Professional Documents

Culture Documents

Financial Modeling Case - Premium Bus Service

Financial Modeling Case - Premium Bus Service

Uploaded by

richa krishnaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Modeling Case - Premium Bus Service

Financial Modeling Case - Premium Bus Service

Uploaded by

richa krishnaCopyright:

Available Formats

Number).

The

actual Bus

costs around

Rs.70,00,000.

The Income

However

Tax along

with the vehicle

Department

there are

follows the

additional

written down

charges

value method levied

likedepreciation.

of -

Registration,

The specified

Insurance,

rate for

Taxes, etc. is

depreciation

40% as per the

Financial Modeling Also

IT ACT. Casethe

since - Premium Bus Service

bus will be

usedCompany

The for hire Interest rate

purpose,

Act prescribes we value if

leave

a rate some

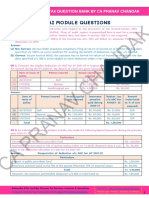

Assumptions of- Bus High

expected

Assumptions -yield to be

Financing Assumptions - General

margin for

16.21% forthe

the assumed.

high as theThis

accessories of

depreciation is done will on be Figures

Cost of Bus vehicle

thatbus

the mght usedget 7,500,000 Debt 5,625,000

purpose

used for to

75% Tax Rate

assumed for

33%

Maintenance / yearforaddedhireto it. 10% Equity 1,875,000

check

commercial if this 25% Interest Income the driver cost 5%

purpose.

Escalation Rate - Maintenan 15% Interest on Debt Miscellaneous

project

purposes. lies 15% and

Diesel rate (Rs./Lit) 64

Some amount

Life of Bus (years) This translates 4 Tenure of loan (years)costs

higherwill up on 4 miscellaneous

Diesel Price escalation 15%

will have

into an to be include,

the Investment the expenditures

Deprecation Rate spent on 25% SLM Cost of Equity 20% Inflation 10%

asumption of 6 costs for

Opportunity

acquiring

years for the All parking

schedule. the bus

India

Assumptions -usefule Permit,

Operating ofto

lifeRevenues Assumptions in -aOperating

shade. Costs Assumptions - Operating General

use bus.

the the bus for

transportation

Seating Capacity purpose. This 35 Fuel Efficiency ( Km /Amount

L) acts as 5 Route Mumbai - Pune

However a buffer and

Load Factor cost for at

looking state

the of 50% Driver Cost (Rs./ Trip)also takes into 600 Distance (Kms) 155

Maharashtra

Tariff (Rs./Ticket) working 360.00 Miscellaneous (Rs. / Trip)

consideration 300 Estimated Time Hours/Trip 3

(case in point)

conditions

Escalation Rate - Tariff and 10% the costs

Toll Amount (Rs. / Trip) 800 Trips / Day 4

is Rs.5,000.

usages we associated with

Interest Working days in a year 365

Source: Income

assume a the co-driver

Income Statement on Surplus

http://transport.

usefule life of

Cash.

delhigovt.nic.in/

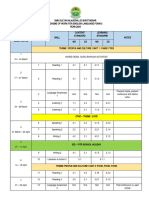

the bus at 4 Year - 0 Year - 1 Year - 2 Year - 3 Year - 4

Flag Find out as % 0

transport/tr8.ht

years. 1 2 3 4

of

m Opening

Revenue (Unit*per

Cash unit)

Balance 9,198,000 10,117,800 11,129,580 12,242,538 Unit * Per Unit = Revenue

Other Income - 49,170.80 105,287.80 168,057.95 Seat occupied * Ticket Price =

Fuel Costs 2,896,640 3,331,136 3,830,806 4,405,427 35*50% * 360 = 6300 Per trip

Maintenance Expenses 750,000 862,500 991,875 1,140,656 25200 per day

Driver Costs 876,000 963,600 1,059,960 1,165,956 9198000 per year

Miscellaneous Costs 438,000 481,800 529,980 582,978 L Km

Toll Amount 1,168,000 1,168,000 1,168,000 1,168,000 Lit Req * Diesel Price = Fuel Cost 1 5

Cost of Revenues 6,128,640 6,807,036 7,580,621 8,463,018 31 * 64 = 1984 Per trip 31 155

