Professional Documents

Culture Documents

Yali Entrepreneurs: Money Management Workbook

Yali Entrepreneurs: Money Management Workbook

Uploaded by

JesseOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Yali Entrepreneurs: Money Management Workbook

Yali Entrepreneurs: Money Management Workbook

Uploaded by

JesseCopyright:

Available Formats

YALI ENTREPRENEURS

Money

Management

Workbook

YALI.STATE.GOV/ENTREPRENEURS

YALI Network | YALI Entrepreneurs Money Management Workbook 1

YALI ENTREPRENEURS MONEY MANAGEMENT

WORKBOOK:

At every stage of life, important financial decisions must be made,

from how much to spend at the market to whether you should pursue

advanced education, apply for a credit card or spend money on the

latest mobile phone. How well you navigate these decisions depends

on your ability to manage your financial resources effectively. With each

section of this workbook, you’ll learn more about budgeting, saving, and

goal setting to better manage your money today and for years to come.

YALI Network | YALI Entrepreneurs Money Management Workbook 2

SECTION ONE: BUDGETING BASICS

To build your financial literacy skills, start by creating a budget. A budget is a system

used to monitor how much money you save and spend over a given period of time.

Budgets help you stay within your spending limits and accomplish your financial goals.

1 - Create Your Budgeting Worksheet

Every budget is unique, but it is helpful to use a budgeting template like the one

included at the end of this section to keep track of how much money you are spending

and saving. You can create a similar worksheet in Microsoft Excel, Google Sheets or

another online spreadsheet to track your income and monthly expenses. There are also

a variety of budgeting apps to simplify the process from your phone or desktop, such as

Monefy, Mint, Whallet, Spendee or MoneyWise.

2 - List Your Income and Expenses

Start by calculating your monthly income. Income is money that an individual or

business receives in exchange for providing labor, producing a good or service,

or investing money. Individuals most often earn income through wages or salary.

Businesses earn income from selling goods or services above their cost of production.

Whether your income is fluctuating, steady, or a combination of both, you should be

able to calculate a monthly average based on your past earnings.

Next, add up your expenses over the past month. Expenses typically fall into one of two

spending categories, which should be listed separately in your budget:

• Fixed expenses : Bills that stay the same each month, such as housing costs.

• Variable or discretionary expenses : Bills such as utilities, groceries, clothing or

entertainment that change from month to month.

YALI Network | YALI Entrepreneurs Money Management Workbook 3

3 - Adjust Your Spending To Meet Your Goals

Keep in mind that there is no one-size-fits-all solution to budgeting. For instance, you

might aim for a zero-dollar budget, in which you account for every single dollar of

income and have no money left over at the end of the month.

Alternatively, you could apply the 50/20/30 rule and spend 50 percent of your income

on essentials, 20 percent on priorities like debt and savings, and 30 percent on lifestyle

expenses such as vacations and entertainment.

Whichever budgeting approach you select, you will need to reduce your spending in

one or more categories if you have spent more than you have earned. Here are some

options to consider to keep your expenses in check:

Fixed expenses

• If you have one, consider trading in your newer vehicle, motorcycle or bicycle for a

used model.

• If you are purchasing a car, avoid doing so on credit; either save up for the purchase or

do not make it at all.

• Cut down on your rent by cost-sharing with a housemate or living in a cheaper part of

town.

Variable or discretionary expenses

• Buy household items in bulk to save on transportation costs.

• Shop around when considering a new purchase. Maybe the first store you visit is not

the most affordable.

• Carry a packed lunch to work instead of buying lunch.

• Host friends at home for dinner instead of going out.

• With every purchase, you should verbally ask yourself, “Do I need this or do I just want

it?” If you do not need an item and it is over your budget, do not purchase it.

YALI Network | YALI Entrepreneurs Money Management Workbook 4

Emergency Funds

It’s important to set money aside for unexpected expenses such as medical bills, car

repairs, rent if you are laid off, or other unforeseen costs. An ideal safety net is about

three to six months worth of your living expenses. A good rule of thumb is to save 20

percent of your paycheck each month.

It’s Your Turn!

