Professional Documents

Culture Documents

Chap 36 - Land and Building Fin Acct 1 - Barter Summary Team PDF

Chap 36 - Land and Building Fin Acct 1 - Barter Summary Team PDF

Uploaded by

Junneth Pearl HomocCopyright:

Available Formats

You might also like

- Construction Method for Pump Station - معدلDocument36 pagesConstruction Method for Pump Station - معدلM.ZEKEBA100% (1)

- To Transact Business With Other Partnership of The Same NatureDocument12 pagesTo Transact Business With Other Partnership of The Same NatureJarren BasilanNo ratings yet

- Financial Accounting III Midterm ExaminationDocument9 pagesFinancial Accounting III Midterm ExaminationKriz-leen TiuNo ratings yet

- LECTURE NOTES-Translation of Foreign FSDocument4 pagesLECTURE NOTES-Translation of Foreign FSGenesis CervantesNo ratings yet

- Exercise - Part 3Document10 pagesExercise - Part 3lois martinNo ratings yet

- Review Questions For Chapter 6 (Statement ofDocument19 pagesReview Questions For Chapter 6 (Statement ofNick Corrosivesnare40% (5)

- ? IA3 SIM Answers Week 12-13 ULO123 Hyperinflation & Current Cost AccountingDocument6 pages? IA3 SIM Answers Week 12-13 ULO123 Hyperinflation & Current Cost AccountingJeric TorionNo ratings yet

- De Leon Solman 2014 2 CostDocument95 pagesDe Leon Solman 2014 2 CostJohn Laurence LoplopNo ratings yet

- Ae 221 PrelimsDocument5 pagesAe 221 PrelimsFernando III PerezNo ratings yet

- 07audit of PPEDocument9 pages07audit of PPEJeanette FormenteraNo ratings yet

- Module 1 ExamDocument4 pagesModule 1 ExamTabatha Cyphers100% (2)

- PRESENTATION OF FS Problems Answer KeyDocument20 pagesPRESENTATION OF FS Problems Answer KeyJazie CadelinaNo ratings yet

- Audit of PPE Comprehensive QuizzerDocument9 pagesAudit of PPE Comprehensive QuizzerAlice WuNo ratings yet

- Tagum College: Self-Instructional Manual (SIM) For Self-Directed Learning (SDL)Document23 pagesTagum College: Self-Instructional Manual (SIM) For Self-Directed Learning (SDL)Pia SurilNo ratings yet

- Homework On Statement of Cash FlowsDocument2 pagesHomework On Statement of Cash FlowsAmy SpencerNo ratings yet

- Pre Week MaterialsDocument44 pagesPre Week MaterialsMarjorie PalmaNo ratings yet

- HB Quiz 2018-2021Document3 pagesHB Quiz 2018-2021Allyssa Kassandra LucesNo ratings yet

- International Acc QuizletDocument4 pagesInternational Acc Quizlet수지No ratings yet

- Lesson 5: Taxation of CorporationsDocument14 pagesLesson 5: Taxation of CorporationsGio yowyowNo ratings yet

- Key Quiz 3 1st 2022 20223Document4 pagesKey Quiz 3 1st 2022 20223Leslie Mae Vargas ZafeNo ratings yet

- MAS First Prebrd SOL FEBRUARY 2024 95th Batch SOLUTIONSDocument4 pagesMAS First Prebrd SOL FEBRUARY 2024 95th Batch SOLUTIONSMikee LabadaNo ratings yet

- Apply Your Knowledge: Case Study 1Document3 pagesApply Your Knowledge: Case Study 1Queen ValleNo ratings yet

- Classification of Land by Real Estate Developer: Philippine Interpretations Committee (Pic) Questions and Answers (Q&A)Document6 pagesClassification of Land by Real Estate Developer: Philippine Interpretations Committee (Pic) Questions and Answers (Q&A)Jobert RamirezNo ratings yet

- Chapter 21 and 22 (Complete)Document6 pagesChapter 21 and 22 (Complete)Leah ValdezNo ratings yet

- AC78 Chapter 3 Investment in Debt Securities Other Non Current Financial AssetsDocument78 pagesAC78 Chapter 3 Investment in Debt Securities Other Non Current Financial AssetsmerryNo ratings yet

- 1398236Document3 pages1398236mohitgaba19No ratings yet

- Group 5 Problem 7 2Document6 pagesGroup 5 Problem 7 2Shieryl BagaanNo ratings yet

