Professional Documents

Culture Documents

Task 1: CSM30004: Integrated Construction Engineering and Management

Task 1: CSM30004: Integrated Construction Engineering and Management

Uploaded by

AS V KameshOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Task 1: CSM30004: Integrated Construction Engineering and Management

Task 1: CSM30004: Integrated Construction Engineering and Management

Uploaded by

AS V KameshCopyright:

Available Formats

CSM30004: Integrated Construction Engineering and Management

Week 9 Activity

Task 1

Assume you can lease an item you need for a project for $800/day; to purchase the item; the

cost is $12,000 plus a daily operational cost of $400/day. How long will it take for the purchase

cost to be the same as the lease cost?

Task 2

A four months project (February to May) looks at the incurred costs and incomes from the

contractor’s position.

Client The client pays four monthly payments of $5,000 one month

after invoice

Labour The contractor employs labour at $2,000 per month paid in

month of work

Materials The contractor procures materials at $500 per month; the

supplier gives one month credit

Equipment The contractor hire equipment at $1,500 per month; payment

is required one month in advance

Make a cash flow statement.

Task 3

Calculate the labour cost from the following table:

Employee’s salary $6000

Employee’s associated labour costs See below

Employee’s contribution to overheads 25% of salary=$1,500

Employee’s contribution to company profit 25% of salary=$1,500

CSM30004: Integrated Construction Engineering and Management

Week 9 Activity

Cost per month Days lost per month

1 Medical insurance $200

2 Sickness benefits 1

3 Annual holiday 2

4 Training course $50 1

5 Protective clothing $50

6 Car allowance $400

7 Housing allowance $100

8 Subsistence allowance $100

9 pension $200

10 Tool allowance $100

11 Standing time 1

12 Inclement weather 1

total $1200 6

Task 4

Calculate the cost rate per hour to the employer for an employee working either 5 days x 8

hours = 40-hour week or 6 days x 10 hours = 60-hour week.

Note:

• Corporate overheads and profit margins have not been included in this example.

• Award rate of $800 per 40-hour week.

• Assume the award provides 4 weeks annual leave, 2 weeks annual public holidays, 2

weeks sick leave annually, plus a 17.5% loading on the award rate during annual leave.

• Assume site allowance $9 per hour on base 40-hour week only.

• Statutory loadings (superannuation, long service leave, payroll tax, worker’s

compensation insurance, etc.) = assume 25% of total paid to employee.

• Ignore any severance pay in this example.

• Allow for weekday overtime at 1.5 x base rate for the first two hours per day, 2 x base

rate for any hours above that.

• Allow for weekend overtime at 2 x base rate for all hours on Saturday and/or Sunday.

• Assume all public holidays will be non-working days.

You might also like

- College Accounting A Contemporary Approach 3rd Edition Haddock Solutions ManualDocument36 pagesCollege Accounting A Contemporary Approach 3rd Edition Haddock Solutions Manualsynomocyeducable6pyb8k100% (28)

- 80D Tax CertificateDocument2 pages80D Tax CertificateShop On the spotNo ratings yet

- Chapter 4: Income Tax Schemes, Accounting Periods and Accounting MethodsDocument44 pagesChapter 4: Income Tax Schemes, Accounting Periods and Accounting MethodsElla Marie Lopez85% (13)

- Test 1 - Ma1 Practice in ClassDocument8 pagesTest 1 - Ma1 Practice in ClassNgaka MokakeNo ratings yet

- Homework Chapter 4Document17 pagesHomework Chapter 4Trung Kiên Nguyễn100% (1)

- Final Exam - Ba 213Document6 pagesFinal Exam - Ba 213api-408647155100% (1)

- Design Capacity Tables Examples PDFDocument8 pagesDesign Capacity Tables Examples PDFAS V KameshNo ratings yet

- Project Description PDFDocument10 pagesProject Description PDFAS V Kamesh100% (1)

