Professional Documents

Culture Documents

Plastic Money PDF

Plastic Money PDF

Uploaded by

Majharul IslamOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Plastic Money PDF

Plastic Money PDF

Uploaded by

Majharul IslamCopyright:

Available Formats

IOSR Journal of Business and Management (IOSR-JBM)

e-ISSN: 2278-487X, p-ISSN: 2319-7668. Volume 19, Issue 3. Ver. III (Mar. 2017), PP 15-18

www.iosrjournals.org

Plastic Money – A Way Forward for Cashless Transactions

Dr. Gurpreet Kaur1, Mrs. Rashmi Sharma2

1

Asstt. Prof. in Commerce Lyallpur Khalsa College for Women Jalandhar City

2

Asstt. Prof. in Commerce Lyallpur Khalsa College for Women Jalandhar City

Abstract: Information Technology has transformed the way people work. Plastic money yet another revolution

which is changing the way businesses buy and sell products and services. Customers can access services such

as banking, insurance and travel reservation without stepping out of these homes or offices. Such technological

advances facilitate the development of new electronic markets. The need for adequate security is vital issue in

internet banking. If systems used for internet banking are secure, then the banks will use them to provide

internet banking and customer will use them because these privacy is not at risk. The study highlights the

importance of these cards and its impact on banking trends in India. The sample size selected was 100 which

consisted of customers including student’s professionals, housewives and senior citizens. The study revealed

that in modern world, plastic money is important for customers and issues. Majority usage of plastic card is due

to convenience and easy portability. Banks have provided good services to customers. Customers feel safe for

using plastic cards. There are some challenges and issues but growth of banking industry depend upon proper

use of these plastic cards and to meet challenges E-finance system should be applied properly.

I. Introduction

Intense competition has forced banks to rethink the way they operated this business. Technology in

form of electronic banking has made it possible to find alternate banking practices at lower cost. It is beneficial

for banks as it increases their productivity and it also improves the delivery of quality service to customer.

Plastic money performs the authentication of merchant. It includes debit cards, credit cards, smart cards etc.

with increased competition and reduced margins the banks must look for other avenues to increase these profits.

The internet is a potential gold use for banks and with computer sales increasing each year, the market just

keeps getting bigger. Indian Economy has flourished with the advent of liberalization, privatization and

globalization. Banking sector is not exception too. These reforms have presented a challenge before Indian

Banking sector to shake hands with the pace of new technology without a sound and effective banking system in

India it cannot have a healthy economy. The Banking System of India should not only be hassle free but it

should be able to meet new challenges posed by technology and any other external and internal factors (Patil

Sushma ,2014). Plastic money in a very recent context replacing the traditional concept of paying through cash.

Plastic money is term coined keeping in view the increasing number of transactions taking place on the part of

consumer for paying for transaction incurred by them to purchase goods and services physically and virtually

(Bisht, Anisha, Nair, Praveen, Dubey Rakshita, Hajela Tany, 2015).

Plastic money will bring us benefits as well as problems. One major benefit of digital cash is its

increased efficiency which will open new business opportunities especially for small businesses on the other

hand it will bring in problems like taxation and money laundering, instability of foreign exchange rate,

disturbance of money supply and the possibility of financial crisis etc. Plastic money are being designed are

Credit cards, Debit Cards, Digital Cash and Electronic fund transfers.

II. Review of Literature

Bisht Anisha, Nair Praveen, Dubey Rakshita, Hajela Tanu (2015),worked on paper entitled ‘Analysis

of use of Plasitc money : A boon or a bane’. The research found that consumer prefer plastic money over paper

money and major benefit that the card provides to the customer is convenience and accessibility. The finding

reveal that majority of respondents use plastic money in one form or another. Therefore, customers are well

aware of plastic money and its usage and have been using plastic money for a long time. Most of consumer

preferred using debit card over credit card and they use it for buying apparels, paying electricity bills/phone bills

and online transactions. Patil Sushma (2014) in her research paper. “Impact of Plastic Money on Banking Trend

in India” examined that plastic money is referring to credit cards or the debit cards that we use to make

purchases. The study highlights the role of these cards as electronic payment tool to be used by customers and

discusses the penetration of these cards in replacement of cash and paper money. Indian customers find it easier

to make payment via plastic cards rather than carrying too much cash which contributes to the growth of plastic

money in the country. But some customers are not able to utilize cards effectively due to its complex nature and

they don’t actually know how to operate it for specific purpose. Thus banks should give them some training