- Topic 1 Corporate Liquidation - ModuleDocument11 pagesTopic 1 Corporate Liquidation - ModuleJenny LelisNo ratings yet

- Revenue Recognition: Long Term ConstructionDocument3 pagesRevenue Recognition: Long Term ConstructionLee SuarezNo ratings yet

- Quiz No. 1 Risks Returns and Capital StructureDocument5 pagesQuiz No. 1 Risks Returns and Capital StructureFaith CastroNo ratings yet

- 221 ExamsDocument10 pages221 ExamsElla Mae AgoniaNo ratings yet

- AbuegDocument10 pagesAbuegswit_kamoteNo ratings yet

- Last QuizDocument5 pagesLast QuizMariah MacasNo ratings yet

- Intacc Chapter 49-50Document17 pagesIntacc Chapter 49-50Cheesca Macabanti - 12 Euclid-Digital ModularNo ratings yet

- 2018-1383. Samsona, Melanie - Prob 3Document2 pages2018-1383. Samsona, Melanie - Prob 3Melanie SamsonaNo ratings yet

- Finals Part 1 Answers May 2019Document5 pagesFinals Part 1 Answers May 2019edwin_dauzNo ratings yet

- DERIVATIVES HEDGE ILLUSTRATIONS Edited AMBOYDocument21 pagesDERIVATIVES HEDGE ILLUSTRATIONS Edited AMBOYsunthatburns00No ratings yet

- Financial Management For Decision Making: Marian G. Magcalas Ishmael Y. ReyesDocument38 pagesFinancial Management For Decision Making: Marian G. Magcalas Ishmael Y. ReyesJordan Mathew Alcaide MalapayaNo ratings yet

- LeasesDocument9 pagesLeasesCris Joy BiabasNo ratings yet

- 03 Cost-Volume-Profit AnalysisDocument6 pages03 Cost-Volume-Profit Analysisrandomlungs121223No ratings yet

- Shareholder'S Equity Multiple Choice QuestionsDocument7 pagesShareholder'S Equity Multiple Choice QuestionsRachel Rivera50% (2)

- Act Day 1-3Document45 pagesAct Day 1-3Joyce Anne GarduqueNo ratings yet

- Acc213 Reviewer Final QuizDocument9 pagesAcc213 Reviewer Final QuizNelson BernoloNo ratings yet

- Test Bank Accounting 25th Editon Warren Chapter 22 BudgetingDocument94 pagesTest Bank Accounting 25th Editon Warren Chapter 22 BudgetingAngely May Jordan100% (1)

- Notes and Loans ReceivableDocument10 pagesNotes and Loans ReceivableKent TumulakNo ratings yet

- Quiz ReorganizationDocument7 pagesQuiz ReorganizationJam SurdivillaNo ratings yet

- QUIZ - RemovalDocument2 pagesQUIZ - RemovalRazel TercinoNo ratings yet

- Comprehensive Illustration of Consolidated Financial Statements - Intercompany Sale of Inventories PDFDocument9 pagesComprehensive Illustration of Consolidated Financial Statements - Intercompany Sale of Inventories PDFamie honnagNo ratings yet

- Chapter 17 - Financial Asset at Amortized CostDocument2 pagesChapter 17 - Financial Asset at Amortized Costlooter198100% (1)

- Joint Arrangements Answer Key Chapter 10 Problems 4 To 7Document3 pagesJoint Arrangements Answer Key Chapter 10 Problems 4 To 7Jeane Mae BooNo ratings yet

- Notes - AFAR - Consolidated Financial Statements (PFRS 10)Document5 pagesNotes - AFAR - Consolidated Financial Statements (PFRS 10)Charles MateoNo ratings yet

- Problems 3 PRELIM TASK FINALDocument4 pagesProblems 3 PRELIM TASK FINALJohn Francis RosasNo ratings yet

- Cash Price Equivalent at The Deferred Beyond Normal CreditDocument5 pagesCash Price Equivalent at The Deferred Beyond Normal CreditSharmin ReulaNo ratings yet

- Cel 1 Prac 1 Answer KeyDocument15 pagesCel 1 Prac 1 Answer KeyNJ MondigoNo ratings yet

- AUD 1.4 Audit Objectives, Procedures, Evidence and Documentation - 2022Document11 pagesAUD 1.4 Audit Objectives, Procedures, Evidence and Documentation - 2022Aimee CuteNo ratings yet

