Professional Documents

Culture Documents

Valuation Sheet

Valuation Sheet

Uploaded by

Harsh Maheshwari0 ratings0% found this document useful (0 votes)

27 views7 pagesThis document summarizes key financial metrics and calculations for evaluating the intrinsic value of Refex Industries. It provides 2019 operating cash flow, maintenance expenses, owner's earnings, growth rate, discount rate, shares outstanding, and EPS. It then calculates the value per share as Rs. 21.1835 based on a discounted cash flow model. Maintenance expenses are also calculated. The document compares multiple companies' net earnings, price to book ratios, and value to price ratios to determine which is the best investment.

Original Description:

Original Title

valuation sheet

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document summarizes key financial metrics and calculations for evaluating the intrinsic value of Refex Industries. It provides 2019 operating cash flow, maintenance expenses, owner's earnings, growth rate, discount rate, shares outstanding, and EPS. It then calculates the value per share as Rs. 21.1835 based on a discounted cash flow model. Maintenance expenses are also calculated. The document compares multiple companies' net earnings, price to book ratios, and value to price ratios to determine which is the best investment.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

27 views7 pagesValuation Sheet

Valuation Sheet

Uploaded by

Harsh MaheshwariThis document summarizes key financial metrics and calculations for evaluating the intrinsic value of Refex Industries. It provides 2019 operating cash flow, maintenance expenses, owner's earnings, growth rate, discount rate, shares outstanding, and EPS. It then calculates the value per share as Rs. 21.1835 based on a discounted cash flow model. Maintenance expenses are also calculated. The document compares multiple companies' net earnings, price to book ratios, and value to price ratios to determine which is the best investment.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 7

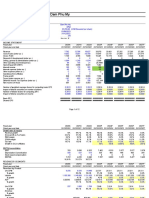

Refex Industries

Owner's Earning Operating Cashflow - Maintenance Expenses

(in lakhs) 2019

Operating cash flow (a) 4418

Maintenance Expense(b) 54.7

Owner's Earning (a-b) 4363.3

Growth Rate (5%) FROM MSN FINANCE LOOKING AT EARNING

CHART TOP HEADLINE 5%

Discount Rate (10 year govt. yield on 1th oct 2020) 8.18%

Shares outstanding (IN LAKHS) FROM MSN FINANCE 210

EPS PER SHARE - ( C ) 20.77762

Terminal Value TV = (FCFn x (1 + g)) / (WACC – g)

Value per share 21.1835

Working of Maintenance Expense

Maintenance Expense= Capital Expenditure from Cash Flow Statement - C

change in plant equipments (taken from increase plants and

building from balance sheet) 160-(1485.57-1430.87)

160-105.3

Maintenance Expense= 54.7

- Maintenance Expenses *numbers are from 2019 annual report

/ (WACC – g)

from Cash Flow Statement - Change in plant and Equipment

Most Value / Least Price

Value = Net Earning + Dividend

Price = Price to Book

Net Earning PER SHARE 11.4 12.82 15.4

Average Earning 13.20667

Price to Book Current price / Book 225/77.6 2.899485

Value/ Price 4.554833

Scores under 2 the stock will fall

Scores under 2 and 10 the stock is average

Scores above 10 stock will rise

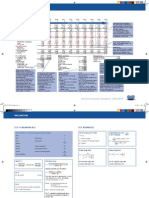

Just Dial

EPS TTM 45.73

Growth rate 9.7

Discount Rate(rate I plan to make) 15%

Margin of safety 50%

P/E ratio( 5 year highest) 38.15 (Can either take 2 times the growth rate phil town recommendation. On Msn

P/E ratio( 5 year lowest) 7.02 (I am taking average of the high and low p/e ratios given in tab.)

Average of both 22.585 ( Take the lowest of either one as well)

1 2 3 4 5 6 7

Projected EPS

(TAKING EPS TTM AND GROWTH

RATE FROM ABOVE) 45.73 49.8457 54.33181 59.22168 64.55163 70.36127 76.69379

637.6454 733.2922 843.286 969.7789 1115.246 1282.533 1474.913

Fair Value 637.65

Price after margin of safety 318.825

commendation. On Msn finance under analysis tab , go to price ratio sub-tab to find historical p/e)

ven in tab.)

