Professional Documents

Culture Documents

Form 16 2 PDF

Form 16 2 PDF

Uploaded by

Jeevan GogalOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form 16 2 PDF

Form 16 2 PDF

Uploaded by

Jeevan GogalCopyright:

Available Formats

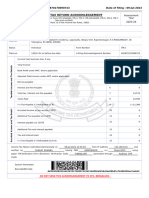

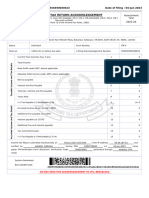

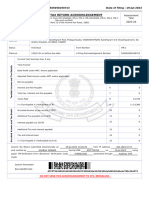

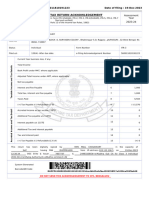

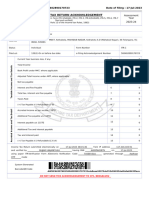

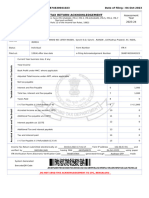

INDIANINCOMETAX RETURN ACKNOWLEDGEMENT Assessment Year

in Form ITR-I (SAHAJ), ITR-2, ITR-3,

Where the data of the Return of Income

rTR-4(SUGAM), ITR-5, ITR-6, ITR-7 Nled and verifled

2020-2

(Please see Rule 12 of the Income-tax Rules, 1962)

PAN ABUPV1695F

Name CSVENKATESHAPPA

NO,, MUSTUR POST, JAGALUR TALUK, Davanagere, KARNATAKA, 577528

Address

Status Individual Form Number ITR-1

Filed us 139(1)-On or before due date e-Filing Acknowledgement Number 456599700110820

Current Year business loss, if any

669920

Total Income

Book Profit under MAT, where applicable 2

Adjusted Total Income under AMT, where applicable

Net tax payable 4 48343

Interest and Fee Payable 1520

Total tax,interest and Fee payable 49863

Taxes Paid 70000

(+Tax Payable /()Refundable (6-7) 8 -20140

Dividend Tax Payable 9

Interest Payable 10

Total Dividend tax and interest payable 11

Taxes Paid 12

(+Tax Payable /(-)Refundable (11-12) 13

Accreted Income as per section 115TD 14 0

Additional Tax payable ws 115TD 15

Interest payable u/s 115TE 16

Additional Tax and interest payable 17

Tax and interest paid

18

(+Tax Payable /(-)Refundable (17-18) 19

Income Tax Return submitted electronically on 11-08-2020 20:09:40 from IP address 61.3.16.149

and verified by

CSVENKATESHAPPA

having PAN ABUPV1695F on 11-08-2020 20:10:09 from IP address 61.3.16.149

using

Electronic Verification Code

6GAEYTCLC generated through Aadhaar OTP mode.

DONOT SEND THIS ACKNOWLEDGEMENT TO CPC, BENGALURU

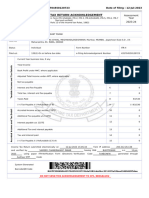

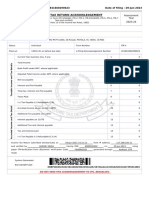

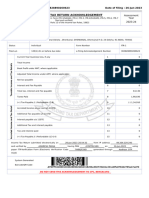

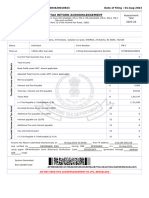

A.Y. 2020-2021

Previous Year: 2019-2020

: C S VENKATESHAPPA

Name : ABUPV 1695 F

PAN

Father's Name: SANNA SATHYAPPA

Address : NO

Status Individual

Date of Birth: 01-Jun-1969

MUSTUR POST

:4751 0911 4086

JAGALUR IALUK, Lavanagere-

Aadhaar No.

577 52R

Resident Statement of Income

Rs. Rs. Rs

Income from SalarieSDEPARIMERN UP PUBLI

Empioye-1: 1

INSTRIICTINNS

Salaries, allowances and perquisites 2 8,72,321

8,72,321

Total salary

Standard deduction uls 16fia) 50,000

Less: Tax on employment u/s 16(ii) 2,400 52,400

Income charyeeble under the head "Salaries" 8,19,921

8,19,921

Gross Total Income

Deductions under Chapter V-A

Investment us 80C, CCC, cCD

Life insurance premium 1,50,000

Deduction subject to ceiling us 80CCE 1,50,000

Deduction in respect ofpayments from 01-Apr-20 to

31-Ju-20 (For Sch.DI)