- MAS - Group 5Document7 pagesMAS - Group 5beleky watersNo ratings yet

- Chapter 11Document7 pagesChapter 11Xynith Nicole RamosNo ratings yet

- Intermediate AccountingDocument12 pagesIntermediate AccountingpolxrixNo ratings yet

- Intermediate Accounting 2Document12 pagesIntermediate Accounting 2polxrixNo ratings yet

- Intermediate Accounting 2Document5 pagesIntermediate Accounting 2Kristine Lara100% (3)

- Chapter 15Document10 pagesChapter 15Jess SiazonNo ratings yet

- Cost of QualityDocument1 pageCost of QualityJunneth Pearl HomocNo ratings yet

- CasDocument29 pagesCasJunneth Pearl Homoc0% (1)

- ReportDocument25 pagesReportJunneth Pearl HomocNo ratings yet

- NyayDocument3 pagesNyayJunneth Pearl HomocNo ratings yet

- 12.1 Specification PDFDocument32 pages12.1 Specification PDFNaresh JirelNo ratings yet

- R 1354 001 01 (Datasheet)Document35 pagesR 1354 001 01 (Datasheet)Benasher IbrahimNo ratings yet

- TD Module #1 QuestionairesDocument24 pagesTD Module #1 QuestionairesKiko EmilaNo ratings yet

- Activity 5: Trends in Industry Alcasar Fine WoodsDocument7 pagesActivity 5: Trends in Industry Alcasar Fine WoodsJhonrey BragaisNo ratings yet

- Genie Charging DC Unit BatteriesDocument6 pagesGenie Charging DC Unit BatteriesRoberto ChinchillaNo ratings yet

- BEJ Expansion JointsDocument10 pagesBEJ Expansion JointsVishnu BalakrishnanNo ratings yet

- SOP 05 - Work at Height & Fall PreventionDocument7 pagesSOP 05 - Work at Height & Fall Preventionrasulya100% (2)

- Real Estate Development Process and PrinciplesDocument6 pagesReal Estate Development Process and PrinciplesAbicha AlemayehuNo ratings yet

- Roofing and Waterproofing Product Catalog 2015 16 2014 - 11 - 04Document44 pagesRoofing and Waterproofing Product Catalog 2015 16 2014 - 11 - 04Liondo PurbaNo ratings yet

- KSRM College of Engineering-Kadapa: Construction, Planning and ManagementDocument85 pagesKSRM College of Engineering-Kadapa: Construction, Planning and ManagementKumarNo ratings yet

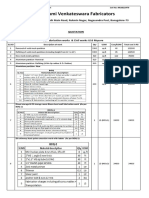

- Sri Lakshmi Venkateswara Fabricators: #49, Belmar Estate, Mattaih Main Road, Rukmin Nagar, Nagasandra Post, Banagalore-73Document3 pagesSri Lakshmi Venkateswara Fabricators: #49, Belmar Estate, Mattaih Main Road, Rukmin Nagar, Nagasandra Post, Banagalore-73Sai JaganNo ratings yet

- 1 ProfileDocument6 pages1 ProfileMohd ShoibNo ratings yet

- Mhse23040029b ObdDocument2 pagesMhse23040029b ObdhennrycaspersNo ratings yet

- Molding RCC in Rectangular Molds Using A Vibratiing Hammer, DRAFT, 10.6.14Document7 pagesMolding RCC in Rectangular Molds Using A Vibratiing Hammer, DRAFT, 10.6.14juanNo ratings yet

- Arch 530 - BT4 Technical SpecificationsDocument13 pagesArch 530 - BT4 Technical SpecificationsAlyanna PanganibanNo ratings yet

- Material Request / Order Sheet For Construction: Sumitomo Mitsui Construction Co., LTDDocument2 pagesMaterial Request / Order Sheet For Construction: Sumitomo Mitsui Construction Co., LTDRamsNo ratings yet

- Pow 17J00056Document3 pagesPow 17J00056GigiNo ratings yet

- SECTION 1: Form of Tender Part A: Non-Price Criteria: Tenderer Name 4.1 Proposed Solution (Method and Approach)Document4 pagesSECTION 1: Form of Tender Part A: Non-Price Criteria: Tenderer Name 4.1 Proposed Solution (Method and Approach)Jessica LacaronNo ratings yet

- List of Document To Be Furnished Along With Building Permission Appication Ownership Aspects (Mandatory) S. No. Document NameDocument3 pagesList of Document To Be Furnished Along With Building Permission Appication Ownership Aspects (Mandatory) S. No. Document NameYashNo ratings yet

