Professional Documents

Culture Documents

Ir328 2021

Ir328 2021

Uploaded by

api-527215716Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ir328 2021

Ir328 2021

Uploaded by

api-527215716Copyright:

Available Formats

IR328

June 2020

Tax due date calendar 2020-2021

APRIL 2020 MAY 2020 JUNE 2020 JULY 2020 AUGUST 2020 SEPTEMBER 2020 OCTOBER 2020 NOVEMBER 2020 DECEMBER 2020 JANUARY 2021 FEBRUARY 2021 MARCH 2021

1 Employment information - IR348 MONDAY 1 Queen’s Birthday 1 1

3 6

payment due for employers who

deduct less than $500,000 PAYE and 2 1 1 2 2

ESCT per year. TUESDAY

9 10

2 Employment information - IR348 1 3 1 2 2 3 3

payment due for employers who WEDNESDAY

deduct $500,000 PAYE and ESCT

or more per year THURSDAY 2 4 2 3 1 3 4 4

• 20th of the month

Payment due for deductions made 3 1 5 3 4 2 4 1 New Year’s Day 5 5

FRIDAY

2

2

2

between the 1st and 15th of the

same month. 4 2 6 4 1 5 3 5 2 6 Waitangi Day 6

SATURDAY

• 5th of the month

Payment due for deductions made 5 3 7 5 2 6 4 1 6 3 7 7

SUNDAY

between the 16th and the end of the

previous month.

6 4 8 6 3 7 5 2 7 4 New Year’s Holiday 8 Waitangi Day Holiday 8

3 GST return and payment due

MONDAY

2

2

2

2

2

7 5 9 7 4 8 6 3 8 5 9 9

4 Provisional tax instalments due for TUESDAY

7 11

2

8

7 11

people and organisations who file GST

on a monthly or two-monthly basis, or 8 6 10 8 5 9 7 4

WEDNESDAY 2 9 6 10 10

aren’t registered for GST

5 Provisional tax instalments due for

people and organisations who file GST

THURSDAY 9

7

3 4 5 6 11 9 6 10 8

5

2 10 7 11 11

on a six-monthly basis

10 Good Friday 8 12 10 7 11 9 6 11 8 12 12

FRIDAY

6 Provisional tax instalments due for

people and organisations who use the

ratio method 11 9 13 11 8 12 10 7 12 9 13 13

SATURDAY

7 End-of-year income tax

12 10 14 12 9 13 11 8 13 10 14 14

• 7 April 2020 SUNDAY

2019 end-of-year income tax due 13 Easter Monday 11 15 13 10 14 12 9 14 11 15 15

for clients of tax agents (with a valid MONDAY

extension of time)

14 12 16 14 11 15 13 10 15 12 16 16

• 7 February 2021 TUESDAY

2020 end-of-year income tax due for 15 13 17 15 12 16 14 11 16 13 17 17

people and organisations who don’t WEDNESDAY

have a tax agent

16 14 18 16 13 17 15 12 17 14 18 18

8 Income tax return THURSDAY

• 7 July 2020

2020 income tax return due for

FRIDAY 17 15 19 17 14 18 16 13 18

15

2 3 4 6 19 19

people and organisations who don’t 18 16 20 18 15 19 17

have a tax agent or extension of time SATURDAY 14 19 16 20 20

• 31 March 2021

19 17 21 19 16 20 18 15 20 17 21 21

SUNDAY

2020 income tax return due for

clients of tax agents (with a valid

20 18 22 20 17 21 19 16 21 18 22 22

extension of time MONDAY

1 2

1 2

1 2 9

1 2

1 2

1 2

1 2

9 Quarterly FBT return and payment due

21 19 23 21 18 22 20

TUESDAY 1 2 9 17 22 19 23 23

10 Annual FBT return and payment due

WEDNESDAY 22 20

1 2 24 22 19 23 21 18 23 20

9 24 24

11 Income year FBT return and payment

• 7 April 2020 23 21 25 23 20

THURSDAY 1 2 24 22 19 24 21 25 25

2019 income year return and

payment due for clients of tax agents 24 22 26 24 21 25 23 20 25 Christmas Day 22 26 26