Using the information you learned in this section, try to fill out the Budgeting

Worksheet on the next page to see how your income and expenses stack up. Be sure

to be as specific as possible when entering what you save and spend each month.

Glossary

• Fixed Expenses: Bills that stay the same each month, such as rent, mortgage and

debt payments.

• Variable or Discretionary Expenses: Utilities, groceries, clothing, entertainment

and other obligations that change from month to month.

• Zero-Dollar Budget: A budget that accounts for every single dollar of income and

results in no money left over at the end of the month.

• 50/20/30 Rule: Rule advising individuals to spend 50 percent of their income on

essentials, 20 percent on priorities like debt and savings, and 30 percent on lifestyle

expenses such as vacations and entertainment

Saving in Your Community

Remember that saving differs from place to place, so be sure to study the financial

landscape in your community to understand what savings method is right for you.

For example, depending on where you live, you should research if your money is

better in a savings account or invested in a business venture. It can vary from country

to country, so you have to do the proper amount of research. Keeping this in mind

will help you to save wisely and with your future in mind.

YALI Network | YALI Entrepreneurs Money Management Workbook 5

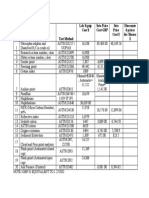

BUDGETING TEMPLATE

Income

INCOME TYPE AMOUNT

Full-time job

Part-time job

Other income

Total

Expenses

EXPENSE TYPE AMOUNT

Fixed Expenses

Housing

Cable/Internet

Insurance (Car, House)

Child Care

Other Fixed Expenses

Variable and

discretionary expenses

Utilities

Food

Transportation/Gas

Miscellaneous

Total Expenses

Once you’ve filled out the Budgeting Worksheet above, continue on to the next page to

complete the activity.

YALI Network | YALI Entrepreneurs Money Management Workbook 6

Budgeting Worksheet Exercise

Look back at your budgeting worksheet and subtract the “Total Expenses” line from

your “Total Income” line. What was the result?

Result: ___________________________________________________________

If the resulting number was positive, it means you earned more than you spent over

the month. Congratulations!

If it is negative, it means you spent more than you earned and will need to consider

changing your spending habits and saving more in the future to better manage your

financial resources.

What would you like to work on saving your money for? Future education expenses?

A bike? A car? Building or buying a house? List three things you are saving your

money for.

1. ________________________________________________________________

2. ________________________________________________________________

3. ________________________________________________________________

What are three ways you can change your spending habits to increase your monthly

savings?

1. ________________________________________________________________

2. ________________________________________________________________

3. ________________________________________________________________

As you recall, an ideal safety net is about three to six months’ worth of your living

expenses. Given the expenses you just compiled, how much would you need to

save for an unforeseen emergency?

__________________________________________________________________

YALI Network | YALI Entrepreneurs Money Management Workbook 7

SECTION TWO: UNDERSTANDING SAVINGS AND SCAMS

Once you have a better grasp of your own personal finances, it is important to understand how

to grow your wealth. In this section, you will learn more about borrowing, saving, and wealth

creation.

Borrowing Money

Whenever an individual or financial institution lends money, there is a possibility that the

borrower will not repay the sum. To compensate lenders for that risk, there must be a reward:

interest. An interest rate is the percentage of a loan that the lender charges to those borrowing

money.

Saving Money

When you deposit your money in certain financial institutions, it can earn interest. When interest

rates fall, chances are you will earn less interest on your savings, but also pay less interest on any

debt you take on. When interest rates increase, your payments on loans and credit cards may be

higher, but your savings will also earn more money.

Where to Save?

It is important to be informed about all of your options when saving your money.

Understanding the financial landscape in your country, the security of the institutions within

it, and the costs associated with saving can help you to determine the best way to grow your

money. There are risks and rewards for each place, so make sure to weigh each before deciding

what is best for you. Take a look at the chart on the next page for more information.

