Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

29 viewsCase Digest 1

Case Digest 1

Uploaded by

Shirley Lucas EsagaLuis Wong was an agent for Limtong Press Inc. who gave the company six postdated checks totaling over 18,000 pesos in December 1985. The checks bounced in June 1986 when deposited. Wong was charged with violating the Bouncing Checks Law. He argued on appeal that since the checks were deposited 157 days after maturity, the presumption of knowledge of lack of funds should not apply. The Court of Appeals upheld his conviction. The Supreme Court ruled that 157 days was not an unreasonable time to deposit the checks and the presumption of knowledge could still be applied.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- Motions, Affidavits, Answers, and Commercial Liens - The Book of Effective Sample DocumentsFrom EverandMotions, Affidavits, Answers, and Commercial Liens - The Book of Effective Sample DocumentsRating: 4.5 out of 5 stars4.5/5 (14)

- Writ of SummonsDocument17 pagesWrit of SummonsNasiru029100% (6)

- The 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsFrom EverandThe 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsRating: 5 out of 5 stars5/5 (1)

- Digest - Wong vs. CADocument1 pageDigest - Wong vs. CAPaul Vincent Cunanan100% (1)

- Statcon Case DigestsDocument7 pagesStatcon Case DigestsMydz Salang LndygNo ratings yet

- LUIS S. WONG v. CA, GR No. 117857, 2001-02-02Document2 pagesLUIS S. WONG v. CA, GR No. 117857, 2001-02-02Thoughts and More ThoughtsNo ratings yet

- Wong v.CA and People of The PhilippinesDocument9 pagesWong v.CA and People of The PhilippinesJako DeleonNo ratings yet

- Wong vs. Court of Appeals (GR 117857, 2 February 2001) The Full Case ResearchDocument6 pagesWong vs. Court of Appeals (GR 117857, 2 February 2001) The Full Case Researchjolly verbatimNo ratings yet

- Wong V CADocument3 pagesWong V CANico CaldozoNo ratings yet

- Wong vs. Court of AppealsDocument5 pagesWong vs. Court of Appealsarsalle2014No ratings yet

- Wong V CADocument5 pagesWong V CABrian TomasNo ratings yet

- Wong Vs CADocument5 pagesWong Vs CAChester Pryze Ibardolaza TabuenaNo ratings yet

- WONG Vs CADocument6 pagesWONG Vs CAKeej DalonosNo ratings yet

- 43 - Wong v. CaDocument9 pages43 - Wong v. CaVia Rhidda ImperialNo ratings yet

- Wong vs. CA DigestDocument2 pagesWong vs. CA DigestavvyalbaNo ratings yet

- Bouncing Checks Law - CasesDocument25 pagesBouncing Checks Law - CasesGretel R. MadanguitNo ratings yet

- G.R. No. 117857 February 2, 2001 LUIS S. WONG, Petitioner, Court of Appeals and People of The Philippines, Respondents. Quisumbing, J.Document7 pagesG.R. No. 117857 February 2, 2001 LUIS S. WONG, Petitioner, Court of Appeals and People of The Philippines, Respondents. Quisumbing, J.maria lourdes lopenaNo ratings yet

- G.R. No. 117857 February 2, 2001 LUIS S. WONG, Petitioner, Court of Appeals and People of The Philippines, Respondents. Quisumbing, J.Document4 pagesG.R. No. 117857 February 2, 2001 LUIS S. WONG, Petitioner, Court of Appeals and People of The Philippines, Respondents. Quisumbing, J.Ariann BarrosNo ratings yet

- Wong Vs CA DigestDocument1 pageWong Vs CA DigestcolleenNo ratings yet

- Title ViiDocument11 pagesTitle ViiELLANo ratings yet

- Wong vs. CA DigestDocument2 pagesWong vs. CA DigestRobNo ratings yet

- Wong v. CADocument11 pagesWong v. CAAna BalceNo ratings yet

- NEGO Finals Last Set Atty BusmenteDocument5 pagesNEGO Finals Last Set Atty BusmenteDarlene GanubNo ratings yet

- Wong v. Court of Appeals, G.R. No. 117857, February 02, 2001Document10 pagesWong v. Court of Appeals, G.R. No. 117857, February 02, 2001Krister VallenteNo ratings yet

- The CaseDocument10 pagesThe Casejuju_batugalNo ratings yet

- BP 22 and Estafa Cases - ReferenceDocument2 pagesBP 22 and Estafa Cases - ReferenceSam LeynesNo ratings yet

- Nego Digest For Nov 8 2016Document7 pagesNego Digest For Nov 8 2016Elca JavierNo ratings yet