- CVE40002 - S1 - 2020 - Assignment 1 Part BDocument6 pagesCVE40002 - S1 - 2020 - Assignment 1 Part BAS V KameshNo ratings yet

- ACT301 (Final), Spring-21Document4 pagesACT301 (Final), Spring-21Papon SarkerNo ratings yet

- Transperfect LimitedDocument12 pagesTransperfect LimitedHàjar AkharrazNo ratings yet

- Grade 10 Mathematics - 2021 - Term 2Document197 pagesGrade 10 Mathematics - 2021 - Term 2Naomi RodriguesNo ratings yet

- Mathematics Grade 10 Weeks 1 - 4Document43 pagesMathematics Grade 10 Weeks 1 - 4Meng WanNo ratings yet

- Chapter 4: Adjusting The Accounts and Preparing The Financial StatementsDocument5 pagesChapter 4: Adjusting The Accounts and Preparing The Financial Statementschi_nguyen_100No ratings yet

- Cost Accounting - LabourDocument7 pagesCost Accounting - LabourSaad Khan YTNo ratings yet

- Staff Mark1Document10 pagesStaff Mark1BarbaraNo ratings yet

- MA1-Pre Exam (R)Document2 pagesMA1-Pre Exam (R)BRos THivNo ratings yet

- Adjusting EntriesDocument4 pagesAdjusting EntriesNoj WerdnaNo ratings yet

- Problem 4-47 Application of Overhead Service IndustryDocument26 pagesProblem 4-47 Application of Overhead Service IndustryIkram100% (1)

- Session 1 ProblemsDocument5 pagesSession 1 ProblemsdonjazonNo ratings yet

- F2 - Chương 4Document3 pagesF2 - Chương 4Thị Thanh Viên CaoNo ratings yet

- CH 3Document10 pagesCH 3Mohammed mostafaNo ratings yet

- Lecture 7 - Chapter 7 - Plant Assets Natural Resources and Intangible AssetsDocument5 pagesLecture 7 - Chapter 7 - Plant Assets Natural Resources and Intangible AssetsImran HussainNo ratings yet

- Individual Assignment 2A - Aisyah Nuralam 29123362Document4 pagesIndividual Assignment 2A - Aisyah Nuralam 29123362Aisyah NuralamNo ratings yet

- Be Advised, The Worksheet and Workbooks Are Not ProtectedDocument5 pagesBe Advised, The Worksheet and Workbooks Are Not ProtectedStan NavratilNo ratings yet

- ACCT 210 - Chapter 2 Extra Problems-1Document29 pagesACCT 210 - Chapter 2 Extra Problems-1Ahmad AlayanNo ratings yet

- 314 Chap 7&8Document9 pages314 Chap 7&8Jonah Marie TaghoyNo ratings yet

- Chapter 7 The Master Budget and Flexible BudgetingDocument14 pagesChapter 7 The Master Budget and Flexible BudgetingJuana LyricsNo ratings yet

- Labour Costing MCQDocument4 pagesLabour Costing MCQSalar CheemaNo ratings yet

- Sohan Business PlanDocument4 pagesSohan Business PlanSanjana PuraiNo ratings yet

- Managerial Accounting (MGM 5500) Student Names: - DateDocument6 pagesManagerial Accounting (MGM 5500) Student Names: - Datemauricio ricardoNo ratings yet

- 2022.debate and Individual ExercisesDocument5 pages2022.debate and Individual ExercisesDuy AAnhNo ratings yet

- Tutorial 1Document3 pagesTutorial 1wan asyiqinNo ratings yet

- Chapter 1 Exercises and ProblemsDocument10 pagesChapter 1 Exercises and ProblemsThuyển ThuyểnNo ratings yet

- Accounting With SolutionsDocument8 pagesAccounting With Solutions26 Athira S Nair CS1No ratings yet

- Agrawal Assignment 2Document8 pagesAgrawal Assignment 2Kritika AgrawalNo ratings yet

- Coffee Shop Business Plan - Financial PL PDFDocument18 pagesCoffee Shop Business Plan - Financial PL PDFSamenNo ratings yet

