Professional Documents

Culture Documents

BNM AR2018 - cp06 - BOD - SR MGMT - Committees

BNM AR2018 - cp06 - BOD - SR MGMT - Committees

Uploaded by

Roslan.Affandi2351Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BNM AR2018 - cp06 - BOD - SR MGMT - Committees

BNM AR2018 - cp06 - BOD - SR MGMT - Committees

Uploaded by

Roslan.Affandi2351Copyright:

Available Formats

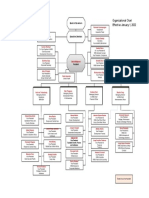

Board of Directors,

Senior Management and

Committees of the Bank

125 Board of Directors

126 Senior Management

127 Monetary Policy Committee

128 Financial Stability Executive Committee

129 Shariah Advisory Council

130 Financial Stability Committee

Board of Directors

Board of Directors, Senior Management and Committees of the Bank

Standing from left to right

Datuk Chin Kwai Yoong1 Jessica Chew Cheng Lian

Deputy Governor

Dato’ Paduka Sulaiman bin Mustafa

Member, Board Governance Committee Abdul Rasheed Ghaffour

Member, Board Risk Committee Deputy Governor

Tan Sri Dato’ Seri Siti Norma binti Yaakob Dato Sri Lim Haw Kuang

Member, Board Governance Committee Chairman, Board Risk Committee

Member, Board Risk Committee

Dato’ Wee Hoe Soon @ Gooi Hoe Soon

Tan Sri Dato’ Sri Dr. Sulaiman bin Mahbob Chairman, Board Audit Committee

Chairman, Board Governance Committee Member, Board Risk Committee

Member, Board Audit Committee

Datuk Ahmad Badri bin Mohd Zahir

Secretary-General of the Treasury

Nor Shamsiah Yunus

Governor and Chairman

Dato’ N. Sadasivan a/l N.N. Pillay

Member, Board Audit Committee

Member, Board Governance Committee

The Board of Directors wishes to extend its appreciation and gratitude to Datuk Chin Kwai Yoong for his nine years of service

since March 2010.

1

Datuk Chin Kwai Yoong completed his term on 28 February 2019.

Annual Report 2018 125

Senior Management

Board of Directors, Senior Management and Committees of the Bank

Senior Management Members

Nor Shamsiah Yunus

Governor

Abdul Rasheed Ghaffour

Deputy Governor

Jessica Chew Cheng Lian

Deputy Governor

Norzila Abdul Aziz

Assistant Governor

Donald Joshua Jaganathan

Assistant Governor

Abu Hassan Alshari Yahaya

Assistant Governor

Marzunisham Omar

Assistant Governor

Mohd. Adhari Belal Din

Assistant Governor

Adnan Zaylani Mohamad Zahid

Assistant Governor

Nazrul Hisyam Mohd Noh

Assistant Governor

Tan Nyat Chuan

Assistant Governor

126 Annual Report 2018

Monetary Policy Committee

Board of Directors, Senior Management and Committees of the Bank

Monetary policy is formulated independently by the Monetary Policy Committee based on

a sound governance framework

The primary objective of monetary policy in Malaysia is to maintain price stability while giving due regard to developments in the economy.

Under the Central Bank of Malaysia Act 2009 (CBA 2009), the Monetary Policy Committee (MPC) of Bank Negara Malaysia is charged

with the responsibility of formulating monetary policy and the policies for the conduct of monetary policy operations.1 In this regard, the

MPC decides on the policy interest rate, the Overnight Policy Rate (OPR), to influence other interest rates in the economy.

In carrying out this mandate, the MPC determines the direction of monetary policy based on its assessment of the balance of risks to the

outlook for both domestic growth and inflation. The MPC also monitors risks of destabilising financial imbalances given their implications

for the prospects of the economy. The Committee meets at least six times a year to decide on the OPR and publishes the Monetary

Policy Statement (MPS) following each meeting to explain its decisions.