(with a valid extension of time)

FRIDAY

1 2

• 7 February 2021 25 ANZAC Day 23 27 25 22 26 24 21 26 Boxing Day 23 27 27

SATURDAY

2020 income year return and

payment due for people and 26 24 28 26 23 27 25 22 27 24 28 28

SUNDAY

organisations who don’t have a tax

agent

Notes MONDAY 27 ANZAC Day Holiday 25

29

3 6 27 24 28 26 Labour Day 23 28 Boxing Day observed 25

29

3

• If a due date falls on a weekend or public

holiday you can file or pay on the next TUESDAY 28 26 30

28

3 25 29 27 24 29 26 30

business day without incurring penalties.

• All payment and return filing due dates WEDNESDAY 29 27 29 26 30

28

3 4 6 25 30 27

31

8

shown are for people and organisations

with a March balance date.

THURSDAY 30

28

1 3 30 27 29 26 31 28

• You can create a personalised due date

calendar on our website, go to ird.govt.nz

(search keyword: calendars). FRIDAY 29 31

28

3 4 6 30 27

29

1

• Due dates for payday filing are not shown

30 29 31 28 30

on this calendar as they vary. For more SATURDAY

information, including when to file, go to

ird.govt.nz (search keyword: payday filing). 31 30 29 31

SUNDAY

• For paydays between 25/12 and 15/1 you

have until after 15/1 to file Employment 31

Information – another 2 working days if MONDAY 30

online, or 10 if by paper. Payment dates

stay the same. You can also file in advance TUESDAY

before you close down.

Income tax and general enquiries ird.govt.nz GST enquiries ird.govt.nz/gst Employer enquiries ird.govt.nz/payroll-employers Overdue tax and return enquiries ird.govt.nz Publications ird.govt.nz “Forms and guides”

ird.govt.nz “Business income tax” or 0800 377 774 or 0800 377 776 ird.govt.nz/fbt or 0800 377 772 (search keyword: overdue) or 0800 377 771 or 0800 257 773 anytime except between 5 am and 6 am

You might also like

- SSG Project Proposal Gift GivingDocument8 pagesSSG Project Proposal Gift GivingRossell Villavicencio100% (9)

- SOMETHING TO TALK ABOUT TextDocument38 pagesSOMETHING TO TALK ABOUT TextIrbaz Khan63% (8)

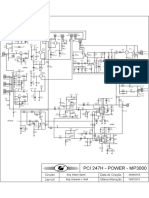

- PCI 247H - POWER - MP3000: Data de Criação Circuito Lay-Out Última AlteraçãoDocument1 pagePCI 247H - POWER - MP3000: Data de Criação Circuito Lay-Out Última AlteraçãoEdson LuizNo ratings yet

- FCCY Songbook FinalDocument63 pagesFCCY Songbook FinalEd Christopher ChuaNo ratings yet

- Notre Dame De Paris 鐘樓怪人 音樂劇全本中法文歌詞Document187 pagesNotre Dame De Paris 鐘樓怪人 音樂劇全本中法文歌詞api-371425140% (5)

- Wicca - Lughnasad Lammas Special - Part OneDocument16 pagesWicca - Lughnasad Lammas Special - Part OneAndrés Jimenez100% (2)

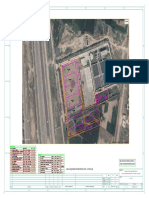

- A C D E F G B: Drawing Is Indicative & For Tender Purpose Only Area Required For Proposed STP 22500 SQ.MDocument1 pageA C D E F G B: Drawing Is Indicative & For Tender Purpose Only Area Required For Proposed STP 22500 SQ.MAshish DongreNo ratings yet

