Professional Documents

Culture Documents

Financial Managers: Types Responsibilities

Financial Managers: Types Responsibilities

Uploaded by

Jomar Cantos0 ratings0% found this document useful (0 votes)

7 views1 pageFinancial managers oversee various aspects of a company's finances. Cash managers monitor cash flow to meet business needs. Risk managers use strategies like hedging to limit financial risk and losses. Insurance managers purchase policies to minimize risks. Branch managers oversee local offices, hiring employees and approving loans. Credit managers set credit policies and monitor past due accounts. Treasurers and finance officers direct budgets, investments, and capital raising. Controllers prepare accurate accounting statements. The chief financial officer is the top financial executive responsible for overall financial reporting.

Original Description:

Original Title

Doc2

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFinancial managers oversee various aspects of a company's finances. Cash managers monitor cash flow to meet business needs. Risk managers use strategies like hedging to limit financial risk and losses. Insurance managers purchase policies to minimize risks. Branch managers oversee local offices, hiring employees and approving loans. Credit managers set credit policies and monitor past due accounts. Treasurers and finance officers direct budgets, investments, and capital raising. Controllers prepare accurate accounting statements. The chief financial officer is the top financial executive responsible for overall financial reporting.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

7 views1 pageFinancial Managers: Types Responsibilities

Financial Managers: Types Responsibilities

Uploaded by

Jomar CantosFinancial managers oversee various aspects of a company's finances. Cash managers monitor cash flow to meet business needs. Risk managers use strategies like hedging to limit financial risk and losses. Insurance managers purchase policies to minimize risks. Branch managers oversee local offices, hiring employees and approving loans. Credit managers set credit policies and monitor past due accounts. Treasurers and finance officers direct budgets, investments, and capital raising. Controllers prepare accurate accounting statements. The chief financial officer is the top financial executive responsible for overall financial reporting.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

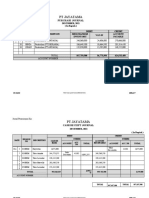

Financial

Managers

Types Responsibilities

Monitor and control the flow of cash that comes in and

Cash Managers goes out of the company to meet the company’s

business and investment needs.

Risk Control financial risk by using hedging and other

strategies to limit or offset the probability of a financial

Managers

loss or a company’s exposure to financial uncertainty.

Risk & Insurance

Managers

Purchase insurance policies for the company to

Insurance

minimize the company's risks against threats such as

Managers lawsuits.

Oversee the operations of a branch office; it includes hiring

employees, approving loans or credit lines, assisting

Branch Managers customers or developing a relationship with members of the

community to help increase business.

Oversee the firm’s credit business; they set credit-

Credit Managers rating criteria, determine credit ceilings, and monitor

the collections of past-due accounts.

Direct their organization’s budgets to meet its financial

Treasures & goals and oversee the investment of funds and carry out

Finance Officers strategies to raise capital and also develop financial plans

for mergers and acquisitions.

Oversees the accurate completion of accounting statements and usually

in charge of the accounting department, the budget department and the

Controller audit department and is required to prepare statements that outline the

company's financial situation for a government or regulatory authority.

The top executive and he is the highest level financial

Chief Financial manager held responsible for the all of the financial

Officer reporting within the company, so he must ensure its

accuracy.

You might also like

- Burton SensorsDocument4 pagesBurton SensorsAbhishek BaratamNo ratings yet

- Chapter 1 An Overview of FinanceDocument6 pagesChapter 1 An Overview of FinanceSyrill CayetanoNo ratings yet

- Role & Functions of Financial ManagerDocument19 pagesRole & Functions of Financial Managersumi0% (1)

- Cadbury and Kraft: A Bittersweet Moment: Case OverviewDocument10 pagesCadbury and Kraft: A Bittersweet Moment: Case OverviewZoo HuangNo ratings yet

- Financial Management: Functions of Financial ManagerDocument9 pagesFinancial Management: Functions of Financial Managernatalie clyde matesNo ratings yet

- Who Are The Persons Responsible For Financial Management in An Organization?Document7 pagesWho Are The Persons Responsible For Financial Management in An Organization?Allanis SolisNo ratings yet

