Professional Documents

Culture Documents

Chapter 15: Standard Costing - Setting Standards and Analyzing Variances

Chapter 15: Standard Costing - Setting Standards and Analyzing Variances

Uploaded by

jenOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 15: Standard Costing - Setting Standards and Analyzing Variances

Chapter 15: Standard Costing - Setting Standards and Analyzing Variances

Uploaded by

jenCopyright:

Available Formats

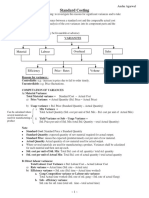

CHAPTER 15: STANDARD COSTING – SETTING 5.

5. Break down the variance for each element into its component parts in order

to determine the cause of variances.

STANDARDS AND ANALYZING VARIANCES 6. Record production costs and variances

ACTUAL COST SYSTEM – product costs are recorded when they are incurred APPLICATION:

- Acceptable for recording DM and DL because they are easily traced to - Considering the standard quantity and standard price

specific jobs (job order costing) or department (process costing) a. Material Price Standards – purchase price, related costs (receiving, storing,

NORMAL COSTING – modification of actual costing it is such that MOH is applied to and handling ex. Freight costs)

production on the basis of actual inputs multiplied by a predetermined overhead b. Material Quantity Standards – quantity required to be consumed, and

application rate. materials spoilage or waste

STANDARD COSTING – all costs attached to products are based on standards or c. Labor Rate Standards (price) – wage rate, payroll taxes, fringe benefits (ex.

predetermined amounts. paid holidays)

- Costs of every product are computed at the start of the period. d. Labor Efficiency Standards (quantity) – required time to finish 1 unit and

- Standard cost – is the predetermined cost of manufacturing a single unit of allowances such as rest periods, machine setup and machine downtime.

product e. Predetermined OH Rates (price) – fixed and variable costs

USES OF STANDARD COSTING: f. Standard OH rate (quantity) – equal the DLH or machine hours

1. Controlling Costs – to aid management in the production of a unit of product - Actual costs include: DM, DL, VARIABLE OH, AND FIXED OH

or service at the lowest possible cost in accordance with predetermined - Actual costs less standard costs = total variance

quality standards. If Actual > Standard – unfavourable

2. Costing Inventories – eliminates complex computations for inventories and If Actual < Standard – favorable

CGS (no adjustments to be made) COMPUTING AND ANALYZING VARIANCES:

3. Planning Budgets – standard is unit amount while budget is a total amount Total Variance = TMV (MPV+MQV) + TLV (LRV +LEV) +TOV (OCV +OVV)

4. Pricing Products – setting prices is greatly enhanced by the availability of TV = TMV (Materials Price Variance + Materials Quantity Variance) + TLV (Labor

reliable standards and the continuous review of standard costs Rate Variance + Labor Efficiency Variance) + TOV (Overhead Controllable Variance

SETTING STANDARDS: + Overhead Volume Variance)

- Management must choose a level of operating efficiency with which to work 1. DIRECT MATERIALS VARIANCE

1. IDEAL STANDARDS – represent goals that could be attained only by TMV = Standard Qty x Standard Price – Actual Qty x Actual Price

achieving perfection, no provision for lost or idle time, breakdowns, and Material Price Variance = Actual Qty x Standard Price – Actual Qty x Actual Price

Materials Quantity Variance = Standard Qty x Standard Price – Actual Qty. x Standard Price

other factors reducing efficiency.

2. DIRECT LABOR VARIANCES

2. NORMAL STANDARDS – represent goals that can be met under reasonably

TLV = Standard Hrs. x Standard Rate – Actual Hrs. x Actual Rate

efficient operating conditions because they provide for idle time, Labor Rate Variance = Actual Hrs. x Standard Rate – Actual Hrs. x Actual Rate

breakdowns, and common operating problems. Labor Efficiency Variance = Standard Hrs. x Standard Rate – Actual Hrs. x Standard Rate

IMPLEMENTING A STANDARD COST SYSTEM: 3. OVERHEAD VARIANCES

1. Establishing standards for each cost element (materials, labor, and OH) TOV = Actual Overhead – Applied (Standard) Overhead

