Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

2K viewsIncome Taxation, Latest Edition, Bangawan, Rex B

Income Taxation, Latest Edition, Bangawan, Rex B

Uploaded by

Princess SalvadorThis course introduces students to income taxation. It focuses on preparing individual and corporate income tax returns and covers topics like the principles of taxation, taxes and classifications, taxation of individuals, corporations, estates, trusts, and partnerships. The course aims to teach students how to ethically prepare income tax returns for different taxpayers. It allocates over 50 hours to cover these tax-related topics over 11 sessions.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Case 29 SolutionDocument7 pagesCase 29 Solutiongators333100% (6)

- Golemans Emotional IntelligenceDocument17 pagesGolemans Emotional IntelligencePrincess SalvadorNo ratings yet

- Corporation ActivityDocument4 pagesCorporation ActivityLFGS FinalsNo ratings yet

- BUS - MATH 11 Q1 Module 3Document25 pagesBUS - MATH 11 Q1 Module 3Princess Salvador92% (12)

- Income Taxation Banggawan 2019 Ed Solution ManualDocument40 pagesIncome Taxation Banggawan 2019 Ed Solution ManualVanilla VanillaNo ratings yet

- FABM2 - Q1 - Module 1 - Statement of Financial PositionDocument24 pagesFABM2 - Q1 - Module 1 - Statement of Financial PositionPrincess Salvador67% (3)

- Income Taxation Solution Manual 2019 ED Income Taxation Solution Manual 2019 EDDocument40 pagesIncome Taxation Solution Manual 2019 ED Income Taxation Solution Manual 2019 EDSha Leen100% (2)

- INTAX Chapter 8Document15 pagesINTAX Chapter 8Levy PanganNo ratings yet

- Intro To Consumption TaxesDocument50 pagesIntro To Consumption TaxesKheianne DaveighNo ratings yet

- Chapter 14 Income Taxation For IndividualsDocument19 pagesChapter 14 Income Taxation For IndividualsShane Sigua-Salcedo100% (2)

- Chapter 1 Succession and Transfer Taxes Part 1Document2 pagesChapter 1 Succession and Transfer Taxes Part 1AngieNo ratings yet

- BUS - MATH 11 Q1 Module 4Document25 pagesBUS - MATH 11 Q1 Module 4Princess Salvador71% (14)

- BUS - MATH 11 Q1 Module 2Document28 pagesBUS - MATH 11 Q1 Module 2Princess Salvador89% (9)

- Resulting Trust Essay PlanDocument3 pagesResulting Trust Essay PlanSebastian Toh Ming WeiNo ratings yet

- POSCO ActDocument14 pagesPOSCO Actnirshan raj100% (1)

- LECTURE 10 Dealings in PropertiesDocument33 pagesLECTURE 10 Dealings in PropertiesJeane Mae Boo100% (1)

- Chap 6 MCQDocument3 pagesChap 6 MCQMahad SheikhNo ratings yet

- Chapter 5 Final Income TaxationDocument26 pagesChapter 5 Final Income TaxationJason MablesNo ratings yet

- Acct Chapter 15BDocument20 pagesAcct Chapter 15BEibra Allicra100% (1)

- Module 6 Income Taxes For Corporations - Part 1Document12 pagesModule 6 Income Taxes For Corporations - Part 1Maricar DimayugaNo ratings yet

- Taxation CH 5Document6 pagesTaxation CH 5Kristel Nuyda LobasNo ratings yet

- Regular Income Tax: Bacc8 TaxationDocument18 pagesRegular Income Tax: Bacc8 TaxationsoonsNo ratings yet

- Module 07 Introduction To Regular Income Tax 3 2Document21 pagesModule 07 Introduction To Regular Income Tax 3 2Joshua BazarNo ratings yet

- Q5 Items of Gross IncomeDocument10 pagesQ5 Items of Gross IncomeNhaj0% (2)

- Items of Gross Income Subject To RegularDocument2 pagesItems of Gross Income Subject To Regularhannah drew ovejasNo ratings yet

- Chapter 9 Other Percentage TaxesDocument56 pagesChapter 9 Other Percentage TaxesKarylle BartolayNo ratings yet

- Introduction To Regular Income TaxationDocument45 pagesIntroduction To Regular Income Taxationcarl patNo ratings yet

- Introduction To Business Taxation: Chapter 3 (Part 1)Document38 pagesIntroduction To Business Taxation: Chapter 3 (Part 1)Niño Mendoza MabatoNo ratings yet

- Operating Segment: Intermediate Accounting 3Document51 pagesOperating Segment: Intermediate Accounting 3Trisha Mae AlburoNo ratings yet

- Business & Transfer Taxation: Rex B. Banggawan, Cpa, MbaDocument38 pagesBusiness & Transfer Taxation: Rex B. Banggawan, Cpa, Mbajustine reine cornicoNo ratings yet

- Intermediate Accounting 3 ModuleDocument13 pagesIntermediate Accounting 3 ModuleShaina GarciaNo ratings yet