- Solution:-Inventory Conversion Period $12 / ($60/365) 73.0 DaysDocument6 pagesSolution:-Inventory Conversion Period $12 / ($60/365) 73.0 DaysKyla Ramos DiamsayNo ratings yet

- Assignment 1Document19 pagesAssignment 1Areeba100% (1)

- Bpo NestleDocument4 pagesBpo NestleAngel Nicole Lane SabioNo ratings yet

- Semester "FALL 2021": Taxation Management (Fin623)Document2 pagesSemester "FALL 2021": Taxation Management (Fin623)Ali Raza NoshairNo ratings yet

- Chapter 4Document7 pagesChapter 4Althea mary kate MorenoNo ratings yet

- ReadmeDocument13 pagesReadmenm.jahidNo ratings yet

- College Accounting 14th Edition Price Solutions ManualDocument26 pagesCollege Accounting 14th Edition Price Solutions Manualniblicktartar.nevn3100% (31)

- Cost AccountingDocument7 pagesCost AccountingCarl AngeloNo ratings yet

- 592198Document11 pages592198mohitgaba19No ratings yet

- Cost MidtermDocument15 pagesCost MidtermDeepakNo ratings yet

- FA Assignment 1 Non-GradedDocument11 pagesFA Assignment 1 Non-GradedVishal RajNo ratings yet

- Final Exam - Fall 2007Document9 pagesFinal Exam - Fall 2007jhouvanNo ratings yet

- Chapter (3) Adjusting The Accounts Practice Exercises and SolutionsDocument5 pagesChapter (3) Adjusting The Accounts Practice Exercises and Solutionsclara2300181No ratings yet

- Borrowing CostsDocument18 pagesBorrowing CostsTsegay ArayaNo ratings yet

- Standard Costing & Variance Analysis - Sample Problems With SolutionsDocument8 pagesStandard Costing & Variance Analysis - Sample Problems With SolutionsMarjorie NepomucenoNo ratings yet

- Chapter 3Document32 pagesChapter 3Angela Marie PenarandaNo ratings yet

- BA-2202 Cost Accounting Week 5 Tut 2 - LabourDocument2 pagesBA-2202 Cost Accounting Week 5 Tut 2 - LabourSaya Lawa113No ratings yet

- Wa0025Document5 pagesWa0025Anggari SaputraNo ratings yet

- Estimate Cost of Products and Services in Entrepreneurship 10Document15 pagesEstimate Cost of Products and Services in Entrepreneurship 10Malia Lopez Aligada100% (1)

- Quiz 3 SolutionDocument5 pagesQuiz 3 SolutionMichel BanvoNo ratings yet

- Dela Pena-Act102-K7 Ass4Document12 pagesDela Pena-Act102-K7 Ass4Danielle Nicole Crisostomo BrocoyNo ratings yet

- Labor 2011Document3 pagesLabor 2011Ejaz KhanNo ratings yet

- Accounting Quiz 4Document10 pagesAccounting Quiz 4Uzma KhanNo ratings yet

- Accounting Revision QuestionsDocument46 pagesAccounting Revision QuestionsshailohNo ratings yet

- LiabilityDocument8 pagesLiabilityelainelxy2508No ratings yet

- Cost & Managerial Accounting II EssentialsFrom EverandCost & Managerial Accounting II EssentialsRating: 4 out of 5 stars4/5 (1)

- 4 - MP02Document1 page4 - MP02AS V KameshNo ratings yet

- Sardar Nagar - 03Document1 pageSardar Nagar - 03AS V KameshNo ratings yet

- Task 1. Measure A Bungalow: CSM30004: Integrated Construction Engineering and ManagementDocument3 pagesTask 1. Measure A Bungalow: CSM30004: Integrated Construction Engineering and ManagementAS V KameshNo ratings yet