2. Record actual costs incurred

3. Determine the standard costs for the number of units produced

4. Compute variances by comparison of actual costs and standard costs

You might also like

- Full Download Solution Manual For Excursions in Modern Mathematics 9th Edition Peter Tannenbaum PDF Full ChapterDocument36 pagesFull Download Solution Manual For Excursions in Modern Mathematics 9th Edition Peter Tannenbaum PDF Full Chapterpratic.collopvg0fx100% (23)

- Bid Form For The Procurement of GoodsDocument2 pagesBid Form For The Procurement of GoodsVyze PeraltaNo ratings yet

- LP5 Standard Costing and Variance AnalysisDocument23 pagesLP5 Standard Costing and Variance AnalysisGwynette DalawisNo ratings yet

- LP5 Standard Costing and Variance AnalysisDocument22 pagesLP5 Standard Costing and Variance AnalysisJace Czhristian SantosNo ratings yet

- Mas 1304Document5 pagesMas 1304Vel JuneNo ratings yet

- MAS 2023 Module 5 Standard Costing and Variance AnalysisDocument20 pagesMAS 2023 Module 5 Standard Costing and Variance AnalysisDzulija Talipan100% (1)

- Standard Costing and Variance AnalysisDocument3 pagesStandard Costing and Variance AnalysisFranz CampuedNo ratings yet

- 09 Standard CostingDocument5 pages09 Standard CostingabcdefgNo ratings yet

- Standard Costing Lecture and Sample ProblemDocument8 pagesStandard Costing Lecture and Sample ProblemAccounting FilesNo ratings yet

- Mas 9203 - Standard Costs and Variance AnalysisDocument20 pagesMas 9203 - Standard Costs and Variance AnalysisShefannie PaynanteNo ratings yet

- Mas 9303 - Standard Costs and Variance AnalysisDocument21 pagesMas 9303 - Standard Costs and Variance AnalysisJowel BernabeNo ratings yet

- Mas 9403 Standard Costs and Variance AnalysisDocument21 pagesMas 9403 Standard Costs and Variance AnalysisBanna SplitNo ratings yet

- Standard Costing and Variance AnalysisDocument37 pagesStandard Costing and Variance AnalysisCornelio SwaiNo ratings yet

- Chapter 10 - Variance AnalysisDocument15 pagesChapter 10 - Variance AnalysisNurryn QistinaNo ratings yet

- Midterm Reviewer Job Order and Standard CostDocument16 pagesMidterm Reviewer Job Order and Standard CostMechaella Shella Ningal ApolinarioNo ratings yet

- Module 2 Sub Mod 2 Standard Costing and Material Variance FinalDocument31 pagesModule 2 Sub Mod 2 Standard Costing and Material Variance Finalmaheshbendigeri5945No ratings yet

- Hansen AISE IM - Ch09Document10 pagesHansen AISE IM - Ch09Andriana ButeraNo ratings yet

- Chapter 13 Standard CostingDocument9 pagesChapter 13 Standard Costingprmsusecgen.nfjpia2324No ratings yet

- Standard Costing: Output (Eg. Pieces Per Unit)Document4 pagesStandard Costing: Output (Eg. Pieces Per Unit)glcpaNo ratings yet

- Lecture Notes: Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocument6 pagesLecture Notes: Manila Cavite Laguna Cebu Cagayan de Oro DavaoClouie Anne TogleNo ratings yet

- MS 3404 Standard Costing and Variance AnalysisDocument6 pagesMS 3404 Standard Costing and Variance AnalysisMonica GarciaNo ratings yet

- Standard CostingDocument10 pagesStandard Costingdharmendraparwar24No ratings yet

- Week 3 Chapter 9 - Standard Costing I, Standard Costing & Variance AnalysisDocument5 pagesWeek 3 Chapter 9 - Standard Costing I, Standard Costing & Variance AnalysisSilesian Sailor888No ratings yet

- Standard Costing Acc516Document11 pagesStandard Costing Acc516Joey Theo100% (1)