Gross Pofit / (EBITDA) 3,069,360 3,359,935 3,654,246 3,947,578 7936 per day

2896640 per year

Depreciation 1,875,000 1,875,000 1,875,000 1,875,000

Interest Expense 843,750 674,776 480,456 256,988

Profit Before Tax 350,610 810,159 1,298,790 1,815,590

Income Taxes 115,701 267,352 428,601 599,145 EMI Equal Monthly Installment

Profit After Tax 234,909 542,806 870,189 1,216,445 EAI Equal Annual Installment

Balance Sheet

Year - 0 Year - 1 Year - 2 Year - 3 Year - 4 Debt Schedule

Assets Year - 0 Year - 1 Year - 2 Year - 3 Year - 4

Cash - 983,416 2,105,756 3,361,159 4,739,350 BOP - Debt 5,625,000 4,498,507 3,203,041 1,713,254

PPE, Gross (Cost Value) 7,500,000 7,500,000 7,500,000 7,500,000 7,500,000 Int Expense 843,750 674,776 480,456 256,988

Acc Depreciation - 1,875,000 3,750,000 5,625,000 7,500,000 EAI 1,970,243 1,970,243 1,970,243 1,970,243

PPE, Net (Book Value) 7,500,000 5,625,000 3,750,000 1,875,000 - EOP - Debt 5,625,000 4,498,507 3,203,041 1,713,254 -

Total Assets 7,500,000 6,608,416 5,855,756 5,236,159 4,739,350

Principle Repaid 1,126,493 1,295,466 1,489,786 1,713,254

Liabilities

Debt 5,625,000 4,498,507 3,203,041 1,713,254 -

Equity 1,875,000 1,875,000 1,875,000 1,875,000 1,875,000

Retained Profit - 234,909 777,715 1,647,905 2,864,350

Total Liabilities 7,500,000 6,608,416 5,855,756 5,236,159 4,739,350

Checksum - - - - -

Cash Flow Statement

Year - 0 Year - 1 Year - 2 Year - 3 Year - 4

Net Income (PAT) - 234,909 542,806 870,189 1,216,445

Depreciation - 1,875,000 1,875,000 1,875,000 1,875,000

Cash Flow From Operations - 2,109,909 2,417,806 2,745,189 3,091,445

Capex (7,500,000) - - - -

Cash Flow from Investing (7,500,000) - - - -

Debt (Repayment)/Issuance 5,625,000 (1,126,493) (1,295,466) (1,489,786) (1,713,254)

Equity Addition 1,875,000 - - - -

Cash Flow from Financing 7,500,000 (1,126,493) (1,295,466) (1,489,786) (1,713,254)

Net change in Cash - 983,416 1,122,340 1,255,403 1,378,191

Cash - BOP - - 983,416 2,105,756 3,361,159

Cash - EOP - 983,416 2,105,756 3,361,159 4,739,350

Checksum

Average Cash

Free Cash Flow - Equity

Year - 0 Year - 1 Year - 2 Year - 3 Year - 4

Net Income - 234,909 542,806 870,189 1,216,445

+ Depreciation - 1,875,000 1,875,000 1,875,000 1,875,000 Escalation Rate %- Tariff

- Capital Expenses (7,500,000) - - - - 1,115,059 3% 5% 8% 10% 13%

- Debt Repayment/+ raised 5,625,000 (1,126,493) (1,295,466) (1,489,786) (1,713,254) 3% 344583.93 887242.59 1446185.75 2021692.01 2614040.02

Diesel Price %

Cash Flow to Equity (1,875,000) 983,416 1,122,340 1,255,403 1,378,191 5% 173689.52 716348.18 1275291.34 1850797.60 2443145.61

8% -2333.21 540325.45 1099268.60 1674774.87 2267122.88

10% -188150.58 359086.65 918029.80 1493536.07 2085884.08

Returns Analysis - Equity 13% -423334.27 172544.04 731487.19 1306993.46 1899341.47

Year - 0 Year - 1 Year - 2 Year - 3 Year - 4 15% -694538.06 -19390.12 539553.03 1115059.30 1707407.30

FCFE (1,875,000) 983,416 1,122,340 1,255,403 1,378,191

cumulative cashflow (1,875,000) (891,584) 230,756 1,486,159 2,864,350

Cost of Equity 20.0% Profit from the project without considering time value of money

NPV 1,115,059 Accept

IRR 47.14% Accept

You might also like

- Cost of Capital NumericalsDocument9 pagesCost of Capital Numericalsckcnathan001No ratings yet