YALI Network | YALI Entrepreneurs Money Management Workbook 8

LOCATION BENEFITS RISKS

Home -No costs to maintain -Can be lost, stolen or destroyed in a fire

or natural disaster

-Convenient

-Might put you at risk of a home

-Easy to access

invasion

Family member or -No costs to maintain -Can be lost, stolen or destroyed in a fire

friend or natural disaster

-Might put your friend or family member

at risk of a home invasion

-May put your money at risk if your

friend or family member betrays your

trust

Account at a -Your money is protected if -You may be charged fees, such as

financial institution the institution is insured overdraft fees, if you do not maintain a

minimum balance

-If fraud occurs, you can

retrieve your money more -Potential limitations on flexibility of

easily transactions

-Your money cannot be lost,

stolen or destroyed in a fire or

disaster

Risk and Reward

While the traditional rule of thumb is “the higher the risk, the higher the reward,” a more

accurate statement is, “the higher the risk, the higher the reward, and the less likely it

will achieve the higher reward.”

To better understand this relationship, you must know what your risk tolerance is and

be able to assess the relative risk of a particular investment correctly. When you choose

to put your money into riskier investments, you run a higher risk of not seeing a return

on your investment.

YALI Network | YALI Entrepreneurs Money Management Workbook 9

Common Pitfalls

Sometimes people do not have the money to repay a loan and the interest it has

accumulated when due. This can happen with short-term loans that have to be paid

back in just one payment or a couple of payments. In this situation, some people take

out another loan to pay off the first one.

It can be difficult to escape the cycle of borrowing to cover the loan payment and

still be able to pay for other expenses like food, rent and transportation. If you are

considering a short-term loan to meet an immediate need, it is important to think about

how you will pay off the loan.

If you are short on cash, consider the following alternatives to borrowing small amounts

of money for a short period of time:

• Negotiate for more time to pay off your original loan rather than taking out

another.

• Think about what you are borrowing the money for. Is it a need, an obligation, or a

want? If it is a want, consider whether it is possible to spend less money for it, not

purchase it, or wait until you have the money for it.

• Use your own emergency savings.

• Discuss the situation with a credit counselor or financial coach.

YALI Network | YALI Entrepreneurs Money Management Workbook 10

Fraud

Financial scams come in many forms. One of the most common is an email, text

message or other communication requesting that you wire funds to an individual or

organization. Most of us have seen or heard of offers to receive millions of dollars from

a foreign prince, jobs that say you can earn $80/hour while working from home, or

prize announcements from a lottery you did not enter. Unfortunately, if the opportunity

appears too good to be true, it probably is!

Tips to Avoid Being Scammed:

• Never send money to a stranger.

• Do not give out your financial information to anyone you do not know.

• Never open hyperlinks in emails from strangers.

Now that you’ve learned a bit more about borrowing, saving and common financial

scams, take a minute to answer the following questions.

What is one thing you learned in this section about borrowing or saving money?

__________________________________________________________________

__________________________________________________________________

What are some of the financial scams you’ve come across? How did you identify

them?

__________________________________________________________________

__________________________________________________________________

What is one change that you can make today in the way that you invest your money?

__________________________________________________________________

__________________________________________________________________

YALI Network | YALI Entrepreneurs Money Management Workbook 11

SECTION THREE : SETTING SMART MONEY GOALS

A lot of people are afraid to discuss their finances, but it is important to have an

understanding of when, where, and how to save and spend your money. Before

beginning this section, take a minute to think about your own finances. What does

money mean to you? Do you shy away from financial conversations? Why?

Your Relationship with Money

It can be hard to talk about your finances. Many people feel uncomfortable talking

about their money with their family and friends. It is important to bring up these

conversations with your family early to encourage a healthy relationship with money,

which will help all of you to make more informed and positive decisions on the way to

your financial goals.

How much do you think your emotions about finances inform your decision-making?

___________________________________________________________________

___________________________________________________________________

.

How did your family handle finances when you were growing up? How might that

impact your comfort level discussing finances with your friends, your family or a financial

adviser?

____________________________________________________________________

____________________________________________________________________

YALI Network | YALI Entrepreneurs Money Management Workbook 12

Money and Family

Whether you have a joint account with your friend, are sending money back to your

family in a different country, or are opening a business with a family member, walking

the line between personal and communal finances can be tricky.

