)

- OBU Policy 2019 FX TXN ForumDocument26 pagesOBU Policy 2019 FX TXN ForumArif IslamNo ratings yet

- First Citizens Checking: Important Account InformationDocument3 pagesFirst Citizens Checking: Important Account InformationAbhishek VNo ratings yet

- 2980 Daf1206 LendingDocument118 pages2980 Daf1206 Lendingmargaret kurgatNo ratings yet

- Saurabh Kansal - Statement 01.11.20 To 08.02.21Document3 pagesSaurabh Kansal - Statement 01.11.20 To 08.02.21sourav84No ratings yet

- 2020 - ED - BED - 001-WPS OfficeDocument3 pages2020 - ED - BED - 001-WPS OfficeAmbroseNo ratings yet

- Case Study & Marketing Strategies of Axis Bank: Tolani College of CommerceDocument56 pagesCase Study & Marketing Strategies of Axis Bank: Tolani College of Commerce2kd Termanito100% (1)

- Republic of Uganda: Ministry of Internal A AirsDocument6 pagesRepublic of Uganda: Ministry of Internal A Airsfreddy tumwiineNo ratings yet

- 4.2. Loan Requirements: Unit 4: Sources and Uses of Short-Term and Long-Term FundsDocument5 pages4.2. Loan Requirements: Unit 4: Sources and Uses of Short-Term and Long-Term FundsTin CabosNo ratings yet

- The Financial Market Environment: All Rights ReservedDocument30 pagesThe Financial Market Environment: All Rights ReservedSajjad RavinNo ratings yet

- 4 5845754552065723218Document23 pages4 5845754552065723218Mehari TemesgenNo ratings yet

- CC GiroDocument1 pageCC GirohjwhtfvttrvakjjchoNo ratings yet

- Nov 2023Document7 pagesNov 2023applybizzNo ratings yet

- BanksDocument34 pagesBanksabhikaamNo ratings yet

- Fbi Last AssignmentDocument3 pagesFbi Last Assignmenttanmay agarwalNo ratings yet

- Economies of ScaleDocument6 pagesEconomies of ScaleWordsmith WriterNo ratings yet

- Develop and Use Saving PlanDocument55 pagesDevelop and Use Saving PlanAshenafi AbdurkadirNo ratings yet

- Deposit Account Agreement 31 933409 (11 19)Document64 pagesDeposit Account Agreement 31 933409 (11 19)Meezoom MDNo ratings yet

- Cash and Cash Equivalents PDFDocument7 pagesCash and Cash Equivalents PDFFritzey Faye RomeronaNo ratings yet

- International FinanceDocument202 pagesInternational FinanceKannan RNo ratings yet

- Statement of Account: State Bank of IndiaDocument10 pagesStatement of Account: State Bank of IndiaChandrasekar SekarNo ratings yet