Professional Documents

Culture Documents

03 Materi & Lat Adjusting Entries

03 Materi & Lat Adjusting Entries

Uploaded by

Roby RamdhanCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Accounting Basics and Interview Questions AnswersDocument43 pagesAccounting Basics and Interview Questions AnswersKothapally Anusha75% (4)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Project Workbook: Student EditionDocument54 pagesProject Workbook: Student EditionAdil Er-rami0% (1)

- Budgeting and Profit Planning CR PDFDocument24 pagesBudgeting and Profit Planning CR PDFLindcelle Jane DalopeNo ratings yet

- Instructions:: SVKM'S Nmims NMIMS Global Access - School For Continuing EducationDocument1 pageInstructions:: SVKM'S Nmims NMIMS Global Access - School For Continuing EducationPrasanth KumarNo ratings yet

- Budget and Budgetary ControlDocument16 pagesBudget and Budgetary Controlnousheen rehmanNo ratings yet

- 09 Ratio AnalysisDocument16 pages09 Ratio AnalysisHimanshu VermaNo ratings yet

- Project Managment Question BankDocument7 pagesProject Managment Question BankRudraSreeramNo ratings yet

- Lesson Plan Accounting 1Document2 pagesLesson Plan Accounting 1Christine Cayosa CahayagNo ratings yet

- Megaworld Corporation: Liabilities and Equity 2010 2009 2008Document9 pagesMegaworld Corporation: Liabilities and Equity 2010 2009 2008Owdray CiaNo ratings yet

- D2Document12 pagesD2neo14No ratings yet

- Updated Complete Cash Flow StatementDocument46 pagesUpdated Complete Cash Flow StatementYashasvi DhankharNo ratings yet

- 119 Jasmine Tirkey PDFDocument30 pages119 Jasmine Tirkey PDFDinki ChouhanNo ratings yet

- Company Profile 22Document32 pagesCompany Profile 22V. HarishNo ratings yet

- Hi-Vogue's Business Proposal PDFDocument24 pagesHi-Vogue's Business Proposal PDFShahRukh KhalidNo ratings yet

- q1 Business Math Module 5Document17 pagesq1 Business Math Module 5Reigi May100% (2)

- Commission On Audit Local Government Sector: Republic of The PhilippinesDocument14 pagesCommission On Audit Local Government Sector: Republic of The PhilippinesJonson Palmares100% (1)

- Chapter3 GEDocument54 pagesChapter3 GEAdalie NageauNo ratings yet

- Chapter 7: Financial Analysis Techniques: Prof. Sandro Brunelli, PH.DDocument49 pagesChapter 7: Financial Analysis Techniques: Prof. Sandro Brunelli, PH.DPatricia RodriguesNo ratings yet

- Switzerland 001Document22 pagesSwitzerland 001Guy_de_Conches_2923No ratings yet

- A211 CC 1 StudentDocument6 pagesA211 CC 1 StudentWon HaNo ratings yet

- Service CostingDocument60 pagesService Costingpranoti tardeNo ratings yet

- Afar1-Exercises 2Document17 pagesAfar1-Exercises 2aleachon100% (1)

- Unit 5 Asset-Liability Management Techniques: 5.1. General Principles of Bank ManagementDocument8 pagesUnit 5 Asset-Liability Management Techniques: 5.1. General Principles of Bank Managementመስቀል ኃይላችን ነውNo ratings yet

- FAR Cheat SheetDocument6 pagesFAR Cheat Sheetngan.foldersNo ratings yet

- Local Government Municipal Finance Management Act No. 56 of 2003Document71 pagesLocal Government Municipal Finance Management Act No. 56 of 2003Ilse FerreiraNo ratings yet

- ch05 PDFDocument95 pagesch05 PDFMargarete DelvalleNo ratings yet

- A Study On Financial Performance of Salem District Co-Operative Milk Producers Union Limited at SalemDocument5 pagesA Study On Financial Performance of Salem District Co-Operative Milk Producers Union Limited at Salemgvani3333No ratings yet

- Performance Analysis in Aditya Birla GroupDocument101 pagesPerformance Analysis in Aditya Birla GroupNavin KumarNo ratings yet

- Chapter 7. Translation of Foreign Currency Financial StatementDocument37 pagesChapter 7. Translation of Foreign Currency Financial Statementnguyễnthùy dươngNo ratings yet

- 11 Chapter 3 (Working Capital Aspects)Document30 pages11 Chapter 3 (Working Capital Aspects)Abin VargheseNo ratings yet

03 Materi & Lat Adjusting Entries

03 Materi & Lat Adjusting Entries

Uploaded by

Roby RamdhanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

03 Materi & Lat Adjusting Entries

03 Materi & Lat Adjusting Entries

Uploaded by

Roby RamdhanCopyright:

Available Formats

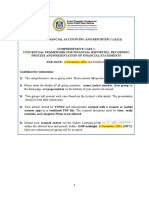

ADJUSTING ENTRIES

Categories of adjusting entries :

Deferrals

1. Prepaid Expenses : Expenses paid in cash and recorded as assets before they are used.

2. Unearned Revenues : Cash received and recorded as liabilities before revenue is earned.

Accruals

1. Accrued Revenues : Revenues earned but not yet received in cash or recorded.

2. Accrued Expenses : Expenses incurred but not yet paid in cash or recorded.

Exercise

Tony Masasi started his own consulting firm, Masasi Company, Inc. on June 1, 2019. The trial balance at June 30 is

shown below.

MASASI COMPANY, INC.

