Professional Documents

Culture Documents

SAP S4 HANA 1809-COGS Split

SAP S4 HANA 1809-COGS Split

Uploaded by

Sai ParekhOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SAP S4 HANA 1809-COGS Split

SAP S4 HANA 1809-COGS Split

Uploaded by

Sai ParekhCopyright:

Available Formats

SAP S/4 HANA 1809 Finance COGS Split

SAP S/4 HANA 1809 – COGS Split

A) Concept: Note 2399030 (Splitting the costs of goods sold in S/4HANA) says

1) COGS Split has been introduced from ‘sFin1.0’

2) Generally, Cost of Goods Sold (COGS) during PGI in a Sales Order is posted

to a single GL account as defined in FI-MM integration for that material

movement.

Dr COGS Account

Cr Inventory Account

3) So, with COGS Split functionality, 2 Accounting entries get generated as

below

1st Entry:

Dr COGS Split Clearing Account 100

Cr Inventory Account 100

2nd Entry:

Dr COGS Direct Material 50

Dr COGS Direct Labor 20

Dr COGS Production Overhead 30

Cr COGS Split Clearing Account 100

B) Configuration:

Path SPRO/Financial Accounting/GL Accounting/Master Data/Periodic

Processing/Integration/Materials Management/Define Accounts

for Splitting the Cost of Goods Sold

Tcode NA

B.1) Create Cost Splitting Profile: Create Cost Splitting Profile (‘New Entries’) in

the combination of Controlling Area & Chart of accounts

LinkedIn: CMA Ramesh Kolluru Page 1 | 9

SAP S/4 HANA 1809 Finance COGS Split

B.2) Maintain ‘Source Accounts & Valuation Views’: Create required new entries

for selected ‘Source Account’ (here, for our COGS Clearing Account) with

requested view (i.e. 0-Legal Valuation, 1-Group Valuation, 2-Profit Center

Valuation)

LinkedIn: CMA Ramesh Kolluru Page 2 | 9

SAP S/4 HANA 1809 Finance COGS Split

B.3) Create Strategy Sequence: Create ‘strategy sequence’ for the selected

‘Source Account’ as 1 with 1000 & 2 with 1001 as shown below to pick up the

‘COGS Split’ from the ‘standard cost split’ of the material in context.

B.4) Create ‘Target Accounts’: Then, create ‘Target Accounts’ against each

combination of ‘Source Account’ + ‘Cost Component’ (Ex: 101-Direct Material) so

that cost will be split into the required segments

LinkedIn: CMA Ramesh Kolluru Page 3 | 9

SAP S/4 HANA 1809 Finance COGS Split

B.5) Maintain ‘Offsetting Accounts’: Maintain ‘Offsetting Accounts’ if needed to

offset the entry of split. Else, leave it blank.

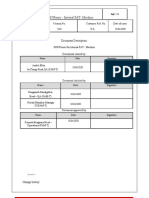

B.6) Define Company Code Settings: Here, you just need to assign ‘Cost Splitting

Profile’ to the required Company Codes with a ‘valid from’ date.

LinkedIn: CMA Ramesh Kolluru Page 4 | 9

SAP S/4 HANA 1809 Finance COGS Split

B.7) Define ‘Document Type Mapping’:

C) Cross-checking:

2 FI & 2 CO documents get generated during PGI as discussed above.

LinkedIn: CMA Ramesh Kolluru Page 5 | 9

SAP S/4 HANA 1809 Finance COGS Split

1st FI Document:

Debit to ‘clearing account’ (like GR/IR account) &

Credit to Finished Goods Inventory account.

2nd FI Document:

Debit to various COGS Split accounts &

Credit to ‘Clearing Account’ (which was debited in 1st document above)

LinkedIn: CMA Ramesh Kolluru Page 6 | 9

SAP S/4 HANA 1809 Finance COGS Split

OKTZ (Cost Component structure)

Let’s take ‘COGS Tariff’ component for instance, which is of USD 22.38 and from

this amount comes from 3 GL accounts as configured in ‘Cost Component

Structure’ (as depicted below):

LinkedIn: CMA Ramesh Kolluru Page 7 | 9

SAP S/4 HANA 1809 Finance COGS Split

From Cost Estimate display (CK13N),

Similarly, other components too can be cross-checked with the configuration

Ex: COGS-Direct Material component is USD 125

Cost Component Split

LinkedIn: CMA Ramesh Kolluru Page 8 | 9

SAP S/4 HANA 1809 Finance COGS Split

LinkedIn: CMA Ramesh Kolluru Page 9 | 9

You might also like

- Sap Functionality For Accounting of Prepaid ExpensesDocument3 pagesSap Functionality For Accounting of Prepaid ExpensesVanshika Narang100% (2)