8 9 10

83.59623 91.11989 99.32068

1696.149 1950.572 2243.158

Just Dial

Growth Rate (1-5)(from yahoo finance, analyst estimate)

Growth Rate (6-10)(taking 1/2 of first 5 years)

Discount Rate (As told in Dhando Investor book)

Terminal Value (FCF) (Pabari suggests taking 10 to 15 times range)

Year 1 Free Cash Flow Operating Cash Flow - Investing Cash Flow)

Excess Capital (FROM YAHOO FINANCE UNDER STATISTICS TAB IN BALANCE SHEET TAKE TOTAL CASH)

working for free cash flow

operating cash flow(FROM MONEY CONTROL)

investing cash flow (FROM MONEY CONTROL)

OPERATING cash flow - INVESTING CASHFLOW

9.70% YEAR FCF PV

4.8 1 25.66 23.32727

10% 2 28.14902 25.59002

10 3 30.87947 28.07225

25.66 4 33.87478 30.79526

563.8 5 37.16064 33.7824

6 38.94435 35.40395

7 40.81368 37.10334

8 42.77273 38.8843

9 44.82583 40.75075

10 46.97746 42.70679

(Assuming we can sell business at 10

times free cash flow at end of year 10) 10 469.7746 427.0679

PV OF FUTURE FREE CASH FLOW 763.4842

INTRINSIC VALUE(PV OF FREE CASH

FLOW+ CASH BALANCE ON BALANCE

SHEET) 1327.284

Current Market Cap 2517.93

Just Dial is over valued

Enterprise Value Market Cap +Debt - Excess Cash

2517.93+0-563.8

Enterprise Value 1954.13

152.56

-126.9

25.66

You might also like

- Teuer Furniture A Case Solution PPT (Group-04)Document13 pagesTeuer Furniture A Case Solution PPT (Group-04)sachin100% (4)

- Solution Manual For Business Analysis and Valuation Ifrs EditionDocument10 pagesSolution Manual For Business Analysis and Valuation Ifrs EditionRobertMitchellmgea100% (45)

- Series 63 ReviewDocument12 pagesSeries 63 ReviewDavid D100% (1)

- Kaspi GDRDocument26 pagesKaspi GDRGodfrey BukomekoNo ratings yet

- Solution Manual For Essentials of Investments 9th Edition by BodieDocument18 pagesSolution Manual For Essentials of Investments 9th Edition by BodieCameronHerreracapt100% (41)

- MIRANDA - Post Task 3,4,5 Compilation PDFDocument9 pagesMIRANDA - Post Task 3,4,5 Compilation PDFSHARMAINE CORPUZ MIRANDANo ratings yet

- Marriott Corporation: The Cost of CapitalDocument43 pagesMarriott Corporation: The Cost of CapitalShamsuzzaman SunNo ratings yet

- Pacific Grove Spice CompanyDocument3 pagesPacific Grove Spice CompanyLaura JavelaNo ratings yet

- Tesla DCF Valuation by Ihor MedvidDocument105 pagesTesla DCF Valuation by Ihor Medvidpriyanshu14No ratings yet

- New Heritage Doll CompanyDocument11 pagesNew Heritage Doll CompanyLightning SalehNo ratings yet

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- Question Paper With Answers - Treasury Management-Final ExamDocument7 pagesQuestion Paper With Answers - Treasury Management-Final ExamHarsh MaheshwariNo ratings yet

- MBTI Personality Type TestDocument4 pagesMBTI Personality Type TestHarsh MaheshwariNo ratings yet

- Financial Performance Metrics - Financial RatiosDocument98 pagesFinancial Performance Metrics - Financial RatiosAjmal SalamNo ratings yet

- CaseDocument4 pagesCaseRaghuveer ChandraNo ratings yet

- Tata MotorsDocument5 pagesTata Motorsinsurana73No ratings yet

- Research Needed For Question 5Document4 pagesResearch Needed For Question 5Ahmed MahmoudNo ratings yet

- Narration Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18Document38 pagesNarration Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18AbhijitChandraNo ratings yet

- Top Glove 140618Document5 pagesTop Glove 140618Joseph CampbellNo ratings yet

- IRCON International 2QFY20 Result Review 14-11-19Document7 pagesIRCON International 2QFY20 Result Review 14-11-19Santosh HiredesaiNo ratings yet

- Business Analysis and Valuation Using Financial Statements Text and Cases 5th Edition Palepu Solutions ManualDocument18 pagesBusiness Analysis and Valuation Using Financial Statements Text and Cases 5th Edition Palepu Solutions Manualdaviddulcieagt6100% (35)

- Mergers and AquisationsDocument10 pagesMergers and AquisationsNeeraj KumarNo ratings yet