DOI: 10.9790/487X-1903031518 www.iosrjournals.org 15 | Page

Plastic Money – A Way Forward for Cashless Transactions

regarding its usage. However all these hurdles will diminish over time and positively influencing trends are

expected to continue in near future. Sonu R. Nirmala conducted a study on “Analysis of the use of Plastic

Money”. The study focused on credit cards and debit cards in order to find out the effectiveness of such cards in

real life and factors affecting the customer perception towards plastic money are discussed. The result of the

study have stressed upon the convenience and ease of use while paying or shopping by plastic money. Security

comes forward as major cause for concern for the population using plastic money. Population is ready as ever to

use money. Population is ready as ever to use plastic money at a greater level due to its high levels of ease and

convenience.

Objectives of Study:

1. To study the perception of card users towards Plastic Money in India.

2. To study the impact of Plastic Money on banking trends in India.

3. To study the issues and challenges faced by banks for using plastic money.

Plastic Money – Present Scenario

E-Finance: With the introduction of internet and opportunities it has provided, new product and

services are emerging that set to change the way we look at money and monetary systems. Smart Card which

can store account balances and update the same periodically can be useful to customer for payment of various

types of utility bills and can function like electronic purses.

Banking: There has been talk for some time that physical cash, notes and coins will become a thing of

past and digital cash, electronically held value will become the norms. Telephone banking and bill payment are

just a couples of examples. The emergence of plastic money can throw.

Issues and Challenges faced by Banks

Business Issues:

Who should be the target customers?

What should be the scale of operation?

What should be technology adopted?

What should be marketing strategy?

Privacy Issues:

What are the laws, Rules and Regulations governing Privacy issues?

Are the data collection and data maintenance agreements?

Security Issues

What security measures are being employed?

What Electronic authentication, Signature and Certification Systems will be used?

Regulatory issues:

What should be

Capital Requirements?

Liquidity Requirements?

Reporting Requirements?

Privacy Policies?

Taxation?

Control over Supply of E-Cash?

Guidelines of Credit Card/ Debit Card operations by RBI.

RBI working group has brought out draft guidelines in June 2005. Some of features of Proposals are

Disclosure of terms and conditions of credit agreement in all important communication to customer.

Cards to be issued to only those consumers with independent financial means.

Customer complaints to be resolved within 60 days.

Confidentiality of personal information which cannot be shared with third parties.

DOI: 10.9790/487X-1903031518 www.iosrjournals.org 16 | Page

Plastic Money – A Way Forward for Cashless Transactions

III. Data Analysis and Interpretation:

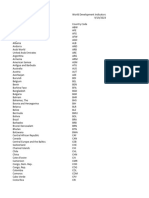

3.1 Impact of introduction of Plastic Money on % usage of Debit Cards, Credit Cards and Cash Cards by

customers.

Table 3.1: ANOVA Results for usage of Plastic Money

Variables SOS between SOS within Df F value P value Significance

groups groups

Debit Cards 2.234 211.206 3.396 1.396 .244 No

Credit Cards 2.337 200.773 5.396 1.537 .204 No

Cash Cards 1.291 289.699 3.396 .862 .461 No

Table 3.1 indicate that there is no significant relationship between awareness about plastic money and its usage

by customer at 5% level of significance.

3.2 Factors affecting Awareness and usage of plastic cards

Table 3.2: Factors affecting Awareness and Usage

Competition High Moderate Neutral Little None WAS Rank

Competition 103 (51.5) 18 (9) -- 68 (34) 11 (5.5) 0.67 2

Customer’s 52 (26) 46 (23) 21 (10.5) 54 (27) 27 (13.5) 0.21 3

Income

Demand of 97 (48.5) 35 (17.5) 58 (29) 10 (5) 0.76 1

Cards

Table 3.2 shows different factors affecting awareness and usage of plastic cards. The factors considered are

customer’s income, competition and demand of cards. Out of these factors customer’s income and his living

standard affect the usage of cards to a maximum extent according to weighted average score calculated for each

variable.