- Wong v. CADocument2 pagesWong v. CAheinnahNo ratings yet

- G.R. No. 117857 February 2, 2001 LUIS S. WONG, Petitioner, Court of Appeals and People of The Philippines, RespondentsDocument2 pagesG.R. No. 117857 February 2, 2001 LUIS S. WONG, Petitioner, Court of Appeals and People of The Philippines, RespondentsJames WilliamNo ratings yet

- Wong v. Court of Appeals, G.R. No. 117857, 2 February 2001Document3 pagesWong v. Court of Appeals, G.R. No. 117857, 2 February 2001Henrick YsonNo ratings yet

- Wong vs. CA Case DigestDocument2 pagesWong vs. CA Case DigestMikey GoNo ratings yet

- Nego 01Document5 pagesNego 01Alyza Montilla BurdeosNo ratings yet

- G.R. No. 117857 February 2, 2001Document3 pagesG.R. No. 117857 February 2, 2001Arthur YamatNo ratings yet

- 2 NEGO Digest and AnalysisDocument82 pages2 NEGO Digest and AnalysisJustin EnriquezNo ratings yet

- Negodie Gests2Document4 pagesNegodie Gests2Shiela PadillaNo ratings yet

- Case Digest - Negotiable InstrumentsDocument43 pagesCase Digest - Negotiable InstrumentsJenineCamilleArgusonVirayNo ratings yet

- NIL Cases July 3Document12 pagesNIL Cases July 3Enrique Legaspi IVNo ratings yet

- Nego Collection DigestDocument15 pagesNego Collection DigestPatrick San AntonioNo ratings yet

- Negotiable Instruments Case Digests For November 8Document3 pagesNegotiable Instruments Case Digests For November 8Megan MateoNo ratings yet

- Nego 1Document9 pagesNego 1Aaron ReyesNo ratings yet

- Revised Digest 2018Document57 pagesRevised Digest 2018Daniel Anthony Cabrera100% (1)

- NEGO Case DigestDocument15 pagesNEGO Case DigestFrancis Gillean Orpilla100% (4)

- People Vs DumayasDocument6 pagesPeople Vs DumayasAnna HulyaNo ratings yet

- CD NIL Wong Vs CADocument13 pagesCD NIL Wong Vs CAGenevive GabionNo ratings yet

- PUA Vs Spouses Tiong and Caroline Teng - AlbinoDocument3 pagesPUA Vs Spouses Tiong and Caroline Teng - AlbinoAileen PeñafilNo ratings yet

- Ricardo Llamado v. Court of AppealsDocument3 pagesRicardo Llamado v. Court of AppealsbearzhugNo ratings yet

- Domangsang Vs CA GR No. 139292 December 5, 2000Document11 pagesDomangsang Vs CA GR No. 139292 December 5, 2000Mak FranciscoNo ratings yet

- Bax vs. PeopleDocument9 pagesBax vs. PeopleMarc Steven VillaceranNo ratings yet

- Asia Brewery, BpiDocument2 pagesAsia Brewery, BpiChristian Aries GarciaNo ratings yet

- Crim 7Document16 pagesCrim 7Lester BalagotNo ratings yet

- 3.jai-Alai Corp. of The Philippines v. Bank of The Philippine IslandDocument3 pages3.jai-Alai Corp. of The Philippines v. Bank of The Philippine IslandBenedicto PintorNo ratings yet

- Jai Alai Vs BPI Facts: (2) Republic Vs Ebrada: NEGO Forgery Cases APR118Document11 pagesJai Alai Vs BPI Facts: (2) Republic Vs Ebrada: NEGO Forgery Cases APR118AlvinRelox100% (1)

- Jai-Alai, V. Bpi 66 Scra 29 August 6, 1975Document3 pagesJai-Alai, V. Bpi 66 Scra 29 August 6, 1975Fritzie G. PuctiyaoNo ratings yet

- Jai-Alai Corp v. BPIDocument10 pagesJai-Alai Corp v. BPIGia DimayugaNo ratings yet

- Metropolitan Trial Court: Counter-AffidavitDocument9 pagesMetropolitan Trial Court: Counter-AffidavitthebeautyinsideNo ratings yet

- bp22 ResearchDocument130 pagesbp22 ResearchNyl AnerNo ratings yet

- Ambito AlmazanDocument17 pagesAmbito AlmazanAlyk Tumayan Calion0% (1)

- Additional Cases:: RTC Ruling: ICB Is Not Entitled To Recover The Value of The Checks From PNB Because The ICB Failed ToDocument10 pagesAdditional Cases:: RTC Ruling: ICB Is Not Entitled To Recover The Value of The Checks From PNB Because The ICB Failed ToDagul JauganNo ratings yet

