Professional Documents

Culture Documents

Bureau of Internal Revenue: CS Form No. 9

Bureau of Internal Revenue: CS Form No. 9

Uploaded by

lili cruzOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bureau of Internal Revenue: CS Form No. 9

Bureau of Internal Revenue: CS Form No. 9

Uploaded by

lili cruzCopyright:

Available Formats

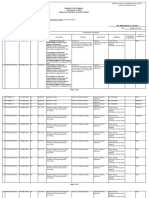

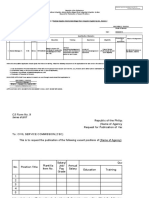

CS Form No.

9 Electronic copy to be submitted to the CSC FO must be in MS Excel

Revised 2018 format

Republic of the Philippines

BUREAU OF INTERNAL REVENUE

Request for Publication of Vacant Positions

To: CIVIL SERVICE COMMISSION (CSC)

We hereby request the publication of the following vacant positions, which are authorized to be filled, at the BUREAU OF INTERNAL REVENUE in the CSC website:

CECILIA C. FELIPE

HRMO

Date: July 15, 2020

Qualification Standards

Position Title Salary/

Monthly

No. (Parenthetical Title, if Plantilla Item No. Job/ Pay Competency Place of Assignment

Salary Education Training Experience Eligibility

applicable) Grade (if applicable)

BS COMMERCE /BSBA ACCOUNTING OR

1 REVENUE OFFICER I (ASSESSMENT) BIRB-REVO1-1494-2000 11 22316 BACHELOR OF LAWS WITH 18 UNITS IN NONE REQUIRED NONE REQUIRED RA1080 (CPA/BAR) N/A RDO 75 - ZARRAGA, ILOILO

ACCOUNTING

BSBA/BSC/BA WITH 18 UNITS IN ACCOUNTING OR

REVENUE OFFICER I (TAXPAYERS ANY BACHELOR'S DEGREE WITH MASTER'S

2 BIRB-REVO1-1505-2000 11 22316 NONE REQUIRED NONE REQUIRED CSP/2ND LEVEL ELIGIBILITY N/A RDO 74 - ILOILO CITY

ASSISTANCE) DEGREE IN BUSINESS ADMINISTRATION/

MANAGEMENT/ ACCOUNTANCY/ TAXATION

BSBA/BSC/BA WITH 18 UNITS IN ACCOUNTING OR

REVENUE OFFICER I (DOCUMENT ANY BACHELOR'S DEGREE WITH MASTER'S DOCUMENT PROCESSING DIVISION

3 BIRB-REVO1-163-2018 11 22316 NONE REQUIRED NONE REQUIRED CSP/2ND LEVEL ELIGIBILITY N/A

PROCESSING) DEGREE IN BUSINESS ADMINISTRATION/ RR-11, ILOILO CITY

MANAGEMENT/ ACCOUNTANCY/ TAXATION

Completion of two years studies in College or RELEVANT MC 11,

Administrative Assistant III (Computer ASSESSMENT DIVISION

4 BIRB-ADAS3-719-2005 9 18784 High School Graduate with relevant 4 HOURS OF RELEVANT TRAINING 1 YEAR OF RELEVANT EXPERIENCE S.96/CSSP/1ST LEVEL N/A

Operator II) RR-11, ILOILO CITY

vocational/trade courses ELIGIBILITY

Completion of two years studies in College or

Administrative Assistant II (Data Relevant MC 11, DOCUMENT PROCESSING DIVISION

5 BIRB-ADAS2-102-2014 8 17505 High School Graduate with relevant 4 hours of relevant training 1 year of relevant experience N/A

Controller II) s.96/CSSP/1st level eligibility RR-11, ILOILO CITY

vocational/trade courses

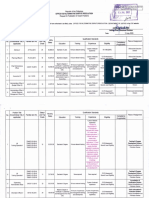

BACHELOR'S DEGREE IN BUSINESS

ADMINISTRATION/COMMERCE WITH 18 UNITS IN

ACCOUNTING and/or TAXATION or BACHELOR'S

6 REVENUE OFFICER I (COLLECTION) BIRB-REVO1-1531-2000 11 22316 DEGREE IN ACCOUNTANCY OR ANY BACHELOR'S NONE REQUIRED NONE REQUIRED CSP/2ND LEVEL ELIGIBILITY N/A RDO 75 - ZARRAGA, ILOILO

DEGREE WITH MASTER'S DEGREE IN BUSINESS

ADMINISTRATION/ MANAGEMENT/

ACCOUNTANCY/ TAXATION

7 Computer Maintenance Technologist II BIR-CTMT2-70-2014 15 32053 BACHELOR'S DEGREE RELEVANT TO THE JOB 4 HOURS OF RELEVANT TRAINING 1 YEAR OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RR7A OFFICE OF THE REGIONAL DIRECTOR

8 Information Systems Analyst II BIRB-INFOSA2-62-2014 16 35106 BACHELOR'S DEGREE RELEVANT TO THE JOB 4 HOURS OF RELEVANT TRAINING 1 YEAR OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RR7A ORD

9 Chief Revenue Officer II BIRB-CRO2-124-2014 21 59353 BACHELOR'S DEGREE RELEVANT TO THE JOB 8 HOURS OF RELEVANT TRAINING 2 YEARS OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RR7A ASSESSMENT DIVISION

10 Chief Revenue Officer II BIRB-CRO2-125-2014 21 59353 BACHELOR'S DEGREE RELEVANT TO THE JOB 8 HOURS OF RELEVANT TRAINING 2 YEARS OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RR7A ASSESSMENT DIVISION

BSBA/BSC/BA WITH 18 UNITS IN ACCOUNTING OR

Revenue Officer IV (DOCUMENT ANY BACHELOR'S DEGREE WITH MASTER'S

11 BIRB-REVO4-166-2000 19 46791 8 HOURS OF RELEVANT TRAINING 3 YEARS OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RR7A ASSESSMENT DIVISION

PROCESSING) DEGREE IN BUSINESS ADMINISTRATION/

MANAGEMENT/ ACCOUNTANCY/ TAXATION

BSBA/BSC/BA WITH 18 UNITS IN ACCOUNTING OR

Revenue Officer IV (DOCUMENT ANY BACHELOR'S DEGREE WITH MASTER'S

12 BIRB-REVO4-167-2000 19 46791 8 HOURS OF RELEVANT TRAINING 3 YEARS OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RR7A ASSESSMENT DIVISION

PROCESSING) DEGREE IN BUSINESS ADMINISTRATION/

MANAGEMENT/ ACCOUNTANCY/ TAXATION

BS COMMERCE /BSBA ACCOUNTING OR

13 Revenue Officer III (ASSESSMENT) BIRB-REVO3-289-2000 16 35106 BACHELOR OF LAWS WITH 18 UNITS IN 4 HOURS OF RELEVANT TRAINING 2 YEARS OF RELEVANT EXPERIENCE RA1080 (CPA/BAR) N/A RR7A ASSESSMENT DIVISION

ACCOUNTING

BS COMMERCE /BSBA ACCOUNTING OR

14 Revenue Officer III (ASSESSMENT) BIRB-REVO3-290-2000 16 35106 BACHELOR OF LAWS WITH 18 UNITS IN 4 HOURS OF RELEVANT TRAINING 2 YEARS OF RELEVANT EXPERIENCE RA1080 (CPA/BAR) N/A RR7A ASSESSMENT DIVISION

ACCOUNTING

BS COMMERCE /BSBA ACCOUNTING OR

15 Revenue Officer III (ASSESSMENT) BIRB-REVO3-291-2000 16 35106 BACHELOR OF LAWS WITH 18 UNITS IN 4 HOURS OF RELEVANT TRAINING 2 YEARS OF RELEVANT EXPERIENCE RA1080 (CPA/BAR) N/A RR7A ASSESSMENT DIVISION

ACCOUNTING

BS COMMERCE /BSBA ACCOUNTING OR

16 Revenue Officer III (ASSESSMENT) BIRB-REVO3-292-2000 16 35106 BACHELOR OF LAWS WITH 18 UNITS IN 4 HOURS OF RELEVANT TRAINING 2 YEARS OF RELEVANT EXPERIENCE RA1080 (CPA/BAR) N/A RR7A ASSESSMENT DIVISION

ACCOUNTING

BS COMMERCE /BSBA ACCOUNTING OR

17 Revenue Officer III (ASSESSMENT) BIRB-REVO3-293-2000 16 35106 BACHELOR OF LAWS WITH 18 UNITS IN 4 HOURS OF RELEVANT TRAINING 2 YEARS OF RELEVANT EXPERIENCE RA1080 (CPA/BAR) N/A RR7A ASSESSMENT DIVISION

ACCOUNTING

BS COMMERCE /BSBA ACCOUNTING OR

18 Revenue Officer III (ASSESSMENT) BIRB-REVO2-407-2000 16 35106 BACHELOR OF LAWS WITH 18 UNITS IN 4 HOURS OF RELEVANT TRAINING 2 YEARS OF RELEVANT EXPERIENCE RA1080 (CPA/BAR) N/A RR7A ASSESSMENT DIVISION

ACCOUNTING

BS COMMERCE /BSBA ACCOUNTING OR

19 Revenue Officer IV (ASSESSMENT) BIRB-REVO4-279-2014 19 46791 BACHELOR OF LAWS WITH 18 UNITS IN 8 HOURS OF RELEVANT TRAINING 3 YEARS OF RELEVANT EXPERIENCE RA1080 (CPA/BAR) N/A RR7A VATAS

ACCOUNTING

BS COMMERCE /BSBA ACCOUNTING OR

20 Revenue Officer II (ASSESSMENT) BIRB-REVO2-946-2000 13 26754 BACHELOR OF LAWS WITH 18 UNITS IN NONE REQUIRED 1 YEAR OF RELEVANT EXPERIENCE RA1080 (CPA/BAR) N/A RR7A VATAS

ACCOUNTING

BS COMMERCE /BSBA ACCOUNTING OR

21 Revenue Officer II (ASSESSMENT) BIRB-REVO2-1155-2000 13 26754 BACHELOR OF LAWS WITH 18 UNITS IN NONE REQUIRED 1 YEAR OF RELEVANT EXPERIENCE RA1080 (CPA/BAR) N/A RR7A VATAS

ACCOUNTING

22 Chief Revenue Officer II BIRB-CRO2-145-2014 21 59353 BACHELOR'S DEGREE RELEVANT TO THE JOB 8 HOURS OF RELEVANT TRAINING 2 YEARS OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RR7A COLLECTION DIVISION

23 Chief Revenue Officer II BIRB-CRO2-146-2014 21 59353 BACHELOR'S DEGREE RELEVANT TO THE JOB 8 HOURS OF RELEVANT TRAINING 2 YEARS OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RR7A COLLECTION DIVISION

24 Chief Revenue Officer II BIRB-CRO2-147-2014 21 59353 BACHELOR'S DEGREE RELEVANT TO THE JOB 8 HOURS OF RELEVANT TRAINING 2 YEARS OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RR7A COLLECTION DIVISION

25 CHIEF REVENUE OFFICER II BIRB-CRO2-21-2016 21 59353 BACHELOR'S DEGREE RELEVANT TO THE JOB 8 HOURS OF RELEVANT TRAINING 2 YEARS OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RR7A AMS

BACHELOR'S DEGREE IN BUSINESS

ADMINISTRATION/COMMERCE WITH 18 UNITS IN

ACCOUNTING and/or TAXATION or BACHELOR'S

26 Revenue Officer III (COLLECTION) BIRB-REVO3-848-2000 16 35106 DEGREE IN ACCOUNTANCY OR ANY BACHELOR'S 8 HOURS OF RELEVANT TRAINING 2 YEARS OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RR7A AMS

DEGREE WITH MASTER'S DEGREE IN BUSINESS

ADMINISTRATION/ MANAGEMENT/

ACCOUNTANCY/ TAXATION

BACHELOR'S DEGREE IN BUSINESS

ADMINISTRATION/COMMERCE WITH 18 UNITS IN

ACCOUNTING and/or TAXATION or BACHELOR'S

27 Revenue Officer II (COLLECTION) BIRB-REVO2-1609-2014 13 26754 DEGREE IN ACCOUNTANCY OR ANY BACHELOR'S 4 HOURS OF RELEVANT TRAINING 1 YEAR OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RR7A AMS

DEGREE WITH MASTER'S DEGREE IN BUSINESS

ADMINISTRATION/ MANAGEMENT/

ACCOUNTANCY/ TAXATION

BACHELOR'S DEGREE IN BUSINESS

ADMINISTRATION/COMMERCE WITH 18 UNITS IN

ACCOUNTING and/or TAXATION or BACHELOR'S

28 Revenue Officer II (COLLECTION) BIRB-REVO2-1171-2000 13 26754 DEGREE IN ACCOUNTANCY OR ANY BACHELOR'S 4 HOURS OF RELEVANT TRAINING 1 YEAR OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RR7A AMS

DEGREE WITH MASTER'S DEGREE IN BUSINESS

ADMINISTRATION/ MANAGEMENT/

ACCOUNTANCY/ TAXATION

BACHELOR'S DEGREE IN BUSINESS

ADMINISTRATION/COMMERCE WITH 18 UNITS IN

ACCOUNTING and/or TAXATION or BACHELOR'S

29 Revenue Officer II (COLLECTION) BIRB-REVO2-1205-2000 13 26754 DEGREE IN ACCOUNTANCY OR ANY BACHELOR'S 4 HOURS OF RELEVANT TRAINING 1 YEAR OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RR7A AMS

