Professional Documents

Culture Documents

Assignment Leverage Analysis: Financial Management

Assignment Leverage Analysis: Financial Management

Uploaded by

Vishal ChandakOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assignment Leverage Analysis: Financial Management

Assignment Leverage Analysis: Financial Management

Uploaded by

Vishal ChandakCopyright:

Available Formats

Financial Management

Assignment

Leverage Analysis

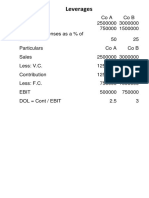

Ques 1: Calculate the three leverages for the following three firms A, B and C:-

Particular A B C

Output(Units) 60,000 15,000 1,00,000

Fixed Costs(Rs.) 7,000 14,000 1,500

Variable Cost per 0.2 1.5 0.02

unit (Rs.)

Interest on Debt 4,000 8,000 -

Selling Price per 0.6 5 0.1

Unit(Rs.)

Solution:

Particulars A (60,000) B (15,000) C (1,00,000)

Selling Price (Rs.) 36,000 75,000 10,000

(-) Variable Cost () 12,000 22,500 2,000

Contribution 24,000 52,500 8,000

(-) Fixed Cost 7,000 14,000 1,500

EBIT(Contribution- 17,000 38,500 6,500

FC)

(-) Interest 4,000 8,000 -

EBT 13,000 30,500 6,500

OL= C/EBIT 24,000/17000 = 1.41 52,500/38500 = 1.36 8,000/6500 = 1.23

FL = EBIT/EBT 17,000/13,000 = 1.31 38500/30500 = 1.26 6,500/6,500 = 0

CL = C/EBT 24,000/13,000 = 1.85 52,500/30,500 = 1.72 8,000/6,500 = 1.23

CL can also be 1.41 * 1.31 1.36 * 1.26 1.23 * 1 =

found as OL*FL = 1.85 = 1.72 1.23

Name: Vishal Chandak

MBA 2nd Semester

Financial Management

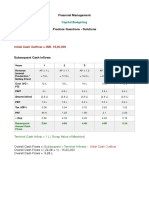

Ques: A firm has sales of Rs. 10,00,000, variable cost Rs. 7,00,000 and fixed cost Rs.

2,00,000. It has a 10% debt of Rs. 5,00,000. Find the leverages.

If the firm wants to double its EBIT, how much % sales should be raised?

Solution:

Particular Amount

Selling Price (Rs.) 10,00,000

(-) V.C (Rs.) 7,00,000

Contribution 3,00,000

(-) Fixed Costs 2,00,000

EBIT (Contribution -FC) 1,00,000

(-) Interest (500000*10%) 50,000

EBT 50,000

OL = C/EBIT 3,00,000/ 1,00,000 = 3

FL = EBIT/EBT 1,00,000/50,000 = 2

CL = C/EBT 3,00,000/ 50,000 = 6 (3*2)

Name: Vishal Chandak

MBA 2nd Semester

You might also like

- SOP Sales ManagerDocument2 pagesSOP Sales ManagerDesyFortuna55% (11)

- Cin7 Inventory Guide PDFDocument10 pagesCin7 Inventory Guide PDFthexsam0% (1)

- INTRODUCTION of AirtelDocument3 pagesINTRODUCTION of AirtelVishal Chandak33% (3)

- Shabbir Tiles Supply Chain ManagementDocument10 pagesShabbir Tiles Supply Chain ManagementAkbar Syed100% (1)

- Otto Shoes Marketing PlanDocument26 pagesOtto Shoes Marketing Planapi-29202597750% (12)

- Answersto Question Bank - Leverages and Capital StructureDocument3 pagesAnswersto Question Bank - Leverages and Capital StructureSakshi SharmaNo ratings yet

- 6 LeveragesDocument9 pages6 LeveragesAishu SathyaNo ratings yet

- Leverages: Solutions To Assignment ProblemsDocument7 pagesLeverages: Solutions To Assignment ProblemsPalash BairagiNo ratings yet

