Professional Documents

Culture Documents

Goods and Services Tax - GSTR-2B

Goods and Services Tax - GSTR-2B

Uploaded by

AMAR KANT0 ratings0% found this document useful (0 votes)

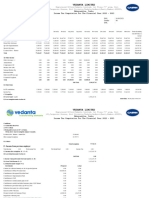

10 views5 pagesThe document contains details of 7 invoices from Jai Bharat Trading C to suppliers in Uttar Pradesh between August 20-24, 2020. It lists the supplier GSTIN, invoice numbers, dates, values, taxable values, taxes charged including integrated, central, and state taxes. The filing period for the invoices was August 2020 with the GSTR-1/5 filing date of September 11, 2020 and input tax credit availability for all invoices.

Original Description:

Original Title

B2B_082020_09AARFB2372B1ZJ_GSTR2B_16102020.xlsx

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document contains details of 7 invoices from Jai Bharat Trading C to suppliers in Uttar Pradesh between August 20-24, 2020. It lists the supplier GSTIN, invoice numbers, dates, values, taxable values, taxes charged including integrated, central, and state taxes. The filing period for the invoices was August 2020 with the GSTR-1/5 filing date of September 11, 2020 and input tax credit availability for all invoices.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

10 views5 pagesGoods and Services Tax - GSTR-2B

Goods and Services Tax - GSTR-2B

Uploaded by

AMAR KANTThe document contains details of 7 invoices from Jai Bharat Trading C to suppliers in Uttar Pradesh between August 20-24, 2020. It lists the supplier GSTIN, invoice numbers, dates, values, taxable values, taxes charged including integrated, central, and state taxes. The filing period for the invoices was August 2020 with the GSTR-1/5 filing date of September 11, 2020 and input tax credit availability for all invoices.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 5

Invoice Details

GSTIN of supplier Trade/Legal name

Invoice number Invoice type Invoice Date

06AAWPB3234F1ZW JAI BHARAT TRADING C 551 Regular 20/08/2020

06AAWPB3234F1ZW JAI BHARAT TRADING C 552 Regular 21/08/2020

06AAWPB3234F1ZW JAI BHARAT TRADING C 553 Regular 21/08/2020

06AAWPB3234F1ZW JAI BHARAT TRADING C 554 Regular 24/08/2020

06AAWPB3234F1ZW JAI BHARAT TRADING C 555 Regular 24/08/2020

06AAWPB3234F1ZW JAI BHARAT TRADING C 556 Regular 24/08/2020

06AAWPB3234F1ZW JAI BHARAT TRADING C 557 Regular 24/08/2020

Goods and Services

Taxable inward supplies receive

s Supply Attract Reverse

Place of supply Rate(%) Taxable Value (₹)

Invoice Value(₹) Charge

1,82,836.00 Uttar Pradesh No 5 1,74,130.00

1,76,541.00 Uttar Pradesh No 5 1,68,135.00

1,71,633.00 Uttar Pradesh No 5 1,63,460.00

1,88,265.00 Uttar Pradesh No 5 1,79,300.00

1,79,371.00 Uttar Pradesh No 5 1,70,830.00

1,69,380.00 Uttar Pradesh No 5 1,61,315.00

1,40,159.00 Uttar Pradesh No 5 1,33,485.00

nd Services Tax - GSTR-2B

ward supplies received from registered persons

Tax Amount

Integrated Tax(₹) Central Tax(₹) State/UT Tax(₹) Cess(₹)

8,706.50 0.00 0.00 0.00

8,406.75 0.00 0.00 0.00

8,173.00 0.00 0.00 0.00

8,965.00 0.00 0.00 0.00

8,541.50 0.00 0.00 0.00

8,065.75 0.00 0.00 0.00

6,674.25 0.00 0.00 0.00

GSTR-1/5 Period GSTR-1/5 Filing Date ITC Availability

Aug'20 11/09/2020 Yes

Aug'20 11/09/2020 Yes

Aug'20 11/09/2020 Yes

Aug'20 11/09/2020 Yes

Aug'20 11/09/2020 Yes

Aug'20 11/09/2020 Yes

Aug'20 11/09/2020 Yes

Reason Applicable % of Tax Rate

100%

100%

100%

100%

100%

100%

100%

You might also like

- Market Structure Cheat SheetDocument55 pagesMarket Structure Cheat SheetMuralidaran Selvaraj100% (9)

