Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

743 viewsLegacy of Wisdom Academy of Dasmariñas, Inc

Legacy of Wisdom Academy of Dasmariñas, Inc

Uploaded by

zavriaThis document contains a list of transactions with instructions to indicate whether assets, liabilities, and owner's equity increase, decrease, or do not change for each transaction. It also contains a second section with transactions to identify as either an owner's investment, withdrawal, income, expense, or not an owner's equity transaction.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- TR Shove Knife InfoDocument1 pageTR Shove Knife InfoAdam Thimmig100% (1)

- Sitxhrm003 Project TaskDocument18 pagesSitxhrm003 Project TaskThilina Dilan WijesingheNo ratings yet

- Porter's Five Forces Model CadburyDocument14 pagesPorter's Five Forces Model CadburyYogita Ghag Gaikwad75% (4)

- Journal (Remedios Palaganas)Document2 pagesJournal (Remedios Palaganas)Mika CunananNo ratings yet

- Crispin Rosales JournalizingDocument5 pagesCrispin Rosales JournalizingNightmare WolfNo ratings yet

- Edgar Detoya Tax Consultant (Acca101)Document56 pagesEdgar Detoya Tax Consultant (Acca101)Hannah Pearl Flores VillarNo ratings yet

- Bfar Chapter 8 Problem 8Document2 pagesBfar Chapter 8 Problem 8AdiraNo ratings yet

- Financial Management Midtem ExamDocument4 pagesFinancial Management Midtem Examzavria100% (1)

- Stephanie Calamba ACCA101Document1 pageStephanie Calamba ACCA101Nicole FidelsonNo ratings yet

- Accounting Problem 15Document1 pageAccounting Problem 15Keitheia QuidlatNo ratings yet

- Kareen Leon, Cpa Page No: - 1 - General JournalDocument4 pagesKareen Leon, Cpa Page No: - 1 - General JournalTayaban Van Gih100% (2)

- CS Executive EBCL Notes Part 1Document71 pagesCS Executive EBCL Notes Part 1CA Himanshu AroraNo ratings yet

- This Study Resource Was: Jia T. Rañesis BSFT 3M2Document6 pagesThis Study Resource Was: Jia T. Rañesis BSFT 3M2Anonymous100% (1)

- Chapter 2 JournalizingDocument21 pagesChapter 2 Journalizingkakao100% (1)

- Problem-5 - AFCAR Chapter 3Document9 pagesProblem-5 - AFCAR Chapter 3kakao100% (1)

- Worksheet PalaganasDocument38 pagesWorksheet PalaganasMomo HiraiNo ratings yet

- Journal TransactionsDocument3 pagesJournal TransactionsFaye Garlitos100% (1)

- Ebin Belderol TB and WorksheetDocument11 pagesEbin Belderol TB and WorksheetMarielle Ebin100% (3)

- Legacy of Wisdom Academy of Dasmariñas, IncDocument5 pagesLegacy of Wisdom Academy of Dasmariñas, InczavriaNo ratings yet

- Legacy of Wisdom Academy of Dasmariñas, IncDocument5 pagesLegacy of Wisdom Academy of Dasmariñas, InczavriaNo ratings yet

- Revit BIM Manual - Procedures Version 4.0 PDFDocument49 pagesRevit BIM Manual - Procedures Version 4.0 PDFClifford Santos100% (1)

- Accounting Assumptions: Introduction To Basic AccountingDocument6 pagesAccounting Assumptions: Introduction To Basic AccountingJon Nell Laguador Bernardo100% (1)

- General Journal Date Particulars FolioDocument4 pagesGeneral Journal Date Particulars FolioJelaina Alimansa100% (2)

- General Journal Date Particulars Folio DebitDocument6 pagesGeneral Journal Date Particulars Folio DebitJelaina AlimansaNo ratings yet

- A. Invested Cash in The Business, P 60,000Document3 pagesA. Invested Cash in The Business, P 60,000Mark Domingo Mendoza100% (1)

- Completing The Acctg CycleDocument14 pagesCompleting The Acctg CycleHearty Hitutua100% (1)

- Conceptual Framework First ProblemDocument12 pagesConceptual Framework First ProblemJohn JosephNo ratings yet

- Kareen LeonDocument10 pagesKareen LeonaminoacidNo ratings yet

- Journal Entries: Edgar DetoyaDocument17 pagesJournal Entries: Edgar DetoyaAntonNo ratings yet

- Jose Rizal Heavy BombersDocument10 pagesJose Rizal Heavy BombersClaud NineNo ratings yet

- Edgar Detoya-Answer KeyDocument14 pagesEdgar Detoya-Answer KeyAMBER GAMERNo ratings yet

- Acctgchap 2Document15 pagesAcctgchap 2Anjelika ViescaNo ratings yet

- ACCTG CYCLE Comprehensive ProblmDocument12 pagesACCTG CYCLE Comprehensive ProblmMaria Nicole OasinNo ratings yet