- Special Issues in Financial ManagementDocument5 pagesSpecial Issues in Financial ManagementAlkhair SangcopanNo ratings yet

- Group 7 The Role of Financial ManagerDocument18 pagesGroup 7 The Role of Financial ManagerAn TrịnhNo ratings yet

- 1 An Overview of Financial ManagementDocument37 pages1 An Overview of Financial ManagementYvoane Roeve SasanaNo ratings yet

- Career As Finance Manager: Job ProfileDocument5 pagesCareer As Finance Manager: Job ProfileSneha KumarNo ratings yet

- BussFinM1 DoneDocument2 pagesBussFinM1 DonePgumballNo ratings yet

- Business SchoolDocument4 pagesBusiness SchoolMoater ImranNo ratings yet

- Financial ManagementDocument28 pagesFinancial Managementjannatuldu03No ratings yet

- Introduction To Financial ManagementDocument6 pagesIntroduction To Financial Managementadena agostoNo ratings yet

- Group 3 Financial Management VILLAMER-RIVERA-BIANDODocument20 pagesGroup 3 Financial Management VILLAMER-RIVERA-BIANDOLeo Noel VillamerNo ratings yet

- TM ReviewerDocument9 pagesTM ReviewerkyliebellecNo ratings yet

- FinanceDocument4 pagesFinanceMoater ImranNo ratings yet

- Lesson 1 (Chapter 1) - Financial Management FunctionDocument27 pagesLesson 1 (Chapter 1) - Financial Management FunctionHafiz HishamNo ratings yet

- Name: Subject: Reg. No: Roll No: Code: TopicDocument9 pagesName: Subject: Reg. No: Roll No: Code: TopicMaster Bhai BhaskarNo ratings yet

- Introduction To Treasury Management: Here Is Where Your Presentation BeginsDocument25 pagesIntroduction To Treasury Management: Here Is Where Your Presentation BeginsAngelie AnilloNo ratings yet

- An Overview of Financial ManagementDocument24 pagesAn Overview of Financial Managementbanesprincess0No ratings yet

- Lesson 1 - FinmanDocument7 pagesLesson 1 - FinmanRainyNo ratings yet

- Treasury Management 1Document13 pagesTreasury Management 1Dolores RosarioNo ratings yet

- Fin Man OverviewDocument4 pagesFin Man OverviewstgcastillonesNo ratings yet

- FinanceDocument9 pagesFinancekhanalsamikcha123No ratings yet

- What Is Over Capitalization and Under Capitalization? What Are The Effects of Over Capitalization? Is Over Capitalization Good For Company?Document7 pagesWhat Is Over Capitalization and Under Capitalization? What Are The Effects of Over Capitalization? Is Over Capitalization Good For Company?Zarathos SinghNo ratings yet

- Basis For Comparison Profit Maximization Wealth MaximizationDocument3 pagesBasis For Comparison Profit Maximization Wealth MaximizationMaricon Rillera PatauegNo ratings yet

- Venn DiagramDocument29 pagesVenn DiagramRJ DimaanoNo ratings yet

- Advanced Introduction 1Document13 pagesAdvanced Introduction 1Nabatanzi HeatherNo ratings yet

- FM8 Module 2Document5 pagesFM8 Module 2Kim HeidelynNo ratings yet

- When Money Realizes That It Is in Good HandsDocument1 pageWhen Money Realizes That It Is in Good HandsblingNo ratings yet

- 5: SME Credit Analysis Framework - Owner/Management Risk AssessmentDocument68 pages5: SME Credit Analysis Framework - Owner/Management Risk AssessmentitsurarunNo ratings yet

- The Role, Tasks and Functions of Management: Underwriting ProceduresDocument3 pagesThe Role, Tasks and Functions of Management: Underwriting ProceduresDanielNo ratings yet

- CH 1Document41 pagesCH 1bjr_shagyounNo ratings yet

- 1.3 The Corporate Risk Management (1) - 1607079952271Document20 pages1.3 The Corporate Risk Management (1) - 1607079952271ashutosh malhotraNo ratings yet

- Financial Management Lesson No. 1Document4 pagesFinancial Management Lesson No. 1Geraldine MayoNo ratings yet