DEGREE WITH MASTER'S DEGREE IN BUSINESS

ADMINISTRATION/ MANAGEMENT/

ACCOUNTANCY/ TAXATION

BACHELOR'S DEGREE IN BUSINESS

ADMINISTRATION/COMMERCE WITH 18 UNITS IN

ACCOUNTING and/or TAXATION or BACHELOR'S

30 Revenue Officer II (COLLECTION) BIRB-REVO2-256-2014 13 26754 DEGREE IN ACCOUNTANCY OR ANY BACHELOR'S 4 HOURS OF RELEVANT TRAINING 1 YEAR OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RR7A AMS

DEGREE WITH MASTER'S DEGREE IN BUSINESS

ADMINISTRATION/ MANAGEMENT/

ACCOUNTANCY/ TAXATION

31 Attorney III BIRB-ATY3-53-2000 21 59353 BACHELOR OF LAWS 4 HOURS OF RELEVANT TRAINING 1 YEAR OF RELEVANT EXPERIENCE RA1080/BAR N/A RR7A LEGAL DIVISION

32 Administrative Officer V (Cashier III) BIRB-ADOF5-142-2005 18 42159 BACHELOR'S DEGREE RELEVANT TO THE JOB 8 HOURS OF RELEVANT TRAINING 2 YEARS OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RR7A AHRMD

33 Administrative Officer V (Supply Officer III) BIRB-ADOF5-144-2005 18 42159 BACHELOR'S DEGREE RELEVANT TO THE JOB 8 HOURS OF RELEVANT TRAINING 2 YEARS OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RR7A AHRMD

Administrative Officer V (Human Resource

34 BIRB-ADOF5-59-2014 18 42159 BACHELOR'S DEGREE RELEVANT TO THE JOB 8 HOURS OF RELEVANT TRAINING 2 YEARS OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RR7A AHRMD

Management Officer III)

Administrative Officer V (Human Resource

35 BIRB-ADOF5-60-2014 18 42159 BACHELOR'S DEGREE RELEVANT TO THE JOB 8 HOURS OF RELEVANT TRAINING 2 YEARS OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RR7A AHRMD

Management Officer III)

Administrative Officer III (Records Officer

36 BIRB-ADOF3-60-2005 14 29277 BACHELOR'S DEGREE RELEVANT TO THE JOB 4 HOURS OF RELEVANT TRAINING 1 YEAR OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RR7A AHRMD

II)

37 Administrative Officer III (Supply Officer II) BIRB-ADOF3-61-2005 14 29277 BACHELOR'S DEGREE RELEVANT TO THE JOB 4 HOURS OF RELEVANT TRAINING 1 YEAR OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RR7A AHRMD

Administrative Officer II (Human Resource

38 BIRB-ADOF2-53-2014 11 22316 BACHELOR'S DEGREE RELEVANT TO THE JOB NONE REQUIRED NONE REQUIRED CSP/2ND LEVEL ELIGIBILITY N/A RR7A AHRMD

Management Officer I)

39 Intelligence Officer III BIRB-INTELO3-10-2000 18 42159 BACHELOR'S DEGREE 8 HOURS OF RELEVANT TRAINING 2 YEARS OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RR7A RID

40 Special Investigator III BIRB-SPI3-16-2000 18 42159 BACHELOR'S DEGREE RELEVANT TO THE JOB 8 HOURS OF RELEVANT TRAINING 2 YEARS OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RR7A RID

BSBA/BSC/BA WITH 18 UNITS IN ACCOUNTING OR

Revenue Officer IV (DOCUMENT ANY BACHELOR'S DEGREE WITH MASTER'S

41 BIRB-REVO4-396-2000 19 46791 8 HOURS OF RELEVANT TRAINING 3 YEARS OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RR7A DPD

PROCESSING) DEGREE IN BUSINESS ADMINISTRATION/

MANAGEMENT/ ACCOUNTANCY/ TAXATION

42 Information Systems Analyst II BIRB-INFOSA2-47-2014 16 35106 BACHELOR'S DEGREE RELEVANT TO THE JOB 4 HOURS OF RELEVANT TRAINING 1 YEAR OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RR7A DPD

BSBA/BSC/BA WITH 18 UNITS IN ACCOUNTING OR

Revenue Officer III (DOCUMENT ANY BACHELOR'S DEGREE WITH MASTER'S

43 BIRB-REVO3-66-2014 16 35106 4 HOURS OF RELEVANT TRAINING 2 YEARS OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RR7A DPD

PROCESSING) DEGREE IN BUSINESS ADMINISTRATION/

MANAGEMENT/ ACCOUNTANCY/ TAXATION

44 Administrative Officer IV BIRB-ADOF4-10-2014 15 32053 BACHELOR'S DEGREE RELEVANT TO THE JOB 4 HOURS OF RELEVANT TRAINING 1 YEAR OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RR7A DPD

Administrative Officer III (Records Officer

45 BIRB-ADOF3-21-2014 14 29277 BACHELOR'S DEGREE RELEVANT TO THE JOB 4 HOURS OF RELEVANT TRAINING 1 YEAR OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RR7A DPD

II)

Administrative Officer III (Records Officer

46 BIRB-ADOF3-22-2014 14 29277 BACHELOR'S DEGREE RELEVANT TO THE JOB 4 HOURS OF RELEVANT TRAINING 1 YEAR OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RR7A DPD

II)

Administrative Officer III (Records Officer

47 BIRB-ADOF3-23-2014 14 29277 BACHELOR'S DEGREE RELEVANT TO THE JOB 4 HOURS OF RELEVANT TRAINING 1 YEAR OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RR7A DPD

II)

Administrative Officer III (Records Officer

48 BIRB-ADOF3-24-2014 14 29277 BACHELOR'S DEGREE RELEVANT TO THE JOB 4 HOURS OF RELEVANT TRAINING 1 YEAR OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RR7A DPD

II)

Administrative Officer III (Records Officer

49 BIRB-ADOF3-25-2014 14 29277 BACHELOR'S DEGREE RELEVANT TO THE JOB 4 HOURS OF RELEVANT TRAINING 1 YEAR OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RR7A DPD

II)

Administrative Officer III (Records Officer

50 BIRB-ADOF3-26-2014 14 29277 BACHELOR'S DEGREE RELEVANT TO THE JOB 4 HOURS OF RELEVANT TRAINING 1 YEAR OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RR7A DPD

II)

Administrative Officer III (Records Officer

51 BIRB-ADOF3-27-2014 14 29277 BACHELOR'S DEGREE RELEVANT TO THE JOB 4 HOURS OF RELEVANT TRAINING 1 YEAR OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RR7A DPD

II)

BSBA/BSC/BA WITH 18 UNITS IN ACCOUNTING OR

Revenue Officer II (DOCUMENT ANY BACHELOR'S DEGREE WITH MASTER'S

52 BIRB-REVO2-45-2018 13 26754 NONE REQUIRED 1 YEAR OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RR7A DPD

PROCESSING) DEGREE IN BUSINESS ADMINISTRATION/

MANAGEMENT/ ACCOUNTANCY/ TAXATION

BSBA/BSC/BA WITH 18 UNITS IN ACCOUNTING OR

Revenue Officer II (DOCUMENT ANY BACHELOR'S DEGREE WITH MASTER'S

53 BIRB-REVO2-46-2018 13 26754 NONE REQUIRED 1 YEAR OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RR7A DPD

PROCESSING) DEGREE IN BUSINESS ADMINISTRATION/

MANAGEMENT/ ACCOUNTANCY/ TAXATION

BSBA/BSC/BA WITH 18 UNITS IN ACCOUNTING OR

Revenue Officer II (DOCUMENT ANY BACHELOR'S DEGREE WITH MASTER'S

54 BIRB-REVO2-47-2018 13 26754 NONE REQUIRED 1 YEAR OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RR7A DPD

PROCESSING) DEGREE IN BUSINESS ADMINISTRATION/

MANAGEMENT/ ACCOUNTANCY/ TAXATION

BSBA/BSC/BA WITH 18 UNITS IN ACCOUNTING OR

Revenue Officer II (DOCUMENT ANY BACHELOR'S DEGREE WITH MASTER'S

55 BIRB-REVO2-48-2018 13 26754 NONE REQUIRED 1 YEAR OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RR7A DPD

PROCESSING) DEGREE IN BUSINESS ADMINISTRATION/

MANAGEMENT/ ACCOUNTANCY/ TAXATION

BSBA/BSC/BA WITH 18 UNITS IN ACCOUNTING OR

Revenue Officer II (DOCUMENT ANY BACHELOR'S DEGREE WITH MASTER'S

56 BIRB-REVO2-49-2018 13 26754 NONE REQUIRED 1 YEAR OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RR7A DPD

PROCESSING) DEGREE IN BUSINESS ADMINISTRATION/

MANAGEMENT/ ACCOUNTANCY/ TAXATION

BSBA/BSC/BA WITH 18 UNITS IN ACCOUNTING OR

Revenue Officer II (DOCUMENT ANY BACHELOR'S DEGREE WITH MASTER'S

57 BIRB-REVO2-50-2018 13 26754 NONE REQUIRED 1 YEAR OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RR7A DPD

PROCESSING) DEGREE IN BUSINESS ADMINISTRATION/

MANAGEMENT/ ACCOUNTANCY/ TAXATION

BSBA/BSC/BA WITH 18 UNITS IN ACCOUNTING OR

Revenue Officer II (DOCUMENT ANY BACHELOR'S DEGREE WITH MASTER'S

58 BIRB-REVO2-51-2018 13 26754 NONE REQUIRED 1 YEAR OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RR7A DPD

PROCESSING) DEGREE IN BUSINESS ADMINISTRATION/

MANAGEMENT/ ACCOUNTANCY/ TAXATION

BSBA/BSC/BA WITH 18 UNITS IN ACCOUNTING OR

Revenue Officer II (DOCUMENT ANY BACHELOR'S DEGREE WITH MASTER'S

59 BIRB-REVO2-52-2018 13 26754 NONE REQUIRED 1 YEAR OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RR7A DPD

PROCESSING) DEGREE IN BUSINESS ADMINISTRATION/

MANAGEMENT/ ACCOUNTANCY/ TAXATION

BSBA/BSC/BA WITH 18 UNITS IN ACCOUNTING OR

Revenue Officer II (DOCUMENT ANY BACHELOR'S DEGREE WITH MASTER'S

60 BIRB-REVO2-53-2018 13 26754 NONE REQUIRED 1 YEAR OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RR7A DPD

PROCESSING) DEGREE IN BUSINESS ADMINISTRATION/

MANAGEMENT/ ACCOUNTANCY/ TAXATION

BSBA/BSC/BA WITH 18 UNITS IN ACCOUNTING OR

Revenue Officer II (DOCUMENT ANY BACHELOR'S DEGREE WITH MASTER'S

61 BIRB-REVO2-54-2018 13 26754 NONE REQUIRED 1 YEAR OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RR7A DPD

PROCESSING) DEGREE IN BUSINESS ADMINISTRATION/

MANAGEMENT/ ACCOUNTANCY/ TAXATION

BSBA/BSC/BA WITH 18 UNITS IN ACCOUNTING OR

Revenue Officer II (DOCUMENT ANY BACHELOR'S DEGREE WITH MASTER'S

62 BIRB-REVO2-55-2018 13 26754 NONE REQUIRED 1 YEAR OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RR7A DPD

PROCESSING) DEGREE IN BUSINESS ADMINISTRATION/

MANAGEMENT/ ACCOUNTANCY/ TAXATION

BSBA/BSC/BA WITH 18 UNITS IN ACCOUNTING OR

Revenue Officer II (DOCUMENT ANY BACHELOR'S DEGREE WITH MASTER'S

63 BIRB-REVO2-56-2018 13 26754 NONE REQUIRED 1 YEAR OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RR7A DPD

PROCESSING) DEGREE IN BUSINESS ADMINISTRATION/

MANAGEMENT/ ACCOUNTANCY/ TAXATION

Completion of two years studies in College or

Senior Administrative Assistant I (Data Relevant MC 11,

64 BIRB-SADAS1-55-2005 13 26754 High School Graduate with relevant 16 hours of relevant training 3 years of relevant experience N/A RR7A DPD

Controller IV) s.96/CSSP/1st level eligibility

vocational/trade courses

Completion of two years studies in College or

Senior Administrative Assistant I (Data Relevant MC 11,

65 BIRB-SADAS1-56-2005 13 26754 High School Graduate with relevant 16 hours of relevant training 3 years of relevant experience N/A RR7A DPD

Controller IV) s.96/CSSP/1st level eligibility

vocational/trade courses

Completion of two years studies in College or

Senior Administrative Assistant I (Data Relevant MC 11,

66 BIRB-SADAS1-58-2005 13 26754 High School Graduate with relevant 16 hours of relevant training 3 years of relevant experience N/A RR7A DPD

Controller IV) s.96/CSSP/1st level eligibility

vocational/trade courses

Completion of two years studies in College or

Senior Administrative Assistant I (Data Relevant MC 11,

67 BIRB-SADAS1-59-2005 13 26754 High School Graduate with relevant 16 hours of relevant training 3 years of relevant experience N/A RR7A DPD

Controller IV) s.96/CSSP/1st level eligibility

vocational/trade courses

Completion of two years studies in College or

Senior Administrative Assistant I (Data Relevant MC 11,

68 BIRB-SADAS1-60-2005 13 26754 High School Graduate with relevant 16 hours of relevant training 3 years of relevant experience N/A RR7A DPD

Controller IV) s.96/CSSP/1st level eligibility

vocational/trade courses

Completion of two years studies in College or

Senior Administrative Assistant I (Data Relevant MC 11,

69 BIRB-SADAS1-61-2005 13 26754 High School Graduate with relevant 16 hours of relevant training 3 years of relevant experience N/A RR7A DPD

