Professional Documents

Culture Documents

PT Alkindo Naratama TBK.: Summary of Financial Statement

PT Alkindo Naratama TBK.: Summary of Financial Statement

Uploaded by

Rahayu RahmadhaniOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PT Alkindo Naratama TBK.: Summary of Financial Statement

PT Alkindo Naratama TBK.: Summary of Financial Statement

Uploaded by

Rahayu RahmadhaniCopyright:

Available Formats

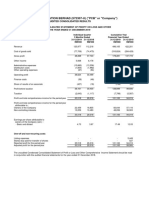

PT Alkindo Naratama Tbk.

Paper and Allied Products

Head Office/Factory Kawasan Industri Cimareme Summary of Financial Statement

Jl. Industri Cimareme II No. 14

Padalarang, Bandung 40553 (Million Rupiah)

Phone (022) 601-1220, 602-8277 2009 2010 2011

Fax (022) 603-6489, 600-4508 Total Assets 106,387 134,599 164,523

E-mail: alikindo@alkindo.co.id Current Assets 62,432 74,732 84,638

of which

Website: http://www.alkindo.co.id Cash and cash equivalents 6,534 3,417 4,739

Business Paper Industry Processing and Marketing Trade receivables 40,800 47,591 50,617

Company Status PMDN Inventories 14,332 20,185 28,472

Non-Current Assets 43,954 59,867 79,885

of which

Financial Performance: The Company booked net Fixed Assets-Net 40,584 53,596 73,125

income at IDR 7.633 billion in 2011, increase by 47.08% from Deffered tax Assets 225 284 359

previous year income. This is supported by increase in net sale Liabilities 83,497 83,883 82,740

by 10.89% to IDR 244.8 billion. Current Liabilities 73,639 75,092 74,371

of which

Brief History: Alkindo was founded in 1989 as a paper Short term-debt 34,117 27,165 26,484

converting company, specializing in paper tubes that are used Trade payables 35,904 41,211 38,696

Taxes payable 348 1,471 1,523

specifically as textile yarn carrier. With more than 20 years of Current maturities of

experience in the industry, we only produce the highest quality long-term debts 3,194 3,807 5,083

Non-Current Liabilities 9,859 8,791 8,369

products possible.

Quality, after all, is always our priority. With that ex- Shareholders' Equity 22,889 50,716 81,783

Paid-up capital 5,000 26,000 55,000

perience, we have also managed to diversify our products to Paid-up capital

include paper core, edge protector and honeycomb. In fact, in excess of par value n.a n.a 16,451

Revaluation of fixed assets 3,686 5,324 99

Alkindo pioneered the manufacturing of honeycomb and is the Retained earnings (accumulated loss) 14,203 19,393 10,233

patent holder for Hexcell® in Indonesia. Net Sales 144,829 220,764 244,803

Cost of Goods Sold 126,652 186,620 204,013

Gross Profit 18,178 34,144 40,790

Operating Expenses 10,424 22,136 24,419

Operating Profit 7,753 12,008 16,371

Other Income (Expenses) ( 4,049) ( 2,901) ( 4,020)

Profit (Loss) before Taxes 3,704 9,108 12,351

Comprehensive Profit (Loss) 2,624 5,190 7,633

Per Share Data (Rp)

Earnings (Loss) per Share n.a n.a 14

Equity per Share n.a n.a 149

Dividend per Share n.a n.a n.a

Closing Price n.a n.a 370

Financial Ratios

PER (x) n.a n.a 26.66

PBV (x) n.a n.a 2.49

Dividend Payout (%) n.a n.a n.a

Dividend Yield (%) n.a n.a n.a

Current Ratio (x) 0.85 1.00 1.14

Leverage Ratio (x) 0.78 0.62 0.50

Gross Profit Margin (x) 0.13 0.15 0.17

Operating Profit Margin (x) 0.05 0.05 0.07

Net Profit Margin (x) 0.02 0.02 0.03

Inventory Turnover (x) 8.84 9.25 7.17

Total Assets Turnover (x) 1.36 1.64 1.49

ROI (%) 2.47 3.86 4.64

ROE (%) (11.46) (10.23) (9.33)

PER = 16,29x ; PBV = 2,14x (June 2012)

Financial Year: December 31

Public Accountant: Anwar & Co.