- PolkaDocument1 pagePolkaCanto BelNo ratings yet

- Treble: Ampeg Ba110 Schematic Loud TechnologiesDocument1 pageTreble: Ampeg Ba110 Schematic Loud Technologiesjesus fuentesNo ratings yet

- Inlet Separator Skid C2Document1 pageInlet Separator Skid C2Arjun PNo ratings yet

- Information and Communication Technology (ICT) : Pearson Edexcel International GCSEDocument24 pagesInformation and Communication Technology (ICT) : Pearson Edexcel International GCSEDinangaNo ratings yet

- Plano OriginalDocument1 pagePlano OriginalJoan Perez TiconaNo ratings yet

- Economy PyqDocument86 pagesEconomy Pyqaryan rajputNo ratings yet

- Correction Form For NameFName and DOB in Recor SectionDocument4 pagesCorrection Form For NameFName and DOB in Recor SectionPrincipalNo ratings yet

- 4 Arioso in F TurkDocument1 page4 Arioso in F Turkzaidenmoses796No ratings yet

- Couperin Les Barricades MysterieusDocument4 pagesCouperin Les Barricades MysterieusAnaNo ratings yet

- (Student) CAF Academic Calendar 2022 - March 2023Document1 page(Student) CAF Academic Calendar 2022 - March 2023Gaggy GiggleNo ratings yet

- Ciudad Del Lago Marinera Modificado 2020Document2 pagesCiudad Del Lago Marinera Modificado 2020yesica flores apazaNo ratings yet

- Compal GH51Z LS-K851P Rev 1.0 IO board СхемаDocument6 pagesCompal GH51Z LS-K851P Rev 1.0 IO board СхемаEdwin RodriguezNo ratings yet

- CV521 - Design and Drawing of Steel Structures - AttendanceRegister - 9Document8 pagesCV521 - Design and Drawing of Steel Structures - AttendanceRegister - 9meenakshi DNo ratings yet

- BR25 A1 Side Structures REmainDocument3 pagesBR25 A1 Side Structures REmainNguyễn Đức HữuNo ratings yet

- التجسس الالكتروني بين الشريعة والقانونDocument23 pagesالتجسس الالكتروني بين الشريعة والقانونNoureddine MathsNo ratings yet

- MSB July 2022Document82 pagesMSB July 2022Moostoopha JeetooNo ratings yet

- Hisense Rsag7.820.464 sg6859 Psu SCH PDFDocument4 pagesHisense Rsag7.820.464 sg6859 Psu SCH PDFDaniel MendezNo ratings yet

- 12 December Bansiloy MD & Co. OBLIGATEDocument8 pages12 December Bansiloy MD & Co. OBLIGATEBPH MaramagNo ratings yet

- Rsag7 820 2256Document4 pagesRsag7 820 2256Manuel Medina100% (1)

- I Really Want To Stay at Your House (Guitar TAB)Document9 pagesI Really Want To Stay at Your House (Guitar TAB)rogue20200429No ratings yet

- E-Commerce Absence Schedule1Document17 pagesE-Commerce Absence Schedule1Yohanes OeyliawanNo ratings yet

- PCC3.3 Diagram: Download NowDocument5 pagesPCC3.3 Diagram: Download NowHillol DuttaguptaNo ratings yet

- List of Project MonitoringDocument1 pageList of Project MonitoringJonnel CatadmanNo ratings yet

- Sekolah Menengah Kebangsaan Kota Marudu, Kota Marudu, Sabah: Takwim Cuti Dan Aktiviti Sekolah Tahun 2020Document4 pagesSekolah Menengah Kebangsaan Kota Marudu, Kota Marudu, Sabah: Takwim Cuti Dan Aktiviti Sekolah Tahun 2020KhursiahNo ratings yet

- Biomolecules - Study Module - Yakeen NEET 2025Document36 pagesBiomolecules - Study Module - Yakeen NEET 2025rushiy08No ratings yet