It’s important to set clear boundaries with your family members and to communicate

clearly and often so that you can establish trust early on. Remember that you can also

say “No” if you are uncomfortable about any financial arrangements that your family

members impose on you. You have the power to make your own financial decisions.

Money management can be influenced by your emotions and past experiences.

Understanding these influences can impact some of your financial choices as an adult

and can help you better understand your unique strengths and challenges when

dealing with your money.

Setting Your Money Goals

Which values are most important to you? Circle your selections below.

- Family - Health - Reputation - Spirituality

- Friends - Freedom - Status - Stability

- Other _______ - Other _______ - Other _______ - Other _______

What are your hopes, wants and dreams?

With your values in mind, write a list of the things you would like to change and dreams

you have. They can be short term (less than six months to achieve) or long term (more

than six months to achieve).

____________________________________________________________________

____________________________________________________________________

YALI Network | YALI Entrepreneurs Money Management Workbook 13

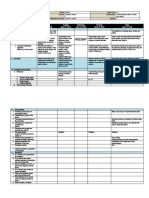

Planning For Your Future

Recognizing the goals you have set for yourself and your family will help you to

prioritize your financial future. Identifying estimated expenses for important life events

and large purchases can put you on the right track to achieve your goals.

Fill out the following table using the instructions below and reflecting on the goals you

have for the future as well as the costs associated with those aims.

• Purchases: List your future expenses.

• Time frame: Note when they are likely to happen.

• Cost: Estimate the cost of these expenses.

• Savings: Identify potential ways to pay for these expenses.

Examples of life events and large purchases to help you brainstorm:

Advanced Education Marriage Buying a House

Starting a Family Buying a Car Starting a Business

YALI Network | YALI Entrepreneurs Money Management Workbook 14

PURCHASES TIME FRAME COST SAVINGS

Next Steps:

Congratulations, you’ve completed the YALIEntrepreneurs Money Management

Workbook! Setting goals and working toward them is an ongoing process and you’ve

made great progress. Remember to continue revisiting and revising your goals and

keep working to make them a reality!

For more money management tips and resources, be sure to check out yali.state.gov/

entrepreneurs to continue developing your personal financial skills!

YALI Network | YALI Entrepreneurs Money Management Workbook 15

You might also like

- Deloitte Financial Advisory Services India Private LimitedDocument1 pageDeloitte Financial Advisory Services India Private LimitedPRASHANT BANDAWARNo ratings yet

- The Caravan - December 2022Document116 pagesThe Caravan - December 2022Viju Menon100% (1)

- Iso 17025 - Corrective Action Request Form (Completed)Document1 pageIso 17025 - Corrective Action Request Form (Completed)Jesse100% (1)

- Iso 17025 - Corrective Action Request Form (Completed)Document1 pageIso 17025 - Corrective Action Request Form (Completed)JesseNo ratings yet

- WeatherfordLabs Reservoir Fluid AnalysisDocument7 pagesWeatherfordLabs Reservoir Fluid AnalysisJesseNo ratings yet

- Money Mindset Workbook MK MAGIC MINDSET.Document15 pagesMoney Mindset Workbook MK MAGIC MINDSET.Satarupa Das100% (1)

- Five Love Languages Summary PDFDocument5 pagesFive Love Languages Summary PDFHarry EdnacotNo ratings yet

- T Harv Ekers Life Makeover Workbook PDFDocument5 pagesT Harv Ekers Life Makeover Workbook PDFEnrique BlancoNo ratings yet

- Southland RRJ 3-5Document3 pagesSouthland RRJ 3-5api-239588480No ratings yet

- FRIAS vs. ALCAYDEDocument2 pagesFRIAS vs. ALCAYDEJay Em75% (4)

- Real Life Money Plan WorkbookDocument26 pagesReal Life Money Plan WorkbookPatricia Antão Moutinho83% (6)

- Project On BudgetDocument11 pagesProject On BudgetRama GNo ratings yet

- Building A Budget That Works: The Power of Paycheck PlanningDocument10 pagesBuilding A Budget That Works: The Power of Paycheck PlanningcreditdotorgNo ratings yet