- 2017 Case Digests - Mercantile LawDocument84 pages2017 Case Digests - Mercantile LawedreaNo ratings yet

- Diongzon V CADocument8 pagesDiongzon V CAJessie Marie dela PeñaNo ratings yet

- BP 22 CasesDocument120 pagesBP 22 Casesakaibengoshi0% (1)

- Samsung VS AppleDocument30 pagesSamsung VS AppleShirley Lucas EsagaNo ratings yet

- Biological Factors Affecting Growth and Development: Prepared By: Shirley EsagaDocument10 pagesBiological Factors Affecting Growth and Development: Prepared By: Shirley EsagaShirley Lucas EsagaNo ratings yet

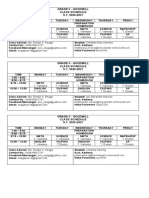

- Grade 3 - Goodwill Class Schedule S.Y. 2020-2021Document4 pagesGrade 3 - Goodwill Class Schedule S.Y. 2020-2021Shirley Lucas EsagaNo ratings yet

- 1 Allocation and Distribution of Net SurplusDocument1 page1 Allocation and Distribution of Net SurplusShirley Lucas EsagaNo ratings yet

- Response MechanismDocument15 pagesResponse MechanismShirley Lucas EsagaNo ratings yet

- Bulacan Employees Credit Cooperative: Report On The Financial StatementsDocument1 pageBulacan Employees Credit Cooperative: Report On The Financial StatementsShirley Lucas EsagaNo ratings yet

- Fm2C (Bsa-3) - Esaga - Shirley 1. Provide The Definition of StocksDocument2 pagesFm2C (Bsa-3) - Esaga - Shirley 1. Provide The Definition of StocksShirley Lucas EsagaNo ratings yet

- 7 Statement of Cash FlowsDocument1 page7 Statement of Cash FlowsShirley Lucas EsagaNo ratings yet

- (Formerly University of Regina Carmeli) : La Consolacion University PhilippinesDocument6 pages(Formerly University of Regina Carmeli) : La Consolacion University PhilippinesShirley Lucas Esaga100% (1)

- Esaga, Shirley L. Bsa 3: Vertical Organization ElementsDocument4 pagesEsaga, Shirley L. Bsa 3: Vertical Organization ElementsShirley Lucas EsagaNo ratings yet

- Articles of Incorporation OF Ambyence Clothing IncorporatedDocument3 pagesArticles of Incorporation OF Ambyence Clothing IncorporatedShirley Lucas EsagaNo ratings yet

- Esaga, Shirley L. Bsa 3: 1.determining Service Level RequirementsDocument2 pagesEsaga, Shirley L. Bsa 3: 1.determining Service Level RequirementsShirley Lucas EsagaNo ratings yet

- Final Examination in Understanding The SelfDocument4 pagesFinal Examination in Understanding The SelfShirley Lucas EsagaNo ratings yet

- Beneficence Non MaleficenceDocument37 pagesBeneficence Non MaleficenceKathryn Ramirez100% (2)

- Liwag vs. Happy Glen Loop Homeowners Association - Inc.Document15 pagesLiwag vs. Happy Glen Loop Homeowners Association - Inc.Court JorsNo ratings yet

- Georg Vs Holy Trinity CollegeDocument3 pagesGeorg Vs Holy Trinity CollegeRois DeduyoNo ratings yet

- Polygamy in The BibleDocument31 pagesPolygamy in The BiblebibletruthinchristNo ratings yet

- Finals Reviewer On The Book On Legal and Judicial Ethics by Justice Rodrigo CosicoDocument4 pagesFinals Reviewer On The Book On Legal and Judicial Ethics by Justice Rodrigo CosicoRoen Descalzo AbeNo ratings yet

- Cosmos Bottling vs. Nagrama Abandonement March 2008Document11 pagesCosmos Bottling vs. Nagrama Abandonement March 2008Jubert CuyosNo ratings yet

- People v. AgoncilloDocument1 pagePeople v. AgoncilloEinstein NewtonNo ratings yet

- Montallana V La Consolacion CollegeDocument3 pagesMontallana V La Consolacion CollegeSocNo ratings yet

- Chapter 3 - Legal IssuesDocument6 pagesChapter 3 - Legal IssuesKTNo ratings yet

- Fernando v. CA (Dobs)Document2 pagesFernando v. CA (Dobs)Trisha Dela RosaNo ratings yet