The MPC comprises the Governor, the Deputy Governors, and not less than three but not more than seven other members, including

external members who are appointed by the Minister of Finance upon recommendation by the Bank’s Board Governance Committee.

At present, the MPC has seven members, two of which are external members. The membership of the MPC is intended to bring together

a diversity of expertise and experiences that is critical for sound decision-making on monetary policy.

Monetary Policy Committee Members

Nor Shamsiah Yunus

Governor and Chairman

Abdul Rasheed Ghaffour

Deputy Governor

Jessica Chew Cheng Lian

Deputy Governor

Norzila Abdul Aziz

Assistant Governor

Marzunisham Omar

Assistant Governor

Prof. Tan Sri Dato’ Seri Dr. Noor Azlan Ghazali

Professor of Economics, Universiti Kebangsaan Malaysia

Prof. Dr. Yeah Kim Leng

Professor of Economics, Sunway University Business School, Sunway University

1

For a detailed account of the evolution of the MPC, and its governance and processes, refer to the ‘Box Article: Evolution of the Monetary Policy Committee of Bank

Negara Malaysia: Key Milestones over the Years’ in the Bank Negara Malaysia Annual Report 2015.

Annual Report 2018 127

Financial Stability Executive Committee

Board of Directors, Senior Management and Committees of the Bank

The Financial Stability Executive Committee (Executive Committee) was established in 2010 pursuant to Section 37 of the Central Bank

of Malaysia Act 2009 (CBA 2009). Its primary purpose is to contribute to the fulfilment of the Bank’s statutory mandate of preserving

financial stability through its powers to decide on specific policy measures that may be taken by the Bank to avert or reduce risks to

financial stability. These measures are:

• the issuance of orders to a person or financial institution that is not supervised by the Bank to undertake specific measures;

• the extension of liquidity assistance to a financial institution that is not supervised by the Bank, or to overseas operations of a licensed

financial institution in Malaysia; and

• the provision of capital support to a non-viable licensed financial institution in Malaysia.

The Executive Committee is a key component of the accountability framework that has been institutionalised for the exercise of the

broad financial stability powers accorded to the Bank under the CBA 2009. It is responsible to ensure that proposed measures within its

purview are appropriate, having regard to the Bank’s assessment of risks to financial stability. The Executive Committee meets at least

twice a year.

The Executive Committee consists of seven members, a majority of whom must be non-executive members who are independent of the

Bank’s Management. Members are subject to the Executive Committee’s Code of Ethics and Conflict of Interest, which serve to preserve the

integrity of the Executive Committee’s decisions.

Financial Stability Executive Committee Members

Nor Shamsiah Yunus

Governor and Chairman

Abdul Rasheed Ghaffour

Deputy Governor

Datuk Ahmad Badri bin Mohd Zahir

Secretary General to the Treasury

Datuk Syed Zaid Albar

Chairman of Securities Commission Malaysia

Rafiz Azuan Abdullah

Chief Executive Officer of Perbadanan Insurans Deposit Malaysia

Datuk Johan bin Idris

External Expert

Yoong Sin Min

External Expert

128 Annual Report 2018

Shariah Advisory Council

Board of Directors, Senior Management and Committees of the Bank

The Shariah Advisory Council of Bank Negara Malaysia (SAC) was established in May 1997 as the highest Shariah authority in

Islamic banking and takaful in Malaysia. In the Central Bank of Malaysia Act 2009 (CBA 2009), the roles and functions of the SAC

were further reinforced as the authority for the ascertainment of Islamic law for the purposes of Islamic financial activities which are

supervised and regulated by the Bank.

The SAC assumes a pivotal role in ensuring the consistency of Shariah rulings applied in the Islamic banking and takaful industry.

The Shariah rulings by the SAC serve as a main reference for Islamic financial institutions to ensure end-to-end Shariah compliance

in the structure and implementation of their financial products and services. In addition, the CBA 2009 provides that, any questions

on Shariah matters in a court or arbitration proceeding must be referred to the SAC, whose opinions shall be binding.