Total Income 6,69,921

Total income rounded off u/s 288A 6,69,920

Tax on total income 46,4,484

Add: Cess 1,859

Tax with cess 48,343

Net Tax 48,343

Advance Tax 4 70,000

Total prepaid taxes 70,000

Balance Tax -21,667

Interest u/s 234C 1,520

Refund Due 20,140

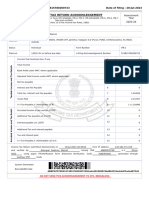

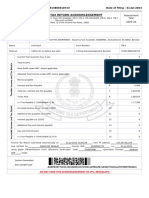

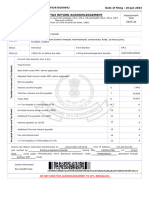

Schedule 2

Salary Income Received Exempt Taxable

Basic Salary 7,61,250 7,61,250

Dearness allowance forming part of Salary 59,587 59,587

Total 8,20,837 8,20,837

Allowances

House Rent Allowance: exempt u/s 10(13A) 60,900 10,916 49,984

OTHER aLLOWANCE 1,500 1,500

Total

62,400 10,916 51,484

HRA exemption Calculation

Rent paid

93,000 City Others

40% of the salary 3,28,335

Rent paid in excess of 10% of salary 10,916

Taxable portion of

Salary income

8,20,837

Allowances

51,484

Total Taxable amount

8,72,321

You might also like

- Arundel Case Group 3 Report DefDocument8 pagesArundel Case Group 3 Report DefJoep Teulings100% (1)

- Notes From - Trade Like A Stock Market Wizard - How To Achieve Super Performance in Stocks in Any MarketDocument4 pagesNotes From - Trade Like A Stock Market Wizard - How To Achieve Super Performance in Stocks in Any Marketvinayak p hNo ratings yet

- Beant Singh ITRDocument7 pagesBeant Singh ITRakhtarnadeem5636No ratings yet

- 2223 Itr Set - SSSDocument11 pages2223 Itr Set - SSSPiyu VaiNo ratings yet

- Sarath Itr (20 - 21)Document3 pagesSarath Itr (20 - 21)bindu mathaiNo ratings yet

- Indian Income Tax Return Acknowledgement 2020-21: Esappo445Q Mohan Prathap PandianDocument4 pagesIndian Income Tax Return Acknowledgement 2020-21: Esappo445Q Mohan Prathap PandianVignesh KanagarajNo ratings yet

- Aakash 2023-24Document5 pagesAakash 2023-24suneetbansalNo ratings yet

- Itr Fy 22-23Document6 pagesItr Fy 22-23Omkar kaleNo ratings yet

- ACK400586250060624Document1 pageACK400586250060624suniloffcNo ratings yet

- ACK570939170200723Document1 pageACK570939170200723Benzene diazonium saltNo ratings yet

- 03_ITRAY2024_ACK_155068870310723Document1 page03_ITRAY2024_ACK_155068870310723Gowtham RockstarNo ratings yet

- ACK426777580130624Document1 pageACK426777580130624mubka354000No ratings yet

- Itr 2Document1 pageItr 2ravinder08021986kumarNo ratings yet

- PDF 242697850160623Document1 pagePDF 242697850160623Sujith GowdaNo ratings yet

- Indian Income Tax Return Acknowledgement: Acknowledgement Number:165940410240523 Date of Filing: 24-May-2023Document1 pageIndian Income Tax Return Acknowledgement: Acknowledgement Number:165940410240523 Date of Filing: 24-May-2023mudhra143No ratings yet

- ACK471398560140723Document1 pageACK471398560140723Dashing ParthiNo ratings yet

- Gurmeet ITRDocument7 pagesGurmeet ITRakhtarnadeem5636No ratings yet

- ACK401870170090723Document1 pageACK401870170090723Kundan SharmaNo ratings yet

- ACK511896830170723Document1 pageACK511896830170723satyabratadebanath2000No ratings yet

- Ack 435704550120723Document1 pageAck 435704550120723sawant.akshay64No ratings yet

- PDF 581584680210723Document1 pagePDF 581584680210723BhauNo ratings yet

- Financial AY 21 22Document23 pagesFinancial AY 21 22NAHID AFSARNo ratings yet

- Itr Ay 22 - 23Document5 pagesItr Ay 22 - 23sagarsavla110No ratings yet

- ACK132018820310723Document1 pageACK132018820310723LikhithVulapuNo ratings yet

- Ratnapal Dadarao Wasnik Itr 22-23Document1 pageRatnapal Dadarao Wasnik Itr 22-23tax advisorNo ratings yet

- ACK160159480020823Document1 pageACK160159480020823SanthoshRajNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument3 pagesIndian Income Tax Return Acknowledgement 2021-22: Assessment YearDeeptimayee SahooNo ratings yet