(million rupiah)

Jun-12 Dec-11

Total Assets 188,937 164,523

Current Assets 108,022 84,638

Non-Current Assets 80,915 79,885

Liabilities 99,172 82,740

Shareholders Shareholders' Equity 89,765 81,783

PT Golden Arista International 58.41% Net Sales * 144,359 121,126

Lili Mulyadi Sutanto 7.66% Profit after Taxes * 7,982 3,880

Herwanto Sutanto 4.48% ROI (%) 4.22 2.36

Erik Sutanto 2.18% ROE (%) 8.89 4.74

Public 27.27% * : In June

238 Indonesian Capital Market Directory 2012

PT Alkindo Naratama Tbk. Paper and Allied Products

Board of Commissioners Board of Directors

President Commissioner Lili Mulyadi Sutanto President Director Herwanto Sutanto

Commissioners Irene Sastroamijoyo, Directors Kuswara, Erik Sutanto

Drs. Gunaratna Andy Tanusasmita

Number of Employees 200

No Type of Listing Listing Date Trading Date Number of Shares Total Listed

per Listing Shares

1 First Issue 12-Jul-11 12-Jul-11 150,000,000 150,000,000

2 Company Listing 12-Jul-11 12-Jul-11 400,000,000 550,000,000

Underwriter

PT Erdhika Elit Sekuritas

Stock Price, Frequency, Trading Days, Number and Value of Shares Traded and Market Capitalization

Stock Price Shares Traded Trading Listed Market

Month High Low Close Volume Value Frequency Day Shares Capitalization

(Rp) (Rp) (Rp) (Thousand Shares) (Rp Million) (Rp Million)

January-11

February-11

March-11

April-11

May-11

June-11

July-11 335 230 305 140,965.00 40,039.00 4,253 14 550,000,000 167,750.00

August-11 355 270 300 134,791.00 41,008.00 6,000 19 550,000,000 165,000.00

September-11 390 280 375 160,454.00 54,480.00 4,075 20 550,000,000 206,250.00

October-11 420 355 400 142,077.00 55,493.00 5,879 21 550,000,000 220,000.00

November-11 495 375 435 203,020.00 87,798.00 10,149 22 550,000,000 239,250.00

December-11 450 340 370 148,886.00 58,201.00 7,716 21 550,000,000 203,500.00

January-12 500 345 475 162,690.00 69,033.00 6,828 21 550,000,000 261,250.00

February-12 550 475 495 145,932.00 73,790.00 11,964 21 550,000,000 272,250.00

March-12 500 400 420 151,571.00 67,421.00 12,943 21 550,000,000 231,000.00

April-12 425 395 410 178,777.00 73,105.00 12,058 20 550,000,000 225,500.00

May-12 420 330 360 137,237.00 50,610.00 9,097 21 550,000,000 198,000.00

June-12 380 340 350 11,789.00 40,538.00 5,804 21 550,000,000 192,500.00

Stock Price and Traded Chart

Institute for Economic and Financial Research 239

You might also like

- Ch05 P24 Build A ModelDocument5 pagesCh05 P24 Build A ModelCristianoF7No ratings yet

- Final Project Report On HDFC Mutual FundsDocument109 pagesFinal Project Report On HDFC Mutual FundsVishal Kapoor82% (22)

- Dark Market PsychologyDocument28 pagesDark Market PsychologyEmmanuel100% (2)

- Webinar by Gomathi ShankarDocument5 pagesWebinar by Gomathi Shankarbytestreams340050% (8)

- Audit of Cash and Cash EquivalentsDocument1 pageAudit of Cash and Cash EquivalentsEmma Mariz Garcia50% (2)

- Kbri ICMD 2009Document2 pagesKbri ICMD 2009abdillahtantowyjauhariNo ratings yet