- FM Module 1Document9 pagesFM Module 1ZekiNo ratings yet

- Fin Management - p1Document42 pagesFin Management - p1Ma. Elene MagdaraogNo ratings yet

- FINMAN2 ReviewerDocument17 pagesFINMAN2 ReviewerKYLA MARIE BLANDONo ratings yet

- Week011 Module 009 Understanding Basic Accounting and Financial ManagementDocument27 pagesWeek011 Module 009 Understanding Basic Accounting and Financial ManagementNoe AgubangNo ratings yet

- IntroDocument39 pagesIntrostd30000No ratings yet

- Financial Management Assignment - 5Document3 pagesFinancial Management Assignment - 5vipul jainNo ratings yet

- Financial ManagementDocument34 pagesFinancial Managementma carol fabraoNo ratings yet

- Controllers Job Function 1Document33 pagesControllers Job Function 1Jacques Mae RoblesNo ratings yet

- LAS BF Q3 Week 1 2 IGLDocument5 pagesLAS BF Q3 Week 1 2 IGLdaisymae.buenaventuraNo ratings yet

- Acctg 402aDocument2 pagesAcctg 402aPauline Keith Paz ManuelNo ratings yet

- ManagerDocument7 pagesManagersrkraman24No ratings yet

- Accounting and Finance NotesDocument7 pagesAccounting and Finance NotesJavan NyakomittaNo ratings yet

- Summary BASICS OF BUSINESS FINANCINGDocument3 pagesSummary BASICS OF BUSINESS FINANCINGScribdTranslationsNo ratings yet

- Value For Money. Basically, It Means Applying: Notes in Financial ManagementDocument6 pagesValue For Money. Basically, It Means Applying: Notes in Financial ManagementKristine PerezNo ratings yet

- Lesson 1&2 - Financial ControllershipDocument4 pagesLesson 1&2 - Financial ControllershipCherrie Mae GumiaNo ratings yet

- Chapter 1 Overview of Financial ManagementDocument6 pagesChapter 1 Overview of Financial ManagementLouise John BacudNo ratings yet

- Overview of Financial ManagementDocument5 pagesOverview of Financial Managementwernan.peraltaNo ratings yet

- What Is Corporate FinanceDocument13 pagesWhat Is Corporate Financeernie_gilasNo ratings yet

- Financial Management FunctionDocument11 pagesFinancial Management FunctionSeema Parboo-AliNo ratings yet

- Role of Finance ManagerDocument4 pagesRole of Finance ManagerphobosanddaimosNo ratings yet

- 01 Financial Management An OverviewDocument27 pages01 Financial Management An OverviewstgcastillonesNo ratings yet

- FM Chapter 1 NotesDocument6 pagesFM Chapter 1 NotesMadesh KuppuswamyNo ratings yet

- FINANCE Week 1 - Introduction To Business FinanceDocument11 pagesFINANCE Week 1 - Introduction To Business FinanceMary DacunoNo ratings yet

- Finman 1Document1 pageFinman 1Mary Louise CamposanoNo ratings yet

- Financial Managers: Top ExecutivesDocument5 pagesFinancial Managers: Top ExecutivesSarah PandaNo ratings yet

- Health and Healing To It I Will Heal My People and Will Let Them Enjoy Abundant Peace and Security." Jeremiah 33:6Document1 pageHealth and Healing To It I Will Heal My People and Will Let Them Enjoy Abundant Peace and Security." Jeremiah 33:6Jomar CantosNo ratings yet

- Education of Jose RizalDocument4 pagesEducation of Jose RizalJomar CantosNo ratings yet

- Education of Jose RizalDocument4 pagesEducation of Jose RizalJomar CantosNo ratings yet

- Business ReportDocument4 pagesBusiness ReportJomar CantosNo ratings yet

- Modern Rizal: Muelmar "Toto" MagallanesDocument2 pagesModern Rizal: Muelmar "Toto" MagallanesJomar CantosNo ratings yet

- Unit 1 PRINCIPLES OF INSURANCE & BANKINGDocument124 pagesUnit 1 PRINCIPLES OF INSURANCE & BANKINGsomangy GaggarNo ratings yet