- Key Operating and Financial Data 2017 For Website Final 20.3.2018Document2 pagesKey Operating and Financial Data 2017 For Website Final 20.3.2018MubeenNo ratings yet

- Capital Budgeting: Initial InvestmentDocument5 pagesCapital Budgeting: Initial InvestmentMd. Shakil Ahmed 1620890630No ratings yet

- CW 221025015738Document2 pagesCW 221025015738Nundu AntoneyNo ratings yet

- GR I Crew XV 2018 TcsDocument79 pagesGR I Crew XV 2018 TcsMUKESH KUMARNo ratings yet

- Mett International Pty LTD Financial Forecast 3 Year SummaryDocument134 pagesMett International Pty LTD Financial Forecast 3 Year SummaryJamilexNo ratings yet

- FINANCIAL STATEMENTS-SQUARE PHARMA (Horizontal & Vertical)Document6 pagesFINANCIAL STATEMENTS-SQUARE PHARMA (Horizontal & Vertical)Hridi RahmanNo ratings yet

- Microsoft ValuationDocument4 pagesMicrosoft ValuationcorvettejrwNo ratings yet

- K10 SFMDocument6 pagesK10 SFMSrijan AgarwalNo ratings yet

- Risk Free Rate 0.97% Market Risk Premium 7.50% Beta 1.45 Terminal Growth Rate 1.00%Document17 pagesRisk Free Rate 0.97% Market Risk Premium 7.50% Beta 1.45 Terminal Growth Rate 1.00%HAMMADHRNo ratings yet

- Business Analysis and Valuation Using Financial Statements Text and Cases Palepu 5th Edition Solutions ManualDocument19 pagesBusiness Analysis and Valuation Using Financial Statements Text and Cases Palepu 5th Edition Solutions ManualStephanieParkerexbf100% (47)

- Chapter 1: Investment Recommendation: How We Have Derived The Summed Up ValueDocument4 pagesChapter 1: Investment Recommendation: How We Have Derived The Summed Up ValueMd. Mehedi HasanNo ratings yet

- Presentation (Company Update)Document16 pagesPresentation (Company Update)Shyam SunderNo ratings yet

- DiviđenDocument12 pagesDiviđenPhan GiápNo ratings yet

- Tarea Heritage Doll CompanyDocument6 pagesTarea Heritage Doll CompanyFelipe HidalgoNo ratings yet

- Amaha Advanced 3 - StatementModelDocument6 pagesAmaha Advanced 3 - StatementModelamahaktNo ratings yet

- 9e Maruti Suzuki FMDocument2 pages9e Maruti Suzuki FMDedhia Vatsal hiteshNo ratings yet

- DCF TakeawaysDocument2 pagesDCF TakeawaysvrkasturiNo ratings yet

- DCF Guide ExampleDocument4 pagesDCF Guide ExampleAlexander RiosNo ratings yet

- Cash FlowsDocument4 pagesCash FlowsMuhammad AkbarNo ratings yet

- K10 SFMDocument6 pagesK10 SFMSrijan AgarwalNo ratings yet

- Principles of Corporate ValuationDocument14 pagesPrinciples of Corporate ValuationSubhrodeep DasNo ratings yet

- FMO M5 Soln.sDocument16 pagesFMO M5 Soln.sVishwas ParakkaNo ratings yet

- Case 02 FedEx UPS 2016 F1773XDocument10 pagesCase 02 FedEx UPS 2016 F1773XJosie KomiNo ratings yet

- KFin Technologies - Flash Note - 12 Dec 23Document6 pagesKFin Technologies - Flash Note - 12 Dec 23palakNo ratings yet

- DCF ModellDocument7 pagesDCF Modellsandeep0604No ratings yet

- RMN - 0228 - THCOM (Achieving The Impossible)Document4 pagesRMN - 0228 - THCOM (Achieving The Impossible)bodaiNo ratings yet

- Quiz 1 Practice ProblemsDocument8 pagesQuiz 1 Practice ProblemsUmaid FaisalNo ratings yet

- DCF ModellDocument7 pagesDCF ModellziuziNo ratings yet

- Microsoft Vs Intuit ValuationDocument4 pagesMicrosoft Vs Intuit ValuationcorvettejrwNo ratings yet

- UAS ALK Dinda Azzahra Salsabilla Contoh Forecasting and Valuation AnalysisDocument9 pagesUAS ALK Dinda Azzahra Salsabilla Contoh Forecasting and Valuation AnalysisDinda AzzahraNo ratings yet

- Financial Management ProjectDocument59 pagesFinancial Management ProjectFaizan MoazzamNo ratings yet