- MAS-04 Standard Costing and Variance Analysis - 1Document11 pagesMAS-04 Standard Costing and Variance Analysis - 1Krizza MaeNo ratings yet

- Standard Costing 2024 - 1397583526Document20 pagesStandard Costing 2024 - 1397583526k.makwetu0No ratings yet

- 13 VariancesDocument7 pages13 VariancesJack PayneNo ratings yet

- MAS - Flexible Budget & Variance AnalysisDocument10 pagesMAS - Flexible Budget & Variance AnalysisKristian ArdoñaNo ratings yet

- Ma Lo5 NotesDocument2 pagesMa Lo5 NotesItumeleng RampatsiNo ratings yet

- AEC 108 (MA) Semifinal Learning Materials 1Document5 pagesAEC 108 (MA) Semifinal Learning Materials 1Dave Shem DivinoNo ratings yet

- MAS 3 - Standard Costing For UploadDocument9 pagesMAS 3 - Standard Costing For UploadJD SolañaNo ratings yet

- Standart Costing PDFDocument3 pagesStandart Costing PDFVIHARI DNo ratings yet

- Standard Cost Accounting Materials, Labor, and Factory OverheadDocument29 pagesStandard Cost Accounting Materials, Labor, and Factory OverheadKristine AlonzoNo ratings yet

- Reponte (235-250)Document16 pagesReponte (235-250)Peter Paul Enero PerezNo ratings yet

- Standard Costing and Variance AnalysisDocument7 pagesStandard Costing and Variance AnalysisNicko CrisoloNo ratings yet

- Managerial Accounting: Tool For Business Decision Making Third EditionDocument43 pagesManagerial Accounting: Tool For Business Decision Making Third EditionAnne Dorcas S. DomingoNo ratings yet

- Chapter Eleven: Standard Costs and Variance AnalysisDocument43 pagesChapter Eleven: Standard Costs and Variance AnalysisnnonscribdNo ratings yet

- Standard Costing and Variance AnalysisDocument2 pagesStandard Costing and Variance AnalysisCasey MagpileNo ratings yet

- Decorion - Acc228 - Focus NotesDocument6 pagesDecorion - Acc228 - Focus NotesAngelyn DecorionNo ratings yet

- Chapter 006 - Standard Costs VariancesDocument43 pagesChapter 006 - Standard Costs VariancesChi Nguyễn Thị KimNo ratings yet

- MODULE 4 - Standard Costing and Variance AnalysisDocument7 pagesMODULE 4 - Standard Costing and Variance AnalysissampdnimNo ratings yet

- MAS 2023 Module 5 Standard Costing and Variance AnalysisDocument20 pagesMAS 2023 Module 5 Standard Costing and Variance AnalysisDzulija TalipanNo ratings yet

- Chapter 2 (Reviewer)Document3 pagesChapter 2 (Reviewer)Erika May EndencioNo ratings yet

- (Mas) 04 - Standard Costing and Variance AnalysisDocument7 pages(Mas) 04 - Standard Costing and Variance AnalysisCykee Hanna Quizo Lumongsod0% (1)

- Managerial Accounting Chap 8 Standard Costing and Variance AnalysisDocument85 pagesManagerial Accounting Chap 8 Standard Costing and Variance AnalysisFlores Jevie VargasNo ratings yet

- Standard Costing and Variance Analysis: Patrick Louie E. Reyes, CTT, Micb, Rca, CpaDocument34 pagesStandard Costing and Variance Analysis: Patrick Louie E. Reyes, CTT, Micb, Rca, CpaPortia SumabatNo ratings yet

- Cost Accounting - Guerrerro Notes: Chapter 1-Cost Accounting - Basic Concepts and Job Order Cost CycleDocument6 pagesCost Accounting - Guerrerro Notes: Chapter 1-Cost Accounting - Basic Concepts and Job Order Cost CycleAyraaahNo ratings yet

- Module 005 Standard CostingDocument12 pagesModule 005 Standard CostinggagahejuniorNo ratings yet

- Standard CostingDocument82 pagesStandard CostingLucio Indiana WalazaNo ratings yet