3.3 Impact of Challenges faced by issuers on customers:

Table 3.3: ANOVA Results for challenges faced by issuers

Variable SOS between SOS within Df F value P value Significant

groups groups

Unsecured lendings .733 80.227 3.396 1.206 .307 No

Upgradation 6.225 111.215 3.396 7.388 .000 Yes

Low Average 2.081 171.109 3.396 1.606 .188 No

Spending

Non-activated card 0.697 202.303 3.396 .455 .714 No

The results shown in Table 3.3 indicate that upgradation of software is the most important challenge faced by

the issuers which ultimately put impact on customers at 5% level of significance.

IV. Conclusion

The study concluded that the majority of customers use plastic money. Plastic Money are emerging and

getting accepted in the market place. They need to gain both consumer and business acceptance. Debit

Card/Credit Card payments are easier way to make payment. It is beneficial for both customer and issuer. But

some customers are not aware about utilization of these cards. According to them it is very complex procedure

so bank must give training regarding its usage. The bank should give them facility to use plastic cards on trial

basis so they can use very confidently. Bank should cut their usage cost. There are some challenges for issuers.

Most of challenges faced by bank is non recovery of funds. So there should be system of recovery of these

funds. Domestic Card industry will have to upgrade from present magnetic strip on plastic technology to chip

based ‘Smart Cards’ in next years. The growth of banking industry depend upon appropriate use of plastic cards

and banks should meet challenges and make use opportunities profitably. There should be E-finance system

used effectively so that issuers can able to meet challenges faced for issuing Plastic Cards and to meet

Competitive edge for success in plastic card business. Above all, interest of customer is of foremost importance.

References

[1]. H.R. Suneja 1994, Innovation in Banking Services, Himalaya Publishing House, pp.1-20.

[2]. Hajela Tanu, Dubey Rakshita, Nair Praveen, Bisht Anisha, march 2015, “Analysis of the use of Plasitc Money. A boon or a bane. “

SiMS Journal of management Research Volume No.1.

[3]. Jarunee Wonglipiyarat 2007, “E-Payment Strategies of Banks Card Innovations”. Journal of Internet Banking.

[4]. Krishnamurthy Narayan, “Be a smart card user.” Money Today, 19th April, 2007.

[5]. K.S. Thakur and Singh D. 2005, Marketing of Financial Services, RBSA Publishers pp.2-4, 16-18.

[6]. Mani Vannan P (2013), “Plastic Money a way for cash less payment system “ Global Research Analysis, Vol.II, No.1

DOI: 10.9790/487X-1903031518 www.iosrjournals.org 17 | Page

Plastic Money – A Way Forward for Cashless Transactions

[7]. Maheswari S.N and Maheswari S.K.” Banking Theory, Law & Practice, Kalyani Publishers Edition 2005, p.1-4.

[8]. Sharma Anupama 2012, “Plastic Card frauds and the countermeasures: Towards a safer payment mechanism.” International Journal

of Research in Commerce. It is management,Vol.2, No.4.

[9]. Sharma M.K, Gupta S.K, Verma, S.B. (2007) E-Banking and Development of Bank” Deep & Deep Publications Pvt. Ltd. New

Delhi.

DOI: 10.9790/487X-1903031518 www.iosrjournals.org 18 | Page

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Module 1, Assessment 1Document31 pagesModule 1, Assessment 1praveena100% (2)

- Assignment On: Submitted ToDocument4 pagesAssignment On: Submitted ToMajharul IslamNo ratings yet

- Assignment The Conflict Handling Intensions With Example For EachDocument4 pagesAssignment The Conflict Handling Intensions With Example For EachMajharul IslamNo ratings yet

- Assignment On HRP in BangladeshDocument5 pagesAssignment On HRP in BangladeshMajharul IslamNo ratings yet

- Analyse of Use Plastic Money PDFDocument4 pagesAnalyse of Use Plastic Money PDFMajharul IslamNo ratings yet

- Awareness About Bharatpe As A Fintech Company Among Merchants in BhopalDocument37 pagesAwareness About Bharatpe As A Fintech Company Among Merchants in BhopalHarshvardhan SolankiNo ratings yet

