Professional Documents

Culture Documents

QUIZ

QUIZ

Uploaded by

lain slng0 ratings0% found this document useful (0 votes)

154 views1 pageCesar Mahusay operates an accounting firm and needs to make adjustments to various accounts in the trial balance as of December 31, 2018. These include recognizing unused supplies, prepaid insurance, depreciation on office equipment, unearned rental income, uncollected service income, interest on a note receivable, estimated bad debts, and accrued salaries.

Original Description:

FAR Quiz

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCesar Mahusay operates an accounting firm and needs to make adjustments to various accounts in the trial balance as of December 31, 2018. These include recognizing unused supplies, prepaid insurance, depreciation on office equipment, unearned rental income, uncollected service income, interest on a note receivable, estimated bad debts, and accrued salaries.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

154 views1 pageQUIZ

QUIZ

Uploaded by

lain slngCesar Mahusay operates an accounting firm and needs to make adjustments to various accounts in the trial balance as of December 31, 2018. These include recognizing unused supplies, prepaid insurance, depreciation on office equipment, unearned rental income, uncollected service income, interest on a note receivable, estimated bad debts, and accrued salaries.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

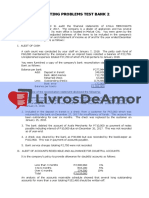

Cesar Mahusay operates an accounting firm.

Shown below are selected accounts that

appear in the Preliminary Trial Balance as of Dec. 31, 2018, and require adjustment.

ACCOUNTS RECEIVABLE P 22,500

ALLOWANCE FOR

1,200

IMPAIRMENT LOSS

NOTES RECEIVABLE 20,000

OFFICE EQUIPMENT 92,000

ACCUMULATED

4,500

DEPRECIATION

RENTAL INCOME 12,000

SERVICE INCOME 450,000

SUPPLIES EXPENSE 6,250

INSURANCE EXPENSE 7,200

SALARIES EXPENSE 120,000

The following adjustments are to be made:

1. Unused office supplies at the end, P 320

2. One year insurance was paid on April 1 of the current year

3. Office equipment has a useful life of 10 years with a salvage value of P 2,000.

It was acquired in July 2018.

4. Unearned rental income is 1/3 of the amount collected

5. Service income not yet collected P 3,000

6. The 60 days 6% note was received on Dec.1

7. Estimated Bad Debts is 10 % of the Accounts Receivable

8. Accrued salaries P 12,000.

Instruction:

Prepare the necessary adjusting entries to arrive at the adjusted balances for the

accounts.

Use these adjusted balances in answering the questions.

You have 30 minutes to work on the adjustments and 10 minutes to answer the

questions.

You might also like

- 162 001Document1 page162 001Christian Mark AbarquezNo ratings yet

- Worksheet Exercise - Acctg. 1Document1 pageWorksheet Exercise - Acctg. 1Evangeline Gicale0% (1)

- AuditingDocument13 pagesAuditingVenilyn Valencia75% (4)

- ACT1101, PRB, Midterm, Wit Ans KeyDocument5 pagesACT1101, PRB, Midterm, Wit Ans KeyDyen100% (1)

- Adjustments Quiz 2Document6 pagesAdjustments Quiz 2Loey ParkNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- 5rd Batch - P1 - Final Pre-Boards - EditedDocument11 pages5rd Batch - P1 - Final Pre-Boards - EditedKim Cristian Maaño0% (1)

- Adjusting Entries ActsDocument5 pagesAdjusting Entries ActsLori100% (1)

- 4 6026199395324659830Document30 pages4 6026199395324659830Beka Asra100% (1)

- Exercises III - Accruals and Deferrals Adjusting EntriesDocument2 pagesExercises III - Accruals and Deferrals Adjusting EntriesJowjie TV50% (2)

- Chapter 3 ExercisesDocument7 pagesChapter 3 ExercisesĐức TiếnNo ratings yet

- Finals - IADocument6 pagesFinals - IAShariine BestreNo ratings yet

- Exercises For Adjusting EntriesDocument3 pagesExercises For Adjusting EntriesJunmirMalicVillanuevaNo ratings yet

- Question April-2010Document51 pagesQuestion April-2010zia4000100% (1)

- 01.correction of Errors - 245038322 PDFDocument4 pages01.correction of Errors - 245038322 PDFMaan CabolesNo ratings yet

- HW AjeDocument5 pagesHW AjeBenicel Lane M. D. V.No ratings yet

- Adjusting Entries and Promissory NotesDocument6 pagesAdjusting Entries and Promissory Noteselma wagwagNo ratings yet

- Adjusting Entries For Bad DebtsDocument6 pagesAdjusting Entries For Bad DebtsKristine IvyNo ratings yet

- Chapter 3 ExercisesDocument7 pagesChapter 3 ExercisesChu Thị ThủyNo ratings yet

- 3 Adjusting Entries HandoutsDocument10 pages3 Adjusting Entries HandoutsJuan Dela CruzNo ratings yet

- Adjusting EntryDocument13 pagesAdjusting Entrymichaella maglinteNo ratings yet

- Auditing ProblemsDocument6 pagesAuditing ProblemsMaurice AgbayaniNo ratings yet