- Intro To Income TaxDocument4 pagesIntro To Income TaxJennifer Arcadio100% (1)

- Chapter 7 Introduction To Regular Income TaxationDocument8 pagesChapter 7 Introduction To Regular Income TaxationJason MablesNo ratings yet

- Chapter 10 Compensation IncomeDocument4 pagesChapter 10 Compensation IncomeJason MablesNo ratings yet

- 2nd Semester Income Taxation Module 10 Exercises On Gross Income - Exclusion and Inclusions Part 2Document3 pages2nd Semester Income Taxation Module 10 Exercises On Gross Income - Exclusion and Inclusions Part 2nicole tolayba100% (1)

- Taxation 2Document11 pagesTaxation 2MerEl Urbano De GuzmanNo ratings yet

- Mas 3 Module 1 Fs AnalysisDocument19 pagesMas 3 Module 1 Fs AnalysisHazel Jane EsclamadaNo ratings yet

- Week 6 - Deduction From Gross IncomeDocument5 pagesWeek 6 - Deduction From Gross IncomeJuan FrivaldoNo ratings yet

- Income Tax Computation For Corporate TaxpayersDocument79 pagesIncome Tax Computation For Corporate TaxpayersPATATASNo ratings yet

- CHAPTER 4: Differential Cost Analysis (Relevant Costing) KaebDocument6 pagesCHAPTER 4: Differential Cost Analysis (Relevant Costing) KaebMark Gelo WinchesterNo ratings yet

- Computed Using Classification and Globalization Rule: or Business Income Such As Passive IncomeDocument10 pagesComputed Using Classification and Globalization Rule: or Business Income Such As Passive IncomelcNo ratings yet

- Chapter 10 - Deductions From The Gross Income PDFDocument68 pagesChapter 10 - Deductions From The Gross Income PDFMary CuisonNo ratings yet

- Income Taxation Chapter 2Document5 pagesIncome Taxation Chapter 2Jasmine OlayNo ratings yet

- IT Tools Application in Business Orig.Document8 pagesIT Tools Application in Business Orig.Alayka Mae Bandales LorzanoNo ratings yet

- Chapter 3Document88 pagesChapter 3giezele ballatanNo ratings yet

- Management Advisory Services - Part 1Document35 pagesManagement Advisory Services - Part 1For AcadsNo ratings yet

- Transfer and Business Taxation - MIDTERMDocument14 pagesTransfer and Business Taxation - MIDTERMYvette Pauline JovenNo ratings yet

- Income Taxation Whole Book Cheat SheetDocument121 pagesIncome Taxation Whole Book Cheat SheetMaryane Angela100% (2)

- Review Business and Transfer TaxDocument201 pagesReview Business and Transfer TaxReginald ValenciaNo ratings yet

- Chapter 1 Introduction To Taxation: Chapter Overview and ObjectivesDocument30 pagesChapter 1 Introduction To Taxation: Chapter Overview and ObjectivesNoeme LansangNo ratings yet

- Intro To Regular Income TaxationDocument2 pagesIntro To Regular Income TaxationhotgirlsummerNo ratings yet

- Chapter 15 BDocument3 pagesChapter 15 BErinNo ratings yet

- Chapter 3 Introduction To Income TaxationDocument38 pagesChapter 3 Introduction To Income TaxationPearlyn Villarin100% (1)

- Tax Review - FinalsDocument8 pagesTax Review - FinalsRobert Castillo100% (2)

- Approved CAE - BSA BSMA BSAIS BSIA - ACC 311 - Clarito - Page-0055-0064Document17 pagesApproved CAE - BSA BSMA BSAIS BSIA - ACC 311 - Clarito - Page-0055-0064Peng GuinNo ratings yet

- Taxation Final Pre Board Oct 2016Document13 pagesTaxation Final Pre Board Oct 2016Maryane AngelaNo ratings yet

- Individual TaxationDocument113 pagesIndividual TaxationGemmalyn Julaton100% (7)

- Tax On CorporationDocument2 pagesTax On CorporationMervidelleNo ratings yet

- Income Tax - ElaineDocument11 pagesIncome Tax - ElaineSamsung AccountNo ratings yet

- Income Taxation Reviewer Banggawan 2021Document13 pagesIncome Taxation Reviewer Banggawan 2021Merwelyn FradesNo ratings yet

- Tax DeductionsDocument4 pagesTax DeductionsAnonymous LC5kFdtcNo ratings yet

- Chapter 10 Average and FIFO CostingDocument34 pagesChapter 10 Average and FIFO CostingJeana SegumalianNo ratings yet

- Review in Business Law and TaxationDocument4 pagesReview in Business Law and TaxationFery AnnNo ratings yet

- Accounting in ActionDocument26 pagesAccounting in Actionمنال عبد الرازقNo ratings yet

- Course Syllabus in Fundamentals of Taxation: Course Intended Learning Outcomes (Cilo) and Time AllotmentDocument8 pagesCourse Syllabus in Fundamentals of Taxation: Course Intended Learning Outcomes (Cilo) and Time AllotmentPATATASNo ratings yet

