Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

32 viewsVolume Profile Analysis Learnings

Volume Profile Analysis Learnings

Uploaded by

himuneshThis document provides guidelines for volume profile analysis (VPA) and harmonic pattern trading. For VPA, it recommends planning trades a day in advance based on stock analysis, avoiding high risk indices, waiting for opportunities, and not revenge trading. It also advises against trading when the point of control level is skipped or breached twice. For harmonics, it suggests only trading at Fibonacci levels like 0.618 and 1.618, avoiding consolidation near the profit zone, and exiting if a candle closes below the stop loss.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- ExoCharts by SassyDocument7 pagesExoCharts by SassycabbattNo ratings yet

- ChartSpots NQ Daytrading Statistics 2022 SampleDocument10 pagesChartSpots NQ Daytrading Statistics 2022 SampleJoão TrocaNo ratings yet

- ChartSpots ES Daytrading Statistics 2022 SampleDocument10 pagesChartSpots ES Daytrading Statistics 2022 SampleJoão TrocaNo ratings yet

- Trading StrategyDocument2 pagesTrading StrategyAzizalindaNo ratings yet

- Stocks: Fundamental Analysis: Sample Investing PlanDocument5 pagesStocks: Fundamental Analysis: Sample Investing PlanNakibNo ratings yet

- Full Guide On Support and ResistanceDocument11 pagesFull Guide On Support and ResistanceBe HappyNo ratings yet

- Advanced Camarilla Trading Technique in ExcelDocument4 pagesAdvanced Camarilla Trading Technique in ExcelMTEASNo ratings yet

- SniperTradingSetups ManualDocument63 pagesSniperTradingSetups ManualDavid SheehanNo ratings yet

- Pivot Trading 1Document5 pagesPivot Trading 1Shah Aia Takaful Planner100% (1)

- Hit and Run: - Number7Document31 pagesHit and Run: - Number7Siva PrakashNo ratings yet

- Vol Profile Presenation SellyDocument100 pagesVol Profile Presenation SellyYazan Barjawi100% (1)

- Trading Plan TemplateDocument29 pagesTrading Plan TemplateGeraldValNo ratings yet

- Pivot Point TradingDocument5 pagesPivot Point Tradingipins0% (1)

- Option Chain Jyoti Budhiya NotesDocument2 pagesOption Chain Jyoti Budhiya NotesShub ShahNo ratings yet

- Where When and HowDocument37 pagesWhere When and Howmohamed hamdallah0% (1)

- Ascending & Descending BroadingDocument9 pagesAscending & Descending BroadingvvpvarunNo ratings yet

- Financial Markets Wizard: Options Trading StrategiesDocument21 pagesFinancial Markets Wizard: Options Trading StrategiesLeonardo ZasNo ratings yet

- Initiative and Responsive Activities in The Market Profile - LinkedInDocument1 pageInitiative and Responsive Activities in The Market Profile - LinkedInShahbaz SyedNo ratings yet

- The Complete Trading SystemDocument5 pagesThe Complete Trading SystemMariafra AntonioNo ratings yet

- Volume Vs Open InterestDocument17 pagesVolume Vs Open InterestVivek AryaNo ratings yet

- How To Avoid Stop Hunting While Other Traders Get Stopped OutDocument8 pagesHow To Avoid Stop Hunting While Other Traders Get Stopped Outsofia rafa0% (1)

- Intra-Day Momentum: Imperial College LondonDocument53 pagesIntra-Day Momentum: Imperial College LondonNikhil AroraNo ratings yet

- ORB IntradayDocument3 pagesORB IntradayryuvaNo ratings yet

- Session Breakout StrategyDocument2 pagesSession Breakout Strategyvamsi kumar0% (1)

- Inside A Traders Mind 1Document4 pagesInside A Traders Mind 1Big BomberNo ratings yet

- Institutional Trading UrviDocument4 pagesInstitutional Trading UrviSunil JatharNo ratings yet

- High Probable Future DirectionDocument19 pagesHigh Probable Future DirectionDavid VenancioNo ratings yet

- ZulTheTrader Choosing Point-of-Interest (POI) (Not For Sale)Document8 pagesZulTheTrader Choosing Point-of-Interest (POI) (Not For Sale)Spine StraightenerNo ratings yet

- Swing Trading Guide by Tanmay BhavsarDocument71 pagesSwing Trading Guide by Tanmay BhavsarTanmayNo ratings yet

- Smart Money Concept - Practical Approach: Badar Din ZounrDocument18 pagesSmart Money Concept - Practical Approach: Badar Din Zounrbadar dinNo ratings yet

