Professional Documents

Culture Documents

Consolidated Total Comprehensive Income Attributable To Parent P106,000

Consolidated Total Comprehensive Income Attributable To Parent P106,000

Uploaded by

Wawex DavisCopyright:

Available Formats

You might also like

- Quizzer-CAPITAL BUDGETING - Non-Discounted (With Solutions)Document3 pagesQuizzer-CAPITAL BUDGETING - Non-Discounted (With Solutions)Ferb Cruzada83% (6)

- Activity 1Document9 pagesActivity 1JESSA ANN A. TALABOC100% (3)

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Resa p1 First PB 1015Document21 pagesResa p1 First PB 1015Din Rose GonzalesNo ratings yet

- Chapter 16Document25 pagesChapter 16Christian Blanza Lleva100% (2)

- Business Combination and Consolidated FS 2020 PDFDocument22 pagesBusiness Combination and Consolidated FS 2020 PDFAPO 0005100% (1)

- Intercompany Transactions Had Not OccurredDocument2 pagesIntercompany Transactions Had Not OccurredWawex DavisNo ratings yet

- Dividend Policy - Q & ADocument4 pagesDividend Policy - Q & AJERICO RAMOSNo ratings yet

- Consolidated Net Income For 20x5Document13 pagesConsolidated Net Income For 20x5Ryan PatitoNo ratings yet

- Sources of Income 2016 2017 2018Document5 pagesSources of Income 2016 2017 2018Chabby ChabbyNo ratings yet

- Intercompany Sales and PurchasesDocument2 pagesIntercompany Sales and PurchasesWawex DavisNo ratings yet

- May 2018 Crammer's Guide Answers: Inventory To Be Removed From Inventory Because of Purchase Cutoff TestDocument14 pagesMay 2018 Crammer's Guide Answers: Inventory To Be Removed From Inventory Because of Purchase Cutoff TestJamieNo ratings yet

- 8 Capital Budgeting - Problems - With AnswersDocument15 pages8 Capital Budgeting - Problems - With AnswersIamnti domnateNo ratings yet

- Chap 15Document17 pagesChap 15pdmallari12No ratings yet

- Examination About Investment 11Document3 pagesExamination About Investment 11BLACKPINKLisaRoseJisooJennieNo ratings yet

- Acc 223a - Answers To CH 15 AssignmentDocument7 pagesAcc 223a - Answers To CH 15 AssignmentAna Leah DelfinNo ratings yet

- Accbusco Chapter 16Document14 pagesAccbusco Chapter 16PaupauNo ratings yet

- Answer:: The Amount of Sales If The Company Lost P36,000 Last Year Was P976,500Document2 pagesAnswer:: The Amount of Sales If The Company Lost P36,000 Last Year Was P976,500Unknowingly AnonymousNo ratings yet

- ITEMS 41 To 46 - AnswersDocument4 pagesITEMS 41 To 46 - AnswersAngel Joy HelicameNo ratings yet

- Chapter 16Document23 pagesChapter 16John MoisesNo ratings yet

- Chapter 4 (Ratio Analysis)Document20 pagesChapter 4 (Ratio Analysis)Brylle LeynesNo ratings yet

- Multiple Choice ACCSTDocument5 pagesMultiple Choice ACCSTJaene L.No ratings yet

- Module 5 - Income Tax On PartnershipsDocument3 pagesModule 5 - Income Tax On PartnershipsNever Letting GoNo ratings yet

- Afar - CVPDocument3 pagesAfar - CVPJoanna Rose Deciar0% (1)

- Capital BudgetingDocument23 pagesCapital BudgetingNoelJr. Allanaraiz100% (4)

- Equity Invest - MC Quest.w AnsDocument3 pagesEquity Invest - MC Quest.w AnsElaineJrV-Igot0% (1)

- Multiple Choices - ComputationalDocument25 pagesMultiple Choices - ComputationalShenna Mae MateoNo ratings yet

- Problem 17-1, ContinuedDocument6 pagesProblem 17-1, ContinuedJohn Carlo D MedallaNo ratings yet

- Chapter 17Document19 pagesChapter 17Christian Blanza LlevaNo ratings yet

- Rules in Holding Period in Capital GainsDocument39 pagesRules in Holding Period in Capital GainsTrine De LeonNo ratings yet

- 3 Mas Answer KeyDocument25 pages3 Mas Answer KeyAngelie0% (1)