- Matling Industrial Vs Coros (G.R. No. 157802 October 13, 2010)Document2 pagesMatling Industrial Vs Coros (G.R. No. 157802 October 13, 2010)James WilliamNo ratings yet

- 1982 SAMAHAN ConstitutionDocument11 pages1982 SAMAHAN ConstitutionSAMAHAN Central BoardNo ratings yet

- Comendador v. de Villa, 200 SCRA 80 (1991) - SummaryDocument2 pagesComendador v. de Villa, 200 SCRA 80 (1991) - SummaryJNo ratings yet

- PPL VS OANIS Mistake of FactDocument8 pagesPPL VS OANIS Mistake of FactGio TriesteNo ratings yet

- 12 Marcos vs. ManglapusDocument4 pages12 Marcos vs. ManglapusKJPL_1987No ratings yet

- 001 Habeas PetitionDocument15 pages001 Habeas PetitionHelen BennettNo ratings yet

- Authority To SellDocument1 pageAuthority To SellRafael GalosNo ratings yet

- Ethics HandbookDocument4 pagesEthics Handbooksweetsaki19No ratings yet

- United States Court of Appeals, Eleventh CircuitDocument41 pagesUnited States Court of Appeals, Eleventh CircuitScribd Government DocsNo ratings yet

- Spec ProDocument34 pagesSpec Prokero keropiNo ratings yet

- Peoria County Booking Sheet 02/27/16Document9 pagesPeoria County Booking Sheet 02/27/16Journal Star police documentsNo ratings yet

- Barangy San Roque vs. Heirs ofDocument6 pagesBarangy San Roque vs. Heirs offjl_302711No ratings yet

- (CRIMPRO) People V LaguioDocument1 page(CRIMPRO) People V LaguioPlaneteer PranaNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument19 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- Chryso 15th July18Document3 pagesChryso 15th July18Utkarsh KhandelwalNo ratings yet

- IGNOU Block-3Document101 pagesIGNOU Block-3Dr. Megha RichhariyaNo ratings yet

- Complaint Jury Demand (00435221)Document21 pagesComplaint Jury Demand (00435221)Circuit MediaNo ratings yet

- Barrister Afroz Imtiaz: The Ethical View of A Company Through The Lenses of Various Ethical TheoriesDocument20 pagesBarrister Afroz Imtiaz: The Ethical View of A Company Through The Lenses of Various Ethical TheoriesAbdullah ShikderNo ratings yet

- Samaniego Celada Vs AbenaDocument7 pagesSamaniego Celada Vs Abenabloome9ceeNo ratings yet

Case Digest 1

Case Digest 1

Uploaded by

Shirley Lucas Esaga0 ratings0% found this document useful (0 votes)

29 views3 pagesLuis Wong was an agent for Limtong Press Inc. who gave the company six postdated checks totaling over 18,000 pesos in December 1985. The checks bounced in June 1986 when deposited. Wong was charged with violating the Bouncing Checks Law. He argued on appeal that since the checks were deposited 157 days after maturity, the presumption of knowledge of lack of funds should not apply. The Court of Appeals upheld his conviction. The Supreme Court ruled that 157 days was not an unreasonable time to deposit the checks and the presumption of knowledge could still be applied.

Original Description:

Original Title

CASE DIGEST 1

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentLuis Wong was an agent for Limtong Press Inc. who gave the company six postdated checks totaling over 18,000 pesos in December 1985. The checks bounced in June 1986 when deposited. Wong was charged with violating the Bouncing Checks Law. He argued on appeal that since the checks were deposited 157 days after maturity, the presumption of knowledge of lack of funds should not apply. The Court of Appeals upheld his conviction. The Supreme Court ruled that 157 days was not an unreasonable time to deposit the checks and the presumption of knowledge could still be applied.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

29 views3 pagesCase Digest 1

Case Digest 1

Uploaded by

Shirley Lucas EsagaLuis Wong was an agent for Limtong Press Inc. who gave the company six postdated checks totaling over 18,000 pesos in December 1985. The checks bounced in June 1986 when deposited. Wong was charged with violating the Bouncing Checks Law. He argued on appeal that since the checks were deposited 157 days after maturity, the presumption of knowledge of lack of funds should not apply. The Court of Appeals upheld his conviction. The Supreme Court ruled that 157 days was not an unreasonable time to deposit the checks and the presumption of knowledge could still be applied.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 3

Esaga, Shirley L.

BSA-3

Case Digest: LUIS WONG VS. CA

(G.R. No. 117857; February 2, 2001)

Limtong Press Inc. (LPI) filed a case with Petitioner Luis

Wong in connection with his conviction for violation of the Bouncing

Checks Law (BP Blg. 22). The RTC rendered a choice sentencing Wong of

the offenses charged. The CA moreover asserted the said choice. That

result to the present petition.