- Intermediate Course: Paper 5: Financial Accounting (One Paper: 3 Hours:100 Marks)Document9 pagesIntermediate Course: Paper 5: Financial Accounting (One Paper: 3 Hours:100 Marks)only_u_onNo ratings yet

- Office of The Dean: College and Tech-Voc DepartmentDocument6 pagesOffice of The Dean: College and Tech-Voc Departmentmyrene cerebanNo ratings yet

- CH 01Document44 pagesCH 01Sidra IqbalNo ratings yet

- Planner StickersDocument1 pagePlanner StickersPrincess SalvadorNo ratings yet

- Year at A Glance 3.5 CM - 6 RowsDocument36 pagesYear at A Glance 3.5 CM - 6 RowsPrincess SalvadorNo ratings yet

- Npa Lec Notes PrelimsDocument9 pagesNpa Lec Notes PrelimsPrincess SalvadorNo ratings yet

- Test Constructions 1 1Document4 pagesTest Constructions 1 1Princess SalvadorNo ratings yet

- Stages of Cognitive DevelopmentDocument10 pagesStages of Cognitive DevelopmentPrincess SalvadorNo ratings yet

- A5 Full Calendar Package and TemplateDocument16 pagesA5 Full Calendar Package and TemplatePrincess SalvadorNo ratings yet

- Assessment of Learning 1 Test Construction Part 2Document5 pagesAssessment of Learning 1 Test Construction Part 2Princess SalvadorNo ratings yet

- Flexible Instruction Delivery Plan Template gROUP 10Document5 pagesFlexible Instruction Delivery Plan Template gROUP 10Princess Salvador50% (2)

- Social and Environmental SafeguardsDocument14 pagesSocial and Environmental SafeguardsPrincess SalvadorNo ratings yet

- Simple and Compound InterestDocument16 pagesSimple and Compound InterestPrincess SalvadorNo ratings yet

- SEA Cold Storage - Palayan CityDocument25 pagesSEA Cold Storage - Palayan CityPrincess SalvadorNo ratings yet

- Cooperative Development Authority Cooperative Annual Performance Report (Document5 pagesCooperative Development Authority Cooperative Annual Performance Report (Princess SalvadorNo ratings yet

- QuizDocument2 pagesQuizPrincess SalvadorNo ratings yet

- Governance and Management Audit ReportDocument1 pageGovernance and Management Audit ReportPrincess SalvadorNo ratings yet

- MC2013 14 Issuance and Distribution of Share Capital Certificates of Electric Coop Pursuant To Art 133 of Ra9520 PDFDocument7 pagesMC2013 14 Issuance and Distribution of Share Capital Certificates of Electric Coop Pursuant To Art 133 of Ra9520 PDFPrincess SalvadorNo ratings yet

- Engineering Report For Single Pass Rice Mills/ Corn Mills: General InformationDocument2 pagesEngineering Report For Single Pass Rice Mills/ Corn Mills: General InformationPrincess SalvadorNo ratings yet

- Articles of Cooperation: Revised January 2020Document24 pagesArticles of Cooperation: Revised January 2020Princess SalvadorNo ratings yet

- RTWPB PresentationDocument44 pagesRTWPB PresentationPrincess SalvadorNo ratings yet

- Problem Solving Skills of Shs Students in General MathematicsDocument86 pagesProblem Solving Skills of Shs Students in General MathematicsPrincess SalvadorNo ratings yet

- MC No. 2020 005 Interim Guidelines For New and Renewal Applications For AccreditationDocument6 pagesMC No. 2020 005 Interim Guidelines For New and Renewal Applications For AccreditationPrincess SalvadorNo ratings yet

- Steering Committee: Workers ManagementDocument1 pageSteering Committee: Workers ManagementPrincess SalvadorNo ratings yet

- MAS Part II Illustrative Examples (Capital Budgeting)Document2 pagesMAS Part II Illustrative Examples (Capital Budgeting)Princess SalvadorNo ratings yet

- PhilHealth Circ2017-0003Document6 pagesPhilHealth Circ2017-0003Toche DoceNo ratings yet

- Ee NewDocument1 pageEe Newhsbibahmed091No ratings yet

- Mayank Mehta EYDocument10 pagesMayank Mehta EYyasmeenfatimak52No ratings yet

- Debate Against UA PDFDocument5 pagesDebate Against UA PDFHermione Shalimar Justice CaspeNo ratings yet

- SociolinguisticsDocument21 pagesSociolinguisticsWella WilliamsNo ratings yet

- INSTA September 2023 Current Affairs Quiz Questions 1Document10 pagesINSTA September 2023 Current Affairs Quiz Questions 1rsimback123No ratings yet

- Cat Menes - Google SearchDocument1 pageCat Menes - Google SearchShanzeh ZehraNo ratings yet

- Tugas AK Hal 337Document45 pagesTugas AK Hal 337Selvy ApriliantyNo ratings yet

- 2008 (When I Have Fears and Mezzo Cammin)Document1 page2008 (When I Have Fears and Mezzo Cammin)Gavi KignerNo ratings yet