- ABUSCOM Lecture 15Document2 pagesABUSCOM Lecture 15Mark Lyndon YmataNo ratings yet

- Chapter 6Document10 pagesChapter 6Mary MarieNo ratings yet

- AcctgDocument11 pagesAcctgsarahbee100% (2)

- AFAR-01A (Supplemental Material To Partnership Accounting)Document2 pagesAFAR-01A (Supplemental Material To Partnership Accounting)Maricris AlilinNo ratings yet

- Solution Chapter 18 PDFDocument78 pagesSolution Chapter 18 PDFMesbrookNo ratings yet

- Investment in Associate IiaDocument4 pagesInvestment in Associate IiaPEARL THERESE SUDARIONo ratings yet

- Advanced Accounting - 2015 (Chapter 17) Multiple Choice Solution (Part M)Document1 pageAdvanced Accounting - 2015 (Chapter 17) Multiple Choice Solution (Part M)John Carlos DoringoNo ratings yet

- Answer Key Quiz 1 and 2Document3 pagesAnswer Key Quiz 1 and 2Jacklyn MapaloNo ratings yet

- Profitability Ratio 2Document18 pagesProfitability Ratio 2Wynphap podiotanNo ratings yet

- Tax ProblemsDocument14 pagesTax Problemsrav dano100% (1)

- 91 - Final Preaboard AFAR Solutions (WEEKENDS)Document9 pages91 - Final Preaboard AFAR Solutions (WEEKENDS)Joris YapNo ratings yet

- Intersale AnswerDocument2 pagesIntersale AnswerJJ JaumNo ratings yet

- MASDocument9 pagesMASJulius Lester AbieraNo ratings yet

- Advanced-Accounting-Part 2-Dayag-2015-Chapter-18Document76 pagesAdvanced-Accounting-Part 2-Dayag-2015-Chapter-18allysa ampingNo ratings yet

- Addtl Exercises 10 12Document5 pagesAddtl Exercises 10 12John Lester C AlagNo ratings yet

- ConsolidationDocument91 pagesConsolidationKNVS Siva KumarNo ratings yet

- MGT Adv Serv 09.2019Document11 pagesMGT Adv Serv 09.2019Weddie Mae VillarizaNo ratings yet

- Tax Reviewer 3Document4 pagesTax Reviewer 3tooru oikawaNo ratings yet

- 1007 (RA, SR and TP)Document6 pages1007 (RA, SR and TP)Neil Ryan CatagaNo ratings yet

- Operating Cash InflowDocument11 pagesOperating Cash InflowQuiroann NalzNo ratings yet

- Investment Account Balance, Dec. 31, 2013 P500,000 P569,000: Cost Method Equity MethodDocument22 pagesInvestment Account Balance, Dec. 31, 2013 P500,000 P569,000: Cost Method Equity MethodLove FreddyNo ratings yet

- Ci - Cni/ Nci-Cni Cni/Group NiDocument2 pagesCi - Cni/ Nci-Cni Cni/Group NiMark CalapatanNo ratings yet

- Practical Accounting 2 - RMYCDocument10 pagesPractical Accounting 2 - RMYCZadharie Abby Gail BurataNo ratings yet

- AST TEST BANK Partnership FormationDocument20 pagesAST TEST BANK Partnership FormationNicole AgostoNo ratings yet

- MASDocument7 pagesMASHelen IlaganNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Leon XIII - Rerum Novarum (1891)Document4 pagesLeon XIII - Rerum Novarum (1891)Wawex DavisNo ratings yet

- NiFor Us Acme Supply Company Computer PaperDocument4 pagesNiFor Us Acme Supply Company Computer PaperWawex DavisNo ratings yet

- 1991 Centesimus Annus - "The One Hundredth Year" - John Paul IIDocument4 pages1991 Centesimus Annus - "The One Hundredth Year" - John Paul IIWawex DavisNo ratings yet

- 1971 Justicia in Mundo - "Justice in The World" - SynodDocument4 pages1971 Justicia in Mundo - "Justice in The World" - SynodWawex DavisNo ratings yet

- 1963 Pacem in Terris - "Peace On Earth" - John XXIIIDocument4 pages1963 Pacem in Terris - "Peace On Earth" - John XXIIIWawex DavisNo ratings yet

- Ang Can We Afford To Give Our Employees A Pay RaiseDocument4 pagesAng Can We Afford To Give Our Employees A Pay RaiseWawex DavisNo ratings yet

- Indicate How To Report Cash and Related Items.Document4 pagesIndicate How To Report Cash and Related Items.Wawex DavisNo ratings yet