- Act3 StatDocument33 pagesAct3 StatAllecks Juel Luchana0% (1)

- FSDocument44 pagesFSMaria Beatriz Aban Munda100% (2)

- Jackielyn Magpantay Chart of AccountsDocument9 pagesJackielyn Magpantay Chart of AccountsIgnite NightNo ratings yet

- Group 6Document6 pagesGroup 6Love KarenNo ratings yet

- 9 Problems After Accounting Cycle Book1Document7 pages9 Problems After Accounting Cycle Book1Efi of the IsleNo ratings yet

- Acc and BMDocument8 pagesAcc and BMShawn Mendez100% (1)

- Activity No. 3 - Principles of Accounting: AnswersDocument2 pagesActivity No. 3 - Principles of Accounting: AnswersLagasca Iris100% (1)

- ASP Notes Page 16Document2 pagesASP Notes Page 16Jeizel ConcepcionNo ratings yet

- Reynaldo Adjusment EntryDocument5 pagesReynaldo Adjusment EntryAra HasanNo ratings yet

- Marichu Fornolles Novelties Transactions in December 2020: Date Particulars DebitDocument4 pagesMarichu Fornolles Novelties Transactions in December 2020: Date Particulars DebitHannah Pearl Flores Villar100% (1)

- C3 - Problem 17 - Correcting A Trial BalanceDocument2 pagesC3 - Problem 17 - Correcting A Trial BalanceLorence John Imperial0% (1)

- General Journal: (To Purchase Equipment Paid With Cash and Account Payable For The Balance)Document7 pagesGeneral Journal: (To Purchase Equipment Paid With Cash and Account Payable For The Balance)Montibon El100% (1)

- Accounting Problem 16Document1 pageAccounting Problem 16sabbyveraNo ratings yet

- Accbp100 2nd Exam Part 1Document2 pagesAccbp100 2nd Exam Part 1emem resuento100% (1)

- Far Assignments Chapter 3Document15 pagesFar Assignments Chapter 3Vesenth May Magaro Rubinos0% (1)

- FABM 2 MIDTERM AutoRecoveredDocument15 pagesFABM 2 MIDTERM AutoRecoveredMerdwindelle AllagonesNo ratings yet

- Moises Dondoyano Information Systems Company Trial Balance: Accounts Dr. CRDocument5 pagesMoises Dondoyano Information Systems Company Trial Balance: Accounts Dr. CR버니 모지코No ratings yet

- Dasmarinas Duplicators VDocument29 pagesDasmarinas Duplicators VBlesh MacusiNo ratings yet

- Acctg Assginment 4 Adjusting EntriesDocument3 pagesAcctg Assginment 4 Adjusting EntriesDaisy Marie A. RoselNo ratings yet

- Problem 14 - Group 4Document26 pagesProblem 14 - Group 4Francine TorresNo ratings yet

- Financial Statement Worksheet DetoyaDocument8 pagesFinancial Statement Worksheet Detoyasharon emailNo ratings yet

- Journal Entries, Ledger and Trial BalanceDocument8 pagesJournal Entries, Ledger and Trial BalanceDan Ryan0% (1)

- Sicat Financial Planning Consultant General Journal December, 2020Document3 pagesSicat Financial Planning Consultant General Journal December, 2020Madelyn SolesNo ratings yet

- DAGUPLO c2 p16 p17Document7 pagesDAGUPLO c2 p16 p17Jane Leona Almosa Daguplo100% (1)

- 4.3.2.3 Elaborate - Preparing Adjusting Entries From Unadjusted and Adjusted Trial BalanceDocument3 pages4.3.2.3 Elaborate - Preparing Adjusting Entries From Unadjusted and Adjusted Trial BalanceMa Fe Tabasa100% (2)

- Teresita Buenaflor Shoes Worksheet 1 RegineDocument24 pagesTeresita Buenaflor Shoes Worksheet 1 RegineBaby Babe100% (1)

- Buenaventuraej Bsa1bmidterm Activity 1 Edgar DetoyaDocument21 pagesBuenaventuraej Bsa1bmidterm Activity 1 Edgar DetoyaAnonnNo ratings yet

- ACCOUNTINGDocument2 pagesACCOUNTINGantibacterialsoapNo ratings yet

- Lab Posttest 3 - Posting and Trial BalanceDocument1 pageLab Posttest 3 - Posting and Trial BalanceRaymond Pacaldo100% (4)

- Answer Key To Fundamentals of Financial Accounting and Reporting CDCDocument3 pagesAnswer Key To Fundamentals of Financial Accounting and Reporting CDCAprile Margareth HidalgoNo ratings yet

- Sample Problem For Last MeetingDocument11 pagesSample Problem For Last MeetingLylanie Alcoran AnibNo ratings yet