- Unit 7 Exercises To StsDocument7 pagesUnit 7 Exercises To StsHưng TrầnNo ratings yet

- Cash Receipt Template 3 WordDocument1 pageCash Receipt Template 3 WordSaqlain MalikNo ratings yet

- Old Pentland Church 2009Document17 pagesOld Pentland Church 2009digitalpastNo ratings yet

- Foreign Words and Legal Maxims by Uma GopalDocument24 pagesForeign Words and Legal Maxims by Uma GopalUma Gopal100% (1)

- Best BA Outline-HagueDocument195 pagesBest BA Outline-HagueAsia LemmonNo ratings yet

- ED Hiring GuideDocument20 pagesED Hiring Guidechokx008No ratings yet

- 中文打字机一个世纪的汉字突围史 美墨磊宁Thomas S Mullaney Z-LibraryDocument490 pages中文打字机一个世纪的汉字突围史 美墨磊宁Thomas S Mullaney Z-Libraryxxx caoNo ratings yet

- A Level Essay Questions by TopicsDocument11 pagesA Level Essay Questions by TopicsDD97No ratings yet

- 05 Alison 9001Document20 pages05 Alison 9001Thant AungNo ratings yet

- Lichauco, Picazo and Agcaoili For Plaintiffs-Appellants. Cebu City Fiscal and Quirico Del Mar For Defendants-AppelleesDocument22 pagesLichauco, Picazo and Agcaoili For Plaintiffs-Appellants. Cebu City Fiscal and Quirico Del Mar For Defendants-AppelleesSugar Fructose GalactoseNo ratings yet

- Coraline QuotesDocument2 pagesCoraline Quotes145099No ratings yet

- FINA3010 Assignment1Document5 pagesFINA3010 Assignment1Hei RayNo ratings yet

- M B ADocument98 pagesM B AGopuNo ratings yet

- 4th Chapter Business Government and Institutional BuyingDocument17 pages4th Chapter Business Government and Institutional BuyingChristine Nivera-PilonNo ratings yet

- Economics of PiggeryDocument3 pagesEconomics of Piggerysrujan NJNo ratings yet

- TIK Single Touch Payroll Processing GuideDocument23 pagesTIK Single Touch Payroll Processing GuideMargaret MationgNo ratings yet

- emPower-API-Specification-v0 90 PDFDocument26 pagesemPower-API-Specification-v0 90 PDFPape Mignane FayeNo ratings yet

- Unit-5 Pollution Notes by AmishaDocument18 pagesUnit-5 Pollution Notes by AmishaRoonah KayNo ratings yet

Income Taxation, Latest Edition, Bangawan, Rex B

Income Taxation, Latest Edition, Bangawan, Rex B

Uploaded by

Princess Salvador0 ratings0% found this document useful (0 votes)

2K views5 pagesThis course introduces students to income taxation. It focuses on preparing individual and corporate income tax returns and covers topics like the principles of taxation, taxes and classifications, taxation of individuals, corporations, estates, trusts, and partnerships. The course aims to teach students how to ethically prepare income tax returns for different taxpayers. It allocates over 50 hours to cover these tax-related topics over 11 sessions.

Original Description:

Original Title

Income Taxation, latest edition, Bangawan, Rex B

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis course introduces students to income taxation. It focuses on preparing individual and corporate income tax returns and covers topics like the principles of taxation, taxes and classifications, taxation of individuals, corporations, estates, trusts, and partnerships. The course aims to teach students how to ethically prepare income tax returns for different taxpayers. It allocates over 50 hours to cover these tax-related topics over 11 sessions.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

2K views5 pagesIncome Taxation, Latest Edition, Bangawan, Rex B

Income Taxation, Latest Edition, Bangawan, Rex B

Uploaded by

Princess SalvadorThis course introduces students to income taxation. It focuses on preparing individual and corporate income tax returns and covers topics like the principles of taxation, taxes and classifications, taxation of individuals, corporations, estates, trusts, and partnerships. The course aims to teach students how to ethically prepare income tax returns for different taxpayers. It allocates over 50 hours to cover these tax-related topics over 11 sessions.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 5

Course Name: XINTAX

Course Title: Income Taxation

Instructors: Agustin, De Vota, Mercado, Sicat and Tinio

Required Text: Income Taxation, latest edition, Bangawan, Rex B

Course Description: Introduce the students to the nature, scope and limitations of

taxation. It focuses on the preparation of income tax returns

affecting individual and corporate taxpayers. At the end of the

course, the students are expected to demonstrate competence in

the ethical preparation of income tax returns.

Topic Outline: Estimated No of Hours

1. Principles of Taxation 1.50

Nature, Scope and Limitations of Taxation

State Powers: Taxation vs. Eminent domain and police power

Basic Principles of a Sound Tax System

2. Taxes and its Classifications 1.50

Definition and nature

Classification of Taxes

Taxes and other Fees

3. Tax on Individuals 4.50

Definition and its classification

Sources of income

Categories of income

Passive income

Allowable deductions

Taxable income and tax due

Quarterly income tax on self-employed and professionals

Exempt individuals from income tax

4. Tax on Corporations 4.50

Definition and classification of corporations

Passive income

Tax rates on different classes of corporations.