- Tele - Your_shivaa Biomolecules Study Module Arjuna NEET 2Document40 pagesTele - Your_shivaa Biomolecules Study Module Arjuna NEET 2prowaves.21No ratings yet

- Piano Sonata No.12 in F Major K.332300k Wolfgang Amadeus MozartDocument21 pagesPiano Sonata No.12 in F Major K.332300k Wolfgang Amadeus MozartTiffaniel HNo ratings yet

- DB-1 1Document6 pagesDB-1 1Julio Alberto EspinozaNo ratings yet

- 4 Seakeeper 26 Hardware Scope of Supply 21aug2020Document1 page4 Seakeeper 26 Hardware Scope of Supply 21aug2020Abrham B. GMNo ratings yet

- Mold Repair Schedule Mold Finished List: Sun Sun Sun Sun Sun 4Document2 pagesMold Repair Schedule Mold Finished List: Sun Sun Sun Sun Sun 4Johny GadianaNo ratings yet

- NPCE885PA0DXDocument1 pageNPCE885PA0DXDila SilamNo ratings yet

- NPCE885LA0DX DatasheetDocument2 pagesNPCE885LA0DX DatasheetHimanshu MishraNo ratings yet

- Graduation RateDocument1 pageGraduation RateIrene CanonigoTorino Nepa LptNo ratings yet

- Fuente+RSAG7.820.2256 DiagramaDocument4 pagesFuente+RSAG7.820.2256 DiagramaEdison Mandujano ChavezNo ratings yet

- 05-2022, Betul - Form - L, S&E ActDocument1 page05-2022, Betul - Form - L, S&E ActPragnaa ShreeNo ratings yet

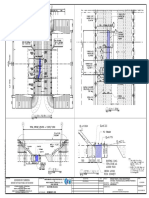

- 05-SEP-16 21-Sep-2016 14:46 Valve Access Pit (Inside BSDocument3 pages05-SEP-16 21-Sep-2016 14:46 Valve Access Pit (Inside BSkarthiNo ratings yet

- 05-2022, ANDAMANS & NICOBAR, Form III, S&E Act, Connect IndiaDocument1 page05-2022, ANDAMANS & NICOBAR, Form III, S&E Act, Connect IndiaPragnaa ShreeNo ratings yet

- THC System DrawingDocument9 pagesTHC System Drawingoscar meijerNo ratings yet

- Format Ppu PPPK Tahap II 2022-2Document3 pagesFormat Ppu PPPK Tahap II 2022-2Bambang HermantoNo ratings yet

- Op IFDocument12 pagesOp IFdesignNo ratings yet

- Rsag7 820 1950Document1 pageRsag7 820 1950Eduardo BresciaNo ratings yet

- Recierres 2021Document190 pagesRecierres 2021Wilson Bravo G.No ratings yet

- RD019 Schematic 02Document2 pagesRD019 Schematic 02JayantARORANo ratings yet

- MintySynth2.0 SchematicDocument1 pageMintySynth2.0 SchematicalanNo ratings yet

- SCH FIle For E226633 BoardDocument1 pageSCH FIle For E226633 BoardVijay Kumar Nattey100% (2)

- Acciona 2020Document167 pagesAcciona 2020woonjunyangNo ratings yet

- Simulador de Ecg222Document1 pageSimulador de Ecg222RICHIHOTS2No ratings yet

- Shemas P PWRDocument1 pageShemas P PWRJdidi AdelNo ratings yet

- Detail of Nozzle AbsorbentDocument1 pageDetail of Nozzle AbsorbentAlbet MulyonoNo ratings yet

- SCHEMATICS - Robusta S - Main Board - 2Document3 pagesSCHEMATICS - Robusta S - Main Board - 2Renato Luiz TécnicoNo ratings yet

- Mapple Tree1Document2 pagesMapple Tree1Yun Kwan ChongNo ratings yet

- George Meyer - 1 Interlude (2013)Document3 pagesGeorge Meyer - 1 Interlude (2013)MillerJ_fluteNo ratings yet