- Chapter 2 DoneDocument30 pagesChapter 2 Doneellyzamae quiraoNo ratings yet

- Dellosa Cleaners Adjusting Entry For The Year Ended September 30, 2022. Accounts Debit CreditDocument6 pagesDellosa Cleaners Adjusting Entry For The Year Ended September 30, 2022. Accounts Debit CreditJaira AsuncionNo ratings yet

- UntitledDocument17 pagesUntitledJoshua Arjay V. ToveraNo ratings yet

- Diliman Preparatory School: Basic Education Department-High School SCHOOL YEAR 2019-2020 First Semester Fabm 2Document2 pagesDiliman Preparatory School: Basic Education Department-High School SCHOOL YEAR 2019-2020 First Semester Fabm 2Althea Nicole CanapiNo ratings yet

- Fitt 1 - Activity 5Document1 pageFitt 1 - Activity 5zavriaNo ratings yet

- Objective: Philippine Physical Fitness TestDocument2 pagesObjective: Philippine Physical Fitness Testzavria0% (1)

- The Family Guy Is Not Appropriate To Watch During School.: Write Down Whether Each Example Is Fact or OpinionDocument2 pagesThe Family Guy Is Not Appropriate To Watch During School.: Write Down Whether Each Example Is Fact or OpinionzavriaNo ratings yet

- Activity - 1Document1 pageActivity - 1zavriaNo ratings yet

- Title Impact of Online Teaching Towards The Behavior of The Students in Legacy of Wisdom Academy of Dasmarinas IncDocument1 pageTitle Impact of Online Teaching Towards The Behavior of The Students in Legacy of Wisdom Academy of Dasmarinas InczavriaNo ratings yet

- Delos Reyes - Grade 12 - EAPPDocument2 pagesDelos Reyes - Grade 12 - EAPPzavriaNo ratings yet

- Activity 1Document1 pageActivity 1zavriaNo ratings yet

- The Family Guy Is Not Appropriate To Watch During School.: Write Down Whether Each Example Is Fact or OpinionDocument2 pagesThe Family Guy Is Not Appropriate To Watch During School.: Write Down Whether Each Example Is Fact or OpinionzavriaNo ratings yet

- General Journal Date: Delos Reyes Gianna Grade 12 - DisciplineDocument2 pagesGeneral Journal Date: Delos Reyes Gianna Grade 12 - DisciplinezavriaNo ratings yet

- Outlining ActivityDocument2 pagesOutlining Activityzavria71% (7)

- Read The Two Paraphrases of The Original Text Below. Select The Most Appropriate Paraphrase Then Explain Your AnswerDocument2 pagesRead The Two Paraphrases of The Original Text Below. Select The Most Appropriate Paraphrase Then Explain Your AnswerzavriaNo ratings yet

- Legacy of Wisdom Academy of Dasmariñas, IncDocument2 pagesLegacy of Wisdom Academy of Dasmariñas, InczavriaNo ratings yet

- Legacy of Wisdom Academy of Dasmariñas, IncDocument2 pagesLegacy of Wisdom Academy of Dasmariñas, InczavriaNo ratings yet

- Legacy of Wisdom Academy of Dasmariñas, IncDocument1 pageLegacy of Wisdom Academy of Dasmariñas, InczavriaNo ratings yet

- Activity-6 ACCOUNTING PRINCIPLEDocument2 pagesActivity-6 ACCOUNTING PRINCIPLEzavriaNo ratings yet

- Delos Reyes Quiz 1Document2 pagesDelos Reyes Quiz 1zavriaNo ratings yet

- Activity 7 - Accounting PrinciplesDocument2 pagesActivity 7 - Accounting PrincipleszavriaNo ratings yet

- Legacy of Wisdom Academy of Dasmariñas, IncDocument1 pageLegacy of Wisdom Academy of Dasmariñas, InczavriaNo ratings yet

- Independent Variable: Name: Delos Reyes Gianna 12 - Discipline Activity 1 Which Variable Is Manipulated by Researcher?Document2 pagesIndependent Variable: Name: Delos Reyes Gianna 12 - Discipline Activity 1 Which Variable Is Manipulated by Researcher?zavriaNo ratings yet

- Legacy of Wisdom Academy of Dasmariñas, IncDocument1 pageLegacy of Wisdom Academy of Dasmariñas, InczavriaNo ratings yet

- Delos Reyes AccountingDocument1 pageDelos Reyes AccountingzavriaNo ratings yet

- PT AccountingDocument2 pagesPT AccountingzavriaNo ratings yet

- Delos Reyes Quiz 1Document2 pagesDelos Reyes Quiz 1zavriaNo ratings yet

- Legacy of Wisdom Academy of Dasmariñas, IncDocument2 pagesLegacy of Wisdom Academy of Dasmariñas, InczavriaNo ratings yet

- Balance SheetDocument2 pagesBalance SheetzavriaNo ratings yet

- EN 1090 White Paper tcm17-119019Document24 pagesEN 1090 White Paper tcm17-119019Gerard BorstNo ratings yet

- The CPV Valley Energy Center - 2013 RFPDocument103 pagesThe CPV Valley Energy Center - 2013 RFP2rQiTPh4KnNo ratings yet

