Professional Documents

Culture Documents

Ty Baf Q 17 Solution

Ty Baf Q 17 Solution

Uploaded by

GANESHOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ty Baf Q 17 Solution

Ty Baf Q 17 Solution

Uploaded by

GANESHCopyright:

Available Formats

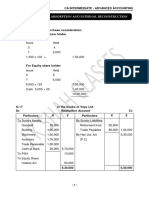

Q.

17

You can buy back 10,000 shares of Rs. 100 each at Rs. 152 per share.

Date Particulars Debit Rs. Credit Rs

1 Due: General Reserve 8,00,000

Equity Share Capital A/c (10,000*100) Dr. 10,00,000 Profit & Loss 4,00,000

Premium on Buyback A/c (10,000*52) Dr. 5,20,000 Security Premium 3,20,000

To Equity Shareholder A/c 15,20,000

No of Shares 10,000

2.a. Arrangement: (Premium): Buyback price 152

Security Premium A/c Dr. 3,20,000 Face Value 100

General Reserve A/c Dr. 2,00,000 Premiume 52 Loss Dr.

To Premium on buyback A/c 5,20,000

Premium Shares

2.b. Arrangement: (CRR): 5,20,000 10,00,000

General Reserve A/c Dr. 6,00,000 Security Premium 3,20,000 GR 6,00,000

Profit & Loss A/c Dr. 4,00,000 General Reserve 2,00,000 P&L 4,00,000

To CRR A/c 10,00,000

Overdraft:

3 Bank Overdraft used for shortage of fund: Bank balance 4,00,000

Cash/Bank A/c Dr. 11,20,000 Received Or paid Nil

To Bank Overdraft A/c 11,20,000 Total Bank Balance 4,00,000

Required for Buyback -15,20,000

4 Payment: Shortage -11,20,000

Equity Shareholder A/c Dr. 15,20,000

To Cash/bank A/c 15,20,000

You might also like

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- ProMed (Apr 09)Document8 pagesProMed (Apr 09)GANESHNo ratings yet

- Managing Cash - What A Difference The Days MakeDocument4 pagesManaging Cash - What A Difference The Days MakeGANESHNo ratings yet

- QUESTION PAPER 36195 (Solution)Document17 pagesQUESTION PAPER 36195 (Solution)Faizu KhamNo ratings yet

- Chapter - 2 BBA Sem 3 Buy-Back of Equity Shares (Que. 3)Document2 pagesChapter - 2 BBA Sem 3 Buy-Back of Equity Shares (Que. 3)shubham ThakerNo ratings yet

- Solution Ultimate Sample Paper 2Document7 pagesSolution Ultimate Sample Paper 2Nitin KumarNo ratings yet

- Xii Accountancy Question Bank 1Document46 pagesXii Accountancy Question Bank 1KavoNo ratings yet

- XII ACCOUNTANCY SET-2 Marking Scheme Ist Pre Board 2023-24-1Document9 pagesXII ACCOUNTANCY SET-2 Marking Scheme Ist Pre Board 2023-24-1Riddhima Murarka50% (2)

- Admission of A Parnter - Work Sheet No - 2Document7 pagesAdmission of A Parnter - Work Sheet No - 2BLUE SKY GAMINGNo ratings yet

- Bhaskar AssignmentDocument2 pagesBhaskar Assignment2009silmshady6709No ratings yet

- QUESTION PAPER 1 (Solution) : Q.1 A) Multiple Choice QuestionsDocument13 pagesQUESTION PAPER 1 (Solution) : Q.1 A) Multiple Choice QuestionsSiddharth VoraNo ratings yet

- Ans. Chapter-9Document6 pagesAns. Chapter-9upscmindworksNo ratings yet

- BuyBack of Shares PQ SolDocument11 pagesBuyBack of Shares PQ SolKaran MokhaNo ratings yet

- Internal Reconstruction - HomeworkDocument25 pagesInternal Reconstruction - HomeworkYash ShewaleNo ratings yet

- Cbse cl12 Ead Accountancy Answers To Sample Paper 6Document15 pagesCbse cl12 Ead Accountancy Answers To Sample Paper 6amaankhan828768No ratings yet

- 637617309804853146SM Session10Document3 pages637617309804853146SM Session10kreshmith2No ratings yet

- 11 Redemption of Preference SharesDocument6 pages11 Redemption of Preference SharesRohith KumarNo ratings yet

- Internal Reconstruction Part-IIDocument13 pagesInternal Reconstruction Part-IIINTER SMARTIANSNo ratings yet

- Caa Assignment SolutionsDocument39 pagesCaa Assignment Solutionschikanesakshi2001No ratings yet