- Big Did The Company Earn A Satisfactory IncomeDocument4 pagesBig Did The Company Earn A Satisfactory IncomeWawex DavisNo ratings yet

- Explain What Accounting IsDocument4 pagesExplain What Accounting IsWawex DavisNo ratings yet

- Principal Agent RelationshipsDocument4 pagesPrincipal Agent RelationshipsWawex DavisNo ratings yet

- Loss in The Current Period On A Profitable ContractDocument4 pagesLoss in The Current Period On A Profitable ContractWawex DavisNo ratings yet

- Guidelines For Revenue Recognition: The Provides That Companies Should Recognize Revenue When It Is or and When It IsDocument4 pagesGuidelines For Revenue Recognition: The Provides That Companies Should Recognize Revenue When It Is or and When It IsWawex Davis100% (1)

- Trade Loading and Channel StuffingDocument4 pagesTrade Loading and Channel StuffingWawex DavisNo ratings yet

- Installment Sales MethodDocument4 pagesInstallment Sales MethodWawex DavisNo ratings yet

- Revenue Recognition For FranchisesDocument4 pagesRevenue Recognition For FranchisesWawex DavisNo ratings yet

Consolidated Total Comprehensive Income Attributable To Parent P106,000

Consolidated Total Comprehensive Income Attributable To Parent P106,000

Uploaded by

Wawex DavisOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Consolidated Total Comprehensive Income Attributable To Parent P106,000

Consolidated Total Comprehensive Income Attributable To Parent P106,000

Uploaded by

Wawex DavisCopyright:

Available Formats

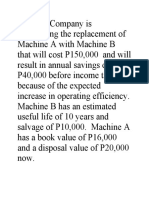

52.

consolidated statement purpose, 2013 depreciation is based on the original amounts RP

1, 1 00,000P100,000) x 1/20 = P50,000]. Therefore, in the 12/31/013 consolidated statement of

financial position, the machine is shown at a cost of P1,100,000 less accumulated depreciation

of P300,000 (P250,000 + P50,000).

55.

PMN Corp. total comprehensive income P 85,000

SST Company total comprehensive 45,000

income

Total 130,000

Unrealized gain on sale of equipment ( 15,000)

Realized gain (P15,000/3 yrs.) 5,00

Total comp. income attributable to NCI: 0

SST Co. total comprehensive income P 45,000

Unrealized gain ( 15,000)

Realized gain 5,000

Adjusted total comprehensive income 35,000

NCI 40% (14,000)

P106,000

Consolidated total comprehensive income attributable to parent

56. The depreciation expense to be recorded by the buying affiliate (PP Inc.) is based on the

selling price of the truck as computed below:

Gain on sale of truck P 12,000

Book value of truck, 1/1/013:

Cost P100,000

Accumulated dep'n (100,000/10) x6 60,000 40,000

Selling price of the truck P 52,000

Divide by the remaining life 4 years

Depreciation recorded by PP Inc P13,000

57.

Share in Sally's income (P262,500 x 80%) P210,000

Unrealized gain (P90,000 S P50,000) ( 40,000)

Realized gain, 12/31/011 (P40,000 5) x 9/12 6,000

P176,000

Investment Income account balance, 12/311013

58.

Peter total comprehensive income from own P

operations 500,000

Investment Income, 12/31/013 176,000

consolidated total comprehensive income attributable P

to parent 676,000

Alternative computations?

You might also like

- Quizzer-CAPITAL BUDGETING - Non-Discounted (With Solutions)Document3 pagesQuizzer-CAPITAL BUDGETING - Non-Discounted (With Solutions)Ferb Cruzada83% (6)

- Activity 1Document9 pagesActivity 1JESSA ANN A. TALABOC100% (3)

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Resa p1 First PB 1015Document21 pagesResa p1 First PB 1015Din Rose GonzalesNo ratings yet

- Chapter 16Document25 pagesChapter 16Christian Blanza Lleva100% (2)

- Business Combination and Consolidated FS 2020 PDFDocument22 pagesBusiness Combination and Consolidated FS 2020 PDFAPO 0005100% (1)

- Intercompany Transactions Had Not OccurredDocument2 pagesIntercompany Transactions Had Not OccurredWawex DavisNo ratings yet

- Dividend Policy - Q & ADocument4 pagesDividend Policy - Q & AJERICO RAMOSNo ratings yet