- Unit 5, 6 & 7 Capital Budgeting 1Document14 pagesUnit 5, 6 & 7 Capital Budgeting 1ankit mehtaNo ratings yet

- Revision - 29 Aug, 28 Aug 2022Document9 pagesRevision - 29 Aug, 28 Aug 2022Kartik SujanNo ratings yet

- AFM IBSB Leverages WordDocument16 pagesAFM IBSB Leverages WordSangeetha K SNo ratings yet

- Chapter 5 Leverages - PracticeDocument10 pagesChapter 5 Leverages - PracticeAkshat SinghNo ratings yet

- Case Study On LeveragesDocument5 pagesCase Study On LeveragesSantosh Kumar Roul100% (3)

- Solution To CVP ProblemsDocument8 pagesSolution To CVP ProblemsGizachew NadewNo ratings yet

- Answer: BDocument6 pagesAnswer: BPatience AkpanNo ratings yet

- Answer c22Document3 pagesAnswer c22Võ Huỳnh BăngNo ratings yet

- Fim Model SolutionDocument7 pagesFim Model Solutionhyp siinNo ratings yet

- Finance&Accounts T3 SolutionDocument4 pagesFinance&Accounts T3 Solutionkanika thakurNo ratings yet

- Capital Budgeting - SolutionDocument5 pagesCapital Budgeting - SolutionAnchit JassalNo ratings yet

- Key To Correction - Intermediate Accounting - Midterm - 2019-2020Document10 pagesKey To Correction - Intermediate Accounting - Midterm - 2019-2020Renalyn ParasNo ratings yet

- (Leverage) Scan Sep 11, 2020Document7 pages(Leverage) Scan Sep 11, 2020Pragya senNo ratings yet

- Solution Assignment Chapter 9 10 1Document14 pagesSolution Assignment Chapter 9 10 1Huynh Ng Quynh NhuNo ratings yet

- FM II Assignment 8 Solution W22Document2 pagesFM II Assignment 8 Solution W22Farah ImamiNo ratings yet

- FM Books Solution - Nov 23Document78 pagesFM Books Solution - Nov 23Arnik AgarwalNo ratings yet

- Preliminary Solutions Exam FEB12003X (Group 1 / Group 2)Document5 pagesPreliminary Solutions Exam FEB12003X (Group 1 / Group 2)Henryck SpierenburgNo ratings yet

- FMsolution 2024Document4 pagesFMsolution 2024Tejaswini BuddhisagarNo ratings yet

- Epjj Latest Tutorial Q and A On Setting Minimum Bid Price and EAC As at 12 Nov 2021Document4 pagesEpjj Latest Tutorial Q and A On Setting Minimum Bid Price and EAC As at 12 Nov 20212022961653No ratings yet

- Analysis of Investments in Associates of An SME1Document3 pagesAnalysis of Investments in Associates of An SME1CJ alandyNo ratings yet

- Analysis of Investments in Associates of An SME1Document3 pagesAnalysis of Investments in Associates of An SME1Jan ryanNo ratings yet

- Bajaj Finserv Investor Presentation - Q2 FY2018-19Document19 pagesBajaj Finserv Investor Presentation - Q2 FY2018-19AmarNo ratings yet

- FMECODocument15 pagesFMECOdemuduvechalapu29No ratings yet

- FAR Final Preboard SolutionsDocument6 pagesFAR Final Preboard SolutionsVillanueva, Mariella De VeraNo ratings yet

- Practical Practice QuestionsDocument17 pagesPractical Practice QuestionsGungun SharmaNo ratings yet

- Class WorkDocument8 pagesClass WorkSanchit AgarwalNo ratings yet

- Solution FM GMDocument11 pagesSolution FM GMDharmateja ChakriNo ratings yet

- Managerial Accounting: SectionDocument17 pagesManagerial Accounting: SectionNostecNo ratings yet