The SAC provides the Shariah basis for the development of a comprehensive Shariah contract-based regulatory framework

for Islamic banking and takaful in Malaysia. In this regard, the SAC defines the essential features of the contracts taking into

consideration the various Shariah views, research findings, as well as custom and market practices. Moving forward, the SAC,

through its members, individually and collectively, will expand its sphere of influence to support more product innovation and

encourage harmonisation of Shariah interpretation locally and globally.

The appointment of the SAC members is made upon approval by the Yang di-Pertuan Agong, on the advice of the Minister of

Finance after consultation with the Bank. Currently, the SAC has ten (10) members consisting of prominent Shariah scholars, jurists

and legal experts.

Shariah Advisory Council Members

Datuk Dr. Mohd Daud bin Bakar (Chairman)

Founder and Executive Chairman, Amanie Group

Prof. Dr. Ashraf bin Md. Hashim (Deputy Chairman)

Chief Executive Officer, ISRA Consultancy

Tan Sri Sheikh Ghazali bin Abdul Rahman

Council of Experts (Shariah), Attorney General Chambers

Sahibus Samahah Dato’ Seri Dr. Hj. Zulkifli

bin Mohamad Al-Bakri

Mufti of Wilayah Persekutuan

Dato’ A. Aziz bin A. Rahim

Chairman, Enforcement Agencies Integrity Commission

Prof. Dr. Mohamad Akram bin Laldin

Executive Director, ISRA

Prof. Dr. Engku Rabiah Adawiah binti Engku Ali

Professor, IIUM Institute of Islamic Banking and Finance (IIiBF),

International Islamic University Malaysia (IIUM)

Prof. Dr. Asmadi bin Mohamed Naim

Professor, Islamic Business School, Universiti Utara Malaysia

Dr. Shamsiah binti Mohamad

Senior Researcher, ISRA

Burhanuddin bin Lukman

Head of Takaful Unit, International Shariah Research Academy

for Islamic Finance (ISRA)

Annual Report 2018 129

Financial Stability Committee

Board of Directors, Senior Management and Committees of the Bank

The Financial Stability Committee (FSC) is a high-level internal committee of the Bank. It is responsible for monitoring and taking actions

to reduce or avert risks to financial stability stemming from both system-wide and institutional developments. Section 29 of the Central

Bank of Malaysia Act 2009 defines “risk to financial stability” as a “risk which in the opinion of the Bank disrupts, or is likely to disrupt, the

financial intermediation process including the orderly functioning of the money market and foreign exchange market, or affects, or is likely

to affect, public confidence in the financial system or the stability of the financial system”.

The FSC reviews and decides on:

• macroprudential policies to reduce or avert identified risks to the financial system as a whole;

• significant supervisory responses to address risks arising in individual financial institutions which are regulated by the Bank;

• actions to resolve a financial institution that has ceased, or is about to cease, to be viable. This includes notifying Perbadanan Insurans

Deposit Malaysia (PIDM) for the purpose of resolution actions by PIDM where applicable; and

• recommendations to the Financial Stability Executive Committee on the exercise of powers within its remit.

An important part of the FSC’s role is to monitor the effectiveness of policies and actions taken; and ensure they remain appropriate,

taking into account risk developments.

The FSC is chaired by the Governor and its members comprise all Deputy Governors and the Assistant Governors responsible for

regulation, supervision, development and financial market and currency sectors. The meeting is generally held four times a year and is

also attended by selected senior officers of the Bank.