- Mint Notion - Budget Rock Star (How-To Guide)Document13 pagesMint Notion - Budget Rock Star (How-To Guide)Nursuhaidah SukorNo ratings yet

- Budgeting For Beginner's Guide With Fillable WorDocument24 pagesBudgeting For Beginner's Guide With Fillable WorAshley Whitmire100% (1)

- How To Make 300,000 Per Month As A Digital Coach: Webinar WorkbookDocument15 pagesHow To Make 300,000 Per Month As A Digital Coach: Webinar WorkbookAbhijeet DesaiNo ratings yet

- Emotionally Healthy Spirituality Course Workbook With DVDDocument7 pagesEmotionally Healthy Spirituality Course Workbook With DVDseoerljbf100% (1)

- Goal Setting FreebieDocument10 pagesGoal Setting FreebieVojce 78No ratings yet

- The Purpose Discovery WorkbookDocument9 pagesThe Purpose Discovery WorkbookAbodunrin Joseph100% (1)

- Will Vs Going ToDocument7 pagesWill Vs Going Toalex gonzalezNo ratings yet

- Super9solutions CoachingPackagesandServicesV6-17Document2 pagesSuper9solutions CoachingPackagesandServicesV6-17Paul Sanbar100% (1)

- How Good Is Your: Do You Know What To Say When You've Made A Mistake?Document2 pagesHow Good Is Your: Do You Know What To Say When You've Made A Mistake?Adimael BarbosaNo ratings yet

- Client Intake Example PDFDocument9 pagesClient Intake Example PDFzarea coneacNo ratings yet

- Purpose To Business WorkbookDocument10 pagesPurpose To Business WorkbookValeriu LazarNo ratings yet

- Daily PlannerDocument1 pageDaily PlannerOgochukwu ChukwuemekaNo ratings yet

- 365 Journal TopicsDocument11 pages365 Journal TopicsDaiana Jean LouisNo ratings yet

- MASTER YOUR MOTIVATION: Unleash Your Inner Drive and Achieve Extraordinary Results (2023 Beginner Guide)From EverandMASTER YOUR MOTIVATION: Unleash Your Inner Drive and Achieve Extraordinary Results (2023 Beginner Guide)No ratings yet

- Module 2 Ascension 1Document25 pagesModule 2 Ascension 1Robelle Ann Shayne DisuNo ratings yet

- VisionBoard2018 1496604087935Document24 pagesVisionBoard2018 1496604087935Aaliyah CsmrtNo ratings yet

- Abundance Mindset WorkbookDocument11 pagesAbundance Mindset WorkbookSagarika SamantarayNo ratings yet

- Unstoppable,: The ProjectDocument43 pagesUnstoppable,: The ProjectHilda Zafra CasajuanaNo ratings yet

- Make Your First Money Online Freelancing: Free Ebook by Lidiya KDocument32 pagesMake Your First Money Online Freelancing: Free Ebook by Lidiya KTreasureNo ratings yet

- Creati Vevi Suali Zati On: Stepone:SetthemoodDocument2 pagesCreati Vevi Suali Zati On: Stepone:SetthemoodChintan Patel100% (1)

- BLOG - Blogging For Profit 47Document47 pagesBLOG - Blogging For Profit 47Akindunni DanielNo ratings yet

- Class Worksheet 6: Describing My ParentsDocument3 pagesClass Worksheet 6: Describing My ParentsJessica MYNo ratings yet

- 5 Simple Tips To Beat Age Bias Webinar WORKSHEETDocument6 pages5 Simple Tips To Beat Age Bias Webinar WORKSHEETIcq joyNo ratings yet

- Loving YourselfDocument12 pagesLoving YourselfRhea Priya100% (1)

- Woeman to Woman: Learning to Break the Cycle and Personal GrowthFrom EverandWoeman to Woman: Learning to Break the Cycle and Personal GrowthNo ratings yet

- All About Me Pinterest ChallengeDocument14 pagesAll About Me Pinterest ChallengeStaff-BSH Ashraf ZhairyNo ratings yet

- Lifeplan Workbook M ZigarelliDocument23 pagesLifeplan Workbook M ZigarelliIon BulicanuNo ratings yet