Controller IV) s.96/CSSP/1st level eligibility

vocational/trade courses

Completion of two years studies in College or

Senior Administrative Assistant I (Data Relevant MC 11,

70 BIRB-SADAS1-159-2014 13 26754 High School Graduate with relevant 16 hours of relevant training 3 years of relevant experience N/A RR7A DPD

Controller IV) s.96/CSSP/1st level eligibility

vocational/trade courses

Completion of two years studies in College or

Senior Administrative Assistant I (Data Relevant MC 11,

71 BIRB-SADAS1-27-2014 13 26754 High School Graduate with relevant 16 hours of relevant training 3 years of relevant experience N/A RR7A DPD

Controller IV) s.96/CSSP/1st level eligibility

vocational/trade courses

Completion of two years studies in College or

Senior Administrative Assistant I (Data Relevant MC 11,

72 BIRB-SADAS1-28-2014 13 26754 High School Graduate with relevant 16 hours of relevant training 3 years of relevant experience N/A RR7A DPD

Controller IV) s.96/CSSP/1st level eligibility

vocational/trade courses

Completion of two years studies in College or

Senior Administrative Assistant I (Data Relevant MC 11,

73 BIRB-SADAS1-29-2014 13 26754 High School Graduate with relevant 16 hours of relevant training 3 years of relevant experience N/A RR7A DPD

Controller IV) s.96/CSSP/1st level eligibility

vocational/trade courses

Completion of two years studies in College or

Senior Administrative Assistant I (Data Relevant MC 11,

74 BIRB-SADAS1-30-2014 13 26754 High School Graduate with relevant 16 hours of relevant training 3 years of relevant experience N/A RR7A DPD

Controller IV) s.96/CSSP/1st level eligibility

vocational/trade courses

Completion of two years studies in College or

Senior Administrative Assistant I (Data Relevant MC 11,

75 BIRB-SADAS1-306-2014 13 26754 High School Graduate with relevant 16 hours of relevant training 3 years of relevant experience N/A RR7A DPD

Controller IV) s.96/CSSP/1st level eligibility

vocational/trade courses

Completion of two years studies in College or

Senior Administrative Assistant I (Data Relevant MC 11,

76 BIRB-SADAS1-307-2014 13 26754 High School Graduate with relevant 16 hours of relevant training 3 years of relevant experience N/A RR7A DPD

Controller IV) s.96/CSSP/1st level eligibility

vocational/trade courses

Completion of two years studies in College or

Senior Administrative Assistant I (Data Relevant MC 11,

77 BIRB-SADAS1-308-2014 13 26754 High School Graduate with relevant 16 hours of relevant training 3 years of relevant experience N/A RR7A DPD

Controller IV) s.96/CSSP/1st level eligibility

vocational/trade courses

Completion of two years studies in College or

Senior Administrative Assistant I (Data Relevant MC 11,

78 BIRB-SADAS1-309-2014 13 26754 High School Graduate with relevant 16 hours of relevant training 3 years of relevant experience N/A RR7A DPD

Controller IV) s.96/CSSP/1st level eligibility

vocational/trade courses

Completion of two years studies in College or

Senior Administrative Assistant I (Data Relevant MC 11,

79 BIRB-SADAS1-54-2005 13 26754 High School Graduate with relevant 16 hours of relevant training 3 years of relevant experience N/A RR7A DPD

Entry Machine Operator IV) s.96/CSSP/1st level eligibility

vocational/trade courses

Completion of two years studies in College or

Senior Administrative Assistant I (Data Relevant MC 11,

80 BIRB-SADAS1-31-2014 13 26754 High School Graduate with relevant 16 hours of relevant training 3 years of relevant experience N/A RR7A DPD

Entry Machine Operator IV) s.96/CSSP/1st level eligibility

vocational/trade courses

Completion of two years studies in College or

Senior Administrative Assistant I (Data Relevant MC 11,

81 BIRB-SADAS1-313-2014 13 26754 High School Graduate with relevant 16 hours of relevant training 3 years of relevant experience N/A RR7A DPD

Entry Machine Operator IV) s.96/CSSP/1st level eligibility

vocational/trade courses

Completion of two years studies in College or

Senior Administrative Assistant I (Data Relevant MC 11,

82 BIRB-SADAS1-49-2014 13 26754 High School Graduate with relevant 16 hours of relevant training 3 years of relevant experience N/A RR7A DPD

Entry Machine Operator IV) s.96/CSSP/1st level eligibility

vocational/trade courses

Completion of two years studies in College or

Administrative Assistant V (Data Relevant MC 11,

83 BIRB-ADAS5-85-2005 11 22316 High School Graduate with relevant 8 hours of relevant training 2 years of relevant experience N/A RR7A DPD

Controller III) s.96/CSSP/1st level eligibility

vocational/trade courses

Completion of two years studies in College or

Administrative Assistant V (Data Relevant MC 11,

84 BIRB-ADAS5-76-2005 11 22316 High School Graduate with relevant 8 hours of relevant training 2 years of relevant experience N/A RR7A DPD

Controller III) s.96/CSSP/1st level eligibility

vocational/trade courses

Completion of two years studies in College or

Administrative Assistant V (Data Relevant MC 11,

85 BIRB-ADAS5-78-2005 11 22316 High School Graduate with relevant 8 hours of relevant training 2 years of relevant experience N/A RR7A DPD

Controller III) s.96/CSSP/1st level eligibility

vocational/trade courses

BS COMMERCE /BSBA ACCOUNTING OR

86 REVENUE OFFICER I (ASSESSMENT) BIRB- REVO1-1047-2014 11 22316 BACHELOR OF LAWS WITH 18 UNITS IN NONE REQUIRED NONE REQUIRED RA1080 (CPA/BAR) N/A RR7A VATAS

ACCOUNTING

BS COMMERCE /BSBA ACCOUNTING OR

87 REVENUE OFFICER I (ASSESSMENT) BIRB-REVO1-390-2014 11 22316 BACHELOR OF LAWS WITH 18 UNITS IN NONE REQUIRED NONE REQUIRED RA1080 (CPA/BAR) N/A RR7A VATAS

ACCOUNTING

BACHELOR'S DEGREE IN BUSINESS

ADMINISTRATION/COMMERCE WITH 18 UNITS IN

ACCOUNTING and/or TAXATION or BACHELOR'S

88 REVENUE OFFICER I (COLLECTION) BIRB-REVO1-350-2000 11 22316 DEGREE IN ACCOUNTANCY OR ANY BACHELOR'S NONE REQUIRED NONE REQUIRED CSP/2ND LEVEL ELIGIBILITY N/A RR7A COLLECTION DIVISION

DEGREE WITH MASTER'S DEGREE IN BUSINESS

ADMINISTRATION/ MANAGEMENT/

ACCOUNTANCY/ TAXATION

BACHELOR'S DEGREE IN BUSINESS

ADMINISTRATION/COMMERCE WITH 18 UNITS IN

ACCOUNTING and/or TAXATION or BACHELOR'S

89 REVENUE OFFICER I (COLLECTION) BIRB-REVO1-351-2000 11 22316 DEGREE IN ACCOUNTANCY OR ANY BACHELOR'S NONE REQUIRED NONE REQUIRED CSP/2ND LEVEL ELIGIBILITY N/A RR7A COLLECTION DIVISION

DEGREE WITH MASTER'S DEGREE IN BUSINESS

ADMINISTRATION/ MANAGEMENT/

ACCOUNTANCY/ TAXATION

BACHELOR'S DEGREE IN BUSINESS

ADMINISTRATION/COMMERCE WITH 18 UNITS IN

ACCOUNTING and/or TAXATION or BACHELOR'S

90 REVENUE OFFICER I (COLLECTION) BIRB-REVO1-352-2000 11 22316 DEGREE IN ACCOUNTANCY OR ANY BACHELOR'S NONE REQUIRED NONE REQUIRED CSP/2ND LEVEL ELIGIBILITY N/A RR7A COLLECTION DIVISION

DEGREE WITH MASTER'S DEGREE IN BUSINESS

ADMINISTRATION/ MANAGEMENT/

ACCOUNTANCY/ TAXATION

BACHELOR'S DEGREE IN BUSINESS

ADMINISTRATION/COMMERCE WITH 18 UNITS IN

ACCOUNTING and/or TAXATION or BACHELOR'S

91 REVENUE OFFICER I (COLLECTION) BIRB-REVO1-355-2000 11 22316 DEGREE IN ACCOUNTANCY OR ANY BACHELOR'S NONE REQUIRED NONE REQUIRED CSP/2ND LEVEL ELIGIBILITY N/A RR7A COLLECTION DIVISION

DEGREE WITH MASTER'S DEGREE IN BUSINESS

ADMINISTRATION/ MANAGEMENT/

ACCOUNTANCY/ TAXATION

BACHELOR'S DEGREE IN BUSINESS

ADMINISTRATION/COMMERCE WITH 18 UNITS IN

ACCOUNTING and/or TAXATION or BACHELOR'S

92 REVENUE OFFICER I (COLLECTION) BIRB-REVO1-356-2000 11 22316 DEGREE IN ACCOUNTANCY OR ANY BACHELOR'S NONE REQUIRED NONE REQUIRED CSP/2ND LEVEL ELIGIBILITY N/A RR7A COLLECTION DIVISION

DEGREE WITH MASTER'S DEGREE IN BUSINESS

ADMINISTRATION/ MANAGEMENT/

ACCOUNTANCY/ TAXATION

BACHELOR'S DEGREE IN BUSINESS

ADMINISTRATION/COMMERCE WITH 18 UNITS IN

ACCOUNTING and/or TAXATION or BACHELOR'S

93 REVENUE OFFICER I (COLLECTION) BIRB-REVO1-357-2000 11 22316 DEGREE IN ACCOUNTANCY OR ANY BACHELOR'S NONE REQUIRED NONE REQUIRED CSP/2ND LEVEL ELIGIBILITY N/A RR7A COLLECTION DIVISION

DEGREE WITH MASTER'S DEGREE IN BUSINESS

ADMINISTRATION/ MANAGEMENT/

ACCOUNTANCY/ TAXATION

Completion of two years studies in College or RELEVANT MC 11,

Administrative Assistant III (Computer

94 BIRB-ADAS3-486-2005 9 18784 High School Graduate with relevant 4 HOURS OF RELEVANT TRAINING 1 YEAR OF RELEVANT EXPERIENCE S.96/CSSP/1ST LEVEL N/A RR7A COLLECTION DIVISION

Operator II)

vocational/trade courses ELIGIBILITY

BACHELOR'S DEGREE IN BUSINESS

ADMINISTRATION/COMMERCE WITH 18 UNITS IN

ACCOUNTING and/or TAXATION or BACHELOR'S

95 REVENUE OFFICER I (COLLECTION) BIRB-REVO1-1600-2014 11 22316 DEGREE IN ACCOUNTANCY OR ANY BACHELOR'S NONE REQUIRED NONE REQUIRED CSP/2ND LEVEL ELIGIBILITY N/A RR7A AMS

DEGREE WITH MASTER'S DEGREE IN BUSINESS

ADMINISTRATION/ MANAGEMENT/

ACCOUNTANCY/ TAXATION

BACHELOR'S DEGREE IN BUSINESS

ADMINISTRATION/COMMERCE WITH 18 UNITS IN

ACCOUNTING and/or TAXATION or BACHELOR'S

96 REVENUE OFFICER I (COLLECTION) BIRB-REVO1-1760-2014 11 22316 DEGREE IN ACCOUNTANCY OR ANY BACHELOR'S NONE REQUIRED NONE REQUIRED CSP/2ND LEVEL ELIGIBILITY N/A RR7A AMS

DEGREE WITH MASTER'S DEGREE IN BUSINESS

ADMINISTRATION/ MANAGEMENT/

ACCOUNTANCY/ TAXATION

BACHELOR'S DEGREE IN BUSINESS

ADMINISTRATION/COMMERCE WITH 18 UNITS IN

ACCOUNTING and/or TAXATION or BACHELOR'S

97 REVENUE OFFICER I (COLLECTION) BIRB-REVO1-1778-2014 11 22316 DEGREE IN ACCOUNTANCY OR ANY BACHELOR'S NONE REQUIRED NONE REQUIRED CSP/2ND LEVEL ELIGIBILITY N/A RR7A AMS

DEGREE WITH MASTER'S DEGREE IN BUSINESS

ADMINISTRATION/ MANAGEMENT/

ACCOUNTANCY/ TAXATION

BACHELOR'S DEGREE IN BUSINESS

ADMINISTRATION/COMMERCE WITH 18 UNITS IN

ACCOUNTING and/or TAXATION or BACHELOR'S

98 REVENUE OFFICER I (COLLECTION) BIRB-REVO1-14-2015 11 22316 DEGREE IN ACCOUNTANCY OR ANY BACHELOR'S NONE REQUIRED NONE REQUIRED CSP/2ND LEVEL ELIGIBILITY N/A RR7A AMS

DEGREE WITH MASTER'S DEGREE IN BUSINESS

ADMINISTRATION/ MANAGEMENT/

ACCOUNTANCY/ TAXATION

BACHELOR'S DEGREE IN BUSINESS

ADMINISTRATION/COMMERCE WITH 18 UNITS IN

ACCOUNTING and/or TAXATION or BACHELOR'S

99 REVENUE OFFICER I (COLLECTION) BIRB-REVO1-266-2014 11 22316 DEGREE IN ACCOUNTANCY OR ANY BACHELOR'S NONE REQUIRED NONE REQUIRED CSP/2ND LEVEL ELIGIBILITY N/A RR7A AMS

DEGREE WITH MASTER'S DEGREE IN BUSINESS

ADMINISTRATION/ MANAGEMENT/

ACCOUNTANCY/ TAXATION

100 Attorney II BIRB-ATY2-68-2000 18 42159 BACHELOR OF LAWS NONE REQUIRED NONE REQUIRED RA1080/BAR N/A RR7A LEGAL DIVISION