Allowable deductions

Taxable income and tax due

Declaration, filing and payment of quarterly and annual corporate income tax.

Corporate exempt from income tax

5. Tax On Estate And Trust 3.00

Definition of estate and trusts.

Gross income of estate and trusts.

Allowable deductions on estate and trusts.

Consolidation of income of two or more trusts.

Computation of taxable income and tax due.

6. Tax On Partnership And Partners 3.00

Definition of general partnership and its classification

Taxation on general professional partnership

Taxation on general co-partnership

Taxation on co-ownership

7. Gross Income 3.00

Gross income from whatever sources.

Compensation income

Business income

Gains from dealings in property

Interests

Rents

Royalties

Dividends

Annuities

Prizes and Winnings

Partner’s distributive share from the net income of a general partnership

Sources of income

Exclusions from gross income

8. Special Treatments Of Fringe Benefit 3.00

Definition of fringe benefit

Computation of fringe benefits

9. Gains And Losses From Dealings In Property 6.00

Measure the gain or loss on the sale or exchange of property.

Definition of capital gains tax.

Transactions involving sale or exchange of property.

Classification of real and personal property.

Acquisition and disposition of capital assets.

Capital gains tax reported by installment.

Computation of capital gains tax.

Filing of capital gains tax.

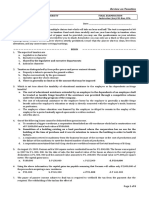

10. Processing Allowable Deductions To Individual And Corporate Taxpayers 9.00

Itemized deductions

Business expenses

Interest

Taxes

Losses

Bad debts

Depreciation

Depletion

Charitable and other Contributions

Research and Development

Pension trusts

Premium payments on health and/or hospitalization insurance

Optional Standard deductions (10% OSD)

Items not deductible.

11. Foreign Tax Credits, Their Computation And Penalties 6.00

Tax Credit

Nature of tax credit

Availability of tax credit

Computation of foreign tax credit.

Taxpayers not entitled to foreign tax credit

Penalties

Surcharges and interests.

Penalty for late filing and deficiency.

Total Sessions Express As Contact Hours 54

Recap

Identification of CPC Topics Covered in this Course Estimated

Contact Hours

Accounting 50

Marketing 1

Finance 2

Management 1

Organizational Behavior 1

Human Resource Management 1

Operations Management 1

Legal Environment of Business 6

Economics 1

Ethics 2

Information System 1

Quantitative Methods/ Statistics 1

International/ Global Dimensions of Business 2

Integrative Experience 4

Total Estimated Contact Hours 74

You might also like

- Case 29 SolutionDocument7 pagesCase 29 Solutiongators333100% (6)

- Golemans Emotional IntelligenceDocument17 pagesGolemans Emotional IntelligencePrincess SalvadorNo ratings yet

- Corporation ActivityDocument4 pagesCorporation ActivityLFGS FinalsNo ratings yet

- BUS - MATH 11 Q1 Module 3Document25 pagesBUS - MATH 11 Q1 Module 3Princess Salvador92% (12)

- Income Taxation Banggawan 2019 Ed Solution ManualDocument40 pagesIncome Taxation Banggawan 2019 Ed Solution ManualVanilla VanillaNo ratings yet

- FABM2 - Q1 - Module 1 - Statement of Financial PositionDocument24 pagesFABM2 - Q1 - Module 1 - Statement of Financial PositionPrincess Salvador67% (3)

- Income Taxation Solution Manual 2019 ED Income Taxation Solution Manual 2019 EDDocument40 pagesIncome Taxation Solution Manual 2019 ED Income Taxation Solution Manual 2019 EDSha Leen100% (2)

- INTAX Chapter 8Document15 pagesINTAX Chapter 8Levy PanganNo ratings yet

- Intro To Consumption TaxesDocument50 pagesIntro To Consumption TaxesKheianne DaveighNo ratings yet

- Chapter 14 Income Taxation For IndividualsDocument19 pagesChapter 14 Income Taxation For IndividualsShane Sigua-Salcedo100% (2)

- Chapter 1 Succession and Transfer Taxes Part 1Document2 pagesChapter 1 Succession and Transfer Taxes Part 1AngieNo ratings yet

- BUS - MATH 11 Q1 Module 4Document25 pagesBUS - MATH 11 Q1 Module 4Princess Salvador71% (14)

- BUS - MATH 11 Q1 Module 2Document28 pagesBUS - MATH 11 Q1 Module 2Princess Salvador89% (9)

- Resulting Trust Essay PlanDocument3 pagesResulting Trust Essay PlanSebastian Toh Ming WeiNo ratings yet

- POSCO ActDocument14 pagesPOSCO Actnirshan raj100% (1)