Financial Stability Committee Members

Nor Shamsiah Yunus

Governor and Chairman

Abdul Rasheed Ghaffour

Deputy Governor

Jessica Chew Cheng Lian

Deputy Governor

Norzila Abdul Aziz

Assistant Governor

Donald Joshua Jaganathan

Assistant Governor

Adnan Zaylani Mohamad Zahid

Assistant Governor

Tan Nyat Chuan

Assistant Governor

130 Annual Report 2018

You might also like

- Assignment IwpDocument7 pagesAssignment IwpKepala AcikNo ratings yet

- Appendix 1 - CIMB Group Organisation Structure PDFDocument1 pageAppendix 1 - CIMB Group Organisation Structure PDFLingYN67% (6)

- BNM Organisation Structure 20200901 - ENwebDocument1 pageBNM Organisation Structure 20200901 - ENwebNorman LucasNo ratings yet

- Internal Audit's Role in Third Party Risk Management (TPRM) : Jon Pastore, Nick FullmerDocument27 pagesInternal Audit's Role in Third Party Risk Management (TPRM) : Jon Pastore, Nick FullmerRoslan.Affandi2351100% (1)

- BankIslami Annual Report 2023Document335 pagesBankIslami Annual Report 2023furqanahmedooo123No ratings yet

- 2018 Annual Report PDFDocument162 pages2018 Annual Report PDFTousif GalibNo ratings yet

- Bank Negara Malaysia: Organisation StructureDocument1 pageBank Negara Malaysia: Organisation Structureshanizam ariffinNo ratings yet

- Annual Report 2007Document56 pagesAnnual Report 2007PakistanNo ratings yet

- 41st - AGM 300718 For WEBSITEDocument13 pages41st - AGM 300718 For WEBSITEAghora Kali Peetham DeccanNo ratings yet

- The World Bank Group Organizational Chart EnglishDocument1 pageThe World Bank Group Organizational Chart Englishken.nguyen.1006No ratings yet

- Full 2014 2015 PDFDocument282 pagesFull 2014 2015 PDFFarjana Hossain DharaNo ratings yet

- City Bank Annual Report 2017Document371 pagesCity Bank Annual Report 2017Auishee BaruaNo ratings yet

- Half Year Report 2023 1Document92 pagesHalf Year Report 2023 1Neha NadeemNo ratings yet

- Fabl Q1 23Document87 pagesFabl Q1 23Hassaan AhmedNo ratings yet

- AAOIFIDocument12 pagesAAOIFIHabibur Rahman TarikNo ratings yet

- Investor Presentation Q2FY22 20211112182612Document38 pagesInvestor Presentation Q2FY22 20211112182612abhishek kasliwalNo ratings yet

- Investor Presentation Q2FY22Document38 pagesInvestor Presentation Q2FY22slohariNo ratings yet

- Comparative Analysis of Financial Statement of ICICI Bank and Kotak Mahindra BankDocument14 pagesComparative Analysis of Financial Statement of ICICI Bank and Kotak Mahindra Bankchandni dhanwaniNo ratings yet

- PRWM - 2020 Prosperity Weaving Mills Limited-OpenDoors - PKDocument89 pagesPRWM - 2020 Prosperity Weaving Mills Limited-OpenDoors - PKAyan NoorNo ratings yet

- Organizational Chart Effective January 1, 2022: Board of GovernorsDocument1 pageOrganizational Chart Effective January 1, 2022: Board of GovernorsSamuel HutaurukNo ratings yet

- Corporate Governance FrameworkDocument24 pagesCorporate Governance FrameworkAghora Kali Peetham DeccanNo ratings yet

- Islamic Financial Services Board: December 2005Document38 pagesIslamic Financial Services Board: December 2005MericanQ.No ratings yet

- Bangldesh Bank Annual Repot 2016 2017 PDFDocument307 pagesBangldesh Bank Annual Repot 2016 2017 PDFChaitaly R.No ratings yet

- FBL September 2023Document88 pagesFBL September 2023syed abdul hamidNo ratings yet

- SBP OrganDocument1 pageSBP OrganSaad Bin MehmoodNo ratings yet

- Annual 2016: Bhutan National Bank LTDDocument137 pagesAnnual 2016: Bhutan National Bank LTDMalcolmNo ratings yet

- Vision: Annual Report 2022Document157 pagesVision: Annual Report 2022umair khanNo ratings yet

- Corporate-Governance 31122019Document23 pagesCorporate-Governance 31122019mohosina789No ratings yet