- Consolidated Net Income For 20x5Document13 pagesConsolidated Net Income For 20x5Ryan PatitoNo ratings yet

- Sources of Income 2016 2017 2018Document5 pagesSources of Income 2016 2017 2018Chabby ChabbyNo ratings yet

- Intercompany Sales and PurchasesDocument2 pagesIntercompany Sales and PurchasesWawex DavisNo ratings yet

- May 2018 Crammer's Guide Answers: Inventory To Be Removed From Inventory Because of Purchase Cutoff TestDocument14 pagesMay 2018 Crammer's Guide Answers: Inventory To Be Removed From Inventory Because of Purchase Cutoff TestJamieNo ratings yet

- 8 Capital Budgeting - Problems - With AnswersDocument15 pages8 Capital Budgeting - Problems - With AnswersIamnti domnateNo ratings yet

- Chap 15Document17 pagesChap 15pdmallari12No ratings yet

- Examination About Investment 11Document3 pagesExamination About Investment 11BLACKPINKLisaRoseJisooJennieNo ratings yet

- Acc 223a - Answers To CH 15 AssignmentDocument7 pagesAcc 223a - Answers To CH 15 AssignmentAna Leah DelfinNo ratings yet

- Accbusco Chapter 16Document14 pagesAccbusco Chapter 16PaupauNo ratings yet

- Answer:: The Amount of Sales If The Company Lost P36,000 Last Year Was P976,500Document2 pagesAnswer:: The Amount of Sales If The Company Lost P36,000 Last Year Was P976,500Unknowingly AnonymousNo ratings yet

- ITEMS 41 To 46 - AnswersDocument4 pagesITEMS 41 To 46 - AnswersAngel Joy HelicameNo ratings yet

- Chapter 16Document23 pagesChapter 16John MoisesNo ratings yet

- Chapter 4 (Ratio Analysis)Document20 pagesChapter 4 (Ratio Analysis)Brylle LeynesNo ratings yet

- Multiple Choice ACCSTDocument5 pagesMultiple Choice ACCSTJaene L.No ratings yet

- Module 5 - Income Tax On PartnershipsDocument3 pagesModule 5 - Income Tax On PartnershipsNever Letting GoNo ratings yet

- Afar - CVPDocument3 pagesAfar - CVPJoanna Rose Deciar0% (1)

- Capital BudgetingDocument23 pagesCapital BudgetingNoelJr. Allanaraiz100% (4)

- Equity Invest - MC Quest.w AnsDocument3 pagesEquity Invest - MC Quest.w AnsElaineJrV-Igot0% (1)

- Multiple Choices - ComputationalDocument25 pagesMultiple Choices - ComputationalShenna Mae MateoNo ratings yet

- Problem 17-1, ContinuedDocument6 pagesProblem 17-1, ContinuedJohn Carlo D MedallaNo ratings yet

- Chapter 17Document19 pagesChapter 17Christian Blanza LlevaNo ratings yet

- Rules in Holding Period in Capital GainsDocument39 pagesRules in Holding Period in Capital GainsTrine De LeonNo ratings yet

- 3 Mas Answer KeyDocument25 pages3 Mas Answer KeyAngelie0% (1)

- ABUSCOM Lecture 15Document2 pagesABUSCOM Lecture 15Mark Lyndon YmataNo ratings yet

- Chapter 6Document10 pagesChapter 6Mary MarieNo ratings yet

- AcctgDocument11 pagesAcctgsarahbee100% (2)

- AFAR-01A (Supplemental Material To Partnership Accounting)Document2 pagesAFAR-01A (Supplemental Material To Partnership Accounting)Maricris AlilinNo ratings yet

- Solution Chapter 18 PDFDocument78 pagesSolution Chapter 18 PDFMesbrookNo ratings yet

- Investment in Associate IiaDocument4 pagesInvestment in Associate IiaPEARL THERESE SUDARIONo ratings yet

- Advanced Accounting - 2015 (Chapter 17) Multiple Choice Solution (Part M)Document1 pageAdvanced Accounting - 2015 (Chapter 17) Multiple Choice Solution (Part M)John Carlos DoringoNo ratings yet

- Answer Key Quiz 1 and 2Document3 pagesAnswer Key Quiz 1 and 2Jacklyn MapaloNo ratings yet

- Profitability Ratio 2Document18 pagesProfitability Ratio 2Wynphap podiotanNo ratings yet

- Tax ProblemsDocument14 pagesTax Problemsrav dano100% (1)