- PDF 442687371160624Document1 pagePDF 442687371160624b2bservices007No ratings yet

- Itr Ay 2022-23 Naveen KumarDocument1 pageItr Ay 2022-23 Naveen Kumarprateek gangwaniNo ratings yet

- Kaka ItrDocument1 pageKaka Itrvermaankur17No ratings yet

- ACK199358390040623Document1 pageACK199358390040623suneetbansalNo ratings yet

- Mandeep Kaur 2023-2024Document1 pageMandeep Kaur 2023-2024amanghou181206No ratings yet

- Itrv 1Document1 pageItrv 1mickieNo ratings yet

- PDF 115914800310723Document1 pagePDF 115914800310723jayanto chowdhuryNo ratings yet

- Itr 1Document1 pageItr 1ravinder08021986kumarNo ratings yet

- Ack 238401890150623Document1 pageAck 238401890150623Alapati RammohanNo ratings yet

- ACK419869410120624Document1 pageACK419869410120624tusharbansal825No ratings yet

- PDF 311993080280623Document1 pagePDF 311993080280623Prabhakaran ANo ratings yet

- PDF 544569290190723Document1 pagePDF 544569290190723DA GAMERZNo ratings yet

- ITR 2021-22 - CompressedDocument36 pagesITR 2021-22 - Compressedjoshikrishnakumar19No ratings yet

- Statement of Accounts OF M/S. Netcore Computers For The Financial Year 2023-24 For The Assessment Year 2024-25Document10 pagesStatement of Accounts OF M/S. Netcore Computers For The Financial Year 2023-24 For The Assessment Year 2024-25Kiran DubeleNo ratings yet

- ACK560011810191223Document1 pageACK560011810191223sumi.ch.tewariNo ratings yet

- Ack 168218680060424Document1 pageAck 168218680060424Niraj JaiswalNo ratings yet

- ACK302828890260623Document1 pageACK302828890260623Jaswanth KumarNo ratings yet

- PDF 254872900180623Document1 pagePDF 254872900180623Sachin KumarNo ratings yet

- Indian Income Tax Return Acknowledgement: Date of Filing: 10-Jun-2023 Acknowledgement Number:218792930100692Document1 pageIndian Income Tax Return Acknowledgement: Date of Filing: 10-Jun-2023 Acknowledgement Number:218792930100692shreemultistateservice23No ratings yet

- Indian Income Tax Return Acknowledgement: Acknowledgement Number:312151100280623 Date of Filing: 28-Jun-2023Document2 pagesIndian Income Tax Return Acknowledgement: Acknowledgement Number:312151100280623 Date of Filing: 28-Jun-2023AMRIT23WALANo ratings yet

- Ack 149928400310723Document1 pageAck 149928400310723arora.parthknlNo ratings yet

- Indian Income Tax Return Acknowledgement: Assessment YearDocument2 pagesIndian Income Tax Return Acknowledgement: Assessment YearSatyanarayana BalusaNo ratings yet

- PDF 397197880050624Document1 pagePDF 397197880050624ansar.rafiqiNo ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment Yearehsan ahmed0% (1)

- ACK326987860300623Document1 pageACK326987860300623sudarshankarn08No ratings yet

- 3.kingsun Financial Statement FinalDocument22 pages3.kingsun Financial Statement FinalDharamrajNo ratings yet

- Indian Income Tax Return Acknowledgement: Acknowledgement Number:500402890170723 Date of Filing: 17-Jul-2023Document1 pageIndian Income Tax Return Acknowledgement: Acknowledgement Number:500402890170723 Date of Filing: 17-Jul-2023tdsbolluNo ratings yet

- ACK384874630041023Document1 pageACK384874630041023v k pitaliaNo ratings yet

- PDF 404118660090723Document1 pagePDF 404118660090723arjunbasfore84No ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment YearTAPAS MAHARANANo ratings yet

- Itr 2020-21Document1 pageItr 2020-21saif.siddiqui.ablNo ratings yet

- ACK203970610060623Document1 pageACK203970610060623salimmama1919No ratings yet

- PDF 181512140110823Document1 pagePDF 181512140110823mohan SNo ratings yet

- PDF 157084620010823Document1 pagePDF 157084620010823Nilamani Umashankar JenaNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- CDMA - Program 6Document9 pagesCDMA - Program 6Jeevan GogalNo ratings yet

- 3rd YearDocument1 page3rd YearJeevan GogalNo ratings yet

- Project Sheet3Document11 pagesProject Sheet3Jeevan GogalNo ratings yet

- InvoiceDocument1 pageInvoiceJeevan GogalNo ratings yet

- New Doc 2019-04-29 18.45.33Document1 pageNew Doc 2019-04-29 18.45.33Jeevan GogalNo ratings yet