- Oblicon 2nd ExamDocument17 pagesOblicon 2nd ExamAda AbelleraNo ratings yet

- Channel List 20210427Document13 pagesChannel List 20210427drpnnreddyNo ratings yet

- Top 50 Linux MCQs (Multiple-Choice Questions and Answers)Document28 pagesTop 50 Linux MCQs (Multiple-Choice Questions and Answers)y.alNo ratings yet

- Document 4 Application Form For 1st Issue or Renewal of MRP Children Under 16 YearsDocument4 pagesDocument 4 Application Form For 1st Issue or Renewal of MRP Children Under 16 YearsImtiaz Nazir-KhaleelNo ratings yet

- SAPM: Book BuildingDocument16 pagesSAPM: Book BuildingsivaaganNo ratings yet

- Assignment 1 - Roles and ResponsibilitiesDocument12 pagesAssignment 1 - Roles and ResponsibilitiesericmcnarteyNo ratings yet

- CM6805Document16 pagesCM6805mtomescu0% (1)

- Ccabeg Case Studies Accountants Business PDFDocument17 pagesCcabeg Case Studies Accountants Business PDFJezza Mae Gomba RegidorNo ratings yet

- Heat Treat 2Document5 pagesHeat Treat 2gawaNo ratings yet

- 11.0 Project Risk ManagementDocument14 pages11.0 Project Risk ManagementEUGENE DEXTER NONES100% (1)

- 2019 49 59 Ford Big CarDocument172 pages2019 49 59 Ford Big CarJanneLaukkanenNo ratings yet

- 3CP08Document1 page3CP08Rakshit VajaNo ratings yet

- Rhythm Music and Education - Dalcroze PDFDocument409 pagesRhythm Music and Education - Dalcroze PDFJhonatas Carmo100% (3)

- PW371-A General Specification Edition 2.0 - July - 2013Document92 pagesPW371-A General Specification Edition 2.0 - July - 2013forbeska100% (3)

- Viking RAD 1ADocument8 pagesViking RAD 1Abestbest07No ratings yet

- Introduction To Programming With Matlab: ExercisesDocument18 pagesIntroduction To Programming With Matlab: ExercisesHương Đặng100% (1)

- 807 Karnataka Yantradhare 2015Document25 pages807 Karnataka Yantradhare 2015MALLIKARJUN BIRADARNo ratings yet

- Sita Code of Conduct August 2022Document19 pagesSita Code of Conduct August 2022marketor21No ratings yet

- Indian PalmistryDocument2 pagesIndian PalmistrynitinkumarpalmistNo ratings yet

- Fineotex Chemical Ltd.Document239 pagesFineotex Chemical Ltd.GaneshNo ratings yet

- Makalah Isloj 6 - 7 Juli 2019 (E3)Document18 pagesMakalah Isloj 6 - 7 Juli 2019 (E3)ayususantinaNo ratings yet

- Iloilo RequiredDocument63 pagesIloilo RequiredShane Catherine BesaresNo ratings yet

- BMW 320dDocument1 pageBMW 320dXDXDXDXDNo ratings yet

Legacy of Wisdom Academy of Dasmariñas, Inc

Legacy of Wisdom Academy of Dasmariñas, Inc

Uploaded by

zavria0 ratings0% found this document useful (0 votes)

743 views4 pagesThis document contains a list of transactions with instructions to indicate whether assets, liabilities, and owner's equity increase, decrease, or do not change for each transaction. It also contains a second section with transactions to identify as either an owner's investment, withdrawal, income, expense, or not an owner's equity transaction.

Original Description:

Original Title

activity 12.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains a list of transactions with instructions to indicate whether assets, liabilities, and owner's equity increase, decrease, or do not change for each transaction. It also contains a second section with transactions to identify as either an owner's investment, withdrawal, income, expense, or not an owner's equity transaction.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

743 views4 pagesLegacy of Wisdom Academy of Dasmariñas, Inc

Legacy of Wisdom Academy of Dasmariñas, Inc

Uploaded by

zavriaThis document contains a list of transactions with instructions to indicate whether assets, liabilities, and owner's equity increase, decrease, or do not change for each transaction. It also contains a second section with transactions to identify as either an owner's investment, withdrawal, income, expense, or not an owner's equity transaction.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 4

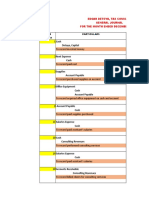

Legacy of Wisdom Academy of Dasmariñas, Inc.

Golden City, Salawag, Dasmariñas City

SY 2020-2021

FUNDAMENTALS OF ACCOUNTING

ACTIVITY-11

Name: Delos Reyes Gianna Date:9/26/20

Directions: For each transaction , indicate whether the assets, liabilities, owner’s

equity Increase or Decreased or ( did not change).

Assets Liabilities Owners equity

1. Bought equipment, D in cash

paying cash. I in equipment

2. Paid the monthly D in cash D in OE

rent expense.