- Pay Slip For October 2018: Fare Portal India Private LimitedDocument1 pagePay Slip For October 2018: Fare Portal India Private LimitedManju ChaudharyNo ratings yet

- Resettlement Area For Informal Settlers Families of Barangay Bucana in Davao CityDocument12 pagesResettlement Area For Informal Settlers Families of Barangay Bucana in Davao CityJERILON LUNTAD100% (1)

- B2B 072023 08abqpy6609n1zj GSTR2B 20082023Document7 pagesB2B 072023 08abqpy6609n1zj GSTR2B 20082023Neeraj SainiNo ratings yet

- B2B 072022 09aqaps1668n1z7 GSTR2B 06102022Document7 pagesB2B 072022 09aqaps1668n1z7 GSTR2B 06102022birpal singhNo ratings yet

- B2B 042023 09bftpk9626k1zi GSTR2B 14052023Document7 pagesB2B 042023 09bftpk9626k1zi GSTR2B 14052023Raja GuptaNo ratings yet

- Siva Vignesh Siva Lingam S (000011170)Document4 pagesSiva Vignesh Siva Lingam S (000011170)Siva VigneshNo ratings yet

- B2B 012024 05PRCPS6451R1ZP GSTR2B 16022024Document7 pagesB2B 012024 05PRCPS6451R1ZP GSTR2B 16022024vbsingh163No ratings yet

- Sanket SafetyDocument1 pageSanket SafetyManoj GaikwadNo ratings yet

- Goods and Services Tax - GSTR-2BDocument7 pagesGoods and Services Tax - GSTR-2BMïhîr PrÆbhátNo ratings yet

- EntityDocument3 pagesEntityMayankNo ratings yet

- B2B 032024 09biypm5469g1zc GSTR2B 18042024Document7 pagesB2B 032024 09biypm5469g1zc GSTR2B 18042024mishraadarsh5454No ratings yet

- Goods and Services Tax - GSTR-2BDocument7 pagesGoods and Services Tax - GSTR-2BMD AZHARNo ratings yet

- Todas Las Ventas Factura Cliente Número de DocumentoDocument4 pagesTodas Las Ventas Factura Cliente Número de Documentodora saldarriagaNo ratings yet

- Tax Invoice: (Valid For Input Tax)Document1 pageTax Invoice: (Valid For Input Tax)अनुरूपम स्वामीNo ratings yet

- Bajrabarahi Sana Krishi Firm Godavari Municipality - 13, LalitpurDocument5 pagesBajrabarahi Sana Krishi Firm Godavari Municipality - 13, LalitpurheroNo ratings yet

- Contoh Laporan JurnalDocument8 pagesContoh Laporan JurnalRojaliNo ratings yet

- B2B 012024 3 GSTR2B 04042024Document7 pagesB2B 012024 3 GSTR2B 04042024ayyanar7No ratings yet

- Unrealised Profit and Loss RM - 3223384 - 05 01 24 03 57 09Document2 pagesUnrealised Profit and Loss RM - 3223384 - 05 01 24 03 57 09ErUmangKoyaniNo ratings yet

- Unrealised Profit and Loss RM - 3213582 - 05 01 24 03 59 15Document2 pagesUnrealised Profit and Loss RM - 3213582 - 05 01 24 03 59 15ErUmangKoyaniNo ratings yet

- 20btvpd8601h1zs Gstr3br1 Reconciled Summary (2024-2025)Document16 pages20btvpd8601h1zs Gstr3br1 Reconciled Summary (2024-2025)Manoj MadhukerNo ratings yet

- B2B 072022 37asxpb9540p1zr GSTR2B 18092022Document7 pagesB2B 072022 37asxpb9540p1zr GSTR2B 18092022Rama KrishnaNo ratings yet

- NR26Q Q2Document82 pagesNR26Q Q2Sachin KumarNo ratings yet

- GeneratePdftax AspxDocument2 pagesGeneratePdftax AspxShiva KumarNo ratings yet

- Bajrabarahi Sana Krishi Firm Godavari Municipality - 13, LalitpurDocument4 pagesBajrabarahi Sana Krishi Firm Godavari Municipality - 13, LalitpurheroNo ratings yet

- Taxsheet 10007162Document2 pagesTaxsheet 10007162Narender KapoorNo ratings yet

- Chakr Innovation 10.04.2024Document1 pageChakr Innovation 10.04.2024Deepak LambaNo ratings yet

- E Salary: Particular Target January February March AprilDocument8 pagesE Salary: Particular Target January February March AprilAlmira ZuluetaNo ratings yet