Facts:

Luis Wong is an agent of Limtong Press. Inc. (LPI), a producer of

calendars. LPI would print samples and give them to agents to present

to customers. The operators would get the buy requests of clients and

forward them to LPI. In the time of printing the calendars, LPI would

transport the calendars to the clients. From there on, the agent would

come around to gather the installments. Petitioner, be that as it may,

had a background marked by unremitted assortments. Henceforth,

petitioner's clients were required to issue postdated checks before

LPI would acknowledge their buy orders.

In the beginning of December 1985, Wong gave six (6) postdated

checks totaling P18,025.00, all dated December 30, 1985 and drawn

payable to the order of LPI. In any case, following organization

approach, LPI wouldn't acknowledge the checks as certifications.

Rather, the gatherings consented to apply the checks to the

installment of candidate's unremitted collections for 1984 adding up

to P18,077.07.3 LPI deferred the P52.07 contrast.

Prior to the development of the checks, petitioner persuaded LPI

not to store the checks and vowed to supplant them inside 30 days. In

any case, applicant reneged on his guarantee. Consequently, on June 5,

1986, LPI kept the checks with Rizal Commercial Banking Corporation

(RCBC). The checks were returned for the explanation "account closed."

The dishonor of the checks was confirmed by the RCBC return slip.

On June 20, 1986, complainant through guidance told the

petitioner of the dishonor. Petitioner neglected to make arrangement

of payment within five (5) banking days. On November 6, 1987,

petitioner was accused of three (3) counts of violation of B.P. Blg.

224 under three separate informations for the three checks adding up

to P5,500.00, P3,375.00, and P6,410.00.5. The RTC rendered

a choice sentencing Wong of the offenses charged. The

CA moreover asserted the said choice. That result to the present

petition.

Issues:

May the prosecution apply the prima facie presumption of

"knowledge of lack of funds" against the drawer if the checks were

belatedly deposited by the complainant 157 days after maturity, or

will it be then necessary for the prosecution to show actual proof of

"lack of funds" during the 90-day term?

Ruling:

Petitioner avers that since the complainant deposited the checks

Under Section 186 of the Negotiable Instruments Law, "a check

must be presented for payment within a reasonable time after its issue

or the drawer will be discharged from liability thereon to the extent

of the loss caused by the delay." By current banking practice, a check

becomes stale after more than six (6) months, or 180 days. Private

respondent herein deposited the checks 157 days after the date of the

check. Hence said checks cannot be considered stale.

157 days after the December 30, 1985 maturity date, the

presumption of knowledge of lack of funds under Section 2 of B.P. Blg.

22 should not apply to him. He further claims that he should not be

expected to keep his bank account active and funded beyond the ninety-

day period.

You might also like

- Motions, Affidavits, Answers, and Commercial Liens - The Book of Effective Sample DocumentsFrom EverandMotions, Affidavits, Answers, and Commercial Liens - The Book of Effective Sample DocumentsRating: 4.5 out of 5 stars4.5/5 (14)

- Writ of SummonsDocument17 pagesWrit of SummonsNasiru029100% (6)

- The 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsFrom EverandThe 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsRating: 5 out of 5 stars5/5 (1)

- Digest - Wong vs. CADocument1 pageDigest - Wong vs. CAPaul Vincent Cunanan100% (1)

- Statcon Case DigestsDocument7 pagesStatcon Case DigestsMydz Salang LndygNo ratings yet

- LUIS S. WONG v. CA, GR No. 117857, 2001-02-02Document2 pagesLUIS S. WONG v. CA, GR No. 117857, 2001-02-02Thoughts and More ThoughtsNo ratings yet

- Wong v.CA and People of The PhilippinesDocument9 pagesWong v.CA and People of The PhilippinesJako DeleonNo ratings yet

- Wong vs. Court of Appeals (GR 117857, 2 February 2001) The Full Case ResearchDocument6 pagesWong vs. Court of Appeals (GR 117857, 2 February 2001) The Full Case Researchjolly verbatimNo ratings yet

- Wong V CADocument3 pagesWong V CANico CaldozoNo ratings yet

- Wong vs. Court of AppealsDocument5 pagesWong vs. Court of Appealsarsalle2014No ratings yet

- Wong V CADocument5 pagesWong V CABrian TomasNo ratings yet

- Wong Vs CADocument5 pagesWong Vs CAChester Pryze Ibardolaza TabuenaNo ratings yet