- LECTURE 10 Dealings in PropertiesDocument33 pagesLECTURE 10 Dealings in PropertiesJeane Mae Boo100% (1)

- Chap 6 MCQDocument3 pagesChap 6 MCQMahad SheikhNo ratings yet

- Chapter 5 Final Income TaxationDocument26 pagesChapter 5 Final Income TaxationJason MablesNo ratings yet

- Acct Chapter 15BDocument20 pagesAcct Chapter 15BEibra Allicra100% (1)

- Module 6 Income Taxes For Corporations - Part 1Document12 pagesModule 6 Income Taxes For Corporations - Part 1Maricar DimayugaNo ratings yet

- Taxation CH 5Document6 pagesTaxation CH 5Kristel Nuyda LobasNo ratings yet

- Regular Income Tax: Bacc8 TaxationDocument18 pagesRegular Income Tax: Bacc8 TaxationsoonsNo ratings yet

- Module 07 Introduction To Regular Income Tax 3 2Document21 pagesModule 07 Introduction To Regular Income Tax 3 2Joshua BazarNo ratings yet

- Q5 Items of Gross IncomeDocument10 pagesQ5 Items of Gross IncomeNhaj0% (2)

- Items of Gross Income Subject To RegularDocument2 pagesItems of Gross Income Subject To Regularhannah drew ovejasNo ratings yet

- Chapter 9 Other Percentage TaxesDocument56 pagesChapter 9 Other Percentage TaxesKarylle BartolayNo ratings yet

- Introduction To Regular Income TaxationDocument45 pagesIntroduction To Regular Income Taxationcarl patNo ratings yet

- Introduction To Business Taxation: Chapter 3 (Part 1)Document38 pagesIntroduction To Business Taxation: Chapter 3 (Part 1)Niño Mendoza MabatoNo ratings yet

- Operating Segment: Intermediate Accounting 3Document51 pagesOperating Segment: Intermediate Accounting 3Trisha Mae AlburoNo ratings yet

- Business & Transfer Taxation: Rex B. Banggawan, Cpa, MbaDocument38 pagesBusiness & Transfer Taxation: Rex B. Banggawan, Cpa, Mbajustine reine cornicoNo ratings yet

- Intermediate Accounting 3 ModuleDocument13 pagesIntermediate Accounting 3 ModuleShaina GarciaNo ratings yet

- Intro To Income TaxDocument4 pagesIntro To Income TaxJennifer Arcadio100% (1)

- Chapter 7 Introduction To Regular Income TaxationDocument8 pagesChapter 7 Introduction To Regular Income TaxationJason MablesNo ratings yet

- Chapter 10 Compensation IncomeDocument4 pagesChapter 10 Compensation IncomeJason MablesNo ratings yet

- 2nd Semester Income Taxation Module 10 Exercises On Gross Income - Exclusion and Inclusions Part 2Document3 pages2nd Semester Income Taxation Module 10 Exercises On Gross Income - Exclusion and Inclusions Part 2nicole tolayba100% (1)

- Taxation 2Document11 pagesTaxation 2MerEl Urbano De GuzmanNo ratings yet

- Mas 3 Module 1 Fs AnalysisDocument19 pagesMas 3 Module 1 Fs AnalysisHazel Jane EsclamadaNo ratings yet

- Week 6 - Deduction From Gross IncomeDocument5 pagesWeek 6 - Deduction From Gross IncomeJuan FrivaldoNo ratings yet

- Income Tax Computation For Corporate TaxpayersDocument79 pagesIncome Tax Computation For Corporate TaxpayersPATATASNo ratings yet

- CHAPTER 4: Differential Cost Analysis (Relevant Costing) KaebDocument6 pagesCHAPTER 4: Differential Cost Analysis (Relevant Costing) KaebMark Gelo WinchesterNo ratings yet

- Computed Using Classification and Globalization Rule: or Business Income Such As Passive IncomeDocument10 pagesComputed Using Classification and Globalization Rule: or Business Income Such As Passive IncomelcNo ratings yet

- Chapter 10 - Deductions From The Gross Income PDFDocument68 pagesChapter 10 - Deductions From The Gross Income PDFMary CuisonNo ratings yet

- Income Taxation Chapter 2Document5 pagesIncome Taxation Chapter 2Jasmine OlayNo ratings yet

- IT Tools Application in Business Orig.Document8 pagesIT Tools Application in Business Orig.Alayka Mae Bandales LorzanoNo ratings yet

- Chapter 3Document88 pagesChapter 3giezele ballatanNo ratings yet

- Management Advisory Services - Part 1Document35 pagesManagement Advisory Services - Part 1For AcadsNo ratings yet

- Transfer and Business Taxation - MIDTERMDocument14 pagesTransfer and Business Taxation - MIDTERMYvette Pauline JovenNo ratings yet

- Income Taxation Whole Book Cheat SheetDocument121 pagesIncome Taxation Whole Book Cheat SheetMaryane Angela100% (2)

- Review Business and Transfer TaxDocument201 pagesReview Business and Transfer TaxReginald ValenciaNo ratings yet