- Prac SolutionsDocument5 pagesPrac SolutionschrstncstlljNo ratings yet

- Management Accounting Set 4Document7 pagesManagement Accounting Set 4Julia ŚwierczyńskaNo ratings yet

- 6 LeveragesDocument7 pages6 LeveragesMumtazAhmadNo ratings yet

- LEVERAGESDocument96 pagesLEVERAGESNaman LadhaNo ratings yet

- FINA 3330 - Notes CH 9Document2 pagesFINA 3330 - Notes CH 9fische100% (1)

- FAR05 - First Pre-Board SolutionsDocument7 pagesFAR05 - First Pre-Board SolutionsMellaniNo ratings yet

- Notes CA Int GMDocument51 pagesNotes CA Int GMDharmateja ChakriNo ratings yet

- Financial Management: Capital StructureDocument18 pagesFinancial Management: Capital StructureSamiul AzamNo ratings yet

- Lecture 1. Basic Costing CVP AnswersDocument9 pagesLecture 1. Basic Costing CVP AnswersTân NguyênNo ratings yet

- M03Document4 pagesM03Anne Thea AtienzaNo ratings yet

- Quali Review Interim Reporting Complete SolutionDocument7 pagesQuali Review Interim Reporting Complete SolutionPaul Ivan CabanatanNo ratings yet

- Mock SFM Answer MarchDocument12 pagesMock SFM Answer MarchMenuka SiwaNo ratings yet

- Variable CostingDocument4 pagesVariable CostingKhairul Ikhwan DalimuntheNo ratings yet

- 01 Leverages Solution Set (Not To Print)Document17 pages01 Leverages Solution Set (Not To Print)Tanay shuklaNo ratings yet

- Sensitivity and Breakeven Analysis: Lecture No. 29 Professor C. S. Park Fundamentals of Engineering EconomicsDocument26 pagesSensitivity and Breakeven Analysis: Lecture No. 29 Professor C. S. Park Fundamentals of Engineering EconomicsFeni Ayu LestariNo ratings yet

- Cristina - BA4008QA Business Decison MakingDocument15 pagesCristina - BA4008QA Business Decison MakingmunnaNo ratings yet

- Test 1 Answer SheetDocument12 pagesTest 1 Answer SheetNaveen R HegadeNo ratings yet

- Sol. Man. - Chapter 9 - Interim Financial ReportingDocument6 pagesSol. Man. - Chapter 9 - Interim Financial ReportingAEDRIAN LEE DERECHONo ratings yet

- Ecsy Cola Question2Document8 pagesEcsy Cola Question2Dhagash SanghaviNo ratings yet

- Taxation Solution To Final PB Oct 2021Document6 pagesTaxation Solution To Final PB Oct 2021keishanget60No ratings yet

- Answer - Capital BudgetingDocument19 pagesAnswer - Capital Budgetingchowchow123No ratings yet

- Exercise On Capital Budgeting-BSLDocument19 pagesExercise On Capital Budgeting-BSLShafiul AzamNo ratings yet

- 123Document2 pages123Novie AriyantiNo ratings yet

- Leverages MaterialDocument15 pagesLeverages MaterialsreevardhanNo ratings yet

- Cash Flow Brigham SolutionDocument14 pagesCash Flow Brigham SolutionShahid Mehmood100% (4)

- FM II Assignment 2 Solution W22Document5 pagesFM II Assignment 2 Solution W22Farah ImamiNo ratings yet

- ln3 NumericalsDocument86 pagesln3 NumericalssangeeiyerNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- CONCLUSION of Advertising ReportDocument2 pagesCONCLUSION of Advertising ReportVishal ChandakNo ratings yet

- DATA ANALYSIS Advertising 1Document11 pagesDATA ANALYSIS Advertising 1Vishal ChandakNo ratings yet

- DATA ANALYSIS AdvertisingDocument11 pagesDATA ANALYSIS AdvertisingVishal ChandakNo ratings yet