- Modern Pharma Is Considering The Manufacture of A New Drug, Floxin, For Which The FollowingDocument7 pagesModern Pharma Is Considering The Manufacture of A New Drug, Floxin, For Which The FollowingbansalparthNo ratings yet

- Corporate Finance Ppt. SlideDocument24 pagesCorporate Finance Ppt. SlideMd. Jahangir Alam100% (1)

- Build A Financial ModelDocument1 pageBuild A Financial Modelm.karthikNo ratings yet

- Chapter 9 Expanding Customer RelationshipsDocument27 pagesChapter 9 Expanding Customer RelationshipsSherren Marie NalaNo ratings yet

- Bus ModelDocument1 pageBus Modelshrish guptaNo ratings yet

- Toyota Case-Class 3Document5 pagesToyota Case-Class 3Sravani Reddy BodduNo ratings yet

- Nature of Investment Decisions: Capital Budgeting, or Capital Expenditure DecisionsDocument49 pagesNature of Investment Decisions: Capital Budgeting, or Capital Expenditure DecisionsRam Krishna Krish100% (2)

- Sugar Project QuestionDocument22 pagesSugar Project QuestionAhisj100% (1)

- Proj Fin Quest Paper 1Document2 pagesProj Fin Quest Paper 1Sunil PeerojiNo ratings yet

- HUL Financial ModellingDocument21 pagesHUL Financial ModellingAnand SinghNo ratings yet

- Finlatics Financial Markets Experience Program Silver-CompressedDocument18 pagesFinlatics Financial Markets Experience Program Silver-CompressedRAVI KUMARNo ratings yet

- Richa Food Case EditedDocument3 pagesRicha Food Case Editedvishal nigamNo ratings yet

- Numericals On Cost of Capital and Capital StructureDocument2 pagesNumericals On Cost of Capital and Capital StructurePatrick AnthonyNo ratings yet

- Balance Sheet of Tata MotorsDocument10 pagesBalance Sheet of Tata Motorssarvesh.bhartiNo ratings yet

- Project Finance Test QuestionDocument18 pagesProject Finance Test QuestionKAVYA GUPTANo ratings yet

- 4 - Estimating The Hurdle RateDocument61 pages4 - Estimating The Hurdle RateDharmesh Goyal100% (1)

- Impact of CSR On Financial Performance of Top 10 Performing CSR Companies in IndiaDocument7 pagesImpact of CSR On Financial Performance of Top 10 Performing CSR Companies in IndiaSoorajKrishnanNo ratings yet

- Chapter 2 - Solved ProblemsDocument26 pagesChapter 2 - Solved ProblemsDiptish RamtekeNo ratings yet

- 20 Difference Between Operating Leverage and Financial LeverageDocument2 pages20 Difference Between Operating Leverage and Financial LeverageVenkatsubramanian R IyerNo ratings yet

- Walter's Model Formula: Unit - Iv Part - C Problems and SolutionsDocument3 pagesWalter's Model Formula: Unit - Iv Part - C Problems and SolutionsHarihara PuthiranNo ratings yet

- Documents - MX - FM Questions MsDocument7 pagesDocuments - MX - FM Questions MsgopalNo ratings yet

- AS 17 Segment ReportingDocument11 pagesAS 17 Segment ReportingNishant Jha Mcom 2No ratings yet

- Responsibility Accounting - Types, Features, Prerequisites & ExamplesDocument8 pagesResponsibility Accounting - Types, Features, Prerequisites & Examplesprakashzodpe2013No ratings yet

- Strategic Analysis of Reliance Industries LTD.: Guide - Dr. Neeraj SinghalDocument20 pagesStrategic Analysis of Reliance Industries LTD.: Guide - Dr. Neeraj SinghalPRITHIKA DASGUPTA 19212441No ratings yet

- Class Questions SolutionsDocument15 pagesClass Questions Solutionsmoneshivangi29No ratings yet

- Tata Consultancy Services: Financial Statements AnalysisDocument13 pagesTata Consultancy Services: Financial Statements AnalysisChhaya ThakorNo ratings yet

- Format For Course Curriculum: Course Code: ACCT315 Credit Units: 3 Level: UGDocument4 pagesFormat For Course Curriculum: Course Code: ACCT315 Credit Units: 3 Level: UGLoolik SoliNo ratings yet

- 12 Additional Solved Problems 11Document17 pages12 Additional Solved Problems 11jjayakumar_vj100% (1)