101 Attorney II BIRB-ATY2-132-2014 18 42159 BACHELOR OF LAWS NONE REQUIRED NONE REQUIRED RA1080/BAR N/A RR7A LEGAL DIVISION

102 Accountant III BIRB-A3-79-2000 19 46791 BS COMMERCE /BSBA ACCOUNTING 8 HOURS OF RELEVANT TRAINING 2 YEARS OF RELEVANT EXPERIENCE RA1080 N/A RR7A FINANCE DIVISION

103 Accountant II BIRB-A2-80-2000 16 35106 BS COMMERCE /BSBA ACCOUNTING 4 HOURS OF RELEVANT TRAINING 1 YEAR OF RELEVANT EXPERIENCE RA1080 N/A RR7A FINANCE DIVISION

104 Accountant I BIRB-A1-80-2000 12 24495 BS COMMERCE /BSBA ACCOUNTING NONE REQUIRED NONE REQUIRED RA1080 N/A RR7A FINANCE DIVISION

BSBA/BSC/BA WITH 18 UNITS IN ACCOUNTING OR

REVENUE OFFICER I (DOCUMENT ANY BACHELOR'S DEGREE WITH MASTER'S

105 BIRB-REVO1-63-2018 11 22316 NONE REQUIRED NONE REQUIRED CSP/2ND LEVEL ELIGIBILITY N/A RR7A DPD

PROCESSING) DEGREE IN BUSINESS ADMINISTRATION/

MANAGEMENT/ ACCOUNTANCY/ TAXATION

BSBA/BSC/BA WITH 18 UNITS IN ACCOUNTING OR

REVENUE OFFICER I (DOCUMENT ANY BACHELOR'S DEGREE WITH MASTER'S

106 BIRB-REVO1-64-2018 11 22316 NONE REQUIRED NONE REQUIRED CSP/2ND LEVEL ELIGIBILITY N/A RR7A DPD

PROCESSING) DEGREE IN BUSINESS ADMINISTRATION/

MANAGEMENT/ ACCOUNTANCY/ TAXATION

BSBA/BSC/BA WITH 18 UNITS IN ACCOUNTING OR

REVENUE OFFICER I (DOCUMENT ANY BACHELOR'S DEGREE WITH MASTER'S

107 BIRB-REVO1-65-2018 11 22316 NONE REQUIRED NONE REQUIRED CSP/2ND LEVEL ELIGIBILITY N/A RR7A DPD

PROCESSING) DEGREE IN BUSINESS ADMINISTRATION/

MANAGEMENT/ ACCOUNTANCY/ TAXATION

BSBA/BSC/BA WITH 18 UNITS IN ACCOUNTING OR

REVENUE OFFICER I (DOCUMENT ANY BACHELOR'S DEGREE WITH MASTER'S

108 BIRB-REVO1-66-2018 11 22316 NONE REQUIRED NONE REQUIRED CSP/2ND LEVEL ELIGIBILITY N/A RR7A DPD

PROCESSING) DEGREE IN BUSINESS ADMINISTRATION/

MANAGEMENT/ ACCOUNTANCY/ TAXATION

BSBA/BSC/BA WITH 18 UNITS IN ACCOUNTING OR

REVENUE OFFICER I (DOCUMENT ANY BACHELOR'S DEGREE WITH MASTER'S

109 BIRB-REVO1-67-2018 11 22316 NONE REQUIRED NONE REQUIRED CSP/2ND LEVEL ELIGIBILITY N/A RR7A DPD

PROCESSING) DEGREE IN BUSINESS ADMINISTRATION/

MANAGEMENT/ ACCOUNTANCY/ TAXATION

BSBA/BSC/BA WITH 18 UNITS IN ACCOUNTING OR

REVENUE OFFICER I (DOCUMENT ANY BACHELOR'S DEGREE WITH MASTER'S

110 BIRB-REVO1-68-2018 11 22316 NONE REQUIRED NONE REQUIRED CSP/2ND LEVEL ELIGIBILITY N/A RR7A DPD

PROCESSING) DEGREE IN BUSINESS ADMINISTRATION/

MANAGEMENT/ ACCOUNTANCY/ TAXATION

BSBA/BSC/BA WITH 18 UNITS IN ACCOUNTING OR

REVENUE OFFICER I (DOCUMENT ANY BACHELOR'S DEGREE WITH MASTER'S

111 BIRB-REVO1-69-2018 11 22316 NONE REQUIRED NONE REQUIRED CSP/2ND LEVEL ELIGIBILITY N/A RR7A DPD

PROCESSING) DEGREE IN BUSINESS ADMINISTRATION/

MANAGEMENT/ ACCOUNTANCY/ TAXATION

BSBA/BSC/BA WITH 18 UNITS IN ACCOUNTING OR

REVENUE OFFICER I (DOCUMENT ANY BACHELOR'S DEGREE WITH MASTER'S

112 BIRB-REVO1-70-2018 11 22316 NONE REQUIRED NONE REQUIRED CSP/2ND LEVEL ELIGIBILITY N/A RR7A DPD

PROCESSING) DEGREE IN BUSINESS ADMINISTRATION/

MANAGEMENT/ ACCOUNTANCY/ TAXATION

BSBA/BSC/BA WITH 18 UNITS IN ACCOUNTING OR

REVENUE OFFICER I (DOCUMENT ANY BACHELOR'S DEGREE WITH MASTER'S

113 BIRB-REVO1-71-2018 11 22316 NONE REQUIRED NONE REQUIRED CSP/2ND LEVEL ELIGIBILITY N/A RR7A DPD

PROCESSING) DEGREE IN BUSINESS ADMINISTRATION/

MANAGEMENT/ ACCOUNTANCY/ TAXATION

BSBA/BSC/BA WITH 18 UNITS IN ACCOUNTING OR

REVENUE OFFICER I (DOCUMENT ANY BACHELOR'S DEGREE WITH MASTER'S

114 BIRB-REVO1-72-2018 11 22316 NONE REQUIRED NONE REQUIRED CSP/2ND LEVEL ELIGIBILITY N/A RR7A DPD

PROCESSING) DEGREE IN BUSINESS ADMINISTRATION/

MANAGEMENT/ ACCOUNTANCY/ TAXATION

BSBA/BSC/BA WITH 18 UNITS IN ACCOUNTING OR

REVENUE OFFICER I (DOCUMENT ANY BACHELOR'S DEGREE WITH MASTER'S

115 BIRB-REVO1-73-2018 11 22316 NONE REQUIRED NONE REQUIRED CSP/2ND LEVEL ELIGIBILITY N/A RR7A DPD

PROCESSING) DEGREE IN BUSINESS ADMINISTRATION/

MANAGEMENT/ ACCOUNTANCY/ TAXATION

BSBA/BSC/BA WITH 18 UNITS IN ACCOUNTING OR

REVENUE OFFICER I (DOCUMENT ANY BACHELOR'S DEGREE WITH MASTER'S

116 BIRB-REVO1-74-2018 11 22316 NONE REQUIRED NONE REQUIRED CSP/2ND LEVEL ELIGIBILITY N/A RR7A DPD

PROCESSING) DEGREE IN BUSINESS ADMINISTRATION/

MANAGEMENT/ ACCOUNTANCY/ TAXATION

BSBA/BSC/BA WITH 18 UNITS IN ACCOUNTING OR

REVENUE OFFICER I (DOCUMENT ANY BACHELOR'S DEGREE WITH MASTER'S

117 BIRB-REVO1-75-2018 11 22316 NONE REQUIRED NONE REQUIRED CSP/2ND LEVEL ELIGIBILITY N/A RR7A DPD

PROCESSING) DEGREE IN BUSINESS ADMINISTRATION/

MANAGEMENT/ ACCOUNTANCY/ TAXATION

BSBA/BSC/BA WITH 18 UNITS IN ACCOUNTING OR

REVENUE OFFICER I (DOCUMENT ANY BACHELOR'S DEGREE WITH MASTER'S

118 BIRB-REVO1-76-2018 11 22316 NONE REQUIRED NONE REQUIRED CSP/2ND LEVEL ELIGIBILITY N/A RR7A DPD

PROCESSING) DEGREE IN BUSINESS ADMINISTRATION/

MANAGEMENT/ ACCOUNTANCY/ TAXATION

BSBA/BSC/BA WITH 18 UNITS IN ACCOUNTING OR

REVENUE OFFICER I (DOCUMENT ANY BACHELOR'S DEGREE WITH MASTER'S

119 BIRB-REVO1-77-2018 11 22316 NONE REQUIRED NONE REQUIRED CSP/2ND LEVEL ELIGIBILITY N/A RR7A DPD

PROCESSING) DEGREE IN BUSINESS ADMINISTRATION/

MANAGEMENT/ ACCOUNTANCY/ TAXATION

BSBA/BSC/BA WITH 18 UNITS IN ACCOUNTING OR

REVENUE OFFICER I (DOCUMENT ANY BACHELOR'S DEGREE WITH MASTER'S

120 BIRB-REVO1-78-2018 11 22316 NONE REQUIRED NONE REQUIRED CSP/2ND LEVEL ELIGIBILITY N/A RR7A DPD

PROCESSING) DEGREE IN BUSINESS ADMINISTRATION/

MANAGEMENT/ ACCOUNTANCY/ TAXATION

Completion of two years studies in College or

Administrative Assistant II (Data Relevant MC 11,

121 BIRB-ADAS2-133-2005 8 17505 High School Graduate with relevant 4 hours of relevant training 1 year of relevant experience N/A RR7A DPD

Controller II) s.96/CSSP/1st level eligibility

vocational/trade courses

Completion of two years studies in College or

Administrative Assistant II (Data Relevant MC 11,

122 BIRB-ADAS2-141-2005 8 17505 High School Graduate with relevant 4 hours of relevant training 1 year of relevant experience N/A RR7A DPD

Controller II) s.96/CSSP/1st level eligibility

vocational/trade courses

Completion of two years studies in College or

Administrative Assistant II (Data Relevant MC 11,

123 BIRB-ADAS2-273-2014 8 17505 High School Graduate with relevant 4 hours of relevant training 1 year of relevant experience N/A RR7A DPD

Controller II) s.96/CSSP/1st level eligibility

vocational/trade courses

Completion of two years studies in College or

Administrative Assistant II (Data Relevant MC 11,

124 BIRB-ADAS2-279-2014 8 17505 High School Graduate with relevant 4 hours of relevant training 1 year of relevant experience N/A RR7A DPD

Controller II) s.96/CSSP/1st level eligibility

vocational/trade courses

Completion of two years studies in College or

Administrative Assistant II (Data Relevant MC 11,

125 BIRB-ADAS2-280-2014 8 17505 High School Graduate with relevant 4 hours of relevant training 1 year of relevant experience N/A RR7A DPD

Controller II) s.96/CSSP/1st level eligibility

vocational/trade courses

Completion of two years studies in College or

Administrative Assistant II (Data Relevant MC 11,

126 BIRB-ADAS2-281-2014 8 17505 High School Graduate with relevant 4 hours of relevant training 1 year of relevant experience N/A RR7A DPD

Controller II) s.96/CSSP/1st level eligibility

vocational/trade courses

Completion of two years studies in College or

Administrative Assistant II (Data Relevant MC 11,

127 BIRB-ADAS2-121-2005 8 17505 High School Graduate with relevant 4 hours of relevant training 1 year of relevant experience N/A RR7A DPD

Controller II) s.96/CSSP/1st level eligibility

vocational/trade courses

Completion of two years studies in College or

Administrative Assistant II (Data Relevant MC 11,

128 BIRB-ADAS2-127-2005 8 17505 High School Graduate with relevant 4 hours of relevant training 1 year of relevant experience N/A RR7A DPD

Controller II) s.96/CSSP/1st level eligibility

vocational/trade courses

Completion of two years studies in College or

Administrative Assistant II (Data Relevant MC 11,

129 BIRB-ADAS2-129-2005 8 17505 High School Graduate with relevant 4 hours of relevant training 1 year of relevant experience N/A RR7A DPD

Controller II) s.96/CSSP/1st level eligibility

vocational/trade courses

Completion of two years studies in College or

Administrative Assistant II (Data Relevant MC 11,

130 BIRB-ADAS2-132-2005 8 17505 High School Graduate with relevant 4 hours of relevant training 1 year of relevant experience N/A RR7A DPD

Controller II) s.96/CSSP/1st level eligibility

vocational/trade courses

Completion of two years studies in College or

Administrative Assistant II (Data Relevant MC 11,

131 BIRB-ADAS2-135-2005 8 17505 High School Graduate with relevant 4 hours of relevant training 1 year of relevant experience N/A RR7A DPD

Controller II) s.96/CSSP/1st level eligibility

vocational/trade courses

Completion of two years studies in College or

Administrative Assistant II (Data Relevant MC 11,

132 BIRB-ADAS2-136-2005 8 17505 High School Graduate with relevant 4 hours of relevant training 1 year of relevant experience N/A RR7A DPD

Controller II) s.96/CSSP/1st level eligibility

vocational/trade courses

Completion of two years studies in College or

Administrative Assistant II (Data Relevant MC 11,

133 BIRB-ADAS2-143-2005 8 17505 High School Graduate with relevant 4 hours of relevant training 1 year of relevant experience N/A RR7A DPD