- Accrual Engine in S4 HANA 1909Document29 pagesAccrual Engine in S4 HANA 1909Гульнар Кожикенова100% (3)

- SAP FICO T-CODE - XLSX FINAL 2021Document23 pagesSAP FICO T-CODE - XLSX FINAL 2021Raju Bothra100% (2)

- Year 7 Drama Marking SheetDocument2 pagesYear 7 Drama Marking Sheetruthdoyle76No ratings yet

- Sap Fico Configuration GuideDocument9 pagesSap Fico Configuration GuidePrathamesh ParkerNo ratings yet

- SAP S4hana Profitability Analysis (COPA)Document124 pagesSAP S4hana Profitability Analysis (COPA)Nawair IshfaqNo ratings yet

- Actual Costs Across Multiple Company Codes Using A New Business Function in SAP Enhancement Package 5 For SAP ERP 6 0Document12 pagesActual Costs Across Multiple Company Codes Using A New Business Function in SAP Enhancement Package 5 For SAP ERP 6 0aliNo ratings yet

- 4L80EDocument156 pages4L80EJames Winsor100% (14)

- GST in HanaDocument23 pagesGST in HanaMakarand Patkar100% (1)

- Enterprise Structure & Global SettingsDocument28 pagesEnterprise Structure & Global SettingsSUBHOJIT BANERJEE100% (1)

- VAT CONFIGURATION For SADocument28 pagesVAT CONFIGURATION For SAMohammed Nawaz Shariff100% (1)

- Configuration Example: SAP Electronic Bank Statement (SAP - EBS)From EverandConfiguration Example: SAP Electronic Bank Statement (SAP - EBS)Rating: 3 out of 5 stars3/5 (1)

- Configuration Guide 1809Document223 pagesConfiguration Guide 1809bikash das100% (4)

- Year End Activity Is SAPDocument13 pagesYear End Activity Is SAP233598No ratings yet

- Sap Error For Cross Company CodeDocument13 pagesSap Error For Cross Company CodeSATYANARAYANA MOTAMARRINo ratings yet

- Change Fiscal Year VariantDocument2 pagesChange Fiscal Year VariantWalid MetwallyNo ratings yet

- Closing Activities Month End in SAP FICODocument3 pagesClosing Activities Month End in SAP FICOmoorthykem100% (5)

- SAP New GL #9 Customise Cross Company Code Postings For Document SplittingDocument11 pagesSAP New GL #9 Customise Cross Company Code Postings For Document SplittingAlan Cheng100% (2)

- Narayan Jyotiraditya Bala Banik Configuration Steps: Main Customizing ActivitiesDocument20 pagesNarayan Jyotiraditya Bala Banik Configuration Steps: Main Customizing ActivitiesJyotiraditya BanerjeeNo ratings yet

- Dispute Management Process FlowDocument14 pagesDispute Management Process FlowEvert Chung100% (1)

- Intigration Between FiDocument144 pagesIntigration Between Fisreekumar100% (1)

- Controling Designe Document S4 HANADocument10 pagesControling Designe Document S4 HANAAnonymous yahXGrlz8No ratings yet

- Interpretation Algorithms SAP DocumentationDocument4 pagesInterpretation Algorithms SAP Documentationsrinivas100% (1)

- Product Costing Order SettlementDocument5 pagesProduct Costing Order SettlementSameer Bagalkot100% (1)

- Down Payment Vendors in SapDocument3 pagesDown Payment Vendors in SapJhon Ching MendozaNo ratings yet

- Capital Investment OrdersDocument7 pagesCapital Investment OrdersSujith Kumar33% (3)

- SAP FICO Interview Question and Answers Series OneDocument67 pagesSAP FICO Interview Question and Answers Series OneSAP allmoduleNo ratings yet

- FI Entries For MTO ScenarioDocument3 pagesFI Entries For MTO ScenarioAchanti Dp100% (1)

- End User Training For Bank RecoDocument114 pagesEnd User Training For Bank Recorohitmandhania100% (1)

- S - 4 HANA - New Asset Accounting - Considering Key Aspects - SAP BlogsDocument15 pagesS - 4 HANA - New Asset Accounting - Considering Key Aspects - SAP BlogsgirijadeviNo ratings yet

- Account Determination SD - FI by Odaiah PelleyDocument41 pagesAccount Determination SD - FI by Odaiah PelleyOdaiah PelleyNo ratings yet