- L-31, 32, 33,34 Standard CostingDocument52 pagesL-31, 32, 33,34 Standard CostingYashvi GargNo ratings yet

- Lecture 2 S1 - AY2022.23 - Cost Behaviors, Drivers and Estimation - StudentDocument44 pagesLecture 2 S1 - AY2022.23 - Cost Behaviors, Drivers and Estimation - StudentGautham PushpanathanNo ratings yet

- Cost Accounting SystemsDocument4 pagesCost Accounting SystemsEDELYN PoblacionNo ratings yet

- CH 02Document40 pagesCH 02hoangmyduyennguyen2004No ratings yet

- Standard Costing and Variance AnalysisDocument4 pagesStandard Costing and Variance AnalysiskylaNo ratings yet

- SummaryDocument8 pagesSummarySittiehaina GalmanNo ratings yet

- Managerial Accounting, 13 Edition,: Standard Costs and Operating Performance MeasuresDocument17 pagesManagerial Accounting, 13 Edition,: Standard Costs and Operating Performance MeasuresAhsan Sayeed Nabeel DeproNo ratings yet

- Chapter 8 - Standard CostingDocument8 pagesChapter 8 - Standard CostingJoey LazarteNo ratings yet

- Material Labour Overhead Cost VarianceDocument15 pagesMaterial Labour Overhead Cost VarianceSandhya RajNo ratings yet

- Review Chapter 1-2-4-18Document55 pagesReview Chapter 1-2-4-18hoangmyduyennguyen2004No ratings yet

- ModuleNo1 BasicConceptsDocument4 pagesModuleNo1 BasicConceptsLyerey Jed MartinNo ratings yet

- Slide of Chapter 5Document10 pagesSlide of Chapter 5Uyen ThuNo ratings yet

- Ethical Principles SynthesisDocument4 pagesEthical Principles SynthesisjenNo ratings yet

- Financial Statement AnalysisDocument12 pagesFinancial Statement AnalysisjenNo ratings yet

- Man010-Module 3 (Canvas)Document4 pagesMan010-Module 3 (Canvas)jenNo ratings yet

- Gee Ch7-Computer Reliability LectureDocument3 pagesGee Ch7-Computer Reliability LecturejenNo ratings yet

- How Institutions and Resources Affect Multinational StrategiesDocument4 pagesHow Institutions and Resources Affect Multinational StrategiesjenNo ratings yet

- Bit - Module 2Document24 pagesBit - Module 2jenNo ratings yet

- Cfas - Module 2 SynthesisDocument10 pagesCfas - Module 2 SynthesisjenNo ratings yet

- GEE002 - Discussion 5.1Document1 pageGEE002 - Discussion 5.1jenNo ratings yet

- Discussion 3.2 - Worksheet BasicsDocument2 pagesDiscussion 3.2 - Worksheet BasicsjenNo ratings yet

- Cell Basics Lecture and Assignment 2Document6 pagesCell Basics Lecture and Assignment 2jenNo ratings yet

- Cfas - Module 2 SynthesisDocument4 pagesCfas - Module 2 SynthesisjenNo ratings yet

- Cfas Lecture 2Document2 pagesCfas Lecture 2jenNo ratings yet

- 6.0 Intended Learning Outcomes and TopicsDocument10 pages6.0 Intended Learning Outcomes and TopicsjenNo ratings yet

- Discussion Sts Module 5Document4 pagesDiscussion Sts Module 5jenNo ratings yet

- Lubna Shah W/O Muhammad Naseem 246-R BLK Paragon City: Web Generated BillDocument1 pageLubna Shah W/O Muhammad Naseem 246-R BLK Paragon City: Web Generated BillAli KhokharNo ratings yet

- IndexDocument2 pagesIndexKrishnaKant sharmaNo ratings yet

- Factsheet India Stainless Steel Flanges Ad CVD Final 081318Document3 pagesFactsheet India Stainless Steel Flanges Ad CVD Final 081318yoggalamarNo ratings yet

- Electricity Amendment Bill 2022Document4 pagesElectricity Amendment Bill 2022Vedant GoswamiNo ratings yet