- Primer Word WorkDocument52 pagesPrimer Word WorkBenjNo ratings yet

- IELTS Daily PlannerDocument1 pageIELTS Daily PlannerChiranjib ParialNo ratings yet

- The Mindset Optimization Workbook: Make 2016 Your Year For Fluency!Document7 pagesThe Mindset Optimization Workbook: Make 2016 Your Year For Fluency!Kata KasasNo ratings yet

- 5LoveLanguages PDFDocument13 pages5LoveLanguages PDFJeff SmithNo ratings yet

- Coach WorkbookDocument39 pagesCoach WorkbookJacky J ZhengNo ratings yet

- 2010catalog PDFDocument80 pages2010catalog PDFAhmed Salah100% (1)

- Goal Setting and Achievement TemplateDocument38 pagesGoal Setting and Achievement TemplateCarlson SiuNo ratings yet

- Screenshot 2021-04-21 at 8.10.21 AMDocument1 pageScreenshot 2021-04-21 at 8.10.21 AMlittle nixterNo ratings yet

- Journal ListDocument9 pagesJournal ListCashmere AbutanNo ratings yet

- 5e9c9f15e014f94c6da68cf8 - Freelancer Starter Kit by The Smart FounderDocument27 pages5e9c9f15e014f94c6da68cf8 - Freelancer Starter Kit by The Smart FounderMario MayansNo ratings yet

- Worbook February22 BOX For BOSSDocument10 pagesWorbook February22 BOX For BOSSMerNo ratings yet

- The Motive Journal (3rd Edition)Document42 pagesThe Motive Journal (3rd Edition)Shubham Sharma0% (1)

- Audience Survey: How To Run A SuccessfulDocument3 pagesAudience Survey: How To Run A SuccessfuldnfNo ratings yet

- How To Do Personal Budgeting Even If You Re Not A Financial ExpertDocument30 pagesHow To Do Personal Budgeting Even If You Re Not A Financial ExpertRichardNo ratings yet

- Ideal Business Workbook-CLARITYDocument10 pagesIdeal Business Workbook-CLARITYsundharNo ratings yet

- Free Brain Dump Worksheet by Fempreneur Secrets 2020 FillableDocument11 pagesFree Brain Dump Worksheet by Fempreneur Secrets 2020 Fillableফাহমিদা আঁখিNo ratings yet

- Emo 09Document6 pagesEmo 09AnitaNo ratings yet

- Life Path WorkbookDocument6 pagesLife Path Workbookkloi tingNo ratings yet

- The-Living-Legacy-Workbook - PDF (How To Make A Difference)Document20 pagesThe-Living-Legacy-Workbook - PDF (How To Make A Difference)hello2222222100% (1)

- Make Money by Online CoursesDocument6 pagesMake Money by Online CoursesNi NeNo ratings yet

- KPD Prisoner TransportationDocument20 pagesKPD Prisoner TransportationWVLT NewsNo ratings yet

- Alissarose Passiveoffer Editable r1Document8 pagesAlissarose Passiveoffer Editable r1Nyanshe StarkNo ratings yet

- Guide To ICF Credentialing ProcessDocument18 pagesGuide To ICF Credentialing Processnova011No ratings yet

- Alto SaxophoneDocument9 pagesAlto SaxophoneJesse100% (2)

- DHC 11 12 2021Document1 pageDHC 11 12 2021JesseNo ratings yet

- Section 3.a Civil (3) FOR BUILDING WORKDocument3 pagesSection 3.a Civil (3) FOR BUILDING WORKJesseNo ratings yet

- DHC 09 04 2022.Document1 pageDHC 09 04 2022.JesseNo ratings yet

- Lab Equip Cost $ Seta Price Cost GBP Seta Price Cost $ Discounte D Prices For Shatox $Document1 pageLab Equip Cost $ Seta Price Cost GBP Seta Price Cost $ Discounte D Prices For Shatox $JesseNo ratings yet

- SPS - Technical Spec.Document2 pagesSPS - Technical Spec.JesseNo ratings yet

- PVTsimHelp 20Document197 pagesPVTsimHelp 20JesseNo ratings yet

- Heptanes PlusDocument15 pagesHeptanes PlusJesseNo ratings yet

- Hydrates: by Sherry Oyagha 28 August, 2020Document45 pagesHydrates: by Sherry Oyagha 28 August, 2020JesseNo ratings yet