- Adelita (Sky Guitar)Document1 pageAdelita (Sky Guitar)obregon.ojugaNo ratings yet

- Santa CLaus CoDocument1 pageSanta CLaus CofabioNo ratings yet

- DAILY REPORT RKH 17 MARET 2024 (Shift 2)Document1 pageDAILY REPORT RKH 17 MARET 2024 (Shift 2)leonardowalewangko08No ratings yet

- Metro 2033 - MarketDocument1 pageMetro 2033 - MarketRodolfo NavasNo ratings yet

- English Literature: Paper 1 Shakespeare and The 19th Century NovelDocument20 pagesEnglish Literature: Paper 1 Shakespeare and The 19th Century NovelkaruneshnNo ratings yet

- I. Choose The Word/ Phrase (A, B, C or D) That Best Fits The Space in Each SentenceDocument2 pagesI. Choose The Word/ Phrase (A, B, C or D) That Best Fits The Space in Each SentenceHao hoànNo ratings yet

- STARLACAROLINGDocument1 pageSTARLACAROLINGPaul CaluzaNo ratings yet

- Halloween Crossword Puzzle: G H O SDocument2 pagesHalloween Crossword Puzzle: G H O SC.E.R San Antonio MaceoNo ratings yet

- (Sheet Music) Christmas - Favourites Collection (Piano & Guitar)Document56 pages(Sheet Music) Christmas - Favourites Collection (Piano & Guitar)Mario Rossi67% (3)

- Freemasonry and The Wise Men: The Place Where Jesus Was Born. TheDocument3 pagesFreemasonry and The Wise Men: The Place Where Jesus Was Born. TheFederico BerardiNo ratings yet

- Frosty The Snowman: Ex.1 Match The Words and The PicturesDocument4 pagesFrosty The Snowman: Ex.1 Match The Words and The PicturesMilena Mićanović HadžimahovićNo ratings yet

- Bicol RegionDocument43 pagesBicol RegionJean Chel Perez JavierNo ratings yet

- Blue Christmas - Walter WykesDocument9 pagesBlue Christmas - Walter WykesMoni KarmanNo ratings yet

- Aps CalendarDocument2 pagesAps CalendarAlex NewmanNo ratings yet

- Annual Meeting 2015 Christ ChurchDocument39 pagesAnnual Meeting 2015 Christ ChurchChristChurchENo ratings yet

- SJSD Calendar 2014-2015-1Document2 pagesSJSD Calendar 2014-2015-1api-262797892No ratings yet

- Item DatabaseDocument2 pagesItem DatabaseJo MartinsNo ratings yet

- 89424Document377 pages89424АнастасияNo ratings yet

- The Color WheelDocument47 pagesThe Color Wheeliancarlo824No ratings yet

- How To Survive Christmas After LossDocument14 pagesHow To Survive Christmas After LossVenetta CoetzeeNo ratings yet

- 2011 NewsletterDocument2 pages2011 NewsletterElizabeth ElliottNo ratings yet

- Cakes DessertsDocument45 pagesCakes DessertsJanani SivaNo ratings yet

- The First Noel in C W ChordsDocument1 pageThe First Noel in C W ChordsGanda Boses100% (1)

- Tone & MoodDocument20 pagesTone & MoodHero DiasNo ratings yet

- UntitledDocument10 pagesUntitledTulnukas MaaltNo ratings yet

- Squidward Homework 3amDocument8 pagesSquidward Homework 3amerb6df0n100% (1)

- Lesson Plan Schedule v3Document5 pagesLesson Plan Schedule v3aurelioNo ratings yet

- Ficha Ingles 8 Ano Past Simple PDFDocument2 pagesFicha Ingles 8 Ano Past Simple PDFLauro ReisNo ratings yet

- Christmas Around The World BookDocument11 pagesChristmas Around The World BookLauren Little100% (1)