3. Purchase supplies I in supplies D in liabilities

on credit.

D in cash I in OE

4. Made an additional

investment in

the company

5. Charged customers I in cash I in OE

for services provided

on account

6. Paid creditor on D in cash D in liabilities

account

I in cash I in OE

7. Received payment

from

customers on

account

8. Received cash for

I in cash I in OE

service rendered

today

9. Permanently

reduced his I in cash D in OE

investment in the

business

By taking out cash .

10. Paid salaries for

D in cash D in liabilities

the week

11. Acquired D in cash I in liabilities

equipment, I in Dequipment

in cash D in OE

paying 50% down,

I in cash I in OE

the balance due

In 30 day

I in cash I in OE

12. Cash received

from delivery service, I in cash D in OE

27,500

D in cash D in liabilities

13. Paid creditors on

D in cash I in liabilities

account 20,000

14. Received cash from I in cash I in OE

the owner as D in cash D in OE

additional investment

D in cash D in liabilities

15. Paid advertising

expense D in cash D in liabilities

16. Billed customers for I in cash I in OE

delivery services

on account 55,200 I in supplies

17. Paid rent for D in cash

July 20,000

18. Received cash

from customers

on account 25,400

19. Owner withdrew

cash for personal

use 20,000

20.Purchase land for

cash worth 100,000

21.Paid cash for rent

Expenses 5,000

22.Paid cash on

accounts payable

45,000

23.Purchase supplies on

account 12,000

II. Owner’s Equity transaction

Identify the foregoing transactions by identifying each a either one of the

following:

Owner’s investment

Owner’s Withdrawal

Owner’s income

Expense

Not an owner’s equity transaction.

24. Received cash for rendering service.

Owners income

25. Withdrew cash for personal expenses

Owners withdrawal

26. Received cash from a customer who have been rendered service on account.

Owners income

27. Transfer personal assets to the business.

Owners investment

28. Paid a service station for gasoline for a business service vehicle.

Owners investment

29. Performed a service and receive a promise payment.

Not an owners equity transaction

30. Paid cash to acquire equipment

Expense

31. Paid cash to an employee for service rendered

Owners withdrawal

You might also like

- TR Shove Knife InfoDocument1 pageTR Shove Knife InfoAdam Thimmig100% (1)

- Sitxhrm003 Project TaskDocument18 pagesSitxhrm003 Project TaskThilina Dilan WijesingheNo ratings yet

- Porter's Five Forces Model CadburyDocument14 pagesPorter's Five Forces Model CadburyYogita Ghag Gaikwad75% (4)

- Journal (Remedios Palaganas)Document2 pagesJournal (Remedios Palaganas)Mika CunananNo ratings yet

- Crispin Rosales JournalizingDocument5 pagesCrispin Rosales JournalizingNightmare WolfNo ratings yet

- Edgar Detoya Tax Consultant (Acca101)Document56 pagesEdgar Detoya Tax Consultant (Acca101)Hannah Pearl Flores VillarNo ratings yet

- Bfar Chapter 8 Problem 8Document2 pagesBfar Chapter 8 Problem 8AdiraNo ratings yet

- Financial Management Midtem ExamDocument4 pagesFinancial Management Midtem Examzavria100% (1)

- Stephanie Calamba ACCA101Document1 pageStephanie Calamba ACCA101Nicole FidelsonNo ratings yet

- Accounting Problem 15Document1 pageAccounting Problem 15Keitheia QuidlatNo ratings yet

- Kareen Leon, Cpa Page No: - 1 - General JournalDocument4 pagesKareen Leon, Cpa Page No: - 1 - General JournalTayaban Van Gih100% (2)

- CS Executive EBCL Notes Part 1Document71 pagesCS Executive EBCL Notes Part 1CA Himanshu AroraNo ratings yet

- This Study Resource Was: Jia T. Rañesis BSFT 3M2Document6 pagesThis Study Resource Was: Jia T. Rañesis BSFT 3M2Anonymous100% (1)

- Chapter 2 JournalizingDocument21 pagesChapter 2 Journalizingkakao100% (1)

- Problem-5 - AFCAR Chapter 3Document9 pagesProblem-5 - AFCAR Chapter 3kakao100% (1)

- Worksheet PalaganasDocument38 pagesWorksheet PalaganasMomo HiraiNo ratings yet

- Journal TransactionsDocument3 pagesJournal TransactionsFaye Garlitos100% (1)

- Ebin Belderol TB and WorksheetDocument11 pagesEbin Belderol TB and WorksheetMarielle Ebin100% (3)

- Legacy of Wisdom Academy of Dasmariñas, IncDocument5 pagesLegacy of Wisdom Academy of Dasmariñas, InczavriaNo ratings yet

- Legacy of Wisdom Academy of Dasmariñas, IncDocument5 pagesLegacy of Wisdom Academy of Dasmariñas, InczavriaNo ratings yet