- Solution Ultimate Sample Paper 4Document5 pagesSolution Ultimate Sample Paper 4Karthick KarthickNo ratings yet

- Problem No.: 1 (March 2018) Assets : Solution.: - Capital Reduction A/CDocument3 pagesProblem No.: 1 (March 2018) Assets : Solution.: - Capital Reduction A/CAnshrNo ratings yet

- Xi See Acc 2021 Set 2 MsDocument5 pagesXi See Acc 2021 Set 2 Mss1672snehil6353No ratings yet

- MS Accountancy Set 2Document9 pagesMS Accountancy Set 2Tanisha TibrewalNo ratings yet

- Answer Key - 1 TermDocument9 pagesAnswer Key - 1 TermsamayaksahuNo ratings yet

- 8 BuyBack of SharesDocument20 pages8 BuyBack of SharesNIKHIL MITTALNo ratings yet

- Redemption of Preference SharesDocument15 pagesRedemption of Preference SharesVasu JainNo ratings yet

- Team 4 FaciDocument14 pagesTeam 4 FaciSherryWooNo ratings yet

- Redemption of Debentures FA - III1644399049Document48 pagesRedemption of Debentures FA - III1644399049Shaista SultanaNo ratings yet

- Introduction To Financial Accounting: Suggested Answers Foundation Examinations - Spring 2011Document5 pagesIntroduction To Financial Accounting: Suggested Answers Foundation Examinations - Spring 2011adnanNo ratings yet

- Ts Grewal Solutions Class 12 Accountancy Volume 2 Chapter 9Document6 pagesTs Grewal Solutions Class 12 Accountancy Volume 2 Chapter 9samuraisurya58No ratings yet

- Conversion or Sale of Partnership Firm Into Limited CompanyDocument24 pagesConversion or Sale of Partnership Firm Into Limited CompanyMadhav TailorNo ratings yet

- Accountancy Set 3 Ms - DocxDocument7 pagesAccountancy Set 3 Ms - DocxKunal GauravNo ratings yet

- Hsslive Xii Acc 3 Admission of A Partner KeyDocument8 pagesHsslive Xii Acc 3 Admission of A Partner KeyShinu ShinadNo ratings yet

- CA Inter Accounts A MTP 1 Nov 2022Document13 pagesCA Inter Accounts A MTP 1 Nov 2022smartshivenduNo ratings yet

- Ledger Book Question SolutionDocument78 pagesLedger Book Question SolutionAKSHAY KUMAR GUPTANo ratings yet

- March 2023 Answer Key CorporateaccountingDocument11 pagesMarch 2023 Answer Key Corporateaccountinghisarahhh4No ratings yet

- Bv2018 Revised Conceptual FrameworkDocument18 pagesBv2018 Revised Conceptual FrameworkTeneswari RadhaNo ratings yet

- Internal Reconstruction PQ SolDocument17 pagesInternal Reconstruction PQ SolKaran MokhaNo ratings yet

- Class 11 Accounts SP 2 Answer KeyDocument18 pagesClass 11 Accounts SP 2 Answer KeyUdyamGNo ratings yet

- Final Accounts 1. As Per Schedule III of Companies Act 2013, Prepare Financial Statement For Gillette India PVT LTDDocument3 pagesFinal Accounts 1. As Per Schedule III of Companies Act 2013, Prepare Financial Statement For Gillette India PVT LTDermiasNo ratings yet

- Marking Scheme: PRE - BOARD-2 (2023 - 2024)Document11 pagesMarking Scheme: PRE - BOARD-2 (2023 - 2024)Kaustav DasNo ratings yet

- Hsslive Xii Acc 4 Retiremnet and Death of A Partner KeyDocument6 pagesHsslive Xii Acc 4 Retiremnet and Death of A Partner Keypirated wallahNo ratings yet

- TS Grewal Solutions Class 12 Accountancy Volume 1 Chapter 7 - Dissolution of Partnership FirmDocument17 pagesTS Grewal Solutions Class 12 Accountancy Volume 1 Chapter 7 - Dissolution of Partnership FirmMayank Garange100% (2)

- 5 Amalgamation, Absorption and External Reconstruction - HomeworkDocument21 pages5 Amalgamation, Absorption and External Reconstruction - HomeworkYash ShewaleNo ratings yet

- Accountancy-MS 23-24Document10 pagesAccountancy-MS 23-24Ashutosh SinghNo ratings yet

- Accountancy MSDocument11 pagesAccountancy MSmansoorbariNo ratings yet

- 5 6084915055709651012Document8 pages5 6084915055709651012Ajit Yadav100% (1)

- COGS CasesDocument24 pagesCOGS CasesPrabhat KharelNo ratings yet

- Set - 1 Acc MS PB12023-24Document10 pagesSet - 1 Acc MS PB12023-24aamiralishiasbackup1No ratings yet