Controller II) s.96/CSSP/1st level eligibility

vocational/trade courses

MASTER'S DEGREE OR CERTIFICATE IN 40 HOURS OF SUPERVISORY/ MANAGEMENT 4 YEARS IN POSITIONS INVOLVING

134 Chief Revenue Officer IV BIRB-CRO4-181-2000 24 85074 CSP/2ND LEVEL ELIGIBILITY N/A RDO 28 NOVALICHES

LEADERSHIP AND MANAGEMENT FROM THE CSC LEARNING AND DEVELOPMENT INTERVENTION MANAGEMENT AND SUPERVISION

135 Chief Revenue Officer II BIRB-CRO2-527-2014 21 59353 BACHELOR'S DEGREE RELEVANT TO THE JOB 8 HOURS OF RELEVANT TRAINING 2 YEARS OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RDO 28 NOVALICHES

136 Chief Revenue Officer II BIRB-CRO2-528-2014 21 59353 BACHELOR'S DEGREE RELEVANT TO THE JOB 8 HOURS OF RELEVANT TRAINING 2 YEARS OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RDO 28 NOVALICHES

137 Chief Revenue Officer II BIRB-CRO2-529-2014 21 59353 BACHELOR'S DEGREE RELEVANT TO THE JOB 8 HOURS OF RELEVANT TRAINING 2 YEARS OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RDO 28 NOVALICHES

138 Chief Revenue Officer II BIRB-CRO2-530-2014 21 59353 BACHELOR'S DEGREE RELEVANT TO THE JOB 8 HOURS OF RELEVANT TRAINING 2 YEARS OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RDO 28 NOVALICHES

3 YEARS OF RELEVANT EXPERIENCE

BACHELOR'S DEGREE IN BUSINESS

PREFERABLY IN THE CONDUCT OF

ADMINISTRATION/COMMERCE WITH 18 UNITS IN

16 HOURS OF RELEVANT TRAINING PREFERABLY TAX MAPPING OR EXPERIENCE IN

ACCOUNTING and/or TAXATION or BACHELOR'S

IN TAX MAPPING, ONLINE FILING AND PAYMENT THE IMPLEMENTATION AND

139 Revenue Officer IV (COMPLIANCE) BIRB-REVO4-399-2014 19 46791 DEGREE IN ACCOUNTANCY OR ANY BACHELOR'S CSP/2ND LEVEL ELIGIBILITY N/A RDO 28 NOVALICHES

SYSTEM, BASIC TAX ADMINISTRATION AND ITS MONITORING OF COMPLIANCE OF

DEGREE WITH MASTER'S DEGREE IN BUSINESS

APPLICATION WITHHOLDING AGENTS TO

ADMINISTRATION/ MANAGEMENT/

WITHHOLDING TAX LAWS AND

ACCOUNTANCY/ TAXATION

REGULATIONS

BACHELOR'S DEGREE IN BUSINESS

ADMINISTRATION/COMMERCE WITH 18 UNITS IN

ACCOUNTING and/or TAXATION or BACHELOR'S

140 Revenue Officer III (COLLECTION) BIRB-REVO3-823-2000 16 35106 DEGREE IN ACCOUNTANCY OR ANY BACHELOR'S 8 HOURS OF RELEVANT TRAINING 2 YEARS OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RDO 28 NOVALICHES

DEGREE WITH MASTER'S DEGREE IN BUSINESS

ADMINISTRATION/ MANAGEMENT/

ACCOUNTANCY/ TAXATION

2 YEARS OF RELEVANT EXPERIENCE

BACHELOR'S DEGREE IN BUSINESS

PREFERABLY IN THE CONDUCT OF

ADMINISTRATION/COMMERCE WITH 18 UNITS IN

8 HOURS OF RELEVANT TRAINING PREFERABLY IN TAX MAPPING OR EXPERIENCE IN

ACCOUNTING and/or TAXATION or BACHELOR'S

TAX MAPPING, ONLINE FILING AND PAYMENT THE IMPLEMENTATION AND

141 Revenue Officer III (COMPLIANCE) BIRB-REVO3-1013-2014 16 35106 DEGREE IN ACCOUNTANCY OR ANY BACHELOR'S CSP/2ND LEVEL ELIGIBILITY N/A RDO 28 NOVALICHES

SYSTEM, BASIC TAX ADMINISTRATION AND ITS MONITORING OF COMPLIANCE OF

DEGREE WITH MASTER'S DEGREE IN BUSINESS

APPLICATION WITHHOLDING AGENTS TO

ADMINISTRATION/ MANAGEMENT/

WITHHOLDING TAX LAWS AND

ACCOUNTANCY/ TAXATION

REGULATIONS

2 YEARS OF RELEVANT EXPERIENCE

BACHELOR'S DEGREE IN BUSINESS

PREFERABLY IN THE CONDUCT OF

ADMINISTRATION/COMMERCE WITH 18 UNITS IN

8 HOURS OF RELEVANT TRAINING PREFERABLY IN TAX MAPPING OR EXPERIENCE IN

ACCOUNTING and/or TAXATION or BACHELOR'S

TAX MAPPING, ONLINE FILING AND PAYMENT THE IMPLEMENTATION AND

142 Revenue Officer III (COMPLIANCE) BIRB-REVO3-1014-2014 16 35106 DEGREE IN ACCOUNTANCY OR ANY BACHELOR'S CSP/2ND LEVEL ELIGIBILITY N/A RDO 28 NOVALICHES

SYSTEM, BASIC TAX ADMINISTRATION AND ITS MONITORING OF COMPLIANCE OF

DEGREE WITH MASTER'S DEGREE IN BUSINESS

APPLICATION WITHHOLDING AGENTS TO

ADMINISTRATION/ MANAGEMENT/

WITHHOLDING TAX LAWS AND

ACCOUNTANCY/ TAXATION

REGULATIONS

BSBA/BSC/BA WITH 18 UNITS IN ACCOUNTING OR

Revenue Officer III (DOCUMENT ANY BACHELOR'S DEGREE WITH MASTER'S

143 BIRB-REVO3-678-2000 16 35106 4 HOURS OF RELEVANT TRAINING 2 YEARS OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RDO 28 NOVALICHES

PROCESSING) DEGREE IN BUSINESS ADMINISTRATION/

MANAGEMENT/ ACCOUNTANCY/ TAXATION

BSBA/BSC/BA WITH 18 UNITS IN ACCOUNTING OR

Revenue Officer III (TAXPAYERS ANY BACHELOR'S DEGREE WITH MASTER'S

144 BIRB-REVO3-679-2000 16 35106 4 HOURS OF RELEVANT TRAINING 2 YEARS OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RDO 28 NOVALICHES

ASSISTANCE) DEGREE IN BUSINESS ADMINISTRATION/

MANAGEMENT/ ACCOUNTANCY/ TAXATION

BS COMMERCE /BSBA ACCOUNTING OR

145 Revenue Officer II (ASSESSMENT) BIRB-REVO2-955-2000 13 26754 BACHELOR OF LAWS WITH 18 UNITS IN NONE REQUIRED 1 YEAR OF RELEVANT EXPERIENCE RA1080 (CPA/BAR) N/A RDO 28 NOVALICHES

ACCOUNTING

BACHELOR'S DEGREE IN BUSINESS

ADMINISTRATION/COMMERCE WITH 18 UNITS IN

ACCOUNTING and/or TAXATION or BACHELOR'S

146 Revenue Officer II (COLLECTION) BIRB-REVO2-1613-2014 13 26754 DEGREE IN ACCOUNTANCY OR ANY BACHELOR'S 4 HOURS OF RELEVANT TRAINING 1 YEAR OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RDO 28 NOVALICHES

DEGREE WITH MASTER'S DEGREE IN BUSINESS

ADMINISTRATION/ MANAGEMENT/

ACCOUNTANCY/ TAXATION

BACHELOR'S DEGREE IN BUSINESS

ADMINISTRATION/COMMERCE WITH 18 UNITS IN

ACCOUNTING and/or TAXATION or BACHELOR'S

147 Revenue Officer II (COLLECTION) BIRB-REVO2-1614-2014 13 26754 DEGREE IN ACCOUNTANCY OR ANY BACHELOR'S 4 HOURS OF RELEVANT TRAINING 1 YEAR OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RDO 28 NOVALICHES

DEGREE WITH MASTER'S DEGREE IN BUSINESS

ADMINISTRATION/ MANAGEMENT/

ACCOUNTANCY/ TAXATION

BACHELOR'S DEGREE IN BUSINESS

ADMINISTRATION/COMMERCE WITH 18 UNITS IN

ACCOUNTING and/or TAXATION or BACHELOR'S

148 Revenue Officer II (COLLECTION) BIRB-REVO2-1615-2014 13 26754 DEGREE IN ACCOUNTANCY OR ANY BACHELOR'S 4 HOURS OF RELEVANT TRAINING 1 YEAR OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RDO 28 NOVALICHES

DEGREE WITH MASTER'S DEGREE IN BUSINESS

ADMINISTRATION/ MANAGEMENT/

ACCOUNTANCY/ TAXATION

BACHELOR'S DEGREE IN BUSINESS

ADMINISTRATION/COMMERCE WITH 18 UNITS IN

ACCOUNTING and/or TAXATION or BACHELOR'S

149 Revenue Officer II (COLLECTION) BIRB-REVO2-1654-2014 13 26754 DEGREE IN ACCOUNTANCY OR ANY BACHELOR'S 4 HOURS OF RELEVANT TRAINING 1 YEAR OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RDO 28 NOVALICHES

DEGREE WITH MASTER'S DEGREE IN BUSINESS

ADMINISTRATION/ MANAGEMENT/

ACCOUNTANCY/ TAXATION

BSBA/BSC/BA WITH 18 UNITS IN ACCOUNTING OR

Revenue Officer II (DOCUMENT ANY BACHELOR'S DEGREE WITH MASTER'S

150 BIRB-REVO2-961-2000 13 26754 NONE REQUIRED 1 YEAR OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RDO 28 NOVALICHES

PROCESSING) DEGREE IN BUSINESS ADMINISTRATION/

MANAGEMENT/ ACCOUNTANCY/ TAXATION

BSBA/BSC/BA WITH 18 UNITS IN ACCOUNTING OR

Revenue Officer II (TAXPAYERS ANY BACHELOR'S DEGREE WITH MASTER'S

151 BIRB-REVO2-960-2000 13 26754 NONE REQUIRED 1 YEAR OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RDO 28 NOVALICHES

ASSISTANCE) DEGREE IN BUSINESS ADMINISTRATION/

MANAGEMENT/ ACCOUNTANCY/ TAXATION

BSBA/BSC/BA WITH 18 UNITS IN ACCOUNTING OR

Revenue Officer II (TAXPAYERS ANY BACHELOR'S DEGREE WITH MASTER'S

152 BIRB-REVO2-962-2000 13 26754 NONE REQUIRED 1 YEAR OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RDO 28 NOVALICHES

ASSISTANCE) DEGREE IN BUSINESS ADMINISTRATION/

MANAGEMENT/ ACCOUNTANCY/ TAXATION

BS COMMERCE /BSBA ACCOUNTING OR

153 REVENUE OFFICER I (ASSESSMENT) BIRB-REVO1-1586-2014 11 22316 BACHELOR OF LAWS WITH 18 UNITS IN NONE REQUIRED NONE REQUIRED RA1080 (CPA/BAR) N/A RDO 28 NOVALICHES

ACCOUNTING

BACHELOR'S DEGREE IN BUSINESS

ADMINISTRATION/COMMERCE WITH 18 UNITS IN

ACCOUNTING and/or TAXATION or BACHELOR'S

154 REVENUE OFFICER I (COLLECTION) BIRB-REVO1-1592-2014 11 22316 DEGREE IN ACCOUNTANCY OR ANY BACHELOR'S NONE REQUIRED NONE REQUIRED CSP/2ND LEVEL ELIGIBILITY N/A RDO 28 NOVALICHES

DEGREE WITH MASTER'S DEGREE IN BUSINESS

ADMINISTRATION/ MANAGEMENT/

ACCOUNTANCY/ TAXATION

BACHELOR'S DEGREE IN BUSINESS

ADMINISTRATION/COMMERCE WITH 18 UNITS IN

ACCOUNTING and/or TAXATION or BACHELOR'S

155 REVENUE OFFICER I (COLLECTION) BIRB-REVO1-1597-2014 11 22316 DEGREE IN ACCOUNTANCY OR ANY BACHELOR'S NONE REQUIRED NONE REQUIRED CSP/2ND LEVEL ELIGIBILITY N/A RDO 28 NOVALICHES

DEGREE WITH MASTER'S DEGREE IN BUSINESS

ADMINISTRATION/ MANAGEMENT/

ACCOUNTANCY/ TAXATION

BACHELOR'S DEGREE IN BUSINESS

ADMINISTRATION/COMMERCE WITH 18 UNITS IN

ACCOUNTING and/or TAXATION or BACHELOR'S

156 Revenue Officer I (COMPLIANCE) BIRB-REVO1-1602-2014 11 22316 DEGREE IN ACCOUNTANCY OR ANY BACHELOR'S NONE REQUIRED NONE REQUIRED CSP/2ND LEVEL ELIGIBILITY N/A RDO 28 NOVALICHES

DEGREE WITH MASTER'S DEGREE IN BUSINESS

ADMINISTRATION/ MANAGEMENT/

ACCOUNTANCY/ TAXATION

BACHELOR'S DEGREE IN BUSINESS

ADMINISTRATION/COMMERCE WITH 18 UNITS IN

ACCOUNTING and/or TAXATION or BACHELOR'S

157 Revenue Officer I (COMPLIANCE) BIRB-REVO1-1603-2014 11 22316 DEGREE IN ACCOUNTANCY OR ANY BACHELOR'S NONE REQUIRED NONE REQUIRED CSP/2ND LEVEL ELIGIBILITY N/A RDO 28 NOVALICHES