- On-Site Building Construction Management Level IV: MODULE TITLE: Managing Subordinates andDocument58 pagesOn-Site Building Construction Management Level IV: MODULE TITLE: Managing Subordinates andKinfe Dufera GonfaNo ratings yet

- Part4 Installation of Distribution PillarsDocument9 pagesPart4 Installation of Distribution PillarsashrafNo ratings yet

- TM 17 Bellingham Delivery MethodDocument39 pagesTM 17 Bellingham Delivery MethodchrispeterNo ratings yet

- OT - Structural-Sealant-Glazed Curtain WallsDocument1 pageOT - Structural-Sealant-Glazed Curtain WallssupadiNo ratings yet

- 2018 LCCE BrochureDocument60 pages2018 LCCE BrochureNyadroh Clement MchammondsNo ratings yet

- AHMED SHAWKY IBRAHIM ResumeDocument3 pagesAHMED SHAWKY IBRAHIM ResumeAhmed IbrahimNo ratings yet

- CORINTHIAN GARDENS ASSOCIATION, INC., Petitioner, vs. SPOUSES REYNALDO and MARIA LUISA TANJANGCO, and SPOUSES FRANK and TERESITA CUASO, Respondent.Document1 pageCORINTHIAN GARDENS ASSOCIATION, INC., Petitioner, vs. SPOUSES REYNALDO and MARIA LUISA TANJANGCO, and SPOUSES FRANK and TERESITA CUASO, Respondent.Charles Roger RayaNo ratings yet

- Application Form C4-E (N) v1Document19 pagesApplication Form C4-E (N) v1Hasnain KhanNo ratings yet

- Tugas 2 BIB Planning (Kel Affi Elvina Tasya Yusril)Document4 pagesTugas 2 BIB Planning (Kel Affi Elvina Tasya Yusril)AldinoSangJuaraNo ratings yet

- Closeout ReportDocument3 pagesCloseout Reportkashan1975No ratings yet

Chap 36 - Land and Building Fin Acct 1 - Barter Summary Team PDF

Chap 36 - Land and Building Fin Acct 1 - Barter Summary Team PDF

Uploaded by

Junneth Pearl HomocOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chap 36 - Land and Building Fin Acct 1 - Barter Summary Team PDF

Chap 36 - Land and Building Fin Acct 1 - Barter Summary Team PDF

Uploaded by

Junneth Pearl HomocCopyright:

Available Formats

LAND AND BUILD ING

*STATEMENT CLASSIFICATIO N

LAND : a. used as plant site. - property, plant, and equipment

b. held for currently undetermined use - investment property

c. held for long-term capital appreciation - investment property

d. held for current sale by a real estate developer - current asset part

of inventory

Costs chargable to land

a. Purchase price

b. Legal fees and other expenditures for establisi g clean title

c. Broker or agent commission

d. Escrow fees

e. Fees for registration and trasfer of title

f. Cost of relocation or reconstruction of property belonging to others in order

to acquire possession.

g. Mortgages , encumbrances and interest om such mortgages assumed by

buyer

h. Unpaid taxes up to date of acquisition assumed by buyer

i. Cost of survey

j. Payments to tenants to induce them to vacate the land in order to prepare

the land for the intended use but not to make room for the construction of

new building

k. Cost of permanent improvements

Cost of option to buy the acquired land

LAND IMPRO VEMENTS

Non-depreciable land improvemens - charge to land account

D epreciable (useful life) - land improvement account

SPECIAL ASSESSMENTS

Taxes paid by landowner as a contribution to the cost of public

improvement

Part of the cost of land

REAL PRO PERTY TAXES

O utright expense

Unpaid taxes assumed by tge buyer - taxes are capitalized but up to

date of acquisition only.

BUILD ING ACCO UNT

Cost (by purchase):

a. Purchase price

b. Legal fees and other expenses incurred in connection with the purchase

c. Unpaid taxes up to date of acquisition

d. Interest , mortgage liens and other encumbrances assumed by the buyer

e. Payments to tenance to.induce them to vacate the building

f. Any renovating and remodeling for tge intended use of the building

CO ST ( by means of construction):

a. Material used , labor employed and overhead incurred during the

construction

b. Building permit

c. Architect fee

d. Superintendent fee

e. Cost of excavation

f. Cost of temporary building

g. Expenditures incurred such as interest on construction loans and

insurance

h. Expenditures for service equipment and fixtyres made a permanent part

of the structure

i. Cost of temporary safety fence

j. Safety inspection fee

SID EW ALKS , PAVEMENTS, PARKING LO T , D RIVEW AYS

a. Expenditures part of blueprint of new building- building account

b. Expenditures not connected with the construction - land improvements

CLAIMS FO R D AMAGES

Cost of insurance - building account

Insurance not taken - outright expense

BUILD ING FIXTURES

Movable fixtures (shelves and cabinets) - building account or furniture

and fixtures (depreciated)

Immovable - building account

VENTILATIO N SYSTEM , LIGHTING SYSTEM , ELEVATO R

a. Installed during construction -building account

b. O therwise - Building improvement and depreciated over the usefuo.life

or remaining life of the building, whichever is shorter.