- M.A. Razzak ID-17102016 Fall 2020Document77 pagesM.A. Razzak ID-17102016 Fall 2020Abdullah Al MamunNo ratings yet

- CIHB - Annual Report 2021Document124 pagesCIHB - Annual Report 2021Mohd FadzilNo ratings yet

- Submitted To: Madam Ayesha Fareed Submitted By: Sabiha Arshad (BS)Document18 pagesSubmitted To: Madam Ayesha Fareed Submitted By: Sabiha Arshad (BS)Komal AnwarNo ratings yet

- 01711711828internship Report Prithila Final-3Document30 pages01711711828internship Report Prithila Final-3কাজী জিয়া উদ্দিনNo ratings yet

- NCML Annual 2023Document85 pagesNCML Annual 2023saleemazeem352No ratings yet

- 2 ChapterDocument14 pages2 ChapterAbdullah Al MahmudNo ratings yet

- 67916532345Document240 pages67916532345Saravanan BalasubramaniamNo ratings yet

- Kawan Food AR 2020 Full SetDocument188 pagesKawan Food AR 2020 Full SetMOHD HAFIZ BIN ABDULLAHNo ratings yet

- PRCL 2022Document216 pagesPRCL 2022alvi2353978No ratings yet

- TRG Grte The AsesDocument4 pagesTRG Grte The AsesGhulam AbbasNo ratings yet

- Ch06 - Bank Negara MalaysiaDocument24 pagesCh06 - Bank Negara MalaysiaSIVA MARANNo ratings yet

- 1.1 Organization Overview: 1,105,226,569 During The Year 2009. and in June 2010 Profit After Tax Is 793,726,000Document94 pages1.1 Organization Overview: 1,105,226,569 During The Year 2009. and in June 2010 Profit After Tax Is 793,726,000Md. Saiful IslamNo ratings yet

- BSE Limited: Investor Presentation - February 2020Document33 pagesBSE Limited: Investor Presentation - February 2020slohariNo ratings yet

- BNM Annual Report 2009 - BookDocument196 pagesBNM Annual Report 2009 - Booknidduz86No ratings yet

- Governance and Organisational DevelopmentDocument16 pagesGovernance and Organisational DevelopmentSam MdyNo ratings yet

- Glaxosmithkline Pakistan Limited: For The Nine Months Ended September 30, 2019Document20 pagesGlaxosmithkline Pakistan Limited: For The Nine Months Ended September 30, 2019Shamsa AkbarNo ratings yet

- Organization StructureDocument3 pagesOrganization StructureTahera AbbasNo ratings yet

- Bank Negara Malaysia Annual Report 2003Document341 pagesBank Negara Malaysia Annual Report 2003Goodnight FranksNo ratings yet

- MGT 251 Term Paper BodyDocument18 pagesMGT 251 Term Paper BodyMatthew AyonNo ratings yet

- C+Executives Report For The Month of July 2011Document29 pagesC+Executives Report For The Month of July 2011kartik baugNo ratings yet

- Occupational Health and Safety Management in NCC Bank (Banani Branch) .Document30 pagesOccupational Health and Safety Management in NCC Bank (Banani Branch) .priamNo ratings yet

- 2015 1126 Organizational StructureDocument1 page2015 1126 Organizational StructureyiuNo ratings yet

- Chapter-11: Appointment of New Directors in The BoardDocument6 pagesChapter-11: Appointment of New Directors in The Boardnazimreza19No ratings yet

- BSE Limited: Investor Presentation - May 2022Document40 pagesBSE Limited: Investor Presentation - May 2022NesNosssNo ratings yet

- A 2017 PDFDocument192 pagesA 2017 PDFAdnan AkhtarNo ratings yet

- Unilever Bangladesh-Annual-Report-2020Document160 pagesUnilever Bangladesh-Annual-Report-2020Ahsanul HaqueNo ratings yet

- Annual Report BNM2004.complete PDFDocument341 pagesAnnual Report BNM2004.complete PDFAli FarhanNo ratings yet