- Revit BIM Manual - Procedures Version 4.0 PDFDocument49 pagesRevit BIM Manual - Procedures Version 4.0 PDFClifford Santos100% (1)

- Accounting Assumptions: Introduction To Basic AccountingDocument6 pagesAccounting Assumptions: Introduction To Basic AccountingJon Nell Laguador Bernardo100% (1)

- General Journal Date Particulars FolioDocument4 pagesGeneral Journal Date Particulars FolioJelaina Alimansa100% (2)

- General Journal Date Particulars Folio DebitDocument6 pagesGeneral Journal Date Particulars Folio DebitJelaina AlimansaNo ratings yet

- A. Invested Cash in The Business, P 60,000Document3 pagesA. Invested Cash in The Business, P 60,000Mark Domingo Mendoza100% (1)

- Completing The Acctg CycleDocument14 pagesCompleting The Acctg CycleHearty Hitutua100% (1)

- Conceptual Framework First ProblemDocument12 pagesConceptual Framework First ProblemJohn JosephNo ratings yet

- Kareen LeonDocument10 pagesKareen LeonaminoacidNo ratings yet

- Journal Entries: Edgar DetoyaDocument17 pagesJournal Entries: Edgar DetoyaAntonNo ratings yet

- Jose Rizal Heavy BombersDocument10 pagesJose Rizal Heavy BombersClaud NineNo ratings yet

- Edgar Detoya-Answer KeyDocument14 pagesEdgar Detoya-Answer KeyAMBER GAMERNo ratings yet

- Acctgchap 2Document15 pagesAcctgchap 2Anjelika ViescaNo ratings yet

- ACCTG CYCLE Comprehensive ProblmDocument12 pagesACCTG CYCLE Comprehensive ProblmMaria Nicole OasinNo ratings yet

- Act3 StatDocument33 pagesAct3 StatAllecks Juel Luchana0% (1)

- FSDocument44 pagesFSMaria Beatriz Aban Munda100% (2)

- Jackielyn Magpantay Chart of AccountsDocument9 pagesJackielyn Magpantay Chart of AccountsIgnite NightNo ratings yet

- Group 6Document6 pagesGroup 6Love KarenNo ratings yet

- 9 Problems After Accounting Cycle Book1Document7 pages9 Problems After Accounting Cycle Book1Efi of the IsleNo ratings yet

- Acc and BMDocument8 pagesAcc and BMShawn Mendez100% (1)

- Activity No. 3 - Principles of Accounting: AnswersDocument2 pagesActivity No. 3 - Principles of Accounting: AnswersLagasca Iris100% (1)

- ASP Notes Page 16Document2 pagesASP Notes Page 16Jeizel ConcepcionNo ratings yet

- Reynaldo Adjusment EntryDocument5 pagesReynaldo Adjusment EntryAra HasanNo ratings yet

- Marichu Fornolles Novelties Transactions in December 2020: Date Particulars DebitDocument4 pagesMarichu Fornolles Novelties Transactions in December 2020: Date Particulars DebitHannah Pearl Flores Villar100% (1)

- C3 - Problem 17 - Correcting A Trial BalanceDocument2 pagesC3 - Problem 17 - Correcting A Trial BalanceLorence John Imperial0% (1)

- General Journal: (To Purchase Equipment Paid With Cash and Account Payable For The Balance)Document7 pagesGeneral Journal: (To Purchase Equipment Paid With Cash and Account Payable For The Balance)Montibon El100% (1)

- Accounting Problem 16Document1 pageAccounting Problem 16sabbyveraNo ratings yet

- Accbp100 2nd Exam Part 1Document2 pagesAccbp100 2nd Exam Part 1emem resuento100% (1)

- Far Assignments Chapter 3Document15 pagesFar Assignments Chapter 3Vesenth May Magaro Rubinos0% (1)

- FABM 2 MIDTERM AutoRecoveredDocument15 pagesFABM 2 MIDTERM AutoRecoveredMerdwindelle AllagonesNo ratings yet

- Moises Dondoyano Information Systems Company Trial Balance: Accounts Dr. CRDocument5 pagesMoises Dondoyano Information Systems Company Trial Balance: Accounts Dr. CR버니 모지코No ratings yet

- Dasmarinas Duplicators VDocument29 pagesDasmarinas Duplicators VBlesh MacusiNo ratings yet

- Acctg Assginment 4 Adjusting EntriesDocument3 pagesAcctg Assginment 4 Adjusting EntriesDaisy Marie A. RoselNo ratings yet

- Problem 14 - Group 4Document26 pagesProblem 14 - Group 4Francine TorresNo ratings yet

- Financial Statement Worksheet DetoyaDocument8 pagesFinancial Statement Worksheet Detoyasharon emailNo ratings yet

- Journal Entries, Ledger and Trial BalanceDocument8 pagesJournal Entries, Ledger and Trial BalanceDan Ryan0% (1)