- Chapter 1 Introduction To Taxation: Chapter Overview and ObjectivesDocument30 pagesChapter 1 Introduction To Taxation: Chapter Overview and ObjectivesNoeme LansangNo ratings yet

- Intro To Regular Income TaxationDocument2 pagesIntro To Regular Income TaxationhotgirlsummerNo ratings yet

- Chapter 15 BDocument3 pagesChapter 15 BErinNo ratings yet

- Chapter 3 Introduction To Income TaxationDocument38 pagesChapter 3 Introduction To Income TaxationPearlyn Villarin100% (1)

- Tax Review - FinalsDocument8 pagesTax Review - FinalsRobert Castillo100% (2)

- Approved CAE - BSA BSMA BSAIS BSIA - ACC 311 - Clarito - Page-0055-0064Document17 pagesApproved CAE - BSA BSMA BSAIS BSIA - ACC 311 - Clarito - Page-0055-0064Peng GuinNo ratings yet

- Taxation Final Pre Board Oct 2016Document13 pagesTaxation Final Pre Board Oct 2016Maryane AngelaNo ratings yet

- Individual TaxationDocument113 pagesIndividual TaxationGemmalyn Julaton100% (7)

- Tax On CorporationDocument2 pagesTax On CorporationMervidelleNo ratings yet

- Income Tax - ElaineDocument11 pagesIncome Tax - ElaineSamsung AccountNo ratings yet

- Income Taxation Reviewer Banggawan 2021Document13 pagesIncome Taxation Reviewer Banggawan 2021Merwelyn FradesNo ratings yet

- Tax DeductionsDocument4 pagesTax DeductionsAnonymous LC5kFdtcNo ratings yet

- Chapter 10 Average and FIFO CostingDocument34 pagesChapter 10 Average and FIFO CostingJeana SegumalianNo ratings yet

- Review in Business Law and TaxationDocument4 pagesReview in Business Law and TaxationFery AnnNo ratings yet

- Accounting in ActionDocument26 pagesAccounting in Actionمنال عبد الرازقNo ratings yet

- Course Syllabus in Fundamentals of Taxation: Course Intended Learning Outcomes (Cilo) and Time AllotmentDocument8 pagesCourse Syllabus in Fundamentals of Taxation: Course Intended Learning Outcomes (Cilo) and Time AllotmentPATATASNo ratings yet

- Intermediate Course: Paper 5: Financial Accounting (One Paper: 3 Hours:100 Marks)Document9 pagesIntermediate Course: Paper 5: Financial Accounting (One Paper: 3 Hours:100 Marks)only_u_onNo ratings yet

- Office of The Dean: College and Tech-Voc DepartmentDocument6 pagesOffice of The Dean: College and Tech-Voc Departmentmyrene cerebanNo ratings yet

- CH 01Document44 pagesCH 01Sidra IqbalNo ratings yet

- Planner StickersDocument1 pagePlanner StickersPrincess SalvadorNo ratings yet

- Year at A Glance 3.5 CM - 6 RowsDocument36 pagesYear at A Glance 3.5 CM - 6 RowsPrincess SalvadorNo ratings yet

- Npa Lec Notes PrelimsDocument9 pagesNpa Lec Notes PrelimsPrincess SalvadorNo ratings yet

- Test Constructions 1 1Document4 pagesTest Constructions 1 1Princess SalvadorNo ratings yet

- Stages of Cognitive DevelopmentDocument10 pagesStages of Cognitive DevelopmentPrincess SalvadorNo ratings yet

- A5 Full Calendar Package and TemplateDocument16 pagesA5 Full Calendar Package and TemplatePrincess SalvadorNo ratings yet

- Assessment of Learning 1 Test Construction Part 2Document5 pagesAssessment of Learning 1 Test Construction Part 2Princess SalvadorNo ratings yet

- Flexible Instruction Delivery Plan Template gROUP 10Document5 pagesFlexible Instruction Delivery Plan Template gROUP 10Princess Salvador50% (2)

- Social and Environmental SafeguardsDocument14 pagesSocial and Environmental SafeguardsPrincess SalvadorNo ratings yet

- Simple and Compound InterestDocument16 pagesSimple and Compound InterestPrincess SalvadorNo ratings yet

- SEA Cold Storage - Palayan CityDocument25 pagesSEA Cold Storage - Palayan CityPrincess SalvadorNo ratings yet

- Cooperative Development Authority Cooperative Annual Performance Report (Document5 pagesCooperative Development Authority Cooperative Annual Performance Report (Princess SalvadorNo ratings yet

- QuizDocument2 pagesQuizPrincess SalvadorNo ratings yet

- Governance and Management Audit ReportDocument1 pageGovernance and Management Audit ReportPrincess SalvadorNo ratings yet

- MC2013 14 Issuance and Distribution of Share Capital Certificates of Electric Coop Pursuant To Art 133 of Ra9520 PDFDocument7 pagesMC2013 14 Issuance and Distribution of Share Capital Certificates of Electric Coop Pursuant To Art 133 of Ra9520 PDFPrincess SalvadorNo ratings yet