- WONG Vs CADocument6 pagesWONG Vs CAKeej DalonosNo ratings yet

- 43 - Wong v. CaDocument9 pages43 - Wong v. CaVia Rhidda ImperialNo ratings yet

- Wong vs. CA DigestDocument2 pagesWong vs. CA DigestavvyalbaNo ratings yet

- Bouncing Checks Law - CasesDocument25 pagesBouncing Checks Law - CasesGretel R. MadanguitNo ratings yet

- G.R. No. 117857 February 2, 2001 LUIS S. WONG, Petitioner, Court of Appeals and People of The Philippines, Respondents. Quisumbing, J.Document7 pagesG.R. No. 117857 February 2, 2001 LUIS S. WONG, Petitioner, Court of Appeals and People of The Philippines, Respondents. Quisumbing, J.maria lourdes lopenaNo ratings yet

- G.R. No. 117857 February 2, 2001 LUIS S. WONG, Petitioner, Court of Appeals and People of The Philippines, Respondents. Quisumbing, J.Document4 pagesG.R. No. 117857 February 2, 2001 LUIS S. WONG, Petitioner, Court of Appeals and People of The Philippines, Respondents. Quisumbing, J.Ariann BarrosNo ratings yet

- Wong Vs CA DigestDocument1 pageWong Vs CA DigestcolleenNo ratings yet

- Title ViiDocument11 pagesTitle ViiELLANo ratings yet

- Wong vs. CA DigestDocument2 pagesWong vs. CA DigestRobNo ratings yet

- Wong v. CADocument11 pagesWong v. CAAna BalceNo ratings yet

- NEGO Finals Last Set Atty BusmenteDocument5 pagesNEGO Finals Last Set Atty BusmenteDarlene GanubNo ratings yet

- Wong v. Court of Appeals, G.R. No. 117857, February 02, 2001Document10 pagesWong v. Court of Appeals, G.R. No. 117857, February 02, 2001Krister VallenteNo ratings yet

- The CaseDocument10 pagesThe Casejuju_batugalNo ratings yet

- BP 22 and Estafa Cases - ReferenceDocument2 pagesBP 22 and Estafa Cases - ReferenceSam LeynesNo ratings yet

- Nego Digest For Nov 8 2016Document7 pagesNego Digest For Nov 8 2016Elca JavierNo ratings yet

- Wong v. CADocument2 pagesWong v. CAheinnahNo ratings yet

- G.R. No. 117857 February 2, 2001 LUIS S. WONG, Petitioner, Court of Appeals and People of The Philippines, RespondentsDocument2 pagesG.R. No. 117857 February 2, 2001 LUIS S. WONG, Petitioner, Court of Appeals and People of The Philippines, RespondentsJames WilliamNo ratings yet

- Wong v. Court of Appeals, G.R. No. 117857, 2 February 2001Document3 pagesWong v. Court of Appeals, G.R. No. 117857, 2 February 2001Henrick YsonNo ratings yet

- Wong vs. CA Case DigestDocument2 pagesWong vs. CA Case DigestMikey GoNo ratings yet

- Nego 01Document5 pagesNego 01Alyza Montilla BurdeosNo ratings yet

- G.R. No. 117857 February 2, 2001Document3 pagesG.R. No. 117857 February 2, 2001Arthur YamatNo ratings yet

- 2 NEGO Digest and AnalysisDocument82 pages2 NEGO Digest and AnalysisJustin EnriquezNo ratings yet

- Negodie Gests2Document4 pagesNegodie Gests2Shiela PadillaNo ratings yet

- Case Digest - Negotiable InstrumentsDocument43 pagesCase Digest - Negotiable InstrumentsJenineCamilleArgusonVirayNo ratings yet

- NIL Cases July 3Document12 pagesNIL Cases July 3Enrique Legaspi IVNo ratings yet

- Nego Collection DigestDocument15 pagesNego Collection DigestPatrick San AntonioNo ratings yet

- Negotiable Instruments Case Digests For November 8Document3 pagesNegotiable Instruments Case Digests For November 8Megan MateoNo ratings yet

- Nego 1Document9 pagesNego 1Aaron ReyesNo ratings yet

- Revised Digest 2018Document57 pagesRevised Digest 2018Daniel Anthony Cabrera100% (1)

- NEGO Case DigestDocument15 pagesNEGO Case DigestFrancis Gillean Orpilla100% (4)

- People Vs DumayasDocument6 pagesPeople Vs DumayasAnna HulyaNo ratings yet

- CD NIL Wong Vs CADocument13 pagesCD NIL Wong Vs CAGenevive GabionNo ratings yet