- Sicat Financial Planning Consultant General Journal December, 2020Document3 pagesSicat Financial Planning Consultant General Journal December, 2020Madelyn SolesNo ratings yet

- DAGUPLO c2 p16 p17Document7 pagesDAGUPLO c2 p16 p17Jane Leona Almosa Daguplo100% (1)

- 4.3.2.3 Elaborate - Preparing Adjusting Entries From Unadjusted and Adjusted Trial BalanceDocument3 pages4.3.2.3 Elaborate - Preparing Adjusting Entries From Unadjusted and Adjusted Trial BalanceMa Fe Tabasa100% (2)

- Teresita Buenaflor Shoes Worksheet 1 RegineDocument24 pagesTeresita Buenaflor Shoes Worksheet 1 RegineBaby Babe100% (1)

- Buenaventuraej Bsa1bmidterm Activity 1 Edgar DetoyaDocument21 pagesBuenaventuraej Bsa1bmidterm Activity 1 Edgar DetoyaAnonnNo ratings yet

- ACCOUNTINGDocument2 pagesACCOUNTINGantibacterialsoapNo ratings yet

- Lab Posttest 3 - Posting and Trial BalanceDocument1 pageLab Posttest 3 - Posting and Trial BalanceRaymond Pacaldo100% (4)

- Answer Key To Fundamentals of Financial Accounting and Reporting CDCDocument3 pagesAnswer Key To Fundamentals of Financial Accounting and Reporting CDCAprile Margareth HidalgoNo ratings yet

- Sample Problem For Last MeetingDocument11 pagesSample Problem For Last MeetingLylanie Alcoran AnibNo ratings yet

- Chapter 2 DoneDocument30 pagesChapter 2 Doneellyzamae quiraoNo ratings yet

- Dellosa Cleaners Adjusting Entry For The Year Ended September 30, 2022. Accounts Debit CreditDocument6 pagesDellosa Cleaners Adjusting Entry For The Year Ended September 30, 2022. Accounts Debit CreditJaira AsuncionNo ratings yet

- UntitledDocument17 pagesUntitledJoshua Arjay V. ToveraNo ratings yet

- Diliman Preparatory School: Basic Education Department-High School SCHOOL YEAR 2019-2020 First Semester Fabm 2Document2 pagesDiliman Preparatory School: Basic Education Department-High School SCHOOL YEAR 2019-2020 First Semester Fabm 2Althea Nicole CanapiNo ratings yet

- Fitt 1 - Activity 5Document1 pageFitt 1 - Activity 5zavriaNo ratings yet

- Objective: Philippine Physical Fitness TestDocument2 pagesObjective: Philippine Physical Fitness Testzavria0% (1)

- The Family Guy Is Not Appropriate To Watch During School.: Write Down Whether Each Example Is Fact or OpinionDocument2 pagesThe Family Guy Is Not Appropriate To Watch During School.: Write Down Whether Each Example Is Fact or OpinionzavriaNo ratings yet

- Activity - 1Document1 pageActivity - 1zavriaNo ratings yet

- Title Impact of Online Teaching Towards The Behavior of The Students in Legacy of Wisdom Academy of Dasmarinas IncDocument1 pageTitle Impact of Online Teaching Towards The Behavior of The Students in Legacy of Wisdom Academy of Dasmarinas InczavriaNo ratings yet

- Delos Reyes - Grade 12 - EAPPDocument2 pagesDelos Reyes - Grade 12 - EAPPzavriaNo ratings yet

- Activity 1Document1 pageActivity 1zavriaNo ratings yet

- The Family Guy Is Not Appropriate To Watch During School.: Write Down Whether Each Example Is Fact or OpinionDocument2 pagesThe Family Guy Is Not Appropriate To Watch During School.: Write Down Whether Each Example Is Fact or OpinionzavriaNo ratings yet

- General Journal Date: Delos Reyes Gianna Grade 12 - DisciplineDocument2 pagesGeneral Journal Date: Delos Reyes Gianna Grade 12 - DisciplinezavriaNo ratings yet

- Outlining ActivityDocument2 pagesOutlining Activityzavria71% (7)

- Read The Two Paraphrases of The Original Text Below. Select The Most Appropriate Paraphrase Then Explain Your AnswerDocument2 pagesRead The Two Paraphrases of The Original Text Below. Select The Most Appropriate Paraphrase Then Explain Your AnswerzavriaNo ratings yet

- Legacy of Wisdom Academy of Dasmariñas, IncDocument2 pagesLegacy of Wisdom Academy of Dasmariñas, InczavriaNo ratings yet

- Legacy of Wisdom Academy of Dasmariñas, IncDocument2 pagesLegacy of Wisdom Academy of Dasmariñas, InczavriaNo ratings yet

- Legacy of Wisdom Academy of Dasmariñas, IncDocument1 pageLegacy of Wisdom Academy of Dasmariñas, InczavriaNo ratings yet