- True Support and ResistanceDocument12 pagesTrue Support and ResistancechajimNo ratings yet

- Intr Say Tra NG StraesDocument6 pagesIntr Say Tra NG Straesspajk6No ratings yet

- Stp2 Step 5 DocumentationDocument9 pagesStp2 Step 5 DocumentationSooraj MittalNo ratings yet

- Trading For Beginner ForexDocument22 pagesTrading For Beginner Forexsalmankhancap67No ratings yet

- How Big Players Traps Retailers in StockmarketDocument4 pagesHow Big Players Traps Retailers in StockmarketDare DesaiNo ratings yet

- TGO Trade PlanDocument15 pagesTGO Trade PlanDemetrius HayesNo ratings yet

- GFF - Using Price Action To Identify TrendsDocument14 pagesGFF - Using Price Action To Identify Trendslilli-pilli100% (1)

- Trading The Order FlowDocument12 pagesTrading The Order FlowLeonidNo ratings yet

- BootcampX Day 5Document67 pagesBootcampX Day 5Vivek LasunaNo ratings yet

- 6 Best Books On Intraday Trading - Financial Analyst Insider PDFDocument8 pages6 Best Books On Intraday Trading - Financial Analyst Insider PDFAbhishek MusaddiNo ratings yet

- Order Flow TradingDocument15 pagesOrder Flow TradingOUEDRAOGO Roland100% (1)

- Gann Master Forex Course 4Document51 pagesGann Master Forex Course 4Trader RetailNo ratings yet

- Stoploss HuntingDocument30 pagesStoploss HuntingYe TotalNo ratings yet

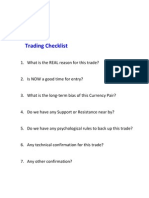

- Trading ChecklistDocument1 pageTrading ChecklistniatsanNo ratings yet

- Order FlowDocument71 pagesOrder FlowNguyen Anh QuanNo ratings yet

- Trading Riot - TradingPlan - 2021 - UpdatedDocument25 pagesTrading Riot - TradingPlan - 2021 - Updatedakeem6073100% (1)

- How To Successfully Use Pitchforks and Median Lines To TradeDocument60 pagesHow To Successfully Use Pitchforks and Median Lines To TradekhangphongnguyengmaiNo ratings yet

- Initial Balance Perspective: The OpenDocument2 pagesInitial Balance Perspective: The OpenwilwilwelNo ratings yet

- Trade ScoreDocument30 pagesTrade Scoresangram1705100% (1)

- Ss Volume ProfileDocument11 pagesSs Volume Profileabcd123467% (3)

- Entry ModelsDocument5 pagesEntry Modelssatori investmentsNo ratings yet

- Online Couse Max B ForexDocument76 pagesOnline Couse Max B ForexUmair KhalidNo ratings yet

- Forex Mastery: Smart Strategies by The MastersDocument4 pagesForex Mastery: Smart Strategies by The MastersjjaypowerNo ratings yet

- Become A Successful Trader Using Smart Money Concept: The Complete Guide to Forex Trading, Stock Trading, and Crypto Currency Trading for BeginnersFrom EverandBecome A Successful Trader Using Smart Money Concept: The Complete Guide to Forex Trading, Stock Trading, and Crypto Currency Trading for BeginnersNo ratings yet

- Trading Triads: Unlocking the Secrets of Market Structure and Trading in Any MarketFrom EverandTrading Triads: Unlocking the Secrets of Market Structure and Trading in Any MarketNo ratings yet

Volume Profile Analysis Learnings

Volume Profile Analysis Learnings

Uploaded by

himunesh0 ratings0% found this document useful (0 votes)

32 views2 pagesThis document provides guidelines for volume profile analysis (VPA) and harmonic pattern trading. For VPA, it recommends planning trades a day in advance based on stock analysis, avoiding high risk indices, waiting for opportunities, and not revenge trading. It also advises against trading when the point of control level is skipped or breached twice. For harmonics, it suggests only trading at Fibonacci levels like 0.618 and 1.618, avoiding consolidation near the profit zone, and exiting if a candle closes below the stop loss.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides guidelines for volume profile analysis (VPA) and harmonic pattern trading. For VPA, it recommends planning trades a day in advance based on stock analysis, avoiding high risk indices, waiting for opportunities, and not revenge trading. It also advises against trading when the point of control level is skipped or breached twice. For harmonics, it suggests only trading at Fibonacci levels like 0.618 and 1.618, avoiding consolidation near the profit zone, and exiting if a candle closes below the stop loss.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