- PUA Vs Spouses Tiong and Caroline Teng - AlbinoDocument3 pagesPUA Vs Spouses Tiong and Caroline Teng - AlbinoAileen PeñafilNo ratings yet

- Ricardo Llamado v. Court of AppealsDocument3 pagesRicardo Llamado v. Court of AppealsbearzhugNo ratings yet

- Domangsang Vs CA GR No. 139292 December 5, 2000Document11 pagesDomangsang Vs CA GR No. 139292 December 5, 2000Mak FranciscoNo ratings yet

- Bax vs. PeopleDocument9 pagesBax vs. PeopleMarc Steven VillaceranNo ratings yet

- Asia Brewery, BpiDocument2 pagesAsia Brewery, BpiChristian Aries GarciaNo ratings yet

- Crim 7Document16 pagesCrim 7Lester BalagotNo ratings yet

- 3.jai-Alai Corp. of The Philippines v. Bank of The Philippine IslandDocument3 pages3.jai-Alai Corp. of The Philippines v. Bank of The Philippine IslandBenedicto PintorNo ratings yet

- Jai Alai Vs BPI Facts: (2) Republic Vs Ebrada: NEGO Forgery Cases APR118Document11 pagesJai Alai Vs BPI Facts: (2) Republic Vs Ebrada: NEGO Forgery Cases APR118AlvinRelox100% (1)

- Jai-Alai, V. Bpi 66 Scra 29 August 6, 1975Document3 pagesJai-Alai, V. Bpi 66 Scra 29 August 6, 1975Fritzie G. PuctiyaoNo ratings yet

- Jai-Alai Corp v. BPIDocument10 pagesJai-Alai Corp v. BPIGia DimayugaNo ratings yet

- Metropolitan Trial Court: Counter-AffidavitDocument9 pagesMetropolitan Trial Court: Counter-AffidavitthebeautyinsideNo ratings yet

- bp22 ResearchDocument130 pagesbp22 ResearchNyl AnerNo ratings yet

- Ambito AlmazanDocument17 pagesAmbito AlmazanAlyk Tumayan Calion0% (1)

- Additional Cases:: RTC Ruling: ICB Is Not Entitled To Recover The Value of The Checks From PNB Because The ICB Failed ToDocument10 pagesAdditional Cases:: RTC Ruling: ICB Is Not Entitled To Recover The Value of The Checks From PNB Because The ICB Failed ToDagul JauganNo ratings yet

- 2017 Case Digests - Mercantile LawDocument84 pages2017 Case Digests - Mercantile LawedreaNo ratings yet

- Diongzon V CADocument8 pagesDiongzon V CAJessie Marie dela PeñaNo ratings yet

- BP 22 CasesDocument120 pagesBP 22 Casesakaibengoshi0% (1)

- Samsung VS AppleDocument30 pagesSamsung VS AppleShirley Lucas EsagaNo ratings yet

- Biological Factors Affecting Growth and Development: Prepared By: Shirley EsagaDocument10 pagesBiological Factors Affecting Growth and Development: Prepared By: Shirley EsagaShirley Lucas EsagaNo ratings yet

- Grade 3 - Goodwill Class Schedule S.Y. 2020-2021Document4 pagesGrade 3 - Goodwill Class Schedule S.Y. 2020-2021Shirley Lucas EsagaNo ratings yet

- 1 Allocation and Distribution of Net SurplusDocument1 page1 Allocation and Distribution of Net SurplusShirley Lucas EsagaNo ratings yet

- Response MechanismDocument15 pagesResponse MechanismShirley Lucas EsagaNo ratings yet

- Bulacan Employees Credit Cooperative: Report On The Financial StatementsDocument1 pageBulacan Employees Credit Cooperative: Report On The Financial StatementsShirley Lucas EsagaNo ratings yet

- Fm2C (Bsa-3) - Esaga - Shirley 1. Provide The Definition of StocksDocument2 pagesFm2C (Bsa-3) - Esaga - Shirley 1. Provide The Definition of StocksShirley Lucas EsagaNo ratings yet

- 7 Statement of Cash FlowsDocument1 page7 Statement of Cash FlowsShirley Lucas EsagaNo ratings yet

- (Formerly University of Regina Carmeli) : La Consolacion University PhilippinesDocument6 pages(Formerly University of Regina Carmeli) : La Consolacion University PhilippinesShirley Lucas Esaga100% (1)

- Esaga, Shirley L. Bsa 3: Vertical Organization ElementsDocument4 pagesEsaga, Shirley L. Bsa 3: Vertical Organization ElementsShirley Lucas EsagaNo ratings yet