- Directives - Unified Directives 2068 PDFDocument277 pagesDirectives - Unified Directives 2068 PDFBhava Nath DahalNo ratings yet

- Overdraft Facility - Bajaj FinserveDocument9 pagesOverdraft Facility - Bajaj FinserveDilip Kumar100% (1)

- Oct StatementDocument1 pageOct StatementShinam AroraNo ratings yet

- Vendor Application Form: (Please Click For A Sample Format)Document3 pagesVendor Application Form: (Please Click For A Sample Format)MITRANZO PAYANo ratings yet

- API BX - Klt.dinv - CD.WD Ds2 en Excel v2 5872141Document74 pagesAPI BX - Klt.dinv - CD.WD Ds2 en Excel v2 5872141Mihalciuc VladNo ratings yet

- Assignment 8 AnswersDocument6 pagesAssignment 8 AnswersMyaNo ratings yet

- List of Relevant NotificationsDocument101 pagesList of Relevant Notificationsbooksanand1No ratings yet

- Financial SystemDocument3 pagesFinancial SystemArko DasNo ratings yet

- QTRDocument26 pagesQTRnnadoziekenneth5No ratings yet

- Wise Transaction Invoice Transfer 881684223 204 231128 181845Document2 pagesWise Transaction Invoice Transfer 881684223 204 231128 181845lyes.megrahNo ratings yet

- Project Report ON Idfc Bank: A Project Report Submitted in Partial Fulfillment of The Department of CommerceDocument25 pagesProject Report ON Idfc Bank: A Project Report Submitted in Partial Fulfillment of The Department of CommerceHitesh kumar jenaNo ratings yet

- Lehman Brothers CSDocument22 pagesLehman Brothers CSKania BilaNo ratings yet

- Banking & Economy PDF - March 2022 by AffairsCloud 1Document141 pagesBanking & Economy PDF - March 2022 by AffairsCloud 1ASHUTOSH KUMARNo ratings yet

- Assignment Unit 4Document1 pageAssignment Unit 4Guillermo VallsNo ratings yet

- FIxed Income PresentationDocument277 pagesFIxed Income PresentationAlexisChevalier100% (1)

- Chapter 4Document4 pagesChapter 4MINTDKS 0112No ratings yet

- 28 CREDTRANS Saludo Vs SCBDocument1 page28 CREDTRANS Saludo Vs SCBJimenez LorenzNo ratings yet

- Statement Sep 23 XXXXXXXX0143Document2 pagesStatement Sep 23 XXXXXXXX0143mohdasimraza84No ratings yet

- M. Kabir Hassan, Rasem N. Kayed, and Umar A. Oseni: Introduction To Islamic Banking and Finance: Principles and PracticeDocument135 pagesM. Kabir Hassan, Rasem N. Kayed, and Umar A. Oseni: Introduction To Islamic Banking and Finance: Principles and PracticesameerNo ratings yet

- Numeral Guide To SEPADocument51 pagesNumeral Guide To SEPAhthomas100100% (1)

- CIBIL - 1st FEB, '23 PDFDocument38 pagesCIBIL - 1st FEB, '23 PDFSamir Kumar DashNo ratings yet

- Account Closure Form For Savings Current and Investment AccountDocument2 pagesAccount Closure Form For Savings Current and Investment AccountParikshit SachdevNo ratings yet

- SBI PO Application FormDocument4 pagesSBI PO Application FormPranav SahilNo ratings yet

- ConfirmationDocument2 pagesConfirmationBenjamin D. RubinNo ratings yet

- Lista Tranzactii: DL Simon Rares-Andrei RO09BRDE270SV26380332700 RON Alina-Ramona SimonDocument5 pagesLista Tranzactii: DL Simon Rares-Andrei RO09BRDE270SV26380332700 RON Alina-Ramona SimonRamona SimonNo ratings yet

- Financial Economics Study MaterialDocument13 pagesFinancial Economics Study MaterialFrancis MtamboNo ratings yet

- Funds Transfers - OverviewDocument7 pagesFunds Transfers - OverviewCajita FelizNo ratings yet

- NRB News Vol.35 20770331 PDFDocument4 pagesNRB News Vol.35 20770331 PDFNarenBistaNo ratings yet