PIC Interpretation on land and building

1. Land and building at a single cost

Usable O ld building - land and building based on relative fair value

Unusable old building - land

2. O ld building demolished for the new building

New building (PPE or Investment property )- carrying amount of usable

old builidng is recognized as a loss.

New building ( inventory) - carrying amount of the usable old building is

capitalized as cost

New building( whether the PPE, IP or Inv) - demolition cost minus

salvage value is capitalized as cost of the new building

O ld builidng demolished to prepare the land for intended use and not

for a new building - net demolition cost is capitalized as cost of the

land.

3. Building acquired is demolished to make room for new building :

Carrying amouny of old building is recognized as a loss

Net demolition cost is capatized as a cost of the new building

O ld buildinh subject to contract lease - any payments to tenance shall

be charge to the cost of the new building

SAMPLE PRO BLEMS:(valix)

1. Airborne Company acquired land and building for P5,500,000 cash at the

beginning of the current year. The land was fairly valued at P2,400,000 and

the building at P3,600,000. The entity incurred the following cost:

Property taxes in arrears 250,000

Building renovation 500,000

Escrow fee 100,000

Real estate commission 200,000

A. W hat is the cost of the land?

Allocated cost to land ( 2,400,000 / *6,000,000 x 5,500,000)

2,200,000

Allocated cost (2,400,000/ 6,000,000 x *550,000) 220,000

2,420,000

*Fair vaue of land and building : 2,400,000 + 3,600,000 = 6,000,000

*Incurred costs: Property taxes 250,000

Escrow fee 100,000

Real estate commission 200,000

550,000

B. W hat is the cost

Allocated cost to building ( 3,600,000/ 6,000,000 x 5,500,000) 3,300,000

Allocatedcost( 3,600,000/6,000,000 x 550,000) 330,000

Renovation 500,000

4,130,000

2. D uring the current year, D auntless Company had the followinh transactions

pertaining to the new office building :

Purchase price of land 600,000

Legal fees for contract purchase land 20,000

Architect fee 80,000

D emolition old building on site 50,000

Sale of scrap from old building and proceeds retained 30,000

by building contractor

Construction cost of new building 3,500,000

A. Cost of land applying PIC Interpretation

Purchase price 600,000

Legal fees 20,000

620,000

B. Cost of building applying PIC interpretation

Architect fee 80,000

D emolition cost 50,000

Construction cost 3,500,000

3,630,000

You might also like

- Construction Method for Pump Station - معدلDocument36 pagesConstruction Method for Pump Station - معدلM.ZEKEBA100% (1)

- To Transact Business With Other Partnership of The Same NatureDocument12 pagesTo Transact Business With Other Partnership of The Same NatureJarren BasilanNo ratings yet

- Financial Accounting III Midterm ExaminationDocument9 pagesFinancial Accounting III Midterm ExaminationKriz-leen TiuNo ratings yet

- LECTURE NOTES-Translation of Foreign FSDocument4 pagesLECTURE NOTES-Translation of Foreign FSGenesis CervantesNo ratings yet

- Exercise - Part 3Document10 pagesExercise - Part 3lois martinNo ratings yet

- Review Questions For Chapter 6 (Statement ofDocument19 pagesReview Questions For Chapter 6 (Statement ofNick Corrosivesnare40% (5)

- ? IA3 SIM Answers Week 12-13 ULO123 Hyperinflation & Current Cost AccountingDocument6 pages? IA3 SIM Answers Week 12-13 ULO123 Hyperinflation & Current Cost AccountingJeric TorionNo ratings yet

- De Leon Solman 2014 2 CostDocument95 pagesDe Leon Solman 2014 2 CostJohn Laurence LoplopNo ratings yet

- Ae 221 PrelimsDocument5 pagesAe 221 PrelimsFernando III PerezNo ratings yet

- 07audit of PPEDocument9 pages07audit of PPEJeanette FormenteraNo ratings yet

- Module 1 ExamDocument4 pagesModule 1 ExamTabatha Cyphers100% (2)