- 91 - Final Preaboard AFAR Solutions (WEEKENDS)Document9 pages91 - Final Preaboard AFAR Solutions (WEEKENDS)Joris YapNo ratings yet

- Intersale AnswerDocument2 pagesIntersale AnswerJJ JaumNo ratings yet

- MASDocument9 pagesMASJulius Lester AbieraNo ratings yet

- Advanced-Accounting-Part 2-Dayag-2015-Chapter-18Document76 pagesAdvanced-Accounting-Part 2-Dayag-2015-Chapter-18allysa ampingNo ratings yet

- Addtl Exercises 10 12Document5 pagesAddtl Exercises 10 12John Lester C AlagNo ratings yet

- ConsolidationDocument91 pagesConsolidationKNVS Siva KumarNo ratings yet

- MGT Adv Serv 09.2019Document11 pagesMGT Adv Serv 09.2019Weddie Mae VillarizaNo ratings yet

- Tax Reviewer 3Document4 pagesTax Reviewer 3tooru oikawaNo ratings yet

- 1007 (RA, SR and TP)Document6 pages1007 (RA, SR and TP)Neil Ryan CatagaNo ratings yet

- Operating Cash InflowDocument11 pagesOperating Cash InflowQuiroann NalzNo ratings yet

- Investment Account Balance, Dec. 31, 2013 P500,000 P569,000: Cost Method Equity MethodDocument22 pagesInvestment Account Balance, Dec. 31, 2013 P500,000 P569,000: Cost Method Equity MethodLove FreddyNo ratings yet

- Ci - Cni/ Nci-Cni Cni/Group NiDocument2 pagesCi - Cni/ Nci-Cni Cni/Group NiMark CalapatanNo ratings yet

- Practical Accounting 2 - RMYCDocument10 pagesPractical Accounting 2 - RMYCZadharie Abby Gail BurataNo ratings yet

- AST TEST BANK Partnership FormationDocument20 pagesAST TEST BANK Partnership FormationNicole AgostoNo ratings yet

- MASDocument7 pagesMASHelen IlaganNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Leon XIII - Rerum Novarum (1891)Document4 pagesLeon XIII - Rerum Novarum (1891)Wawex DavisNo ratings yet

- NiFor Us Acme Supply Company Computer PaperDocument4 pagesNiFor Us Acme Supply Company Computer PaperWawex DavisNo ratings yet

- 1991 Centesimus Annus - "The One Hundredth Year" - John Paul IIDocument4 pages1991 Centesimus Annus - "The One Hundredth Year" - John Paul IIWawex DavisNo ratings yet

- 1971 Justicia in Mundo - "Justice in The World" - SynodDocument4 pages1971 Justicia in Mundo - "Justice in The World" - SynodWawex DavisNo ratings yet

- 1963 Pacem in Terris - "Peace On Earth" - John XXIIIDocument4 pages1963 Pacem in Terris - "Peace On Earth" - John XXIIIWawex DavisNo ratings yet

- Ang Can We Afford To Give Our Employees A Pay RaiseDocument4 pagesAng Can We Afford To Give Our Employees A Pay RaiseWawex DavisNo ratings yet

- Indicate How To Report Cash and Related Items.Document4 pagesIndicate How To Report Cash and Related Items.Wawex DavisNo ratings yet

- Big Did The Company Earn A Satisfactory IncomeDocument4 pagesBig Did The Company Earn A Satisfactory IncomeWawex DavisNo ratings yet

- Explain What Accounting IsDocument4 pagesExplain What Accounting IsWawex DavisNo ratings yet

- Principal Agent RelationshipsDocument4 pagesPrincipal Agent RelationshipsWawex DavisNo ratings yet

- Loss in The Current Period On A Profitable ContractDocument4 pagesLoss in The Current Period On A Profitable ContractWawex DavisNo ratings yet

- Guidelines For Revenue Recognition: The Provides That Companies Should Recognize Revenue When It Is or and When It IsDocument4 pagesGuidelines For Revenue Recognition: The Provides That Companies Should Recognize Revenue When It Is or and When It IsWawex Davis100% (1)

- Trade Loading and Channel StuffingDocument4 pagesTrade Loading and Channel StuffingWawex DavisNo ratings yet

- Installment Sales MethodDocument4 pagesInstallment Sales MethodWawex DavisNo ratings yet

- Revenue Recognition For FranchisesDocument4 pagesRevenue Recognition For FranchisesWawex DavisNo ratings yet