- f-44 - Manual ClearingDocument7 pagesf-44 - Manual Clearingmesnehashis0% (1)

- Uploads Files List SAP FICO-SATYANARAYANaDocument183 pagesUploads Files List SAP FICO-SATYANARAYANaRanjan Kumar Srivastava100% (1)

- Year End Closing Activities in Sap Fi CoDocument30 pagesYear End Closing Activities in Sap Fi CoAndrea Cutrera100% (3)

- User Manual AcDocument20 pagesUser Manual Acpower1001No ratings yet

- SAP Internal Order: Conceptual Background and Usage For Harvey NormanDocument15 pagesSAP Internal Order: Conceptual Background and Usage For Harvey NormanDeepesh100% (1)

- FI To MM IntegrationDocument8 pagesFI To MM Integrationsurendra100% (1)

- FI Project in SAPDocument75 pagesFI Project in SAPmani254722305100% (1)

- Fico Enterprise StructureDocument101 pagesFico Enterprise StructureMafeel SAP100% (1)

- Cross-Company - Inter-Company Transactions - SAP BlogsDocument26 pagesCross-Company - Inter-Company Transactions - SAP Blogspuditime100% (1)

- Intercompany Reconciliation With Sap ErpDocument18 pagesIntercompany Reconciliation With Sap ErpJanibasha100% (1)

- Inter-Company Billing - Automatic Posting To Vendor Account (SAP-EDI)Document17 pagesInter-Company Billing - Automatic Posting To Vendor Account (SAP-EDI)pavan.mstNo ratings yet

- 1KEK Transferring Payables - Receivables To PCADocument6 pages1KEK Transferring Payables - Receivables To PCABrigitta BallaiNo ratings yet

- AIAB & AIBU & AIST - AUC Settlement & ReversalDocument10 pagesAIAB & AIBU & AIST - AUC Settlement & Reversalvaishaliak2008No ratings yet

- Sap Fico Configuration DocumentDocument82 pagesSap Fico Configuration DocumentPham Anh TaiNo ratings yet

- Automatic Payment Program Run F110 - SAP TutorialDocument20 pagesAutomatic Payment Program Run F110 - SAP TutorialVenkateswarlu vNo ratings yet

- FI - End User Manual PDFDocument620 pagesFI - End User Manual PDFbanerjee23No ratings yet

- SAP Cost Center - Profit CenterDocument14 pagesSAP Cost Center - Profit CenterClaudio BezerrilNo ratings yet

- Closing Activities - SAP FICODocument6 pagesClosing Activities - SAP FICOShiva KumarNo ratings yet

- Configuration Document For Prepaid Expense AutomationDocument28 pagesConfiguration Document For Prepaid Expense AutomationAjinkya MohadkarNo ratings yet

- SAP S 4HANA Finance 2022 Introduction 1683550397Document50 pagesSAP S 4HANA Finance 2022 Introduction 1683550397Thirumalai ShanmugamNo ratings yet

- WITHHOLDING TAX (TDS) - Tax FICO (Financial Accounting and Controlling) Tutorial - STechiesDocument7 pagesWITHHOLDING TAX (TDS) - Tax FICO (Financial Accounting and Controlling) Tutorial - STechiesAman VermaNo ratings yet

- Material Ledgers - Actual CostingDocument17 pagesMaterial Ledgers - Actual CostingAbp PbaNo ratings yet

- Multiple Valuation Approaches Transfer Prices PDFDocument9 pagesMultiple Valuation Approaches Transfer Prices PDFmaheshNo ratings yet

- SAP FSCM Dispute Management Case Study Dow CorningDocument29 pagesSAP FSCM Dispute Management Case Study Dow Corningvenky3105No ratings yet

- COPA Configuration and Painter GuideDocument217 pagesCOPA Configuration and Painter Guideresky surbakti0% (1)

- SAP Dunning Configuration Very ImportDocument26 pagesSAP Dunning Configuration Very Importvittoriojay123No ratings yet

- Expert Session SAP Simple Finance ExpertumDocument45 pagesExpert Session SAP Simple Finance ExpertumSkumarsapSahoo100% (4)

- Deloitte SFIN-Copa PoVDocument16 pagesDeloitte SFIN-Copa PoVPavel100% (1)

- New Version of This Material Will Coming Soon: Sap Fi/Co Integration of FI With MMDocument10 pagesNew Version of This Material Will Coming Soon: Sap Fi/Co Integration of FI With MMSai ParekhNo ratings yet