- Balance Sheet of Mahindra&Mahindra L.T.D: LiabilitiesDocument2 pagesBalance Sheet of Mahindra&Mahindra L.T.D: LiabilitiesDelectable Food DiariesNo ratings yet

- Step # 1: Calculation of Installment For BorrowingDocument5 pagesStep # 1: Calculation of Installment For BorrowingSyed HammadNo ratings yet

- Lipon, Service Encounter of DominoDocument5 pagesLipon, Service Encounter of DominoMd SyfuddinNo ratings yet

- Operating Costing Questions (FINAL)Document4 pagesOperating Costing Questions (FINAL)Tejas YeoleNo ratings yet

- Liquidity Ratios AssignmentDocument6 pagesLiquidity Ratios AssignmentNoor Hidayah Binti Taslim0% (1)

- Break Even Point No Profit No Loss Sales - Variable Contribution - Fixed Cost ProfitDocument10 pagesBreak Even Point No Profit No Loss Sales - Variable Contribution - Fixed Cost ProfitShilpan ShahNo ratings yet

- Leverage Unit-4 Part - IIDocument34 pagesLeverage Unit-4 Part - IIAstha ParmanandkaNo ratings yet

- Financial Statements of Insurance Companies (PDFDrive)Document106 pagesFinancial Statements of Insurance Companies (PDFDrive)Putin PhyNo ratings yet

- Ratio Analysis - HeroDocument25 pagesRatio Analysis - HeroGOURAV SHRIVASTAVA Student, Jaipuria IndoreNo ratings yet

- Financial Management - PROBLEMS FROM UNIT - 4Document5 pagesFinancial Management - PROBLEMS FROM UNIT - 4jeganrajraj100% (1)

- What Is A CMA Report PDFDocument2 pagesWhat Is A CMA Report PDFभगवा समर्थकNo ratings yet

- 7 Deductions ICAI SM + PCA + Past RTPs + Past Exam Questions WatermarkDocument25 pages7 Deductions ICAI SM + PCA + Past RTPs + Past Exam Questions WatermarkSavya SachiNo ratings yet

- From The Following Summary of Cash Account of X LTDDocument2 pagesFrom The Following Summary of Cash Account of X LTDLysss EpssssNo ratings yet

- Payroll in TallyDocument227 pagesPayroll in Tallybhatia_pria100% (1)

- BCG ApproachDocument2 pagesBCG ApproachAdhityaNo ratings yet

- Unit V-Project Network Analysis - CPMPERT - PPT PDFDocument34 pagesUnit V-Project Network Analysis - CPMPERT - PPT PDFSharmila ShettyNo ratings yet

- Financial Management: Unit 3Document47 pagesFinancial Management: Unit 3muralikarthik31No ratings yet

- AFM Capital Structure Cp5Document61 pagesAFM Capital Structure Cp5drmsellan7No ratings yet

- 2 - Time Value of MoneyDocument68 pages2 - Time Value of MoneyDharmesh GoyalNo ratings yet

- Receivables ManagementDocument4 pagesReceivables ManagementVaibhav MoondraNo ratings yet

- Issue ManagementDocument30 pagesIssue Managementmohanbkp100% (2)

- TVM Sums & SolutionsDocument7 pagesTVM Sums & SolutionsRupasree DeyNo ratings yet

- CH 14Document17 pagesCH 14rameshmbaNo ratings yet

- KFT Accounting Solutions: Instructions For TestDocument10 pagesKFT Accounting Solutions: Instructions For TestKanika Sharma100% (1)

- Travel Agency Model CaseDocument4 pagesTravel Agency Model Caseudaywal.nandiniNo ratings yet

- Bus ProjectDocument3 pagesBus ProjectnikhilbNo ratings yet

- Valuation Cheat SheetDocument1 pageValuation Cheat SheetRISHAV BAIDNo ratings yet

- Safari - 22-Apr-2019 at 5:47 PM PDFDocument1 pageSafari - 22-Apr-2019 at 5:47 PM PDFSurbhi MohindruNo ratings yet

- Wacc Calculation SimplifiedDocument2 pagesWacc Calculation SimplifiedPranjalNo ratings yet

- AMC Standardization - SchemesDocument7 pagesAMC Standardization - Schemesfloor arasutvs2No ratings yet

- Issue and Change ListDocument4 pagesIssue and Change ListPankaj ShindeNo ratings yet

- WithholdingTaxesICAP PDFDocument23 pagesWithholdingTaxesICAP PDFaliNo ratings yet