- BSNL Wishes All Its Esteemed Customers A Very Happy and Safe DiwaliDocument3 pagesBSNL Wishes All Its Esteemed Customers A Very Happy and Safe DiwaliFiroz ShaikhNo ratings yet

- Designing Global Supply Chain Networks: Powerpoint Presentation To Accompany Powerpoint Presentation To AccompanyDocument26 pagesDesigning Global Supply Chain Networks: Powerpoint Presentation To Accompany Powerpoint Presentation To AccompanyAlaa Al HarbiNo ratings yet

- K Electric Consumer-Tariff-Nov-5-2021Document2 pagesK Electric Consumer-Tariff-Nov-5-2021Kamal WorkshopNo ratings yet

- Bilal GangDocument1 pageBilal GangMehar ZamaanNo ratings yet

- "A Study On Impact of GST On India Financial MarketDocument86 pages"A Study On Impact of GST On India Financial MarketPranav Paste100% (1)

- Mobile Services: Your Account Summary This Month'S ChargesDocument2 pagesMobile Services: Your Account Summary This Month'S ChargesChalla RamanamurtyNo ratings yet

- Monthly Statement: This Month's SummaryDocument4 pagesMonthly Statement: This Month's SummaryTushar AnandNo ratings yet

- Park and Pay at The End of Your StayDocument2 pagesPark and Pay at The End of Your StayDaniel AdebayoNo ratings yet

- Stay-Even and Cost Based PricingDocument6 pagesStay-Even and Cost Based PricingFaith Lorein LorejoNo ratings yet

- Jackson, States' Rights and The National BankDocument2 pagesJackson, States' Rights and The National BankDaniel CoteNo ratings yet

- LESCO - Web BillDocument1 pageLESCO - Web Billfazal ahmadNo ratings yet

- National Law Institute University, Bhopal: Synopsis Topic: Dumping and Its Impact On India With Reference To ChinaDocument4 pagesNational Law Institute University, Bhopal: Synopsis Topic: Dumping and Its Impact On India With Reference To Chinarashi bakshNo ratings yet

- Most Important Terms and ConditionsDocument6 pagesMost Important Terms and ConditionsMit CreationNo ratings yet

- WT/TPR/S/339: Trade Policy ReviewDocument126 pagesWT/TPR/S/339: Trade Policy ReviewDawitNo ratings yet

- LTDC - Sample 4Document2 pagesLTDC - Sample 4Mehak KotraNo ratings yet

- Deposit Slip For Bank: Amount Advance Tax Sales Tax/Excise Duty Total (RS.)Document2 pagesDeposit Slip For Bank: Amount Advance Tax Sales Tax/Excise Duty Total (RS.)Faizan AliNo ratings yet

- TheMomsCo Invoice 1658466994-76Document1 pageTheMomsCo Invoice 1658466994-76Aravind KrishNo ratings yet

- Wind Future in Asia Report (Final) Updated23Aug12 - 0 PDFDocument104 pagesWind Future in Asia Report (Final) Updated23Aug12 - 0 PDFSahil GargNo ratings yet

- Annex A Revised RDWR March2021Document124 pagesAnnex A Revised RDWR March2021Deb GonzalesNo ratings yet

- Mepco Full Bill MarchDocument1 pageMepco Full Bill MarchZafar Sahabir khanNo ratings yet

- Your Claim Will Be Processed in 1 Cycle of March 2021 Subject To Receipts/submission of Your BillsDocument5 pagesYour Claim Will Be Processed in 1 Cycle of March 2021 Subject To Receipts/submission of Your BillsnidhisasidharanNo ratings yet

- BIR Form No. 0901-S1Document2 pagesBIR Form No. 0901-S1Aldrinn BenamirNo ratings yet

- Nishat Ali Gulfam S/O M Shareef Old Kahna: Web Generated BillDocument1 pageNishat Ali Gulfam S/O M Shareef Old Kahna: Web Generated BillshahzadtecNo ratings yet

- Invoice: Excelcargo LogisticsDocument1 pageInvoice: Excelcargo LogisticsJohn MaxwellNo ratings yet