- LITERATURE REVIEW of PepsicoDocument1 pageLITERATURE REVIEW of PepsicoVishal ChandakNo ratings yet

- Director ProvisionsDocument14 pagesDirector ProvisionsVishal ChandakNo ratings yet

- Unit-I Introduction To AdvertisingDocument17 pagesUnit-I Introduction To AdvertisingVishal ChandakNo ratings yet

- The Creative Side and Message StrategyDocument32 pagesThe Creative Side and Message StrategyVishal Chandak100% (1)

- Televisio N Asan Advertisi NG MediaDocument37 pagesTelevisio N Asan Advertisi NG MediaVishal ChandakNo ratings yet

- Advertising Budgeting Methods: Percentage of Sales MethodDocument2 pagesAdvertising Budgeting Methods: Percentage of Sales MethodVishal ChandakNo ratings yet

- Buy Back, DividentDocument13 pagesBuy Back, DividentVishal ChandakNo ratings yet

- GDR, Doctrine of Constructive Notice & Indoor MGMT Prospectus, Red Herring Prospectus, Shelf Prospectus, MisstaementDocument22 pagesGDR, Doctrine of Constructive Notice & Indoor MGMT Prospectus, Red Herring Prospectus, Shelf Prospectus, MisstaementVishal ChandakNo ratings yet

- Assignment Capital Structure: Financial ManagementDocument3 pagesAssignment Capital Structure: Financial ManagementVishal ChandakNo ratings yet

- Auditor & Its ProvisionDocument10 pagesAuditor & Its ProvisionVishal ChandakNo ratings yet

- Books of AccountDocument17 pagesBooks of AccountVishal ChandakNo ratings yet

- 08.08.18 Unit-1 Meaning Importance and Limitations of Economics and Its Relevence in Management Decision MakingDocument28 pages08.08.18 Unit-1 Meaning Importance and Limitations of Economics and Its Relevence in Management Decision MakingVishal ChandakNo ratings yet

- Marketing Management - AssignmentDocument7 pagesMarketing Management - AssignmentVishal ChandakNo ratings yet

- Contemporary Issues in Leadership: Instructor: Prof. Dr. Tomas Benz Team 10: Pham Thanh Lam Pham Tran Thai SonDocument16 pagesContemporary Issues in Leadership: Instructor: Prof. Dr. Tomas Benz Team 10: Pham Thanh Lam Pham Tran Thai SonVishal ChandakNo ratings yet

- Assignment Capital Budgeting: Financial ManagementDocument3 pagesAssignment Capital Budgeting: Financial ManagementVishal ChandakNo ratings yet

- RNB Global University: TOPIC: Leadership Development and Workforce Training and Development DateDocument37 pagesRNB Global University: TOPIC: Leadership Development and Workforce Training and Development DateVishal ChandakNo ratings yet

- MarketingDocument76 pagesMarketingVishal ChandakNo ratings yet

- Demand Forecasting: Dr. M.K.Ghadoliya WWW - Ghadoliyaseconomics-Mahendra - Blogspot.inDocument12 pagesDemand Forecasting: Dr. M.K.Ghadoliya WWW - Ghadoliyaseconomics-Mahendra - Blogspot.inVishal ChandakNo ratings yet

- Accounting FOR Decision Making: Unit-Ii Ledger AccountsDocument5 pagesAccounting FOR Decision Making: Unit-Ii Ledger AccountsVishal ChandakNo ratings yet

- Introduction To Economics For ManagersDocument6 pagesIntroduction To Economics For ManagersVishal ChandakNo ratings yet

- Accounting For Decision Making: Unit - I Accounting EquationDocument25 pagesAccounting For Decision Making: Unit - I Accounting EquationVishal ChandakNo ratings yet

- Elasticity of Demand and SupplyDocument38 pagesElasticity of Demand and SupplyVishal ChandakNo ratings yet