- Activity-6 ACCOUNTING PRINCIPLEDocument2 pagesActivity-6 ACCOUNTING PRINCIPLEzavriaNo ratings yet

- Delos Reyes Quiz 1Document2 pagesDelos Reyes Quiz 1zavriaNo ratings yet

- Activity 7 - Accounting PrinciplesDocument2 pagesActivity 7 - Accounting PrincipleszavriaNo ratings yet

- Legacy of Wisdom Academy of Dasmariñas, IncDocument1 pageLegacy of Wisdom Academy of Dasmariñas, InczavriaNo ratings yet

- Independent Variable: Name: Delos Reyes Gianna 12 - Discipline Activity 1 Which Variable Is Manipulated by Researcher?Document2 pagesIndependent Variable: Name: Delos Reyes Gianna 12 - Discipline Activity 1 Which Variable Is Manipulated by Researcher?zavriaNo ratings yet

- Legacy of Wisdom Academy of Dasmariñas, IncDocument1 pageLegacy of Wisdom Academy of Dasmariñas, InczavriaNo ratings yet

- Delos Reyes AccountingDocument1 pageDelos Reyes AccountingzavriaNo ratings yet

- PT AccountingDocument2 pagesPT AccountingzavriaNo ratings yet

- Delos Reyes Quiz 1Document2 pagesDelos Reyes Quiz 1zavriaNo ratings yet

- Legacy of Wisdom Academy of Dasmariñas, IncDocument2 pagesLegacy of Wisdom Academy of Dasmariñas, InczavriaNo ratings yet

- Balance SheetDocument2 pagesBalance SheetzavriaNo ratings yet

- EN 1090 White Paper tcm17-119019Document24 pagesEN 1090 White Paper tcm17-119019Gerard BorstNo ratings yet

- The CPV Valley Energy Center - 2013 RFPDocument103 pagesThe CPV Valley Energy Center - 2013 RFP2rQiTPh4KnNo ratings yet

- Oblicon 2nd ExamDocument17 pagesOblicon 2nd ExamAda AbelleraNo ratings yet

- Channel List 20210427Document13 pagesChannel List 20210427drpnnreddyNo ratings yet

- Top 50 Linux MCQs (Multiple-Choice Questions and Answers)Document28 pagesTop 50 Linux MCQs (Multiple-Choice Questions and Answers)y.alNo ratings yet

- Document 4 Application Form For 1st Issue or Renewal of MRP Children Under 16 YearsDocument4 pagesDocument 4 Application Form For 1st Issue or Renewal of MRP Children Under 16 YearsImtiaz Nazir-KhaleelNo ratings yet

- SAPM: Book BuildingDocument16 pagesSAPM: Book BuildingsivaaganNo ratings yet

- Assignment 1 - Roles and ResponsibilitiesDocument12 pagesAssignment 1 - Roles and ResponsibilitiesericmcnarteyNo ratings yet

- CM6805Document16 pagesCM6805mtomescu0% (1)

- Ccabeg Case Studies Accountants Business PDFDocument17 pagesCcabeg Case Studies Accountants Business PDFJezza Mae Gomba RegidorNo ratings yet

- Heat Treat 2Document5 pagesHeat Treat 2gawaNo ratings yet

- 11.0 Project Risk ManagementDocument14 pages11.0 Project Risk ManagementEUGENE DEXTER NONES100% (1)

- 2019 49 59 Ford Big CarDocument172 pages2019 49 59 Ford Big CarJanneLaukkanenNo ratings yet

- 3CP08Document1 page3CP08Rakshit VajaNo ratings yet

- Rhythm Music and Education - Dalcroze PDFDocument409 pagesRhythm Music and Education - Dalcroze PDFJhonatas Carmo100% (3)

- PW371-A General Specification Edition 2.0 - July - 2013Document92 pagesPW371-A General Specification Edition 2.0 - July - 2013forbeska100% (3)

- Viking RAD 1ADocument8 pagesViking RAD 1Abestbest07No ratings yet

- Introduction To Programming With Matlab: ExercisesDocument18 pagesIntroduction To Programming With Matlab: ExercisesHương Đặng100% (1)

- 807 Karnataka Yantradhare 2015Document25 pages807 Karnataka Yantradhare 2015MALLIKARJUN BIRADARNo ratings yet

- Sita Code of Conduct August 2022Document19 pagesSita Code of Conduct August 2022marketor21No ratings yet

- Indian PalmistryDocument2 pagesIndian PalmistrynitinkumarpalmistNo ratings yet

- Fineotex Chemical Ltd.Document239 pagesFineotex Chemical Ltd.GaneshNo ratings yet

- Makalah Isloj 6 - 7 Juli 2019 (E3)Document18 pagesMakalah Isloj 6 - 7 Juli 2019 (E3)ayususantinaNo ratings yet

- Iloilo RequiredDocument63 pagesIloilo RequiredShane Catherine BesaresNo ratings yet

- BMW 320dDocument1 pageBMW 320dXDXDXDXDNo ratings yet