- Engineering Report For Single Pass Rice Mills/ Corn Mills: General InformationDocument2 pagesEngineering Report For Single Pass Rice Mills/ Corn Mills: General InformationPrincess SalvadorNo ratings yet

- Articles of Cooperation: Revised January 2020Document24 pagesArticles of Cooperation: Revised January 2020Princess SalvadorNo ratings yet

- RTWPB PresentationDocument44 pagesRTWPB PresentationPrincess SalvadorNo ratings yet

- Problem Solving Skills of Shs Students in General MathematicsDocument86 pagesProblem Solving Skills of Shs Students in General MathematicsPrincess SalvadorNo ratings yet

- MC No. 2020 005 Interim Guidelines For New and Renewal Applications For AccreditationDocument6 pagesMC No. 2020 005 Interim Guidelines For New and Renewal Applications For AccreditationPrincess SalvadorNo ratings yet

- Steering Committee: Workers ManagementDocument1 pageSteering Committee: Workers ManagementPrincess SalvadorNo ratings yet

- MAS Part II Illustrative Examples (Capital Budgeting)Document2 pagesMAS Part II Illustrative Examples (Capital Budgeting)Princess SalvadorNo ratings yet

- PhilHealth Circ2017-0003Document6 pagesPhilHealth Circ2017-0003Toche DoceNo ratings yet

- Ee NewDocument1 pageEe Newhsbibahmed091No ratings yet

- Mayank Mehta EYDocument10 pagesMayank Mehta EYyasmeenfatimak52No ratings yet

- Debate Against UA PDFDocument5 pagesDebate Against UA PDFHermione Shalimar Justice CaspeNo ratings yet

- SociolinguisticsDocument21 pagesSociolinguisticsWella WilliamsNo ratings yet

- INSTA September 2023 Current Affairs Quiz Questions 1Document10 pagesINSTA September 2023 Current Affairs Quiz Questions 1rsimback123No ratings yet

- Cat Menes - Google SearchDocument1 pageCat Menes - Google SearchShanzeh ZehraNo ratings yet

- Tugas AK Hal 337Document45 pagesTugas AK Hal 337Selvy ApriliantyNo ratings yet

- 2008 (When I Have Fears and Mezzo Cammin)Document1 page2008 (When I Have Fears and Mezzo Cammin)Gavi KignerNo ratings yet

- Unit 7 Exercises To StsDocument7 pagesUnit 7 Exercises To StsHưng TrầnNo ratings yet

- Cash Receipt Template 3 WordDocument1 pageCash Receipt Template 3 WordSaqlain MalikNo ratings yet

- Old Pentland Church 2009Document17 pagesOld Pentland Church 2009digitalpastNo ratings yet

- Foreign Words and Legal Maxims by Uma GopalDocument24 pagesForeign Words and Legal Maxims by Uma GopalUma Gopal100% (1)

- Best BA Outline-HagueDocument195 pagesBest BA Outline-HagueAsia LemmonNo ratings yet

- ED Hiring GuideDocument20 pagesED Hiring Guidechokx008No ratings yet

- 中文打字机一个世纪的汉字突围史 美墨磊宁Thomas S Mullaney Z-LibraryDocument490 pages中文打字机一个世纪的汉字突围史 美墨磊宁Thomas S Mullaney Z-Libraryxxx caoNo ratings yet

- A Level Essay Questions by TopicsDocument11 pagesA Level Essay Questions by TopicsDD97No ratings yet

- 05 Alison 9001Document20 pages05 Alison 9001Thant AungNo ratings yet

- Lichauco, Picazo and Agcaoili For Plaintiffs-Appellants. Cebu City Fiscal and Quirico Del Mar For Defendants-AppelleesDocument22 pagesLichauco, Picazo and Agcaoili For Plaintiffs-Appellants. Cebu City Fiscal and Quirico Del Mar For Defendants-AppelleesSugar Fructose GalactoseNo ratings yet

- Coraline QuotesDocument2 pagesCoraline Quotes145099No ratings yet

- FINA3010 Assignment1Document5 pagesFINA3010 Assignment1Hei RayNo ratings yet

- M B ADocument98 pagesM B AGopuNo ratings yet

- 4th Chapter Business Government and Institutional BuyingDocument17 pages4th Chapter Business Government and Institutional BuyingChristine Nivera-PilonNo ratings yet

- Economics of PiggeryDocument3 pagesEconomics of Piggerysrujan NJNo ratings yet

- TIK Single Touch Payroll Processing GuideDocument23 pagesTIK Single Touch Payroll Processing GuideMargaret MationgNo ratings yet

- emPower-API-Specification-v0 90 PDFDocument26 pagesemPower-API-Specification-v0 90 PDFPape Mignane FayeNo ratings yet

- Unit-5 Pollution Notes by AmishaDocument18 pagesUnit-5 Pollution Notes by AmishaRoonah KayNo ratings yet