DEGREE WITH MASTER'S DEGREE IN BUSINESS

ADMINISTRATION/ MANAGEMENT/

ACCOUNTANCY/ TAXATION

BACHELOR'S DEGREE IN BUSINESS

ADMINISTRATION/COMMERCE WITH 18 UNITS IN

ACCOUNTING and/or TAXATION or BACHELOR'S

158 Revenue Officer I (COMPLIANCE) BIRB-REVO1-1604-2014 11 22316 DEGREE IN ACCOUNTANCY OR ANY BACHELOR'S NONE REQUIRED NONE REQUIRED CSP/2ND LEVEL ELIGIBILITY N/A RDO 28 NOVALICHES

DEGREE WITH MASTER'S DEGREE IN BUSINESS

ADMINISTRATION/ MANAGEMENT/

ACCOUNTANCY/ TAXATION

BSBA/BSC/BA WITH 18 UNITS IN ACCOUNTING OR

REVENUE OFFICER I (TAXPAYERS ANY BACHELOR'S DEGREE WITH MASTER'S

159 BIRB-REVO1-349-2000 11 22316 NONE REQUIRED NONE REQUIRED CSP/2ND LEVEL ELIGIBILITY N/A RDO 28 NOVALICHES

ASSISTANCE) DEGREE IN BUSINESS ADMINISTRATION/

MANAGEMENT/ ACCOUNTANCY/ TAXATION

BSBA/BSC/BA WITH 18 UNITS IN ACCOUNTING OR

REVENUE OFFICER I (TAXPAYERS ANY BACHELOR'S DEGREE WITH MASTER'S

160 BIRB-REVO1-1411-2000 11 22316 NONE REQUIRED NONE REQUIRED CSP/2ND LEVEL ELIGIBILITY N/A RDO 28 NOVALICHES

ASSISTANCE) DEGREE IN BUSINESS ADMINISTRATION/

MANAGEMENT/ ACCOUNTANCY/ TAXATION

161 Chief Revenue Officer II BIRB-CRO2-598-2014 21 59353 BACHELOR'S DEGREE RELEVANT TO THE JOB 8 HOURS OF RELEVANT TRAINING 2 YEARS OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RDO 38 NORTH QC

BACHELOR'S DEGREE IN BUSINESS

ADMINISTRATION/COMMERCE WITH 18 UNITS IN

ACCOUNTING and/or TAXATION or BACHELOR'S

162 Revenue Officer IV (COLLECTION) BIRB-REVO4-481-2000 19 46791 DEGREE IN ACCOUNTANCY OR ANY BACHELOR'S 16 HOURS OF RELEVANT TRAINING 3 YEARS OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RDO 38 NORTH QC

DEGREE WITH MASTER'S DEGREE IN BUSINESS

ADMINISTRATION/ MANAGEMENT/

ACCOUNTANCY/ TAXATION

3 YEARS OF RELEVANT EXPERIENCE

BACHELOR'S DEGREE IN BUSINESS

PREFERABLY IN THE CONDUCT OF

ADMINISTRATION/COMMERCE WITH 18 UNITS IN

16 HOURS OF RELEVANT TRAINING PREFERABLY TAX MAPPING OR EXPERIENCE IN

ACCOUNTING and/or TAXATION or BACHELOR'S

IN TAX MAPPING, ONLINE FILING AND PAYMENT THE IMPLEMENTATION AND

163 Revenue Officer IV (COMPLIANCE) BIRB-REVO4-439-2014 19 46791 DEGREE IN ACCOUNTANCY OR ANY BACHELOR'S CSP/2ND LEVEL ELIGIBILITY N/A RDO 38 NORTH QC

SYSTEM, BASIC TAX ADMINISTRATION AND ITS MONITORING OF COMPLIANCE OF

DEGREE WITH MASTER'S DEGREE IN BUSINESS

APPLICATION WITHHOLDING AGENTS TO

ADMINISTRATION/ MANAGEMENT/

WITHHOLDING TAX LAWS AND

ACCOUNTANCY/ TAXATION

REGULATIONS

BSBA/BSC/BA WITH 18 UNITS IN ACCOUNTING OR

Revenue Officer IV (TAXPAYERS ANY BACHELOR'S DEGREE WITH MASTER'S

164 BIRB-REVO4-482-2000 19 46791 8 HOURS OF RELEVANT TRAINING 3 YEARS OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RDO 38 NORTH QC

ASSISTANCE) DEGREE IN BUSINESS ADMINISTRATION/

MANAGEMENT/ ACCOUNTANCY/ TAXATION

2 YEARS OF RELEVANT EXPERIENCE

BACHELOR'S DEGREE IN BUSINESS

PREFERABLY IN THE CONDUCT OF

ADMINISTRATION/COMMERCE WITH 18 UNITS IN

8 HOURS OF RELEVANT TRAINING PREFERABLY IN TAX MAPPING OR EXPERIENCE IN

ACCOUNTING and/or TAXATION or BACHELOR'S

TAX MAPPING, ONLINE FILING AND PAYMENT THE IMPLEMENTATION AND

165 Revenue Officer III (COMPLIANCE) BIRB-REVO3-1077-2014 16 35106 DEGREE IN ACCOUNTANCY OR ANY BACHELOR'S CSP/2ND LEVEL ELIGIBILITY N/A RDO 38 NORTH QC

SYSTEM, BASIC TAX ADMINISTRATION AND ITS MONITORING OF COMPLIANCE OF

DEGREE WITH MASTER'S DEGREE IN BUSINESS

APPLICATION WITHHOLDING AGENTS TO

ADMINISTRATION/ MANAGEMENT/

WITHHOLDING TAX LAWS AND

ACCOUNTANCY/ TAXATION

REGULATIONS

2 YEARS OF RELEVANT EXPERIENCE

BACHELOR'S DEGREE IN BUSINESS

PREFERABLY IN THE CONDUCT OF

ADMINISTRATION/COMMERCE WITH 18 UNITS IN

8 HOURS OF RELEVANT TRAINING PREFERABLY IN TAX MAPPING OR EXPERIENCE IN

ACCOUNTING and/or TAXATION or BACHELOR'S

TAX MAPPING, ONLINE FILING AND PAYMENT THE IMPLEMENTATION AND

166 Revenue Officer III (COMPLIANCE) BIRB-REVO3-1078-2014 16 35106 DEGREE IN ACCOUNTANCY OR ANY BACHELOR'S CSP/2ND LEVEL ELIGIBILITY N/A RDO 38 NORTH QC

SYSTEM, BASIC TAX ADMINISTRATION AND ITS MONITORING OF COMPLIANCE OF

DEGREE WITH MASTER'S DEGREE IN BUSINESS

APPLICATION WITHHOLDING AGENTS TO

ADMINISTRATION/ MANAGEMENT/

WITHHOLDING TAX LAWS AND

ACCOUNTANCY/ TAXATION

REGULATIONS

BSBA/BSC/BA WITH 18 UNITS IN ACCOUNTING OR

Revenue Officer III (DOCUMENT ANY BACHELOR'S DEGREE WITH MASTER'S

167 BIRB-REVO3-821-2000 16 35106 4 HOURS OF RELEVANT TRAINING 2 YEARS OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RDO 38 NORTH QC

PROCESSING) DEGREE IN BUSINESS ADMINISTRATION/

MANAGEMENT/ ACCOUNTANCY/ TAXATION

Administrative Officer IV (Administrative

168 BIRB-ADOF4-147-2005 15 32053 BACHELOR'S DEGREE RELEVANT TO THE JOB 4 HOURS OF RELEVANT TRAINING 1 YEAR OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RDO 38 NORTH QC

Officer II)

BS COMMERCE /BSBA ACCOUNTING OR

169 Revenue Officer II (ASSESSMENT) BIRB-REVO2-1161-2000 13 26754 BACHELOR OF LAWS WITH 18 UNITS IN NONE REQUIRED 1 YEAR OF RELEVANT EXPERIENCE RA1080 (CPA/BAR) N/A RDO 38 NORTH QC

ACCOUNTING

BS COMMERCE /BSBA ACCOUNTING OR

170 Revenue Officer II (ASSESSMENT) BIRB-REVO2-1165-2000 13 26754 BACHELOR OF LAWS WITH 18 UNITS IN NONE REQUIRED 1 YEAR OF RELEVANT EXPERIENCE RA1080 (CPA/BAR) N/A RDO 38 NORTH QC

ACCOUNTING

BS COMMERCE /BSBA ACCOUNTING OR

171 Revenue Officer II (ASSESSMENT) BIRB-REVO2-1169-2000 13 26754 BACHELOR OF LAWS WITH 18 UNITS IN NONE REQUIRED 1 YEAR OF RELEVANT EXPERIENCE RA1080 (CPA/BAR) N/A RDO 38 NORTH QC

ACCOUNTING

BS COMMERCE /BSBA ACCOUNTING OR

172 Revenue Officer II (ASSESSMENT) BIRB-REVO2-414-2000 13 26754 BACHELOR OF LAWS WITH 18 UNITS IN NONE REQUIRED 1 YEAR OF RELEVANT EXPERIENCE RA1080 (CPA/BAR) N/A RDO 38 NORTH QC

ACCOUNTING

BS COMMERCE /BSBA ACCOUNTING OR

173 Revenue Officer II (ASSESSMENT) BIRB-REVO2-415-2000 13 26754 BACHELOR OF LAWS WITH 18 UNITS IN NONE REQUIRED 1 YEAR OF RELEVANT EXPERIENCE RA1080 (CPA/BAR) N/A RDO 38 NORTH QC

ACCOUNTING

BS COMMERCE /BSBA ACCOUNTING OR

174 Revenue Officer II (ASSESSMENT) BIRB-REVO2-416-2000 13 26754 BACHELOR OF LAWS WITH 18 UNITS IN NONE REQUIRED 1 YEAR OF RELEVANT EXPERIENCE RA1080 (CPA/BAR) N/A RDO 38 NORTH QC

ACCOUNTING

BS COMMERCE /BSBA ACCOUNTING OR

175 Revenue Officer II (ASSESSMENT) BIRB-REVO2-417-2000 13 26754 BACHELOR OF LAWS WITH 18 UNITS IN NONE REQUIRED 1 YEAR OF RELEVANT EXPERIENCE RA1080 (CPA/BAR) N/A RDO 38 NORTH QC

ACCOUNTING

BS COMMERCE /BSBA ACCOUNTING OR

176 Revenue Officer II (ASSESSMENT) BIRB-REVO2-418-2000 13 26754 BACHELOR OF LAWS WITH 18 UNITS IN NONE REQUIRED 1 YEAR OF RELEVANT EXPERIENCE RA1080 (CPA/BAR) N/A RDO 38 NORTH QC

ACCOUNTING

BACHELOR'S DEGREE IN BUSINESS

ADMINISTRATION/COMMERCE WITH 18 UNITS IN

ACCOUNTING and/or TAXATION or BACHELOR'S

177 Revenue Officer II (COLLECTION) BIRB-REVO2-1170-2000 13 26754 DEGREE IN ACCOUNTANCY OR ANY BACHELOR'S 4 HOURS OF RELEVANT TRAINING 1 YEAR OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RDO 38 NORTH QC

DEGREE WITH MASTER'S DEGREE IN BUSINESS

ADMINISTRATION/ MANAGEMENT/

ACCOUNTANCY/ TAXATION

BACHELOR'S DEGREE IN BUSINESS

ADMINISTRATION/COMMERCE WITH 18 UNITS IN

ACCOUNTING and/or TAXATION or BACHELOR'S

178 Revenue Officer II (COLLECTION) BIRB-REVO2-1173-2000 13 26754 DEGREE IN ACCOUNTANCY OR ANY BACHELOR'S 4 HOURS OF RELEVANT TRAINING 1 YEAR OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RDO 38 NORTH QC

DEGREE WITH MASTER'S DEGREE IN BUSINESS

ADMINISTRATION/ MANAGEMENT/

ACCOUNTANCY/ TAXATION

BACHELOR'S DEGREE IN BUSINESS

ADMINISTRATION/COMMERCE WITH 18 UNITS IN

ACCOUNTING and/or TAXATION or BACHELOR'S

179 Revenue Officer II (COLLECTION) BIRB-REVO2-1769-2014 13 26754 DEGREE IN ACCOUNTANCY OR ANY BACHELOR'S 4 HOURS OF RELEVANT TRAINING 1 YEAR OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RDO 38 NORTH QC

DEGREE WITH MASTER'S DEGREE IN BUSINESS

ADMINISTRATION/ MANAGEMENT/

ACCOUNTANCY/ TAXATION

1 YEAR OF RELEVANT EXPERIENCE

BACHELOR'S DEGREE IN BUSINESS

PREFERABLY IN THE CONDUCT OF

ADMINISTRATION/COMMERCE WITH 18 UNITS IN

4 HOURS OF RELEVANT TRAINING PREFERABLY IN TAX MAPPING OR EXPERIENCE IN

ACCOUNTING and/or TAXATION or BACHELOR'S

TAX MAPPING, ONLINE FILING AND PAYMENT THE IMPLEMENTATION AND

180 Revenue Officer II (COMPLIANCE) BIRB-REVO2-1770-2014 13 26754 DEGREE IN ACCOUNTANCY OR ANY BACHELOR'S CSP/2ND LEVEL ELIGIBILITY N/A RDO 38 NORTH QC