- PRESENTATION OF FS Problems Answer KeyDocument20 pagesPRESENTATION OF FS Problems Answer KeyJazie CadelinaNo ratings yet

- Audit of PPE Comprehensive QuizzerDocument9 pagesAudit of PPE Comprehensive QuizzerAlice WuNo ratings yet

- Tagum College: Self-Instructional Manual (SIM) For Self-Directed Learning (SDL)Document23 pagesTagum College: Self-Instructional Manual (SIM) For Self-Directed Learning (SDL)Pia SurilNo ratings yet

- Homework On Statement of Cash FlowsDocument2 pagesHomework On Statement of Cash FlowsAmy SpencerNo ratings yet

- Pre Week MaterialsDocument44 pagesPre Week MaterialsMarjorie PalmaNo ratings yet

- HB Quiz 2018-2021Document3 pagesHB Quiz 2018-2021Allyssa Kassandra LucesNo ratings yet

- International Acc QuizletDocument4 pagesInternational Acc Quizlet수지No ratings yet

- Lesson 5: Taxation of CorporationsDocument14 pagesLesson 5: Taxation of CorporationsGio yowyowNo ratings yet

- Key Quiz 3 1st 2022 20223Document4 pagesKey Quiz 3 1st 2022 20223Leslie Mae Vargas ZafeNo ratings yet

- MAS First Prebrd SOL FEBRUARY 2024 95th Batch SOLUTIONSDocument4 pagesMAS First Prebrd SOL FEBRUARY 2024 95th Batch SOLUTIONSMikee LabadaNo ratings yet

- Apply Your Knowledge: Case Study 1Document3 pagesApply Your Knowledge: Case Study 1Queen ValleNo ratings yet

- Classification of Land by Real Estate Developer: Philippine Interpretations Committee (Pic) Questions and Answers (Q&A)Document6 pagesClassification of Land by Real Estate Developer: Philippine Interpretations Committee (Pic) Questions and Answers (Q&A)Jobert RamirezNo ratings yet

- Chapter 21 and 22 (Complete)Document6 pagesChapter 21 and 22 (Complete)Leah ValdezNo ratings yet

- AC78 Chapter 3 Investment in Debt Securities Other Non Current Financial AssetsDocument78 pagesAC78 Chapter 3 Investment in Debt Securities Other Non Current Financial AssetsmerryNo ratings yet

- 1398236Document3 pages1398236mohitgaba19No ratings yet

- Group 5 Problem 7 2Document6 pagesGroup 5 Problem 7 2Shieryl BagaanNo ratings yet

- Topic 1 Corporate Liquidation - ModuleDocument11 pagesTopic 1 Corporate Liquidation - ModuleJenny LelisNo ratings yet

- Revenue Recognition: Long Term ConstructionDocument3 pagesRevenue Recognition: Long Term ConstructionLee SuarezNo ratings yet

- Quiz No. 1 Risks Returns and Capital StructureDocument5 pagesQuiz No. 1 Risks Returns and Capital StructureFaith CastroNo ratings yet

- 221 ExamsDocument10 pages221 ExamsElla Mae AgoniaNo ratings yet

- AbuegDocument10 pagesAbuegswit_kamoteNo ratings yet

- Last QuizDocument5 pagesLast QuizMariah MacasNo ratings yet

- Intacc Chapter 49-50Document17 pagesIntacc Chapter 49-50Cheesca Macabanti - 12 Euclid-Digital ModularNo ratings yet

- 2018-1383. Samsona, Melanie - Prob 3Document2 pages2018-1383. Samsona, Melanie - Prob 3Melanie SamsonaNo ratings yet

- Finals Part 1 Answers May 2019Document5 pagesFinals Part 1 Answers May 2019edwin_dauzNo ratings yet

- DERIVATIVES HEDGE ILLUSTRATIONS Edited AMBOYDocument21 pagesDERIVATIVES HEDGE ILLUSTRATIONS Edited AMBOYsunthatburns00No ratings yet

- Financial Management For Decision Making: Marian G. Magcalas Ishmael Y. ReyesDocument38 pagesFinancial Management For Decision Making: Marian G. Magcalas Ishmael Y. ReyesJordan Mathew Alcaide MalapayaNo ratings yet

- LeasesDocument9 pagesLeasesCris Joy BiabasNo ratings yet

- 03 Cost-Volume-Profit AnalysisDocument6 pages03 Cost-Volume-Profit Analysisrandomlungs121223No ratings yet