- Fiscal PolicyDocument2 pagesFiscal PolicymunnabetaNo ratings yet

- Ebook Synthetics en HQDocument53 pagesEbook Synthetics en HQBrian MwangiNo ratings yet

- Loan Calculator ExcelDocument16 pagesLoan Calculator ExcelAtif NazirNo ratings yet

- Assemble Enterprises: Account Relationship SummaryDocument12 pagesAssemble Enterprises: Account Relationship Summaryok okNo ratings yet

- Rights and Obligations of Banker and CustomerDocument12 pagesRights and Obligations of Banker and Customerbeena antu100% (1)

- G11 Abma ManuscriptDocument47 pagesG11 Abma Manuscriptaiox huxedoNo ratings yet

- Value at Risk and Expected Shortfall: Risk Management and Financial Institutions 4e by John C. HullDocument23 pagesValue at Risk and Expected Shortfall: Risk Management and Financial Institutions 4e by John C. HullPhương KiềuNo ratings yet

- Certamen 1 - JC Penny CompanyDocument15 pagesCertamen 1 - JC Penny CompanySebastian MansillaNo ratings yet

- Which of The Following Is An Auditor Least Likely To Consider A Departure From Generally Accepted Accounting PrinciplesDocument3 pagesWhich of The Following Is An Auditor Least Likely To Consider A Departure From Generally Accepted Accounting PrinciplesKudryNo ratings yet

- Study On Working Capital ManagementDocument25 pagesStudy On Working Capital ManagementAmrutha Ammu100% (1)

- AccountStatement-2024-04-30Document13 pagesAccountStatement-2024-04-30infoNo ratings yet

- Open An FD and Get An Amazon E-Voucher Worth INR 250: Terms & ConditionsDocument2 pagesOpen An FD and Get An Amazon E-Voucher Worth INR 250: Terms & ConditionsVinay NarsimhaswamyNo ratings yet

- Jawaban Siklus Manual Ukk 2022Document7 pagesJawaban Siklus Manual Ukk 2022irma nurmayantiNo ratings yet

- Madhobi Internship ReportDocument90 pagesMadhobi Internship ReportMd. Shahriar NayeemNo ratings yet

- ZHWQ Unmetered PDFDocument4 pagesZHWQ Unmetered PDFkoragiNo ratings yet

- Pchome PresentationDocument38 pagesPchome Presentationecommerce zenNo ratings yet

- HDFC Life Sanchay Plus - Retail - Brochure - Final - CTCDocument16 pagesHDFC Life Sanchay Plus - Retail - Brochure - Final - CTCvkbasavaNo ratings yet

- Beverly High Hero Project Draws Nearly 400 Participants - Beverly Hills Weekly, Issue #664Document1 pageBeverly High Hero Project Draws Nearly 400 Participants - Beverly Hills Weekly, Issue #664BeverlyHillsWeeklyNo ratings yet

- Income Tax - Income Tax Guide 2023, Latest NewsDocument34 pagesIncome Tax - Income Tax Guide 2023, Latest NewsnandiniNo ratings yet

- BHI SEC Cert & Amended Articles of Incorporation PDFDocument9 pagesBHI SEC Cert & Amended Articles of Incorporation PDFkimberly_uymatiaoNo ratings yet

- SSRN Id2014351Document19 pagesSSRN Id2014351SrivastavaNo ratings yet

- Income Taxation - PartnershipDocument4 pagesIncome Taxation - PartnershipJuan Dela CruzNo ratings yet

- Ceda Application FormDocument6 pagesCeda Application Formphilliprampa.limitedNo ratings yet

- Frost Marwadi Finance StudyDocument11 pagesFrost Marwadi Finance StudySindhu DaruwalaNo ratings yet

- 2 Semester AY 2018 - 2019 ofDocument3 pages2 Semester AY 2018 - 2019 ofVirgil Kit Augustin AbanillaNo ratings yet

- A Thesis On Customer Satisfaction OF Nepal Investment Bank LimitedDocument80 pagesA Thesis On Customer Satisfaction OF Nepal Investment Bank LimitedBijay PradhanNo ratings yet

- Lakh Datta Flour MillsDocument14 pagesLakh Datta Flour MillsjimmuNo ratings yet