32 views2 pagesVolume Profile Analysis Learnings

Volume Profile Analysis Learnings

Uploaded by

himuneshThis document provides guidelines for volume profile analysis (VPA) and harmonic pattern trading. For VPA, it recommends planning trades a day in advance based on stock analysis, avoiding high risk indices, waiting for opportunities, and not revenge trading. It also advises against trading when the point of control level is skipped or breached twice. For harmonics, it suggests only trading at Fibonacci levels like 0.618 and 1.618, avoiding consolidation near the profit zone, and exiting if a candle closes below the stop loss.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

VPA + HA Learnings

Volume Profile Analysis (VPA)

Proper analysis of stocks one day before (plan ahead and only execute them next day)

Trade only in stocks (never in Banknifty or Nifty – high risk)

Don’t jump into trade (wait for right opportunity)

Don’t try to recover losses in single day (avoid revenge trading)

Avoid trade where movement is strong against the bet

o Continuous green/ red candles

o Long wick in the opposite direction

o Prefer to trade after 10:00am as stocks settle down

Avoid trading when POC level is skipped by gap up or gap down

Use one level only once (important)

Don’t trade when POC level has been breached twice in the past

Avoid trading when opening level of day is very close to POC level

POC level is considered tested if prices don’t touch and reverse 0.2% from POC

Harmonic Patterns

All numbers should be Fibonacci levels

Ideal values are 0.618/ 0.786/ 1.27/ 1.618

Avoid trading when there is consolidation/ accumulation before reaching the PRZ

Avoid trading when there is gap up and gap down near PRZ

Exit when there is 5min candle closing below stoploss

You might also like

- ExoCharts by SassyDocument7 pagesExoCharts by SassycabbattNo ratings yet

- ChartSpots NQ Daytrading Statistics 2022 SampleDocument10 pagesChartSpots NQ Daytrading Statistics 2022 SampleJoão TrocaNo ratings yet

- ChartSpots ES Daytrading Statistics 2022 SampleDocument10 pagesChartSpots ES Daytrading Statistics 2022 SampleJoão TrocaNo ratings yet

- Trading StrategyDocument2 pagesTrading StrategyAzizalindaNo ratings yet

- Stocks: Fundamental Analysis: Sample Investing PlanDocument5 pagesStocks: Fundamental Analysis: Sample Investing PlanNakibNo ratings yet

- Full Guide On Support and ResistanceDocument11 pagesFull Guide On Support and ResistanceBe HappyNo ratings yet

- Advanced Camarilla Trading Technique in ExcelDocument4 pagesAdvanced Camarilla Trading Technique in ExcelMTEASNo ratings yet

- SniperTradingSetups ManualDocument63 pagesSniperTradingSetups ManualDavid SheehanNo ratings yet

- Pivot Trading 1Document5 pagesPivot Trading 1Shah Aia Takaful Planner100% (1)

- Hit and Run: - Number7Document31 pagesHit and Run: - Number7Siva PrakashNo ratings yet

- Vol Profile Presenation SellyDocument100 pagesVol Profile Presenation SellyYazan Barjawi100% (1)

- Trading Plan TemplateDocument29 pagesTrading Plan TemplateGeraldValNo ratings yet

- Pivot Point TradingDocument5 pagesPivot Point Tradingipins0% (1)

- Option Chain Jyoti Budhiya NotesDocument2 pagesOption Chain Jyoti Budhiya NotesShub ShahNo ratings yet

- Where When and HowDocument37 pagesWhere When and Howmohamed hamdallah0% (1)

- Ascending & Descending BroadingDocument9 pagesAscending & Descending BroadingvvpvarunNo ratings yet

- Financial Markets Wizard: Options Trading StrategiesDocument21 pagesFinancial Markets Wizard: Options Trading StrategiesLeonardo ZasNo ratings yet

- Initiative and Responsive Activities in The Market Profile - LinkedInDocument1 pageInitiative and Responsive Activities in The Market Profile - LinkedInShahbaz SyedNo ratings yet

- The Complete Trading SystemDocument5 pagesThe Complete Trading SystemMariafra AntonioNo ratings yet

- Volume Vs Open InterestDocument17 pagesVolume Vs Open InterestVivek AryaNo ratings yet

- How To Avoid Stop Hunting While Other Traders Get Stopped OutDocument8 pagesHow To Avoid Stop Hunting While Other Traders Get Stopped Outsofia rafa0% (1)