- ACCT 440 FMGT Exams 2021 SandwichDocument4 pagesACCT 440 FMGT Exams 2021 SandwichNubor RichardNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Gadde Niharika ChowdaryNo ratings yet

- Bluedart Pickup ProcessDocument2 pagesBluedart Pickup ProcessMitesh JainNo ratings yet

- Managerial Economics and Business Strategy - Ch. 1 - The Fundamentals of Managerial Economics PDFDocument36 pagesManagerial Economics and Business Strategy - Ch. 1 - The Fundamentals of Managerial Economics PDFRayhanNo ratings yet

- Chapter 9Document61 pagesChapter 9SILVIANA PUTRINo ratings yet

- ManEco - MC and Problems - Chapter 2-5Document7 pagesManEco - MC and Problems - Chapter 2-5Glenn VeluzNo ratings yet

- New Luxury Creators and The Forces That Support Them: Opportunities For Action in Consumer MarketsDocument11 pagesNew Luxury Creators and The Forces That Support Them: Opportunities For Action in Consumer MarketsAlejandro LamasNo ratings yet

- Direct Marketing NotesDocument4 pagesDirect Marketing NotesShantanu WeKidsNo ratings yet

- Unit 5 Managing Sales Force in The OrganizationDocument20 pagesUnit 5 Managing Sales Force in The OrganizationSudip ThapaNo ratings yet

- Perfectly Competitive MarketsDocument36 pagesPerfectly Competitive MarketsSaurabh SharmaNo ratings yet

- Sourcing Strategy: DR U Bahadur SpjimrDocument20 pagesSourcing Strategy: DR U Bahadur SpjimrchhavibNo ratings yet

- Business Reading ComprehensionDocument5 pagesBusiness Reading ComprehensionOuijdane Semlali100% (1)

- A Taxonomy On Subscription Models in RetailingDocument4 pagesA Taxonomy On Subscription Models in RetailingAndrea Celi VillanuevaNo ratings yet

- Updated E Auction Catalogue of Marathon Electric India Private Limited Faridabad For 3 Months Scrap Items Auction To Be Conducted On 27th Dec 2023Document12 pagesUpdated E Auction Catalogue of Marathon Electric India Private Limited Faridabad For 3 Months Scrap Items Auction To Be Conducted On 27th Dec 2023singhgujralgNo ratings yet

- Chapter 10-13 Marketing ChannelDocument32 pagesChapter 10-13 Marketing ChannelCarol Smith-Campbell100% (1)

- Applied Econ Week 1 4THDocument4 pagesApplied Econ Week 1 4THjgpanizales03No ratings yet

- Sales Clerk Job DescriptionDocument1 pageSales Clerk Job Descriptionshenric16No ratings yet

- Ordinance No 1 TaxationDocument5 pagesOrdinance No 1 TaxationMiguel BravoNo ratings yet

- Principles of Auditing Other Assurance Services 21st Edition Whittington Solutions ManualDocument26 pagesPrinciples of Auditing Other Assurance Services 21st Edition Whittington Solutions Manualalexandrapearli5zj100% (32)

- Philippine Match Co., Ltd. vs. City of CebuDocument6 pagesPhilippine Match Co., Ltd. vs. City of CebuChristian Joe QuimioNo ratings yet

- Furniture Store Business Plan ExampleDocument37 pagesFurniture Store Business Plan ExamplekenetiNo ratings yet

- 李圣杰演唱会票Document1 page李圣杰演唱会票kelvingoo2112No ratings yet

- 3B - Chapter 4 - OperationsDocument78 pages3B - Chapter 4 - OperationsLit Jhun Yeang BenjaminNo ratings yet

- Chap 1-5 NotesDocument14 pagesChap 1-5 NotesBismah SaleemNo ratings yet

- Acct 3Document12 pagesAcct 3Annie RapanutNo ratings yet

- Comprehensive Case Scenario Wilson BrosDocument8 pagesComprehensive Case Scenario Wilson BrosMe MeNo ratings yet