- EVA ExampleDocument14 pagesEVA ExampleKhouseyn IslamovNo ratings yet

- Presentation Group F Update T6Document21 pagesPresentation Group F Update T6Phạm Hồng SơnNo ratings yet

- DCF ModellDocument7 pagesDCF ModellVishal BhanushaliNo ratings yet

- VA Tech Wabag-KotakDocument9 pagesVA Tech Wabag-KotakADNo ratings yet

- DCF ModelDocument6 pagesDCF ModelKatherine ChouNo ratings yet

- Corporate ValuationDocument32 pagesCorporate ValuationNishant DhakalNo ratings yet

- EVA ExplainedDocument1 pageEVA Explainedatelje505No ratings yet

- Harley-Davidson, Inc. (HOG) Stock Financials - Annual Income StatementDocument5 pagesHarley-Davidson, Inc. (HOG) Stock Financials - Annual Income StatementThe Baby BossNo ratings yet

- Performance AGlanceDocument1 pagePerformance AGlanceHarshal SawaleNo ratings yet

- A Report On Financial Analysis of Next PLC 3Document11 pagesA Report On Financial Analysis of Next PLC 3Hamza AminNo ratings yet

- Annual Report - Attock CementDocument10 pagesAnnual Report - Attock CementAbdul BasitNo ratings yet

- TVS Motor Company: CMP: INR549 TP: INR548Document12 pagesTVS Motor Company: CMP: INR549 TP: INR548anujonwebNo ratings yet

- Principles of Cash Flow Valuation: An Integrated Market-Based ApproachFrom EverandPrinciples of Cash Flow Valuation: An Integrated Market-Based ApproachRating: 3 out of 5 stars3/5 (3)

- Agency Costs of Free Cash FlowDocument3 pagesAgency Costs of Free Cash FlowHarsh MaheshwariNo ratings yet

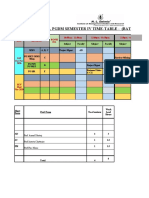

- PGDM Course Structure - Batch 2020-22 Course Code Courses Credits Semester IDocument3 pagesPGDM Course Structure - Batch 2020-22 Course Code Courses Credits Semester IHarsh MaheshwariNo ratings yet

- MINUTES OF MEETING 19 OCT 20-FinalDocument1 pageMINUTES OF MEETING 19 OCT 20-FinalHarsh MaheshwariNo ratings yet

- Final Question Bank With Answers - Treasury Management-Final ExamDocument7 pagesFinal Question Bank With Answers - Treasury Management-Final ExamHarsh MaheshwariNo ratings yet

- Finance Department Subject Allocation AY 2021-22 PGDM Sem Ii/ MFM Sem Iv/Vi Sr. No Name of The Subject Program Sem DivDocument2 pagesFinance Department Subject Allocation AY 2021-22 PGDM Sem Ii/ MFM Sem Iv/Vi Sr. No Name of The Subject Program Sem DivHarsh MaheshwariNo ratings yet

- Semester 4 Time-Table 21st Nov 2020Document2 pagesSemester 4 Time-Table 21st Nov 2020Harsh MaheshwariNo ratings yet

- Sem 4 Final ProjectDocument6 pagesSem 4 Final ProjectHarsh MaheshwariNo ratings yet

- M.C. Jensen FA AssignmentDocument8 pagesM.C. Jensen FA AssignmentHarsh MaheshwariNo ratings yet

- The Job Search Dilemma: Good Vs Right: Noel F. Palmer, Kyle W. Luthans and Jeffrey S. OlsonDocument6 pagesThe Job Search Dilemma: Good Vs Right: Noel F. Palmer, Kyle W. Luthans and Jeffrey S. OlsonHarsh MaheshwariNo ratings yet

- Agency Costs of Free Cash FlowDocument3 pagesAgency Costs of Free Cash FlowHarsh MaheshwariNo ratings yet

- Indian Institute of Management Rohtak: FPM (PT)Document3 pagesIndian Institute of Management Rohtak: FPM (PT)Harsh MaheshwariNo ratings yet

- E I S - A T - : Motional Ntelligence ELF Ssessment OOLDocument2 pagesE I S - A T - : Motional Ntelligence ELF Ssessment OOLHarsh MaheshwariNo ratings yet

- Texas Tech University System Complaint of Discrimination or Harassment Including Sexual Harassment, Sexual Assault, or Sexual MisconductDocument2 pagesTexas Tech University System Complaint of Discrimination or Harassment Including Sexual Harassment, Sexual Assault, or Sexual MisconductHarsh MaheshwariNo ratings yet