- Intra-Day Momentum: Imperial College LondonDocument53 pagesIntra-Day Momentum: Imperial College LondonNikhil AroraNo ratings yet

- ORB IntradayDocument3 pagesORB IntradayryuvaNo ratings yet

- Session Breakout StrategyDocument2 pagesSession Breakout Strategyvamsi kumar0% (1)

- Inside A Traders Mind 1Document4 pagesInside A Traders Mind 1Big BomberNo ratings yet

- Institutional Trading UrviDocument4 pagesInstitutional Trading UrviSunil JatharNo ratings yet

- High Probable Future DirectionDocument19 pagesHigh Probable Future DirectionDavid VenancioNo ratings yet

- ZulTheTrader Choosing Point-of-Interest (POI) (Not For Sale)Document8 pagesZulTheTrader Choosing Point-of-Interest (POI) (Not For Sale)Spine StraightenerNo ratings yet

- Swing Trading Guide by Tanmay BhavsarDocument71 pagesSwing Trading Guide by Tanmay BhavsarTanmayNo ratings yet

- Smart Money Concept - Practical Approach: Badar Din ZounrDocument18 pagesSmart Money Concept - Practical Approach: Badar Din Zounrbadar dinNo ratings yet

- True Support and ResistanceDocument12 pagesTrue Support and ResistancechajimNo ratings yet

- Intr Say Tra NG StraesDocument6 pagesIntr Say Tra NG Straesspajk6No ratings yet

- Stp2 Step 5 DocumentationDocument9 pagesStp2 Step 5 DocumentationSooraj MittalNo ratings yet

- Trading For Beginner ForexDocument22 pagesTrading For Beginner Forexsalmankhancap67No ratings yet

- How Big Players Traps Retailers in StockmarketDocument4 pagesHow Big Players Traps Retailers in StockmarketDare DesaiNo ratings yet

- TGO Trade PlanDocument15 pagesTGO Trade PlanDemetrius HayesNo ratings yet

- GFF - Using Price Action To Identify TrendsDocument14 pagesGFF - Using Price Action To Identify Trendslilli-pilli100% (1)

- Trading The Order FlowDocument12 pagesTrading The Order FlowLeonidNo ratings yet

- BootcampX Day 5Document67 pagesBootcampX Day 5Vivek LasunaNo ratings yet

- 6 Best Books On Intraday Trading - Financial Analyst Insider PDFDocument8 pages6 Best Books On Intraday Trading - Financial Analyst Insider PDFAbhishek MusaddiNo ratings yet

- Order Flow TradingDocument15 pagesOrder Flow TradingOUEDRAOGO Roland100% (1)

- Gann Master Forex Course 4Document51 pagesGann Master Forex Course 4Trader RetailNo ratings yet

- Stoploss HuntingDocument30 pagesStoploss HuntingYe TotalNo ratings yet

- Trading ChecklistDocument1 pageTrading ChecklistniatsanNo ratings yet

- Order FlowDocument71 pagesOrder FlowNguyen Anh QuanNo ratings yet

- Trading Riot - TradingPlan - 2021 - UpdatedDocument25 pagesTrading Riot - TradingPlan - 2021 - Updatedakeem6073100% (1)

- How To Successfully Use Pitchforks and Median Lines To TradeDocument60 pagesHow To Successfully Use Pitchforks and Median Lines To TradekhangphongnguyengmaiNo ratings yet

- Initial Balance Perspective: The OpenDocument2 pagesInitial Balance Perspective: The OpenwilwilwelNo ratings yet

- Trade ScoreDocument30 pagesTrade Scoresangram1705100% (1)

- Ss Volume ProfileDocument11 pagesSs Volume Profileabcd123467% (3)

- Entry ModelsDocument5 pagesEntry Modelssatori investmentsNo ratings yet

- Online Couse Max B ForexDocument76 pagesOnline Couse Max B ForexUmair KhalidNo ratings yet

- Forex Mastery: Smart Strategies by The MastersDocument4 pagesForex Mastery: Smart Strategies by The MastersjjaypowerNo ratings yet

- Become A Successful Trader Using Smart Money Concept: The Complete Guide to Forex Trading, Stock Trading, and Crypto Currency Trading for BeginnersFrom EverandBecome A Successful Trader Using Smart Money Concept: The Complete Guide to Forex Trading, Stock Trading, and Crypto Currency Trading for BeginnersNo ratings yet

- Trading Triads: Unlocking the Secrets of Market Structure and Trading in Any MarketFrom EverandTrading Triads: Unlocking the Secrets of Market Structure and Trading in Any MarketNo ratings yet