SYSTEM, BASIC TAX ADMINISTRATION AND ITS MONITORING OF COMPLIANCE OF

DEGREE WITH MASTER'S DEGREE IN BUSINESS

APPLICATION WITHHOLDING AGENTS TO

ADMINISTRATION/ MANAGEMENT/

WITHHOLDING TAX LAWS AND

ACCOUNTANCY/ TAXATION

REGULATIONS

1 YEAR OF RELEVANT EXPERIENCE

BACHELOR'S DEGREE IN BUSINESS

PREFERABLY IN THE CONDUCT OF

ADMINISTRATION/COMMERCE WITH 18 UNITS IN

4 HOURS OF RELEVANT TRAINING PREFERABLY IN TAX MAPPING OR EXPERIENCE IN

ACCOUNTING and/or TAXATION or BACHELOR'S

TAX MAPPING, ONLINE FILING AND PAYMENT THE IMPLEMENTATION AND

181 Revenue Officer II (COMPLIANCE) BIRB-REVO2-1771-2014 13 26754 DEGREE IN ACCOUNTANCY OR ANY BACHELOR'S CSP/2ND LEVEL ELIGIBILITY N/A RDO 38 NORTH QC

SYSTEM, BASIC TAX ADMINISTRATION AND ITS MONITORING OF COMPLIANCE OF

DEGREE WITH MASTER'S DEGREE IN BUSINESS

APPLICATION WITHHOLDING AGENTS TO

ADMINISTRATION/ MANAGEMENT/

WITHHOLDING TAX LAWS AND

ACCOUNTANCY/ TAXATION

REGULATIONS

BS COMMERCE /BSBA ACCOUNTING OR

182 REVENUE OFFICER I (ASSESSMENT) BIRB-REVO1-1863-2000 11 22316 BACHELOR OF LAWS WITH 18 UNITS IN NONE REQUIRED NONE REQUIRED RA1080 (CPA/BAR) N/A RDO 38 NORTH QC

ACCOUNTING

BS COMMERCE /BSBA ACCOUNTING OR

183 REVENUE OFFICER I (ASSESSMENT) BIRB-REVO1-1883-2000 11 22316 BACHELOR OF LAWS WITH 18 UNITS IN NONE REQUIRED NONE REQUIRED RA1080 (CPA/BAR) N/A RDO 38 NORTH QC

ACCOUNTING

BS COMMERCE /BSBA ACCOUNTING OR

184 REVENUE OFFICER I (ASSESSMENT) BIRB-REVO1-1751-2014 11 22316 BACHELOR OF LAWS WITH 18 UNITS IN NONE REQUIRED NONE REQUIRED RA1080 (CPA/BAR) N/A RDO 38 NORTH QC

ACCOUNTING

BS COMMERCE /BSBA ACCOUNTING OR

185 REVENUE OFFICER I (ASSESSMENT) BIRB-REVO1-1756-2014 11 22316 BACHELOR OF LAWS WITH 18 UNITS IN NONE REQUIRED NONE REQUIRED RA1080 (CPA/BAR) N/A RDO 38 NORTH QC

ACCOUNTING

BS COMMERCE /BSBA ACCOUNTING OR

186 REVENUE OFFICER I (ASSESSMENT) BIRB-REVO1-1757-2014 11 22316 BACHELOR OF LAWS WITH 18 UNITS IN NONE REQUIRED NONE REQUIRED RA1080 (CPA/BAR) N/A RDO 38 NORTH QC

ACCOUNTING

BACHELOR'S DEGREE IN BUSINESS

ADMINISTRATION/COMMERCE WITH 18 UNITS IN

ACCOUNTING and/or TAXATION or BACHELOR'S

187 REVENUE OFFICER I (COLLECTION) BIRB-REVO1-1885-2000 11 22316 DEGREE IN ACCOUNTANCY OR ANY BACHELOR'S NONE REQUIRED NONE REQUIRED CSP/2ND LEVEL ELIGIBILITY N/A RDO 38 NORTH QC

DEGREE WITH MASTER'S DEGREE IN BUSINESS

ADMINISTRATION/ MANAGEMENT/

ACCOUNTANCY/ TAXATION

BACHELOR'S DEGREE IN BUSINESS

ADMINISTRATION/COMMERCE WITH 18 UNITS IN

ACCOUNTING and/or TAXATION or BACHELOR'S

188 REVENUE OFFICER I (COLLECTION) BIRB-REVO1-1886-2000 11 22316 DEGREE IN ACCOUNTANCY OR ANY BACHELOR'S NONE REQUIRED NONE REQUIRED CSP/2ND LEVEL ELIGIBILITY N/A RDO 38 NORTH QC

DEGREE WITH MASTER'S DEGREE IN BUSINESS

ADMINISTRATION/ MANAGEMENT/

ACCOUNTANCY/ TAXATION

BACHELOR'S DEGREE IN BUSINESS

ADMINISTRATION/COMMERCE WITH 18 UNITS IN

ACCOUNTING and/or TAXATION or BACHELOR'S

189 REVENUE OFFICER I (COLLECTION) BIRB-REVO1-1891-2000 11 22316 DEGREE IN ACCOUNTANCY OR ANY BACHELOR'S NONE REQUIRED NONE REQUIRED CSP/2ND LEVEL ELIGIBILITY N/A RDO 38 NORTH QC

DEGREE WITH MASTER'S DEGREE IN BUSINESS

ADMINISTRATION/ MANAGEMENT/

ACCOUNTANCY/ TAXATION

BACHELOR'S DEGREE IN BUSINESS

ADMINISTRATION/COMMERCE WITH 18 UNITS IN

ACCOUNTING and/or TAXATION or BACHELOR'S

190 REVENUE OFFICER I (COLLECTION) BIRB-REVO1-1892-2000 11 22316 DEGREE IN ACCOUNTANCY OR ANY BACHELOR'S NONE REQUIRED NONE REQUIRED CSP/2ND LEVEL ELIGIBILITY N/A RDO 38 NORTH QC

DEGREE WITH MASTER'S DEGREE IN BUSINESS

ADMINISTRATION/ MANAGEMENT/

ACCOUNTANCY/ TAXATION

BACHELOR'S DEGREE IN BUSINESS

ADMINISTRATION/COMMERCE WITH 18 UNITS IN

ACCOUNTING and/or TAXATION or BACHELOR'S

191 REVENUE OFFICER I (COLLECTION) BIRB-REVO1-1900-2000 11 22316 DEGREE IN ACCOUNTANCY OR ANY BACHELOR'S NONE REQUIRED NONE REQUIRED CSP/2ND LEVEL ELIGIBILITY N/A RDO 38 NORTH QC

DEGREE WITH MASTER'S DEGREE IN BUSINESS

ADMINISTRATION/ MANAGEMENT/

ACCOUNTANCY/ TAXATION

BACHELOR'S DEGREE IN BUSINESS

ADMINISTRATION/COMMERCE WITH 18 UNITS IN

ACCOUNTING and/or TAXATION or BACHELOR'S

192 REVENUE OFFICER I (COLLECTION) BIRB-REVO1-1758-2014 11 22316 DEGREE IN ACCOUNTANCY OR ANY BACHELOR'S NONE REQUIRED NONE REQUIRED CSP/2ND LEVEL ELIGIBILITY N/A RDO 38 NORTH QC

DEGREE WITH MASTER'S DEGREE IN BUSINESS

ADMINISTRATION/ MANAGEMENT/

ACCOUNTANCY/ TAXATION

BACHELOR'S DEGREE IN BUSINESS

ADMINISTRATION/COMMERCE WITH 18 UNITS IN

ACCOUNTING and/or TAXATION or BACHELOR'S

193 Revenue Officer I (COMPLIANCE) BIRB-REVO1-1762-2014 11 22316 DEGREE IN ACCOUNTANCY OR ANY BACHELOR'S NONE REQUIRED NONE REQUIRED CSP/2ND LEVEL ELIGIBILITY N/A RDO 38 NORTH QC

DEGREE WITH MASTER'S DEGREE IN BUSINESS

ADMINISTRATION/ MANAGEMENT/

ACCOUNTANCY/ TAXATION

BACHELOR'S DEGREE IN BUSINESS

ADMINISTRATION/COMMERCE WITH 18 UNITS IN

ACCOUNTING and/or TAXATION or BACHELOR'S

194 Revenue Officer I (COMPLIANCE) BIRB-REVO1-1763-2014 11 22316 DEGREE IN ACCOUNTANCY OR ANY BACHELOR'S NONE REQUIRED NONE REQUIRED CSP/2ND LEVEL ELIGIBILITY N/A RDO 38 NORTH QC

DEGREE WITH MASTER'S DEGREE IN BUSINESS

ADMINISTRATION/ MANAGEMENT/

ACCOUNTANCY/ TAXATION

BACHELOR'S DEGREE IN BUSINESS

ADMINISTRATION/COMMERCE WITH 18 UNITS IN

ACCOUNTING and/or TAXATION or BACHELOR'S

195 Revenue Officer I (COMPLIANCE) BIRB-REVO1-1764-2014 11 22316 DEGREE IN ACCOUNTANCY OR ANY BACHELOR'S NONE REQUIRED NONE REQUIRED CSP/2ND LEVEL ELIGIBILITY N/A RDO 38 NORTH QC

DEGREE WITH MASTER'S DEGREE IN BUSINESS

ADMINISTRATION/ MANAGEMENT/

ACCOUNTANCY/ TAXATION

Completion of two years studies in College or RELEVANT MC 11,

Administrative Assistant III (Computer

196 BIRB-ADAS3-510-2005 9 18784 High School Graduate with relevant 4 HOURS OF RELEVANT TRAINING 1 YEAR OF RELEVANT EXPERIENCE S.96/CSSP/1ST LEVEL N/A RDO 38 NORTH QC

Operator II)

vocational/trade courses ELIGIBILITY

Completion of two years studies in College or RELEVANT MC 11,

Administrative Assistant III (Computer

197 BIRB-ADAS3-513-2005 9 18784 High School Graduate with relevant 4 HOURS OF RELEVANT TRAINING 1 YEAR OF RELEVANT EXPERIENCE S.96/CSSP/1ST LEVEL N/A RDO 38 NORTH QC

Operator II)

vocational/trade courses ELIGIBILITY

198 Chief Revenue Officer II BIRB-CRO2-573-2014 21 59353 BACHELOR'S DEGREE RELEVANT TO THE JOB 8 HOURS OF RELEVANT TRAINING 2 YEARS OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RDO 39 SOUTH QC

199 Chief Revenue Officer II BIRB-CRO2-574-2014 21 59353 BACHELOR'S DEGREE RELEVANT TO THE JOB 8 HOURS OF RELEVANT TRAINING 2 YEARS OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RDO 39 SOUTH QC

BACHELOR'S DEGREE IN BUSINESS

ADMINISTRATION/COMMERCE WITH 18 UNITS IN

ACCOUNTING and/or TAXATION or BACHELOR'S

200 Revenue Officer IV (COLLECTION) BIRB-REVO4-503-2000 19 46791 DEGREE IN ACCOUNTANCY OR ANY BACHELOR'S 16 HOURS OF RELEVANT TRAINING 3 YEARS OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RDO 39 SOUTH QC

DEGREE WITH MASTER'S DEGREE IN BUSINESS

ADMINISTRATION/ MANAGEMENT/

ACCOUNTANCY/ TAXATION

3 YEARS OF RELEVANT EXPERIENCE

BACHELOR'S DEGREE IN BUSINESS

PREFERABLY IN THE CONDUCT OF

ADMINISTRATION/COMMERCE WITH 18 UNITS IN

16 HOURS OF RELEVANT TRAINING PREFERABLY TAX MAPPING OR EXPERIENCE IN

ACCOUNTING and/or TAXATION or BACHELOR'S

IN TAX MAPPING, ONLINE FILING AND PAYMENT THE IMPLEMENTATION AND

201 Revenue Officer IV (COMPLIANCE) BIRB-REVO4-505-2000 19 46791 DEGREE IN ACCOUNTANCY OR ANY BACHELOR'S CSP/2ND LEVEL ELIGIBILITY N/A RDO 39 SOUTH QC

SYSTEM, BASIC TAX ADMINISTRATION AND ITS MONITORING OF COMPLIANCE OF

DEGREE WITH MASTER'S DEGREE IN BUSINESS

APPLICATION WITHHOLDING AGENTS TO

ADMINISTRATION/ MANAGEMENT/

WITHHOLDING TAX LAWS AND

ACCOUNTANCY/ TAXATION

REGULATIONS

BSBA/BSC/BA WITH 18 UNITS IN ACCOUNTING OR

Revenue Officer IV (TAXPAYERS ANY BACHELOR'S DEGREE WITH MASTER'S

202 BIRB-REVO4-504-2000 19 46791 8 HOURS OF RELEVANT TRAINING 3 YEARS OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RDO 39 SOUTH QC

ASSISTANCE) DEGREE IN BUSINESS ADMINISTRATION/

MANAGEMENT/ ACCOUNTANCY/ TAXATION

203 Administrative Officer V BIRB-ADOF5-146-2005 18 42159 BACHELOR'S DEGREE RELEVANT TO THE JOB 8 HOURS OF RELEVANT TRAINING 2 YEARS OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RDO 39 SOUTH QC

BS COMMERCE /BSBA ACCOUNTING OR

204 Revenue Officer III (ASSESSMENT) BIRB-REVO3-1054-2014 16 35106 BACHELOR OF LAWS WITH 18 UNITS IN 4 HOURS OF RELEVANT TRAINING 2 YEARS OF RELEVANT EXPERIENCE RA1080 (CPA/BAR) N/A RDO 39 SOUTH QC

ACCOUNTING

BACHELOR'S DEGREE IN BUSINESS

ADMINISTRATION/COMMERCE WITH 18 UNITS IN

ACCOUNTING and/or TAXATION or BACHELOR'S

205 Revenue Officer III (COLLECTION) BIRB-REVO3-849-2000 16 35106 DEGREE IN ACCOUNTANCY OR ANY BACHELOR'S 8 HOURS OF RELEVANT TRAINING 2 YEARS OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RDO 39 SOUTH QC