- 3 - MP01Document1 page3 - MP01AS V KameshNo ratings yet

- 5 - MP03Document1 page5 - MP03AS V KameshNo ratings yet

- Part II: Design of RC BeamsDocument4 pagesPart II: Design of RC BeamsAS V KameshNo ratings yet

- Tutorial 05 Q01. (I) : Clause DescriptionsDocument8 pagesTutorial 05 Q01. (I) : Clause DescriptionsAS V KameshNo ratings yet

- Floor PlanDocument1 pageFloor PlanAS V KameshNo ratings yet

- CSM30004 Week 8 Tuturial PDFDocument1 pageCSM30004 Week 8 Tuturial PDFAS V KameshNo ratings yet

- Task 1: CSM30004: Integrated Construction Engineering and ManagementDocument2 pagesTask 1: CSM30004: Integrated Construction Engineering and ManagementAS V KameshNo ratings yet

- CVE30002 (HES3121) Design of Steel Structures Tutorial 6: Simple ConnectionsDocument2 pagesCVE30002 (HES3121) Design of Steel Structures Tutorial 6: Simple ConnectionsAS V KameshNo ratings yet

- ENG40001 Final Year Research Project 1 Semester 2, 2020: RubricsDocument8 pagesENG40001 Final Year Research Project 1 Semester 2, 2020: RubricsAS V KameshNo ratings yet

- CVE30002 (HES3121) Design of Steel Structures Tutorial 7: Fastener GroupsDocument3 pagesCVE30002 (HES3121) Design of Steel Structures Tutorial 7: Fastener GroupsAS V KameshNo ratings yet

- Typical Secondary Beam To Primary Beam Connection DetailDocument1 pageTypical Secondary Beam To Primary Beam Connection DetailAS V KameshNo ratings yet

- CVE40002-S1-2020-Assignment 2Document2 pagesCVE40002-S1-2020-Assignment 2AS V KameshNo ratings yet

- Curriculum Vitae: SI NO Qualification School Board Year OF Passing Percentage of MarksDocument2 pagesCurriculum Vitae: SI NO Qualification School Board Year OF Passing Percentage of MarksAS V KameshNo ratings yet

- Option A PDFDocument1 pageOption A PDFAS V KameshNo ratings yet

- Task 1: CSM30004: Integrated Construction Engineering and ManagementDocument2 pagesTask 1: CSM30004: Integrated Construction Engineering and ManagementAS V KameshNo ratings yet

- Elevation - Def: 610 UB 113 (114) 610 UB 113Document1 pageElevation - Def: 610 UB 113 (114) 610 UB 113AS V KameshNo ratings yet

- AC - 800493 (Abhishek Mann)Document1 pageAC - 800493 (Abhishek Mann)AS V KameshNo ratings yet

- Area 8639.0975m, Perimeter 401.8261mDocument1 pageArea 8639.0975m, Perimeter 401.8261mAS V KameshNo ratings yet

- Elevation - BehDocument1 pageElevation - BehAS V KameshNo ratings yet

- UNIT-6 (154 Blocks) : Area 8639.0975m, Perimeter 401.8261mDocument1 pageUNIT-6 (154 Blocks) : Area 8639.0975m, Perimeter 401.8261mAS V KameshNo ratings yet

- Basement: 149 Lakeshore AveDocument2 pagesBasement: 149 Lakeshore AveAS V KameshNo ratings yet

- UNIT-6 (210 Blocks) : Area 8639.0975m, Perimeter 401.8261mDocument1 pageUNIT-6 (210 Blocks) : Area 8639.0975m, Perimeter 401.8261mAS V KameshNo ratings yet

- Area 8639.0975m, Perimeter 401.8261m: UNIT-1,2,3,4: 76x52m 3952m UNIT-5: 52x76m 3952mDocument1 pageArea 8639.0975m, Perimeter 401.8261m: UNIT-1,2,3,4: 76x52m 3952m UNIT-5: 52x76m 3952mAS V KameshNo ratings yet

- Pump Technical Datasheet - BISHA PDFDocument3 pagesPump Technical Datasheet - BISHA PDFAS V KameshNo ratings yet