- MAT Calculation: Setoff MAT Credits - End Net Tax PayableDocument1 pageMAT Calculation: Setoff MAT Credits - End Net Tax Payablericha krishnaNo ratings yet

- Kansai Nerolac QuestionDocument6 pagesKansai Nerolac Questionricha krishnaNo ratings yet

- Nerolac - On Ratio - SolvedDocument6 pagesNerolac - On Ratio - Solvedricha krishnaNo ratings yet

- Nerolac - Solution PDFDocument5 pagesNerolac - Solution PDFricha krishnaNo ratings yet

- Performance Leadership PresentatiomDocument31 pagesPerformance Leadership PresentatiomMuhd HasansyukriNo ratings yet

- Supreme CourtDocument5 pagesSupreme CourtDivyasri JeganNo ratings yet

- MOB Unit 1 SyllabusDocument18 pagesMOB Unit 1 SyllabussadNo ratings yet

- For Many Persons Science Is Considered The Supreme Form of All KnowledgeDocument13 pagesFor Many Persons Science Is Considered The Supreme Form of All KnowledgeMidz SantayanaNo ratings yet

- Cultural Education in The Philippines PDFDocument31 pagesCultural Education in The Philippines PDFAyllo CortezNo ratings yet

- Novartis 2012Document284 pagesNovartis 2012Direct55No ratings yet

- Phrasal AdverbsDocument20 pagesPhrasal AdverbsOmar H. AlmahdawiNo ratings yet

- LLP Agreement Altered India1Document6 pagesLLP Agreement Altered India1Shishir YadavNo ratings yet

- Nara Introduction To Hsa SC Al 1Document11 pagesNara Introduction To Hsa SC Al 1api-293251883No ratings yet

- Burmese DanceDocument2 pagesBurmese DanceKo Ye50% (2)

- Platonic Atomisim and Moore's Refutation of IdealismDocument13 pagesPlatonic Atomisim and Moore's Refutation of Idealismusuyitik100% (1)

- TITLE-IV-Powers NG CorpDocument3 pagesTITLE-IV-Powers NG CorpRichard Dan Ilao ReyesNo ratings yet

- Bruno Latour AIR SENSORIUMpdfDocument4 pagesBruno Latour AIR SENSORIUMpdfAura OanceaNo ratings yet

- Karnataka Power Corporation Limited: Post Office Challan (Post Office Copy) Post Office Challan (Applicant Copy)Document3 pagesKarnataka Power Corporation Limited: Post Office Challan (Post Office Copy) Post Office Challan (Applicant Copy)channaveerashastryNo ratings yet

- Palawan Palawan: Palawan All You Need To KnowDocument2 pagesPalawan Palawan: Palawan All You Need To Knowreg speckNo ratings yet

- CRIM ASIATICO Vs PEOPLEDocument2 pagesCRIM ASIATICO Vs PEOPLEBug RancherNo ratings yet

- Maxim Australia - December 2017Document100 pagesMaxim Australia - December 2017wdmalik60% (5)

- Review Trip Details and BookDocument1 pageReview Trip Details and BookHamza HamdanNo ratings yet

- Hotspots 160209Document288 pagesHotspots 160209marciopinaNo ratings yet

- Rpt-Sow Form 3 2024Document6 pagesRpt-Sow Form 3 2024g-16025707No ratings yet

- Assignment One and TwoDocument6 pagesAssignment One and TwoHiwot AderaNo ratings yet

- Financial Statemnt AnalysisDocument39 pagesFinancial Statemnt AnalysisNor CahayaNo ratings yet

- BMI Vietnam Food and Drink Report Q3 2013Document120 pagesBMI Vietnam Food and Drink Report Q3 2013chip12384No ratings yet

- Hgs Tax Reviewer 2022Document204 pagesHgs Tax Reviewer 2022Christine SumawayNo ratings yet

- Connection Lost - Modern FamilyDocument3 pagesConnection Lost - Modern FamilydanNo ratings yet

- 218850794Document9 pages218850794Priscilla JONo ratings yet

- CMAT-2024 Admit CardDocument3 pagesCMAT-2024 Admit Cardraoaditi016No ratings yet

- Eurodisney PDFDocument2 pagesEurodisney PDFLoliNo ratings yet

- Acdasoa On The Spot Logo Making Contest GuidelinesDocument2 pagesAcdasoa On The Spot Logo Making Contest GuidelinesAlma Reynaldo TucayNo ratings yet