DEGREE WITH MASTER'S DEGREE IN BUSINESS

ADMINISTRATION/ MANAGEMENT/

ACCOUNTANCY/ TAXATION

2 YEARS OF RELEVANT EXPERIENCE

BACHELOR'S DEGREE IN BUSINESS

PREFERABLY IN THE CONDUCT OF

ADMINISTRATION/COMMERCE WITH 18 UNITS IN

8 HOURS OF RELEVANT TRAINING PREFERABLY IN TAX MAPPING OR EXPERIENCE IN

ACCOUNTING and/or TAXATION or BACHELOR'S

TAX MAPPING, ONLINE FILING AND PAYMENT THE IMPLEMENTATION AND

206 Revenue Officer III (COMPLIANCE) BIRB-REVO3-1055-2014 16 35106 DEGREE IN ACCOUNTANCY OR ANY BACHELOR'S CSP/2ND LEVEL ELIGIBILITY N/A RDO 39 SOUTH QC

SYSTEM, BASIC TAX ADMINISTRATION AND ITS MONITORING OF COMPLIANCE OF

DEGREE WITH MASTER'S DEGREE IN BUSINESS

APPLICATION WITHHOLDING AGENTS TO

ADMINISTRATION/ MANAGEMENT/

WITHHOLDING TAX LAWS AND

ACCOUNTANCY/ TAXATION

REGULATIONS

2 YEARS OF RELEVANT EXPERIENCE

BACHELOR'S DEGREE IN BUSINESS

PREFERABLY IN THE CONDUCT OF

ADMINISTRATION/COMMERCE WITH 18 UNITS IN

8 HOURS OF RELEVANT TRAINING PREFERABLY IN TAX MAPPING OR EXPERIENCE IN

ACCOUNTING and/or TAXATION or BACHELOR'S

TAX MAPPING, ONLINE FILING AND PAYMENT THE IMPLEMENTATION AND

207 Revenue Officer III (COMPLIANCE) BIRB-REVO3-1056-2014 16 35106 DEGREE IN ACCOUNTANCY OR ANY BACHELOR'S CSP/2ND LEVEL ELIGIBILITY N/A RDO 39 SOUTH QC

SYSTEM, BASIC TAX ADMINISTRATION AND ITS MONITORING OF COMPLIANCE OF

DEGREE WITH MASTER'S DEGREE IN BUSINESS

APPLICATION WITHHOLDING AGENTS TO

ADMINISTRATION/ MANAGEMENT/

WITHHOLDING TAX LAWS AND

ACCOUNTANCY/ TAXATION

REGULATIONS

BSBA/BSC/BA WITH 18 UNITS IN ACCOUNTING OR

Revenue Officer III (DOCUMENT ANY BACHELOR'S DEGREE WITH MASTER'S

208 BIRB-REVO3-851-2000 16 35106 4 HOURS OF RELEVANT TRAINING 2 YEARS OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RDO 39 SOUTH QC

PROCESSING) DEGREE IN BUSINESS ADMINISTRATION/

MANAGEMENT/ ACCOUNTANCY/ TAXATION

BSBA/BSC/BA WITH 18 UNITS IN ACCOUNTING OR

Revenue Officer III (TAXPAYERS ANY BACHELOR'S DEGREE WITH MASTER'S

209 BIRB-REVO3-850-2000 16 35106 4 HOURS OF RELEVANT TRAINING 2 YEARS OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RDO 39 SOUTH QC

ASSISTANCE) DEGREE IN BUSINESS ADMINISTRATION/

MANAGEMENT/ ACCOUNTANCY/ TAXATION

BSBA/BSC/BA WITH 18 UNITS IN ACCOUNTING OR

Revenue Officer III (TAXPAYERS ANY BACHELOR'S DEGREE WITH MASTER'S

210 BIRB-REVO3-852-2000 16 35106 4 HOURS OF RELEVANT TRAINING 2 YEARS OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RDO 39 SOUTH QC

ASSISTANCE) DEGREE IN BUSINESS ADMINISTRATION/

MANAGEMENT/ ACCOUNTANCY/ TAXATION

BS COMMERCE /BSBA ACCOUNTING OR

211 Revenue Officer II (ASSESSMENT) BIRB-REVO2-1198-2000 13 26754 BACHELOR OF LAWS WITH 18 UNITS IN NONE REQUIRED 1 YEAR OF RELEVANT EXPERIENCE RA1080 (CPA/BAR) N/A RDO 39 SOUTH QC

ACCOUNTING

BS COMMERCE /BSBA ACCOUNTING OR

212 Revenue Officer II (ASSESSMENT) BIRB-REVO2-419-2000 13 26754 BACHELOR OF LAWS WITH 18 UNITS IN NONE REQUIRED 1 YEAR OF RELEVANT EXPERIENCE RA1080 (CPA/BAR) N/A RDO 39 SOUTH QC

ACCOUNTING

BS COMMERCE /BSBA ACCOUNTING OR

213 Revenue Officer II (ASSESSMENT) BIRB-REVO2-1734-2014 13 26754 BACHELOR OF LAWS WITH 18 UNITS IN NONE REQUIRED 1 YEAR OF RELEVANT EXPERIENCE RA1080 (CPA/BAR) N/A RDO 39 SOUTH QC

ACCOUNTING

BACHELOR'S DEGREE IN BUSINESS

ADMINISTRATION/COMMERCE WITH 18 UNITS IN

ACCOUNTING and/or TAXATION or BACHELOR'S

214 Revenue Officer II (COLLECTION) BIRB-REVO2-1203-2000 13 26754 DEGREE IN ACCOUNTANCY OR ANY BACHELOR'S 4 HOURS OF RELEVANT TRAINING 1 YEAR OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RDO 39 SOUTH QC

DEGREE WITH MASTER'S DEGREE IN BUSINESS

ADMINISTRATION/ MANAGEMENT/

ACCOUNTANCY/ TAXATION

BACHELOR'S DEGREE IN BUSINESS

ADMINISTRATION/COMMERCE WITH 18 UNITS IN

ACCOUNTING and/or TAXATION or BACHELOR'S

215 Revenue Officer II (COLLECTION) BIRB-REVO2-1206-2000 13 26754 DEGREE IN ACCOUNTANCY OR ANY BACHELOR'S 4 HOURS OF RELEVANT TRAINING 1 YEAR OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RDO 39 SOUTH QC

DEGREE WITH MASTER'S DEGREE IN BUSINESS

ADMINISTRATION/ MANAGEMENT/

ACCOUNTANCY/ TAXATION

BACHELOR'S DEGREE IN BUSINESS

ADMINISTRATION/COMMERCE WITH 18 UNITS IN

ACCOUNTING and/or TAXATION or BACHELOR'S

216 Revenue Officer II (COLLECTION) BIRB-REVO2-1736-2014 13 26754 DEGREE IN ACCOUNTANCY OR ANY BACHELOR'S 4 HOURS OF RELEVANT TRAINING 1 YEAR OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RDO 39 SOUTH QC

DEGREE WITH MASTER'S DEGREE IN BUSINESS

ADMINISTRATION/ MANAGEMENT/

ACCOUNTANCY/ TAXATION

1 YEAR OF RELEVANT EXPERIENCE

BACHELOR'S DEGREE IN BUSINESS

PREFERABLY IN THE CONDUCT OF

ADMINISTRATION/COMMERCE WITH 18 UNITS IN

4 HOURS OF RELEVANT TRAINING PREFERABLY IN TAX MAPPING OR EXPERIENCE IN

ACCOUNTING and/or TAXATION or BACHELOR'S

TAX MAPPING, ONLINE FILING AND PAYMENT THE IMPLEMENTATION AND

217 Revenue Officer II (COMPLIANCE) BIRB-REVO2-1737-2014 13 26754 DEGREE IN ACCOUNTANCY OR ANY BACHELOR'S CSP/2ND LEVEL ELIGIBILITY N/A RDO 39 SOUTH QC

SYSTEM, BASIC TAX ADMINISTRATION AND ITS MONITORING OF COMPLIANCE OF

DEGREE WITH MASTER'S DEGREE IN BUSINESS

APPLICATION WITHHOLDING AGENTS TO

ADMINISTRATION/ MANAGEMENT/

WITHHOLDING TAX LAWS AND

ACCOUNTANCY/ TAXATION

REGULATIONS

1 YEAR OF RELEVANT EXPERIENCE

BACHELOR'S DEGREE IN BUSINESS

PREFERABLY IN THE CONDUCT OF

ADMINISTRATION/COMMERCE WITH 18 UNITS IN

4 HOURS OF RELEVANT TRAINING PREFERABLY IN TAX MAPPING OR EXPERIENCE IN

ACCOUNTING and/or TAXATION or BACHELOR'S

TAX MAPPING, ONLINE FILING AND PAYMENT THE IMPLEMENTATION AND

218 Revenue Officer II (COMPLIANCE) BIRB-REVO2-1738-2014 13 26754 DEGREE IN ACCOUNTANCY OR ANY BACHELOR'S CSP/2ND LEVEL ELIGIBILITY N/A RDO 39 SOUTH QC

SYSTEM, BASIC TAX ADMINISTRATION AND ITS MONITORING OF COMPLIANCE OF

DEGREE WITH MASTER'S DEGREE IN BUSINESS

APPLICATION WITHHOLDING AGENTS TO

ADMINISTRATION/ MANAGEMENT/

WITHHOLDING TAX LAWS AND

ACCOUNTANCY/ TAXATION

REGULATIONS

BSBA/BSC/BA WITH 18 UNITS IN ACCOUNTING OR

Revenue Officer II (TAXPAYERS ANY BACHELOR'S DEGREE WITH MASTER'S

219 BIRB-REVO2-1207-2000 13 26754 NONE REQUIRED 1 YEAR OF RELEVANT EXPERIENCE CSP/2ND LEVEL ELIGIBILITY N/A RDO 39 SOUTH QC

ASSISTANCE) DEGREE IN BUSINESS ADMINISTRATION/

MANAGEMENT/ ACCOUNTANCY/ TAXATION

BS COMMERCE /BSBA ACCOUNTING OR

220 REVENUE OFFICER I (ASSESSMENT) BIRB-REVO1-1774-2014 11 22316 BACHELOR OF LAWS WITH 18 UNITS IN NONE REQUIRED NONE REQUIRED RA1080 (CPA/BAR) N/A RDO 39 SOUTH QC

ACCOUNTING

BACHELOR'S DEGREE IN BUSINESS

ADMINISTRATION/COMMERCE WITH 18 UNITS IN

ACCOUNTING and/or TAXATION or BACHELOR'S

221 REVENUE OFFICER I (COLLECTION) BIRB-REVO1-1968-2000 11 22316 DEGREE IN ACCOUNTANCY OR ANY BACHELOR'S NONE REQUIRED NONE REQUIRED CSP/2ND LEVEL ELIGIBILITY N/A RDO 39 SOUTH QC

DEGREE WITH MASTER'S DEGREE IN BUSINESS

ADMINISTRATION/ MANAGEMENT/

ACCOUNTANCY/ TAXATION

BACHELOR'S DEGREE IN BUSINESS

ADMINISTRATION/COMMERCE WITH 18 UNITS IN

ACCOUNTING and/or TAXATION or BACHELOR'S

222 REVENUE OFFICER I (COLLECTION) BIRB-REVO1-1970-2000 11 22316 DEGREE IN ACCOUNTANCY OR ANY BACHELOR'S NONE REQUIRED NONE REQUIRED CSP/2ND LEVEL ELIGIBILITY N/A RDO 39 SOUTH QC

DEGREE WITH MASTER'S DEGREE IN BUSINESS

ADMINISTRATION/ MANAGEMENT/

ACCOUNTANCY/ TAXATION

BACHELOR'S DEGREE IN BUSINESS

ADMINISTRATION/COMMERCE WITH 18 UNITS IN

ACCOUNTING and/or TAXATION or BACHELOR'S

223 REVENUE OFFICER I (COLLECTION) BIRB-REVO1-1974-2000 11 22316 DEGREE IN ACCOUNTANCY OR ANY BACHELOR'S NONE REQUIRED NONE REQUIRED CSP/2ND LEVEL ELIGIBILITY N/A RDO 39 SOUTH QC

DEGREE WITH MASTER'S DEGREE IN BUSINESS

ADMINISTRATION/ MANAGEMENT/

ACCOUNTANCY/ TAXATION

BACHELOR'S DEGREE IN BUSINESS

ADMINISTRATION/COMMERCE WITH 18 UNITS IN

ACCOUNTING and/or TAXATION or BACHELOR'S

224 REVENUE OFFICER I (COLLECTION) BIRB-REVO1-1975-2000 11 22316 DEGREE IN ACCOUNTANCY OR ANY BACHELOR'S NONE REQUIRED NONE REQUIRED CSP/2ND LEVEL ELIGIBILITY N/A RDO 39 SOUTH QC

DEGREE WITH MASTER'S DEGREE IN BUSINESS

ADMINISTRATION/ MANAGEMENT/

ACCOUNTANCY/ TAXATION

BACHELOR'S DEGREE IN BUSINESS

ADMINISTRATION/COMMERCE WITH 18 UNITS IN

ACCOUNTING and/or TAXATION or BACHELOR'S

225 REVENUE OFFICER I (COLLECTION) BIRB-REVO1-1982-2000 11 22316 DEGREE IN ACCOUNTANCY OR ANY BACHELOR'S NONE REQUIRED NONE REQUIRED CSP/2ND LEVEL ELIGIBILITY N/A RDO 39 SOUTH QC

DEGREE WITH MASTER'S DEGREE IN BUSINESS

ADMINISTRATION/ MANAGEMENT/

ACCOUNTANCY/ TAXATION

BACHELOR'S DEGREE IN BUSINESS

ADMINISTRATION/COMMERCE WITH 18 UNITS IN

ACCOUNTING and/or TAXATION or BACHELOR'S