- PT Hotel Mandarine Regency TBK.: Summary of Financial StatementDocument2 pagesPT Hotel Mandarine Regency TBK.: Summary of Financial StatementMaradewiNo ratings yet

- Abba PDFDocument2 pagesAbba PDFAndriPigeonNo ratings yet

- MBA Session 2 Carrick QuestionDocument2 pagesMBA Session 2 Carrick QuestionTafsir-i- AliNo ratings yet

- PT Hero Supermarket TBK.: Summary of Financial StatementDocument2 pagesPT Hero Supermarket TBK.: Summary of Financial StatementMaradewiNo ratings yet

- Spma ICMD 2009Document2 pagesSpma ICMD 2009abdillahtantowyjauhariNo ratings yet

- PT Gozco Plantations TBK.: Summary of Financial StatementDocument2 pagesPT Gozco Plantations TBK.: Summary of Financial StatementMaradewiNo ratings yet

- PT Inti Agri ResourcestbkDocument2 pagesPT Inti Agri ResourcestbkmeilindaNo ratings yet

- Icmd 2010Document2 pagesIcmd 2010meilindaNo ratings yet

- PT Radana Bhaskara Finance Tbk. (Formerly PT HD Finance TBK)Document2 pagesPT Radana Bhaskara Finance Tbk. (Formerly PT HD Finance TBK)MaradewiNo ratings yet

- PT Pelat Timah Nusantara TBK.: Summary of Financial StatementDocument2 pagesPT Pelat Timah Nusantara TBK.: Summary of Financial StatementTarigan SalmanNo ratings yet

- KrenDocument2 pagesKrenMaradewiNo ratings yet

- Directors' Report: For The Period Ended 31 March 2018Document24 pagesDirectors' Report: For The Period Ended 31 March 2018Asma RehmanNo ratings yet

- June 2022 Accounts - For Auditors - Monthly FormatDocument253 pagesJune 2022 Accounts - For Auditors - Monthly Formatmuhammad ahmedNo ratings yet

- Akku PDFDocument2 pagesAkku PDFMaradewiNo ratings yet

- Case 9Document11 pagesCase 9Nguyễn Thanh PhongNo ratings yet

- IHC Financial Statments For Period Ended 30 September 2020 - English PDFDocument40 pagesIHC Financial Statments For Period Ended 30 September 2020 - English PDFHafisMohammedSahibNo ratings yet

- Aeon 2023Document3 pagesAeon 20232021892056No ratings yet

- English Q3 2018 Financials For Galfar WebsiteDocument24 pagesEnglish Q3 2018 Financials For Galfar WebsiteMOORTHYNo ratings yet

- Hand Protection PLCDocument8 pagesHand Protection PLCasankaNo ratings yet

- Gita AgricultureDocument20 pagesGita AgriculturemrigendrarimalNo ratings yet

- IcbpDocument2 pagesIcbpdennyaikiNo ratings yet

- Hade PDFDocument2 pagesHade PDFMaradewiNo ratings yet

- Berger Paints Bangladesh Limited Statement of Financial PositionDocument8 pagesBerger Paints Bangladesh Limited Statement of Financial PositionrrashadattNo ratings yet

- 2019FY Anual ResultDocument48 pages2019FY Anual ResultJ. BangjakNo ratings yet

- Unity Food QR Sep 2021 (Nov 02)Document31 pagesUnity Food QR Sep 2021 (Nov 02)Sohail MehmoodNo ratings yet

- Ratio AnalysisDocument15 pagesRatio AnalysisNSTJ HouseNo ratings yet

- CF Export 28 11 2023Document17 pagesCF Export 28 11 2023juan.farrelNo ratings yet

- PT Astra Agro Lestari TBK.: Summary of Financial StatementDocument2 pagesPT Astra Agro Lestari TBK.: Summary of Financial Statementkurnia murni utamiNo ratings yet

- Uba Annual Report Accounts 2022Document286 pagesUba Annual Report Accounts 2022G mbawalaNo ratings yet