- Mumbai Finance DatabaseDocument8 pagesMumbai Finance DatabaseVikram0% (1)

- Reserve Bank of India: EstablishmentDocument16 pagesReserve Bank of India: EstablishmentRaviKiran AvulaNo ratings yet

- Background of The Organization: Page - 1Document25 pagesBackground of The Organization: Page - 1Ferdous GalibNo ratings yet

- 2GO 2018 ASM - Minutes of 2018 Stockholders MeetingDocument8 pages2GO 2018 ASM - Minutes of 2018 Stockholders MeetingAlaine DobleNo ratings yet

- Financial Management: The Basic Knowledge of Financial Management for StudentFrom EverandFinancial Management: The Basic Knowledge of Financial Management for StudentNo ratings yet

- ADB Annual Report 2013: Promoting Environmentally Sustainable Growth in Asia and the PacificFrom EverandADB Annual Report 2013: Promoting Environmentally Sustainable Growth in Asia and the PacificNo ratings yet

- Excellence in Third Party Risk Management (TPRM) : WWW - PWC.CHDocument6 pagesExcellence in Third Party Risk Management (TPRM) : WWW - PWC.CHRoslan.Affandi2351No ratings yet

- KPMG TPRM PDFDocument12 pagesKPMG TPRM PDFRoslan.Affandi2351No ratings yet

- BNM Ar2019 en Full PDFDocument124 pagesBNM Ar2019 en Full PDFRoslan.Affandi2351No ratings yet

- Auditing Third Party Risk Management Programs: ISACA/IIA San Diego IT Seminar April 12, 2018 Presented byDocument48 pagesAuditing Third Party Risk Management Programs: ISACA/IIA San Diego IT Seminar April 12, 2018 Presented byRoslan.Affandi2351100% (2)

- Kansai 03 - Tds - Epoxy - PrimerDocument3 pagesKansai 03 - Tds - Epoxy - PrimerRoslan.Affandi2351No ratings yet

- ISO 13485:2016 Quality Systems Manual: Document No. QMD-001Document11 pagesISO 13485:2016 Quality Systems Manual: Document No. QMD-001Roslan.Affandi2351100% (1)

- 1 - 0113 LXE108642 RevCDocument33 pages1 - 0113 LXE108642 RevCRoslan.Affandi2351No ratings yet

- Tackling Today's Challenges Together:: Corruption in EducationDocument2 pagesTackling Today's Challenges Together:: Corruption in EducationRoslan.Affandi2351No ratings yet

- Accreditation and QA in TVETDocument61 pagesAccreditation and QA in TVETRoslan.Affandi2351No ratings yet

- Change ManagementDocument4 pagesChange ManagementRoslan.Affandi2351No ratings yet

- SAC LogoDocument6 pagesSAC LogoRoslan.Affandi2351No ratings yet

- Indian Financial System Financial Markets-M-23-to Be Sent PDFDocument106 pagesIndian Financial System Financial Markets-M-23-to Be Sent PDFYASEEN AKBARNo ratings yet

- George O'Connell Essay Srinivas MedidaDocument3 pagesGeorge O'Connell Essay Srinivas MedidaSrinivas MedidaNo ratings yet

- Governor's Statement - August 6, 2020: TH TH TH THDocument13 pagesGovernor's Statement - August 6, 2020: TH TH TH THThe QuintNo ratings yet

- Pami Dua Monetary PolicyDocument38 pagesPami Dua Monetary PolicyIshika KumariNo ratings yet

- 03 and 04 OctDocument23 pages03 and 04 OctRishikesh TupeNo ratings yet

- Countdown Mock - 22 (CLAT) 2022 EnglishDocument53 pagesCountdown Mock - 22 (CLAT) 2022 EnglishAkanksha PriyadarshiniNo ratings yet

- Tybcom Banking Art 1 Indian Monetary and Financial System Sem 6 Tybcom C DivDocument6 pagesTybcom Banking Art 1 Indian Monetary and Financial System Sem 6 Tybcom C Divsunil shindeNo ratings yet