- Articles of Incorporation OF Ambyence Clothing IncorporatedDocument3 pagesArticles of Incorporation OF Ambyence Clothing IncorporatedShirley Lucas EsagaNo ratings yet

- Esaga, Shirley L. Bsa 3: 1.determining Service Level RequirementsDocument2 pagesEsaga, Shirley L. Bsa 3: 1.determining Service Level RequirementsShirley Lucas EsagaNo ratings yet

- Final Examination in Understanding The SelfDocument4 pagesFinal Examination in Understanding The SelfShirley Lucas EsagaNo ratings yet

- Beneficence Non MaleficenceDocument37 pagesBeneficence Non MaleficenceKathryn Ramirez100% (2)

- Liwag vs. Happy Glen Loop Homeowners Association - Inc.Document15 pagesLiwag vs. Happy Glen Loop Homeowners Association - Inc.Court JorsNo ratings yet

- Georg Vs Holy Trinity CollegeDocument3 pagesGeorg Vs Holy Trinity CollegeRois DeduyoNo ratings yet

- Polygamy in The BibleDocument31 pagesPolygamy in The BiblebibletruthinchristNo ratings yet

- Finals Reviewer On The Book On Legal and Judicial Ethics by Justice Rodrigo CosicoDocument4 pagesFinals Reviewer On The Book On Legal and Judicial Ethics by Justice Rodrigo CosicoRoen Descalzo AbeNo ratings yet

- Cosmos Bottling vs. Nagrama Abandonement March 2008Document11 pagesCosmos Bottling vs. Nagrama Abandonement March 2008Jubert CuyosNo ratings yet

- People v. AgoncilloDocument1 pagePeople v. AgoncilloEinstein NewtonNo ratings yet

- Montallana V La Consolacion CollegeDocument3 pagesMontallana V La Consolacion CollegeSocNo ratings yet

- Chapter 3 - Legal IssuesDocument6 pagesChapter 3 - Legal IssuesKTNo ratings yet

- Fernando v. CA (Dobs)Document2 pagesFernando v. CA (Dobs)Trisha Dela RosaNo ratings yet

- Matling Industrial Vs Coros (G.R. No. 157802 October 13, 2010)Document2 pagesMatling Industrial Vs Coros (G.R. No. 157802 October 13, 2010)James WilliamNo ratings yet

- 1982 SAMAHAN ConstitutionDocument11 pages1982 SAMAHAN ConstitutionSAMAHAN Central BoardNo ratings yet

- Comendador v. de Villa, 200 SCRA 80 (1991) - SummaryDocument2 pagesComendador v. de Villa, 200 SCRA 80 (1991) - SummaryJNo ratings yet

- PPL VS OANIS Mistake of FactDocument8 pagesPPL VS OANIS Mistake of FactGio TriesteNo ratings yet

- 12 Marcos vs. ManglapusDocument4 pages12 Marcos vs. ManglapusKJPL_1987No ratings yet

- 001 Habeas PetitionDocument15 pages001 Habeas PetitionHelen BennettNo ratings yet

- Authority To SellDocument1 pageAuthority To SellRafael GalosNo ratings yet

- Ethics HandbookDocument4 pagesEthics Handbooksweetsaki19No ratings yet

- United States Court of Appeals, Eleventh CircuitDocument41 pagesUnited States Court of Appeals, Eleventh CircuitScribd Government DocsNo ratings yet

- Spec ProDocument34 pagesSpec Prokero keropiNo ratings yet

- Peoria County Booking Sheet 02/27/16Document9 pagesPeoria County Booking Sheet 02/27/16Journal Star police documentsNo ratings yet

- Barangy San Roque vs. Heirs ofDocument6 pagesBarangy San Roque vs. Heirs offjl_302711No ratings yet

- (CRIMPRO) People V LaguioDocument1 page(CRIMPRO) People V LaguioPlaneteer PranaNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument19 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- Chryso 15th July18Document3 pagesChryso 15th July18Utkarsh KhandelwalNo ratings yet

- IGNOU Block-3Document101 pagesIGNOU Block-3Dr. Megha RichhariyaNo ratings yet

- Complaint Jury Demand (00435221)Document21 pagesComplaint Jury Demand (00435221)Circuit MediaNo ratings yet

- Barrister Afroz Imtiaz: The Ethical View of A Company Through The Lenses of Various Ethical TheoriesDocument20 pagesBarrister Afroz Imtiaz: The Ethical View of A Company Through The Lenses of Various Ethical TheoriesAbdullah ShikderNo ratings yet

- Samaniego Celada Vs AbenaDocument7 pagesSamaniego Celada Vs Abenabloome9ceeNo ratings yet