- Seats Availability in Ayurveda - (Non Hyd-Kar Quota) TotalDocument1 pageSeats Availability in Ayurveda - (Non Hyd-Kar Quota) TotalJeevan GogalNo ratings yet

- Application For Closure of BusinessDocument3 pagesApplication For Closure of BusinessNorberto Cercado50% (2)

- Payslip For The Month of February - 2022: Spanidea Systems Private LimitedDocument1 pagePayslip For The Month of February - 2022: Spanidea Systems Private LimitedChinmaya SahooNo ratings yet

- Quiz: Corporate Liquidation Final Term: Problem 1Document3 pagesQuiz: Corporate Liquidation Final Term: Problem 1Eel GiNo ratings yet

- Check List For Yearly ClosingDocument4 pagesCheck List For Yearly Closingvaishaliak2008No ratings yet

- Choose The Best Answer: 1. Briefly Explain The Component/elements of A Business Plan 1) Executive SummaryDocument4 pagesChoose The Best Answer: 1. Briefly Explain The Component/elements of A Business Plan 1) Executive SummaryGemechuNo ratings yet

- Financial LiteracyDocument39 pagesFinancial Literacyahire.krutika100% (2)

- 162.005.exercises and AssignDocument2 pages162.005.exercises and AssignAngelli Lamique50% (2)

- AlembicPharma ReportDocument29 pagesAlembicPharma ReportSneha SinhaNo ratings yet

- Quiz 4 - With AnswersDocument6 pagesQuiz 4 - With Answersjanus lopezNo ratings yet

- Tacoma DebriefingDocument11 pagesTacoma DebriefingNam Nguyen hoaiNo ratings yet

- Appropriation Account in PartnershipDocument3 pagesAppropriation Account in PartnershipumeshNo ratings yet

- Traders Club - Nov. 21Document5 pagesTraders Club - Nov. 21Peter ErnstNo ratings yet

- Company Law ProjectDocument8 pagesCompany Law ProjectDouble A CreationNo ratings yet

- Fitness FitnessDocument21 pagesFitness FitnessAndinetNo ratings yet

- Project On Training and Development On HDFC BankDocument40 pagesProject On Training and Development On HDFC BankDinesh Metkari83% (6)

- Present State of Bangladesh Stock Market-Its Problems & ProspectsDocument45 pagesPresent State of Bangladesh Stock Market-Its Problems & ProspectsAbdul HaiNo ratings yet

- (Term Paper) The Rationale of Shari'ah Supporting Contracts - A Case of MPODocument22 pages(Term Paper) The Rationale of Shari'ah Supporting Contracts - A Case of MPOHaziyah HalimNo ratings yet

- Wells Fargo Everyday Checking: Important Account InformationDocument6 pagesWells Fargo Everyday Checking: Important Account InformationMiguel A RevecoNo ratings yet

- UMIX Group ENDocument11 pagesUMIX Group ENLukas AndriyanNo ratings yet

- The Second Wave Resilient Inclusive Exponential FintechsDocument70 pagesThe Second Wave Resilient Inclusive Exponential FintechsjlknspceppuqowxxtaNo ratings yet

- 5 Tahmoures A AfsharDocument9 pages5 Tahmoures A AfsharZouher EL BrmakiNo ratings yet

- Ushahidi, Inc.: Financial StatementsDocument12 pagesUshahidi, Inc.: Financial StatementsChristinaHolmanNo ratings yet

- Process Mapping of GDCL Contracts & Projects in Oracle & Site SolutionDocument64 pagesProcess Mapping of GDCL Contracts & Projects in Oracle & Site SolutionkrmcharigdcNo ratings yet

- Visa Classic 3. Rupay Classic 6. Mastercard Gold 8. Rupay Platinum 9. Rupay Select CardDocument4 pagesVisa Classic 3. Rupay Classic 6. Mastercard Gold 8. Rupay Platinum 9. Rupay Select CardVikramjeet SinghNo ratings yet

- 01 - Accounting For Managers PDFDocument151 pages01 - Accounting For Managers PDFAmit Kumar PandeyNo ratings yet

- Equizilation Levy AssignmentDocument3 pagesEquizilation Levy AssignmentNagarjuna ReddyNo ratings yet

- A Study of Investors Attitude Towards Mutual Funds in DelhiDocument14 pagesA Study of Investors Attitude Towards Mutual Funds in DelhiarcherselevatorsNo ratings yet

- 2022 12 01 Answer Key Additional M6 M7Document15 pages2022 12 01 Answer Key Additional M6 M7Niger RomeNo ratings yet