- Shareholder'S Equity Multiple Choice QuestionsDocument7 pagesShareholder'S Equity Multiple Choice QuestionsRachel Rivera50% (2)

- Act Day 1-3Document45 pagesAct Day 1-3Joyce Anne GarduqueNo ratings yet

- Acc213 Reviewer Final QuizDocument9 pagesAcc213 Reviewer Final QuizNelson BernoloNo ratings yet

- Test Bank Accounting 25th Editon Warren Chapter 22 BudgetingDocument94 pagesTest Bank Accounting 25th Editon Warren Chapter 22 BudgetingAngely May Jordan100% (1)

- Notes and Loans ReceivableDocument10 pagesNotes and Loans ReceivableKent TumulakNo ratings yet

- Quiz ReorganizationDocument7 pagesQuiz ReorganizationJam SurdivillaNo ratings yet

- QUIZ - RemovalDocument2 pagesQUIZ - RemovalRazel TercinoNo ratings yet

- Comprehensive Illustration of Consolidated Financial Statements - Intercompany Sale of Inventories PDFDocument9 pagesComprehensive Illustration of Consolidated Financial Statements - Intercompany Sale of Inventories PDFamie honnagNo ratings yet

- Chapter 17 - Financial Asset at Amortized CostDocument2 pagesChapter 17 - Financial Asset at Amortized Costlooter198100% (1)

- Joint Arrangements Answer Key Chapter 10 Problems 4 To 7Document3 pagesJoint Arrangements Answer Key Chapter 10 Problems 4 To 7Jeane Mae BooNo ratings yet

- Notes - AFAR - Consolidated Financial Statements (PFRS 10)Document5 pagesNotes - AFAR - Consolidated Financial Statements (PFRS 10)Charles MateoNo ratings yet

- Problems 3 PRELIM TASK FINALDocument4 pagesProblems 3 PRELIM TASK FINALJohn Francis RosasNo ratings yet

- Cash Price Equivalent at The Deferred Beyond Normal CreditDocument5 pagesCash Price Equivalent at The Deferred Beyond Normal CreditSharmin ReulaNo ratings yet

- Cel 1 Prac 1 Answer KeyDocument15 pagesCel 1 Prac 1 Answer KeyNJ MondigoNo ratings yet

- AUD 1.4 Audit Objectives, Procedures, Evidence and Documentation - 2022Document11 pagesAUD 1.4 Audit Objectives, Procedures, Evidence and Documentation - 2022Aimee CuteNo ratings yet

- MAS - Group 5Document7 pagesMAS - Group 5beleky watersNo ratings yet

- Chapter 11Document7 pagesChapter 11Xynith Nicole RamosNo ratings yet

- Intermediate AccountingDocument12 pagesIntermediate AccountingpolxrixNo ratings yet

- Intermediate Accounting 2Document12 pagesIntermediate Accounting 2polxrixNo ratings yet

- Intermediate Accounting 2Document5 pagesIntermediate Accounting 2Kristine Lara100% (3)

- Chapter 15Document10 pagesChapter 15Jess SiazonNo ratings yet

- Cost of QualityDocument1 pageCost of QualityJunneth Pearl HomocNo ratings yet

- CasDocument29 pagesCasJunneth Pearl Homoc0% (1)

- ReportDocument25 pagesReportJunneth Pearl HomocNo ratings yet

- NyayDocument3 pagesNyayJunneth Pearl HomocNo ratings yet

- 12.1 Specification PDFDocument32 pages12.1 Specification PDFNaresh JirelNo ratings yet

- R 1354 001 01 (Datasheet)Document35 pagesR 1354 001 01 (Datasheet)Benasher IbrahimNo ratings yet

- TD Module #1 QuestionairesDocument24 pagesTD Module #1 QuestionairesKiko EmilaNo ratings yet

- Activity 5: Trends in Industry Alcasar Fine WoodsDocument7 pagesActivity 5: Trends in Industry Alcasar Fine WoodsJhonrey BragaisNo ratings yet

- Genie Charging DC Unit BatteriesDocument6 pagesGenie Charging DC Unit BatteriesRoberto ChinchillaNo ratings yet

- BEJ Expansion JointsDocument10 pagesBEJ Expansion JointsVishnu BalakrishnanNo ratings yet

- SOP 05 - Work at Height & Fall PreventionDocument7 pagesSOP 05 - Work at Height & Fall Preventionrasulya100% (2)