Trial Balance

June 30, 2019

Account Number Acoount Titles Debit Credit

101 Cash $ 7,150

112 Accounts Receivable 6,000

126 Supplies 2,000

130 Prepaid Insurance 3,000

157 Office Equipment 15,000

201 Accounts Payable $ 4,500

209 Unearned Service Revenue 4,000

311 Share Capital – Ordinary 21,750

400 Service Revenue 7,900

726 Salaries Expense 4,000

729 Rent Expense 1,000

$38,150 $38,150

In additional to those accounts listed on the trial balance, the chart of accounts for Masasi Company, Inc. also

contains the following accounts and account numbers: No.158 Accumulated Depreciation-Office Equipment , No.212

Salaries Payable, No.224 Utilities Payable, No.631 Supplies Expense, No.711 Depreciation Expense-Office Equipment,

No.722 Insurance Expense, and No.732 Utilities Expense.Other data:

1. Supplies on hand at June 30 are $600

2. A utility bill for $150 has not been recorded and will not be paid until next month

3. The insurance policy is for a year

4. $2,500 of unearned service revenue has been earned at the end of month

5. Salaries of $2,000 are accrued at June 30

6. The office equipment has a 5-year life with no salvage value. It is being depreciated at $250 per month for 60

month

7. Invoices representing $1,000 of services performed during the month have not been recorded as for June 30.

Instruction

(a) Prepare the adjusting entries for the month of June. Use J3 as the page number of your journal.

(b) Post the adjusting entries to the ledger accounts. Enter the totals from the trial balance as beginning account

balances and place a check mark in the posting reference column.

(c) Prepare an adjusted trial balance at June 30, 2019.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Accounting Basics and Interview Questions AnswersDocument43 pagesAccounting Basics and Interview Questions AnswersKothapally Anusha75% (4)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Project Workbook: Student EditionDocument54 pagesProject Workbook: Student EditionAdil Er-rami0% (1)

- Budgeting and Profit Planning CR PDFDocument24 pagesBudgeting and Profit Planning CR PDFLindcelle Jane DalopeNo ratings yet

- Instructions:: SVKM'S Nmims NMIMS Global Access - School For Continuing EducationDocument1 pageInstructions:: SVKM'S Nmims NMIMS Global Access - School For Continuing EducationPrasanth KumarNo ratings yet

- Budget and Budgetary ControlDocument16 pagesBudget and Budgetary Controlnousheen rehmanNo ratings yet

- 09 Ratio AnalysisDocument16 pages09 Ratio AnalysisHimanshu VermaNo ratings yet

- Project Managment Question BankDocument7 pagesProject Managment Question BankRudraSreeramNo ratings yet

- Lesson Plan Accounting 1Document2 pagesLesson Plan Accounting 1Christine Cayosa CahayagNo ratings yet

- Megaworld Corporation: Liabilities and Equity 2010 2009 2008Document9 pagesMegaworld Corporation: Liabilities and Equity 2010 2009 2008Owdray CiaNo ratings yet

- D2Document12 pagesD2neo14No ratings yet

- Updated Complete Cash Flow StatementDocument46 pagesUpdated Complete Cash Flow StatementYashasvi DhankharNo ratings yet

- 119 Jasmine Tirkey PDFDocument30 pages119 Jasmine Tirkey PDFDinki ChouhanNo ratings yet

- Company Profile 22Document32 pagesCompany Profile 22V. HarishNo ratings yet

- Hi-Vogue's Business Proposal PDFDocument24 pagesHi-Vogue's Business Proposal PDFShahRukh KhalidNo ratings yet

- q1 Business Math Module 5Document17 pagesq1 Business Math Module 5Reigi May100% (2)

- Commission On Audit Local Government Sector: Republic of The PhilippinesDocument14 pagesCommission On Audit Local Government Sector: Republic of The PhilippinesJonson Palmares100% (1)

- Chapter3 GEDocument54 pagesChapter3 GEAdalie NageauNo ratings yet

- Chapter 7: Financial Analysis Techniques: Prof. Sandro Brunelli, PH.DDocument49 pagesChapter 7: Financial Analysis Techniques: Prof. Sandro Brunelli, PH.DPatricia RodriguesNo ratings yet

- Switzerland 001Document22 pagesSwitzerland 001Guy_de_Conches_2923No ratings yet

- A211 CC 1 StudentDocument6 pagesA211 CC 1 StudentWon HaNo ratings yet

- Service CostingDocument60 pagesService Costingpranoti tardeNo ratings yet

- Afar1-Exercises 2Document17 pagesAfar1-Exercises 2aleachon100% (1)

- Unit 5 Asset-Liability Management Techniques: 5.1. General Principles of Bank ManagementDocument8 pagesUnit 5 Asset-Liability Management Techniques: 5.1. General Principles of Bank Managementመስቀል ኃይላችን ነውNo ratings yet

- FAR Cheat SheetDocument6 pagesFAR Cheat Sheetngan.foldersNo ratings yet

- Local Government Municipal Finance Management Act No. 56 of 2003Document71 pagesLocal Government Municipal Finance Management Act No. 56 of 2003Ilse FerreiraNo ratings yet

- ch05 PDFDocument95 pagesch05 PDFMargarete DelvalleNo ratings yet

- A Study On Financial Performance of Salem District Co-Operative Milk Producers Union Limited at SalemDocument5 pagesA Study On Financial Performance of Salem District Co-Operative Milk Producers Union Limited at Salemgvani3333No ratings yet

- Performance Analysis in Aditya Birla GroupDocument101 pagesPerformance Analysis in Aditya Birla GroupNavin KumarNo ratings yet

- Chapter 7. Translation of Foreign Currency Financial StatementDocument37 pagesChapter 7. Translation of Foreign Currency Financial Statementnguyễnthùy dươngNo ratings yet

- 11 Chapter 3 (Working Capital Aspects)Document30 pages11 Chapter 3 (Working Capital Aspects)Abin VargheseNo ratings yet