- General Comprehensive Quality Plan & Manual Sample: Selected Pages Sample IncludesDocument28 pagesGeneral Comprehensive Quality Plan & Manual Sample: Selected Pages Sample IncludesJesseNo ratings yet

- Construction Quality Control Plan Draft - Rev0 - 27feb09Document24 pagesConstruction Quality Control Plan Draft - Rev0 - 27feb09JesseNo ratings yet

- KDC HSE-IIPPManual v.2015Document156 pagesKDC HSE-IIPPManual v.2015JesseNo ratings yet

- Challenges During Operation and Shutdown of Waxy Crude PipelinesDocument13 pagesChallenges During Operation and Shutdown of Waxy Crude PipelinesJesseNo ratings yet

- 1963 Tribute To TunkuDocument187 pages1963 Tribute To TunkuAwan KhaledNo ratings yet

- Payslip 1Document1 pagePayslip 1Vikram SinghNo ratings yet

- Jurnal Enron 2Document17 pagesJurnal Enron 2Mochamad RisnandaNo ratings yet

- Mba Project of WelingkarDocument9 pagesMba Project of WelingkarrakeshNo ratings yet

- Political Science Double JeopordyDocument1 pagePolitical Science Double JeopordyBethylGoNo ratings yet

- UntitledDocument1 pageUntitledsotiris3085No ratings yet

- Conclusion of Nuclear Accident at Fukushima DaiichiDocument2 pagesConclusion of Nuclear Accident at Fukushima DaiichiEnformableNo ratings yet

- New TIP Course 6 DepEd TeacherDocument100 pagesNew TIP Course 6 DepEd TeacherHelen HidlaoNo ratings yet

- Iphone 4 SettlementDocument2 pagesIphone 4 SettlementEmbeunin NguyenNo ratings yet

- PT ManunggalDocument4 pagesPT Manunggalnimasz nin9szihNo ratings yet

- GimDocument165 pagesGimmdgemrNo ratings yet

- Corporation Cases FinalsDocument584 pagesCorporation Cases FinalsRochelle Ofilas LopezNo ratings yet

- Aff. of Witness - Kimberly EstoleroDocument2 pagesAff. of Witness - Kimberly EstoleroSteps RolsNo ratings yet

- E&Y ContactsDocument2 pagesE&Y ContactsZerohedgeNo ratings yet

- Witron Electromechanical TechnicianDocument2 pagesWitron Electromechanical Technicianbillel.morakechiNo ratings yet

- Toyota: Group 3Document16 pagesToyota: Group 3Mahesh GangurdeNo ratings yet

- Chapter 7Document4 pagesChapter 7MALTI MAHESH VASHISTHNo ratings yet

- 1.0.1.2 Class Activity - Network by Design - ILMDocument3 pages1.0.1.2 Class Activity - Network by Design - ILMLajos HomorNo ratings yet

- Alif School Deliverables - Final UpdatedDocument11 pagesAlif School Deliverables - Final UpdatedAraoye AbdulwaheedNo ratings yet

- Assignemnt 1 - 3 MarksDocument3 pagesAssignemnt 1 - 3 MarksHafsa HayatNo ratings yet

- AS-Live LogDocument3 pagesAS-Live LogarteadNo ratings yet

- Acc9 Accounting For Special Transactions University of BatangasDocument2 pagesAcc9 Accounting For Special Transactions University of BatangasHannahbea LindoNo ratings yet

- Sustainable Supermarkets: DiscussionDocument1 pageSustainable Supermarkets: DiscussionЮлія ПапірникNo ratings yet

- Daily Lesson Log Ucsp RevisedDocument46 pagesDaily Lesson Log Ucsp RevisedHin Yan100% (1)

- The Big HouseDocument6 pagesThe Big HouseSintas Ng SapatosNo ratings yet

- Internship Report: Northern UniversityDocument12 pagesInternship Report: Northern UniversityLiya JahanNo ratings yet