- Real Estate Development Process and PrinciplesDocument6 pagesReal Estate Development Process and PrinciplesAbicha AlemayehuNo ratings yet

- Roofing and Waterproofing Product Catalog 2015 16 2014 - 11 - 04Document44 pagesRoofing and Waterproofing Product Catalog 2015 16 2014 - 11 - 04Liondo PurbaNo ratings yet

- KSRM College of Engineering-Kadapa: Construction, Planning and ManagementDocument85 pagesKSRM College of Engineering-Kadapa: Construction, Planning and ManagementKumarNo ratings yet

- Sri Lakshmi Venkateswara Fabricators: #49, Belmar Estate, Mattaih Main Road, Rukmin Nagar, Nagasandra Post, Banagalore-73Document3 pagesSri Lakshmi Venkateswara Fabricators: #49, Belmar Estate, Mattaih Main Road, Rukmin Nagar, Nagasandra Post, Banagalore-73Sai JaganNo ratings yet

- 1 ProfileDocument6 pages1 ProfileMohd ShoibNo ratings yet

- Mhse23040029b ObdDocument2 pagesMhse23040029b ObdhennrycaspersNo ratings yet

- Molding RCC in Rectangular Molds Using A Vibratiing Hammer, DRAFT, 10.6.14Document7 pagesMolding RCC in Rectangular Molds Using A Vibratiing Hammer, DRAFT, 10.6.14juanNo ratings yet

- Arch 530 - BT4 Technical SpecificationsDocument13 pagesArch 530 - BT4 Technical SpecificationsAlyanna PanganibanNo ratings yet

- Material Request / Order Sheet For Construction: Sumitomo Mitsui Construction Co., LTDDocument2 pagesMaterial Request / Order Sheet For Construction: Sumitomo Mitsui Construction Co., LTDRamsNo ratings yet

- Pow 17J00056Document3 pagesPow 17J00056GigiNo ratings yet

- SECTION 1: Form of Tender Part A: Non-Price Criteria: Tenderer Name 4.1 Proposed Solution (Method and Approach)Document4 pagesSECTION 1: Form of Tender Part A: Non-Price Criteria: Tenderer Name 4.1 Proposed Solution (Method and Approach)Jessica LacaronNo ratings yet

- List of Document To Be Furnished Along With Building Permission Appication Ownership Aspects (Mandatory) S. No. Document NameDocument3 pagesList of Document To Be Furnished Along With Building Permission Appication Ownership Aspects (Mandatory) S. No. Document NameYashNo ratings yet

- On-Site Building Construction Management Level IV: MODULE TITLE: Managing Subordinates andDocument58 pagesOn-Site Building Construction Management Level IV: MODULE TITLE: Managing Subordinates andKinfe Dufera GonfaNo ratings yet

- Part4 Installation of Distribution PillarsDocument9 pagesPart4 Installation of Distribution PillarsashrafNo ratings yet

- TM 17 Bellingham Delivery MethodDocument39 pagesTM 17 Bellingham Delivery MethodchrispeterNo ratings yet

- OT - Structural-Sealant-Glazed Curtain WallsDocument1 pageOT - Structural-Sealant-Glazed Curtain WallssupadiNo ratings yet

- 2018 LCCE BrochureDocument60 pages2018 LCCE BrochureNyadroh Clement MchammondsNo ratings yet

- AHMED SHAWKY IBRAHIM ResumeDocument3 pagesAHMED SHAWKY IBRAHIM ResumeAhmed IbrahimNo ratings yet

- CORINTHIAN GARDENS ASSOCIATION, INC., Petitioner, vs. SPOUSES REYNALDO and MARIA LUISA TANJANGCO, and SPOUSES FRANK and TERESITA CUASO, Respondent.Document1 pageCORINTHIAN GARDENS ASSOCIATION, INC., Petitioner, vs. SPOUSES REYNALDO and MARIA LUISA TANJANGCO, and SPOUSES FRANK and TERESITA CUASO, Respondent.Charles Roger RayaNo ratings yet

- Application Form C4-E (N) v1Document19 pagesApplication Form C4-E (N) v1Hasnain KhanNo ratings yet

- Tugas 2 BIB Planning (Kel Affi Elvina Tasya Yusril)Document4 pagesTugas 2 BIB Planning (Kel Affi Elvina Tasya Yusril)AldinoSangJuaraNo ratings yet

- Closeout ReportDocument3 pagesCloseout Reportkashan1975No ratings yet