- BEE Content Design, Inc.: Invoice ToDocument1 pageBEE Content Design, Inc.: Invoice ToALEJANDRO PINZON LOPEZNo ratings yet

- HRA DeclarationFormDocument1 pageHRA DeclarationFormPrashant TripathiNo ratings yet

- Tds GuidelineDocument23 pagesTds GuidelineYash BhayaniNo ratings yet

- Law of Taxation ShivaniDocument29 pagesLaw of Taxation ShivaniShivani Singh ChandelNo ratings yet

- Print BillDocument1 pagePrint BillSumit NandalNo ratings yet

- App III Summer Final ExamDocument7 pagesApp III Summer Final ExamPamela SantosNo ratings yet

- Amendments To IFRS 2 'Share-Based Payment'Document1 pageAmendments To IFRS 2 'Share-Based Payment'Rizshelle D. AlarconNo ratings yet

- BAR Taxation Syllabus: I. General Principles of TaxationDocument12 pagesBAR Taxation Syllabus: I. General Principles of TaxationAnonymous wDganZNo ratings yet

- DLL FABM Week17Document3 pagesDLL FABM Week17sweetzelNo ratings yet

- 2 Tips & Tricks For MSMEs Tax Compliance Handouts PDFDocument79 pages2 Tips & Tricks For MSMEs Tax Compliance Handouts PDFGetty Reagan DyNo ratings yet

- Hindu Undivided Family (HUF) For AY 2022-2023 - Income Tax DepartmentDocument13 pagesHindu Undivided Family (HUF) For AY 2022-2023 - Income Tax DepartmentAnkit A DesaiNo ratings yet

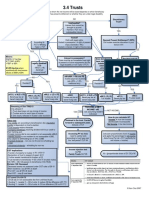

- 3-4 TrustsDocument1 page3-4 Trustsoddsey0713No ratings yet

- Role of Government Unit 9 PobDocument7 pagesRole of Government Unit 9 PobJAVY BUSINESSNo ratings yet

- Invoice: Gross Invoice Total Minus Outstanding AmountDocument2 pagesInvoice: Gross Invoice Total Minus Outstanding AmountMadz Alcoy BautistaNo ratings yet

- Falsity of False Tax ReturnsDocument6 pagesFalsity of False Tax ReturnsShaike Harvin DaquioagNo ratings yet

- Royan Bonny Anthony - Offer LetterDocument2 pagesRoyan Bonny Anthony - Offer LetterTeresa GilbertNo ratings yet

- Estadosfinancieros FerreycorpDocument2 pagesEstadosfinancieros Ferreycorpluxi0No ratings yet

- 022 Article A010 enDocument3 pages022 Article A010 enRaghunath JeyaramanNo ratings yet

- Inherent PowersDocument2 pagesInherent PowersJudiel ParejaNo ratings yet

- Fac4863 104 - 2020 - 0 - BDocument93 pagesFac4863 104 - 2020 - 0 - BNISSIBETINo ratings yet

- Thittayil Builders & Developers: Form GST Inv - 1Document2 pagesThittayil Builders & Developers: Form GST Inv - 1SujithNo ratings yet

- GST Invoice Format No. 12 PDFDocument1 pageGST Invoice Format No. 12 PDFArindam ChandaNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Pavan KumarNo ratings yet

- Tutorial 1Document7 pagesTutorial 1Shan JeefNo ratings yet

- Republic vs. Heirs of JalandoniDocument2 pagesRepublic vs. Heirs of JalandoniJo BudzNo ratings yet

- Test Paper Deduction From GtiDocument2 pagesTest Paper Deduction From GtiAkshit GuptaNo ratings yet

- Taxation: Concept, Nature and Characteristics of Taxation and TaxesDocument11 pagesTaxation: Concept, Nature and Characteristics of Taxation and TaxesMohammad FaizanNo ratings yet

- V Litton Worksheet AdjDocument1 pageV Litton Worksheet AdjDing Costa100% (1)