- Exercise 5 - Completing The Accounting Cycle For Merchandising and Service BusinessDocument4 pagesExercise 5 - Completing The Accounting Cycle For Merchandising and Service BusinessShiela Rengel0% (2)

- Review of The Accounting Process PDFDocument3 pagesReview of The Accounting Process PDFShiela Marie Sta AnaNo ratings yet

- FAR - Midterms and FinalsDocument14 pagesFAR - Midterms and FinalsShanley Vanna EscalonaNo ratings yet

- Changes and Error Has Been Prepared But Have Not Been ClosedDocument1 pageChanges and Error Has Been Prepared But Have Not Been Closeddwi wijiNo ratings yet

- Error Correction Problem 1: Lord Gen A. Rilloraza, CPADocument5 pagesError Correction Problem 1: Lord Gen A. Rilloraza, CPAMae-shane SagayoNo ratings yet

- 2019.1.19 20 Aud Prob Error Correction Cash Inventory Non Financial Assets Equity PDFDocument25 pages2019.1.19 20 Aud Prob Error Correction Cash Inventory Non Financial Assets Equity PDFMae-shane SagayoNo ratings yet

- Fragment M 11Document7 pagesFragment M 11sm munNo ratings yet

- Basic Accounting Mock PrelimsDocument4 pagesBasic Accounting Mock Prelimshadassah VillarNo ratings yet

- Adjustment EntriesDocument12 pagesAdjustment EntriesthachuuuNo ratings yet

- ADJUSTING Activities With AnswersDocument5 pagesADJUSTING Activities With AnswersRenz RaphNo ratings yet

- Q 1 3Document9 pagesQ 1 3Ahasanul AlamNo ratings yet

- Acctg336 - Opening CaseDocument6 pagesAcctg336 - Opening CaseSheila DominguezNo ratings yet

- Lester Ontolan. - Unit-3-ActivitiesDocument12 pagesLester Ontolan. - Unit-3-Activitieslesterontolan756No ratings yet

- Auditing Problems Test Bank 2Document10 pagesAuditing Problems Test Bank 2Ne BzNo ratings yet

- Auditing Problems Test Bank 2Document15 pagesAuditing Problems Test Bank 2Mark Jonah Bachao80% (5)

- Adjusting Entries ProblemDocument3 pagesAdjusting Entries ProblemElla Mae SaludoNo ratings yet

- Notes Receivable SampleDocument6 pagesNotes Receivable SamplekrizzmaaaayNo ratings yet

- Adjusting Entries QuizDocument12 pagesAdjusting Entries QuizJuan Dela CruzNo ratings yet

- Quiz - ReceivablesDocument2 pagesQuiz - ReceivablesAna Mae HernandezNo ratings yet

- Accounting Unit 4Document3 pagesAccounting Unit 4Swapan Kumar SahaNo ratings yet

- Comprehensive ProblemDocument1 pageComprehensive ProblemDavid Con RiveroNo ratings yet

- Audit ProbDocument16 pagesAudit ProbJewel Mae Mercado100% (1)

- Applied Auditing Quiz #1 (Diagnostic Exam)Document15 pagesApplied Auditing Quiz #1 (Diagnostic Exam)xjammerNo ratings yet

- Review of The Accounting Process Straight Problems Problem 1Document13 pagesReview of The Accounting Process Straight Problems Problem 1angielynNo ratings yet

- Applied Auditing Quiz #1 (Diagnostic Exam)Document7 pagesApplied Auditing Quiz #1 (Diagnostic Exam)ephraimNo ratings yet

- Exercise 3 Adjusting Entries - Service BusinessDocument2 pagesExercise 3 Adjusting Entries - Service BusinessMarc Viduya75% (4)

- Far ExercisesDocument34 pagesFar ExercisesTrisha Mae CorpuzNo ratings yet

- Individual Assignment 1 ACTDocument4 pagesIndividual Assignment 1 ACTKalkidanNo ratings yet

- Accounting Battaglia 1 Question and AnswersDocument7 pagesAccounting Battaglia 1 Question and AnswersRina RaymundoNo ratings yet

- 162 PreSummative2Document4 pages162 PreSummative2Alvin John San JuanNo ratings yet

- Midterms Problem SolvingDocument3 pagesMidterms Problem SolvingTRINA ARUTANo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNo ratings yet

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 3.5 out of 5 stars3.5/5 (2)

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Distinction Manufacturing ServiceDocument1 pageDistinction Manufacturing Servicelain slngNo ratings yet

- Assignment Far1Document1 pageAssignment Far1lain slngNo ratings yet

- A 4.1 FAR1 AngelineDocument16 pagesA 4.1 FAR1 Angelinelain slngNo ratings yet

- Assignment Far1Document1 pageAssignment Far1lain slngNo ratings yet

- Problem: Required:: (Note: Fill-In The Yellow Boxes Only With The Correct Answer)Document9 pagesProblem: Required:: (Note: Fill-In The Yellow Boxes Only With The Correct Answer)lain slngNo ratings yet