- MS - Accountancy - 12-Practice Paper-1Document7 pagesMS - Accountancy - 12-Practice Paper-1Arun kumarNo ratings yet

- Debenture 10 Years ExplanationDocument17 pagesDebenture 10 Years Explanationoldtaxi9No ratings yet

- 7.8 BCHNDocument7 pages7.8 BCHNChiêu HạNo ratings yet

- Accounts Solution Mock 2 12-11Document21 pagesAccounts Solution Mock 2 12-11Foundation Group tuitionNo ratings yet

- Accounting-Bonus Issue and Right-Issue-1653399117076303Document17 pagesAccounting-Bonus Issue and Right-Issue-1653399117076303Badhrinath ShanmugamNo ratings yet

- Single QuestionsDocument5 pagesSingle QuestionsEduskill Learning CentreNo ratings yet

- Answer Keys & Marking Scheme Acc XiiDocument8 pagesAnswer Keys & Marking Scheme Acc XiiGHOST FFNo ratings yet

- 17269pe2 Sugg June09 1 PDFDocument22 pages17269pe2 Sugg June09 1 PDFSahil GoyalNo ratings yet

- Mgt402 Assigenment Result Fall2009Document5 pagesMgt402 Assigenment Result Fall2009maqsoom471No ratings yet

- Consolidated Financial Statements IFRS 10Document12 pagesConsolidated Financial Statements IFRS 10m7md.nagaNo ratings yet

- Pass The Journal Entries For The Following Transactions On The Dissolution of The Firm of P and Q After Various Assets - AccountancyDocument3 pagesPass The Journal Entries For The Following Transactions On The Dissolution of The Firm of P and Q After Various Assets - Accountancydhanya1995No ratings yet

- 637617311650478425SM Session12Document4 pages637617311650478425SM Session12kreshmith2No ratings yet

- Accountancy 2023-24 MSDocument11 pagesAccountancy 2023-24 MSirfanoushad15No ratings yet

- Chapter 1 Case Study Case StudyDocument1 pageChapter 1 Case Study Case StudyGANESHNo ratings yet

- Little Champs PortfolioDocument5 pagesLittle Champs PortfolioGANESHNo ratings yet

- Law - GK Law - GK Law - GK Law - GK: Ma - Vs Ma - Vs Ma - Vs Ma - Vs Ma - VsDocument3 pagesLaw - GK Law - GK Law - GK Law - GK: Ma - Vs Ma - Vs Ma - Vs Ma - Vs Ma - VsGANESHNo ratings yet

- Performance of Select Stocks Over Last 20 Years (2000-2020)Document12 pagesPerformance of Select Stocks Over Last 20 Years (2000-2020)GANESHNo ratings yet

- Ganesh Jain: Personal Information AcademicsDocument1 pageGanesh Jain: Personal Information AcademicsGANESHNo ratings yet

- Batch2 Group3 IMDocument4 pagesBatch2 Group3 IMGANESHNo ratings yet

- q17 Format PDFDocument1 pageq17 Format PDFGANESHNo ratings yet

- IssueBoardingPass PFDocument1 pageIssueBoardingPass PFGANESHNo ratings yet

- Sector Fund - Risk or Opportunity For InvestorsDocument46 pagesSector Fund - Risk or Opportunity For InvestorsGANESHNo ratings yet

- Sector Fund - Risk or Opportunity For InvestorsDocument46 pagesSector Fund - Risk or Opportunity For InvestorsGANESHNo ratings yet

- Smart CitiesDocument10 pagesSmart CitiesGANESHNo ratings yet

- S.K Somaiya College of Arts, Science and Commerce: Submitted For The Partial Fulfillment of Degree of B.M.SDocument75 pagesS.K Somaiya College of Arts, Science and Commerce: Submitted For The Partial Fulfillment of Degree of B.M.SGANESHNo ratings yet

- S.K Somaiya College of Arts, Science and Commerce: Submitted For The Partial Fulfillment of Degree of B.M.SDocument7 pagesS.K Somaiya College of Arts, Science and Commerce: Submitted For The Partial Fulfillment of Degree of B.M.SGANESHNo ratings yet

- Https WWW - Irctc.co - in Eticketing PrintTicketDocument2 pagesHttps WWW - Irctc.co - in Eticketing PrintTicketGANESHNo ratings yet

- S.K Somaiya College of Arts, Science and Commerce: Submitted For The Partial Fulfillment of Degree of B.M.SDocument7 pagesS.K Somaiya College of Arts, Science and Commerce: Submitted For The Partial Fulfillment of Degree of B.M.SGANESHNo ratings yet