- PARCO ProjectDocument6 pagesPARCO ProjectQasim MalikNo ratings yet

- 0d354cf1-781e-48d0-bf53-a637b1e60960Document3 pages0d354cf1-781e-48d0-bf53-a637b1e60960Zubair AhmedNo ratings yet

- PT Saraswati Griya Lestari TBK.: Summary of Financial StatementDocument2 pagesPT Saraswati Griya Lestari TBK.: Summary of Financial StatementMaradewiNo ratings yet

- Quarterly Report 20191231Document21 pagesQuarterly Report 20191231Ang SHNo ratings yet

- Financial Publication MarchDocument2 pagesFinancial Publication MarchFuaad DodooNo ratings yet

- RBGH Financials 31 December 2020 Colour 18.03.2021 3 Full PageseddDocument3 pagesRBGH Financials 31 December 2020 Colour 18.03.2021 3 Full PageseddFuaad DodooNo ratings yet

- Annual Financial Statement 2021Document3 pagesAnnual Financial Statement 2021kofiNo ratings yet

- Cover PageDocument209 pagesCover PageABHISHREE JAINNo ratings yet

- Income Statement: in ThousandsDocument29 pagesIncome Statement: in ThousandsDaviti LabadzeNo ratings yet

- Abda ICMD 2009Document2 pagesAbda ICMD 2009abdillahtantowyjauhariNo ratings yet

- COMPANY 1 - SupaFood Financial Statements - 240102 - 143648Document5 pagesCOMPANY 1 - SupaFood Financial Statements - 240102 - 143648Marcel JonathanNo ratings yet

- NP SCBNL Fourth Quarter Two Thousand Seventy Six Seventy Seven ResultsDocument23 pagesNP SCBNL Fourth Quarter Two Thousand Seventy Six Seventy Seven ResultsMaahi MaharjanNo ratings yet

- 9.+LBO+Model ABC AfterDocument14 pages9.+LBO+Model ABC Afterashishvani1992No ratings yet

- Abda PDFDocument2 pagesAbda PDFTRI HASTUTINo ratings yet

- Balance Sheet Summary Cash Flow Summary: (AED M) 2014 2015 (AED M) 2014Document18 pagesBalance Sheet Summary Cash Flow Summary: (AED M) 2014 2015 (AED M) 2014Mohammad ElabedNo ratings yet

- Vivimed Model VFDocument19 pagesVivimed Model VFShaileshAgrawalNo ratings yet

- Financial Statement 2020Document3 pagesFinancial Statement 2020Fuaad DodooNo ratings yet

- RBGH Financials - 31 December 2021 - Colour - 21.02.2022 (3 Full Pages)Document3 pagesRBGH Financials - 31 December 2021 - Colour - 21.02.2022 (3 Full Pages)Fuaad DodooNo ratings yet

- Annual Report 2018 PDFDocument288 pagesAnnual Report 2018 PDFАндрей СилаевNo ratings yet

- Acct 401 Tutorial Set FiveDocument13 pagesAcct 401 Tutorial Set FiveStudy GirlNo ratings yet

- Take Home Examination Bdfa1103Document7 pagesTake Home Examination Bdfa1103zul arifNo ratings yet

- AYER HOLDINGS BERHAD - Financial Report 2021-16-17Document2 pagesAYER HOLDINGS BERHAD - Financial Report 2021-16-172023149467No ratings yet

- Annual Report 2015 EN 2 PDFDocument132 pagesAnnual Report 2015 EN 2 PDFQusai BassamNo ratings yet

- BERISO, Ella's Financial Status Analysis 2022Document8 pagesBERISO, Ella's Financial Status Analysis 2022kasandra dawn BerisoNo ratings yet

- GB20003: International Financial Statement Analysis Individual Case Study (30%)Document7 pagesGB20003: International Financial Statement Analysis Individual Case Study (30%)Priyah RathakrishnahNo ratings yet

- 7-E Fin Statement 2022Document4 pages7-E Fin Statement 20222021892056No ratings yet

- Inru ICMD 2009Document2 pagesInru ICMD 2009abdillahtantowyjauhariNo ratings yet