- Fiannce Accounting Efpm 2020 Outline PDFDocument6 pagesFiannce Accounting Efpm 2020 Outline PDFHarsh MaheshwariNo ratings yet

- Prestige Telephone Company SlidesDocument13 pagesPrestige Telephone Company SlidesHarsh MaheshwariNo ratings yet

- Fibonacci: Cheat SheetDocument4 pagesFibonacci: Cheat SheetThato SeanNo ratings yet

- FINS3625 Applied Corporate Finance: Lecture 3 (Chapter 13) Jared Stanfield March 14, 2012Document58 pagesFINS3625 Applied Corporate Finance: Lecture 3 (Chapter 13) Jared Stanfield March 14, 2012paula_mon89No ratings yet

- 12 Cardinal Mistakes of Commodity TradingDocument9 pages12 Cardinal Mistakes of Commodity Tradingamna tabbasumNo ratings yet

- P - E Ratio - Price-to-Earnings Ratio Formula, Meaning, and ExamplesDocument9 pagesP - E Ratio - Price-to-Earnings Ratio Formula, Meaning, and ExamplesACC200 MNo ratings yet

- 10 Emh (FM)Document4 pages10 Emh (FM)Dayaan ANo ratings yet

- 1705383722Ch 5 Financial Decisions Capital Structure CA Inter CTSanswerDocument6 pages1705383722Ch 5 Financial Decisions Capital Structure CA Inter CTSanswerPratyushNo ratings yet

- 16E44NIZNIYBBMHGBVCH9XPYQDocument9 pages16E44NIZNIYBBMHGBVCH9XPYQVintNo ratings yet

- Financial Analysis On Marico Bangladesh Ltd.Document24 pagesFinancial Analysis On Marico Bangladesh Ltd.7BaratNo ratings yet

- Time Value of Money Part IIDocument3 pagesTime Value of Money Part IINailiah MacakilingNo ratings yet

- Quiz 4 With SolutionDocument5 pagesQuiz 4 With SolutionKarl Lincoln TemporosaNo ratings yet

- Project Report MyDocument102 pagesProject Report MySana MoidNo ratings yet

- Eiteman PPT CH01Document37 pagesEiteman PPT CH01Divya BansalNo ratings yet

- Swap Free Account Request Form (V-1W) 2nd March 23Document2 pagesSwap Free Account Request Form (V-1W) 2nd March 23basantbwr86No ratings yet

- MGMT 41150 - Chapter 13 - Binomial TreesDocument41 pagesMGMT 41150 - Chapter 13 - Binomial TreesLaxus DreyerNo ratings yet

- Study Notes On DerivativesDocument13 pagesStudy Notes On DerivativesAbrar Ahmed100% (2)

- Ch-3: Intermediate Term Debt FinancingDocument8 pagesCh-3: Intermediate Term Debt Financingjack johnsonNo ratings yet

- Digvijay Construction 4may2021Document7 pagesDigvijay Construction 4may2021hesham zakiNo ratings yet

- Final Questionnair PDFDocument4 pagesFinal Questionnair PDFRinkesh K MistryNo ratings yet

- Summer 2021 19-08-2021Document2 pagesSummer 2021 19-08-2021Grishma BhindoraNo ratings yet

- What Is A Primary MarketDocument4 pagesWhat Is A Primary MarketbutterfilyNo ratings yet

- São Paulo Stock Exchange and The Brazilian Capital Market: SurveillanceDocument36 pagesSão Paulo Stock Exchange and The Brazilian Capital Market: SurveillanceAbhimanyu SisodiaNo ratings yet

- Marketing Strategic Equipo CafeDocument8 pagesMarketing Strategic Equipo CafeGerza7No ratings yet

- Distribution Channel NotesDocument2 pagesDistribution Channel NotesRuth PecsonNo ratings yet

- Feauters & Tutorial Feauters & Tutorial Feauters & TutorialDocument7 pagesFeauters & Tutorial Feauters & Tutorial Feauters & Tutorialkapoor_mukesh4uNo ratings yet

- Mock SFM Answer MarchDocument12 pagesMock SFM Answer MarchMenuka SiwaNo ratings yet

- TITLE: Effect of Sales Promotion On The Consumer Purchase Decision of Soft Drinks in Dar EsDocument2 pagesTITLE: Effect of Sales Promotion On The Consumer Purchase Decision of Soft Drinks in Dar Eshekaya hajiNo ratings yet