- Vijaya Po 1Document1 pageVijaya Po 1adrijaswiagenciesNo ratings yet

- Cebu Car-Tech CenterDocument17 pagesCebu Car-Tech CenterAlbert Moreno100% (2)

- Cpayslip 2022 2023 Inf0047318 ISSINDIADocument1 pageCpayslip 2022 2023 Inf0047318 ISSINDIAManohar NMNo ratings yet

- Mughal Innovations QRDocument1 pageMughal Innovations QRasharusmaniNo ratings yet

- Statement of GPF Accounts For The Year Ended: (Rupees One Lakh Seventy-Three Thousand Two Hundred Fifty-Four Only)Document12 pagesStatement of GPF Accounts For The Year Ended: (Rupees One Lakh Seventy-Three Thousand Two Hundred Fifty-Four Only)Nani Gopal SahaNo ratings yet

- Corona Remedies PVT LTD: Pay Slip For The Month of Apr - 2019Document1 pageCorona Remedies PVT LTD: Pay Slip For The Month of Apr - 2019Emmanuel melvinNo ratings yet

- GST Tally Invoice Format FinalDocument1 pageGST Tally Invoice Format FinalJugaadi BahmanNo ratings yet

- GST Tally Invoice Format Final PDFDocument1 pageGST Tally Invoice Format Final PDFSyed Danish FayazNo ratings yet

- India Post Payments Bank Limited Income Tax Computation For The Financial Year 2019-2020Document4 pagesIndia Post Payments Bank Limited Income Tax Computation For The Financial Year 2019-2020Swati Rohan JadhavNo ratings yet

- B2B 062022 09aqaps1668n1z7 GSTR2B 06102022Document7 pagesB2B 062022 09aqaps1668n1z7 GSTR2B 06102022birpal singhNo ratings yet

- AIN05425706Document1 pageAIN05425706Soujanya NayakNo ratings yet

- Financial StatementDocument17 pagesFinancial Statementsaorabh13No ratings yet

- Unrealised Profit and Loss RM - 3228264 - 05 01 24 04 00 43Document2 pagesUnrealised Profit and Loss RM - 3228264 - 05 01 24 04 00 43ErUmangKoyaniNo ratings yet

- Cumulative B8983Document1 pageCumulative B8983bharathkumar jNo ratings yet

- QTN Asia Crystal-1 PDFDocument1 pageQTN Asia Crystal-1 PDFIJAJ AHAMED MBANo ratings yet

- Power Information Technology Company (PITC) Customer Data SummaryDocument8 pagesPower Information Technology Company (PITC) Customer Data SummaryUmeshNo ratings yet

- JTC - Bill 44 (Same State)Document2 pagesJTC - Bill 44 (Same State)rishishekhawat1029No ratings yet

- Cpayslip 2022 2023 Inf0047318 ISSINDIADocument1 pageCpayslip 2022 2023 Inf0047318 ISSINDIAManohar NMNo ratings yet

- Gopal Ji Steel GSTR3B jUNE2022Document1 pageGopal Ji Steel GSTR3B jUNE2022Nikita VarshneyNo ratings yet

- TALLYDocument1 pageTALLYNikita VarshneyNo ratings yet

- Integra - Business Case GeneratorDocument27 pagesIntegra - Business Case GeneratorAmigo SecretoNo ratings yet

- Budget ExpenditureDocument33 pagesBudget ExpenditureLan So NessNo ratings yet

- Cumulative 192029Document1 pageCumulative 192029Ryalapeta Venu YadavNo ratings yet

- Components Earnings: Amounts Are in INRDocument1 pageComponents Earnings: Amounts Are in INRDheeraj KumarNo ratings yet

- Components Earnings: Amounts Are in INRDocument1 pageComponents Earnings: Amounts Are in INRDheeraj KumarNo ratings yet

- Genius NRDocument72 pagesGenius NRSachin KumarNo ratings yet

- UntitledDocument4 pagesUntitledancestral chileNo ratings yet

- Quickbook Company Accounts.Document1 pageQuickbook Company Accounts.Talal KhanNo ratings yet

- CRM Services India Private LimitedDocument1 pageCRM Services India Private LimitedPraveen SainiNo ratings yet

- 09dpxpk2191m1zx Gstr3br1 Reconciled Summary (2022-2023)Document19 pages09dpxpk2191m1zx Gstr3br1 Reconciled Summary (2022-2023)birpal singhNo ratings yet