- Itcertmaster: Safe, Simple and Fast. 100% Pass Guarantee!Document4 pagesItcertmaster: Safe, Simple and Fast. 100% Pass Guarantee!Sai ParekhNo ratings yet

- A Solution For Indian GST Implementation For Simple Procurement Scenario Using TAXINNDocument9 pagesA Solution For Indian GST Implementation For Simple Procurement Scenario Using TAXINNSai ParekhNo ratings yet

- C TFIN52 67demo PDFDocument5 pagesC TFIN52 67demo PDFSai ParekhNo ratings yet

- Sample Sebk100750 Sap Isu Fica Conf v1Document26 pagesSample Sebk100750 Sap Isu Fica Conf v1Sai ParekhNo ratings yet

- FicaDocument41 pagesFicaSai ParekhNo ratings yet

- Hand NotesDocument3 pagesHand Notesmehul rabariNo ratings yet

- Ril Sa71m15017693 R00Document5 pagesRil Sa71m15017693 R00Android100% (1)

- Nimble Number Logic Puzzle II QuizDocument1 pageNimble Number Logic Puzzle II QuizpikNo ratings yet

- D. Raghuram: Work ExperienceDocument3 pagesD. Raghuram: Work ExperienceNaveen KumarNo ratings yet

- Nepal National Building Code: Draft Final NBC 205: 2012Document52 pagesNepal National Building Code: Draft Final NBC 205: 2012Sudan ShresthaNo ratings yet

- English Project CompileDocument33 pagesEnglish Project CompileAbdul QayyumNo ratings yet

- Lesson 3 DiscussionDocument3 pagesLesson 3 DiscussionElaineVidalRodriguezNo ratings yet

- Be RealDocument3 pagesBe RealТатьяна СоколоваNo ratings yet

- Linear Programming TheoryDocument104 pagesLinear Programming Theorykostas_ntougias5453No ratings yet

- Earth Dams Foundation & Earth Material InvestigationDocument111 pagesEarth Dams Foundation & Earth Material Investigationmustafurade1No ratings yet

- Measurement GER NER GPI - Version 1.0Document8 pagesMeasurement GER NER GPI - Version 1.0Wouter RijneveldNo ratings yet

- 3d Internet PDFDocument3 pages3d Internet PDFSam CrazeNo ratings yet

- The Dino GameDocument1 pageThe Dino Game296 004 Aditya ChaudhariNo ratings yet

- Delayed Hospital Discharges of Older Patients A Systematic Review On Prevalence and CostsDocument12 pagesDelayed Hospital Discharges of Older Patients A Systematic Review On Prevalence and CostsGabriela ObonNo ratings yet

- Worksheet in Deloittes System Design DocumentDocument32 pagesWorksheet in Deloittes System Design Documentascentcommerce100% (1)

- Anullment CATHOLIC TRIBUNALDocument20 pagesAnullment CATHOLIC TRIBUNALMons Jr BaturianoNo ratings yet

- SK 135 SR 3Document327 pagesSK 135 SR 3Trung Cuong100% (1)

- Ag Test Package FormatDocument25 pagesAg Test Package FormatoparoystNo ratings yet

- 13.4.2 WBS 6.6 Cerberus Corperation Case Study Managing Stakeholder ConflictDocument7 pages13.4.2 WBS 6.6 Cerberus Corperation Case Study Managing Stakeholder ConflictJorge Alejandro Betancur JaramilloNo ratings yet

- Zen and The ArtDocument3 pagesZen and The ArtMaria GonzálezNo ratings yet

- AMRITA EXAM DatesheetDocument9 pagesAMRITA EXAM DatesheetSARRALLE EQUIPMENT INDIA PVT LTDNo ratings yet

- Error Handling in ASPDocument116 pagesError Handling in ASPkagga1980No ratings yet

- SOP - Internal FAT-MachineDocument12 pagesSOP - Internal FAT-MachineSarvesh DaradeNo ratings yet

- Thesis PDFDocument120 pagesThesis PDFPrajwal NiraulaNo ratings yet

- Oxford Thesis CollectionDocument5 pagesOxford Thesis Collectionkimberlybundypittsburgh100% (2)

- StaircasesDocument11 pagesStaircasesatiNo ratings yet

- 1g Rainbow Antimagic ColoringDocument9 pages1g Rainbow Antimagic ColoringRosanita NisviasariNo ratings yet

- Toyota Corolla A-131L OVERHAULDocument61 pagesToyota Corolla A-131L OVERHAULgerber damian100% (2)