- BRM Assignment 07Document17 pagesBRM Assignment 07Sahan RodrigoNo ratings yet

- April Current Affairs 2022Document48 pagesApril Current Affairs 2022Akshay KumarNo ratings yet

- DR Chivukula Annirvinna Chapter 3 Unit 3 Monetary Policy 1653047575Document22 pagesDR Chivukula Annirvinna Chapter 3 Unit 3 Monetary Policy 1653047575rakshita7351No ratings yet

- Critical For The MPC To Maintain Credibility, Says Jayanth Varma Finmin Summons Infy Chief Today Over Bugs in Tax PortalDocument20 pagesCritical For The MPC To Maintain Credibility, Says Jayanth Varma Finmin Summons Infy Chief Today Over Bugs in Tax PortalNeeraj KumarNo ratings yet

- GK Tornado Ibps RRB and Sbi Main Exams 2020 Eng 2 57Document227 pagesGK Tornado Ibps RRB and Sbi Main Exams 2020 Eng 2 57payal gargNo ratings yet

- TTBR 13 January 2024 LDocument20 pagesTTBR 13 January 2024 LKhushi BerryNo ratings yet

- Statement of The Monetary Policy Committee January 2023Document9 pagesStatement of The Monetary Policy Committee January 2023Storm SimpsonNo ratings yet

- June NewsletterDocument4 pagesJune NewsletterDhairya BuchNo ratings yet

- Central Bank of Nigeria Communiqué No. 146 of The Monetary Policy Committee Meeting Held On Monday 23 and Tuesday 24 JANUARY 2023Document70 pagesCentral Bank of Nigeria Communiqué No. 146 of The Monetary Policy Committee Meeting Held On Monday 23 and Tuesday 24 JANUARY 2023QS OH OladosuNo ratings yet

- Review Economic Monthly: Bank of TanzaniaDocument32 pagesReview Economic Monthly: Bank of TanzaniaAnonymous FnM14a0No ratings yet

- QE HouseOfLordsDocument68 pagesQE HouseOfLordsVincyNo ratings yet

- CRISIL Mutual Fund Ranking June 22Document48 pagesCRISIL Mutual Fund Ranking June 22Saurabh BhargavaNo ratings yet

- RCF26022021FULDocument210 pagesRCF26022021FULForkLogNo ratings yet

- Predictability of Monetary PolDocument84 pagesPredictability of Monetary PolSt MelisaNo ratings yet

- Boe FS 2019Document169 pagesBoe FS 2019Qorxmaz AydınlıNo ratings yet

- BNM Ar2019 en Full PDFDocument124 pagesBNM Ar2019 en Full PDFRoslan.Affandi2351No ratings yet

- Bifm Pula Money Market Fund Factsheet Q4 2021Document1 pageBifm Pula Money Market Fund Factsheet Q4 2021Unaswi Pearl ShavaNo ratings yet

- Bank of EnglandDocument13 pagesBank of EnglandSwati DixitNo ratings yet

- Oriental Weavers Carpet (ORWE) PPTXDocument21 pagesOriental Weavers Carpet (ORWE) PPTXa.adel.eegNo ratings yet

- Staff Working Paper No. 899: The Central Bank Balance Sheet As A Policy Tool: Past, Present and FutureDocument52 pagesStaff Working Paper No. 899: The Central Bank Balance Sheet As A Policy Tool: Past, Present and FutureJohnyMacaroniNo ratings yet

- RBI Keeps Key Policy Rates On HoldDocument15 pagesRBI Keeps Key Policy Rates On HoldNDTVNo ratings yet

- Fmi 4 Sem Long NotesDocument28 pagesFmi 4 Sem Long Notessatyam ranaNo ratings yet

- Why Is India Reaching Out To Latin America?: Barks vs. TweetsDocument18 pagesWhy Is India Reaching Out To Latin America?: Barks vs. TweetsboxorNo ratings yet