- ZenatixDocument5 pagesZenatixabhi kamaleNo ratings yet

- rptExAnnualSlip WoRefLoanDocument1 pagerptExAnnualSlip WoRefLoanumesh chitrodaNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNo ratings yet

- Business Mathematics: Simple InterestDocument6 pagesBusiness Mathematics: Simple InterestVishal MehtaNo ratings yet

- Case Project: Awash To Mieso (72 KM) Toll Road ProjectDocument4 pagesCase Project: Awash To Mieso (72 KM) Toll Road ProjectDemewez AsfawNo ratings yet

- DEVISDocument7 pagesDEVISمحمد الزراريNo ratings yet

- The Economic Outlook For California Pistachios: Steven C. BlankDocument17 pagesThe Economic Outlook For California Pistachios: Steven C. BlankmohammadebrahimiNo ratings yet

- Bitsat Ques and SolDocument47 pagesBitsat Ques and SollafaNo ratings yet

- Chapter 12 - Monopolistic Competition and OligopolyDocument5 pagesChapter 12 - Monopolistic Competition and OligopolyAwesa IhsysNo ratings yet

- Medical Paper CoverDocument1 pageMedical Paper Coverashik345No ratings yet

- 1 Use The Numbers Given To Complete The Cash BudgetDocument1 page1 Use The Numbers Given To Complete The Cash BudgetAmit PandeyNo ratings yet

- Inventory Management 2018 (Autosaved) 1Document14 pagesInventory Management 2018 (Autosaved) 1Morebodi MabeNo ratings yet

- Cug No Details TahsildarDocument10 pagesCug No Details TahsildardaksheduhubNo ratings yet

- Absorption Costing and VariableDocument2 pagesAbsorption Costing and VariableKIRUTHIGAAH A/P KANADASANNo ratings yet

- CA Inter Adv Accounts (New) Suggested Answer Dec21Document30 pagesCA Inter Adv Accounts (New) Suggested Answer Dec21omaisNo ratings yet

- Agriculture Has Always Been A Vital Part of The Philippine NationDocument2 pagesAgriculture Has Always Been A Vital Part of The Philippine NationLemuel Jefferson CastilloNo ratings yet

- Top 9 Importanc-WPS OfficeDocument2 pagesTop 9 Importanc-WPS OfficePrecy CaseroNo ratings yet

- Draft Bill-12012022Document2 pagesDraft Bill-12012022xidaNo ratings yet

- Cambridge International AS & A Level: Economics 9708/32Document16 pagesCambridge International AS & A Level: Economics 9708/32fathima mohamedNo ratings yet

- Read 6-5 1 Feudalism and Manorialism 1 Feudalism and ManorialismDocument6 pagesRead 6-5 1 Feudalism and Manorialism 1 Feudalism and Manorialismapi-296674326No ratings yet

- Introducing Economic Development: A Global PerspectiveDocument34 pagesIntroducing Economic Development: A Global PerspectiveAprile Margareth HidalgoNo ratings yet

- Bill Statement: (Invoice)Document1 pageBill Statement: (Invoice)Terrence LimNo ratings yet

- National Income ConceptsDocument22 pagesNational Income ConceptsData AnalystNo ratings yet

- Growth & Changing Structure of Non-Banking Financial InstitutionsDocument12 pagesGrowth & Changing Structure of Non-Banking Financial InstitutionspremdeepsinghNo ratings yet

- Banking Law Unit 1Document89 pagesBanking Law Unit 1RHEA VIJU SAMUEL 1850355No ratings yet

- Final Exam Sample Questions Attempt Review 1Document9 pagesFinal Exam Sample Questions Attempt Review 1leieparanoicoNo ratings yet

- The Case For Small and Medium Enterprises in Afghanistan PDFDocument34 pagesThe Case For Small and Medium Enterprises in Afghanistan PDFNomanNo ratings yet

- The Contemporary WorldDocument11 pagesThe Contemporary WorldPrincess UmipigNo ratings yet

- O-H Äohh-H Hu+Hme+Hmh: PHFHHSH-H Huphv-HhDocument220 pagesO-H Äohh-H Hu+Hme+Hmh: PHFHHSH-H Huphv-HhSourabh PorwalNo ratings yet

- " A Study On " IDBI Bank's Performance" Submitted ToDocument40 pages" A Study On " IDBI Bank's Performance" Submitted TosalmaNo ratings yet

- Burundi EconomyDocument112 pagesBurundi EconomyMandar RasaikarNo ratings yet