- Prime Finance First MF2012Document1 pagePrime Finance First MF2012Abrar FaisalNo ratings yet

- AME - 2022 - Case IDocument5 pagesAME - 2022 - Case IjjpasemperNo ratings yet

- Financial Institutions Management - Chap020Document20 pagesFinancial Institutions Management - Chap020renad_No ratings yet

- P5 1Document2 pagesP5 1Achmad RizalNo ratings yet

- Strategy Process and The Management of Technology and InnovationDocument32 pagesStrategy Process and The Management of Technology and InnovationStanley MufdesNo ratings yet

- Forward ContractsDocument23 pagesForward Contractsnikhil tiwariNo ratings yet

- BFC5935 - Tutorial 3 Solutions PDFDocument6 pagesBFC5935 - Tutorial 3 Solutions PDFXue XuNo ratings yet

- Week 2 - Measures of Risks and ReturnsDocument37 pagesWeek 2 - Measures of Risks and ReturnsAbdullah ZakariyyaNo ratings yet

- FINM009 - Assignment 1Document22 pagesFINM009 - Assignment 1Meena Das100% (1)

- 03 Debt Markets SOLUTIONSDocument22 pages03 Debt Markets SOLUTIONSSusanNo ratings yet

- Money TheoryDocument10 pagesMoney Theoryetebark h/michaleNo ratings yet

- Banking Awareness Ebook 1 PDFDocument18 pagesBanking Awareness Ebook 1 PDFThakur Rashttra BhushanNo ratings yet

- Financial Markets and Institutions 7th Edition Saunders Test BankDocument35 pagesFinancial Markets and Institutions 7th Edition Saunders Test Bankrosiegarzamel6100% (30)

- Derivatives 1Document16 pagesDerivatives 1Daisy KetchNo ratings yet

- Feroldi Quality Score & Anti-Fragile ChecklistDocument106 pagesFeroldi Quality Score & Anti-Fragile ChecklistEmrahNo ratings yet

- Traditional Theory Approach: Illustrations 1Document7 pagesTraditional Theory Approach: Illustrations 1PRAMOD VNo ratings yet

- International Finance Paper AssignmentDocument2 pagesInternational Finance Paper AssignmentAbdullah Al ShahinNo ratings yet

- Rbi Functions ListDocument7 pagesRbi Functions ListVinod Kumar ReddyNo ratings yet

- Houlihan Lokey - Travel-&-Hospitality-Update - q3-2023Document17 pagesHoulihan Lokey - Travel-&-Hospitality-Update - q3-2023Antonius VincentNo ratings yet

- 2022 ICT Mentorship Ep 06 - Market Efficiency Paradigm & Institutional Order FlowDocument44 pages2022 ICT Mentorship Ep 06 - Market Efficiency Paradigm & Institutional Order FlowBarbara MartinsNo ratings yet

- International Financial Management 2Nd Edition Bekaert Test Bank Full Chapter PDFDocument29 pagesInternational Financial Management 2Nd Edition Bekaert Test Bank Full Chapter PDFDeniseWadeoecb100% (11)

- 6 Ways Not To Get Duped by An IPODocument4 pages6 Ways Not To Get Duped by An IPONitin PanaraNo ratings yet

- Investment Manager Financial Analyst in Seattle WA Resume Greg EisenDocument2 pagesInvestment Manager Financial Analyst in Seattle WA Resume Greg EisenGregEisenNo ratings yet

- 02 IPO Process in Bangladesh Raw FileDocument38 pages02 IPO Process in Bangladesh Raw FileAndy DropshipperNo ratings yet

- 1.sangchan Et Al. (2022)Document31 pages1.sangchan Et Al. (2022)linus.koekeNo ratings yet

- Mbaf 605 Lecture Week 2-4Document135 pagesMbaf 605 Lecture Week 2-4Gen AbulkhairNo ratings yet

- FM Jack Tar Case StudyDocument2 pagesFM Jack Tar Case StudyjanelleNo ratings yet